Transcription

Your Guide to Coverage & ChoicesFOR MEDICARE-ELIGIBLE RETIREES &THEIR ELIGIBLE SPOUSES/DEPENDENTS

Now that you’reMedicare-eligible.health care benefits will change for you and yourMedicare-eligible spouse and/or dependents.This guide explains these changes and the steps you must taketo ensure that you make the best choices regarding your Turnerretiree health care benefits.This guide will explain in detail how to evaluate Medicareplan options and enroll in the plan that is right for you. Turnerhas selected OneExchange to help you navigate this changeand ensure that you are well equipped to make informed andconfident health care choices. You are to call OneExchangeand work with a licensed Benefit Advisor to complete theenrollment process.The information in this guide pertains only to Medicare-eligibleretirees, Medicare-eligible spouses of retirees, survivingspouses, and dependents of retirees who are Medicareeligible due to age or disability. Those who are not currentlyMedicare-eligible remain on Turner’s plans for early retirees.The materials in this guide do not apply to those who are notMedicare-eligible.

Table ofCONTENTSCoverage that Works for You. 2introducing OneExchange. 4Steps Toward Enrollment. 6Get Familiar with Medicare.8Medicare Options:At a Glance.10What Is An RRA?. 14How An RRA Works:An Overview.16RRA Scenarios. 18What Happens Next?. 20Frequently Asked Questions. 22Glossary of Terms. 24Calendar of Events. Back Cover1

COVERAGE THAT WORKS FOR YOUDifferent coverage options, and financial flexibility for Medicareeligible retirees.If you are similar to many retirees, you would like help navigating through thedifferent Medicare-related plans and options to find the coverage that meetsyour individual need—both in terms of cost and the benefits provided.2

This is why Turner has partneredwith OneExchange, an expertin the commercial Medicaremarket. OneExchange offers ourMedicare-eligible retirees severalSupplemental plan options andassistance in choosing the optionthat works best for them.As you go through the processof enrolling in a health plan,OneExchange’s licensed BenefitAdvisors will become youradvocates—helping you find andenroll in an individual plan that bestserves your medical needs and fitsyour budget.In addition, Turner providesbenefit dollars through a RetireeReimbursement Arrangement (RRA)to all Medicare-eligible retirees andtheir spouses and dependents whoare also eligible for Medicare.The benefit dollars Turner provideswill be placed in a special, taxfree account. You can receivereimbursement from the accountfor the premiums of your selectedMedicare-coordinated plan.These benefit dollars can be used forreimbursement when you purchaseindividual health care coverage,including coverage that coordinateswith Medicare, such as MedicareAdvantage and Medicare Supplementcoverage. They also can be used toreimburse you for other eligible outof-pocket health care expenses.Additionally, you can receivereimbursement for eligible medical,dental, and even vision expenses!You will have flexibility in how youuse your Turner retiree benefits.OneExchange: With You Every Step of the WayWe understand that you will need to make important choices aboutyour health care coverage. OneExchange’s Benefit Advisors areobjective, knowledgeable, and will be available to guide you throughthe process.3

INTRODUCING ONEEXCHANGEOneExchange is dedicated to making the transition to your newhealth coverage as easy and as straightforward as possible.OneExchange is the leading provider of Medicare-coordinated health caresolutions. With OneExchange’s assistance, retirees and their dependentswho are Medicare-eligible gain access to the health insurance market,including a wide range of coverage choices offered by the leading nationaland regional insurance companies.DURING YOUR ENROLLMENT PERIOD,OneExchange’s Benefit Advisors will beavailable to help you understand all yourbenefit options and answer questions.An experienced OneExchangeBenefit Advisor will provide youand your eligible dependents withpersonalized assistance, including: UNLIMITED ACCESS, adviceand decision making support,based on your current coverageand future needs. You may callOneExchange’s Benefit Advisorsas many times as you want—andtalk as long as you need until youfully understand your options. EDUCATION about the differencesbetween various plans, and thecosts of each of those plans. ASSISTANCE with enrolling inmedical, prescription drug, dental,and even vision plans during ascheduled appointment.If you and an eligible spouse ordependent are eligible for thisservice, you must each make aseparate election. Both Medicareand supplemental insurance areonly offered as individual coverage.4

Are You Enrolled in Medicare Part B?Only Turner retirees, their spouses, and eligible dependents whoare enrolled in both Medicare Part A and Part B are eligible forOneExchange’s services. if you are eligible for Medicare, but have notyet enrolled for Part B services, you will need to contact Medicaredirectly to enroll as soon as possible. For more information onMedicare, call 1-800-MEDICARE or visit www.Medicare.gov.BE ON THE LOOKOUT!OneExchange will mail your Enrollment Guide soon after you receive thiscommunication. It is important that you review the information provided,as it will include helpful information on eligibility and plan options.5

