Transcription

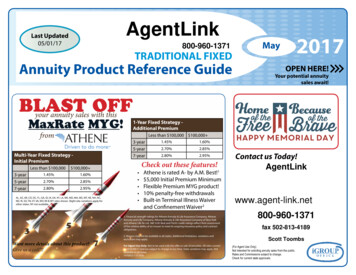

AgentLinkLast Updated05/01/17800-960-1371TRADITIONAL FIXEDAnnuity Product Reference GuideBLASTOFFyour annuity sales with thisMaxRate MYG!from3-year5-year7-yearYour potential annuitysales await!Less than 100,000 100,000 100,000 1.45%1.60%2.70%2.85%2.80%2.95%AL, AZ, AR, CO, DC, FL, GA, ID, IA, KA, KY, LA, ME, MD, MA, MS, MT, NE, NH, NC,ND, RI, SD, TN, VT, VA, WV, WI & WY rates shown. Slight rate variations apply forother states. NY not available.3OPEN HERE!1-Year Fixed Strategy Additional Premium3-year5-year7-yearMulti-Year Fixed Strategy Initial PremiumLess than 100,0002017May1.60%2.70%2.85%2.80%2.95%Check out these features!Athene is rated A- by A.M. Best!1 5,000 Initial Premium MinimumFlexible Premium MYG product!10% penalty-free withdrawalsBuilt-in Terminal Illness Waiverand Confinement Waiver21. Financial strength ratings for Athene Annuity & Life Assurance Company, AtheneAnnuity and Life Company, Athene Annuity & Life Assurance Company of New Yorkand Athene Life Re Ltd. S&P, A.M. Best and Fitch’s credit ratings reflect their assessmentof the relative ability of an insurer to meet its ongoing insurance policy and contractobligations.5Want more details about this product?Give us a call!!! 1.45%72. Waivers may not be available in all states. Additional limitations, variations andexclusions may apply.For Agent Use Only. Not to be used with the offer or sale of annuities .All rates currentas of 03/09/17 and are subject to change at any time. State variations may apply. Notavailable in all states.1476852-1211016Contact us Today!AgentLinkwww.agent-link.net800-960-1371fax 502-813-4189Scott Toombs(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.

Table of Contents - Company Overviews3MULTI-YEAR GUARANTEES4AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANYA.M. Best Rating A- (excellent) (888) 221-12345AMERICAN GENERAL LIFE COMPANIES*Policies issued by American General Life and United States Life (NY only)A.M. Best Rating* A (excellent) (888) 438-69336AMERICAN NATIONAL INSURANCE COMPANYA.M. Best Rating A (excellent) (800) 835-53207ATHENE ANNUITY & LIFE ASSURANCE COMPANYA.M. Best Rating A- (excellent) (855) 428-4363, option 18EQUITRUST LIFE INSURANCE COMPANYA.M. Best Rating B (good) (866) 598-36949GREAT AMERICAN LIFE INSURANCE COMPANYA.M. Best Rating A (excellent) (800) 438-3398 x1719710GUGGENHEIM LIFE & ANNUITY COMPANYA.M. Best Rating B (good) (800) 767-774911LINCOLN FINANCIAL GROUPA.M. Best Rating A (superior) (800) 238-625211MUTUAL OF OMAHAA.M. Best Rating A (superior) (800) 775-7898 x416812NORTH AMERICAN COMPANY FOR LIFE AND HEALTHA.M. Best Rating A (superior) (877) 586-0242 x356766SAGICOR LIFE INSURANCE COMPANYA.M. Best Rating A- (excellent) (888) 724-4267 x6180(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.