Transcription

Disputes

Before we get started Lines will be muted on entry! This session will be recorded and shared with you following the Disputes Webinar. Please use the Q&A functionality to type in your question to all panelists. (see screenshot below)

TheAmerican ExpressDisputes ProcessWhat to do whenyou're presentedwith Inquiries &ChargebacksWhat we’ll cover todayHow you canprevent disputesHow to managedisputes onlineHow tomanage fraudDispute policyupdates

Process

What is a Dispute?When a Card Member questions some aspect of an item on their billingstatement, he or she can dispute the charge for a variety of reasons:

The Dispute Process: Inquiry

What is an Inquiry?An Inquiry is a notification you receive asking for more informationon a Transaction. We ask for your help, if we cannot resolve theCard Member’s disputes using the information we have on file.

The Dispute Process: ChargebackUpfront Chargeback*Chargeback StatusThe Chargeback stands ifyour reply is insufficient, youdo not reply on time or youaccept the chargeback

What is a Chargeback?A Chargeback is the debit of funds from your Merchant Account for the disputed amount.We will send you a Chargeback notification for your review.

The Dispute Process: OutcomesUpfront ChargebackChargeback StatusThe Chargeback stands ifyour reply is insufficient, youdo not reply on time or youaccept the chargeback

Chargebacks& Inquiries

How to Respond to a DisputeTiming is key. You have 20 days to respond to an Inquiry and mustrespond with all the appropriate documents to avoid a Chargeback. Address the specific dispute reasonClearly explain all of the submitteddocuments and address updates made tothe original purchase or agreement Include a copy of the charge record/creditrecord and other supporting documentation Address the specific Card Member disputeclaim in your response Clearly explain all of the submitteddocuments and add any changes/edits madeto the original purchase /agreement Update American Express with steps thathave been taken to resolve the dispute

How to Avoid Chargebacks After an InquiryYou can avoid some of the common Chargebacks by responding to allinquiries and ensuring all requested documentation is included.

Types of DisputesWHAT DOES IT MEAN?WHAT DOES IT MEAN?WHAT DOES IT MEAN?Card Member claims to not recognise orremember the charge.Card Member claims that the goods orservices ordered were cancelled.The Card Member denies participating ina mail order, telephone order, or internetcharge, and claims it is fraud.WHAT SHOULD YOU DO TO APPEALTHE CHARGEBACK?WHAT SHOULD YOU DO TO APPEAL THECHARGEBACK?WHAT SHOULD YOU DO TO APPEALTHE CHARGEBACK?Respond to the Inquiry, or request forinformation, with as much context aboutthe charge as possible.To appeal this Chargeback respond with asmuch detail as possible. First, make sureto address the status of the cancellation.If you have no record of the Card Membercancelling the charge, please advise us.To appeal this Chargeback respondwith as much detail as possible.For more information about what you willneed to provide for each type of dispute– please see the appendix of this doc.

Disputes

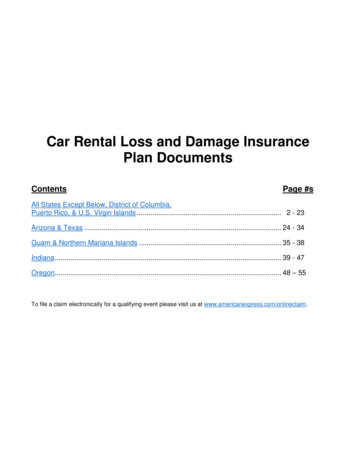

Clear Billing Statement DetailsUse your customer facing Business Name on the card member billing statement.Merchant Business Name appears as ABC Hospitality on Card Member Statement for charge taken at Sea view restaurantAPRIL 24ABC HOSPITALITY211.27APRIL 24SEA VIEW RESTAURANT211.27

At the Time of Purchase

Your Practices & Policies

Online

Manage Disputes Online for a Quick Resolution

Start Managing your Disputes OnlineLog in or register for an Online Merchant Account at:Australia – americanexpress.com.au/MerchantSingapore – americanexpress.com.sg/Merchant

Fraud

Fraud ToolsAs an American Express Merchant, you have access to our fraud mitigation tools free of chargeCHIPIN/CHIPSIGNtransactions must be encouragedSAFEKEYThis fraud tool authenticates the CardMember during an online purchaseDAMAGED/EXPIRED CARDClosely look out for Exp Date ofCard and any damage to plasticENHANCED AUTHORISATIONAdditional data elements enhancethe fraud risk assessmentCIDThe 4 Digit Batch Code printed on frontof card is the CID for American Expressissued CardsVERIFY - ITVerifies Name and Address ofAmerican Express proprietary CardMember

