Transcription

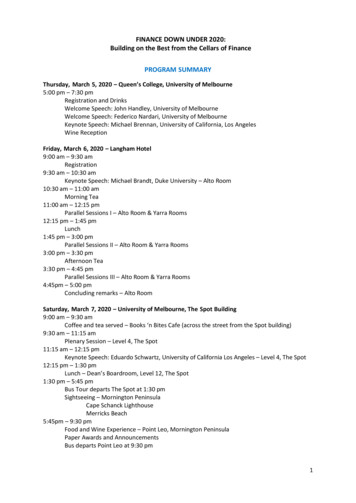

FINANCE DOWN UNDER 2020:Building on the Best from the Cellars of FinancePROGRAM SUMMARYThursday, March 5, 2020 – Queen’s College, University of Melbourne5:00 pm – 7:30 pmRegistration and DrinksWelcome Speech: John Handley, University of MelbourneWelcome Speech: Federico Nardari, University of MelbourneKeynote Speech: Michael Brennan, University of California, Los AngelesWine ReceptionFriday, March 6, 2020 – Langham Hotel9:00 am – 9:30 amRegistration9:30 am – 10:30 amKeynote Speech: Michael Brandt, Duke University – Alto Room10:30 am – 11:00 amMorning Tea11:00 am – 12:15 pmParallel Sessions I – Alto Room & Yarra Rooms12:15 pm – 1:45 pmLunch1:45 pm – 3:00 pmParallel Sessions II – Alto Room & Yarra Rooms3:00 pm – 3:30 pmAfternoon Tea3:30 pm – 4:45 pmParallel Sessions III – Alto Room & Yarra Rooms4:45pm – 5:00 pmConcluding remarks – Alto RoomSaturday, March 7, 2020 – University of Melbourne, The Spot Building9:00 am – 9:30 amCoffee and tea served – Books ‘n Bites Cafe (across the street from the Spot building)9:30 am – 11:15 amPlenary Session – Level 4, The Spot11:15 am – 12:15 pmKeynote Speech: Eduardo Schwartz, University of California Los Angeles – Level 4, The Spot12:15 pm – 1:30 pmLunch – Dean’s Boardroom, Level 12, The Spot1:30 pm – 5:45 pmBus Tour departs The Spot at 1:30 pmSightseeing – Mornington PeninsulaCape Schanck LighthouseMerricks Beach5:45pm – 9:30 pmFood and Wine Experience – Point Leo, Mornington PeninsulaPaper Awards and AnnouncementsBus departs Point Leo at 9:30 pm1

CONFERENCE SESSIONS AT A GLANCELanghamAlto RoomYarra Room OneYarra Room TwoParallelSessions IAsset Pricing ICorporate Finance IMicrostructureMarch 6,11:00 am –12:15 pmParallelSessions IIMarch 6,1:45 pm –3:00 pmParallelSessions IIIThe Origins and Real Effectsof the Gender Gap:Predicting Interest RatesBenchmark Interest Rates ifEvidencefromCEOs’the Government is RiskyFormative YearsSplitting and Shuffling:Institutional TradingOne anomaly to explainDreamChasers:HousePriceMotives and Orderthem allBooms and theSubmissions AcrossMisallocation of HumanBrokersCapitalAsset Pricing IICorporate Finance IIMore than 100% of theequity premium: How muchis really earned onmacroeconomicannouncement days?PlenarySessionElectoral Vulnerability andSubsidized Small BusinessLending: Evidence fromGerrymanderingEye in the sky: privatesatellites and governmentmacro dataInflexibility and LeverageLeft Behind: PartisanIdentity and WealthInequalityAsset Pricing IIICorporate Finance IIIMutual FundsQ: Risk, Rents, or Growth?March 6,3:30 pm –4:45 pmCourt Congestion andTransmission of ShocksBehavioural Finance andBankingDemand DisagreementMobility Restrictions andA Horizon BasedRisk-Related AgencyDecomposition of MutualConflicts: Evidence from a Fund Performance usingQuasi-Natural ExperimentTransaction DataShareholder illiquidity and The Economic Impact offirm behavior: Financial and Distributing Financialreal effects of the personal Products on Third-Partywealth tax in private firmsOnline PlatformsOption Pricing, Trading and VolatilityStock Return Extrapolation, Option Prices, and Variance Risk PremiumMarch 7,9:30 am –11:15 amOption Trading and Stock Price InformativenessThe International Commonality of Idiosyncratic Variances2

PROGRAM DETAILSFRIDAY, March 8, 2019, 11:00 am – 12:15 pmAsset Pricing I – Alto RoomSession Chair: Kris Jacobs, University of HoustonBenchmark Interest Rates if the Government is RiskyPatrick Augustin, McGill UniversityMikhail Chernov, University of California, Los AngelesLukas Schmid, Duke UniversityDongho Song, Johns Hopkins UniversityOne anomaly to explain them allJack Favilukis, University of British ColumbiaTerry Zhang, Australian National UniversityDiscussants:Michael Gallmeyer, University of VirginiaLiz Wang, University of MelbourneCorporate Finance I – Yarra Room OneSession Chair: Abe de Jong, Monash UniversityThe Origins and Real Effects of the Gender Gap: Evidence from CEOs’ Formative YearsRan Duchin, University of WashingtonMikhail Simutin, University of TorontoDenis Sosyura, Arizona State UniversityDream Chasers: House Price Booms and the Misallocation of Human CapitalTaylor Begley, Washington University in St. LouisPeter Haslag, Vanderbilt UniversityDaniel Weagley, Georgia Institute of TechnologyDiscussants:Audra Boone, Texas Christian UniversityIlona Babenko, Arizona State University3