*The most prominent independent ratings agencies continue to recognize American General Life Insurance Company in terms of insurerfinancial strength. For current insurer financial strength ratings, please consult our Internet Web page, www.americangeneral.com/ratings. See Advertising Disclosures for additional information.2

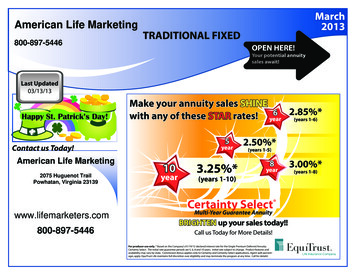

Multi-Year GuaranteesCompanyAthene AnnuityEqui-Trust LifeGuggenheimGuggenheimGuggenheimAthene AnnuityNorth AmericanAmerican EquityAmerican NationalGuggenheimEquiTrust LifeAmerican EquityNorth AmericanAthene AnnuityNorth AmericanAmerican NationalAmerican EquityGuggenheimNorth AmericanGuggenheimAM BestRatingSurrenderChargesAB B B B AA AA3 years3 years3 years4 years5 years5 years5 years5 years6 yearsB B AA AA AAB A B 6 years6 years6 years6 years7 years7 years7 years7 years7 years8 years8 yearsProduct NameMaxRate - 3Certainty Select - 3Preserve MYG - 3Preserve MYG - 4Preserve MYG - 5MaxRate - 5Guarantee Choice II - 5Guarantee - 5Palladium MYG - 6Preserve MYG - 6Choice Four: MVA & Liquidity OptionGuarantee - 6Guarantee Choice II - 6MaxRate - 7Guarantee Choice II - 7Palladium MYG - 7Guarantee - 7Preserve MYG - 7Guarantee Choice II - 8Preserve MYG - 8GUARANTEE PERIOD1st YearRate .35%2.95%1.45% yrs 2-32.00% yrs 2-32.00% yrs 2-32.25% yrs 2-42.60% yrs. 2-52.70% yrs 2-52.45% yrs. 2-52.35% yrs. 2-52.95% yrs. 2-6AverageAnnual 2.80%4.00%2.80% yrs. 2-6Min. 2.00% yrs .65%3.10%2.55% yrs. 2-52.20% yrs. 2-62.80% yrs 2-72.45% yrs. 2-72.90% yrs. 2-72.70% yrs. 2-73.00% yrs. 2-72.65% yrs. 2-83.10% yrs. ui-Trust LifeB 8 yearsCertainty Select – 83.00%3.00% yrs. 2-83.00%GuggenheimB 9 yearsPreserve MYG - 93.20%3.20% yrs. 2-93.20%EquiTrust LifeB 10 yearsCertainty Select - 103.25%3.25% yrs. 2-103.25%North AmericanAmerican NationalAmerican GeneralGuggenheimNorth AmericanA AAB A 9 years9 years10 years10 years10 yearsGuarantee Choice II - 9Palladium MYG - 9Solutions MYG - 10Preserve MYG - 10Guarantee Choice II - 102.75%4.80%2.60%3.25%2.85%2.75% yrs. 2-92.80% yrs. 2-92.60% yrs. 2-103.25% yrs. 2-102.85% yrs. 2-102.75%3.02%2.60%3.25%2.85%3For Agents Use Only . Call for state approvals. Rates and commissions subject to change. Check individual commission schedules for guaranteed accuracy and descriptions.

