Transcription

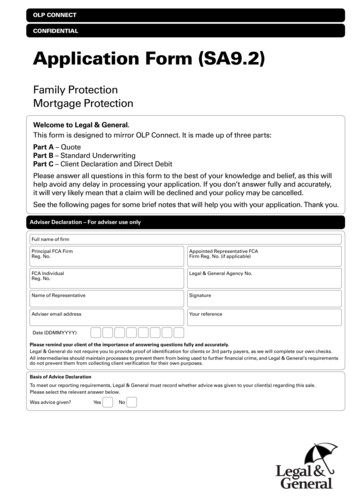

OLP CONNECTCONFIDENTIALApplication Form (SA9.2)Family ProtectionMortgage ProtectionWelcome to Legal & General.This form is designed to mirror OLP Connect. It is made up of three parts:Part A – QuotePart B – Standard UnderwritingPart C – Client Declaration and Direct DebitPlease answer all questions in this form to the best of your knowledge and belief, as this willhelp avoid any delay in processing your application. If you don’t answer fully and accurately,it will very likely mean that a claim will be declined and your policy may be cancelled.See the following pages for some brief notes that will help you with your application. Thank you.Adviser Declaration – For adviser use onlyFull name of firmPrincipal FCA FirmReg. No.Appointed Representative FCAFirm Reg. No. (if applicable)FCA IndividualReg. No.Legal & General Agency No.Name of RepresentativeSignatureAdviser email addressYour referenceDate (DDMMYYYY)Please remind your client of the importance of answering questions fully and accurately.Legal & General do not require you to provide proof of identification for clients or 3rd party payers, as we will complete our own checks.All intermediaries should maintain processes to prevent them from being used to further financial crime, and Legal & General’s requirementsdo not prevent them from collecting client verification for their own purposes.Basis of Advice DeclarationTo meet our reporting requirements, Legal & General must record whether advice was given to your client(s) regarding this sale.Please select the relevant answer below.Was advice given?YesNo

Tips for completing this application form Pages 3 to 19 and pages 34 to 35 must be completed. Pages 21 to 29 are additional questionnaires which only need to be completed if you are instructed to do so withinthe form. For joint life plans, please complete Client 1 and Client 2 sections, each client must fill out their own details. If your financial adviser is going to complete this form on your behalf using the information you have provided, youmust read all of the questions and answers carefully before signing the Client Declaration at the end.Your financial adviser is acting on your behalf in this respect.To help you complete this application you will need: Information relating to existing or previous life insurance. Details of medication or treatment that you are currently having. Your doctor’s name and the practice name and address (including their postcode). Your bank account details.Please be aware of the following points before proceeding with this application:IMPORTANT CUSTOMER INFORMATION You must answer the application questions truthfully and accurately. If you don’t, it could mean a claim may notbe paid and your policy may be amended or cancelled. The questions must only be answered by the person(s) to be insured. Around one in ten applications will be checked by obtaining information from your doctor, either before or shortlyafter your policy has started. You must give Legal & General your doctor’s details, and consent to contact them for a medical report if we need to. You must have been registered with a general practitioner (GP) in the United Kingdom for at least the last two years toapply for an Income Protection Benefit (IPB) policy. You may complete the medical questions in private and return the answers in a sealed envelope directly to theMedical Officer at Legal & General Assurance Society Limited, Brunel House, 2 Fitzalan Road, Cardiff CF24 0EBYour medical informationLegal & General follow a strict confidentiality code about all medical information you give them, or which they get fromany additional medical report. This is held securely and access is limited to authorised individuals who need to see it.Genetic TestingThe only genetic test result which you will need to tell Legal & General about is one for Huntington’s disease, and you willonly need to tell them about this when the total life insurance you have or are buying is over 500,000.Complaints ProcedureLegal & General have a formal complaints procedure and details will be given to you when you receive your policydocumentation.MARKETING CONSENTAt Legal & General we take your privacy seriously; this is why we never share your personal details with anyoneelse for their own marketing purposes. However, from time to time we would like to contact you with news, usefulinformation and exclusive offers on our products and services. If you’d like to be kept up to date, please let us knowhow you would like to hear from us: Post Email SMS Telephone Personalised online marketing*You can find out how to opt out of marketing at any time in our Privacy Policy (see pages 30 – 33) or visit:legalandgeneral.com/privacy-policy*e.g. via our own systems such as My Account, social media platforms and third party websites such as YouTube.

