Transcription

Issue Date: November 2018G LO B A L E C O M M E R C EMARKET RANKING 2019Sell Global. Feel LocalW W W.ESHOPWORLD.COMGROWMYBR AND@ESHOPWORLD.COM

GLOB A L ECOMME RCE M A R K E T R A NK ING 2 0 19For any brand looking at the cross-border growthopportunity, there is one crucial question: whichcountries are likely to offer the easiest path tosuccess? This is often not an easy question to answeras there are multiple influencing factors, such asshopper demand, ease of doing business, andnumber of cross-border shoppers.We have compiled the latest industry data to createa global eCommerce market ranking that comparesmarkets across a number of key, weighted criteria.Some of the results will come as no surprise – it’s hardto de-emphasise the sheer scale of the markets in theUSA and China. However, there are other importantcriteria that allow markets such as Korea, India andMexico to perform well in the ranking.In this whitepaper, we take a look at factors such aslogistics and average shopper spending, and coverwhich markets to watch, the state of cross-bordershopping, and emerging markets with potential forgrowth.Let’s get started!GLOBAL ECOMMERCE MARKET RANKING 2019 - 2

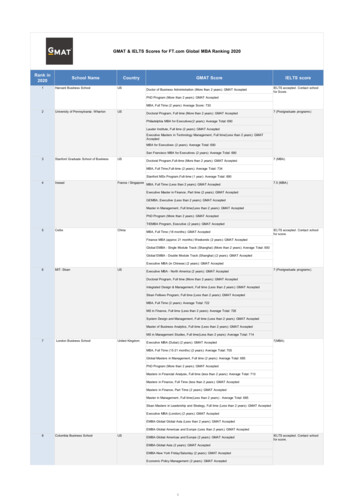

TOP 3 0 M A R K E T SOur top 30 ranking was scored and weighted along the following key metrics: 123Logistics rankingAverage revenue per shopperTotal market revenuePercentage of population shopping onlineUnitedStatesChinaUnitedKingdom Number of online shoppersPercentage of cross-border shoppersNumber of cross-border shoppersCAGR 2018-202211Sweden21Saudi xico28Finland9Spain1929Hong Kong10Korea2030PortugallandsSwitzerlandIndonesiaIn the next section, we will take a closer look into the top 5 markets in the ranking.GLOBAL ECOMMERCE MARKET RANKING 2019 - 3

SPOT LIGH T ON: U S AThe United States is the number one eCommercemarket in the world for 2018. This is largely due tothe ease of doing business in America – there is greatlogistics infrastructure and high demand for crossborder retailers with eCommerce market revenuetotalling 504.58 billion USD this year alone.A key metric that has placed the US at the top of ourranking this year is the number of cross-border onlineshoppers. The US has the second highest numberof cross-border online shoppers in the world – 82.72million – although as a percentage of total onlineshoppers, it places significantly lower.The US is a formidable online force – it was thebirthplace of the online marketplace and largely,Americans are very trusting online shoppers whohave a high level of comfort shopping online – around79% of the population, or 258.5 million people,has made a purchase in the past year. This level ofcomfort is also evident in both the amount of moneyspent on average per shopper ( 1951 USD annually)and the size of the overall US eCommerce market.1GLOBAL ECOMMERCE MARKET RANKING 2019 - 4

SPOT LIGH T ON: CHIN AChina is second in our ranking, which should comeas no surprise to brands who are looking to expandcross-border. This booming eCommerce market ishome to some of the savviest shoppers in the world,many of whom are cash-rich millennials that covetluxury high-end goods from foreign brands.China scored highly across a number of key metricsin our ranking, largely in part thanks to a hugepopulation and a keen desire to shop online andacross borders. China consistently scored numberone in three key metrics: largest market by revenue( 636.09 billion in 2018), highest number of onlineshoppers (1 billion), and the highest number of crossborder online shoppers (149.42 million).As the largest eCommerce market in the world, Chinais a popular choice for foreign brands, however itshould be noted that the ease of doing business in theregion can be regarded as somewhat complicated.Brands need to assess the demand for their productsin China, and be prepared to apply local marketingstrategies, especially via social media platforms suchas WeChat and Weibo.2GLOBAL ECOMMERCE MARKET RANKING 2019 - 5

