Transcription

Volume 4, Chapter 17DoD Financial Management RegulationCHAPTER 17EXPENSES AND MISCELLANEOUS ITEMS1701GENERAL170105 A miscellaneous item is a gain or lossnot expected to be incurred during a normaloperating cycle. As such, they are not reflectedin reports as a current expense but are classifiedand reported as nonrecurring items,extraordinary items, or unusual items. Anexample of a miscellaneous item would be a gainor loss resulting from the disposal of unusableequipment. A gain could be a miscellaneousgain whereas a loss on disposal would be amiscellaneous loss.170101 Purpose.This chapter prescribesguidance to account for expenses incurred incarrying out Department of Defense operations.170102 Overview. An expense is a recognitionof the portion of an outlay applicable to thecurrent accounting period, or other use of aresource, or the incurring of a liability (or acombination of these events) as a result of theDoD’s efforts to perform its missions.170106 The treatment of expense items byDefense Business Operations Fund activities isdifferent from the treatment accorded toexpenses related to appropriation fundedactivities. For Defense Business Operations Fundactivities expenses flow through the "Work inProcess" Account to the "Cost of Goods"Account.170103 Expenses are the natural culmination ofany DoD Component’s operations. They occuras a part of normal, routine operations, and notan extraordinary or an unexpected event such asdestruction through natural disasters or war.They are an application of budgetary resourcesmade available to DoD Components withoutregard to the period of availability of theaccount.Goods and services ordered andreceived are recorded in the budgetary accountsas accrued expenditures and in the proprietaryaccounts as an expense or an asset, such as acapital item, or an inventory item.Theproprietary accounts maintain financial controlover the resources provided to the Departmentof Defense and assure full accountability oncethe budget execution process has beencompleted.Full financial control over allmaterial, labor, supplies, etc., shall be maintaineduntil consumed (expensed), sold or transferred toanother Federal Agency in accordance withstatutory authority.For Defense businessoperations fund activities, expenses are incurredin providing goods and services to customers.Figure 17-1 on the following page illustrates therelationship between the budgetary accounts andthe expense accounts.1702ACCOUNTING POLICY FOREXPENSES AND MISCELLANEOUSITEMS170201 The Department of Defense isaccountable for its stewartship in expendingresources necessary in carrying out its missions.Examples of operating expenses include those forpersonnel, contractual services, and material.Also included is an allocation of prior capitaloutlays (depreciation/amortization) when suchinformation is necessary for managementdecision-making purposes, to meet externalreporting requirements, or to recover costs ofoperations.170202 Particular attention is to be given toexpenses incurred by research and developmentprograms, or related to the search for knowledgeand the conversion of knowledge into use forDoD missions.170104 Expenses are classified as to specificcategories, such as accounts to recorddepreciation, amortization, bad debt and interestexpenses.336

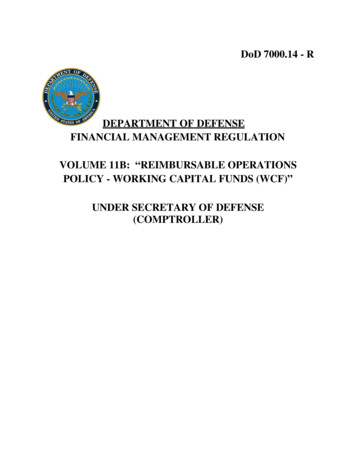

DoD Financial Management RegulationVolume 4, Chapter 17ACCRUED EXPENDITURES PAID ANDEXPENSE ACCOUNTS RELATIONSHIPSACCRUED EXPENDITURESPAIDFIXED ASSETSWORK INPROCESS ORCONSTRUCTIONIN PROGRESSEXPENSESFIXED ASSETORINVENTORYWhen goods or services purchased are paid for they are recorded as an AccruedExpenditure-Paid in budgetary accounts. In proprietary accounts, they are recordedeither in an account such as fixed assets (if capitalized) or inventory, or as an expense.Those items recorded as an asset are ultimately consumed in the DoD Component’soperation. Items initially recorded as an expense may, especially at DBOF depotmaintenance activities, be transferred to work in process until such time as an item iscompleted.Figure 17-1337