AMERICAN EQUITY INVESTMENT LIFE INSURANCE COMPANY tMinimumPremiumWithdrawalProvisionsSurrender ChargesMVAY YesN NoStates NotAvailableNCT, FL, IN, MN, NJ, NV,NY, OH, OK, OR, PA,TX, WA18-78 Q and NQNAK, CT, DE, IN, MN, NJ,NV, NY, OH, OK, OR, PA,TX, UT, WA18-85 Q and NQYNYIssueAgesPremier Eagle 10NEW10% Premium Bonus on premiums added in years 1-5(5% bonus issue ages 76-80)Current Fixed Value Rate– 2.00%MGIR-CV:Currently 2.00% 10,000Q & NQ10% of contract value annually starting in year 2.Systematic W/D & RMD immediately.(5% bonus yrs 1-5 ages 1880 in AK, DE, SC, UT)15 years (18-75)20, 19.5, 19, 18.5, 18,17.5, 17, 16, 15, 14, 12,10, 7.5, 5, 2.5, 0%)18-80 Q and NQ10 years for ages 76-80(15, 14, 13, 12, 11, 9.5, 8,6.5, 5, 2.5, 0%)Premier Eagle 12NEW8% Premium Bonus on allfirst year premiumsCurrent fixed value rate– 1.00%MGIR-CV: currently1.00% 10,000Q & NQ10% of contract value annually starting in year 2.Systematic W/D & RMD immediatelyAsk about the 14 year bonus vesting schedule10 years(12.5, 12, 12, 11, 10, 9, 8,7, 6, 4, 0%)Guarantee 5Guarantee 6Guarantee 7NEWGuarantee 52.35%Guarantee 62.55%Guarantee 72.70%(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.5 years(9, 8, 7, 6, 5, 0%)MGIR:Currently 1.00% 10,000Annually, Penalty-free withdrawal of interest creditedthat contract year6 years(9, 8, 7, 6, 5, 4, 0%)7 years(9, 8, 7, 6, 5, 4, 3, 0%)4

AMERICAN GENERAL LIFE COMPANIES (AGLC)FIXEDPRODUCTSAmerican PathwaySMFixed 5 PremiumOne Yearwith Premium Bonus andwith Guarantee ROP: 100,000NQQYear 11.50%1.65%NQQYear ueAgesMVAY YesN NoStates NotAvailable5 years(9,8,7,6,5)0-90(0-85 inNY)Q&NQYIA, MN, MO, SC7 years(9,8,7,6,5,4,2)0-90(0-85 inNY)Q&NQYIA, MN, MO, SC0-85Q&NQYIA, MN, MO, SCPenalty-Free Withdrawal Privilege: After 30 days from contract dateExtended Care Waiver: After 1st contract year, early withdrawal charge fees will bewaived if the owner is confined to a qualifying insitution or extended care facility for 90consecutive days or longer.1.00% 100,000Rates effective as of April 3, 2017 5,000 NQ 2,000 QTerminal Illness Waiver: Early withdrawal charge fees will be waived on one full or partialwithdrawal upon the diagnosis of a terminal illness that will result in the death of a contract owner within one year. Written documentation from a qualified physician is required.Death Benefits: If the spouse is the sole beneficiary of a deceased owner, he/she mayelect to become the new “owner” or receive a disttibutionOptional Return of Premium Guarantee: The annuity may be returned at anytime for anamount equal to the single premium paid, less prior withdrawals, or the withdrawal value,whichever is greater. Adding this feature will result in a slightly lower initial interest ratethan a contract without the feature would receive.American PathwaySMFixed 7 AnnuityNEWOne Yearwith Premium Bonus andwith Guarantee ROP: 100,000NQQYear 12.51%2.66% 100,000NQQYear 13.53%3.68%Penalty-Free Withdrawal Privilege: After 30 days from contract dateExtended Care Waiver: After 1st contract year, early withdrawal charge fees will bewaived if the owner is confined to a qualifying insitution or extended care facility for 90consecutive days or longer.1.00% 5,000 NQ 2,000 QTerminal Illness Waiver: Early withdrawal charge fees will be waived on one full or partialwithdrawal upon the diagnosis of a terminal illness that will result in the death of a contract owner within one year. Written documentation from a qualified physician is required.Death Benefits: If the spouse is the sole beneficiary of a deceased owner, he/she mayelect to become