Transcription

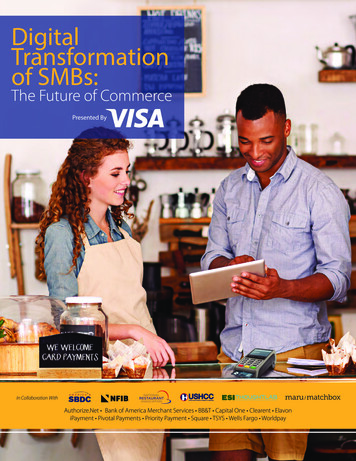

DigitalTransformationof SMBs:The Future of CommercePresented ByIn Collaboration WithAuthorize.Net Bank of America Merchant Services BB&T Capital One Clearent ElavoniPayment Pivotal Payments Priority Payment Square TSYS US Bank Wells Fargo Worldpay

About VisaVisa Inc. (NYSE: V) is a global payments technologycompany that connects consumers, businesses,financial institutions, and governments in more than200 countries and territories to fast, secure and reliableelectronic payments. We operate one of the world’smost advanced processing networks — VisaNet — thatis capable of handling more than 65,000 transactionmessages a second, with fraud protection forconsumers and assured payment for merchants.Visa is not a bank and does not issue cards, extend creditor set rates and fees for consumers. Visa’s innovations,however, enable its financial institution customers tooffer consumers more choices. For more information,visit https://usa.visa.com and @VisaNews.For media or corporate inquiries, please contactsmbdigital@visa.com.2

About Maru/MatchboxAbout ESI ThoughtLabMaru/Matchbox is a market research consultancyESI ThoughtLab is a leading economics consultancyproviding strategic advice, proprietary platforms, andfirm. With access to a global team of over 100empirical analysis to help business, government, andeconomists, industry analysts, and urban experts, ournon-profit leaders to better understand their customers,firm brings together macro-to-micro analytics with thecompetitors, services, and markets.ability to survey and interview executives, consumers,and policy makers around the world. We provide ourOur clients include the world’s leading brands inanalysis in a variety of engaging executive formats, fromfinancial services, technology, media & entertainment,global ranking and benchmarking tools to cost-benefitretail, and consumer goods. Maru’s Financial Servicesand economic impact models.Practice is headquartered in New York City with officesin Chicago, Vancouver, and Toronto. For moreinformation, visit https://marumatchbox.com or pleasecontact sales@marumatchbox.com.This paper is intended for informational purposes only and should not be relied upon for operational, business, legal, regulatory, or other advice. While efforts have beenmade to ensure the accuracy of the content of this guide, errors may exist, and we do not guarantee the accuracy of the content, including but not limited to any contentthat relies on information collected from third parties. Visa is not responsible for any use or reliance on the content of this guide.Copyright 2018 Visa. All rights reserved.3

Table ofContents4

7IntroductionExecutive Summary Case Study: Little Green Cyclo – More Customers, More Revenue, More Free Time for Owners12Enabling Consumer Discovery and Marketing in the Digital AgeWebsites How to: Create a Website Case Study: Silloway Maple – E-commerce Creates National Reach How to: Promote Your WebsiteDigital Marketing (Includes E-mail, Social Media & Review Sites) How to: List Your Products in an Online Marketplace Case Study: Amy's Gourmet Apples – The Power of Going Digital How to: Market Your Business Online Case Study: Colonel De’s Gourmet Herbs & Spices –24Connecting with Customers On- and Off-lineEnhancing the Customer ExperienceCustomer Service ConsiderationsLoyalty Programs How to: Launch a Loyalty Program Case Study: Mixt – Digital Loyalty App Speeds Up Lines, Grows Customer Loyalty Case Study: Keva Juice – Growing with Digital Loyalty32The Impact of Digital PaymentsImpact on SMB’s Expenses: Cost of Digital and Non-Digital PaymentsImpact on SMB’s Revenue How to: Set Up Digital Payment Acceptance (In-Store and Online) Case Study: Caribbean Café – Accepting Digital Payments Adds 20% to Business Case Study: Epic Burger – Going Cash-Free: Safer, Faster, More Profitable41Other Digital Transformation Tips How to: Run Other Parts of Your Business Digitally How to: Generate Funds to Grow Your Business4547ConclusionEnd MatterMethodology Quantitative Analysis DetailsDisclaimers and Permissions5

IntroductionThe insights provided in this guide are for small and medium sizebusinesses (SMBs) in the United States, with a focus on helping businessesgrow and improve the customer experience by leveraging technology anddigital commerce. We hope you enjoy reading it!6