SPOT LIGH T ON: UKIn third place is the UK, another very lucrativeeCommerce market for international brands. Themarket is driven largely by millennials who love fastfashion and want to find the best price possible.Despite a desire for bargains, UK shoppers spend ahuge amount online annually – nearly 1650 USD pershopper, with an overall market revenue of 86.45billion. Not only that, but the UK has the thirdhighest number of online shoppers in the world bypercentage – almost 80% of the population.UK online shoppers have high expectations forforeign brands and want fast shipping and a flexiblefree returns policy. They also love to shop on mobile,therefore brands considering expanding into theUK need to provide a localized, dynamic websitethat offers a seamless shopping experience. Theseshoppers are fickle and will shop elsewhere if theirexpectations are not met.3GLOBAL ECOMMERCE MARKET RANKING 2019 - 6

SPOT LIGH T ON: J A PA NFourth in this year’s ranking is Japan, one ofthe biggest eCommerce markets in Asia. With 104.04 billion USD revenue in the past year, andexcellent logistics infrastructure (5th globally), theJapanese eCommerce market represents a greatopportunity for foreign brands. Japan’s 89.9 milliononline shoppers love foreign brands that theycan trust to provide an excellent product. Unliketheir counterparts in the UK and the US, Japaneseshoppers are willing to pay high prices for qualityproducts, and their love of high-end brands has led tothe emergence of a mass-luxury market.Foreign brands that want to expand into Japanwould be wise to enlist the help of a cross-bordereCommerce expert to help deal with the nuances ofthe market, as Japanese shoppers are significantlydifferent to shoppers in Europe and the US – they’reolder, like to stay at home, and have a high averageorder spend.4GLOBAL ECOMMERCE MARKET RANKING 2019 - 7

SPOT LIGH T ON: GE R M A N YGermany, the biggest online shopping marketin mainland Europe, has placed fifth on oureCommerce market ranking. As one of the mostmature eCommerce markets in the world, Germanyis home to 63.9 million online shoppers who wereamong some of the first to embrace eCommerce.Additionally, Germany was ranked number 1 forlogistics globally, making it the perfect market forbrands to consider in their cross-border strategy.The reasons Germany ranks so highly for logisticsare numerous: it is a trans-European hub thatshares a border with nine neighbouring countries,it is considered the gateway to Europe thanks toits attractive location, and it has some of the mostadvanced transportation infrastructure in the world.This makes cross-border delivery significantly easierfor international brands as there are much lowerbarriers to entry.5GLOBAL ECOMMERCE MARKET RANKING 2019 - 8

GLOB A LECOMME RCEMARKETR A NK ING2 0 19GLOBAL ECOMMERCE MARKET RANKING 2019 - 9

THE R A NK INGDiscover the top performingmarkets in each category.S HOPPE R S PE NDINGWhen international brands are formulating theircross-border strategy, they need to think aboutshopper demand for their product, and averageshopper spend in the country.2 000The top 5 eCommerce markets for revenue pershopper are: 1 951.112. Norway 1 719.963. UK 1 639.234. Denmark 1 383.155. Austria 1 249.62Revenue in U.S. dollars1. USA1 5001 0005000USANORWAYUKDENMARKAUSTRIAGLOBAL ECOMMERCE MARKET RANKING 2019 - 10