Volume 4, Chapter 17DoD Financial Management RegulationA. Expenses incurred for research anddevelopment shall be recorded and reported asan expense in the period incurred.accounts are available for use except thefollowing:1.B. Costs for property, plant, orequipment acquired or constructed for aparticular research and development project areto be capitalized if the acquisition cost is over 50,000 and the items have a life expectancy ofmore than 2 years.When the project iscompleted, these items shall be disposed of inaccordance with the guidance contained inChapter 7 of this Volume. Chapters 1 and 6 ofthis Volume provide accounting guidance forcapitalizing and depreciating or amortizingassets.17032.3.4.5.6.7.8.9.B. Defense Business Operations Fundactivities. The 6100 series accounts may be usedto systematically accumulate costs. All otheraccounts are available for use as necessarydepending upon the specific business area,except the following:ACCOUNTING FOR EXPENSES170301 The following sections discuss eachtype of expense. The sections are categorized asto operating/program expenses, interestexpenses, benefit program expenses, cost ofgoods sold, applied overhead, and otherexpenses.Unless otherwise stated, theseaccounts shall be applicable to all DoDComponents. Closing entries are not illustrated;these entries are contained in Chapter 16 of thisVolume.1.2.3.4.5.1.2.3.4.5.6.Accounts 6111-6115 -- payroll expensesAccounts 6116-6124 -- general expensesAccounts 6125-6126 -- depreciation expensesAccount 6127 -- depletion expenseAccount 6128 -- amortization expenseAccount 6129 -- bad debt expenseAccount 6130 -- annual leave6310 Interest Expenses on Borrowing FromTreasury6320 Interest Expenses on Federal Securities6600 Applied Overhead7500 Distribution of Income-Dividend7191 Inventory Gains7291 Inventory Losses170304 For expense transactions that passthrough an accounts payable or accrued payrollaccount, the budget account entry to be made isprovided in Table 17-1.170305 In some instances, an immediate cashoutlay is made at the time the expense isincurred. This is the situation when the expenseis incurred through the use of an imprest fund.To ensure that the budgetary and the proprietaryaccounts are posted in the same accountingperiod, imprest funds shall be reimbursed at170303 The use of the accounts discussed inthis Chapter by appropriated, businessoperations fund and trust fund activities issummarized as follows:A.6310 Interest Expense on Borrowing fromTreasury6320 Interest Expenses on Federal Securities6400 Benefit Program Expenses7500 Distribution of Income-Dividend7600 Changes in Actuarial LiabilityC. Trust Fund activities. All accountsare available for use as necessary depending onthe specific trust fund, except the following:170302 T h e a c c o u n t i n g e n t r i e s f o roperating/program expenses are, for the mostpart, the same. Accordingly, each of the expenseaccounts is first discussed in a logical groupingand the accounting entries associated with thosegroupings are then presented. These groupingsare:A.B.C.D.E.F.G.6310 Interest Expenses on Borrowing FromTreasury6600 Applied Overhead6900 Other Expenses7191 Inventory Gains7192 Investment Gains7291 Inventory Losses or Adjustments7292 Investment Losses7500 Distribution of Income-Dividend7600 Changes in Actuarial LiabilityAppropriated Fund Activities. All338

DoD Financial Management RegulationVolume 4, Chapter 17minimum, to report expenses by budget programline, the Future Years Defense Plan, the forcestructure, and organizational unit.least once during each accounting period. Thebudgetary account entry to be made forimmediate cash outlay situations is provided inTable 17-2.170308 Group A: Accounts 6111-6115 - Payroll Expenses170306 Expenses (Account 6000) "Expenses" isthe control account for all expenses. As such, itis a summary general ledger account intendedfor general financial statement purposes. Notransactions are posted to this account.1703076100)A. Personnel Compensation-Civilian(Account 6111)1. " P e r s o n n e lCompensation-Civilian" is used to record thegross compensation for personal servicesrendered by federal civilian employees andnon-federal personnel. Compensation expensesincluded in this account are those for full timepermanent; other than full time permanent;special personal services payments (whichincludes payments for reimbursable workperformed for other agencies for services ofcivilian and military personnel; payments to theCivil Service retirement and disability fund forreemployed annuitants); and other personnelcompensation.Operating/Program Expenses (AccountA. "Operating/Program Expenses" isa summary account to control subsidiaryaccounts established to accumulate operatingexpenses for personnel, travel, communications,contractual services, etc.As such, notransactions are posed to this account.B. Expenses shall be identified to theprograms to which they relate. Accordingly,accounting systems shall have the ability, at aBUDGETARY ENTRIES - ACCRUED EXPENSESDr 4810 Undelivered Orders-Direct Programor, as appropriate,Dr 4820 Undelivered Orders-Reimbursable ProgramCr 4910 Accrued Expenditures-Unpaid-Direct Programor, as appropriate,Cr 4920 Accrued Expenditures-Unpaid-Reimbursable ProgramTABLE 17-1BUDGETARY ENTRIES - IMPREST FUNDDr 4810 Undelivered Orders-Direct Programor, as appropriate,Dr 4820 Undelivered Orders-Reimbursable ProgramCr 4930 Accrued Expenditures-Paid-Direct Programor, as appropriate,Cr 4940 Accrued Expenditures-Paid-Reimbursable ProgramTABLE 17-2339

