Transcription

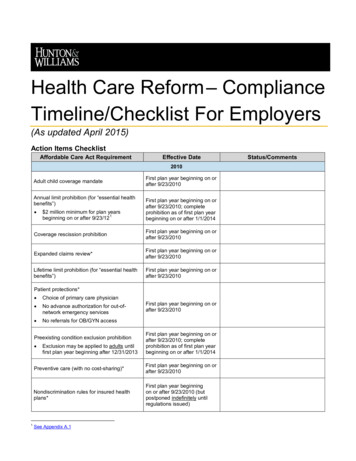

Health Care Reform – ComplianceTimeline/Checklist For Employers(As updated April 2015)Action Items ChecklistAffordable Care Act RequirementEffective Date2010Adult child coverage mandateAnnual limit prohibition (for “essential healthbenefits”) 2 million minimum for plan years1beginning on or after 9/23/12First plan year beginning on orafter 9/23/2010First plan year beginning on orafter 9/23/2010; completeprohibition as of first plan yearbeginning on or after 1/1/2014Coverage rescission prohibitionFirst plan year beginning on orafter 9/23/2010Expanded claims review*First plan year beginning on orafter 9/23/2010Lifetime limit prohibition (for “essential healthbenefits”)First plan year beginning on orafter 9/23/2010Patient protections* Choice of primary care physician No advance authorization for out-ofnetwork emergency services No referrals for OB/GYN accessPreexisting condition exclusion prohibition 1Exclusion may be applied to adults untilfirst plan year beginning after 12/31/2013First plan year beginning on orafter 9/23/2010First plan year beginning on orafter 9/23/2010; completeprohibition as of first plan yearbeginning on or after 1/1/2014Preventive care (with no cost-sharing)*First plan year beginning on orafter 9/23/2010Nondiscrimination rules for insured healthplans*First plan year beginningon or after 9/23/2010 (butpostponed indefinitely untilregulations issued)See Appendix A.1Status/Comments

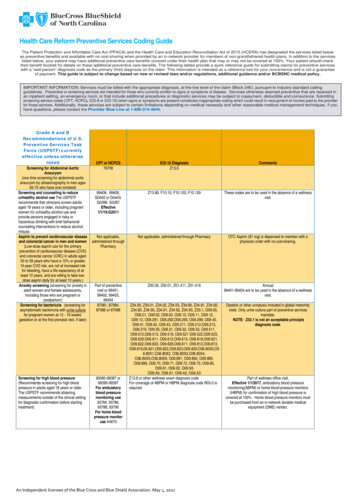

Affordable Care Act RequirementEffective DateStatus/Comments2011Over-the-counter drug reimbursementprohibition (without a prescription) for flexspending, health reimbursement and healthsavings account arrangements1/1/20112012Preventive care for women (with no cost2sharing)*First plan year beginning on orafter 8/1/2012Summary of benefits and coverage (SBC)3disclosureFirst open enrollment periodbeginning on or after 9/23/2012Comparative effectiveness research (CER)4feeFirst plan year ending on orafter 10/1/2012 (for calendaryear plans, first fee due7/31/2013)Form W-2 reporting of value of employer5provided health coverageEffective 2012 (for W-2sdue in 2013)2013Healthcare flexible spending account 2,5006contribution limitationFirst FSA plan year beginningon or after 1/1/2013Medicare employment tax increase for high7earners1/1/2013Employee exchange notice810/1/2013Adult obesity screening/counseling*First plan year beginning onor after 7/1/132014Adult child coverage mandateAnnual limit prohibitionhealth benefits”)109First plan year beginning on orafter 1/1/2014(for “essentialFirst plan year beginning on orafter 1/1/2014Essential health benefits coverage11mandate* (for small insured GHPs only)First plan year beginning on orafter 1/1/20142See Appendix A.2See Appendix A.3See Appendix A.45See Appendix A.56See Appendix A.67See Appendix A.78See Appendix A.89See Appendix B.110See Appendix B.211See Appendix B.3342Hunton & Williams LLP Health Care Reform—Compliance Checklist Timeline (4/2015)