the new “owner” or receive a disttibutionOptional Return of Premium Guarantee: The annuity may be returned at anytime for anamount equal to the single premium paid, less prior withdrawals, or the withdrawal value,whichever is greater. Adding this feature will result in a slightly lower initial interest ratethan a contract without the feature would receive.American PathwaySMSolutions MYGNEWLow BandHigh Band5 Year2.35%2.55%6 Year2.35%2.55%7 Year2.40%2.60%10 Year2.55%2.80%(For Agent Use Only)Not intended for soliciting annuity sales from the public.Rates and Commissions subject to change.Check for current state approvals.Penalty-Free Withdrawal Privilege: After Year 1, 15% free withdrawals. After 30 days fromcontract date1.00% 10,000 NQ 2,000 QDeath Benefits: If the spouse is the sole beneficiary of a deceased owner, he/she mayelect to become the new “owner” or receive a disttibutionEarly Withdrawal Charge Waiver: After the first contract year, withdrawal charge fees willbe waived if the owner cannot perform two or more of the six defined activities of dailyliving (bathing, continence, dressing, eating, toileting, and transferring) for at least 90consecutive days. Written certification by a licensed healthcare practitioner is required.10 years(8,8,8,7,6,5,4,3,2,1)In New York7 Years(7,6,5,4,3,2,1)Policies issued by American General Life Insurance Company, 2727-A Allen Parkway, Houston, TX 77019 The underwriting risks, financial and contractual obligations and support functions associated with products issued by American General Life InsuranceCompany (AGL) are its responsibility. AGL does not solicit business in the state of New York. Policies (or annuities) and riders not available in all states.These contracts are not insured by the FDIC, the Federal Reserve Board or any similar agency. The contract is nota deposit or other obligation of, nor is it guaranteed or endorsed by, any bank or depository institution.5

AMERICAN NATIONAL INSURANCE COMPANY (ANL)FIXEDPRODUCTSPalladium MYGHigh Band Shown. Under 100,000, subtrack10basis pointsPalladiumCentury - 12PalladiumCentury - 32PalladiumCentury - 52PalladiumCentury - 72GREATCurrentInterest5 Year6 Year7 Year8 Year9 Year10 Year1st Year3.50%3.05%4.00%3.20%4.90%3.95%Base stYield2.70%3.05%3.14%3.20%3.12%3.05%2.90% Yr-1(in FL, IN, NC, TX, UT, VA, WA, WI der ChargesIssueAgesMVAY YesN No0-85YNY, UTYAL, CT, FL, IL,MA, MN, NJ,NY, OH, OK,OR, PA, TX,UT, WAStatesStatesNotNotAvailableAvailable1.00% 5,000Q&NQMonthly interest option. 10% free beginning yr 2. Transplant surgery waiver.Confinement Waiver. Available thru issue ages. Full account value paid atdeath.5-yr 8,8,8,7,66-yr (8,8,8,7,6,5)7-yr (8,8,8,7,6,5,4)8-yr(8,8,8,7,6,5,4,3)9yr 8,8,8,7,6,5,4,3,210yr 8,8,8,7,6,5,4,3,2,1(30 day bail out after guaranteed period)1.00% 5,000Q&NQConfin. waiver, Disabil. wavier Available thru issue ages. (add. Prem. willbe accepted during the 1st. contract yr. only. The add. Prem. will receiveenhanced interest for a full 12-mo. from the date received. The death benefitwill be annuity value (prem. plus interest earned - any withdrawals) 10% Penal.Free begin. yr 1. Mo. Interest. option.10 years(10,9,8,7,6,5,4,3,2,1)0-90Q&NQ10 years(11,10,9,8,7,6,5,4,3,2)0-85Q&NQYAL, CT, FL, IL,MA, MN, NJ,NY, OH, OK,OR, PA, TX,UT, WA4.90% Yr-1(in FL, IN, NC, TX, UT, VA, WA, WI .10%lower)1.00% 5,000-Q&NQConfin. waiver, Disabil. wavier Available thru issue ages. (add. Prem. willbe accepted during the 1st. contract yr. only. The add. Prem. will receiveenhanced interest for a full 12-mo. from the date