Transcription

Factors Influencing Customers Intention To Use Mobile Banking ServiceOf Private Banks In Myanmar: Conceptual Research ModelMr. Phyo Min Tunphyomintun.sg@gmail.comAbstractThe number of mobile user in Myanmar is rapidly growing since three main mobile operatorslaunched distributing SIM card in lowest rate compare to past a few years ago. With thereforming of national economic policy, private banks sectors are growing and expending itsservices including mobile banking (MB). There is lack of research studies regarding MBservice in Myanmar due to there is no maturity in MB context. Therefore, a conceptual researchmodel will be proposed to investigates risks, net benefits, customer satisfaction and quality ofMB service such as information quality, system quality and service quality are the factorsinfluence on users intention to use MB. Trust factor is also considered as necessary factor todetermine the intention to use MB service.Keywords- quality of mobile banking, risk, trust, net benefit, intention to use, private bank.I. INTRODUCTIONBanks produce financial products using by mobile and internet technology to facilitate thetransactions of their customer. They realize that MB will be their competitive advantages andto provide the best banking services to their customers. MB service is one of the major servicesof banks. There is 24 private banks in Myanmar [1] and 5 local banks have launched MBservices (The Voice Weekly 2015). However MB is still new to the vast majority of the localpeople [2]. Several banks are entering into local market on mobile financial services to developmobile applications to provide services such as disbursements, airtime top-ups, e-commerceand remittances [3]. Customers are able to perform checking balance, fun transfer, beneficiarypayment and viewing exchange rates through MB. Although there is several benefits of usingMB, people are still lack of awareness on it [4]. In recent years, with the increase the numberof mobile and internet users [5], banks are launching their MB service to facilitate financialtransaction. However lack of trust on banks (MB services provider) is a significant issue inMyanmar community since bank crisis 2003 [3].II. MOBILE BANKINGRapidly growing of innovations in mobile phone and telecommunication technology ledfinancial service industry to market with highly competitive (Khraim & Shoubaki , 2011). MBis an innovative system to facilitate convenient financial transactions for customer throughmobile devices [6]. [7] called MB as “pocket banking” of users. “Mobile banking is one of theservices provided by the banks to support financial services to their customers through mobilephones or other similar devices” defined by Tiwari and Buse (2007). Rapidly growing ofmobile phone technology, users are introduced with feature rich smart phones and it isconsidered as a sector encouraging intention to use MB. MB becomes a focal point for banksand mobile operators (Goswami and Raghavendran, 2009) by providing real-time bankingservices using with data transmission to allow accessibility of financial information andservices (Jacob, 2007) through MB applications.

III. SAMPLING COUNTRIES AND EXAMINED FACTORSTable 1 shows summarized the factors influencing on customers intention to use MB studiedin neighbourhood countries of Myanmar and countries in ASEAN region. TAM and ETAM ismost frequent used in empirical studies to investigate the factor influencing.AuthorsKrishanan,Khin, Teng(2015)Alam (2014)Dasgupta,Paul, Fuloria(2011)Chansaenroj,Techakittiroj(2015)Jeong, d FactorsTAMTo determine the factors that influences theintention to adopt MB service using factors ofperceived risk, perceived cost, relativeadvantage, usefulness and easefulness.Bangladesh UTAUTThe empirical study investigated consumer’sadoption of MB using factors of socialinfluence, effort expectancy, performanceexpectancy, perceived financial cost, perceivedcredibility, perceived self-efficacy andfacilitating conditionsIndiaExtendedPerceived usefulness, perceived image,TAMperceived ease of use, perceived risk,perceived value, self efficacy, perceivedcredibility and tradition were used as factors toascertain the impact of the antecedents over thebehavioral intentions towards MB usage.ThailandTAM andThe study found that the perceived usefulness,Innovationperceived ease of use, the perceived cost andDiffusionperceived risk were affected with the intentionTheoryto use MB service.SingaporeExtendedPerceived usefulness, perceived ease of use,TAMperceived credibility, self-efficacy andperceived financial cost are factors influencingon consumer acceptance of MB service.Table 1: Empirical Study Of Users’ Intention To Use MBIV. THEORETICAL BACKGROUNDUpdated D&M IS Success Model, 2003

