Transcription

Certified Accounting TechnicianRegistered Cost AccountantCertified BookkeeperTopnotch CAT Reviewerswww.catreviewers.com

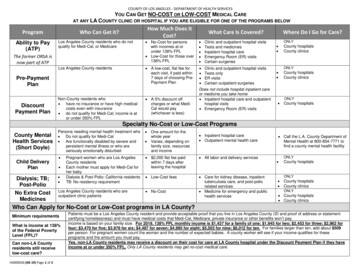

The ProgramThe CAT Program is a globally recognized program of the NationalInstitute of Accounting Technicians (NIAT) that grants the CAT designation to the successful professional here and abroad.The CAT Program focuses on developing a strong base of technicalaccounting knowledge and skills; analytical, organizational and interpersonal skills; and professional values essential for today’s successfulaccounting professionals.The CAT Program is designed to be an intensive bookkeeping programthat will equip the participant all the necessary skills for real life accountingwork.The CAT Program is recognized to be equivalent to the CAT designations of different institutes in the world, giving NIAT CAT s accessto memberships and recognition in countries such as Canada, UnitedKingdom, Australia, New Zealand, Europe, Hong Kong, China, Taiwan,Macau, the Middle East and Singapore.What is an ‘Accounting Technician’?Accounting Technician is a new terminology in the Philippine marketplacebut is widely used in Australia and the United Kingdom to identify a rangeof accounts or bookkeeping occupations working in all industries andsectors. An Accounting Technician carries out valuable accounting andrelated jobs. They work at all levels from account clerks to financialcontrollers. They work in all industries and sectors and in organizationslarge and small. In small organization, accounting technicians maybe theonly trained and qualified finance staff employed. In large corporation, theyare crucial part of a balanced team working alongside auditors andmanagement staffs.Topnotch CAT Reviewerswww.catreviewers.com

Like many professions, accountancy is changing. Rapid technologydevelopment, tax reform and organizational restructures require broaderand more flexible skills. Today's Accounting Technicians play an integralrole in the overall business management function and need to be equippednot only with core technical accountancy skills, but also vitalcomplementary skills in areas such as IT, communication, leadership andtime management.Certified Accounting Technician (CAT ) ExaminationThe CAT examination consists of three (3) levels:Part 1: Practical AccountingPart 2: Management AccountingPart 3: Taxation AccountingCertified Bookkeeper (CB) – CAT Part1 ExaminationSuccessful passers of the Part 1Examination are immediately eligible toapply as Certified Bookkeeper (CB)member of the Institute of CertifiedBookkeepers of UK, the largestbookkeeping institute in the world with over 150,000 members globally. CBmembers who wish to provide bookkeeping service, particularly in the UKcan avail of the Practicing Certificate sealed by the Institute, equivalent toLicensed Bookkeeper status in the UK.The Institute of Certified Bookkeepers of UK is the largest bookkeepinginstitute in the world with over 150,000 members globally. It promotes andmaintains the standards of bookkeeping as a profession, through theestablishment of series of relevant qualifications and the award of grade ofmemberships that recognize academic attainment and competence.Topnotch CAT Reviewerswww.catreviewers.com

Registered Cost Accountant (RCA) – CAT Part 2 ExaminationThe part 2 examination of CAT isaccredited by the Institute of CertifiedManagement Accountants (ICMA) ofAustralia to be equivalent to RegisteredCost Accountant (RCA) designation.CAT candidates can take this examindependently and qualified to apply asRCA upon passing.Institute of Certified Management Accountants (ICMA) of AustraliaThe Institute of Certified ManagementAccountants of Australia is the premiereprofessionalbodyofmanagementaccountants in the Australasian region.ICMA offers it eduCAT ion programs,including the master level post graduatecertification program, the CMA in all itsbranches in the region such as Australia,New Zealand, India, China, Singapore,Middle East, Hong Kong and now thePhilippines.Certified Accounting Technician CAT Part 3 ExaminationThe part 3 examination of CAT consists of payroll and taxationexamination. This is the final exam to complete the CAT examination.Candidates who pass all three levels of the CAT examination can applyas CAT from the Institute of Accounting Technicians of North America.IAT Canada is the premiere professional body of Accounting Technicians inNorth America. The CAT designation of IAT is accredited by variousuniversities from the UK and Australia as equivalent to Bachelors degree inInternational Accounting and recognized by many professionalTopnotch CAT Reviewerswww.catreviewers.com

