Transcription

The 2012 EHR UserSatisfaction Survey:RESPONSES FROM 3,088 FAMILY PHYSICIANSWhere else can you getEHR advice from a fewthousand colleagues?PRON CHANRobert L. Edsall and Kenneth G. Adler, MD, MMMerhaps it’s the Medicare andMedicaid incentives, or perhapsit’s just that the time has come.Regardless, physicians seem to becomputerizing their records in larger numbersthan ever before, making this an opportunetime to release the results of the latest FamilyPractice Management (FPM) survey of usersatisfaction with electronic health records(EHRs). If you are in the market for an EHR,we hope you will find this report useful.As with our four earlier surveys,1-4 wepublished the survey instrument in an issueof FPM and made an online version availablethrough the FPM website.5 Again this year, inan effort to maximize responses, we kept thesurvey short and offered incentives for usableresponses (one Apple iPad and 10 one-yearsubscriptions to FPM, which were awardedto randomly selected respondents). We alsofollowed up publication of the survey withreminders in FPM email newsletters and sentone email reminder to most active membersof the AAFP. Given the wide availability ofthe survey instrument, we accepted responsesonly from AAFP members as a way of avoiding frivolous responses, multiple responses perindividual, and other such potential sourcesof bias.As with previous surveys in this series, ouraim was not to provide a statistically accuratepicture of EHR use among AAFP members;rather, we simply wished to collect opinionsfrom as many users of as many EHR systems as possible and to convey the range ofresponses as clearly as we could in an easilydigestible form. Downloaded from the Family Practice Management Web site at www.aafp.org/fpm. Copyright 2012 FAMILY 23American Academy of Family Physicians. For theprivate, noncommercialof one individualuser ofPRACTICEthe WebMANAGEMENTsite.November/December2012 usewww.aafp.org/fpmAll other rights reserved. Contact copyrights@aafp.org for copyright questions and/or permission requests.

