Transcription

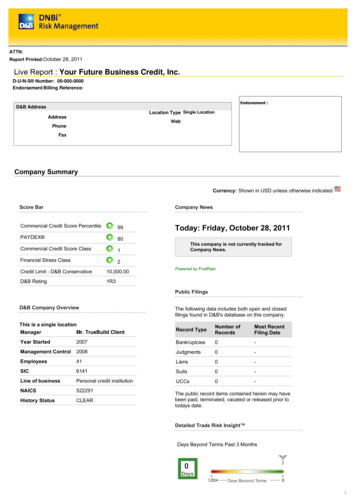

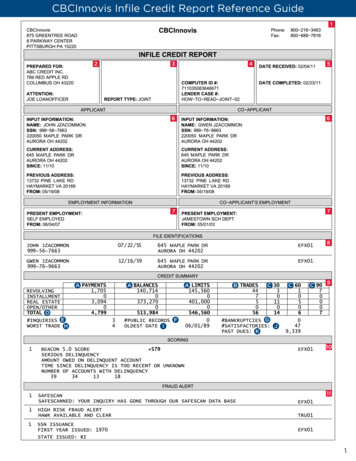

CBCInnovis Infile Credit Report Reference Guide1234566778AAACBCC9DEHGFIKJ10111

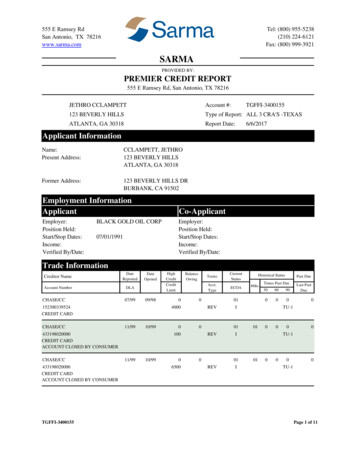

CBCInnovis Infile Credit Report Reference Guide1234B Total number of tradelines by each accountPROCESSING CENTER CONTACT INFORMATION:Please contact the Processing Center if you haveany questions regarding a CBCInnovis creditreport.type: revolving, installment, real estate, open,or other.C Total number of times tradelines have beendelinquent 30, 60, 90 days.PREPARED FOR:Name of the company requesting the report andthe person who ordered it.D Total amount for each column heading.E Number of inquiries within a period of time(usually 2 years).REPORT TYPE:Individual or JointF The number of public records on the report.G Number of bankruptcies.ID NUMBERS:CHARGES - Report price. (OPTIONAL)H The most delinquent tradeline (0-9)displayed on the report.COMPUTER ID # - CBCInnovis referencenumber.LENDER CASE # - Loan number (as defined bythe requestor, or generated by CBCInnovis ifnone specified by the requestor.)5DATES:DATE RECEIVED - The date the credit reportwas ordered.DATE COMPLETED - This date will match theDate Received, unless repositories are addedor dropped from the report, or the report isupdated by a CBCInnovis processor, in whichcase the Date Completed will be updated tothe current date.6789APPLICANT:Identifying information for the applicant (and coapplicant if the report is a joint report), includinginput Social Security number, date of birth, andphone number, plus repository returned currentaddress and up to two previous addresses.EMPLOYMENT INFORMATION:The applicant’s current and previous employersand addresses, job titles and dates, if available,are listed.IOldest date of a tradeline on the report.JNumber of accounts rated satisfactory onthe report.K Total amount of all past due values on alltradelines on the report.1011SCORING: (OPTIONAL)Displays any requested scores, includingcredit, auto, finance, bankruptcy, and propertymanagement models. Numeric and/or narrativereason codes can also be optionally displayed.FRAUD ALERT: (OPTIONAL)Comparison of applicant’s information fromcredit report or input information with nationalfraud system data. Fraud detection productsalert customers of potentially dishonest orcounterfeit information. Repository reportingfraud information is displayed.DID YOU KNOW?FILE IDENTIFICATIONS:The name of the consumer, as well as SocialSecurity number, date of birth, and currentaddress are displayed. Variations in theinformation reported are listed, as well as therepository that provided the information. If theSocial Security number is different than the oneinput, it will not be displayed.The CBCInnovis Infile Credit Report can beCREDIT SUMMARY: (OPTIONAL)A All amounts on the report for revolving,installment, real estate, and accountsshowing as open or other are added toprovide total of monthly payments, balancesand credit limits.your specific needs and preferences.customized using a variety of sorting, filtering,and formatting options (see page 6 of thisguide for a list of the more popular options).Consult with your CBCInnovis salesrepresentative to personalize the report to suit2

