Transcription

Georgia DreamHomeownershipProgramSeller GuideGeorgia Department of Community AffairsOffice of Housing Finance60 Executive Park South, NEAtlanta, Georgia 30329-22311-800-359-HOMEwww.gadream.com

Georgia Dream Homeownership ProgramSELLER GUIDEGeorgia Department of Community Affairs60 Executive Park South, N.E.Atlanta, GA 30329Phone (404) 679-4840 Fax (404) 679-5839Toll Free Inside Georgia (800) 359-4663TDD (800) 736-1155TTY (800) 228-4992Web Site: www.gadream.comPara información en Español acerca de nuestro programa Georgia Dream Home(El Sueño Compra de Casa Georgia), por favor deje nos nombre y número ynosotros les contactaremos lo antes posibleAn Equal Housing Opportunity LenderAn Equal Opportunity Employer

Georgia Dream Homeownership ProgramSeller GuideOffice of HomeownershipAll numbers begin in 404 prefixes unless stated otherwiseNathan Christiansen, HomeownershipOffice ey Turman, Housing OutreachCoordinator/Lender Training470-504-8173tracey.turman@dca.ga.govBrian Connor, Program SpecialistLender Portal s Suero, Program .suero@dca.ga.govSteven Apell, Loan acy Ali, Underwriter679-1731tracy.ali@dca.ga.govAgatha Turner, te Gleason, ie Lamar,Loan Administration Manager679-0595tamie.lamar@dca.ga.govSharon Kenney, Loan milla Byrd, GrantsConsultant/Home Buyer Education327-6858jamilla.byrd@dca.ga.govRate Line/Underwriting Turn time679-0581State Home Mortgage (Loan Servicing)Donna Martin,Servicing Manager/Customer Service679-0584donna.martin@dca.ga.govMichael Galloway,Servicing Director679-4908michael.galloway@dca.ga.govKerry Haynes,Servicing SG Update 2021-1Staff ListPage 1 of 1

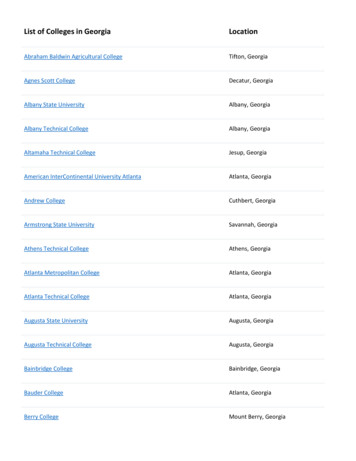

Georgia Dream Homeownership ProgramSeller GuideTable of ContentsINTRODUCTIONChapter 3111112113114Chapter .3207.4207.5207.6207.7207.8SG Update 2021-1Lender RelationshipsDCA LendersApplication Process for New LendersApplication Review ProcessLoan Seller AgreementLender's Basic Duties and ResponsibilitiesElectronic MediaLender Organizational ChangesLoan ServicingProgram ContactLender’s Repurchase ObligationRemedies for Non-PerformanceLimited ParticipationTerminationNotification and AppealLender PortalProgram ComplianceAnnual Lender RenewalChanges to the ProgramThe DCA Loan ProcessGeneralFunds AvailabilityLoan OriginationIssuance of ReservationsFirst Mortgage Loan Interest RatesReservation PeriodReservation Period ExtensionExtension FeesCancellation of ReservationUnderwritingCompliance UnderwritingCredit UnderwritingCredit ReportAutomated UnderwritingManual UnderwritingMinimum Credit Score Requirements for FHA, VA, USDA/RD& Conventional Uninsured LoansUnderwriting Package FormatIncomplete Underwriting PackageTable of ContentsPage 1 of 6