L A RGE S T M A R K E T SAs part of general research for a cross-border strategy,it is important for retail brands to have knowledge ofthe world’s largest eCommerce markets.600Top 5 eCommerce markets by revenue1. China 636.09 billion2. USA 504.58 billion3. Japan 104.04 billion4. UK 86.45 billion5. Germany 70.35 billionRevenue in billion U.S. INDIAUSAINDONESIAJAPANSWEDENKOREAUKNORWAYUSA1 0001. China1 billion2. India360.1 million3. USA258.5 million4. Indonesia107 million5. Japan89.9 million800Million of onilne shoppersTop 5 markets by total number of online shoppers6004002000Top 5 markets by number of online shoppers(% of population)1. Sweden84.65%2. Korea80.56%3. UK79.8%4. Norway79.25%5. USA78.9%Percent of population shopping online100806040200GLOBAL ECOMMERCE MARKET RANKING 2019 - 11

LOGI S T IC SLogistics are one of the most crucial considerations for any brandexpanding internationally. A successful logistics strategy not only requiresan excellent delivery experience, it encompasses the entire supplychain: inventory, fulfilment and warehousing, customs processing andreverse logistics. The World Bank’s LPI Ranking is the global standard forlogistics and compares 160 countries across 6 subindicators: customs,infrastructure, international shipment, logistics competence, tracking andtracing, and timeliness. Three particularly important metrics in the LPIRanking are:The top 5 countries forlogistics globally pan3Austria1Germany4Germany2Sweden5United ArabEmirates3Japan4Denmark5NetherlandsThe top 5 countries forinternational shipments:The top 5 countriesfor customs:GLOBAL ECOMMERCE MARKET RANKING 2019 - 12

CROS S BOR DE R S HOPPINGAs consumer trust for eCommerce grows, a significantamount of online shoppers are now shopping acrossborders. This is an important metric for brands as itwill provide insight into the appetite for internationalbrands within a region.1. China149.42 million2. USA82.72 million3. India53.02 million4. Russia49.66 million5. Mexico40.33 millionMillion cross border online shoppersTop 5 countries by number of cross-border onlineshoppers15010050Top 5 countries for cross-border eCommerce by %of overall online spend1. Portugal86%2. Latvia86%3. Ireland81%4. Croatia81%5. Switzerland80%% of overall online spend for cross-border MEXICO100806040200CROATIA SWITZERLANDGLOBAL ECOMMERCE MARKET RANKING 2019 - 13

GROW T HThe high-growth region of Southeast Asia representsa huge opportunity for international brands. Thisexciting region is home to over 350 million onlineshoppers, however it is has not yet been saturated byinternational retail players, unlike China or Japan.Double-digit eCommerce growth in emerging Asianmarkets has been triggered by the introduction ofmarketplaces such as Flipkart in India, and increasedlogistics and broadband infrastructure.1. India19.8%2. Malaysia17.6%3. Indonesia16.6%4. Philippines15.2%5. Vietnam13.5%% of CAGR growth 2018-2022Top 5 countries by % of CAGR growth 2018-202220151050INDIAMALAYSIA INDONESIA PHILIPPINES VIETNAMGLOBAL ECOMMERCE MARKET RANKING 2019 - 14

M A R K E T S TO WATCHOutside of the top 30 ranking, there are some othervery interesting markets that should not be ignoredwhen it comes to CAGR. The following countries haveseen incredible growth in the past few years and areforecasted to continue the same trajectory until 2022.These five countries are experiencing extraordinarygrowth in the eCommerce sector thanks to a strongpopulation of internet users that are well-versed inthe use of digital technologies, mobile and onlineshopping.15Top 5 countries to watch (beyond the top 30)101. Thailand – 13.3%2. South Africa – 13.2%3. New Zealand – 13%4. Romania – 11.3%% of CAGR growth 2018-2022Growing internet users mean these countries areideal markets for foreign brands to sell into.55. Estonia – 10.6%0THAILANDSOUTH AFRICA NEW ZEALANDROMANIAESTONIAGLOBAL ECOMMERCE MARKET RANKING 2019 - 15