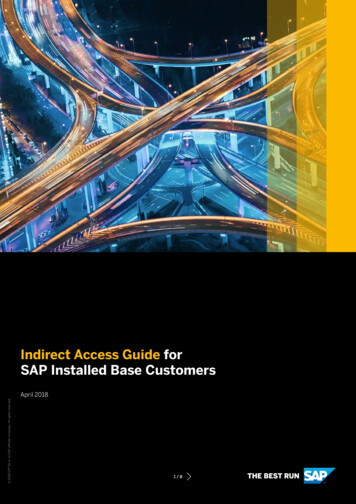

Many researchers studied to understand user’s intention to use MB services in differentcountries. But there is no empirically study regarding Myanmar banking user’s intention to useMB services. It is seen that there is needed a study on perception of attitude of users towardMB in the Myanmar context after reviewing the existing research papers. DeLone and McLeanproposed to measure the success of IS by using dimension of Information Quality, SystemQuality and Service Quality, User Satisfaction and Net Benefits [8]. Many of past researchesin MB has used Technology Acceptance Model (TAM) of Davis (1989). [9] and [10] proposedfurther development on existing TAM model by incorporating perceived risk and trust to betterinvestigate consumer intention to use MB. Many studies have been validated D&M model andextended TAM in MB environments. User satisfaction on the system is also an important aspectto consider in this model. D&M suggested to make sure distinguish clearly on Net Benefit forwhom (Example: Individual, Group or Organization). In this model, net benefit will bemeasured for individual users of MB service. Wright (1975) explained that customers executea decision making procedure by engaging in cost-benefit analysis. Furthermore, Laforet and Li(2005) found that overcoming critical barriers of adopt an activity will happen when there isexpanding benefits.H1: User Satisfaction has positively relationship with intention to use MB. (DeLone &McLean, 2003)H2: Net Benefits has positively relationship with intention to use MB. (DeLone & McLean,2003)H3: Net Benefits has positively relationship with User Satisfaction. (DeLone & McLean, 2003)4.1. Quality Of Mobile BankingD&M model, measure three dimensions: “system quality”, “information quality” and extendeddimension in 2003 “service quality”. The system quality can be measured in terms of frequencyof system use, time of system use, number of accesses to system, system usage pattern andsystem dependency [8]. System quality is a key issue in MB development for strengthening ofits functionalities and features. Information quality reflects accuracy, timeliness, completeness,relevance and consistency. Accurate information is mandatory requirement for financialinstitutions and provide the valuable information in real-time through MB services willenhance customer satisfaction. D&M added service quality factor in extend IS success model(2003) and many empirically studies examined the relationships between service quality andattitudes to measure the user’s intention to use system. Service quality can be considered as agap between an expectation of customer and actual outcome. Assurance, Empathy andResponsiveness are variables to measure for service quality suggested by D&M. Dian (2008)explained that MB development process consist with different players such as providers,content partners, users and investors and it is complex process.H4: Quality of Mobile Banking has positively relationship with intention to use MB. (Alqasa,Othman, Isa, Faaeq , 2013, Talukder, Quazi, Sathye, 2014; Lee, Kim, Noh, 2017)H5: Quality of Mobile Banking has positively relationship with User Satisfaction (DeLone &McLean, 2003, Chhikara & Ankit, 2015).H6: Quality of Mobile Banking has positively relationship with Net Benefits. (DeLone &