institutes, including the Association of Chartered Certified Accountants(ACCA) of UK, the largest accounting body in the world. CAT membersfrom IAT can in fact become as CAT of ACCA UK without furtherexamination.Benefits of CAT CertificationWhen you attain the Certified Accounting Technician designation, you: Offer an employer proven specific skills and knowledge.Advance your career and increase your compensation.Put “CAT ” after your name, giving you the same distinction amongbookkeepers that “CPA” gives to certified public accountants.Increase your value to your company or clients — CertifiedAccounting Technicians can and do take on new responsibilities.Topnotch CAT Reviewerswww.catreviewers.com

CAT Examination Pathway3In Summary:Certified Bookkeeper a student may apply to become a CB if he or shefinished and passed Part 1 only.Registered Cost Accountant a student may apply to become an RCA ifhe or she finished and passed Part 2 only.Certified Accounting Technician a student may apply to become a CAT ifhe or she finished and passed ALL the Examinations (Parts 1, 2 and 3).Topnotch CAT Reviewerswww.catreviewers.com

CAT Challenge Exam SyllabusPART I FINANCIAL ACCOUNTINGModule 1 Recording Business TransactionsThis module covers the following learning objectives: Understand the basic principles of double entry accounting Understand the nature and accounting of a merchandising business and howit differs with a service business Analyze and record transactions in the accounts such as purchases andsales Prepare chart of accounts for a merchandising and service business Use T accounts to analyze transactions into debit and credit parts Compute total balances of accounts Prepare trial balance and learn its purposeModule 2 – Drafting Financial StatementsThis module covers the following learning objectives: Understand how the matching concept relates to and supports the accrualbasis of accounting Analyze and clarify why adjustments are necessary Make adjusting journal entries that will update the matching process Use six (6) column worksheet and prepare an adjusted trial balance Use worksheet serves as a device for collecting and summarizing data Prepare classified financial statement from a worksheet Prepare the adjusting and closing entries from a worksheet Post the adjusting and closing entries Prepare a post closing trial balance Prepare a multi-step and single-step income statement, statement of owner’sequity and balance sheet for a merchandising and service business. Complete the accounting cycle Prepare Financial StatementsModule 3 – Maintaining Financial RecordsThis module covers the following learning objectives: Understand how Special Journals, Controlling Accounts and SubsidiaryLedgers are used to summarize classes of business transactions Record Sales on account transactions in a Sales Journal Record Cash Receipts transactions in a Cash Receipts Journal Record Purchases on account transactions in Purchases JournalTopnotch CAT Reviewerswww.catreviewers.com

Record Cash Disbursements transactions in a Cash Payments JournalRecord Other transactions and adjustments in a General JournalPost and reconcile subsidiary account balances with controlling accountLearn the basic steps in computerizing an Accounting System using MicrosoftExcelUse Voucher system to control expendituresPrepare a voucher and record transactions in a Voucher RegisterModule 4 – Reconstructing Incomplete RecordsThis module covers the following learning objectives: Establish internal controls to safeguard assets, most especially cash Understand Single-Entry Bookkeeping systems Reconstruct incomplete records and looking for missing information Audit and review the accounting records of a business entity Convert cash basis of accounting to accrual basis of accounting Locate, analyze, and correct the errors committed Prepare of correcting entries, if necessary Recast of financial statements, if necessary or practical Detect the presence of frauds or misappropriations Reconcile a bank statement and prepare necessary entries Prepare reconstructed financial statements Analyze and interpret the financial statements prior to making an informeddecisionPART 2 MANAGEMENT ACCOUNTINGModule 5 – Understanding Management InformationThis module covers the following learning objectives: Appreciate the importance of financial and non-financial information forplanning, control and decision-making purposes Recognize the variety of cost units, cost centers and profit centers Differentiate between direct and indirect costs; fixed and variable costs;period and product costs; controllable and uncontrollable costs; avoidableand unavoidable costs; etc Identify cost classification for decision-making and planning Appreciate cost behavior patterns including linear, curvilinear and stepfunctions Appreciate the importance of unit costs for both financial and managementdecision makingTopnotch CAT Reviewerswww.catreviewers.com