PE A K S E A S ONRetail brands need to prepare for an influx of salesduring the peak holiday season in that starts in earlyOctober and runs until after Christmas. To provide aninsight for brands forecasting their peak season sales,we have analysed our own data and found the topperforming markets by percentage uplift during theprevious 2017 holiday period.Additionally, we saw significant sales increases duringthe peak 2016 and 2017 retail periods across ourtop 5 best performing markets: Australia, Canada,Germany, Mexico and the UK. It is evident from ourdata that there has been a consistent spike in salesstarting around early October, before peaking in lateNovember – Black Friday and Cyber Monday andgradually decreasing back to steady sales throughJanuary. Across these 5 markets, our data shows anaverage order increase of 117% between November23 and November 24 (Black Friday 2017).Average peak season % uplift in eCommerce market0Top 10 eCommerce markets by average peakseason % uplift1. Ireland – 634%2. Italy – 311%3. Poland – 308%4. Denmark – 300%5. Netherlands – 291%6. USA – 291%7. Sweden – 279%8. UK – 270%9. Slovenia – 264%10. Hungary – HERLANDSUSASWEDENUKSLOVENIAHUNGARYGLOBAL ECOMMERCE MARKET RANKING 2019 - 16

CONCLU S IONAs the appetite for online shopping grows, retailersneed to consider their strategy for gaining crossborder shoppers. Brands should not fear increasedcompetition by expanding internationally – delayingthis will be much more detrimental to sales in thelong term.With this in mind, brands wishing to expand shouldweigh up all the considerations outlined in the abovemarket ranking and compare this to their own figuresto decide which markets should be entered.Brands need also be prepared to enhance everyaspect of the end-to-end online shopping experiencefrom fully-landed pricing, localized paymentmethods, international shipping, customs clearance,international returns to duty drawback.To do this, consideration should be made to partnerwith a provider that can navigate each market’sintricacies and nuances, so the retail brand can focuson doing what they do best – sell products.GLOBAL ECOMMERCE MARKET RANKING 2019 - 17

A BOU T E S HOP WOR LDeShopWorld guides the world’s best brands andretailers to make global shopping better, safer, simplerand faster, by optimizing the end-to-end crossborder eCommerce customer experience. From localpricing with duty and tax calculations, to optimizedcheckout, local payments, preferred shipping,customer service and returns, our solution managesthe entire shopper journey. Leveraging their existingsite, retailers can rapidly enter markets with highconverting, hyper-localized experiences that driveprofitability and growth.promotions, checkout messaging, shipping thresholds,pricing strategies and more. And all shopper dataremains the property of the brand.Our global eCommerce experts and active accountmanagers are located around the world, to guidebrands in delivering optimal shopper experiences,market by market. Our deep local shopperknowledge and our suite of reporting and analyticaltools give retailers deep insight into what is drivingsuccess in each market, with strategic and tacticalrecommendations on how to maximize performance.With mature, in-country solutions across Nth America,eShopWorld takes the complexity and uncertaintyEurope and Asia, our platform protects the brandout of global eCommerce, empowering brands andrelationship with the shopper at every touchpointretailers to Sell Global, Feel Local TMon the shopper journey, and offers full branding,control and flexibility over key propositions such asSources include: eShopWorld, Statista, WorldBank, eMarketer, New ZealandEVERY GREAT JOURNEY BEGINS WITH THE FIRST STEPThat first step is a conversation. If you’re ready to talk, we’re ready to share withyou how we can drive success on your global eCommerce journey.Ready?SCHEDULE A DEMOGLOBAL ECOMMERCE MARKET RANKING 2019 - 18

Issue Date: November 2018

GLOBAL ECOMMERCE MARKET RANKING 2019 - 8 SPOTLIGHT ON: GERMANY Germany, the biggest online shopping market in mainland Europe, has placed fifth on our eCommerce market ranking. As one of the most mature eCommerce markets in the world, Germany is home to 63.9 million online shoppers who were among some of the