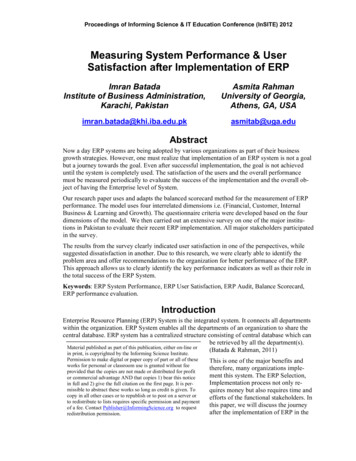

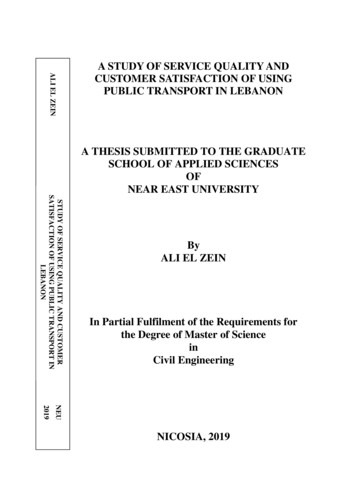

Survey resultsWe were able to collect a total of 3,397 responses. Ofthose, we excluded 303 because the respondents eithersaid they did not use EHR systems or didn’t nameidentifiable systems. We excluded six more because therespondents indicated that they had a significant financialinterest in or affiliation with a manufacturer or vendor ofan EHR program (e.g., an ownership interest, a sizablestock purchase, or involvement in development of thesoftware). That left 3,088 responses for analysis.Respondents in the analysis group reported a total of160 identifiable EHR systems, 129 of which were used by12 or fewer respondents. (Compare these numbers withthose from our 2011 survey.1 Then, 12 percent fewerrespondents, 2,719, reported 28 percent more systems,205. The difference may indicate a continuing consolidation of the EHR market.) The 31 systems reported thisyear by 13 or more respondents accounted for 92 percentof responses (2,830). These 31 systems are the ones wewill provide system-specific results for, using the averageof all 3,088 responses as a point of comparison. We choseto focus on these 31 systems because we believed that thenumber of responses was sufficient to represent a reasonable spread of opinions on each system. These are the31 systems in question, with the number of respondentsreporting each system given in parentheses: AHLTA (N 69) Allscripts Enterprise (N 189) Allscripts MyWay (N 19) Allscripts Professional (N 177) Amazing Charts (N 102) Aprima (N 19) athenaClinicals (N 63) Care360 EHR (N 13) Centricity EMR (N 181) Centricity Practice Solution (N 65) eClinicalWorks (N 303)DISTRIBUTION OF SURVEY RESPONDENTS BY PRACTICE SIZE FOR 31 EHR SYSTEMSPractice Fusion (N 47)Care360 EHR (N 13)Praxis (N 21)SOAPware (N 53)Amazing Charts (N 102)Allscripts MyWay (N 19)eMDs (N 130)Aprima (N 19)Practice Complete (N 13)PrimeSuite (N 50)MEDENT (N 49)SuccessEHS (N 19)Practice Partner (N 104)eClinicalWorks (N 303)RPMS (N 14)athenaClinicals (N 63)Point and Click EHR (N 14)Allscripts Professional (N 177)Intergy EHR (N 48)All Respondents (N 3088)MPM (N 40)VistA CPRS (N 20)NextGen Ambulatory (N 294)Centricity Practice Solution (N 65)Centricity EMR (N 181)PowerChart/PowerWorks (N 136)Allscripts Enterprise (N 189)EpicCare Ambulatory (N 509)AHLTA (N 69)Horizon Ambulatory Care (N 26)InteGreat EHR (N 15)HealthConnect (N 28)0%10%20%Number of physicians in the practice:30%1240%3-56-1024 FAMILY PRACTICE MANAGEMENT www.aafp.org/fpm November/December 201250%11-2060%21-5070% 5080%Blank90%100%

EHR SURVEYAbout half of respondents came from practices with10 or fewer physicians, and almost as many camefrom practices of more than 20 physicians. eMDs (N 130) EpicCare Ambulatory (N 509) HealthConnect* (N 28) Horizon Ambulatory Care (N 26) InteGreat EHR (N 15) Intergy EHR (N 48) MEDENT (N 49) MPM (N 40) NextGen Ambulatory (N 294) Point and Click EHR (N 14) PowerChart/PowerWorks (N 136) Practice Complete (N 13) Practice Fusion (N 47) Practice Partner (N 104) Praxis (N 21) PrimeSuite (N 50) RPMS (N 14) SOAPware (N 53) SuccessEHS (N 19) VistA CPRS (N 20)A more detailed list that includes the vendor name andweb address for each system is available in a downloadable online appendix to this article (http://www.aafp.org/fpm/2012/1100/p23-rt1.pdf). Three of the 31 systemsare government-developed EHRs. AHLTA is the DefenseDepartment’s EHR, RPMS is the Indian Health Service’ssystem, and VistA CPRS is the Veterans Administrationsystem. HealthConnect is a system used by Kaiser Permanente. Point and Click EHR is used by college health services. We have included these systems for comparison.About half of respondents came from practices with 10or fewer physicians (49 percent, or 1,498), and almost asmany (42 percent, or 1,285) came from practices of morethan 20 physicians, with 828 of those (27 percent of thetotal) coming from groups of more than 50 physicians.As we expected, certain EHR systems were reported morecommonly in small practices and others more commonlyin large ones. The practice-size distribution of the 31systems is shown on page 24. At least 67 percent of usersreporting the first 13 systems shown in the chart (fromPractice Fusion through Practice Partner) come frompractices of one to 10 physicians, while at least 67 percentof users reporting the last seven systems (from PowerChart/PowerWorks through HealthConnect) come frompractices of more than 20 physicians.The majority of respondents (57 percent, or 1,769)said they had up to three years of experience with thesystem they reported on. Another 38 percent (1,166)reported more than three years but less than 10 years ofexperience. Asked to estimate their skill in using theirEHR systems, a large majority of respondents said theyconsidered themselves average or above average but notexpert users of their EHR systems (75 percent, or 2,320),while 17 percent (524) considered themselves experts,and only 4 percent (113) considered themselves novice users. The percentage of respondents who reportedhaving switched EHR systems at least once because ofunhappiness with a prior system remained at about thesame level as in the 2011 survey (15 percent, or 471).Dimensions of satisfactionTo determine users’ satisfaction with various aspects oftheir EHR systems, we asked respondents to indicatetheir level of agreement or disagreement with each of thefollowing 19 statements, using the scale Strongly Agree,Agree, Neutral, Disagree, Strongly Disagree, and Unsure: I can document care easily and efficiently withthis EHR. I can find the information I need easily andefficiently with this EHR. This EHR clearly displays the information I needwithout unnecessary information or other clutter. This EHR helps me avoid making mistakes. Using this EHR, I can create notes that promotebetter patient care; for instance, other physicians wouldfind that the notes provide all the information they needin an easy-to-digest format. This EHR allows me to complete tasks efficiently,without seemingly unnecessary steps. About the AuthorsRobert Edsall is the former editor-in-chief of Family Practice Management. Dr. Adler is a practicing family physician, medical director ofinformation technology for Arizona Community Physicians in Tucson, Ariz., a Certified Professional in Healthcare Information and Management Systems, a juror for the Certification Commission for Health Information Technology, and an independent consultant in healthcare information technology. He holds a Master of Medical Management degree and a Certificate in Healthcare Information Technology,and he serves on the Family Practice Management Editorial Advisory Board. Author disclosure: no relevant financial affiliations disclosed.November/December 2012 www.aafp.org/fpm FAMILY PRACTICE MANAGEMENT 25