Affordable Care Act RequirementEffective DateParticipant cost-sharing for all GHPs limitedto high deductible health plan maximums,while only small insured GHPs are subject to12specified deductible limits*First plan year beginning on orafter 1/1/2014Preexisting condition exclusion prohibition90-day waiting period limitation1314Wellness program incentive increaseFirst plan year beginning on orafter 1/1/2014First plan year beginning on orafter 1/1/201415Prohibition on provider discrimination*First plan year beginning on orafter 1/1/201416First plan year beginning on orafter 1/1/2014Prohibition on discrimination with respect to17clinical trial participation*First plan year beginning on orafter 1/1/2014Health insurance exchange coverage18available1/1/2014Excise tax (individual coverage mandate)19Transitional Reinsurance Program20contribution1/1/2014First contribution due 2015, with initialreporting at 2014 year-end1/1/2014 (Submission ofenrollment counts delayed fromNovember 17, 2014 toDecember 5, 2014)Mental Health Parity and Addiction Equity Act21of 2008 (MHPAEA) rulesFirst plan year beginning on orafter 7/1/2014Additional preventive care coverage22requirementsFirst plan year beginning after9/24/2014 Status/Comments2015 and LaterExcise tax/penalties (employer “shared23responsibility” coverage mandate) Penalty for failing to offer coverage tosubstantially all “full-time” employees and24their dependents Alternative penalty for failure to providecoverage to “full-time” employees that is“affordable” and provides “minimum25value” (applies only if not subject tofailure to offer coverage penalty)Originally 1/1/2014; now 2015for employers with 100 or morefull-time employees; 2016 foremployers with less than 100full-time employeesNOTE: Prohibition on use of minimum valuecalculator for plans that do not providesubstantial coverage for in-patienthospitalization services issued November 4,2014.12See Appendix B.4See Appendix B.5See Appendix B.615See Appendix B.716See Appendix B.817See Appendix B.918See Appendix B.1019See Appendix B.1120See Appendix B.1221See Appendix B.1322See Appendix B.1423See Appendix C.11314Hunton & Williams LLP Health Care Reform—Compliance Checklist Timeline (4/2015)3

Affordable Care Act RequirementIRS annual reporting requirements for HealthInsurance Issuers and Self-Insured GroupHealth Plan Sponsors and for Applicable26Larger EmployersHHS annual reporting requirements*27Status/CommentsFirst returns due in 2016 (forcoverage in 2015)Generally effective 1/1/2014(but reporting to begin noearlier than 2015)By 12/31/2015 (12/31/2016 forsmall health plans)HIPAA electronic transaction rules –28compliance certification requirementsAuto enrollmentEffective Date29To be determined (under DOLregs)Excise tax (employer-sponsored high cost30health coverage)1/1/2018HIPAA electronic transaction rules – Health31Plan Identifier (HPID) requirementOriginally 11/5/2014 (11/5/2015for small health plans);indefinitely delayedNote that several Affordable Care Act requirements do not apply to plans, policies or benefit packages that constitute exceptedbenefits. (See “Note Regarding Excepted Benefits,” below.)*Applies only to non-grandfathered health plans – generally, plans established on or after March 23, 2010 and pre-existinghealth plans that lose grandfathered status on or after March 23, 2010.24See Appendix C.1.aSee Appendix C.1.c26See Appendix C.2 & Appendix C.327See Appendix C.428See Appendix C.529See Appendix C.630See Appendix C.731See Appendix C.8254Hunton & Williams LLP Health Care Reform—Compliance Checklist Timeline (4/2015)