McLean, 2003)4.2. TrustTrust should be considered as a social factor when developing and launching a MB service.Although trust has been widely examined and proven to be a crucial factor predictingcustomer’s intention to use MB, there is no study investigating different perspectives of trust.In this study, trust will be examined and confirmed as a key factor in different perspectivessuch as trust on mobile phone technology, mobile operator and MB service provider (bank).Customers hesitate to use mobile commerce if they feel the risk of processing transactionfalsely due to insecure communication operator, device operation system and mobileapplications [13]. (Lin, 2011) suggests that enhance trust will encourage customers to use MBfrequently. McKnight et al. (2011) explained that trust is an additional value for adoption useof technology and other studies. Benefits and advantages of MB service are not only for itsusers and providers but also for mobile network operators (telecommunication providers) [11].Mobile network operators become realized the opportunity to build their brand, expand theirservices and execute competitive marketing strategy to attract new customers in terms of MB(Gemalto, 2011). Since the mobile telephone networks are mainly controlled bytelecommunication provider or telecoms in MB environment, it becomes critical issues toconsider [12]. Retail banks are predominant financial firm providing MB services and [11]refers as MB providers.H7: Trust has positively relationship with intention to use MB. (Lee, 2005, Meng, Min, Li,2008, Sreenivasan & Noor, 2010, Masrek, Uzir, Khairuddin, 2012, Masrek, Mohamed, Daud,Omar, 2013, Wangari & Willy, 2014)User satisfaction will be lead by making customer believe that the technologies they are usingis secure and reliable in the context of MB. [14] claimed that trust has positive relationshipwith mobile banking satisfaction.H8: Trust has positively relationship with User Satisfaction. (Kassim, Jailani, Hairuddin,Zamzuri, 2012, Masrek, Mohamed, Daud, Omar, 2013)MB service becomes an additional channel of maintain relationship with customers, a way ofgenerating revenue and enhance reputation for banks. So that banks should be taken asimportant issue to consider into trust factor. Although [15] suggested low system quality andinformation quality will lead to decrement of initial trust in MB, author did not consider servicequality sector. [16] highlighted that perspective of customers on MB quality provided by bankis critical factor to build their trust in MB.H9: Trust has positively relationship with Quality Of Mobile Banking. (Zhou, 2011, Kassim,Jailani, Hairuddin, Zamzuri, 2012, Chhikara & Ankit, 2015)4.3. Perceived RiskShi Yu (2009) considered perceived risk as a major factor affecting on using new technologyapplications such as mobile banking. Jacoby and Kaplan (1972) suggested five key facets(financial, performance, social, physical and psychological risk) to measure perceived risk. Lee(2009) proposed five dimensions (performance, social, temporal, financial and security risks)for perceived risk and validated that they have a negative affecting on attitudes of customer. Inthe study of (Ndumba, Wangari, Willy, 2014) and (Kabir, 2013) about adoption MB, perceived

risk is considered in four dimensions (privacy, financial, system and physical security risks).Social and performance risk have negative relationship with intention to use MB howeverfinancial, security and privacy risks do not have due to major respondents are universitystudents aged 18-25 with experience in internet, mobile phone, online shopping and bankingin the study of Akturan & Tezcan (2012). According to Nguyen & Singh (2015), perceived riskconstructed with performance, privacy, security and time risks using perception of customerson risk of using e-banking. In the study, social risk, time risk, security risk and financial riskwill be considered under the factor of perceived risk.H10: Perceived Risk has negatively relationship with intention to use MB. (Shi Yu, 2009,Dasgupta, Paul, Fuloria, 2011, Khraim & Shoubaki, 2011, Akturan & Tezcan, 2012,Vasileiadis, 2014, Chansaenroj & Techakittiroj, 2015)Vasileiadis (2014) found that customers actually have intention to use m-commerce when theyhave high level of trust in using m-commerce and feel free of risk. On the other hand,Featherman & Pavlou (2003) claimed that trust in m-commerce is able to reduce perception ofrisk of customers to process online transaction with a service provider. Respondents in thestudy of Ashtiani & Iranmanesh (2012) denied that trust has negative impact on the perceivedrisk of using e-banking service.H11: Perceived Risk has positively relationship with Trust. (Ashtiani & Iranmanesh, 2012,Vasileiadis, 2014, Nguyen & Singh, 2015)Trust- Reputation of Bank- Tele Com Provider- Mobile TechnologyH8H7H5H9H1Quality Of MB- System Quality- Information Quality- Service QualityH11UserSatisfactionH4IntentionTo UseMBH3H2H10Perceived Risk- Social- Time- Security- FinancialH6Net BenefitsProposed Conceptual Research ModelV. RECOMMENDATIONSProposed conceptual research model is based on financial institution from the least developedcountry such as Myanmar [18] and it is required to further development or modify on modelfor other countries. Even though there will be same development level of country, the natureof private banking sector is unlike due to people have encountered bank crisis. Familiarity ofusing mobile technology is also immature compare to other countries. Author will developquestionnaire to validate proposed model for further quantitative research. All of major mobilebanking service providers are private banks in Myanmar so that proposed research model will

