Transcription

Pa sserellesENApril 2015ISSN 2354-5402N 1Bridgingacademicresearch withfield practiceMicrofinance andClimate Change

AfricanMicrofinance WeekDakar, SENEGAL29 June - 3 July 2015The annual meetingfor microfinanceprofessionals in Africawww.microfinance-africa.orgThe African Microfinance Week 2015 is organised by the African networks AMT, AFMIN, AFRACA and MAIN, and is supported by ADA,the Government of Senegal and the Government of the Grand Duchy of Luxembourg.Pub passerelles 2015 UK.indd 110/04/2015 15:58:13

Microfinance and climate changeSummaryForewordJoaquim Monteiro5IntroductionCan microfinance makea siginificant contributionto sustainable development?Sophie WiesnerEditorADA asbl39, rue GlesenerL-1631 LuxembourgTel.: 352 45 68 68 1Fax: 352 45 68 68 68www.ada-microfinance.orgRCS Luxembourg F 199CCPL IBAN LU64 1111 1189 2705 0000Copyright: ADA, april 2015 pictures: ADA, Daniel Tiveau, Olivier Girard cover picture: Pablo ToscoClimate change and microfinanceAn urgent need to be managed,an opportunity to be seizedMarc Bichler610MFI’s environnemental performance in Central America undera context of climate changeDavide Forcella, Juana Ramirez,Marion Allet16Climate change mitigationand adaptation strategies16Methodology16Environment and Microfinance:who is doing what?17Evolution in environmentalperformance between 2011and 2014 in Central America22Two countries, two institutionsand a common concernWhen microfinance institutionsdecide to go green29An interview with CARD,Philippines30An interview withFundecooperación, Costa Rica32MFIs’ awareness of enviromentalprotection policies: a driver of goodenvironmental perfomance andMFIs’ good governance?24Conclusion28Graphic work: CropmarkPrint: Imprimerie CentraleWith the financial support of:Under the High Auspices of HRHthe Grand Duchess Maria Teresa of LuxembourgADA is able to pursue its mission thanks to the support provided by theLuxembourg Directorate for Development Cooperation and Humanitarian Affairs.Disclaimer: Views and opinions expressed in this publication are those of the author(s) and do not necessarily reflect those of ADA. Neither ADA nor any of its employees, agents, third-partycontent providers or affiliates may be held liable for the use which may be made of the information contained therein. The authors acknowledge that no third-party textual or artistic material hasbeen included in the publication without prior consent of the copyright holder to further dissemination by third parties.3

P asserelles – n 14

Microfinance and climate changeForewordSetting the agenda for a newglobal partnershipJoaquim Monteiro *2015 is one of those years during which, global high-level meetings seem to succeed each other at an incredible pace. This yearmarks wrap up of the landmark UN Millennium DevelopmentGoals, which world leaders agreed on 15 years ago. There hasbeen significant progress in meeting the targets, however, a lotstill lies ahead. In order to adopt the post-2015 developmentagenda, the UN plans a World Summit from 25 to 27 Septemberin New York.The summit will be preceded by the Third International Conference on Financing for Development, which will be held in AddisAbaba, Ethiopia from 13 to 16 July. The expected result of theconference is an intergovernmental, negotiated and agreedoutcome, which should constitute an important contribution toand support the implementation of the post-2015 developmentagenda. In particular, the UN Secretary General, Ban Ki-Moon,has already estimated the channelling of both public and privatesector cash flows into sustainable development initiatives as“crucial for securing an ambitious post-2015 agenda 1.”At the European level, 2015 has been designated “EuropeanYear for Development”. For the first time ever, the EU’s externalaction and Europe’s role in the world will be under discussion.Apart from global initiatives, sustainable development requires anaction from all stakeholders. Thus, in this issue of “Passerelles”,we try to provide the reader with some insights on ongoingresearch and opportunities related to Green Microfinance andattempt to partially answer the question what role microfinancecould play in tackling climate change?Far from being exhaustive, “Passerelles” offers readers someselected perspectives on the topic and invite those interested insharing their experiences and points of view to submit commentson ADA’s website.Finally, at the global level, the 21st session of the Conferenceof the Parties (COP) to the UNFCCC2 will take place in Parisin December. Much is awaited in terms of outcome from theCOP21, in particular clear and ambitious goals to tackle climatechange and thus guarantee a sustainable development for all.*Joaquim Monteiro, Manager R&D, ADA1http://www.un.org/apps/news/story.asp?NewsID 50519#.VSfWWJNZsZM2United Nations Framework Convention on Climate Change5