CBCInnovis Infile Credit Report Reference Guide1213LNMUPRQVY14ZabcdkefghijlEqual Credit Opportunity Act (ECOA) Codes:1 BorrowerB Borrower2 JointJ Joint3 Authorized UserA Authorized User4 JointJ Joint5 Co-MakerS Co-Maker7 MakerM Maker8 Co-BorrowerC Co-Borrower9 TerminatedT Terminated0 UndesignatedU UndesignatedApplicant Account Ownership (Joint reports):B Primary Applicant C Co-ApplicantRating Codes:00 - Account too new to rate; approved but not used.01 - Pays/paid as agreed, customarily within 30 daysof payment due date.02 - Pays/paid at least 30 days past due.03 - Pays/paid at least 60 days past due.04 - Pays/paid at least 90 days past due.05 - Pays/paid at least 120 days past due.06 - Pays/paid at least 180 days past due.07 - Account included under Wage Earner, Chapter 13Bankruptcy, NPFC Plan.08 - Merchandise repossessed.09 - Bad debt, placed for collection.X - No information or rating available.N - No activity, current account with zero balance.3

CBCInnovis Infile Credit Report Reference Guide1213REGULATORY MESSAGES:These messages alert the customer to factorsaffecting the score, potential fraud, active militarystatus and address discrepancies.aCREDITOR/ACCOUNT NO - Credit grantorwho is reporting debt and consumer’s accountnumber. The phone number and address ofthe creditor can optionally be displayed.Narrative information related to the accountmay also be displayed (e.g., real estate, accountclosed by consumer, etc.).bRPTD - The last time the account wasreported by the creditor to the credit file.cLAST ACT - Last paid date or other activityrelated to the account.dOPND - The date the account was openedwith the creditor.eLIMIT OR HIGHEST CREDIT - The credit limitpermitted by the credit grantor, or the highestcredit amount used by the consumer.fBALANCE OWING - The outstanding balanceowed to the creditor as of the date reported.gAMOUNT PAST DUE - The amount currentlypast due.hTERMS/PYMT AMT - Arrangements forrepayment of the account (number of monthsand/or monthly payments); note that M or X months, E estimated and V varies.iTYPE, RATE and VENDOR - Type and statusof the account per the creditor and creditreporting repository.ACCT TYPE - (See list below.)RATE - (See rating codes on page 3.)VENDOR - TRU TransUnion; EFX Equifax;XPN ExperianPUBLIC RECORD INFORMATION:*Some fields are only applicable to certain record types.L ECOA - The Equal Credit Opportunity Act(ECOA) code indicates who is responsiblefor repayment of the debt. This code is usedto identify the responsible party for publicrecords, inquiries and alerts as well astradelines. (See ECOA Codes on page 3.)M TYPE OF RECORD - e.g., lien, judgment,bankruptcy.N FILED/RPTD - Month and year the informationwas reported to the credit repository file/filedinitially at the court.O VRFD - The month and year the informationwas last verified.P CASE - The case number often indicates thecourt where the information is recorded,the year the information originated, the caseor docket number and in some circumstancesa journal page number to find the information.Q COURT - Source of information, generallycourt identification or level (federal, etc.).R AMT - The dollar amount involved in the case.S ASSET - Value of assets involved.T LIAB - Liabilities or amount owed.ACCOUNT TYPESINS - Installment. Fixed number of paymentsover specific time.OPN - Open. Payment due on billing at 30 or90 days.REV - Revolving. Percentage of total balance dueeach month. May also include more specificinformation such as secured or unsecured, auto,real estate, home equity or charge account.MTG - Mortgage on real estate property.U LACT - Month and year of last activity on thecase. This will be blank unless the case hasbeen satisfied, dismissed or otherwise closed.V PLTF - Information regarding the plaintiff oradditional notes, such as the location wherethe information is filed, i.e., records or deeds,county common pleas, etc.W BAL - Any outstanding balances involved inthe case.X DEF - Information regarding the defendant.jY ATNY - Information regarding the attorney.14CREDIT HISTORY:Shaded tradelines indicate derogatoryinformation, i.e., account was not paid as agreed.Z ECOA - The Equal Credit Opportunity Act(ECOA) code indicates who is responsiblefor repayment of the debt. This code is usedto identify the responsible party for publicrecords, inquiries and alerts as well astradelines. (See ECOA Codes on page 3.)kl12-24 MONTH HISTORY (OPTIONAL) - Showsthe record of the account over a period up to24 months. The numbers represent the ratingsfor each month beginning from the top leftwith the status of the most current reportedmonth first (1 current, 2 p/due 30 days, etc.).HISTORICAL STATUS - Number of months theaccount status has been reviewed and howmany times the account has been delinquentover 30, 60, 90 days during the months reviewed.DEROG DATES - Display of applicablederogatory dates.4