Georgia Dream Homeownership 11.2211.3211.4211.5211.6211.7211.8212213214Chapter 3.5303.6304SG Update 2021-1Seller GuideDCA’s Underwriting PeriodUnderwriting DecisionUnderwriting Approval LetterUnderwriting Deferral LetterUnderwriting Rejection LetterClearing ConditionsClosingPower of AttorneyLoan PurchasePurchase DeadlineContents of Purchase PackagesPurchase Package Review and Purchase Delay Penalty FeesIncomplete Purchase PackagesLoan Purchase PriceNon-Purchase of Closed LoanNon-Purchase of Delinquent LoanMortgage Record changes in FHA connectionFinal DocumentsQuality ControlLoan Servicing – State Home MortgageGeorgia Dream Homeownership Program RequirementEligible LoansWarranties and RepresentationsLoan RequirementsInterest RateMortgage Insurance RequirementsFHA Loans RequirementsVA LoansConventional LoansUSDA/RD LoansPool InsuranceSubordinate FinancingLoan AmountDetermining the Down PaymentConstruction LoansAmortizationEligible ApplicantsFirst-Time Home Buyer RequirementOwnership InterestsNo Ownership of Other Residential Real EstatePrincipal Residence RequirementCo-SignersLiquid Assets LimitationHousehold Annual Income & DebtTable of ContentsPage 2 of 6

Georgia Dream Homeownership 1.7311.8311.9312312.1SG Update 2021-1Seller GuideHousehold MembersHousehold Income LimitationsCalculating Household IncomeTermination of EmploymentChild Support/AlimonyOvertime/BonusesUnemployment CompensationSelf Employed ApplicantsStudent LoansBank Statements, Paystubs and Section 1010 LanguageTax TranscriptsHomebuyer EducationEligible PropertiesMaximum Purchase PriceManufactured & Modular HomesCondominiumTrade, Business, or Investment PropertyProperty StandardsPrivate WellsSeptic SystemNew ConstructionAcreageEnvironmental ReviewFlood Hazard Zone CertificationUtilities and AppliancesLead PaintSwimming PoolsAppraisal GuidelinesStandards for AppraisersFHA AppraisalsFHA Single Family Property Disposition ProgramUSDA/RD Guaranteed LoansVA LoansConventional LoansLoan Closing DocumentsWarranty Deed & TransferSurveyTitle Insurance PolicyHazard Insurance (See (d) for Mortgagee Clause)Flood InsuranceTermite LettersNote & EndorsementMortgage Loan EstimateTax Exempt Financing RiderClosing Costs and Lender FeesCalculating the PrepaidsTable of ContentsPage 3 of 6

Georgia Dream Homeownership 4315.5Chapter 4Interest Credit at ClosingCash Out at ClosingTaxed, Special Assessments and Contractor LiensLoan AssumptionsHigh Cost LoansRecapture TaxIRS Reporting and Calculation of Recapture TaxRefinancingAssumptionsLender’s ResponsibilityNotice at ClosingSpecial Georgia Dream Second Mortgage 1.5401.6402403404405406407408409410411SG Update 2021-1Seller GuideLoan TermsInterest RateLoan AmountStandardProtectors, Educators and Nurses (PEN)CHOICE (Consumers Homeownership & Independence Choices forEveryone)Mortgage Insurer RequirementsUse of the Georgia Dream Second Mortgage Loan AmountDebarred and Suspended ListRecapture TaxEligible ApplicantsHousehold Annual IncomeEligible PropertiesAppraisal RequirementsAdditional Documentation for Underwriting PackageLoan Closing and PurchaseSubordinate FinancingPurchase DocumentationLoan PurchaseApplicants Funds RequiredTable of ContentsPage 4 of 6

