Transcription

2-1

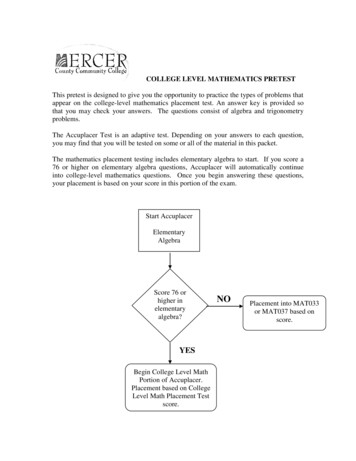

Chapter2Analyzing BusinessTransactionsSection 1: Property and Financial InterestSection ObjectivesMcGraw-Hill1.Record in equation form the financialeffects of a business transaction.2.Define, identify, and understand therelationship between asset, liability, andowner’s equity accounts. 2009 The McGraw-Hill Companies, Inc. All rights reserved.

Meet JT’s Consulting Services.JT’s Consulting JT’s Consulting Services is a firm that provides a wide range ofaccounting and consulting services.Jason Taylor is the sole proprietor of the firm.Tennille Brisbane is the office manager of the firm.Every month the firm bills clients for the services provided thatmonth.Customers can also pay in cash when the services are provided.2-3

Steps to analyze the effect of abusiness transaction.1. Describe the financial event. Identify the property.Identify who owns the property.Determine the amount of increase or decrease.2. Make sure the equation is in balance.Property Financial Interest2-4

Objective 1Record in equation form the financialeffects of a business transactionBusiness TransactionJason Taylor withdrew 90,000 from personalsavings and deposited it in a new checking accountin the name of JT’s Consulting Services.Analysis:(a) The business received 90,000 of property in theform of cash.(b) Taylor had an 90,000 financial interest in the business.2-5

The owner invested cash into the business.PropertyCash(a) Invested cash Financial Interest Jason Taylor, Capital 90,000(b) Increased equityNew balances 90,000 90,000 90,000Jason Taylor now has 90,000 equity in JT’sConsulting Services.2-6

The company buys equipment for 10,000 cash.Property Financial InterestCashPrevious balances Equipment Jason Taylor, Capital 90,000(c) Purchased equip.(d) Paid cash- 10,000New balances 80,000 90,000 10,000 10,000 90,000 90,000 90,0002-7

The company buys 12,000 of equipmenton account.Property Financial InterestCash EquipmentPrevious balances 80,000 (e) Purchased equipment 10,000 90,000 12,000 12,000(f) Incurred debtNew balancesJason Taylor,AccountsPayable Capital 80,000 22,000 12,000 102,000 102,000Notice the new claim against the firm’sproperty – the creditor’s claim of 12,000.2-8 90,000

The firm purchases supplies for 3,000 cash.PropertyCashPreviousbalances Supplies 80,000 (g) PurchasedsuppliesFinancial InterestAccounts Jason Taylor,Equipment Payable Capital 22,000 12,000 90,000 22,000 12,000 90,000 102,000 102,000 3,000(h) Paid cash-3,000Newbalances 77,000 3,000 2-9

The firm makes a payment of 5,000 on account.PropertyCashPreviousbalances(i) Paid cash 77,000 SuppliesAccounts Jason Taylor, Equipment Payable Capital 3,000 22,000 12,000 90,000-5,000(j) DecreaseddebtNewbalancesFinancial Interest- 5,000 72,000 3,000 22,000 7,000 97,000 97,0002-10 90,000

The firm makes a payment of 7,000 rentin advance.PropertyCash Supplies Prepaid Equipment Accounts Jason Taylor,Rent Payable CapitalPreviousbalances 72,000 3,000(k) PaidcashFinancial Interest 22,000 7,000 90,000 22,000 7,000 90,000 97,000 97,000-7,000(l) PrepaidrentNewbalances 65,000 3,000 7,000 7,000 2-11

Objective 2 Define, identify, and understand the relationshipbetween asset, liability, and owner’s equity accountsAssets, Liabilities, andOwner’s EquityQUESTION:What are assets?ANSWER:Assets are property owned by abusiness.2-12

Liabilities and EquityQUESTION:What are liabilities?ANSWER:Liabilities are debts or obligations of abusiness.QUESTION:What is owner’s equity?ANSWER:Owner’s equity is the term used for soleproprietorships. It is the financial interest ofan owner of a business. It is also calledproprietorship or net worth.2-13