be adopted in private banking sector.VI. CONCLUSIONSTrust is considered as an additional critical factor in that model. [11] suggests to focus on retailbanks (MB service providers), mobile operators and current mobile phone technology tomeasure trust in MB. To investigate customer’s intention to use MB services, it is necessaryto consider quality of MB, trust, risk, customer satisfaction and net benefits after readingseveral literature reviews.References:[1]. Private Banks, Central Bank Of Myanmar, http://www.cbm.gov.mm/content/privatebanks, 22-NOV-2017.[2]. Myanmar’s Financial Sector A Challenging Environment for Banks, Foerch, Ki, Thein,Waldschmidt, February 2015, detail.php?ID 594&sphrase id 595, 29 June2017.[4]. The Future of Banking in Myanmar, Online Banking and the Challenges that lie -ahead, August 2015.[5]. ICT Works, Wow! Myanmar is Going ing-straight-tosmartphones/#.WhpyLrT1VmA, September 30, 2015.toSmartphones,[6] K. Lee, J. Kim, M.Noh, Influence Factors On Intention To Use Mobile Banking, 44thIASTEM International Conference, Rome, Italy, 20th-21st January 2017, ISBN: 978-9386291-97-4.[7] Amin, H., Hamid, M.R., Tanakinjal, G.H. and Lada, S., Determinants of Mobile BankingAdoption in the Ghanaian Banking Industry: A Case of Access Bank Ghana Limited, 2006,Journal of Internet Banking and Commerce, 11, 15-20.[8]. W. D. DeLone, and E. R. McLean, “The DeLone and McLean model of informationsystems success: a ten-year update,” Journal of Management Information Systems, vol. 19, no.4, pp. 9-30, 2003.[9] Wang, Y.S., Lin, H.H. and Luarn, P. (2006), Predicting Consumer Intention to Use MobileService, Information Systems Journal, Vol. 16(2), pp. 157 - 179.[10] Lee, K.S., Lee, H.S. and Kim, S.Y. (2007), Factors Influencing the Adoption Behavior ofMobile Banking: A South Korean Perspective, Journal of Internet Banking & Commerce, Vol.12(2). pp. 1 - 9.[11]. M. N. Masrek, N. A. Uzir and I. I. Khairuddin, "Trust in Mobile Banking Adoption inMalaysia: A Conceptual Framework" ,Vol. 2012 (2012), Article ID 281953