Executive SummaryFueled by smart technologies, mobiledevices, and 24/7 connectivity, the wayconsumers browse, shop, and pay ismoving toward a digital means.In 2018, nearly 280 million people, or 85% of the U.S.population, are expected to go online at least once amonth.1 Of those, 81% will browse, research or compareproducts digitally and 70% will use the internet tomajority of American enterprise.5 According to a newactually make a purchase.2 As a result, cross-channel2018 Maru/Matchbox survey,6 46% of SMBs sell theirbuying is becoming increasingly common – eMarketerproducts and services online, and of the SMBs who do,estimates that 25% of purchases started online arethey estimate that about 15% of their sales come fromcompleted in-store, and 25% of purchases started in-the online channels.store are completed online.3 Given these data points, it’sAs SMBs are the focus of this research, it’s worth taking anot surprising to see that in 2017, payments mademoment to understand the size and scale theyusing cards overtook cash globally: 23.3 trillion versusrepresent. SMBs are an undisputed engine of the 20.4 trillion.4nation’s economy. Per the SBA’s 2017 Small BusinessIn response to these evolving consumer practices,Profile, they make up 99.9% of all companies in thecommerce itself is undergoing a profoundUnited States and employ 58 million people, or 48% oftransformation, with businesses looking at digitalAmerica’s workers.7 They are a vital force of internationalsolutions to improve sales, acquire new customers, andtrade, making up 98% of all U.S. exporters. And, SMBreduce costs. This presents particular opportunities forowners are diverse: 8 million of them are minorities, andSMBs, the 29.6 million firms which make up the vast10 million are women, with both groups growing.1eMarketer, US Digital Users, eMarketer’s Estimates for 2018, March 2018.2eMarketer, Digital Shoppers & Buyers by Country, February 2018.3eMarketer, ForeSee “Customer Experience 2017,” April 2017.4Euromonitor International, Consumer Finance 2017 Edition.5Small Business Profile 2017, US SBA Office of Advocacy. SBA defines a “small business” as a firm having fewer than 500 employees. Only 18,500 firms in the US employ more than 500 people, less than 0.1% of all firms.6Throughout this report, data is drawn from the Maru/Matchbox 2018 survey of SMBs and consumers unless otherwise noted. Please see Methodology section for details.7Small Business Profile 2017, US SBA Office of Advocacy.7

For all these reasons, and many others enumerated intasks necessary to run businesses. To help close thesethe pages that follow, this guide focuses on ways thatgaps, Digital Transformation of SMBs provides real-lifedigital commerce can make life better for SMBs.testimonials and a ‘how-to’ primer for those interested innext steps. Key findings are interspersed alongside theTo bring these ideas to life, Visa partnered with amost important survey learnings, which are:consortium of trade associations, technology providers,banks, and researchers to answer the question:Enabling digital consumer discovery andmarketing are critically important in today’senvironment.Do SMB’s need to transform digitally to prosper in thisenvironment, and if so, how can they start? This guideincludes findings from a 2018 Maru/Matchbox survey ofIn order to win prospective and existing customers, it’sSMB decision-makers across four industries, food andimportant for SMBs to have a digital presence duringdining, retail, grocery, and services, and consumersthe discovery and evaluation stages of the customerasking them about their experience and expectationsshopping journey.with digital channels and payments.8 What we found Over 80% of consumers surveyed say they arewas a gap between what consumers want and whatsome SMBs are doing. The gap suggests that there aremotivated to shop at a business if they have an easyopportunities for SMBs to utilize consumer-sought,to use website.digital ways to capture revenue, stay in front of 52% of consumers surveyed search online and/or checkcustomers, and save time and expenses on the dailythe business website before visiting a new business. Over 60% prefer to be contacted through a digitalchannel, such as e-mail, website banners, orbusiness’s website.These behaviors and preferences highlight anopportunity, as currently less than half of SMBs conductbusiness online.The gap suggests that there areopportunities for SMBs to utilizeconsumer-sought, digital ways tocapture revenue, stay in front ofcustomers, and save time andexpenses on the daily tasksnecessary to run businesses.8Digital channels defined as online presence through business or third-party website and/or mobile app. Digital payments defined as payments made through cards or mobile phone. See Methodology section for details.8

