Transcription

3-1

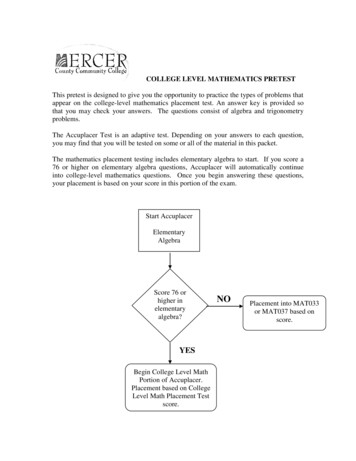

Chapter3Analyzing Business TransactionsUsing T AccountsSection 1: Transactions That AffectAssets, Liabilities, and Owner’s EquitySection Objectives1.2.3.McGraw-HillSet up T accounts for assets, liabilities,and owner’s equity.Analyze business transactions and enterthem in the accounts.Determine the balance of an account. 2009 The McGraw-Hill Companies, Inc. All rights reserved.

The Accounting EquationASSETSThe property abusiness ownsLIABILITIES The debts ofthe business OWNER’SEQUITYThe owner’s financialinterest in the business3-3

Classification of Accounts Asset AccountsAsset accounts show the property a businessowns. Liability AccountsLiability accounts show the debts of thebusiness. Owner’s Equity AccountsOwner’s equity accounts show the owner’sfinancial interest in the business.3-4

Objective 1Set up T accounts for assets, liabilitiesand owner’s equity.T AccountsASSETS LIABILITIES OWNER’S EQUITY RecordIncreasesRecordDecreasesRecordDecreases RecordIncreasesRecordDecreases RecordIncreasesLEFT SIDERIGHT SIDELEFT SIDERIGHT SIDELEFT SIDERIGHT SIDE3-5

Objective 2Analyze business transactions and enterthem in the accounts.Effects of Business TransactionsSteps to analyze the effects of the businesstransactions:1. Analyze the financial event. Identify the accounts affected. Classify the accounts affected. Determine the amount of increase or decrease for eachaccount.2. Apply the left-right rules for each account affected.3. Make the entry in T-account form.3-6

Initial InvestmentJason Taylor withdrew 90,000 from personalsavings and deposited it in the new businesschecking account for JT’s Consulting Services. LEFTIncreases to asset accounts are recorded on theleft side of the T account. RIGHTIncreases to owner’s equity accounts arerecorded on the right side of the T account.CashJason Taylor, Capital(a) 90,000(b) 90,0003-7

Business TransactionJT’s Consulting Services issued a 10,000 check topurchase a computer and other equipment.Analysis:(c) The asset account, Equipment, is increased by 10,000.(d) The asset account, Cash, is decreased by 10,000.EquipmentCash(c) 10,000(d) 10,0003-8

Purchase of Equipment on AccountThe firm bought office equipment for 12,000 on accountfrom Office Plus.Analysis:(e) The asset account, Equipment, is increased by 12,000.(f) The liability account, Accounts Payable, is increased by 12,000.EquipmentAccounts Payable(e) 12,000(f) 12,0003-9

Purchase of Supplies for CashJT’s Consulting Services issued a check for 3,000 toOffice Supplies Inc. to purchase office supplies.Analysis:(g) The asset account, Supplies, is increased by 3,000.(h) The asset account, Cash, is decreased by 3,000.SuppliesCash(g) 3,000(h) 3,0003-10

Payment of a LiabilityJT’s Consulting Services issued a check in the amountof 5,000 to Office Plus.Analysis:(i) The asset account, Cash, is decreased by 5,000.(j) The liability account, Accounts Payable, is decreased by 5,000.Accounts PayableCash(j) 5,000(i) 5,0003-11

Prepayment of RentJT’s Consulting Services issued a check for 7,000 topay rent for the months of December and January.Analysis:(k) The asset account, Prepaid Rent, is increased by 7,000.(l) The asset account, Cash, is decreased by 7,000.Prepaid RentCash(k) 7,000(l) 7,0003-12

Objective 3Determine the balance of anaccountAn account balance is the difference between theamounts recorded on the two sides of an account.A footing is a small pencil figure written at the base of anamount column showing the sum of the entries in thecolumn.3-13