P asserelles – n 1Can microfinance makea significant contributionto sustainable development?Sophie Wiesner *Back in 1987, the World Commission for Environment and Development (better known as theBrundtland Commission) definedsustainable development as developmentthat allows the present generation to meetits needs today without compromising theability of future generations to meet theirneeds tomorrow1.This concept of sustainability gives priorityto the needs of the poor and the vulnerable and highlights the limitations of natural resources in meeting these needs. Itaddresses not only economic and social,but also environmental aspects of development; and – in this sense – it connects thedomain of development with the domainsof microfinance and climate change.From the early days, during which the focus of inclusive finance2 was on microcreditand on the output or income of micro-enterprises, until today, where the provision ofmicro-savings, micro-insurance, and manyother financial services centers around theopportunities and choices of low-incomehouseholds, microfinance is considered asa potential tool to advance development.1Cf. WCED (1987), p.4. The report is availablefor download at: 2We define inclusive finance as the range offinancial products and services available tomarginalised, low-income populations excludedfrom the conventional banking system. We usethe terms “inclusive finance” and “microfinance”interchangeably.6*Sophie Wiesner, Project Officer R&D, ADAIn recent years, however, microfinancewas also recognised as a tool to addressclimate change. The funders of microfinance attach increasing importance to thefinancial, social, and environmental performance of microfinance institutions (or tothe triple bottom line of profits, people, andplanet). The providers of microfinance are“going green” by financing renewable-energy and low-emission solutions, projectsrelated to adaptive agriculture, or resourcemanagement at the community level; andlocal initiatives of microfinance are thereby inscribed in national, international, andglobal frameworks for development andclimate change.But, can microfinance really make a significant contribution to sustainable development as defined by the BrundtlandCommission? The present issue of “Passerelles” tries to shed some light on thisquestion and looks both at the opportunities and the challenges in this endeavour.