Traditional Customer JourneyCurrent Customer JourneyWebAdsWord ch CardLoyaltyProgramWebSearchOnlineStoreBlogs Reviews tal ingEngageDiscover Word ofSocialMedia AdsRadio& TVRadio& TVEvaluateEmailAdsSocialMediaPunch CardOnlineLoyaltyPromotion ProgramPrint / CatalogCommunityFourmsInstant Message ers are looking for experiences thatenhance and simplify their lives.This presents an opportunity to increase customerWhen shopping or considering where to shop, customeragree that customer experiences such as innovative newservice considerations are motivating factors forordering or payment services will have a positive impactconsumers we surveyed:on their business's bottom line.engagement as roughly half (55%) of the SMBs surveyed Over 80% of consumers surveyed mention digitalbusiness, such as the ability to order ahead, participateDigital payments may positively impact SMB’sbottom line.in loyalty programs, and receive fast responses back toGiven consumers’ preference for digital channels, it’s notinquiries.surprising to see that 78% of consumers ranked a digitalrelated benefits are motivating factors to shop at apayment method, such as a card or being able to pay Millennials are most inclined to take advantage ofwith their phone, as their #1 preferred payment option.digital services such as shipping or delivery incentives,Further, there could be expense and revenue benefits toself-serve kiosks, and Wi-Fi at businesses.9accepting digital payments.9Includes card, such as debit or credit, and mobile payments. See Methodology for details.9Print /Catalog

Based on the 2018 Maru/Matchbox SMB survey data:Only 27% of SMBs reported that they prefer to acceptdigital payments from consumers. However, given the The average cost of processing digital payments,potential financial benefits, showcasing and enablinginclusive of direct expenses and labor costs, is 57%digital acceptance may help increase revenue andless than that of non-digital payments.10reduce costs. 65% of SMBs agree that customers spend moreIt’s important to mention that in addition to consumerswhen they use cards versus cash.expressing preference for digital commerce, 87% also On average, SMBs reported an 8% increase inthink it’s important to support local SMBs – providing arevenue after accepting digital payments.11great opportunity for SMBs to increase engagementwith consumers.87%of consumers think it’simportant to supportlocal SMBs.10Digital payments defined as wire transfers, cards (such as credit, debit, prepaid), mobile payments and peer-to-peer payments. Non-digital payments defined as cash, check and money orders. See Methodology for details.11Based on survey participants who reported either specific increase or no impact in sales volume after accepting digital payments. No participant reported decrease in sales volume. See Methodology for details.1010

CASE STUDY: Little Green CycloLittle Green Cyclo – More Customers,More Revenue, More Free Time forOwnersLittle Green Cyclo has been bringing fresh, authenticVietnamese street food to the Bay Area for eight years.The founders — Chef Quynh Nguyen, Monica Wongand Susie Pham — serve up a menu that showcases thegreat flavors of Vietnam using local, free range,sustainable, organic and seasonal ingredients.The business started as one cash-only food truck. Notonly have they added two trucks, they have alsoexpanded to include a commercial kitchen, distributingproduct to 16 Philz coffee shops and local grocers. LittleGreen Cyclo also stocks smart vending machines thatsell fresh packaged goods at hotels.Customers also tipped more on cards, they discovered,Accepting digital payments was a big part of theirespecially on big-ticket orders. “Our customers like thegrowth, say the owners. “By accepting only cash, we wereeasy tipping feature that displays “10, 15, or 20% tip”turning away many customers every day,” says Monica.options after they swipe. Before, they would just leaveone or two dollars in the tip box,” says Monica.Susie mentions how employees noticed that digitalpayments helped to move people through the busyAccepting digital payments has alsomade daily bookkeeping easier asmanagers can see the sales data inseconds, pull accounting records,and check cash flow, freeing up twoto three hours a week, or over ahundred hours a year.lunch lines faster and reduced customer complaints.Accepting digital payments has also made dailybookkeeping easier as managers can see the sales datain seconds, pull accounting records, and check cash flow,freeing up two to three hours a week, or over a hundredhours a year.Monica Wong says, “Adding digital paymentscontributed significantly to our growth. We wouldn’t bewhere we are today without digital payments.”11