QUESTION:What is a Balance Sheet?ANSWER:A balance sheet is a formal report of abusiness’s financial condition on a certaindate. It reports the assets, liabilities, andowner’s equity of the business.2-14

JT’s Consulting ServicesBalance SheetNovember 30, 2010AssetsCashSuppliesPrepaid RentEquipmentTotal 097,000.00Accounts Payable7,000.00Owner’s EquityJason Taylor, Capital90,000.00Total Liabilities and Owner’s Equity 97,000.00– the amount and types of property owned by the business Liabilities – the amount owed to the creditors Equity – the owner’s interest Assets2-15

Liabilities erty equals Financial Interest2-16

Chapter2Analyzing Business TransactionsSection 2: The Accounting Equation andFinancial StatementsSection Objectives3. Analyze the effects of business transactions on afirm’s assets, liabilities, and owner’s equity andrecord these effects in accounting equation form.4. Prepare an income statement.5. Prepare a statement of owner’s equity and abalance sheet.McGraw-Hill 2009 The McGraw-Hill Companies, Inc. All rights reserved.

QUESTION:What is the fundamental accountingequation?ANSWER:The fundamentalaccounting equationis the relationshipbetween assets andliabilities plus owner’sequity.2-18

The Fundamental Accounting EquationIn accounting terms the firm’s assets must equal thetotal of its liabilities and owner’s equity. This equality can be expressed in equation form as: Assets Liabilities Owner’s EquityThe entire accounting process of analyzing,recording and reporting business transactions isbased on the fundamental accounting equationIf any two parts of the equation are known, the thirdpart can be determined.2-19

Objective 3Analyze the effects ofbusiness transactions on afirm’s assets, liabilities,and owner’s equity andrecord these effects inaccounting equation form.2-20

QUESTION:What is revenue?ANSWER:A revenue is an inflow of money orother assets that results from thesales of goods or services or fromthe use of money or property. It isalso called income.2-21

QUESTION:What is an expense?ANSWER:An expense is an outflow of cash,use of other assets, or incurring of aliability.2-22

The firm receives 26,000 in cash for servicesprovided to clients.Assets PrepaidCash Supplies Rent Previousbalances 65,000 (m) Recd. cash 3,000 7,000 Owner’s EquityAccountsJ. Taylor,Equip. Payable Capital Revenue 22,000 7,000 90,000 26,000(n) Increasedowner's equityNew balancesLiab. 91,000 3,000 7,000 22,000 7,000 90,000 123,000 123,0002-2326,000 26,000

The company performs services on accountfor 9,000.AssetsCash Accts.PrepaidRec. Supplies Previousbalances 91,000(o) Receivednew asset(p) Increasedowner’s equityNew bal. Rent 3,000 7,000 Liab. Owner's EquityAccts.J. Taylor,Equip. Pay. Capital 22,000 7,000 90,000 Rev. 26,000 9,000 91,000 9,000 3,000 7,000 132,000 22,000 7,000 90,000 2-24 132,0009,000 35,000

Collection of 4,000 from customerson account.AssetsCashAccts. Rec. Supplies PreviousBalances 91,000 9,000 (q) Recd.cash 4,000 3,000 PrepaidRent 7,000(r) Decreasedaccts. rec.- 4,000New bal. 95,000 5,000 3,000Liab. Owner's EquityAccts.J. Taylor,Equip. Pay. Capital Rev. 22,000 7,000 90,000 35,000 7,000 22,000 7,000 90,000 35,000 132,000 2-25 132,000

The firm pays 7,000 in salaries expensefor the month.AssetsCashAccts.Prepaid Rec. Supplies Rent Equip. Previousbalances 95,000 5,000 3,000(s) Paidcash Liab. Owner's EquityAccts. J. Taylor,Pay. Capital Rev.- Exp. 7,000 22,000 7,000 90,000 35,000-7,000(t) Decreasedowner’s equity- 7,000New bal. 88,000 5,000 3,000 7,000 22,000 7,000 90,000 35,000 - 7,000 125,000 2-26 125,000

The firm pays 500 for utilitiesexpenses.AssetsCashLiab. Owner's EquityAccts.PrepaidAccts.J. Taylor, Rec. Supplies Rent Equip. Pay. Capital Previousbalances 88,000 5,000 3,000(u) Paidcash Rev. - Exp. 7,000 22,000 7,000 90,000 35,000 - 7,000-500(v) Decreasedowner’s equity-500New bal. 87,500 5,000 3,000 7,000 22,000 7,000 90,000 35,000 - 7,500 124,500 2-27 124,500