STEPS TOWARD ENROLLMENTA step-by-step guide to enrolling for new coverage.BEGIN YOUR ENROLLMENTPROCESS WITH6

OneExchange has identified three steps in completing this process:Education, Evaluation and Enrollment. You will be fully supported througheach of these steps by licensed Benefit Advisors from OneExchange.STEP 1: EducationSoon, you will receive an Enrollment Guide from OneExchange containinginformation on how their Benefit Advisors will work with you to evaluateand enroll in the plan that is right for you. This guide will includecomparisons of plan options and helpful information on eligibility, and itwill refer you to OneExchange’s online tools and call center.STEP 2: EvaluationUsing the Enrollment Guide and/or OneExchange’s online tools, you willbe able to review the options available to you before speaking with aBenefit Advisor. When you call, a Benefit Advisor will spend time learningabout your specific needs in order to assist you with your enrollmentchoices.STEP 3: EnrollmentA OneExchange Benefit Advisor will help you through every step ofthe enrollment process, and assist you with enrolling in the Medicaresupplemental plan you choose. During your dedicated enrollmentperiod, and using OneExchange’s customized tools, your BenefitAdvisor will ensure that you make informed and confident decisionsand that you have expert support throughout the entire process.7

GET FAMILIAR WITH MEDICAREHow Medicare Parts A and B combine to provide you withcoverage.Before you contact OneExchange to select your individualcoverage, it is good to become familiar with Medicare.WHAT YOU GETPART A & PART BOriginal Medicare consists of Part A and Part B. You automaticallyreceive Part A and become eligible for Part B when you qualify forMedicare either due to age or disability.PART APART BPart A provides inpatient care, andcovers inpatient hospital stays,home health care, stays in skillednursing facilities, and hospice care.Part B provides outpatient care,and it covers physician fees andother medical services not requiringhospitalization. You must enroll inPart B to receive this benefit.8

Medicare benefits are broken into several components. To decide how tobest meet your medical needs and budget, it helps to understand how theseparts work together.The simple outline shown on the next few pages will familiarize you with theparts of Medicare and the decisions you must make.WHAT YOU CHOOSEMedicare Advantage, Medigap, and/or Part DYou choose between these three different types of supplemental plans that addcoverage where original Medicare may have less than you require.MEDICARE ADVANTAGEMEDIGAPPART DMedicare Advantage is a plan offered by aprivate company to provide you with all yourMedicare Part A and Part B benefits plusadditional benefits. There are two versionsof Medicare Advantage plans: MAPD, whichincludes prescription drug coverage, and MA,which does not. Within these two MedicareAdvantage types there are three doctornetworks: HMO, PPO, and Private Fee-forService (PFFS) Plans. Medicare Advantage isalso referred to as Part C.Medigap issupplementalinsurance sold byprivate insurancecompanies to fill“gaps” in OriginalMedicare plancoverage.Part D refers tooptional prescriptiondrug coverage,which is availableto all people whoare eligible forMedicare. Plansare offered throughprivate insurancecompanies.HOW TO DECIDEChoosing the Best CombinationYou may combine the supplemental plans above to get a package of plans that coversall of your needs. Choosing the best combination requires some education and somecomparison of plan features and costs. For additional details on the options available,please review the following page for a more complete description of each plan type.9

MEDICARE OPTIONS: AT A GLANCEUnderstand your Medicare options.PARTAWHAT DOES IT COVER?Hospital InsurancePart A covers hospice care, home health care, skilled nursing facilities, and inpatienthospital stays.PART Medical InsuranceBPart B covers physician fees and other medical services not requiring hospitalization.PART Medicare AdvantageCPart C is a plan offered by a private company to provide you with Part A and Part Bbenefits plus additional benefits. There are two versions of Medicare Advantage plans:MAPD, which includes prescription drug coverage, and MA, which does not. MedicareAdvantage plans vary by the type of doctor network they provide: PFFS, PPO, and HMO.PFFS PlansPPO PlansHMO PlansPrivate Fee-for-Service(PFFS) plans cover visitsto any primary care doctor,specialist, or hospital thataccepts the terms of theplan’s payment. PFFSplans usually include aprescription drug plan.Preferred ProviderOrganization (PPO) planscover visits to any physicianwhether they are in or out ofthe plan’s network. However,you will pay less if youuse primary care doctors,specialists, and hospitalsin the plan’s network. APPO usually includes aprescription drug plan.Except for emergencies,a Health MaintenanceOrganization (HMO) onlycovers care that is providedby primary care doctors,specialists, or hospitals inthe plan’s network.10