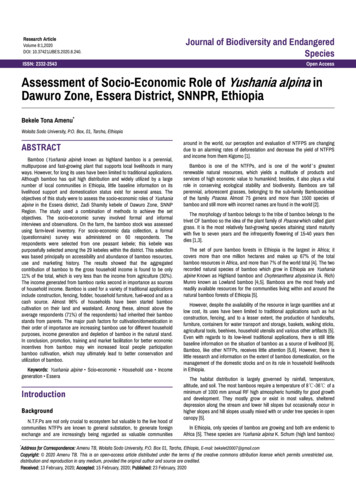

Microfinance and climate changeClimate change, development, andmicrofinance – 3 interlinked domainsDevelopmentDeveloping countriesand poor/vulnerablepeople hardest hitby climate changeComplementarity ratherthan contradiction betweenclimate change anddevelopmentClimate ChangeMitigation of challengesAdaptation toconsequencesDevelopmentEconomic development(Output, income, wealth)Human development(Opportunities, freedom,well-being)SUSTAINABILITYKey role for agricultureMF as a toolto approachclimate changeMF as adevelopmenttoolNorth-Southand South-Southcooperation in termsof development andmicrofinanceNorth-South dividein terms of approachesto climate changeMicrofinanceFunders providing financial andtechnical support to MFIsMFIs providing financial and nonfinancial services to entreprises,households, and communitiesFigure 1: Climate change, development, and microfinance as interlinked domains (Sophie Wiesner)Climate ChangeFirst and foremost, it must be recognisedthat the dynamics of climate change, development, and microfinance are mutually reinforcing and interlinked through themacro-level, meso-level, and micro-level.As already stated in the Stern Review in2006 and as also confirmed by academicresearch in recent years, there is overwhelming evidence that climate change isman-made and that it does not only present serious global risks, but also asks forprompt global responses3.The extensive emission of greenhouse gases4 leads to global warming, disappearingglaciers, and raising sea levels; it implies extreme weather events, floods and droughts,and also has effects on our ecosystems (including the fauna, the flora, and microorganisms). Besides problems concerning the environment as such, however, climate changeleads to problems concerning economic ac-tivities (especially with respect to agriculture)and human wellbeing (including nutrition andhealth) – with some of these consequencesalready being felt in parts of the world5.Measures of mitigation try to reduce therisks of climate change by limiting the emissions of greenhouse gases in the short andmedium term; while measures of adaptation try to reduce the impact of climatechange by adjusting life to the changedconditions in the medium and long term.Individual initiatives must thereby bebrought together in one integrated approcah, which must not only consist in theformulation of strategies and in the implementation of action plans, but must alsocomprise the respective funding from yearto year and for the next decades. An implication of the public and the private sector(also on the basis of public-private partnerships), as well as of civil society is key, butreaching agreements and putting them inpractice is not an easy task6.There is a clear North-South divide in termsof the approaches to climate change, whichseriously slows down the process. Whilesome developed countries (and especiallysome emerging economies) are alreadyactively involved in climate action, somedeveloping countries claim for a “right topollute” in order to push industrialisation.But there is also a close North-South (andSouth-South) cooperation possibility interms of development, which might accelerate the activities. Developing countries(and thus the poor and the vulnerable) arehardest hit by climate change, but developed countries’ historical experiences bothin terms of industrialisation and in terms ofclimate action offer them inspiration andopportunities for leapfrogging.Thereby, the goals in approaching economic development, human development,and climate change must not be conflicting,but can and should be complementary.Economic development, defined as growthin output, income or wealth, is usually supposed to be possible only on the basis ofan extensive use of energy and an exploitation of the environment, but in the medium and long term the industrial sectorwill no longer find the respective resourcesto grow and cannot be powered anymore,if we don’t take measures now7.The economic benefits of climate action outweighby far its economic costs.3The Stern Review is accessible at http://webarchive.nationalarchives.gov.uk/ /http:/www.hm-treasury.gov.uk/independent reviews/stern review economics climate change/stern review report.cfm.The latest report of the IntergovernmentalPanel on Climate Change (please see IPCC(2015)) includes information on recent researchon climate change and can be downloaded athttp://www.ipcc.ch.4Greenhouse gases are all the gases that trapinfrared radiation in the atmosphere, includingcarbon dioxide (CO2) and methane. Cf. Rippey(2009).5Cf. Rippey (2009).6For examples of such initiatives andpartnerships, please see UN Climate ChangeConference (2014).7For indicators of economic development, pleasesee http://data.worldbank.org.7