APPLICATION FORM – PART AOLP Connect – QuoteFamily ProtectionMortgage ProtectionPart A is designed to mirror the quote section in OLP Connect so that you can capture yourclient’s requirements in advance and complete the quote in OLP Connect.BASIC DETAILSFull name and titlePlease ensure you giveall of your names.GenderClient oneClient v/OtherForename(s) in fullForename(s) in fullSurnameSurnameMaleFemaleMaleFemaleDate of birth (DDMMYYYY)During the last 12 monthshave you smoked anycigarettes, cigars, a pipe orused nicotine replacements?Employment statusYes –regularlyYes –occasionallyNone at allYes –regularlyYes –occasionallyNone at allA simple medical test may be required to check youranswer.If you’ve smoked any cigarettes, cigars, a pipe,used e-cigarettes (whether or not they containnicotine), or used nicotine replacements at all in thelast 12 months you need to answer ‘Yes – regularlyor Yes – occasionally’.A simple medical test may be required to check youranswer.If you’ve smoked any cigarettes, cigars, a pipe,used e-cigarettes (whether or not they containnicotine), or used nicotine replacements at all in thelast 12 months you need to answer ‘Yes – regularlyor Yes – occasionally’.Full timeemploymentPart timeemploymentFull timeemploymentPart timeemploymentContract workerSelf employedContract workerSelf epersonUnemployedHousepersonEmail address**Legal & General need your email address in order to contact you about your application and to provideyou with secure access to your policy information once you have bought your policy. This will enable usto provide you with an improved experience whilst helping to protect the environment by reducing theamount of paper we use to set up your policy.Application Form – Part APage 3

PRODUCT SELECTION AND PRODUCT DETAILS – FAMILY AND MORTGAGE PROTECTION continuedPlease note: CIC stands for Critical Illness Cover throughout this application. Start date. If this plan replaces another, please consider the premium collection date of your existing plan, to reducethe possibility of double cover.PRODUCT SELECTIONPRODUCT DETAILSReason for PurchaseSelect ClientFamily ProtectionClient 1 only (single life)Mortgage ProtectionClient 2 only (single life)Rental ProtectionBoth (joint life)Select a ProductAmount of Cover/Monthly BenefitPremiumFrequency MonthlyAnnualor Premium Length of CoverLife InsurancePolicy InterestRateWaiver of PremiumBenefitDecreasingcover onlyNoyrsIncreasing Life Insurance%Client 1 onlyCritical Illness Cover (reviewable)Client 2 onlyIncreasing Critical Illness Cover (reviewable)BothLife Insurance with Critical Illness CoverGuaranteed orReviewable PremiumsTotal and Permanent Disability CoverGuaranteedNo – TPD not requiredIncreasing Life Insurance with Critical Illness CoverMortgage Protection onlyDecreasing Life InsuranceOnly available on plans thatinclude CICYes – Own OccupationDecreasing Critical Illness Cover (reviewable)Reviewable(plans thatinclude CIC)Decreasing Life Insurance with Critical Illness CoverStart date (DDMMYYYY)Yes – Specified Work TasksFamily Protection onlyFamily and Personal Income PlanIncreasing Family and Personal Income PlanOr not knownFamily and Personal Income Plan Critical Illness CoverIncreasing Family and Personal Income Plan Critical Illness CoverFamily and Personal Income Plan with Critical Illness CoverIncreasing Family and Personal Income Plan with Critical Illness CoverPage 4Children’s Critical Illness Extra BenefitAvailable on plans that include CICYesNoApplication Form – Part A