AppendixA.several new definitions to the uniform glossary,and make certain clarifications regardingprovision of the SBC to plans and participants.The proposed changes will affect SBCs anduniform glossaries for open enrollment periodsbeginning on or after September 1, 2015.Compliance Requirements for 2010 – 20131.Restricted Annual Limit on Essential HealthBenefits (effective first plan year beginning on orafter September 23, 2010) Annual limit, if any, must not be less than 2,000,000 for plan years beginning on or afterSeptember 23, 2012.2. The government indicated in an FAQ inMarch 2015 that it expects to finalize theregulations in the “near future” and tofinalize the template and associateddocuments by January 2016; the finaltemplate is expected to apply for openenrollment starting in fall 2016.Preventive Care Services for Women (effectivefirst plan year beginning on or after August 1, 2012) Specific preventive care services for women mustbe covered without cost-sharing Breastfeeding support, supplies, andcounseling Contraceptive methods and counseling* Counseling and screening for humanimmune-deficiency virus Counseling for sexually transmitted infections Human papillomavirus testing4. Screening and counseling for interpersonaland domestic violence Self-insured plans and health insurance issuersmust pay a CER fee (initially, 1 per covered life; 2 for plan years ending on or after 10/1/2013 orbefore 10/1/2014; and to be determined by HHSthereafter) to help fund the Patient-CenteredOutcomes Research Institute. The fee must bereported/paid to the IRS by July 31 of the calendaryear following the end of the applicable plan yearon IRS Form 720. (See Form 720 Instructions.) Screening for gestational diabetes Well-woman visits3.*NOTE: There are exceptions to this requirementfor qualifying religious organizations and qualifyingnonprofit religious organizations that provide noticeto their insurers or third-party administrators, plus adelayed effective date for nonqualifying religiousorganizations to the first plan year that starts on orafter January 1, 2014. Proposed rules seekcomment on extending this exception to closelyheld for-profit entities.Summary of Benefits and Coverage (SBC)(effective first open enrollment period beginning onor after September 23, 2012) Coverage descriptions, exceptions, reductions,and limitations must be disclosed, in addition tocost-sharing provisions and other related items;Department of Labor (“DOL”) standard template.5.6.(See August 6, 2012 HELP Blog for additionaldetails.)Healthcare Flexible Spending Account 2,500Contribution Limit (effective for FSA plan yearsbeginning on or after January 1, 2013) Limit applies only to employee elective contributions, and not employer matching or other nonelective contributions to an FSA. Uniform glossary of health coverage-related andmedical-related terms must be available in paperor electronic form; Health and Human Services(“HHS”) standard template. In December 2014 the government proposedregulations that would shorten the SBC to 2 ½pages from 4 pages, add one new example(broken foot and emergency room visit), add(See July 10, 2012 HELP Blog for additional details.)Form W-2 Reporting Requirement (effectiveJanuary 1, 2012 for W-2s to be issued in 2013) In general, aggregate value of employer-providedhealth coverage must be reported annually on theForm W-2 for each covered person. Notice of coverage modifications must beprovided at least 60 days in advance of theeffective date of the changes. For SBCs for 2014, the SBC must state whetherthe plan/coverage (1) provides “minimumessential coverage” for purposes of meeting theindividual coverage mandate (see B.12 on page7) and (2) meets the “minimum value”requirements (see B.11 on page 7)(See July 17, 2012 Hunton Employment & LaborPerspectives (HELP) Blog, FAQS About ACAImplementation (Part XIV), and January 29, 2015HELP Blog post for additional details)SBCs are not required for plans, policies or benefitpackages that constitute excepted benefits. (See“Note Regarding Excepted Benefits,” on page 12.)Comparative Effectiveness Research (CER) Fee(effective for plan years ending on or afterOctober 1, 2012) Cafeteria/flexible benefits plan must be amendedto include the new contribution limit byDecember 31, 2014.7.(See July 11, 2012 HELP Blog for additional details.)Medicare Employment Tax Increase (effectiveJanuary 1, 2013) New 0.9% rate increase for earnings over 200,000 for single filers and 250,000 formarried joint filers. Employees are liable for payment of the tax, asthe increase only applies to the employee-paidportion of FICA taxes.Hunton & Williams LLP Health Care Reform—Compliance Checklist Timeline (4/2015)5