P asserelles – n 1Human development, in turn, defined interms of increases in opportunities, choices and wellbeing cannot even be thoughtwithout climate action, as our quality of life(and the fulfillment of our most basic human needs, such as breathing clean air,drinking clean water, and finding food) crucially depends on the integrity of our ecosystems8.Rural activities and agriculture are particularly relevant in this context, taking intoaccount their effects on human well-beingand their direct impact on natural resources. Moreover, agriculture is the most important form of economic activity in developingcountries. It is a key channel through whichthe impact of climate change is transmitted,and it is in the focus of development, aswell as of microfinance.MicrofinancePeople in remote rural areas, active in agriculture, are exposed to high risks; andmicrofinance, (including savings, credit,insurance and other financial services) isan important tool for managing risks. Butthe respective communities in developingcountries are also at the center of innovations in terms of climate action; and microfinance allows them to access and use newproducts for this purpose.The offer of microfinance institutions includes working capital for micro-entrepreneurs, involved in the production, distribution, or maintenance of green products,small- or medium-sized loans to households for the acquisition of these products(although leasing gains in importance9),as well as teaching and training on newtechnologies. Providers thereby take advantage of their track-record in serving thismarket segment, of their linkages alongthe market chain, and also of their funds(specifically dedicated to “green” projects).Besides external actions, i.e. in terms ofthe offer of green products and servicesto clients, MFIs also undertake internal actions, i.e. in terms of their own emissions orresource management10.8The definition of human development in termsof opportunities, choices, and freedom goesback to Sen (1999). For indicators of humandevelopment, please see http://hdr.undp.org.9For more information on micro-leasing, pleasesee Deelen et al. (2003).10For more information, please see Allet (2012),SOS Faim (2014).11Cf. Allet (2012).8Microfinance donors and investors, in turn,provide funding and technical assistanceto microfinance institutions and promotethe “green” performance of MFIs. Theythereby contribute to the consolidation andcredibility of the movement and also fosterthe competition in the sector with respect toclimate action11.But in fact, not only microfinance institutions, putting in place the governance andmanagement for “going green”, or funders,making efforts in terms of their energy consumption and greenhouse gases, but alsoevery one of us should start thinking anewand acting immediately.Content and structureThis first issue of “Passerelles” looks atmicrofinance and climate change from theperspective of practice and research, itanalyses the opportunities and challengesfor sustainable development at the macrolevel, meso-level, and micro-level, and itpresents the key actors, initiatives, andideas.A first article, written by Marc Bichler, Ambassador-at-Large for Climate Change atthe Ministry of Foreign Affairs in Luxembourg, presents the political agenda withrespect to sustainable development for2015 and beyond. His article focuses on thefunding needs for climate action, as well ason the methods to meet these needs. Thepast experience of microfinance in attracting funds, defining objectives, and provingresults is taken into account, and the articlealso analyses the future potential of microfinance in terms of climate action.A second article, jointly written by MarionAllet, Davide Forcella, and Juana Ramirez,experts in the domain of microfinance andclimate change, analyses a sample of microfinance institutions with respect to theirmotivations for “going green”, their offerin terms of energy products and services,as well as their environmental governanceand management. The article identifieskey drivers, key players, and overall trendswith respect to microfinance and climatechange and specifically focuses on theCentral American context.The last part of the magazine, finally, is devoted to the experiences of two MFIs, FUNDECOOPERACIÓN from Central America/Costa Rica and CARD from SoutheastAsia/ The Philippines. Interviews provideinformation on the different country contexts and the situation of a small, specialised foundation, engaged in environmentalactivities and in microfinance, as well asa large, fully-fledged microfinance institution. There appear similar lessons learnedwith respect to microfinance and climatechange, but a close collaboration betweenresearch and practice is key in order totranslate them into perspectives for thefuture, and thus to seize the opportunitiesand to master the challenges of sustainable development. The present issue of“Passerelles” tries to contribute to this collaboration and to the exchange betweenresearchers and practitioners.ReferencesAllet, M. (2012): “Why Do Microfinance InstitutionsGo Green?”, CEB Working Paper, 12/015, elen, L., Dupleich, M., Othieno, L., and Wakelin,O. (2003): Leasing for Small and Micro Enterprises- A Guide for Designing and Managing LeasingSchemes in Developing Countries (Ed.) RobertBerold, International Labor Organization.IPCC (2015): Climate Change 2014 - SynthesisReport. http://www.ipcc.ch.Rippey, P. (2009): “Microfinance and ClimateChange: Threats and Opportunities”, CGAPFocus Note, 53, March 2009. climate-changethreats-and-opportunitiesSen, A. (1999): Development as Freedom, Oxford:Oxford University Press.SOS Faim (2014): « Une microfinance de plus enplus verte : tendance lourde ou effet de mode ? »,zoom microfinance, 42, Septembre 2014.UN Climate Change Conference (2014): Amaray– Energía y desarollo para zonas rurales, ediciónespecial, Lima COP20/CMP10, New York: UnitedNations.WCED (1987): Report of the World Commissionon Environment and Development: Our CommonFuture, New York: United Nations, WorldCommission on Environment and -future.pdf.Stern, N. (2006): Stern Review: The Economics ofClimate Change, Cambridge: Cambridge UniversityPress. http://webarchive.nationalarchives.gov.uk/ tern review economics climate change/stern review report.cfmFurther linkshttp://data.worldbank.orghttp://hdr.undp.org

Microfinance and climate change9

P asserelles – n 1Climate changeand microfinanceAn urgent need to be managed,an opportunity to be seizedMarc Bichler *ment. Today, the human origin of climatechange is clear but, fortunately, it is not toolate to do something about it.Tackling the effects of climatechange is not only desirable butnecessary, even essential. Thiswarning is not new, just as thecall for urgent action, which needs to beglobal and coordinated to be effective.Naturally, an international reaction using mitigation or adaptation measures tocounter the effects of climate change entails considerable costs. So, what sourcesof financing can cover these costs? Canlessons be learnt from innovative fundingsolutions introduced in the microfinancesector? Can approaches like those usedin inclusive finance serve as a role model?110http://www.ipcc.ch/home languages mainfrench.shtmlSince 1988, the Intergovernmental Panelon Climate Change (IPCC) has been studying different forms of climate change tobetter understand their causes, their consequences and the most effective ways oftackling them. In its fifth assessment report1 whose different parts have been published separately between 2013 and 2014,scientific experts made an effort to reachout to political and economic decisionmakers and present them with a summaryreport. The IPCC

Davide Forcella, Juana Ramirez, Marion Allet 16 Climate change mitigation and adaptation strategies 16 Methodolo