received. The death benefitwill be annuity value (prem. plus interest earned - any withdrawals) 10% Penal.Free begin. yr 1. Mo. Interest. option.6.90% Yr-1(in FL, IN, NC, TX, UT, VA, WA, WI .10%lower)1.00% 5,000-Q&NQConfin. waiver, Disabil. wavier Available thru issue ages. (add. Prem. willbe accepted during the 1st. contract yr. only. The add. Prem. will receiveenhanced interest for a full 12-mo. from the date received. The death benefitwill be annuity value (prem. plus interest earned - any withdrawals) 10% Penal.Free begin. yr 1. Mo. Interest. option.10 years(12,12,11,10,9,8,6,4,3,2)0-80Q&NQYAL, CT, FL, IL,MA, MN, NJ,NY, OH, OK,OR, PA, TX,UT, WA8.90% Yr-1(in FL, IN, NC, TX, UT, VA, WA, WI .10%lower)1.00% 5,000-Q&NQConfin. waiver, Disabil. wavier Available thru issue ages. (add. Prem. willbe accepted during the 1st. contract yr. only. The add. Prem. will receiveenhanced interest for a full 12-mo. from the date received. The death benefitwill be annuity value (prem. plus interest earned - any withdrawals) 10% Penal.Free begin. yr 1. Mo. Interest. option.10 years(12,12,11,11,10,9,8,6,4,2)0-80Q&NQ(Utah0-55-Q &NQ)YAL, CT, FL, IL,MA, MN, NJ,NY, OH, OK,OR, PA, TX, WA1.00% 5,000-Q&NQ(Initial deposits over 100,000 receive .10additional basis points)10% Penalty Free beginning year 1. Mo. interest option. Full account value paid at death. Principal Guarantee: Minimum surrender value is a return of premiums paid, less any cumulativewithdrawals. The policy will now be owner driven. The death benefit will be paid only upon deathof owner, not the annuitant. Please note this will affect chargebacks. In the event of a deathor full surrender in the first year, and owner is over 80, there will be a 100% chargeback. Nowbeing marketed as only Confinement and Disability. The definition of Confinement is changingfrom 60 days to 30 days. If the contract owner is confined for will be imposed on any surrenderor withdrawal. Please note Terminal Illness is included in the disability waiver.5 years(7,7,7,6,5)0-85NQ & QNNY, OR1.00% 2,000Q 5,000NQ(Initial dep. over 100Kreceive .10 add. basispoints.) Add. Prem 1,000 random or 100/mo. bank draft.10% Penalty Free beginning year 1. Mo. interest option. Full account value paid at death. Principal Guarantee: Minimum surrender value is a return of premiums paid, less any cumulativewithdrawals. The policy will now be owner driven. The death benefit will be paid only upon deathof owner, not the annuitant. Please note this will affect chargebacks. In the event of a deathor full surrender in the first year, and owner is over 80, there will be a 100% chargeback. Nowbeing marketed as only Confinement and Disability. The definition of Confinement is changingfrom 60 days to 30 days. If the contract owner is confined for will be imposed on any surrenderor withdrawal. Please note Terminal Illness is included in the disability waiver.7 years(7,7,7,6,5,4,2)0-85NQ & QNNY, ORDiamondCitadel - 52.90% Yr-11.90% Yr-2(2 year rate)DiamondCitadel - 7(2 year rate)4.00% Yr-12.00% Yr-2SAGICOR LIFE INSURANCE COMPANY erestMinimumPremiumGold Series2.50%2.00%Sage Choiceyear 1(yrs 1-10with Bailout& 3.00%Featurethereafter)Before sending business to Sagicor: Everyagent in all states must have it confirmedthat the product training has beensuccessfully completed.SinglePurchasePayment urrenderChargesIssueAgesMVAY YesN NoStates NOTAvailableMonthly Interest Option (MIO) available for policies with an account valie of 25,000 or greater.6 Years15 days to ageYAK, CT, ME, MI,Death benefit is equal to contract values as of the