Transcription

2018 FallFinancial Education

Housekeeping Slides will advance automaticallyToday’s presentation is being recordedPresentation will be posted online within a weekSubmit questions for Q&A at the end of the webinaraba.com/GetSmart

ABA Staff Point of ContactJeni PastierSenior Manager,Financial art

Webinar Agenda Introduction to 2018 Get Smart About Credit Making Get Smart About Credit a Successo Kalyn Black, CRM Manager, Skowhegan Savings Banko Tracie Travers, Workforce Development Manager, JMG Bankers and You – Careers in Banking Presentations Registration Questions & Answersaba.com/GetSmart

What is Get Smart About Credit? Annual, banker-driven, financial education campaign.o Example of valuable role banks play in communities they serve. Foundation Material TopicsoooooKnowing Your Credit ScoreProtecting Your IdentityPaying of CollegeManaging Your MoneyNEW! Bankers and You – Careers in Banking available in Spanish Celebrating 16 Yearso Annual event held Thursday, October 18th, 2018.o Make credit-focused presentations throughout the month or year.aba.com/GetSmart

Skowhegan Savings BankKalyn BlackCRM ManagerSkowhegan Savings Bankkblack@skowhegansavings.com

JMGTracie TraversWorkforce Development ManagerJMGttravers@jmg.org

Humble beginnings Partnering to host financial literacy fairs at Skowhegan HighSchool Unmet business, community, and student needs Patience and perseverance were required, and searching for the“YES” One key to the program’s success is finding the right network Relationships!

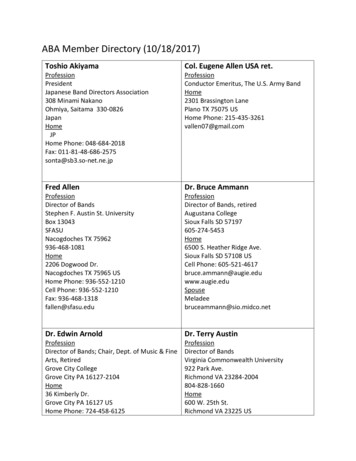

A look at the numbers Year One: July 2015 – June 20169 Schools, 81 Businesses, 1,025 Students Year Two: July 2016 – June 201713 Schools, 307 Businesses, 3,321 Students Year Three: July 2017 – June 201818 Schools, 390 businesses, 4,535 Students Another key to the program’s success is collaboration

Who did we collaborate with? Other banks and credit unions Organizations such as Chambers of Commerce, Small Business Associations,MELMAC, GearUp Maine, Healthy Communities Coalition, MainStreet Skowhegan K-12 Schools and Colleges Our bank employees coordinated many meetings with groups:Manager Business AllianceSenior Vice President Entrepreneur GroupSenior Vice President Maine Wood Products Association Who do your employees know? Where do they volunteer?

Reverse Career Fair

Jr. Entrepreneur Challenge

Jr. Entrepreneur Challenge

Summer Career Exploration CampIf we are to preparestudents for lifeafter high school,the process beginswith engaging themin learning.

Summer Career Exploration Camp“It’s very educational, very hands on, you are not just sitting by a desk, you’re in the community” Lakeasha, student participant

Financial Reality Fair

Next Steps Expansion of the Reverse Career Fair, Jr. Entrepreneur Challenge and SummerCareer Exploratory Programs Continue to share resources with schools and businesses Create more collaborative teams in communities Develop marketing tools to share our successes and best practices And any other cool projects we can create! Where there’s a will, there’s a way.

How can this be recreated in your community? For an easier start-up, consider partnering with an existing program that has a trackrecord of success as measured by qualitative and quantitative data, such as JMG. Be willing to collaborate with outside individuals or institutions—even if you competewith them in other arenas. The competition may come into play when students arechoosing which bank to work for. But it will take the collaboration of many institutionsto improve the field as a whole. Develop and maintain a common goal. Effective communication, including activelistening, is important. Assess the communities you work in. Speak with educators, businesses, and nonprofits to know the strengths and opportunities for growth. Sharing resources cutsdown on duplicated efforts. It also increases efficiency while decreasing time andmoney in the long run.

Kalyn BlackLet’sConnectCRM ManagerSkowhegan Savings Bankkblack@skowhegansavings.comTracie TraversWorkforce Development ManagerJMGttravers@jmg.orgThank you!

Bankers and Youaba.com/GetSmart

Bankers and Banking –What’s In It For You?aba.com/GetSmart

Becoming a Bankeraba.com/GetSmart

How to Use Bankers and You As a complement to Get Smart About Credit Day Additional Options:After School ProgramsSunday SchoolBoy and Girls ClubCareer Day PresentationGirl/Boy ScoutsBank FieldtripBig Brothers Big SistersUnited WayTransitional Housing SheltersFoster Home OrganizationsInternshipsWork Study Programsaba.com/GetSmart

Registration 1-2-31. Go to aba.com/GetSmart2. Shopping Cart Login3. Complete Registration Formaba.com/GetSmart

GSAC ResourcesConfirmation Email within 24 HoursMaterials Resource Webpageaba.com/GetSmart

Communication Resources Customizable Media Advisory Customizable Media Pitch Customizable Press Release Event Planning Checklist Outreach Letter Sample Photo Release Social Media Guideaba.com/GetSmart

Q&Ao Lights, Camera, Save! Teen Video Contest Sign up at aba.com/lightscamerasaveo Joint #CreditChat with Experian Wednesday, October 17 at 3pm ETo Get Smart About Credit Day Thursday, October 18 Submit question using “Q & A” chat feature Questions after webinar - Contact Jeni Pastier at jpastier@aba.comaba.com/GetSmart

Skowhegan Savings Bank. JMG. Tracie Travers. Workforce Development Manager. JMG. ttravers@jmg.org. Humble beginnings Partnering to host financial literacy fairs at Skowhegan High School Unmet business, community, and student needs Patie