The firm records a withdrawal by the ownerof 4,000. Liab.AssetsAccts.Cash Rec. PreviousbalancesPrepaidAccts.Supp. Rent Equip. Pay. Owner’s EquityJ. Taylor, Capital Rev.- Exp. 87,500 5,000 3,000 7,000 22,000 7,000 90,000 35,000 - 7,500(w) Withdrewcash-4,000(x) Decreasedowner's equityNew bal.-4,000 83,500 3,000 7,000 22,000 7,000 86,000 5,000 35,000- 7,500 120,500 2-28 120,500

Objective 4Prepare An Income StatementQUESTION:What is an income statement?ANSWER:An income statement is a formalreport of business operationscovering a specific period of time. Itis also called a profit and lossstatement or a statement of incomeand expenses.2-29

The income statement hasa three-line heading.The third line shows that the report coversoperations over a period of time.JT’s Consulting ServicesIncome StatementMonth Ended December 31, 2010RevenueFees Income 35,000.00ExpensesSalaries ExpenseUtilities ExpenseTotal Expenses 7,000.00500.007,500.00Net Income 27,500.002-30

The income statement reports revenue.JT’s Consulting ServicesIncome StatementMonth Ended December 31, 2010RevenueFees Income 35,000.00ExpensesSalaries ExpenseUtilities ExpenseTotal Expenses7,000.00500.007,500.00Net Income 27,500.002-31

The income statement also reports expenses.JT’s Consulting ServicesIncome StatementMonth Ended December 31, 2010RevenueFees Income 35,000.00ExpensesSalaries ExpenseUtilities ExpenseTotal Expenses7,000.00500.007,500.00Net Income 27,500.002-32

The result is net income or net loss for the period.JT’s Consulting ServicesIncome StatementMonth Ended December 31, 2010RevenueFees Income 35,000.00ExpensesSalaries ExpenseUtilities ExpenseTotal Expenses7,000.00500.007,500.00Net Income 27,500.002-33

Objective 5Prepare a Statement of Owner’sEquity and Balance SheetA Statement of Owner’s EquityJT’s Consulting ServicesStatement of Owner’s EquityMonth Ended December 31, 2010Jason Taylor, Capital, December 1, 2010Net Income for DecemberLess Withdrawals for DecemberIncrease in CapitalJason Taylor, Capital, December 31, 2010372-34 90,000.00 27,500.004,000.0023,500.00 113,500.00

The Balance SheetJT’s Consulting ServicesBalance SheetDecember 31, 2010AssetsCashAccounts ReceivableSuppliesPrepaid RentEquipmentTotal Assets .00120,500.00Accounts Payable7,000.00Owner’s EquityJason Taylor, CapitalTotal Liabilities and Owner’s Equity113,500.00120,500.00A single line shows that the amounts above it are being added orsubtracted. A double line indicates final amounts for the column or sectionof a report.2-35

The Importance of FinancialStatementsBusiness managers andowners use the balancesheet and the incomestatement to control currentoperations and plan for thefuture.Creditors, prospectiveinvestors, governmentalagencies, and others areinterested in the profits ofthe business and in theasset and equity structure.2-36

Financial statements are prepared ina specific order:1st Income Statement2nd Statement of Owner’s equity3rd Balance Sheet2-37

JT’s Consulting ServicesStatement of Owner’s EquityMonth Ended December 31, 2010Jason Taylor, Capital, December 1, 2010Net Income for DecemberLess Withdrawals for DecemberIncrease in CapitalJason Taylor, Capital, December 31, T’s Consulting ServicesBalance SheetDecember 31, 2010LiabilitiesAssetsCash 83,500.00Accounts Receivable5,000.00Supplies3,000.00Prepaid Rent7,000.00Equipment22,000.00Total Assets 120,500.00Accounts PayableOwner’s EquityJason Taylor, CapitalTotal Liabilities and Owner’s Equity2-38 7,000.00113,500.00 120,500.00

Thank Youfor usingCollege Accounting, 12th EditionPrice Haddock Farina2-39

Analyzing Business Transactions Section 2: The Accounting Equation and Financial Statements Chapter 2 Section Objectives 3. Analyze the effects of business transactions on a firm’s assets, liabilities, and owner’s equity and record these effects in acc