Transcription

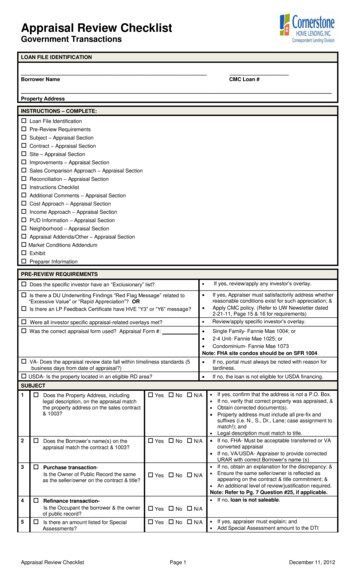

Appraisal Review ChecklistGovernment TransactionsLOAN FILE IDENTIFICATIONBorrower NameCMC Loan #Property AddressINSTRUCTIONS – COMPLETE: Loan File Identification Pre-Review Requirements Subject – Appraisal Section Contract – Appraisal Section Site – Appraisal Section Improvements – Appraisal Section Sales Comparison Approach – Appraisal Section Reconciliation – Appraisal Section Instructions Checklist Additional Comments – Appraisal Section Cost Approach – Appraisal Section Income Approach – Appraisal Section PUD Information – Appraisal Section Neighborhood – Appraisal Section Appraisal Addenda/Other – Appraisal Section Market Conditions Addendum Exhibit Preparer InformationPRE-REVIEW REQUIREMENTS Does the specific investor have an “Exclusionary” list?If yes, review/apply any investor’s overlay. Is there a DU Underwriting Findings “Red Flag Message” related toIf yes, Appraiser must satisfactorily address whetherreasonable conditions exist for such appreciation; &Apply CMC policy. (Refer to UW Newsletter dated2-21-11, Page 15 & 16 for requirements)Review/apply specific investor’s overlay. “Excessive Value” or “Rapid Appreciation”? ORIs there an LP Feedback Certificate have HVE “Y3” or “Y6” message? Were all investor specific appraisal-related overlays met? Was the correct appraisal form used? Appraisal Form #:Single Family- Fannie Mae 1004; or2-4 Unit- Fannie Mae 1025; orCondominium- Fannie Mae 1073Note: FHA site condos should be on SFR 1004 VA- Does the appraisal review date fall within timeliness standards (5business days from date of appraisal?) USDA- Is the property located in an eligible RD area?If no, portal must always be noted with reason fortardiness.If no, the loan is not eligible for USDA financing.SUBJECT1 Does the Property Address, including Yes No N/Alegal description, on the appraisal matchthe property address on the sales contract& 1003?2 Does the Borrower’s name(s) on the Yes No N/Aappraisal match the contract & 1003?3 Purchase transactionIs the Owner of Public Record the sameas the seller/owner on the contract & title?4 Refinance transactionIs the Occupant the borrower & the ownerof public record?5 Yes No N/A Is there an amount listed for Special Yes No N/A Yes No N/AAssessments?Appraisal Review ChecklistIf yes, confirm that the address is not a P.O. Box.If no, verify that correct property was appraised, &Obtain corrected document(s).Property address must include all pre-fix andsuffixes (i.e. N., S., Dr., Lane; case assignment tomatch!); andLegal description must match to title.If no, FHA- Must be acceptable transferred or VAconverted appraisalIf no, VA/USDA- Appraiser to provide correctedURAR with correct Borrower’s name (s)If no, obtain an explanation for the discrepancy; &Ensure the same seller/owner is reflected asappearing on the contract & title commitment; &An additional level of review/justification required.Note: Refer to Pg. 7 Question #25, if applicable.If no, loan is not saleable.Page 1If yes, appraiser must explain; andAdd Special Assessment amount to the DTIDecember 11, 2012