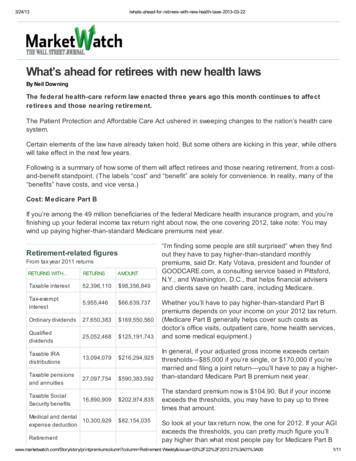

Understanding the various components of Medicare is important as youmake new choices for health care benefits and coverage. The table belowsummarizes specific information about Medicare plans. Unfamiliar withterms used in this chart? Refer to the glossary on page 24.ENROLLING WHAT YOU PAY FOR COVERAGEEnrollment isautomatic whenyou becomeMedicare-eligible. Monthly Premium: 0 if you have 10 years of Medicare-covered employment Annual Deductible: 1,260 for your first 60 days of inpatient care Co-insurance: No co-insurance for your first 60 days of inpatient careYou must choose toenroll. Monthly Premium: 104.90* for many individuals, depending on income Annual Deductible: 147 Co-insurance: Part B covers 80% of medically necessary services. You areresponsible for the remaining 20%.*Income adjustment rates apply.You may chooseto enroll in aMedicareAdvantage plan.Each Medicare Advantage plan sets its own premium, deductible, andco‑insurance. In addition, you will continue to pay your Medicare Part B premiums.11

MEDICARE OPTIONS: AT A GLANCEcontinuedWHAT DOES IT COVER?MEDIGAP Supplemental insuranceMedigap is Medicare supplemental insurance sold by private insurance companies to fill “gaps” inOriginal Medicare plan coverage. Sold by private insurers, these 10 plans—labeled Plans A, B, C,D, F, G, K, L, M and N—offer standardized menus of benefits. (Massachusetts, Minnesota, andWisconsin have their own versions of these plans.) Medigap policies only work in conjunction withthe Original Medicare plans. Generally, there is no prescription drug coverage.PARTDPrescription Drug CoveragePart D covers generic and brand-name drugs included in the plan’s formulary, which is alist of drugs the plan will pay for.12

ENROLLINGWHAT YOU PAY FOR COVERAGEYou may choose toenroll in Medigapsupplementalinsurance.If you choose to enroll in a Medigap plan, you will pay a monthlypremium to the insurance company you choose. In addition, youwill continue to pay your Medicare Part B premiums and you areresponsible for Part B deductibles and co-insurance. There are nodeductibles or co-insurance specific to Medigap plans.You may choose toenroll. A premiumpenalty is applied ifyou do not enrollwhen you first becomeMedicare-eligible.Whether you pay a Part D premium, deductible, or co-insurancedepends on the plan you choose, as each Part D plan has a differentcost-sharing structure. Depending on the plan you select, you may payboth a monthly premium and a share of the cost of your prescriptionsin a Part D plan.13

WHAT IS AN RRA?Use the RRA account to get reimbursed for your premiums andeligible expenses.RRA-ELIGIBLEEXPENSESThe following are someRRA qualified health careexpenses that can bereimbursed: Premiums for MedicarePart A and Part B Premiums for individualMedicare supplementalinsurance such asMedicare Advantage,Medigap, and prescriptiondrug plans. Out-of-pocket expenses,such as deductibles andco-pays. Dental and/or vision planpremiums. Dental and vision expensesnot covered by aninsurance plan.Note: Any expenses orpremiums incurred by aspouse or dependent who isnot Medicare-eligible cannotbe reimbursed from the RRA.A Retiree Reimbursement Arrangement (RRA)is an account that is used to reimburse youfor eligible health care expenses on a taxfree basis.When you enroll through OneExchangeas a Medicare-eligible participant, Turnerwill credit your account on a proratedbasis when you first enroll and then at thebeginning of each subsequent year, if youand your eligible dependents are enrolled ina plan through OneExchange.You can use the funds in your account to getreimbursed for any premiums you pay and/oryour share of eligible health care expensesduring the year. You decide how to use thebenefit dollars in your RRA. Any dollarsremaining in your RRA at the end of the yearwill roll over for you to use in future years,provided you remain enrolled in the plan.If you also have a Medicare-eligible spouseor dependent, Turner will contributetheir benefit dollars to the same RRAyou have. This means you will all submiteligible expenses to the same RRA forreimbursement.14