Microstructure – Yarra Room TwoSession Chair: Zhuo Zhong, University of MelbournePredicting Interest RatesRobert Czech, Bank of EnglandShiyang Huang, University of Hong KongDong Lou, London School of EconomicsTianyu Wang, Tsinghua UniversitySplitting and Shuffling: Institutional Trading Motives and Order Submissions AcrossBrokersMunhee Han, The University of Texas at DallasDiscussants:Carole Comerton-Forde, University of New South WalesDavid Lesmond, Tulane UniversityFRIDAY, March 8, 2019, 1:45 pm – 3:00 pmAsset Pricing II – Alto RoomSession Chair: Rainer Schuessler, University of RostockMore than 100% of the equity premium: How much is really earned on macroeconomicannouncement days?Rory Ernst, University of WashingtonThomas Gilbert, University of WashingtonChristopher Hrdlicka, University of WashingtonEye in the sky: private satellites and government macro dataAbhiroop Mukherjee, Hong Kong University of Science and TechnologyGeorge Panayotov, Hong Kong University of Science and TechnologyJanghoon Shon, Hong Kong University of Science and TechnologyDiscussants:Oliver Boguth, Arizona State UniversityPatrick Kelly, University of Melbourne4

Corporate Finance II – Yarra Room OneSession Chair: Nicholas Crain, University of MelbourneCourt Congestion and Transmission of ShocksDimas Fazio, London Business SchoolThiago Silva, Central Bank of BrazilJanis Skrastins, Washington University in St. LouisInflexibility and LeverageLifeng Gu, The University of Hong KongDirk Hackbarth, Boston University School of ManagementTong Li, University of Hong KongDiscussants:Garry Twite, University of MelbourneSudipto Dasgupta, Chinese University of Hong KongBanking & Behavioural Finance – Yarra Room TwoSession Chair: Kevin Davis, University of MelbourneElectoral Vulnerability and Subsidized Small Business Lending: Evidence fromGerrymanderingSahil Raina, University of AlbertaSheng-Jun Xu, University of AlbertaLeft Behind: Partisan Identity and Wealth InequalityDa Ke, University of South CarolinaDiscussants:Kristle Cortés, University of New South WalesDouglas Foster, University of SydneyFRIDAY, March 8, 2019, 3:30 pm – 4:45 pmAsset Pricing III – Alto RoomSession Chair: Andrea Lu, University of MelbourneQ: Risk, Rents, or Growth?Alexandre Corhay, University of TorontoHoward Kung, London Business SchoolLukas Schmid, Duke UniversityDemand DisagreementChristian Heyerdahl-Larsen; Kelley School of BusinessPhilipp Illeditsch, The Wharton SchoolDiscussants:Neal Galpin, Monash UniversityFernando Zapatero, University of Southern California5

Corporate Finance III – Yarra Room OneSession Chair: Lyndon Moore, Monash UniversityMobility Restrictions and Risk-Related Agency Conflicts: Evidence from a Quasi-NaturalExperimentEmdad Islam, University of New South WalesRonald Masulis, University of New South WalesLubna Rahman, University of New South WalesShareholder illiquidity and firm behavior: Financial and real effects of the personal wealthtax in private firmsJanis Berzins, BI Norwegian Business SchoolØyvind Bøhren, BI Norwegian Business SchoolBogdan Stacescu, BI Norwegian Business SchoolDiscussants:David Reeb, National University of SingaporeBruce Grundy, University of MelbourneMutual Funds – Yarra Room TwoSession Chair: Stephen Brown, Monash UniversityA Horizon Based Decomposition of Mutual Fund Performance using Transaction DataRan Xing, Aarhus UniversityHongxun Ruan, Peking UniversityJules van Binsbergen, The Wharton SchoolThe Economic Impact of Distributing Financial Products on Third-Party Online PlatformsYurong Hong, Shanghai Advanced Institute of Finance, Shanghai Jiao Tong UniversityXiaomeng Lu, Shanghai Advanced Institute of Finance, Shanghai Jiao Tong UniversityJun Pan, Shanghai Advanced Institute of FinanceDiscussants:Min Zhu, University of QueenslandJoakim Westerholm, University of Sydney6

SATURDAY, March 9, 2019, 9:30 am – 11:15 amOption Pricing, Trading and Volatility – Level 4, The SpotSession Chair: Federico Nardari, University of MelbourneStock Return Extrapolation, Option Prices, and Variance Risk PremiumAdem Atmaz, Purdue UniversityOption Trading and Stock Price InformativenessJie Cao, Chinese University of Hong KongAmit Goyal, University of LausanneSai Ke, University of HoustonXintong Zhan, Chinese University of Hong KongThe International Commonality of Idiosyncratic VariancesGeert Bekaert, Columbia UniversityRobert Hodrick, Columbia Business SchoolXue Wang, Nankai UniversityXiaoyan Zhang, Tsinghua UniversityDiscussants:Mikhail Chernov, UCLANeal Pearson, University of Illinois Urbana-ChampagnePedro Santa Clara, Nova School of Business and Economics7

Jules van Binsbergen, The Wharton School The Economic Impact of Distributing Financial Products on Third-Party Online Platforms Yurong Hong, Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University Xiaomeng Lu, Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University Jun Pan, Shanghai Advanced Institute of Finance .