Transcription

ADP TotalSourcE Health Care ReformEmployer SolutionsADP TotalSource offers acomprehensive solution to helpbusinesses address their HRbusiness strategy as it relatesto Health Care Reform.HR. Payroll. Benefits.

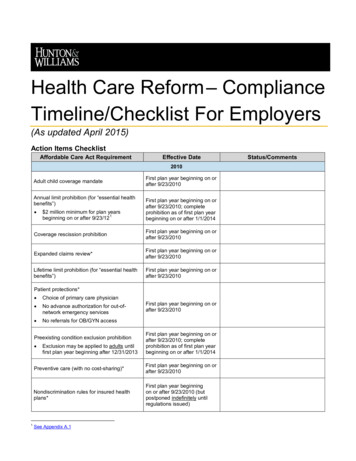

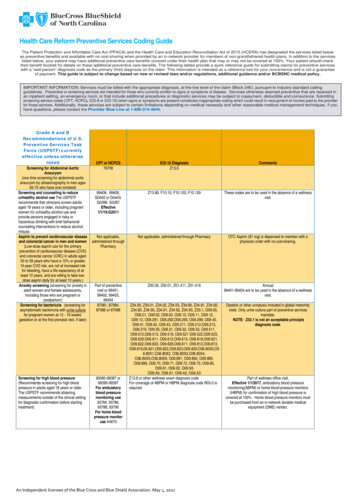

Health Care Reform Is Here to Stay – Now What?Companies of all sizes are affected by the Affordable Care Act (ACA), also known as Health CareReform (HCR). Trying to make sense of the law and the corresponding regulations and guidance can beoverwhelming. This is particularly true for employers, who may need to revise their policies and proceduresin order to remain compliant with the additional administrative and reporting requirements.It’s now a certainty that Health Care Reform is here to stay. So, what does an employer need to knowabout complying with the law? You can start by understanding key provisions and important dates andtaking proactive measures in order to prepare for the still-pending requirements and deadlines of theAffordable Care Act.A Trusted PartnerAs a Health Care Reform trusted partner, ADP TotalSource supports its clients in complying with mandatedprovisions and, in addition, provides educational guidance on the implications of new Affordable Care Actprovisions in the evolving health and benefits environment. A PEO such as ADP TotalSource is uniquelypositioned to assist clients in complying with the Affordable Care Act, as we manage payroll data, benefitsplan information and employer tax withholding as part of the PEO relationship. With other outsourcingmodels, an employer may be responsible for doing additional work to comply, as those providers may not beactively managing all the information and data that may be required to determine compliance with certainACA provisions. There is no better time than now to leverage the expertise and guidance of ADP TotalSource.TotalBenefits, the ADP TotalSource Health Care Reform Employer Solution, provides an integratedadministration solution, including fiduciary and compliance oversight coupled with integrated payroll and HRdata management – all powered by the Web and the latest mobile technology. As a client, you’ll have access tothe ADP TotalSource Solution, which includes a cost-effective, high-end and robust product offerings throughthe Health and Welfare Plan sponsored by ADP TotalSource. In addition to Plan offerings, you’ll also haveaccess to other valuable benefits and programs.The ADP TotalSource SolutionAdvantages to Your Business Health, Dental & Vision coverage Consumer-driven health plans, including HighDeductible Health Plan offerings and access toJPMorgan Chase Health Savings Account (HSA)TotalSource maintains fiduciary responsibilityas Plan Sponsor and handles all ERISA reportingand disclosure requirements for the Health andWelfare Plan Life & Disability coverage Flexible Spending Account (FSA)Flexibility and choice for your employees withoutthe administrative burden Employee Assistance Program (EAP) TotalChoice Voluntary Benefit ProgramAbility to attract top talent, reduce employeeturnover and drive profits Online Commuter Benefits (OCB) Program Enhance employee total compensation package Health Advocate Allows you to focus on your business strategiesand growth initiatives 401(k) Full plan administration, including COBRA/HIPAA administration Self-service enrollment tools