Georgia Dream Homeownership ProgramSeller GuideWorksheetsHousehold Income WorksheetYear-to-date Conversion ChartYear-to-date Conversion Chart for Leap YearChecklistsUnderwriting Package Checklist (First and Second Mortgage Loans)Closing Checklist (First and Second Mortgage Loans)Purchase Package Checklist (First and Second Mortgage Loans)Servicing Package Checklist (First Mortgage Loans)Final Documents Checklist (First and Second Mortgage tan Statistical AreasTargeted AreasPrivate Mortgage InsurersDCA Approved Housing Counseling AgenciesSection 1010 SF-31SF-40SF-44SF-46SF-50SF-60SF-61SF-82SF-84SG Update 2021-1Program Forms List“Extension Form”“Reservation Cancellation”“Reservation Change Form”“Loan Applicant Profile”“Application Affidavit”“Affidavit of Non-Applicant Household Member”“Acquisition Cost Certification”“Loan Funding Profile”“Servicing Loan Profile”“Tax-Exempt Financing Rider”“Transfer and Assignment”“Mortgagor's Closing Affidavit”“Notice to Purchaser of Potential Recapture Tax on Sale of Home”“Lender Certification”“Notice of Assignment, Sale or Transfer or Servicing Rights”“Second Mortgage Note”“Second Mortgage Subordinate Security Deed”Table of ContentsPage 5 of 6

Georgia Dream Homeownership ProgramSF-100SF-6012SG Update 2021-1Seller Guide“Surviving Spouse Affidavit”“Tax Return Affidavit”Table of ContentsPage 6 of 6

Georgia Dream Homeownership ProgramSeller GuideChapter 1Lender RelationshipsOur relationships with DCA Lenders are central to the success of the Georgia Dream HomeownershipProgram. Throughout the year, a mortgage lender may apply to be a DCA Lender. This Chapter outlinesthe process for becoming a DCA Lender, the basic duties and responsibilities of a DCA Lender, and theannual renewal process for DCA Lenders. The duties and responsibilities of a DCA Lender are morespecifically described in the Loan Seller Agreement and other chapters in this Guide.The Georgia Department of Community Affairs is committed to providing all persons with equal accessto its services, programs, activities, education and employment regardless of race, color, national origin,religion, sex, familial status, marital status, disability or age.101DCALendersSG Update 2020-1A DCA Lender must:a) be a legally organized and properly licensed business entity with aoffice located in the State of Georgia or in a State contiguous toGeorgia; different branch offices of the same legal entity will notqualify as individual Lenders but different wholly owned subsidiariesmay qualify as individual Lenders if they constitute separate legalentities;b) have as a principal purpose the origination of secured single familyresidential mortgage loans;c) be approved as (i) an FHA Direct Endorsement lender and VA lender,or (ii) be a federally regulated financial institution or a state or federalagency;d) be approved as (i) a Fannie Mae, Freddie Mac, or Ginnie Mae Issuer,or (ii) be a federally regulated financial institution, or a state or federalagency;e) demonstrate a proven ability to originate mortgage loans for sale in thesecondary market;f) maintain quality control and management systems to evaluate andmonitor the quality of loan production and compliance with DCAprocedures;g) have in effect and maintain fidelity bond and errors and omissionscoverage in amounts equal to that established for Fannie MaeSeller/Servicers and agree to any modifications needed to meet ourrequirements;h) have a minimum net worth of 2,500,000; andi) document a HUD Neighborhood Watch compare ratio for Georgia ofless than 125%. If there are no Georgia loans, then a compare ratio of125% of national production will be considered.Chapter 1Page 1 of 7