Volume 4, Chapter 17DoD Financial Management Regulation2. Awards made to employeessuch as those for suggestions, performancebonuses, special act awards, and productivitygain sharing programs are increases in payrollcompensation.the DoD productivity gainsharing (PGS) program permits up to amaximum of 50 percent of achieved PGS savingsto be paid to eligible employees. Subject to the50 percent ceiling, the PGS program allowsconsiderable flexibility in determination of theamount and form of payment--monetary orcompensated absence (administrative leave).DoD activities develop their individualorganization-wide PGS plans based on theirmission functions. PGS plans should include aspecified effort to be on board to be eligible toreceive a share of the PGS payout. PGS plansshould also provide specifics as to whether anemployee remains eligible or forfeits his/hershare if the employee leaves the organizationprior to the payout. If the plan and conditionspermit, employees may elect to receiveadministrative leave, or cash payment, or acombination of administrative leave and pay.The administrative leave option may be grantedat the discretion of the activity commander basedupon workload requirements at the time. Theperiod of time for which administrative leavemay be granted to an employee will be derivedby dividing the value of the employee’s gainshare award by his/her hourly rate plus andaverage factor for benefits.allowances for subsistence and quarters.Excluded are cost of living allowances forlocations outside the contiguous 48 states andthe District of Columbia, which is recorded inaccount 6114, Personnel Benefits-Military. Alsoexcluded are payments made to other Agenciesfor services of military personnel onreimbursable detail, that are posted to account6120, "Other Services."3. This account shall be used byall DoD activities. Revolving fund activities mayuse this account to accumulate civilian personnelcosts for work in process or construction inprogress. Trust fund activities that need toaccount for personnel related expenses also mayuse this account.2. This account shall be used byall DoD activities. Revolving fund activities mayuse this account to accumulate civilian personnelcosts for work in process or construction inprogress. Trust fund activities that need toaccount for personnel related expenses also mayuse this account.4.of this account.3.of this account.2. This account shall be used bythose DoD activities which account for the costof military personnel appropriations.3.of this accountTable 17-3 illustrates the useC. Personnel(Account 6113)Benefits-Civilian1. "Personnel Benefits-Civilian"is used to record the benefits paid directly toDoD civilian personnel and payments to otherfunds for the benefit of the employees. Itexcludes DoD reimbursements for reemployedannuitants, i.e., payments by an agencyemploying an annuitant that reimburses the CivilService retirement and disability fund for theannuity paid to that employee as required byP.L. 94-397 (5 U.S.C. 8339, 8344). These arerecorded in account 6111, "PersonnelCompensation-Civilian."Table 17-3 illustrates the useTable 17-4 illustrates the useB. Personnel Compensation-Military(Account 6112)D. Personnel(Account 6114)1. " P e r s o n n e lCompensation-Military" is used to record theearned basic, incentive and special pays ofmilitary personnel. Included are extra pay basedon environmental conditions and basic1. "Personnel Benefits-Military"is used to record the benefits paid directly tomilitary personnel. Included are allowances foruniforms, reenlistment bonuses, cost of livingallowances paid to personnel on duty outside the340Benefits-Military

DoD Financial Management RegulationVolume 4, Chapter 17contiguous 48 States and the District ofColumbia, dislocation and family separationallowances and personal allowances. Allowancesfor items such as hazardous duty, flight pay andenvironmental conditions are excluded; these areconsidered part of gross pay. DoD Componentcontributions to the military retirement, socialsecurity, the Serviceman’s Group Life Insuranceand educational benefits programs are chargedto this account.use this account to accumulate civilian personnelcosts for work in process or construction inprogress. Trust fund activities that need toaccount for personnel related expenses also mayuse this account. Benefit payments to retiredmilitary personnel and their survivors arerecorded in Account 6400, "Benefit ProgramExpenses."F. Table 17-5 illustrates the use ofthis account.2. This account shall be usedonly in those accounting systems that are used torecord obligations for military pay.3.of this account.G.Sources of entries to this accountinclude payroll vouchers and journal vouchers.Table 17-4 illustrates the use170309 Group B: Accounts 6116-6124 General ExpensesE. Benefits for "Former Personnel"(Account 6115)A. Travel andPersons (Account 6116)Transportationof1. "Benefits for "FormerPersonnel" is used to record amounts paid toformer DoD personnel or their survivors duringthe current period. Included in the account areretirement benefits (excluding foreign nationalsthat is recorded in account 2114, AccountsPayable-Public-Non-current), severance pay,unem-ployment compensation, and the DoD’spayment to the Employees Health Benefits Fundfor annuitants.1. "Travel and Transportation ofPersons" is used to record the expenses related totransporting employees and others, includingpublic transportation fares, per diem allowances,and other related expenses that are paid directlyby the Department of Defense to the traveler orthe organization providing the traveltransportation.2. This account shall be used byall DoD activities that account for benefitpayments to former DoD civilian employees andtheir survivors. Revolving fund activities may2. This account shall be used byall DoD activities. Revolving fund activities mayuse this account to accumulate costs for work inprocess or construction in progress. Trust fundactivities that need to account for such expensesalso may use this account.ACCOUNTING ENTRIES FOR ACCOUNTS 6111 & 6112"PERSONNEL COMPENSATION-MILITARY" & "PERSONNEL COMPENSATION-CIVILIAN"Dr 6111 Personnel Compensation-CivilianDr 6112 Personnel Compensation-MilitaryCr 2211 Accrued Payroll-CivilianCr 2212 Accrued Payroll-MilitaryTo record employee compensation earned during the period.TABLE 17-3341