limits for high deductible health plans (HDHPs).(Note, though, that the required COLAadjustments for these limits are different fromthose that apply to HDHPs, and, therefore, will notnecessarily be the same dollar amount in lateryears.) Employers are required to collect the additional0.9% tax only to the extent that the employer payswages to the employee that exceed 200,000each calendar year (regardless of the employee’sfiling status or other income). For example, anemployer is not required to collect the additionaltax from an employee who earns 100,000, eventhough the employee’s spouse earns 300,000(and they file a joint return).8.(See September 18, 2012 HELP Blog for additionaldetails.)Employee Exchange Notice (effective October 1,2013) Employers must provide written notice about thehealth insurance exchanges to current employeesand new employees “at the time of hiring.” DOLissued guidance that provides that the notice mustbe given to current employees by October 1, 2013and new hires thereafter within 14 days of hire.The agency also provided the following modelnotices -- Notice for employer offering coverageand Notice for employer offering no coverage.(Note that only Part A of the model notice foremployers offering coverage is required in order tocomply). The DOL guidance also requires actualdelivery of the notice – so, simply posting thenotice to a company intranet site may not besufficient.B.Compliance Requirements for 20141.Adult Child Coverage (effective first plan yearbeginning on or after January 1, 2014) Grandfathered plans must extend coverage tochildren, up to age 26, regardless of otheravailable employer-sponsored coverage.2.Annual Limit on Essential Health Benefits(effective first plan year beginning on or afterJanuary 1, 2014) Annual dollar limits no longer allowed for essentialhealth benefits.3.Essential Health Benefits Coverage (effective firstplan year beginning on or after January 1, 2014) Non-grandfathered insured group health plans inthe small group market (“small insured GHPs”) arerequired to cover essential health benefits. Essential health benefits include: ambulatorypatient services; emergency services; hospitalization coverage; maternity and newborn care;mental health and substance use disorderservices, including behavioral health treatment;prescription drug coverage; rehabilitative andhabilitative services and devices; laboratoryservices; preventive and wellness services;chronic disease management; and pediatricservices, including oral and vision care; HHS hasissued proposed regulations addressing theserequirements.4. However, only small non-grandfathered insuredGHPs must comply with the applicable deductiblelimits ( 2,000 for individual coverage; 4,000 forfamily coverage).(See FAQs About ACA Implementation (Part XII)(Q&As 1 & 2) and (Part XIX) (Q&As 2-4) foradditional details).5.Preexisting Condition Exclusion (effective firstplan year beginning on or after January 1, 2014) All preexisting condition exclusions are prohibited. As a result, no certificates of creditable coverageare required to be issued after December 31,2014.6.90-Day Waiting Period Limitation (effective firstplan year beginning on or after January 1, 2014) Period in which an otherwise eligible employeecan commence health plan participation cannotexceed 90 days. Final regulations provide that a bona fideorientation period, a cumulative hours of servicerequirement (up to 1,200 hours) and certain otherlimitations not based solely on the passage of timewill generally qualify as a bona fide eligibilityrequirement that will not be treated as a waitingperiod. For plan years beginning before January 1,2015, an orientation period of up to 1 calendarmonth will be considered bona fide. For plan years beginning on or after January 1,2015, the 1-month bona fide orientation periodis calculated by adding one calendar month andsubtracting one calendar day. Note that the orientation period rules do notapply in determining whether coverage is timelyoffered for purposes of the employer mandate(discussed in Appendix C.1). The final regulations also clarify that formeremployees who are rehired can be treated as“new” employee and be subject again to a waitingperiod (as long as the termination was notintended to avoid compliance). The same is alsotrue for employees transferring to and from eligiblepositions/categories, as they can be treated asnewly eligible for this purpose upon transfer to aneligible position/category.(See December 4, 2012 HELP Blog, April 21, 2014HELP Blog, and July 7, 2014 HELP Blog posts foradditional details and background on the waitingperiod rules.)Cost-Sharing Restrictions (effective first plan yearbeginning on or after January 1, 2014) All non-grandfathered GHPs must limit participantcost sharing expenses to the annual out-of-pocket6Hunton & Williams LLP Health Care Reform—Compliance Checklist Timeline (4/2015)