Medical Loss Ratio (MLR) RebatesEmployers/Plan Sponsors must evaluate available MLR rebates in accordance with regulatory guidanceannually and determine whether to distribute MLR rebate dollars to all employees/former employees who wereplan participants for the reporting plan year, reduce the cost of future participant premiums, or spend the rebateon enhancing their health and welfare programs.The ADP TotalSource SolutionAdvantages to Your Business As Plan Sponsor, TotalSource manages theadministration and analysis of any MLRrebates received from our health insurancecarriers annually Reduces the administrative burden of rebatecalculation analysis and distribution Increases employee satisfaction and engagementwith timely and detailed answersEmpowers employees with access to theADP TotalSource Employee Service Center toaddress questions regarding rebate notifications Helps optimize rebate dollars most effectively toreduce total cost of healthcare Summary of Benefits and Coverage (SBC)Insurers and employers must provide SBCs during annual enrollment periods beginning on or after9/23/12 and for other enrollments; and upon request, for plan years beginning on or after 9/23/12.The ADP TotalSource SolutionAdvantages to Your Business Distributes SBCs during open enrollmentperiods, qualified life status change events,new hire enrollment and upon request Mitigates risk of penalties due to noncompliance Reduces administrative burden ofcommunicating SBCs to employees Supports electronic and/or paper deliveryof SBCs to employees Empowers employees with access to coveragerelated information upon demand Empowers employees with access to theADP TotalSource Employee Service Centerto address questions

2013Form W-2 ReportingEmployers that issued 250 or more W-2s in 2011 must include the value of group health coverage providedto employees on Forms W-2 beginning with those issued for the 2012 tax year. This requires employers toconfirm that their payroll system is set up to track and include this figure on Forms W-2 issued for tax years2012 and beyond.The ADP TotalSource SolutionAdvantages to Your Business Year-end payroll processing and validation Reduces the risk of penalties for incorrect W-2s As W-2 employer of record and Plan Sponsor,ADP TotalSource reports the value of coverageprovided through the ADP TotalSource Healthand Welfare Plan Reduces the administrative burden of trackinghealth premium values and analysis Increases transparency and helps employeesunderstand their overall compensationpackage better Empowers employees with access to the ADPTotalSource Employee Service Center to addressquestions concerning payroll Proactively reaches out to clients to confirmW-2 updates1 Answers W-2 inquiries from employeesand clientsMedicare Tax on Wages and Unearned IncomeAn additional Medicare tax of 0.9% will apply to wages earned over 200,000 if filing single, 250,000 ifmarried filing jointly, and 125,000 if married filing separately. Additionally, a new 3.8% Medicare tax will beimposed on unearned income for individuals that exceed those salary thresholds.The ADP TotalSource SolutionAdvantages to Your Business Conducts an analysis of payrolland deductions for high-incomeemployees who may meet criteriafor the new taxes, and shares withour clientsIncreases employee satisfaction andallows highly compensated/executiveassociates to work with their taxadvisors to plan for the future1E mployer must determine whether there are any benefits costs that should be reported on the W-2that are not part of the ADP TotalSource, Inc. Health and Welfare Plan, and report to ADP TotalSourcepayroll for inclusion in the W-2.

Flexible Spending Account(FSA) Annual LimitFor plan years beginning on or after 1/1/2013,a 2,500 limit applies to employee healthcareFSA pretax contributions.The ADP TotalSource Solution As Plan Sponsor, TotalSource managesthe Healthcare FSA administrationand monitors employee pretaxcontribution limits Delivers communications on new limitsand manages employee and clientinquiriesAdvantages to Your Business Reduces the administrative burden ofFSA product management Boosts employee engagement byproviding informative communicationand increasing participationEmployee Notice of ExchangePending additional guidance, employers must provide current employees with notice describing availability ofexchange coverage. Notice must also be provided upon hire for employees hired on or after the effective date.2The ADP TotalSource SolutionAdvantages to Your Business Helps ensure compliance with exchange noticerequirements Reduces the administrative burden ofcommunicating the exchange option to employees Timely electronic and hard copycommunications/notices to new hires as partof the onboarding process describing theavailability of exchange coverageAnswers inquiries from employees and clients2 The Department of Labor (DOL) has announced that the March 1, 2013 deadline for employers to distribute the “Notice of Exchange” to employees hasbeen delayed until the late summer or fall of 2013. The DOL has indicated that it plans to issue further guidance in the late summer or fall of 2013which may include model language, or specific guidance regarding the required format and content of the notice.

2014Automatic Enrollment and Nondiscrimination RuleThere are two provisions that are pending guidance before they become effective in 2014 or later.The automatic enrollment provisions require that employers with 200 or more full-time employeesmust automatically enroll new employees in the employer’s group health plan. In addition, new nondiscrimination rules will be issued that apply to insured employer group health plans, regardless of size,which will prohibit certain practices that may discriminate in favor of highly compensated employees.The ADP TotalSource SolutionAdvantages to Your Business ADP TotalSource will assist larger clients withcomplying with the automatic enrollmentprovisions Reduces the administrative burden of complyingwith nondiscrimination testing and automaticenrollment requirements Managing application of nondiscriminationrules and testing Mitigates the risk of penalties due tononcomplianceAnnual Dollar Limits and Waiting Periods/Pre-ExistingCondition ExclusionsFor plan years beginning on or after 1/1/2014, employer group health plans may not impose annualdollar limits on essential health benefits, waiting periods of longer than 90 days, or pre-existingcondition exclusions.The ADP TotalSource SolutionAdvantages to Your Business Compliant group health plan offerings Reduces the administrative burden Automated benefits eligibility system Helps ensure compliance and mitigate risk Consultation and education to employersregarding new requirements