Volume 4, Chapter 17DoD Financial Management RegulationACCOUNTING ENTRIES FOR ACCOUNTS 6113 & 6114"PERSONNEL BENEFITS-MILITARY" & "PERSONNEL BENEFITS-CIVILIAN"Dr 6113 Personnel Benefits-CivilianDr 6114 Personnel Benefits-MilitaryCr 2213 Accrued Payroll-Civilian-Employer Share of Personnel BenefitsCr 2214 Accrued Payroll-Military-Employer Share of Personnel BenefitsTo record benefits earned by DoD personnel not recorded in civilian andmilitary personnel compensation accounts.TABLE 17-4ACCOUNTING ENTRIES FOR ACCOUNT 6115 BENEFITS FOR "FORMER PERSONNEL"Dr 6115 Benefits for Former PersonnelCr 6400 Benefit Program ExpensesCr 2113 Accounts Payable-Public-CurrentTo record benefits earned by former personnel, based on prior employment.TABLE 17-5B.process or construction in progress. Trust fundactivities that need to account for such expensesalso may use this account.Transportation of Things (Account6117)1. "Transportation of Things" isused to record the expenses incurred to transportequipment, material, animals, deceasedemployees and for the care of such items whilebeing transported.Vendor transportationcharges associated with purchased items areexcluded; these are charged to the general ledgeraccounts associated with the purchased items.Included are freight and express charges bycommon carrier and contract carrier; truckingand other local transportation charges forhauling, handling, and other services incident tolocal transportation, including contractualtransfers of supplies and equipment; mailtransportation, including parcel post postage;and, transportation of household goods relatedto permanent change of station.C. Rents, Communications,Utilities (Account 6118)and1. "Rents, Communications, andUtilities" is used to record the expenses incurredfor possession and use of land, structures orequipment owned by others and charges forcommunication and utility services. It includesdirect charges for rental of space and rent relatedservices assessed by the General ServicesAdministration as rent, formerly known asstandard level user charges (but excludespayments for services such as extra protection,extra cleaning or extra alterations, which arecharged to account 6120, "Other Services); rentalcharges to others for leased space, land, andstructures; communication expenses fortelephone and other wire services, andmicrowave and satellite communications; utilityservice charges for heat, light, power, water, gas,2. This account shall be used byall DoD activities. Revolving fund activities mayuse this account to accumulate costs for work in342

DoD Financial Management RegulationVolume 4, Chapter 17electricity, and other utility services; and,miscellaneous charges under purchase rentalagreements for equipment (but excludespayments under lease-purchase contracts forconstructing buildings).Rental charges fortransportation equipment are recorded as a"Transportation of Things" expense, Account6117.of vehicles and storage of household goods,including those associated with a permanentchange of station; contractual expenses for board,lodging, and care of persons, including hospitalcare (except for travel items that are recorded inaccount 6116); ADP custom software contractexpenses covering development of software inaccordance with current budget criteria.2. This account shall be used byall DoD activities. Revolving fund activities mayuse this account to accumulate costs for work inprocess or construction in progress. Trust fundactivities that need to account for such expensesalso may use this account.2. This account shall be used byall DoD activities. Revolving fund activities mayuse this account to accumulate costs for work inprocess or construction in progress. Trust fundactivities that need to account for such expensesalso may use this account.D. Printing(Account 6119)6121)andReproductionF.1. "Printing and Reproduction"is used to record expenses incurred for printing,reproduction, composition and bindingoperations provided by U.S. Government andcommercial printers and photographers

DoD Financial Management Regulation Volume 4, Chapter 17 least once during each accounting period. The budgetary account entry to be made for immediate cash outlay situations is provided in Table 17-2. 170306 Expenses (Account 6000) "Expenses" is the control account for all expenses. As such, it is a summary general ledger account intended