Recording Account BalancesTHENIFthe total on the right side is largerthan the total on the left side,the balance is recorded on the rightside.the total on the left side is larger,the balance is recorded on the leftside.an account shows only one amount,that amount is the balance.an account contains entries on onlyone side,the total of those entries is theaccount balance.3-14

Computing theAccount BalanceCash(a) 90,000Bal. 65,000(90,000 – 25,000)(d) 10,000(h) 3,000(i) 5,000(l) 7,000----------25,0003-15Footing

Summary of Account BalancesASSETSCash LIABILITIESAccounts Payable OWNER’S EQUITYJason Taylor, Capital(a) 90,000 (d) 10,000(h) 3,000(i)5,000(l)7,000Bal. 65,00025,000(j) 5,000 (f)12,000(b) 90,000Account balancesforCarterConsultingServicesBal. 7,000SuppliesSUMMARY OF ACCOUNT BALANCES(g)3,000ASSETSPrepaid Rent(k)7,000 65,0003,0007,00022,000LIABILITIES OWNER’S EQUITY7,00090,000Equipment97,000 (c) 10,000(e) 12,000Bal. 22,0003-167,000 90,000

Chapter3Analyzing Business TransactionsUsing T AccountsSection 2: Transactions That AffectRevenue, Expenses, and WithdrawalsSection ObjectivesMcGraw-Hill4.Set up T accounts for revenue and expenses.5.Prepare a trial balance from T accounts.6.Prepare an income statement, a statement ofowner’s equity, and a balance sheet.7.Develop a chart of accounts. 2009 The McGraw-Hill Companies, Inc. All rights reserved.

T-Account for RevenueOwner’s aseSideSide Revenues increase owner’s equity. Increases in owner’s equity appear on the right side ofthe T account. Therefore, increases in revenue appear on the rightside of revenue T accounts.3-18

RevenueDecreaseIncreaseSideSideThe right side of the revenue account showsincreases and the left side shows decreases.Decreases in revenue accounts are rare but mightoccur because of corrections or transfers.3-19

Set up T accounts for revenueand expensesObjective 4Reviewing the Effects of the TransactionsCashFees Income(n) 26,000Bal. 65,000(m) 26,000 26,000 (m) is entered onthe left (increase) side ofthe asset account Cash. 26,000 (n) is entered onthe right side of the FeesIncome account.3-20

Recording Revenue from Services Soldon CreditIn December JT’s Consulting Services earned 9,000 from various charge accounts clients.Analysis:(o) The asset account, Accounts Receivable, is increasedby 9,000.(p) The revenue account, Fees Income, is increased by 9,000.Accounts ReceivableFees Income(p) 9,000(o) 9,0003-21

Receipt of Payments on AccountCharge account clients paid 4,000, reducing theamount owed to JT’s Consulting Services.Analysis:(q) The asset account, Cash, is increased by 4,000.(r) The asset account, Accounts Receivable, is decreased by 4,000.CashAccounts Receivable(q) 4,000(r) 4,0003-22

Owner’s evenueDecreaseSideDecreaseSideIncreaseSide Expenses decrease owner’s equity. Decreases in owner’s equity appear on the left side of theT accounts.3-23

Payment of SalariesIn December JT’s Consulting Services paid 7,000 insalaries.Analysis:(s) The asset account, Cash, is decreased by 7,000.(t) The expense account, Salaries Expense, is increased by 7,000.Salaries ExpenseCash(t) 7,000(s) 7,0003-24

Payment of UtilitiesJT’s Consulting Services issued a check for 500 to paythe utilities bill.Analysis:(u) The asset account, Cash, is decreased by 500.(v) The expense account, Utilities Expense, is increased by 500.Utilities ExpenseCash(v) 500(u) 5003-25

Owner WithdrawalsOwner’s EquityDecrease SideIncrease SideExpenseIncrease SideRevenueDecrease SideDecrease SideIncrease SideDrawingIncrease SideDecrease Side Drawing decreases owner’s equity. Decreases in owner’s equity appearT accounts.3-26on the left side of the

The Owner Withdraws FundsJason Taylor wrote a check to withdraw 4,000 cash forpersonal use.Analysis:(w) The asset account, Cash, is decreased by 4,000.(x) The owner’s equity account, Jason Taylor, Drawing, isincreased by 4,000.Jason Taylor, DrawingCash(x) 4,000(w) 4,0003-27