[12] Bangens, L. & Soderberg, B. (2008). 'Mobile Banking: Financial Services for theUnbanked?,' The Swedish Program for ICT in Developing Countries.[13] Alexios Vasileiadis, Security Concerns And Trust In The Adoption Of M-Commerce,Social Technologies, 2014, 4(1), p. 179–191.[14] Masrek, Mohamed, Daud, Omar, Technology Trust and Mobile Banking Satisfaction: ACase of Malaysian Consumers, Social and Behavioral Sciences 129 (2014) 53 – 58[15] Tao Zhou, (2011). An empirical examination of initial trust in mobile banking, InternetResearch, Vol. 21 Issue: 5, pp.527-540,[16] Lee, K. C. & Chung, N. (2009). Understanding Factors Affecting Trust in and Satisfactionwith Mobile Banking in Korea: A Modified DeLone and McLean’s Model Perspective.Interacting with Computers, 21(5), 85–392.[17] Davis, F.D. (1989), Perceived Usefulness, Perceived Ease of Use, and User Acceptanceof Information Technology, MIS Quarterly, Vol.13(3), pp. 319 – 340.[18] Least developed countries: UN classification, ountries-un-classification?view chart, November 2017.[19] Khraim,H.S., Shoubaki, Y.E. and Khraim, A.S. (2011). Factors Affecting JordanianConsumers’ Adoption of Mobile Banking Services. International Journal of Business andSocial Science, Vol. 2 No. 20.[20] Tiwari, R. and Buse, S. (2007), The Mobile Commerce Prospects: A Strategic Analysisof Opportunities in the Banking Sector, Hamburg, Hamburg University Press.[21] Goswami, D. and Raghavendran, S. (2009), “Mobile banking: can elephants and hippostango?”, Journal of Business Strategy, Vol. 30 No. 1, pp. 14-20.[22] Jacob, K. (2007), “Are mobile payments the smart cards of the aughts?”, Chicago FedLetter No. 240 (2007), Federal Reserve Bank of Chicago, Chicago, IL.[23] Khaled Al-Qasa, Filzah Md Isa, Siti Norezam Othman and Munadil K.Faaeq, 2013.Factors Affecting Intentions to Use Banking Services in Yemen. Journal of Internet Bankingand Commerce, December 2013, vol. 18, no.3.[24] Talukder, Majharul; Quazi, Ali; and Sathye, Milind, Mobile Phone Banking UsageBehaviour: An Australian Perspective, Australasian Accounting, Business and FinanceJournal, 8(4), 2014, 83-104.[25] Tejvir Singh Chhikara, Ankit .Information Quality - Crucial Aspect of E-Commerce.IOSR Journal of VLSI and Signal Processing (IOSR-JVSP). Volume 5, Issue 3, Ver. II (May- Jun. 2015), PP 31-35.

[26] Lee, T. (2005), “The impact of perceptions of interactivity on customer trust andtransaction intentions in mobile commerce”, Journal of Electronic Commerce Research, Vol.6 No. 3, pp. 165-80.[27] Meng, D., Min, Q. & Li, Y. (2008). “Study on Trust in Mobile Commerce Adoption: AConceptual Framework,” Proceedings of the 2008 International Symposium on ElectronicCommerce and Security, Ghuangzhou City, China, August 3- 5, 2008.[28] Sreenivasan, J., & Mohd Noor, M. N. (2010). A conceptual framework on mobilecommerce acceptance and usage among Malaysian consumers: The influence of location,privacy, trust and purchasing power. WSEAS Transactions on Information Science andApplications, 7(5), 661–670.[29] Masrek MN, Ahmad Uzir N, Khairuddin II. Examining trust in mobile banking: Aconceptual framework. Proceeding of the 18th International Business Information Management(IBIMA) Conference, 9-10th May 2012, Istanbul Turkey; 2012.[30] Masrek, M. N., Mohamed, I. S., Daud, N. M., & Omar, N. (2014). Technology Trust andMobile Banking Satisfaction: A Case of Malaysian Consumers. Procedia - Social andBehavioral Sciences, 129, 53–58.[31] Wangari, H., & Willy, M. (2014). Factors Affecting Adoption Of Mobile Banking InKenya; Case Study Of Kenya Commercial Bank Limuru. International Journal of SocialSciences Management and Entrepreneurship 1(3):92-112.[32] Kassim, E. S., Jailani, S. F. A. K., Hairuddin, H., & Zamzuri, N. H. (2012). InformationSystem

(DeLone & McLean, 2003) H2: Net Benefits has positively relationship with intention to use MB. (DeLone & McLean, 2003) H3: Net Benefits has positively relationship with User Satisfaction. (DeLone & McLean, 2003) 4.1. Quality Of Mobile Banking D&M model, measure three dimensi