date we receive due proof of the Owner’s(7,7,7,6,5,3)90-NQ(MVAnotNH, NY, VTdeath Surrender charges and MVA waived upon death of the Owner. Waiver of Surrender15 days to age availableCharge Rider: If the Owner of the contract is confined to a licensed nursing home or hospital for90 consecutive days or more, the policy accumulation value will be available without a surrender75-Qin MOcharge or MVA. This rider is provided at no extra cost. Available thru issue ages. Free PartialWithdrawals: Beginning in Year 1 the Owner may make one withdrawal per year up to 10% of Due to unprecedented volume, Sagicor Life Insurance Companythe accumulation value without incurring charges. After the first contract year, thewill be limiting the premium amounts for all Sagicor deferredrenewal rate is lower than a rate that is 1% below the initial fixed interestrate, the owner msy request, within 30 days of notification, to receive the annuities to 300,000 or less per owner until further notice.accumulation value without incurring a surrender charge or MVA.Rates and Commissions subject to change.(For Agent Use Only)Check for current state approvals.Not intended for soliciting annuity sales from the public.2) Two year charge back - 100% year 1 & 50% year 26

ATHENE ANNUITY & LIFE ASSURANCE COMPANY Year FixedStrategy3 yearHigh Band 100,0001.60%Low BandUp to 100,001.45%5 e Withdrawal - Equal to the Multi-Year Fixed Strategy ratemultiplied by the accumulated Value (as of the most recent ContractAnniversary) beginning in the first contract year.7 year2.95%1.00%2.70%MinimumPremium2.80% 5,000Q&NQAdditionalPremium 1,000per paymentRequired Minimum Distribution (RMDs) - Considered part of yourannual Free Withdrawal, even if they exceed your Free Withdrawalamount.Flexible Premium!Terminal Illness Waiver and Confinement Waiver built-in (not availablein all states)NEWMaxRate:1-Year Fixed (additionalpremium)3 year5 year7 yearHigh Band 100,0001.60%2.85%2.95%Low BandUp to 100,001.45%2.70%2.80%Free Withdrawal - Equal to the Multi-Year Fixed Strategy ratemultiplied by the accumulated Value (as of the most recent ContractAnniversary) beginning in the first contract year.1.00% 5,000Q&NQAdditionalPremium 1,000per paymentRequired Minimum Distribution (RMDs) - Considered part of yourannual Free Withdrawal, even if they exceed your Free Withdrawalamount.Flexible Premium!Terminal Illness Waiver and Confinement Waiver built-in (not availablein all states)NEWMaxRate:Multi-Year FixedStrategyHigh Band 100,000Low BandUp to 100,003 year5 year7 year1.60%2.80%2.90%Free Withdrawal - Equal to the Multi-Year Fixed Strategy ratemultiplied by the accumulated Value (as of the most recent ContractAnniversary) beginning in the first contract year.1.00%1.45%2.65%2.75% 5,000Q&NQAdditionalPremium 1,000per paymentRequired Minimum Distribution (RMDs) - Considered part of yourannual Free Withdrawal, even if they exceed your Free Withdrawalamount.Flexible Premium!Terminal Illness Waiver and Confinement Waiver built-in (not availablein all states)Free Withdrawal - Equal to the Multi-Year Fixed Strategy ratemultiplied by the accumulated Value (as of the most recent ContractAnniversary) beginning in the first contract year.NEWMaxRate:1-Year Fixed (additionalpremium)3 year5 year7 yearHigh Band 100,0001.60%2.8

7 ATHENE ANNUITY & LIFE ASSURANCE COMPANY A.M. Best Rating A- (excellent) (855) 428-4363, option 1 8 EQUITRUST LIFE INSURANCE COMPANY A.M. Best Rating B (good) (866) 598-3694 9 GREAT AMERICAN LIFE INSURANCE COMPANY A.M. Best Rating A (excellent) (800) 438-3398 x17197