PRODUCT SELECTION AND PRODUCT DETAILS – FAMILY AND MORTGAGE PROTECTION continuedPlease note: CIC stands for Critical Illness Cover throughout this application. Start date. If this plan replaces another, please consider the premium collection date of your existing plan, to reducethe possibility of double cover.PRODUCT SELECTIONPRODUCT DETAILSReason for PurchaseSelect ClientFamily ProtectionClient 1 only (single life)Mortgage ProtectionClient 2 only (single life)Rental ProtectionBoth (joint life)Select a ProductAmount of Cover/Monthly BenefitPremiumFrequency MonthlyAnnualor Premium Length of CoverLife InsurancePolicy InterestRateWaiver of PremiumBenefitDecreasingcover onlyNoyrsIncreasing Life Insurance%Client 1 onlyCritical Illness Cover (reviewable)Client 2 onlyIncreasing Critical Illness Cover (reviewable)BothLife Insurance with Critical Illness CoverGuaranteed orReviewable PremiumsTotal and Permanent Disability CoverOnly available on plans thatinclude CICGuaranteedNo – TPD not requiredIncreasing Life Insurance with Critical Illness CoverMortgage Protection onlyDecreasing Life InsuranceYes – Own OccupationDecreasing Critical Illness Cover (reviewable)Reviewable(plans thatinclude CIC)Decreasing Life Insurance with Critical Illness CoverStart date (DDMMYYYY)Yes – Specified Work TasksFamily Protection onlyFamily and Personal Income PlanIncreasing Family and Personal Income PlanOr not knownFamily and Personal Income Plan Critical Illness CoverIncreasing Family and Personal Income Plan Critical Illness CoverFamily and Personal Income Plan with Critical Illness CoverIncreasing Family and Personal Income Plan with Critical Illness CoverApplication Form – Part AChildren’s Critical Illness Extra BenefitAvailable on plans that include CICYesNoPage 5

PRODUCT SELECTION AND PRODUCT DETAILS – FAMILY AND MORTGAGE PROTECTION continuedPlease note: CIC stands for Critical Illness Cover throughout this application. Start date. If this plan replaces another, please consider the premium collection date of your existing plan, to reducethe possibility of double cover.PRODUCT SELECTIONPRODUCT DETAILSReason for PurchaseSelect ClientFamily ProtectionClient 1 only (single life)Mortgage ProtectionClient 2 only (single life)Rental ProtectionBoth (joint life)Select a ProductAmount of Cover/Monthly BenefitPremiumFrequency MonthlyAnnualor Premium Length of CoverLife InsurancePolicy InterestRateWaiver of PremiumBenefitDecreasingcover onlyNoyrsIncreasing Life Insurance%Client 1 onlyCritical Illness Cover (reviewable)Client 2 onlyIncreasing Critical Illness Cover (reviewable)BothLife Insurance with Critical Illness CoverGuaranteed orReviewable PremiumsTotal and Permanent Disability CoverOnly available on plans thatinclude CICGuaranteedNo – TPD not requiredIncreasing Life Insurance with Critical Illness CoverMortgage Protection onlyDecreasing Life InsuranceDecreasing Critical Illness Cover (reviewable)Decreasing Life Insurance with Critical Illness CoverYes – Own OccupationReviewable(plans thatinclude CIC)Yes – Specified Work TasksStart date (DDMMYYYY)Family Protection onlyFamily and Personal Income PlanIncreasing Family and Personal Income PlanOr not knownFamily and Personal Income Plan Critical Illness CoverIncreasing Family and Personal Income Plan Critical Illness CoverFamily and Personal Income Plan with Critical Illness CoverIncreasing Family and Personal Income Plan with Critical Illness CoverPage 6Children’s Critical Illness Extra BenefitAvailable on plans that include CICYesNoApplication Form – Part A