CBCInnovis Infile Credit Report Reference Guide1516171815INQUIRIES:Displays lenders, employers, etc., who have recently obtained a copy of the consumer’s credit file. Therepository reporting the inquiry is noted on the right column. You have the option of displaying theinquiries for the last 90 days, 120 days, year, or two years. KOB refers to Kind of Business (see KOB codesat the bottom of page 5).16ADDITIONAL INFORMATION:This indicates any additional, miscellaneous information or changes to the report, including, but not limitedto, aliases, consumer narratives, processing history and miscellaneous statements related to the report.17CONSUMER REFERRAL INFORMATION:The repository source of the report is listed with an address and a phone number.18DISCLOSURE:The repository(ies) accessed for the respective reports are displayed on all reports. Merged reports andRMCRs display the approval statements via the FNMA, FHLMC, HUD, FHA and VA guidelines.KOB (KIND OF BUSINESS) CODES:A AutomotiveL Lumber, Building Material, andHardwareB Banks and S&LsM Medical and Related HealthC ClothingN Credit Card and Travel/D Department, Variety andEntertainment Companiesother RetailO Oil CompaniesE EmploymentP Personal Services Other ThanG GroceriesMedicalH Home FurnishingsQ Finance Companies Other ThanI InsurancePersonal Finance CompaniesJ Jewelry, Cameras, andR Real Estate and PublicComputersAccommodationsK ContractorsS Sporting GoodsT Farm and Garden SuppliesU Utilities and FuelV GovernmentW WholesaleX AdvertisingY CollectionZ Miscellaneous*These represent the first letter in aKOB code. A second letter is added tospecify a particular category in eachof these levels.5

Credit Report Customization OptionsCBCInnovis offers a variety of customization options to suit your specific needs and preferences.Your CBCInnovis Account Representative can assist you with implementing these options.Print Order and Delete OptionsYou have the flexibility to specify the order in which the various sections of the credit report aredisplayed. Sections that can be controlled with print order options include: Credit Summary Tradelines (Credit History) Inquiries Consumer Referral Information Identity Cross Check File Identifications Scores Fraud Information Decision Credit Assure Derogatory Summary Public Records Regulatory Messages Additional InformationThe delete option allows you to remove the repository-returned consumer address and/or employmentrecords from the Applicant Information section, freeing up space on the report.Tradeline Sort OptionsEven though the default sorts tradelines alphabetically by creditor name, you have the flexibility to sort by: Descending Balance Rate: From most to least derogatory Account Status: Open Closed Derogatory Account Type: Mortgage Installment Revolving Open Descending balance within each account type. Account Type: Mortgage Installment Revolving Open Excludes zero and blank balances from the sort and then repeats the sort with the zeroand blank balances. Account Type: Installment Mortgage Open Revolving Account Type: Revolving Installment Mortgage OpenFormatting Options Derogatory Dates Derived from Payment History – obtains derogatory dates and rates from paymenthistory instead of repositories, allowing up to 24 to be displayed. Exclude Derogatory Tradelines from Credit History – isolates information to the DerogatorySummary. Derogatory Summary: Reason for Delinquency Explanation – provides space for the borrower toexplain each derogatory account. Inquiry Status Update – repeats all inquiries on a separate page with space for the borrower to explainwhether or not an account was opened. Alternate Scoring Format – allows for score records to be displayed in a format that changes theposition of the score value and increases its font size, making it more prominent. Sort Scores from Highest to Lowest – changes the score display order from the default of Equifaxfirst, followed by TransUnion, and then Experian to displaying the highest score to lowest scorefor the primary applicant and then repeats the sort for the co-applicant. Tradeline Numbering – tradelines can be numbered consecutively for easier reference. Alternate Tradeline Format – offers a different way to display tradeline data for ease of interpretation.6

www.cbcinnovis.com102-R4/6-20119366-B

Infile Credit ReportReference Guide

Nov 11, 2014 · CBCInnovis offers a variety of customization options to suit your specific needs and preferences. Your CBCInnovis Account Representative can assist you with implementing these options. Print Order and Delete Options You have the flexibility to specify the order in which the various sections of the credit report are displayed.File Size: 1MB