2015Employer Shared Responsibility*Employers with 50 or more full-time employees, including full-time equivalents, must offer affordable coveragethat also provides a “minimum value” to their full-time employee workforce or potentially be subject to penalties.The ADP TotalSource SolutionAdvantages to Your Business Helps mitigate the penalty risk related to theoffering of benefits Aids compliance regardless of company size Helps reduce the administrative burden indetermining the cost of benefits to employeesrelative to employee wage levels Makes recommendations on benefitsthresholds relative to wage trendingto mitigate the risk of penalty inaccordance with the employeraffordability safe harbor anceActiveManagementof the SharedResponsibilityProvisionsWill Require anIntegratedApproachReporton Hoursof ServiceRBOLAView &Adjust ilityDeterminationE&TIMProvides assistance in determiningbenefits eligibility for employers thatmay have a variable workforceSITFEAbility ToSet ThresholdNotificationFor Total HoursCredited**MANAGEMENTDeductions& OtherEarningsAcquisition& Retentionof s an analysis of the employeeseligible to purchase benefits todetermine if all full-time employeesare offered coverage and if the coverageis affordableOPTIM BENProvides guidance and benefit options throughthe TotalSource Health and Welfare Plan thatmeets, or exceeds, minimum value requirementsL CORFRKEProvides tools to assist you in calculating yourlarge employer status (i.e., number of fulltime employees and/or full-time equivalents)and whether you are subject to a SharedResponsibility requirementWOActive Management of theShared Responsibility Provisions* The U.S. Department of Treasury announced Tuesday, July 2, 2013, that it would delay until 2015 the penalties and reporting requirements of the Affordable CareAct’s (ACA) shared responsibility provisions (also known as the employer “play or pay” mandate). Both the employer and insurer reporting requirements andany penalties under the employer mandate have been delayed until 2015.** This feature is scheduled to become available January 2014.

Partnering with a Professional Employer OrganizationA Collaborative ApproachIn this uncertain, quickly changing environment, employers need a guide. PEOscan relieve businesses of the compliance and administrative burdens that are associatedwith the Affordable Care Act, allowing them to focus on their core competencies and buildtheir businesses.For example, ADP TotalSource has been working since the inception of the ACA legislationto ensure that we have the most up-to-date information on reform guidance. As anorganization supporting more than 200,000 worksite employees, we have contracted withindustry-leading consulting and legal firms that also advise Fortune 500 companies. Butthe expertise of ADP TotalSource isn’t exclusively on the large-employer level. Because wework with thousands of small-to-midsized businesses nationwide, we’re also focused onissues that may be specific to those businesses.The primary question small businesses are asking about the Affordable Care Act is: Howis it going to affect my company? By using the resources of a trusted PEO such as ADPTotalSource to help manage the complexity of the Affordable Care Act, businesses canfocus on their future success. The ADP TotalSource integrated HR management solutionis driven by a powerful combination of benefits expertise, marketplace insight andexceptional client service.For more information, please go to: adptotalsource.com or call 1-800-447-3237.ADP TotalSource is committed to keeping you informed about how Health Care Reform will affect your business. Our goalis to minimize your administrative burden across the entire spectrum of payroll, tax, HR and benefits, so that you can focuson running your business. Neither the content nor the manner in which this notice is presented reflects the thoughts oropinions of ADP or its employees. This notice is provided as a courtesy, to assist in understanding the impact of certainregulatory requirements, and should not be construed as tax or legal advice. Such information is by nature subject torevision and may not be the most current information available. ADP encourages interested readers to consult withappropriate legal and/or tax advisors.ADP, the ADP logo, ADP TotalSource, TotalSource and In the Business of Your Success are registered trademarks of ADP, Inc.MKT263V2 0713 Printed in the USA Copyright 2013 ADP, Inc.

A PEO such as ADP TotalSource is uniquely positioned to assist clients in complying with the Affordable Care Act, as we manage payroll data, benefits plan information and employer tax with

![Financial Services Regulatory Reform (00C) [Read-Only]](/img/2/2018-03-29-davis-polk-financial-services-regulatory-reform-tool-march-2018.jpg)