Georgia Dream Homeownership ProgramSeller Guide102ApplicationProcess forNew LendersA Lender Application package must be completed and returned to DCA forreview and approval. The application package must contain:a) a completed Lender Application form and all required attachments;b) two (2) original Loan Seller Agreements executed by a duly authorizedsenior officer;c) two (2) original Loan Servicing Release Agreements executed by aduly authorized senior officer;d) the three (3) most recent year-end financial statements available,certified by an independent certified public accountant;e) evidence of fidelity bond and errors and omissions coverage inamounts equal to that established for Fannie Mae Seller/Servicers;f) a copy of the Lender’s Quality Control Plan. If applicable, a 203(k)Quality Control Plan must also be provided;g) a complete O.C.G.A. §50-36-1(e)(2) Affidavit executed by a dulyauthorized officer and a copy of one verifiable documentation ofcitizenship;h) a Corporate Resolution designating the officers or individualsauthorized to execute assignments and other legal documents; andi) an Original Limited Power of Attorney executed by a duly authorizedsenior officer.103ApplicationReview ProcessUpon receipt of a complete application package, we will analyze the Lender’sability to originate Georgia Dream Loans in compliance with our proceduresand requirements. Upon completion of our review, we will send notification byemail of the approval or denial of the application.Information and/or documentation submitted to DCA as a part of theapplication process may be subject to public disclosure.104Loan SellerAgreementThe Loan Seller Agreement between Lender and DCA:a) sets forth the requirements with which Lender must comply in order tomaintain its status as a DCA Lender;b) provides the terms and conditions for the sale of Georgia Dream Loans;c) incorporates this Seller Guide by reference; andd) incorporates DCA’s Fair Housing Statement and requires DCA Lendersto maintain policies prohibiting discrimination based on race, color,sex, religion, national origin, familial status, disability or age. It alsorequires DCA Lenders to comply with all federal and state fair housingand lending laws, rules, regulations, orders, and provisions.The Lender performs origination and selling functions under the Loan SellerAgreement as an independent contractor and principal, not as an agent orrepresentative of GHFA or DCA.SG Update 2020-1Chapter 1Page 2 of 7

Georgia Dream Homeownership Program105Seller GuideLender'sLender’s duties and responsibilities include but are not limited to the following:Basic Dutiesa) Ensuring compliance with the requirements set forth in this SellerandGuide and the Loan Seller Agreement;Responsibilitiesb) Ensuring Georgia Dream Loans meet Program requirements and allapplicable mortgage insurer requirements;c) Having adequate staff and facilities to originate and sell quality GeorgiaDream Loans on a timely basis, including but not limited to:o Assisting each loan applicant with the requirements of theProgram and advising of the status of the loan application;o Reserving, underwriting and submitting approved GeorgiaDream Loans to DCA for compliance underwriting approvalbefore closing;o Funding and closing of the Georgia Dream Loans;o If applicable, submitting required documents to the MortgageInsurer to obtain mortgage insurance and arranging for thetransfer of the insurance to GHFA;d) Ensuring staff are knowledgeable in all aspects of loan origination andselling;e) Having fully documented written procedures and quality controlmeasures to determine that the procedures are being followed;f) Protecting GHFA and DCA against fraud, misrepresentation ornegligence by any parties involved in the origination process; andg) Designating a Program Contact as described in this Chapter.105.1ElectronicMediaIf Lender elects to transfer a paper copy of this Seller Guide into electronicformat, the Lender expressly warrants that all such electronic Seller Guideforms and material used in connection with Georgia Dream Loans shall haveonly minor variations in format.Acceptable minor format variations include:a) change in type font;b) change in type size, so long as the document is easily readable; andc) absence of the form borders.Unacceptable format variations include:a) absence of Georgia Dream Homeownership Program form number;b) absence of Georgia Dream Homeownership Program form versiondesignation; andc) any change in content, including substitution, omission or addition ofone (1) or more words.You should contact us with any questions about reproduction of the SellerGuide or its forms before distribution of these documents in conjunction withthe origination of Georgia Dream Loans.SG Update 2020-1Chapter 1Page 3 of 7