Module 6 – Accounting for Materials, Labor and Overhead costsThis module covers the following learning objectives: Describe the methods and procedure of storekeeping, stocktaking andinventory control Explain and illustrate the perpetual inventory system and its proceduresdocumentation Explain and illustrate the methods available for pricing stores issues and forinventory valuation Explain the impact of different remuneration methods on the cost of finishedgoods Explain and illustrate the problems and procedures of identifying, analyzing,allocating and absorbing overhead costs Explain the different bases for overhead absorption rates Compute overhead absorption rate Differentiate and calculate plant-wide overhead rates and departmentaloverhead rates Explain and illustrate the principles and methods of treatment of under andover absorption of overhead costsModule 7 – Accumulating Costs for Products and ServicesThis module covers the following learning objectives: Explain the flow and accumulation of costs when using job costing Describe the purpose and content of job cost sheet Identify appropriate units for accumulation of control costs Explain the treatment of profit/loss on contracts including uncompletedcontracts Demonstrate the application and identification of cost units Explain and determine the equivalent units and cost per equivalent unit Demonstrate how costs are assigned to equivalent units using processcosting Demonstrate cost accounting methods used in cost processes, processlosses and work in progress Explain the difference between joint product and byproduct costingModule 8 – Budgeting for planning and controlThis module covers the following learning objectives: Identify and apply techniques for forecasting revenue and expenditures Prepare operational, cash, and capital expenditure budgets Explain the differences between fixed budgets, flexible budgets andreforecast Calculate variances and identify their casesTopnotch CAT Reviewerswww.catreviewers.com

Explain and illustrate the concept of zerobased budgetingExplain the uses and limitations of standard costingIdentify and determine different standards; basic, ideal, attainable and currentstandardsIdentify and calculate sales and cost variancesPrepare standard product cost and analyze different types of variancesbetween standard and actual product costsIdentify the significance of, and interrelationship between, variancesModule 9 – Estimating Costs and Revenues for Decision MakingThis module covers the following learning objectives: Calculate and explain the usefulness of contribution margin and contributionmargin ratio Determine the sales volume required to earn a desired level of operatingincome Identify the purposes of breakeven analysis Illustrate and determine the margin of safety Use Cost Volume Profit (CVP) relationships to evaluate a new marketingstrategy Identify assumptions underlying CVP analysisPART 3 TAXATION ACCOUNTINGModule 10 – Preparing Payroll ComputationsThis module covers the following learning objectives: Prepare the Withholding Tax, SSS, and Phil Health Tables Prepare payroll and pay slip formats Make the Formulas for Withholding Tax, SSS, Phil Health and Pag Ibigdeductions and Payslips using Link, Lookup and IF functions Customize Printing the Payroll and Payslips and use of macros Record gross pay and payroll deductionsModule 11 – Preparing Income Tax ComputationsThis module covers the following learning objectives: Understand the different sources of Income Identify allowable deductions and business expenses Compute Minimum Corporate Income Tax, Improperly Accumulated EarningsTax and Gross Income Tax for Corporations Prepare BIR (Bureau of Internal Revenue) Form 1702 Annual Income TaxReturnTopnotch CAT Reviewerswww.catreviewers.com

Prepare BIR Form 1702Q Quarterly Income Tax ReturnUnderstand compliance requirements such as keeping of Book of Accountsand preservation of Book of Accounts.Understand Registration Requirements of BIRUnderstand Issuance and Printing of Receipts, Sales Invoice or CommercialInvoiceModule 12 – Preparing Transfer and Business Tax ComputationsThis module covers the following learning objectives: Understand the concept and scope of Value Added Tax Compute VAT on Sale of Goods or Property, Sale of Service and Use orLease of Property, and Importation of Goods Compute Output and Input Taxes and VAT payable Prepare VAT accounting entries Understand VAT Exempt Transactions Understand compliance requirements for VAT as of registration, invoicing,accounting and return and payment of VAT Apply rates and bases of Percentage Tax Prepare BIR Form 1600 Monthly Remittance of VAT and Other PercentageTaxTopnotch CAT Reviewerswww.catreviewers.com