American Express SafeKey is a Critical ToolAmerican Express SafeKey is a 3D Secure authentication tool that helps reduceonline fraud through two-factor authentication. You can sign up at:Australia - americanexpress.com.au/merchantsafekeySingapore - americanexpress.com.sg/safekeyOptimise operationalefficiency by reducingthe costs of fraudDrive incrementalrevenue by givingcustomers andprospects the confidenceto spendImplement with easewithin your existinginfrastructure

Policy Updates

New/Revised Policies, Fewer ChargebacksIn the past three years, we’ve made changes to enhance the disputes experience. We’veheard your feedback and enhanced dispute policies and processes as we are committed inhelping to reduce disputes and Chargebacks. Revised SafeKey Fraud Liability Policy Estimated Authorisation for Taxi and Limousines Estimated Authorisation for Online Retail and Grocery Second Presentment rights for Cancelled Recur BillingChargebacks Raised contactless thresholds Recurring Billing – Introductory Offer/Free Trial**Effective April 2021

Expanding Estimated Authorisation to other IndustriesIn response to Merchant request, we have expanded industries permitted to obtain an estimatedAuthorisation to Merchants in Taxi and Limousine and Online Retail and Grocery.Taxi and Limousine Customers can add driver tips into a single charge for the ride Faster, simpler checkouts for your customers Card Not Present Retail and Grocery: Merchant can include variations in weight and shipping charges underthe original authorisation approval amount The amount you submit on the final Card Not Present retail or groceryorder will be valid for up to 15% above the authorisation amount The Card Member must provide consent to bill the full total amount Authorisations and charges must be submitted under the Card NotPresent point of service codesTaxis and Limousine services may validate Card approval upfrontwhen the ride is requestedIf the final charges, including tips and tolls, are not more than 20%above the initial authorisation amount, no re-authorisation isneeded

Recurring Billing – Introductory Offer/Free TrialWe are making updates to the Recurring Billing policy to help you manage your disputes better.Beginning on April 16th, 2021, we have updated our Recurring Billing policy to include requirements around Introductory Offers and Free Trials.This means, the new requirements will provide guidance to Merchants who do recur billing around Introductory Offers and Free Trials.What do Merchants need to do: Simple and Easy Cancelation process : Disclose all terms of the Introductory Offer/Free Trial to theCard Member, including a simple and easy cancelation process that allows Card Members to cancelbefore submitting the first Recurring Billing Charge. Obtain Consent: Obtain the Card Member’s consent to accept the terms and conditions Enrollment confirmation :Send Card Member a confirmation notification in writing (email, text orletter) upon enrollment Reminder notification : Send a reminder notification in writing (email, text or letter) beforesubmitting the first Recurring Billing Charge, that gives the Card Member a good amount of time tocancel their subscription if needed

Incorporating best practices and fraud tools can help prevent disputesAustraliaSingaporeView more resources om.sg/disputesLog in or register for anOnline Merchant Account om.sg/MerchantFor more information, contact your clientmanager/American Expressrepresentative, or call:1300 363 614(Mon - Fri, 8am-6pm AEST/AEDT)1800 235 6755(Mon - Fri, 9am-6pm SG Time)View International Merchant Regulations at: americanexpress.com/InternationalRegs

Appendix – Types of DisputesPROVIDE:PROVIDE:PROVIDE:A charge record that includes: Card number Card Member name Merchant location Transaction date or the date goods orservices were shipped or provided Transaction amount Authorisation approval Description of goods or services Proof of delivery with the full deliveryaddress (if the charge relates to items thatwere shipped) A copy of your cancellation policy,An explanation of your procedures fordisclosing it to the Card Member, andDetails explaining how the Card Member didnot follow the cancellation policy orA copy of the charge record indicating theterms and conditions ofthe purchase, andDetails explaining how the Card Member didnot follow the policy orProof that a credit which directly offsets thedisputed charge has already been processedAdditionally, if you have a recurring billingagreement with a Card Member that cancelled,you must cancel all future billings Proof that the Card Member participatedin the charge (e.g. billing authorisation,usage details, contract) orProvide all Card Member details andreceipts: - e.g. for airlines provideboarding pass - e.g. for retailers provideorder delivery details orProof that you validated the address viaauthoriation and shipped goods to theaddress we have on file orProof that a credit which directly offsetsthe disputed charge has already beenprocessed

Clear Billing Statement Details Use your customer facing Business Name on the card member billing statement. Merchant Business Name appears as ABC Hospitality on Card Member Statement for charge tak