EnablingConsumerDiscovery andMarketing inthe Digital Age12

Consumer discovery and marketing playa key role in attracting consumers.Research shows that consumers preferusing digital channels such as a businesswebsite, social media, and e-mail whendetermining where to shop.WebsitesWhile close to 90% of consumers surveyed think it’simportant to support SMBs, they are also heavily relianton digital channels when considering where to dineand shop. More than half (52%) of survey participantsoften search online and/or check a new business’swebsite before visiting in person. Millennials are mostConsumers are increasingly making purchases online.likely to do so (68%), followed by Gen X (61%) and BabyPer the 2018 Maru/Matchbox survey, 38% of consumers’Boomers (40%). In fact, over 80% of consumersretail purchases are currently made online. This numbersurveyed say they are motivated to consider or shopis expected to grow as 61% of consumers surveyed arewith a business if they have an easy to use website.planning to increase their online purchases in the next 5years. On the other hand, 78% of consumers surveyedWhat motivates you to shop with acertain business?are planning to decrease or keep their in-storepurchases the same.These findings present an opportunity for SMBs to91%82%increase their online presence. Currently, 46% of SMBs85%surveyed have an online presence, such as through abusiness website or online marketplace. Servicesindustries lag behind others, with only about a thirdusing digital channels, compared to about one-half forQ Stores (Based on retail, includesfood and dining, retail, and grocery. SMBs estimated thatdrugstores and groceries)Q RestaurantsQ Services15% of sales come from these channels, with the higherproportion of sales coming from medium size firmsEasy to Use Website(27%) versus 11% for micro and 21% for small.12Source: Visa Digital Transformation Research, 2018 Maru/Matchbox survey.12Annual sale criteria by SMB size – Micro 500K, Small 500K- 5MM, Medium 5MM- 10MM. See Methodology for details.13

How to: Create a websiteThe following are key steps to consider when creatingyour business website:Create and register a domain nameBuild your website Set up your business online by getting a websiteaddress, also called a domain name or URL. Domainnames should be easy to say, spell, and remember. Ifyour first choice of domain name is already taken,choose another that’s different enough to avoid anyconfusion with similar businesses. When people visit your website, you want them toinstantly understand your business, easily navigatethe site, find pricing, know how to buy and askquestions. Be sure that your website has a clearnavigation (search) bar and a call to action button,like “buy now,”“make an appointment/reservation,” or“contact us.” There are many domain registration websites that canhelp you get you started. Put yourself in the shoes of your customer and thinkabout what else they’d like to see on your website.When developing content, create copy that is notonly catchy but also SEO (search engine optimization)friendly. See the Promote Your Website section formore details.Select a host and platform A “host” connects your website to the wider internet,sets you up on a server, and offers services like e-mailmanagement. Important things to look for arereliability (your host doesn’t crash) and flexibility (youcan make changes to your website easily andquickly). Business websites usually include the followingpages: Homepage, Products/services and OnlineOrdering, About Us, Contact information. Otherconsiderations include cross-promoting your socialmedia or review sites, along with business policiessuch as any terms or conditions you may have. Most hosting providers offer numerous service plansdepending on the size of your website and theamount of traffic your website is likely to receive. Ifconsidering free Web hosting services, do note thatthese sites typically deliver advertising like bannersand pop-ups on your website. Consider making your website mobile-friendly. InOctober 2016, mobile internet use passed desktopinternet use for the first time ever.13 Selecting the right “platform” is important if you’retaking the “DIY” approach. A platform is a tool thathelps you design and build your website, offeringtemplates and tips on the ways to craft the look andfeel of your website. PRO TIP: Does your website have a blog section?Within your field, you have unique knowledge that yourcustomers may lack. By sharing knowledge, you canattract traffic from people who are seeking information,strengthen your brand and establish yourself as anexpert within your field.14 PRO TIP: Some hosting companies will offer you adeal if you register a domain name and host with theirservices. With this option, do note that if you decide tochange your hosting company later on, you may have topull down your domain name and could encounterunexpected hurdles.13NFIB, “How to Make It Easier for Customers to Find Your Business,” February 9, 2017.14Authorize.Net, “Keep Customers Coming Back. Five Tips to Increase Customer Retention.” March 7, 2018.Accept online payments Please see Set Up Digital Payment Acceptancesection for more details.14

CASE STUDY: Silloway MapleSilloway Maple – E-Commerce CreatesNational ReachI’m not as tech savvy as some, butthe people at Authorize.Net havebeen helpful and patient with myquestions. I can take paymentsonline or over the phone, trackdown orders, and give refundswhenever needed. It’s great beingable to take orders outside of ourVermont community so we canshare our 100% maple syrup acrossthe country.Bette Lambert and herson Paul manage SillowayMaple, a family-runbusiness that makes 100%pure Vermont maplesyrup. Silloway started inthe 1940s as a sidebusiness to the familydairy

digital services such as shipping or delivery incentives, self-serve kiosks, and Wi-Fi at businesses. This presents an opportunity to increase customer engagement as roughly half (55%) of the SMBs surveyed agree that customer experiences such as innovative new ordering or payment services wil