PRODUCT SELECTION AND PRODUCT DETAILS – LIFE AND CRITICAL ILLNESS COVER PRODUCTS continuedPRODUCT SELECTIONPRODUCT DETAILSReason for PurchaseSelect ClientFamily ProtectionClient 1 only (single life)Mortgage ProtectionClient 2 only (single life)Rental ProtectionBoth (joint life)Select a ProductAmount of Cover/Monthly BenefitPremiumFrequency MonthlyAnnualor Premium Length of CoverLife InsurancePolicy InterestRateWaiver of PremiumBenefitDecreasingcover onlyNoyrsIncreasing Life Insurance%Client 1 onlyCritical Illness Cover (reviewable)Client 2 onlyIncreasing Critical Illness Cover (reviewable)BothLife Insurance with Critical Illness CoverGuaranteed orReviewable PremiumsTotal and Permanent Disability CoverOnly available on plans thatinclude CICGuaranteedNo – TPD not requiredIncreasing Life Insurance with Critical Illness CoverMortgage Protection onlyDecreasing Life InsuranceYes – Own OccupationDecreasing Critical Illness Cover (reviewable)Reviewable(plans thatinclude CIC)Decreasing Life Insurance with Critical Illness CoverStart date (DDMMYYYY)Yes – Specified Work TasksFamily Protection onlyFamily and Personal Income PlanIncreasing Family and Personal Income PlanOr not knownFamily and Personal Income Plan Critical Illness CoverIncreasing Family and Personal Income Plan Critical Illness CoverFamily and Personal Income Plan with Critical Illness CoverIncreasing Family and Personal Income Plan with Critical Illness CoverApplication Form – Part AChildren’s Critical Illness Extra BenefitAvailable on plans that include CICYesNoPage 7

INCOME PROTECTION BENEFITPRODUCT SELECTIONPRODUCT DETAILSReason for PurchaseAnnual EarningsFamily ProtectionMortgage ProtectionRental ProtectionSelect ClientClient 1 (only) Earnings are defined as your annualpre tax earnings for PAYE assessmentpurposes and can include your P11dbenefits. Please refer to your PolicySummary for full information.Monthly Benefit(stage 1)Deferred period(stage 1)Do you work for at least16 hours per week?Type of coverYesStandardNoLow Cost (1 year)If ‘No’, your occupation willbe classed as a ‘houseperson’Low Cost (2 years)Start date (DDMMYYYY)Age at expiry2 weeks Client 2 (only)yrs4 weeksOr not known8 weeks13 weeks26 weeks52 weeksSelect a ProductIncome Protection BenefitStage 2 (only if Stepped Benefit selected)Stepped Benefit4 weeksYes8 weeksRental IncomeProtection BenefitNoIncreasing IncomeProtection BenefitNot available for Low Cost13 weeksIncreasing Rental IncomeProtection BenefitPRODUCT DETAILSReason for PurchaseAnnual EarningsMortgage ProtectionRental ProtectionSelect ClientClient 1 (only)Monthly benefit26 weeks52 weeks PRODUCT SELECTIONFamily ProtectionDeferred period Earnings are defined as your annualpre tax earnings for PAYE assessmentpurposes and can include your P11dbenefits. Please refer to your PolicySummary for full information.Monthly Benefit(stage 1) Client 2 (only)Deferred period(stage 1)2 weeksDo you work for at least16 hours per week?Type of coverYesStandardNoLow Cost (1 year)If ‘No’, your occupation willbe classed as a ‘houseperson’Low Cost (2 years)Start date (DDMMYYYY)Age at expiryyrs4 weeksOr not known8 weeks13 weeks26 weeks52 weeksSelect a ProductStepped BenefitIncome Protection BenefitYesRental IncomeProtection BenefitIncreasing IncomeProtection BenefitIncreasing Rental IncomeProtection BenefitNoStage 2 (only if Stepped Benefit selected)Deferred period4 weeksPage 8Not available for Low Cost8 weeks13 weeksMonthly benefit 26 weeks52 weeksApplication Form – Part A