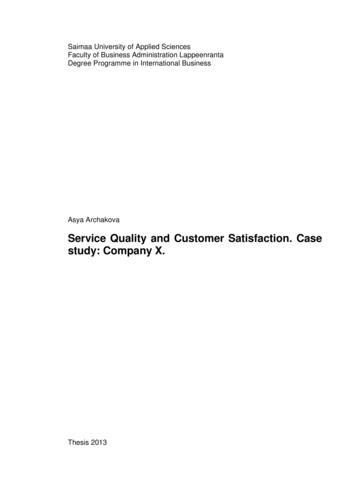

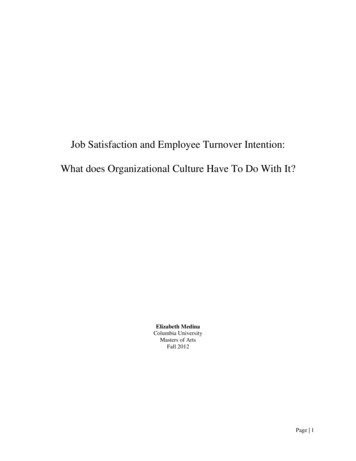

SURVEY OVERVIEW:31 EHR systems ranked on 19 dimensionsEHR notes promote better patient care.I can complete tasks efficiently.EHR helps me focus on patient care.EHR alerts are concise, appropriate, helpful.EHR offers useful disease management tools.EHR offers useful preventive medicine tools.E-prescribing is fast, easy, error-free.Messaging/tasking is fast, easy, effective.EHR vendor provides excellent support.I can see more patients or go home earlier.I enjoy using this EHR.I am highly satisfied with this EHR.1111111112241421115555644536131371333Learning to use this EHR is easy.EHR helps avoid me making mistakes.2EHR helps me provide better patient care.EHR clearly displays information/no clutter.Praxis (N 21)MEDENT (N 49)EHR makes meaningful use incentives easy.EHR systemsI can find information easily and efficiently.Abbreviated survey statementsI can document care easily and efficiently.The rankings in this table arebased on the percentage ofrespondents for each system whoagree or strongly agree with thesurvey statements representedin brief form across the top. Foreach statement, rankings runfrom 1 (best) to 31 (worst). Foreach statement, the five bestrankings are color coded greenand the five worst are orange.Systems are listed in order of thesum of their rankings.HealthConnect (N 28)4793458222312493522Amazing Charts (N 102)3326332447747524444SOAPware (N 53)64445233738551756255eMDs (N 130)86677867651066888976Point and Click EHR (N 891199VistA CPRS (N 20)714121113914654199127101281110Practice Fusion (N 47)987128798131811131325351567EpicCare Ambulatory (N 509)athenaClinicals (N 63)161118912131010108512826157101612eClinicalWorks (N 303)111010151011122115139111591210121211Centricity EMR (N s Professional (N 177)151516141716191417141217361615131717Practice Partner (N 104)1212141315141112111122202311142471818Aprima (N 19)1823111722171615201715162120614141514Practice Complete (N 13)191622191612717161625818182216221015Care360 EHR (N 13)13178299182118252142817271111291320Centricity Practice Solution (N 65)17182416192217131212232120152023232021Intergy EHR (N 48)22212027231529162115161810132117212319RPMS (N s Enterprise (N te (N t/PowerWorks (N 136)24262723262120242224242426192726202425NextGen Ambulatory (N HS (N 19)28272824212627252627212324282821252522InteGreat EHR (N s MyWay (N 19)23282128292428232925293125232925182630Horizon Ambulatory Care (N 26)29302522252525222423273027291730273029AHLTA (N 69)26242926282830292829302622313127172927MPM (N 40)3131313131313131303128292830263131313126 FAMILY PRACTICE MANAGEMENT www.aafp.org/fpm November/December 2012