Academe PartnersIn cooperation with NIAT International partners, the CAT is recognized inselected UK and Australian universities for credit exemptions andadvanced standing. They can enroll in the following universities with yearlevel exceptions:Universities that accept CAT members at second year (level two) of theBA (Hons) Accounting and Finance degree:Universities that accept CAT members at third year (level three) of theBA (Hons) Accounting and Finance degree:Universities that accept CAT members at final year (level four) of the BA(Hons) International Accounting degree:Universities that provide course exemptions to CAT members forBachelor of Business degree:Topnotch CAT Reviewerswww.catreviewers.com

Global Employers trust the CAT The CAT is first and foremost an occupational qualification. You learnand develop by actually doing the work, rather than just preparing for theexam. We recognize your professional ability not just your memory whichis why CAT staffs are in such demand by employers.The CAT is recognized by employers across all sectors and all industries.The respect that employers hold for the CAT can be a massive boost toyour career prospects, whether you have already started out in your careeror are taking your first steps. The CAT will help develop your existingskills and help you gain new ones, which will open up new opportunitiesand give you the chance to prove yourself.The CAT title will also help you gain practical understanding and developfirst-class skills in other areas, including IT communications and personaleffectiveness. These skills not only give you extra confidence to make themost of your career, but they are held in high regard by employers.Rewards of CAT The CAT Program is the ideal certification for anyone wanting to work asan accounting technician. This vocational course provides the knowledgeand skills to perform the tasks demanded by this role; it offers you thechance to gain a useful and practical qualification while studying at yourown pace.The CAT Program offers great rewards. That is the reason so manypeople around the world take courses to become CAT . But you will alsoknow that the rewards are only earned if you are prepared to work hardtowards your qualification.The CAT will give you valuable new skills and increase the value you canadd to your organization thus paving the way for career development.Topnotch CAT Reviewerswww.catreviewers.com

National Institute of Accounting Technicians of the Philippines (NIAT Phils)The National Institute of AccountingTechnician of the Philippines is the largestbookkeeping institute in the Philippines representingover 30,000 accounting professionals. It conductstraining and examination for bookkeepers andaccounting technicians who want to enhance theirbookkeeping and accounting skills through theCertified Accounting Technician (CAT) program.It is a professional organization for accountants recognized for their practicalbookkeeping skills. The NIAT is committed to raising standards in the accountingtechnician industry through developing direct and practical educational and certificationprograms promoting an enhanced profile for accounting technicians with the highest levelof professional and ethical conduct.The NIAT was formed to represent the accounting professionals in the Philippineswho work as accounting technicians in industry, government, academia and privatepractice. It has a mission to raise the level of recognition for its members, their specializedskills and the accounting profession in general.Mission & VisionThe NIAT is a premier body of accounting technicians that strives for the recognition andemployability of the accounting technician profession across all business sectors.The Institute thus aims: To promote and develop accounting technology and to encourage education anddisseminate knowledge related to or connected with accounting technology; To provide a professional organization for accounting technicians and by means ofexamination and other methods of assessment to test the skill and knowledge ofpersons desiring to enter the profession; To further the development of accounting technology in the industry, government,academe, and private practice; To provide continuing education programs as a means for disseminating updatesand information in the discipline of accounting technology, and for promoting theCAT qualificationTopnotch CAT Reviewerswww.catreviewers.com

Relationship Diagram of Organizationsorganizations which awards the international certificationsICB UKCMA AUTopnotch CAT Reviewers one of the first accreditedreview/learning providerfor the CAT program(CAT, RCA, CB) conducts review classesfor the CAT program coordinates with NIATPhils for the CAT exam assist students/participantsfor the preparation of theirrequirements to besubmitted to NIATTopnotch CAT ReviewersNIAT Phils.TopnotchCATReviewersIAT CAACCA UKNIAT Phils. largest institute of accountingtechnicians in the country conducts review and exam forthe international certifications administers the exams of theinternational certificates here inthe country coordinates and process therequirements of exam passersfor the application ofcertifications (andmemberships) to thecorresponding organizationwhich awards the internationalcertificationswww.catreviewers.com

Topnotch CAT ReviewersTopnotch CAT Reviewers is one of the first review provider duly accredited by NIATto provide CAT Review Classes.The review group started in August 2008 and is continually growing to be thepremier review provider for exami

apply as Certified Bookkeeper (CB) member of the Institute of Certified bookkeeping institute in the world with over 150,000 members globally. CB members who wish to provide bookkeeping service, particularly in the UK can avail of the Practicing Certificate sealed by the Institute, equivalent