Turner’s Contributionsto Your RRAIMPORTANT NOTE ABOUTPREMIUMSYou will receive a monthly bill forthe premiums from the insurancecarrier for the plan you elect. Youwill need to pay these bills andsubmit documentation of paymentto your RRA for reimbursement ofyour premiums.Each year, Turner contributes benefitdollars to an RRA on your behalf.The amount of benefit dollars Turnercontributes to your RRA is based onyour years of service with Turner.Turner will automatically establish anRRA for you through OneExchange,the administrator of the RRA. Thismeans you will submit claims toOneExchange, and OneExchange willreimburse you from your RRA.If you have a spouse or dependentwho is currently enrolled in Turner’searly retiree medical plan and hasmedical premiums deducted fromyour pension, these premiums cancontinue to be deducted from yourpension check. You will not be ableto use your RRA funds to covermedical premiums or expenses fornon-Medicare-eligible spouses and/or dependents.How It WorksYou enroll in a participating planwith OneExchange and pay thepremiums directly to the carrier. Youcan then be reimbursed for thesepremiums from your RRA. The RRAGuide you will receive shortly beforethe effective date of your chosensupplemental Medicare coverage willhelp you access and manage yourRRA, as well as provide you withclaims and processing information.The RRA Guide will also provide acomplete listing of reimbursableexpenses. RRA funds used toreimburse your eligible expenses arenot considered taxable income.15

HOW AN RRA WORKS: AN OVERVIEWLearn the basics about the process.When your new coverage with OneExchange takes effect, Turner will place yourretiree medical benefit dollars in your RRA (instead of applying them againstyour medical premiums). You choose the plan that is best for you and pay thecarrier directly for your health care coverage. You can then be reimbursed fromyour RRA to the extent that benefit dollars are available in your account.16

How Your RRA Account Is EstablishedYou andOneExchangework togetherto evaluate theoptions and selectthe plan that isright for you.You enroll in aplan throughOneExchangeduring yourenrollment period.After you enroll,and your newcoverage takeseffect, Turnerplaces benefitdollars in yourRRA.Getting Reimbursed from Your RRAYou pay yourpremium directlyto your insurancecarrier and anyrequired out-ofpocket expensesnot covered byMedicare to yourhealth care providerwhen you receiveservices. Yousave all bills andreceipts.You submit yourclaim, along withrequired receipts,to OneExchange.OneExchangereimburses youfrom your RRAaccount.Establishing Direct Deposit for Your RRAReimbursementsTo receive your reimbursements as quickly as possible, we encourage you toestablish direct deposit, which allows for reimbursements to be depositeddirectly into your checking or savings account.Information on how to set up direct deposit is included in the OneExchangeRRA Guide, which will be mailed to you soon. Unless you choose to set updirect deposit, all reimbursements will be made by check and mailed to theaddress on file with OneExchange.17

RRA SCENARIOSUnderstand when your RRA begins and coverage under Turner’scurrent plan ends.Here are some sample scenarios to help you better understand when theRRA begins and when Turner’s current health care coverage ends.18

Remember:If you are not Medicare-eligible, but your spouse or dependent is, he orshe must enroll in a health plan through OneExchange and you will remainenrolled in Turner’s early retiree health care coverage.MEDICARE-ELIGIBLE RETIREES & DEPENDENTSYouWhen you are eligibleand Medicare becomesyour primary coverage,your Turner health plantransitions to the Medicaresupplemental coverageyou choose throughOneExchange. Retirementbenefit dollars are placedin your RRA when youenroll in a plan throughOneExchange.Your Spouse or DependentYour spouse or dependent’s coverageon Turner’s health plan transitions whenhe or she becomes eligible for Medicare.When your spouse or dependent enrolls inMedicare Parts A and B and chooses a planthrough OneExchange, their retirementhealth care dollars are placed in your RRA.You and your spouse or dependent willshare your joint RRA, which may be used forexpenses incurred by just one individual orby all eligible participants.NON-MEDICARE-ELIGIBLE RETIREES & DEPENDENTSYouYou continue on Turner’shealth care coverageuntil you becomeMedicare‑eligible due toage or disability. At thattime, Turner’s health carecoverage will end, and youwill need to enroll in a planthrough OneExchange.Your Spouse or DependentYour spouse or dependent continuescoverage on Turner’s health plan as long ashe or she meets all eligibility requirements.When your spouse or dependent becomesMedicare-eligible due to age or disability, hisor her coverage under Turner’s early retireemedical plan will end and then he or she willneed to enroll through OneExchange.19

WHAT HAPPENS NEXT?Know the key dates for your upcoming enrollment.The following timeframes are important to note as you begin the transition toyour new Medicare supplemental plans. These periods indicate the actionsand events required to enroll in a new Medicare supplemental plan by theenrollment deadlines.Pre-En

OneExchange is the leading provider of Medicare-coordinated health care solutions. With OneExchange’s assistance, retirees and their dependents who are Medicare-eligible gain access to the health insurance market