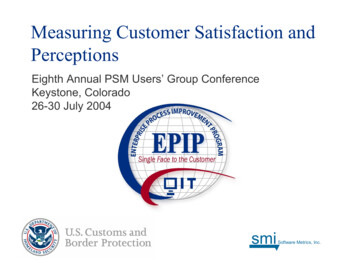

EHR SURVEY This EHR helps me focus on patient care ratherthan on the computer. This EHR presents alerts that are concise, appropriate, and helpful. This EHR provides useful tools for disease management (for instance, diagnosis-specific prompts, alerts, andpatient education materials). This EHR provides useful tools for preventive medicine (for instance, flow sheets, alerts, and patient education materials). This EHR makes it easy to qualify for meaningfuluse incentive dollars from Medicare or Medicaid. This EHR doesn’t just enable me to meet meaningfuluse criteria; it actually helps me provide better patient care. E-prescribing is fast, easy, and error-free with this EHR. Intra-office messaging and tasking are fast, easy,and effective with this EHR. Learning to use this EHR is easy. Our EHR vendor provides excellent support (forinstance, fixing bugs quickly, offering useful training, andproviding timely upgrades that go well). This EHR helps me see more patients per day (orgo home earlier) than I could with paper charts. I enjoy using this EHR. I am highly satisfied with this EHR.Preliminary rankingFor a rough, preliminary sense of the survey results, weranked the 31 systems by the percentage of respondentswho indicated that they agreed or strongly agreed witheach of the statements. The results are shown in “Surveyoverview: 31 EHR systems ranked on 19 dimensions,”page 26. To help make sense of the array of numbers, thehighest five rankings for each statement are tinted greenand the lowest five are tinted orange. The systems arelisted by the sum of their ranks.This ranking, although crude in that it weights all 19dimensions equally, offers some useful insights. As you’llsee, the high and low rankings tend to cluster in certainsystems. As in past surveys, the systems most commonlyreported by physicians in small practices tend to appeartoward the top of the rankings, while those most commonly reported in large practices tend to appear towardthe bottom of the rankings. We have reason to believethat practice size is independently related to satisfaction,6 so this may not be due entirely to the qualitiesof the EHR systems themselves. Given that clustering,though, it may be useful to note that three systems commonly reported in small practices – Allscripts MyWay,PrimeSuite, and SuccessEHS – are ranked toward theRESPONSE SPECTRUM:‘Our EHR vendor provides excellent support.’MEDENT (N 49)Praxis (N 21)HealthConnect (N 28)Amazing Charts (N 102)Practice Fusion (N 47)SOAPware (N 53)athenaClinicals (N 63)eMDs (N 130)EpicCare Ambulatory (N 509)eClinicalWorks (N 303)Care360 EHR (N 13)All respondents (N 3088)VistA CPRS (N 20)Point and Click EHR (N 14)Aprima (N 19)Allscripts Professional (N 177)Practice Complete (N 13)Intergy EHR (N 48)PrimeSuite (N 50)Centricity EMR (N 181)RPMS (N 14)SuccessEHS (N 19)InteGreat EHR (N 15)Centricity Practice Solution (N 65)Practice Partner (N 104)Allscripts MyWay (N 19)PowerChart/PowerWorks (N 136)AHLTA (N 69)Allscripts Enterprise (N 189)NextGen Ambulatory (N 294)Horizon Ambulatory Care (N 26)MPM (N 40)100%Blank80%Unsure60%Neutral40%20%Strongly Disagree0%20%Disagree40%Agree60%80%100%Strongly AgreeNovember/December 2012 www.aafp.org/fpm FAMILY PRACTICE MANAGEMENT 27