Georgia Dream Homeownership Program106LenderOrganizationalChangesSeller GuideLenders must send written notice to DCA of any major organizational changescontemplated, including, but not limited to:a) resignation or replacement of any senior management personnel;b) mergers, consolidations or reorganizations;c) changes in ownership of over 5% by whatever means;d) a change in corporate name;e) a change in a savings and loan association's charter from federal to stateor vice versa or change to a banking association; and/orf) a change in your financial position which would render you unable tohonor the Loan Seller Agreement.Lenders must notify the DCA’s Program Specialist by email of any changes inprimary business office address, email or wiring instructions within five (5)Business Days of the change. On a periodic basis, Lender may be asked toverify addresses, telephone numbers, primary contacts and email addresses.107Loan ServicingLenders must release the servicing rights on Georgia Dream Loans to DCA’sservicing division, State Home Mortgage. Servicing rights released must betransferred immediately after closing in accordance with this Guide.108ProgramContactThe Lender must designate one (1) employee to serve as the Program Contactfor the purpose of participating in the Program. The Program Contact shouldbe an individual who can fulfill the responsibilities outlined in this Section ona timely and informed basis.The Program Contact is expected to disseminate information to the appropriatepersons involved with the origination, underwriting, closing and servicingassociated with Georgia Dream Loans. The Program Contact should inform allappropriate person to sign up for the weekly Georgia Dream rate sheet at thefollowing meownership/georgiadream/lenders.While specific questions related to underwriting, reservations, purchase or finaldocuments may be directed to other Lender staff, the Program Contact isexpected to resolve problems, answer questions or represent Lender’s positionon various issues related to Lender’s participation in the Program.The Program Contact must be designated at the time of lender application.Lender must notify DCA’s Program Specialist by email within five (5)Business Days of a decision to designate a new Program Contact due to changein staff or change in staff responsibilities. Failure to provide this notificationmay result in immediate limited participation as described in this Chapter andmay result in additional sanctions.SG Update 2020-1Chapter 1Page 4 of 7

Georgia Dream Homeownership Program109Lender'sRepurchaseObligationSeller GuideFor reasons including but not limited to the following, Lender must repurchaseany Loan sold to GHFA by the 15th Business Day following our demand inaccordance with the Loan Seller Agreement:a) Any of the warranties contained in the forms and certifications requiredby the Seller Guide are untrue or misleading in any material respect;b) the Loan is found to be in violation of any applicable Program orMortgage Insurer requirements;c) Lender fails to deliver any required documents and/or certifications;d) Lender takes action which impairs GHFA’s security and/or causes theLoan to no longer meet the requirements of the Seller Guide, eitherbefore or after the sale of the Loan to GHFA and execution of theLender Certification (Form SF-60); and/ore) Lender fails to take action that protects GHFA’s security and/or causesthe Loan to no longer meet the requirements of the Seller Guide, eitherbefore or after the sale of the Loan to GHFA.In the event Lender is required to repurchase a Loan, the amount due to DCAon GHFA’s behalf will be governed by the terms of the most recently executedLoan Seller Agreement.110Remedies forNonPerformanceDCA retains the right to either limit or terminate Lender’s participation in theProgram for (i) any failure to abide by the terms of the Loan Seller Agreementor this Guide, (ii) any untrue or materially misleading statement in the LenderApplication or Lender Application Renewal forms or attachments thereto, or(iii) lack of loan participation110.1LimitedParticipationLimited participation means the Lender will be unable to make a reservationuntil the specific violations which caused the limited participation have beenresolved to our satisfaction. Such violations include but are not limited to:a) loss of mortgage insurer certification;b) failure to maintain a branch in Georgia or contiguous state;c) outstanding repurchases of loans or outstanding final documents; ord) excessive HUD or GHFA delinquency ratios.Limited participation does not relieve the Lender of any responsibilities underthe Loan Seller Agreement or this Guide. At the conclusion of the period oflimited participation, DCA will notify Lender either (i) when reservations mayresume, or (ii) the Lender’s participation in the Program has been terminated.110.2TerminationSG Update 2020-1Termination means Lender will no longer be allowed to participate in theProgram and Lender’s name will be removed from all DCA materials intendedfor the public as soon as practical. The decision to terminate participation willbe based upon an evaluation of the severity and magnitude of the violation andwill be solely within DCA’s discretion. After termination, a Lender which hastaken the necessary steps to prevent a reoccurrence of the violation that led tothe termination may submit a request to reinstate participation to DCA’sChapter 1Page 5 of 7