7.Increased Wellness Program Incentive (effectivefirst plan year beginning on or after January 1, 2014) Final regulations provide that all plans (and notjust non-grandfathered plans) that offer “healthcontingent” wellness incentives may provide areward of up to 30% (up from 20%) of the cost ofhealth coverage (50% for tobacco cessationprograms) for such incentives. The final regulations also: Clarify that the incentive may be based on thetotal cost of the applicable coverage (and notjust the employer-paid piece). If onlyemployees may participate in the healthcontingent wellness program, the reward mustbe based on the total cost of employee-onlycoverage. If, however, dependents may alsoparticipate in the program, the reward may bebased on the total cost of coverage in which anemployee and any dependents are enrolled. Provide that to satisfy the “reasonable alternative” standard, the employer is required to makeavailable and pay the cost of the alternative,e.g., membership fees for a diet program (butnot the cost of the food), and the timecommitment for the alternative must bereasonable. Distinguish between two types of healthcontingent wellness programs: (i) “activity-only”(not based on attaining a specific healthoutcome); and (ii) “outcome-based” (based onsatisfying a measurement, screening or test,such as having a specified BMI or cholesterollevel). Provide that the “reasonable alternativestandard” requirement applies to bothactivity-only and outcome-based programs, asfollows: (i) activity-only programs must providethe reasonable alternative standard for anyindividual with a medical condition that preventsthem from meeting the initial standard, and(ii) outcome-based programs must provide thereasonable alternative standard for allindividuals who do not meet the initial standard,regardless of their medical condition.8.Provider Discrimination (effective first plan yearbeginning on or after January 1, 2014) Non-grandfathered plans may not discriminateagainst health care providers due to the provider’sunwillingness to provide, pay for, cover, or referfor abortions.9.Clinical Trial Participation (effective first plan yearbeginning on or after January 1, 2014) Non-grandfathered plans may not restrict (orengage in any discriminatory practices regarding)participation in federally-funded clinical trials,FDA-studies, or other exempt drug studies.10. Health Insurance Exchange (effective January 1,2014) Health insurance exchange coverage is available.11. Individual Excise Tax/Individual CoverageMandate (effective January 1, 2014) Individuals who do not enroll in minimum essentialcoverage must, beginning in 2014, pay an excisetax equal to the greater of (i) 1% of householdincome that exceeds certain threshold amountsand (ii) 95 per uninsured adult in the household.This will increase to the greater of 325 peruninsured adult or 2% of household income in2015 and 695 per uninsured adult or 2.5% ofhousehold income in 2016.12. Transitional Reinsurance Program Contribution(effective January 1, 2014) Health insurance issuers and self-insured plans(or third party administrators, on behalf of selfinsured plans) must pay annual contributions toHHS to help stabilize premiums in the individualmarket from 2014 through 2016. HHS will determine a national contribution rate(which HHS has announced will be 63 percovered life for 2014 and 44 per covered life for2015); States may assess additional amounts ifthey establish their own reinsurance programs(but these will not apply to ERISA-covered selfinsured group health plans). Because the contribution will be based on thenumbered of “covered lives” under covered programs, each will be required to submit an annualcensus count to HHS at the end of each year.Covered lives are determined in a manner similarto

6 Hunton & Williams LLP Health Care Reform—Compliance Checklist Timeline (4/2015) limits for high deductibEmployers are required to collect the additional 0.9% tax only to the extent that the employer pays wages to the employee that exceed 200,000 each calendar year (reg

![Financial Services Regulatory Reform (00C) [Read-Only]](/img/2/2018-03-29-davis-polk-financial-services-regulatory-reform-tool-march-2018.jpg)