bottom, while two systems commonly reported in largepractices – HealthConnect and EpicCare Ambulatory –show up near the top of the rankings. In our 2011 survey,Allscripts MyWay ranked similarly low and EpicCareAmbulatory ranked similarly high; PrimeSuite fell towardthe middle of the rankings, and neither HealthConnectnor SuccessEHS was reported by enough respondents tomake the system-specific results.Response spectrum chartsTo better visualize the full range of responses to eachstatement, we rely on charts such as “Response spectrum:‘Learning to use this EHR is easy,’” below. Each barin a response spectrum chart represents 100 percent ofresponses for a given system (or for all systems reported,in the case of the “All respondents” bar), so all bars on thechart have the same overall length. The bars are dividedinto sections representing, from left to right, Blank(respondents who left the item blank, if any), Unsure,Neutral, Strongly Disagree, Disagree, Agree, and StronglyAgree. Bar segments for Blank, Unsure, and Neutral arepositioned to the left and given only light tints to helphighlight the segments representing active agreement ordisagreement. Keep in mind, however, that the Blank,Unsure, and Neutral segments do not represent negativeresponses and could as easily have been placed on thefar right end of the bars. The bars are positioned so thedividing line between agreement and disagreement fallson a midline, so bars that fall mostly to the right of themidline represent a predominance of agreement with thestatement, while those that fall mostly to the left indicatea predominance of disagreement. Bars are ordered by thesum of Agree and Strongly Agree responses so that thesystems with the most positive responses appear towardthe top of the chart. To interpret the chart, though, youneed to look at individual bar segments, not just theorder of the bars. For instance, while Aprima shows upas the sixth bar in the chart, it received a much lowerpercentage of Strongly Agree responses (5 percent) thaneither SOAPware or MEDENT, immediately above andbelow it (21 percent and 22 percent, respectively), suggesting a somewhat weaker intensity of agreement. It alsohelps to note the position of the “All Respondents” barin each chart, since you can think of systems appearingabove that bar as receiving above-average responses andthose below that bar as receiving below-average responses.While we have room here to display only a few responsespectrum charts, the online appendix (http://www.aafp.org/fpm/2012/1100/p23-rt1.pdf) does provide all 19.The appendix also includes a summary chart, which sumsresponses to all 19 items, and charts of results for otherRESPONSE SPECTRUM:‘Learning to use this EHR is easy.’Point and Click EHR (N 14)Amazing Charts (N 102)Practice Fusion (N 47)Praxis (N 21)SOAPware (N 53)Aprima (N 19)MEDENT (N 49)eMDs (N 130)HealthConnect (N 28)VistA CPRS (N 20)Care360 EHR (N 13)eClinicalWorks (N 303)InteGreat EHR (N 15)Practice Partner (N 104)All respondents (N 3088)athenaClinicals (N 63)Allscripts Professional (N 177)Horizon Ambulatory Care (N 26)EpicCare Ambulatory (N 509)Centricity EMR (N 181)Centricity Practice Solution (N 65)Intergy EHR (N 48)Practice Complete (N 13)RPMS (N 14)Allscripts Enterprise (N 189)PrimeSuite (N 50)MPM (N 40)PowerChart/PowerWorks (N 136)SuccessEHS (N 19)Allscripts MyWay (N 19)NextGen Ambulatory (N 294)AHLTA (N 69)100%Blank80%Unsure60%Neutral40%20%Strongly Disagree0%Disagree28 FAMILY PRACTICE MANAGEMENT www.aafp.org/fpm November/December 201220%40%Agree60%Strongly Agree80%100%

EHR SURVEYRESPONSE SPECTRUM:‘This EHR helps me see more patients per day (or go home earlier) than I could with paper charts.’Praxis (N 21)SOAPware (N 53)MEDENT (N 49)Amazing Charts (N 102)HealthConnect (N 28)Point and Click EHR (N 14)Practice Partner (N 104)VistA CPRS (N 20)eMDs (N 130)athenaClinicals (N 63)EpicCare Ambulatory (N 509)eClinicalWorks (N 303)All respondents (N 3088)Allscripts Professional (N 177)Aprima (N 19)Practice Fusion (N 47)Centricity EMR (N 181)AHLTA (N 69)Allscripts MyWay (N 19)NextGen Ambulatory (N 294)PowerChart/PowerWorks (N 136)Intergy EHR (N 48)Practice Complete (N 13)Centricity Practice Solution (N 65)Allscripts Enterprise (N 189)SuccessEHS (N 19)PrimeSuite (N 50)Horizon Ambulatory Care (N 26)RPMS (N 14)Care360 EHR (N 13)InteGreat EHR (N 15)MPM (N 40)100%Blank80%Unsure60%Neutral40%20%Strongly Disagreequestions asked on the survey. The charts we’ve selected toinclude here display results for four qualities that see

interest in or affiliation with a manufacturer or vendor of an EHR program (e.g., an ownership interest, a siz