Georgia Dream Homeownership ProgramSeller GuideProgram Specialist with an explanation of the steps taken. After review, wewill notify you of our decision.At time of Lender renewal, if Lender has zero production the previous year,Lender participation in the Program will be terminated.110.3Notification andAppealThe Program Contact will be notified of limited participation or termination viaemail. Lenders will have 15 Business Days from the date of the notice to appealthe action to DCA’s Program Manager of Homeownership. The appeal must(i) demonstrate why Lender feels the action was unwarranted, (ii) describe anymeasures underway to correct the deficiencies, and (iii) demonstratemeasurable progress toward correcting the deficiencies. DCA may, in our solediscretion, schedule an informal conference with Lender to gather informationrelated to the limited participation or termination. A decision will be madewithin 15 Business Days of receipt of the appeal.111Lender PortalLender Portal is DCA’s internet-based system that allows Lenders to enterReservations, complete and print DCA required forms, check the status ofReservations, submit electronic documents for review and access variousreports. Lenders are required to utilize Lender Portal to reserve funds withDCA. Anyone utilizing Lender Portal must be assigned an individual usernameand password.112ProgramComplianceLender is responsible for ensuring each Loan submitted to DCA complies withour Program requirements and the requirements of the Mortgage Insurer as setforth in the Loan Seller Agreement and this Guide.Even if the loan is purchased based upon DCA’s review of the underwritingpackage, DCA reserves the right to require Lender to repurchase the Loan ifthe Loan does not comply with the applicable Program requirements and/or therequirements of the Mortgage Insurer as set forth in the Loan Seller Agreementand/or this Guide.113Annual LenderRenewalSG Update 2020-1Each year, Lender is required to complete a Lender Application Renewalpackage within the time specified by DCA. The renewal package must contain:a) a completed Lender Application Renewal form and all requiredattachments;b) if required by DCA, two (2) original Loan Seller Agreements executedby a duly authorized senior officer;c) the most recent year-end financial statements available, certified by anindependent certified public accountant;d) evidence of fidelity bond and errors and omissions coverage in amountsequal to that established for Fannie Mae Seller/Servicers;e) any requirements of new applicants specified in this Guide notpreviously requested of Lender; andChapter 1Page 6 of 7

Georgia Dream Homeownership ProgramSeller Guidef) documentation showing a HUD Neighborhood Watch compare ratio forGeorgia of less than 150%. If compare ratio exceeds 150%, we willconsider the Lender’s Georgia Dream loan performance. If the compareratio exceeds 150% for two consecutive quarters, we reserve the rightto remedies for non-performance, in accordance with this guide.114Changes to theProgramThe provisions of the Loan Seller and Loan Servicing Agreements and thisGuide may be amended from time to time. Lender must abide by any suchchanges or may withdraw from participation by providing notice to DCA’sProgram Specialist within ten (10) Business Days following notification of anysuch changes.Federal and State laws governing the Program are subject to change. When yousign the Loan Seller Agreement and/or Loan Servicing Agreement, you areacknowledging and agreeing that Federal or State legislation or both could beenacted in the future that would require amendment of the provisions of thisGuide, Loan Seller Agreement and/or the Loan Servicing Agreement. You arealso acknowledging and agreeing that future DCA Program changes mightrequire an amendment of the provisions of this Guide and/or the Loan SellerAgreement.You also acknowledge and agree that the requirements and procedures ofMortgage Insurers applicable to the Program may change. When you sign theLoan Seller Agreement and Loan Servicing Agreement you are agreeing tocomply with any such future changes in the Mortgage Insurers' requirementsor procedures.SG Update 2020-1Chapter 1Page 7 of 7