The Rules of Debit and Credit A debit is an entry on the left side of anaccount. A credit is an entry on the right side of anaccount. A double-entry system is an accountingsystem that involves recording the effects ofeach transaction as debits and credits. Every transaction in a Double entryaccounting system has at least one debit andone credit. Every transaction must have at least onedebit and one credit.3-28

Any AccountLeft SideRight Side Accountantsrefer to the left side of an account as the debit sideinstead of saying the left side. The right side of the account is called the credit side.3-29

Rules for Debits and CreditsAsset AccountsLiability AccountsOwner’s Capital AccountDebit Credit-Debit-Credit Debit-Credit creaseSide( Normal Bal.)DecreaseSideIncrease Side( Normal Bal.)Owner’s Drawing AccountDebit IncreaseSideRevenue t IncreaseSide(NormalBal.)(NormalBal.)3-30Expense AccountsDebit IncreaseSide(NormalBal.)CreditDecreaseSide

Objective 5 Prepare a trial balance from T accounts1. Use the proper heading.2. List the accounts in chart of account order.3. Enter the ending balance of each account in theappropriate debit or credit column.4. Total the debit column.5. Total the credit column.6. Compare the column totals. They should be equal.3-31

JT’s Consulting ServicesTrial BalanceDecember 31, 2010ACCOUNT NAMEDEBITCREDIT83,500CashAccounts ReceivableSuppliesPrepaid nts PayableJason Taylor, CapitalJason Taylor, DrawingFees IncomeSalaries ExpenseUtilities Expense4,00035,0007,000500132,000Totals3-32132,000

Some common errors in a trial balance are:Adding trial balance columns incorrectlyRecording only half a transaction – for example, recordinga debit but not recording a credit, or vice versaRecording both halves of a transaction as debits or creditsrather than recording one debit and one creditRecording an amount incorrectly from a transactionRecording a debit for one amount and a credit for adifferent amountMaking an error when calculating the account balances3-33

Objective 6 Prepare an income statement, a statementof owner’s equity, and a balance sheetAfter the trial balance is prepared, the financial statementsare prepared.Net income from the income statement is used onthe statement of owner’s equity.The ending balance of the Jason Taylor, Capitalaccount, computed on the statement of owner’sequity, is used on the balance sheet.3-34

JT’s CONSULTING SERVICESIncome StatementMonth Ended December 31, 2010RevenueFees IncomeExpensesSalaries ExpenseUtilities ExpenseTotal ExpensesNet �s CONSULTING SERVICESStatement Of Owner’s EquityMonth Ended December 31, 2010Jason Taylor, Capital, Dec. 1, 201090,000.00Net Income for December27,500.00Less Withdrawals for December4,000.00Increase in Capital23,500.00Jason Taylor, Capital, Dec. 31, 2010113,500.00ASSETSCashAccounts ReceivableSuppliesPrepaid RentEquipmentTotal AssetsJT’s CONSULTING SERVICESBalance SheetDecember 31, 2010LIABILITIES83,500.00Accounts Payable5,000.003,000.007,000.00OWNER’S EQUITY22,000.00Jason Taylor, Capital120,500.00Total Liabilities and Owner’s Equity3-357,000.00113,500.00120,500.00

Objective 7Develop a chart of accountsEach account has a number and a name.The balance sheet accounts are listed first,followed by the income statement accounts.The account number is assigned based on thetype of account.3-36

JT’s CONSULTING SERVICESChart of AccountsAccount NumberAccount NameBalance Sheet Accounts ReceivableSuppliesPrepaid RentEquipmentLIABILITIESAccounts PayableOWNER’S EQUITYJason Taylor, Capital300-399301Statement of Owner’s Equity Account302Income Statement Accounts400-499401500-599511514Jason Taylor, DrawingREVENUEFees IncomeEXPENSESSalaries ExpenseUtilities Expense3-37

Permanent and Temporary AccountsA permanent account is an accountthat is kept open from oneaccounting period to the next.A temporary account is an accountwhose balance is transferred toanother account at the end of anaccounting period.3-38

Thank Youfor usingCollege Accounting, 12th EditionPrice Haddock Farina3-39

Analyzing Business Transactions Using T Accounts Section 2: Transactions That Affect Revenue, Expenses, and Withdrawals Chapter 3 Section Objectives 4. Set up T accounts for revenue and expenses. 5. Prepare a trial balance from T accounts. 6. Prepare an income statement, a statement of ow