APPLICATION FORM – PART AOCCUPATION DETAILSOnly applicable for applications which include Income Protection Benefit or Critical Illness Cover.You don’t need to answer this question if you are a houseperson, retired, a student or unemployed.Client onePlease indicate youroccupation type from thecategories listed opposite.If your occupation doesn’t fitinto one of these categories,tick ‘Another category’.Client twoWorking in an office-type environment for at least 75% of yourtypical working dayRetail – for example, salesperson, retailer, shop worker ormanager, (except market traders)Catering – for example, caterer, chef, cook, waiter, waitress,kitchen staffEducation – for example, teacher, lecturer, head teacher,classroom assistant, nursery workerHealthcare – for example, nursing, medical, surgical, carerAnother category (including market traders)If ‘Healthcare’, please select:Nurse, staff nurse, charge nurse, sister, matron, auxiliary,paramedic, practice nurse, dental nurse, district nurse, midwifeSurgeon, anaesthetist, obstetrician, gynaecologist, dentist,dental hygienist, carer, care assistant, social worker, physiotherapistPhysician, medical or general practitioner, hospital doctor(other than surgeon, anaesthetist, obstetrician or gynaecologist –see above), psychiatrist, osteopathClient oneClient twoIf ‘Another category’, or if the application includesIncome Protection Benefit, please give youroccupation title:If ‘Another category’, or if the application includesIncome Protection Benefit, please give youroccupation title:Occupation*Occupation*Occupation classThe occupation class is to becompleted by your financialadviser.Application Form – Part A12Occupation class34*Please complete for main occupation only.1234*Please complete for main occupation only.Page 9

APPLICATION FORM – PART BOLP Connect –Standard Underwriting (SA9.1)Family ProtectionMortgage ProtectionPart B is designed to mirror the Standard Underwriting route in OLP Connect so that you cancapture your client’s answers in advance and complete the application in OLP Connect. Thisform cannot be used with the Interactive Underwriting route.PERSONAL DETAILSClient oneClient twoAs Client 1What is your contact address,including postcode?Please check that you’ve filledin your postcode as this isessential for processing theapplication more quickly.Phone NumbersWe may need to contact youabout your application, whichmight involve discussingsensitive matters. If we contactyou by telephone, calls may berecorded and monitored.Work phone (optional)Work phone (optional)Home phone (optional)Home phone (optional)Mobile phone (optional)Mobile phone (optional)As Client 1What is your home address,including postcode, if differentfrom the contact addressprovided above?Please check that you’vefilled in your postcode.EXISTING POLICIESIs this policy/policies to replacean existing Legal & General policyor policies?YesNoYesNoPolicy Number(s)If you don’t have these to handplease leave blank and we willcontact you.PERMISSION TO REQUEST A MEDICAL REPORT FROM YOUR DOCTORLegal & General may need to request a medical report from your doctor in order to assess your application.Legal & General will need your consent to be able to do this and a form for this is provided as part of this application form.You don’t have to provide consent but it will mean we won’t be able to continue with your application if consent is not given.If you have any questions relating to the process of obtaining, assessing or storing medical information, please write to:The Claims and Underwriting Director, Legal & General, City Park, The Droveway, Hove BN3 7PYPage 10Application Form – Part B

ACCESS TO MEDICAL REPORTS AND CONSENT FORM FOR CLIENT ONELegal & General would like to ask you for your consent to request a medical report to help usassess your application. This request is made using the Access to Medical Reports Act 1988, theAccess to Personal Files and Medical reports (Northern Ireland) Order 1991, and the Isle of ManAccess to Health Records and Reports Act 1993.Please complete the following details to help your doctor’s surgery to match your records:GP Name (if known):Mr/Mrs/Miss/Ms/Dr/Rev/OtherFull Name:GP Address:Current Address:Date of Birth (DDMMYYYY):Things you need to know before you give your consent If you would like to see a copy of the report before Legal & General receive it, please let Legal & General know below. Youwill then have 21 days fr

Pages 3 to 19 and pages 34 to 35 must be completed. Pages 21 to 29 are additional questionnaires which only need to be completed if you are instructed to do so within the form. For joint life plans, please complete Client 1 and Client 2 sections, each client must fill out their own details. If your financial adviser is