Georgia Dream Homeownership ProgramSeller GuideChapter 2DCA Loan ProcessThe loan process described in this Chapter allows DCA to manage the Georgia DreamHomeownership Program pipeline and provide DCA Lenders with information about the loans inthe pipeline. It is critical that Lenders maintain correct information and take timely action to ensureloans meet our deadlines.201 GeneralAs a DCA Lender, it is your responsibility to ensure each loan submittedto DCA complies with Program requirements and the requirements of theMortgage Insurer and to assist eligible borrowers throughout the loanprocess.DCA will review Underwriting Packages, clear underwriting conditions,and review Purchase Packages on a first-come, first-served basis. Lendersshould submit Underwriting Packages and Purchase Packages as early aspossible to allow sufficient time for DCA to review each package and forthe Lender to address any issues.202FundsAvailabilityGenerally, DCA expects to make funds for the Program available toLenders on an ongoing basis. DCA must, however, comply with certainState and Federal laws relating to the geographic allocation of its funds.Therefore, we reserve the right to select Reservations that meet thoserequirements and hold other Reservations for a later date if sufficient fundsare not available for all Reservation requests.In the unlikely event that funds are not available for all expectedReservations, DCA will post notification on the Rate Sheet, Lender Portal,and notify the Program Contacts by email.203LoanOriginationSG Update 2021-2DCA recognizes there are procedural variations among Lenders.Therefore, the procedures outlined in this section only suggest thesequence of events for loan origination:a) The Lender is encouraged to provide Applicants who inquire about theProgram with a Georgia Dream Homeownership Program brochureand answer any questions the Applicant may have regarding theProgram, eligibility requirements and the loan process;b) The Lender advises the Applicant to attend homebuyer educationthrough a HUD approved housing counseling agency and provideevidence of completion in the Underwriting Package;c) The Lender takes a formal application and determines if the Applicantis eligible for the Program based on information received forHousehold Annual Income, Acquisition Cost, prior homeownership,and other relevant information. If the Applicant appears eligible, theChapter 2Page 1 of 11

Georgia Dream Homeownership ProgramSeller GuideLender obtains completed and signed copies of the Programdocuments required at application,d) The Lender reserves funds pursuant to the Reservation proceduresoutlined in this Chapter,e) The Lender underwrites the application for credit approval based onthe requirements of the Mortgage Insurer and determines if the loancomplies with DCA’s guidelines, andf) Once the Lender’s underwriter has approved the loan and completedits review, an underwriting package is submitted to DCA for acompliance underwriting review.203.1Completion ofFormsLender must submit fully completed and signed Georgia Dreamdocuments at time loan is submitted to the Lender Portal for review. Ifrequired forms are not included in the loan file, review of the loan file maybe suspended until documents are uploaded to the Lender Portal.Georgia Dream Documents which have been signed with borrower’selectronic signature must be accompanied by the borrower(s) ElectronicSignature Authorization. If unable to provide, all forms must be wetsigned.The Note and Deed must continue to be signed by the borrower(s) atclosing.204Issuance ofReservationsTo request a Reservation for the Program, Lender must enter the requiredinformation via the Lender Portal. Lender should select the correctcategory for the loan.If the Reservation request meets Program requirements and funds areavailable, Lender will receive a Reservation Number via a “ReservationAccepted” response from the Lender Portal. The “Reservation Accepted”screen must be printed and uploaded in the Underwriting Package ineDocs.Lender must make note of the DCA Reservation Number and make itaccessible to all personnel involved with the loan. The ReservationNumber must be included in all verbal and written communication withDCA to facilitate accessing information about the loan.If any information needs to be changed (property address, income,purchase price, loan amount, etc.) after a Reservation Number has beenissued, Lender must complete the Reservation Change Form (SF-7) andemail it to dcareservations@dca.ga.gov. DCA will make the changes uponreceipt of the Reservation Change Form and notify Lender once thechanges have been made.SG Update 2021-2Chapter 2Page 2 of 11

Georgia Dream Homeownership ProgramSeller GuideIf the Reservation Period expires, the loan will be cancelled unless Lenderrequests an extension in accordance with this Chapt

Para información en Español acerca de nuestro programa Georgia Dream Home . 679-4851 brian.connor@dca.ga.gov Doris Suero, Program Coordinator . 679-0653 doris.suero@dca.ga.gov steven.apell@dca.ga.gov Tracy Ali, Underwriter 679-1731 tracy.ali@dca.ga.gov Agatha Turner, Underwriter Charlotte Gleason, Underwriter 679-5278 679-0613 .