Appraisal Review ChecklistGovernment TransactionsAppraisal SectionSUBJECT (Continued)6 Is the property a PUD or Condo?Answer Yes No N/A7 Condo–a) Is the project FHA/VA approved?8 Is the property listed as Fee Simple? Yes No N/A9 Does the Assignment (i.e., transaction) Yes No N/A Yes No N/AType match 1003?10 Is the Lender/Client listed as Cornerstone Yes No N/AMortgage Co. or other CMC eligible ABA?11 Has the property been listed for sale in Yes No N/Athe last 12 months?12 If the subject property was listed for sale Yes No N/Ain the past 12 months, is the appraisedvalue significantly less than the priorlisting price(s)?Action RequiredIf yes, add HOA fee amount to the DTI calculation.If PUD – refer to PUD Information section-Pg. 8.If no, loan is not saleable.If yes, Provide evidence of project approval.FHABoth Summary screen & Project maintenanceScreen required. Use Condo Quick Underwriting Checklist toensure all loan level certifications are met. Execute Lender Condo certificationAttachment C. Ensure all data reflected on the FHA projectmaintenance screen matches appraisal andHOA Condo questionnaire (i.e. # of units)USDA- Project must be FHA or VA approved.If no, and “Leasehold”, apply FHA/VA & applicableinvestor overlays for Leasehold Properties.If no, confirm product eligibility; andObtain a revised appraisal report.If loan is a purchase, ensure appraiser has themost current and complete sales contract.If no, VA- Lender/Client must always reflect“Intended user any VA approved lender”If no, FHA- Appraisal must be acceptabletransferred or VA converted appraisal and reflectthe name of the transferring lender.If HUD REO- M & M contractor is listed as clientIf yes and currently listed and refinance product,loan is unsalableIf yes, Appraiser must provide listing history.Incomplete listing histories are a USPAP violation.If the appraisal does not include listing histories ofsubject and all comparable properties, it should berejected.Review/apply any investor’s overlay with respectto required number of days off the market forrefinance product. Evidence of cancellation oflisting required.If yes, appraiser must comment, andAppraiser to address declining market concerns.13 Is the FHA/VA case number reflectedaccurately on the appraisal? Yes No N/AIf no, then request correction to appraisal unlessHUD REO appraisal (o.k. to reflect old Case#)FHA- Ensure ADP code is accurate for loan type(refer to ADP code list in FHA connection)Note: Correct AUS & Case Assign. ,if applicable14 Does the appraisal reflect that the propertyis currently vacant? Yes No N/AFHA/USDA-If yes, ensure all utilities were on andinspected at the appraiser’s site visit or appraisalmade subject to required inspection.Note: HUD REO- Property Condition Report maybe used to satisfy utility check for FHA.CONTRACT (This section N/A for HUD REO and Refinance Transactions)1 Did appraiser analyze the sales contract? Yes No N/A2 Do the Contract Price and date of Contract Yes No N/Amatch the information included on thesales contract in the file?3 Is the Owner of Public Record the same Yes No N/Aas the seller/owner on the contract & title?4 Is the Contract sales price greater than the Yes No N/Alist price?Appraisal Review ChecklistPage 2If yes, appraiser to explain results of his/heranalysis.If no, Appraiser to provide a revised appraisalreport after analyzing the most current salescontract.If no, Ensure the appraiser has the most currentsales contract; andObtain a corrected appraisal report.If no, must be acceptable transferred or VAconverted appraisal.If no, obtain corrected report reflecting Owner ofPublic Record same as the seller/owner on thecontract and title.(only exception is when seller isa relocation company); andIf FHA-Refer to Sales Comparison ApproachPg. 7- Question #25Note: Any obvious Identity of Interest?If yes, an additional level of review required toensure the appraisal is well supported; andApply any investor overlay if sales contract was renegotiated after the date of the appraisal.December 11, 2012

Appraisal Review ChecklistGovernment TransactionsAppraisal SectionAnswerCONTRACT (This section N/A for HUD REO and Refinance Transactions)5 Are there any Interested Party Yes NoContributions (IPCs)?6 Are there any Sales Concessions (notAction Required N/A Yes No N/Astandard acceptable IPCs)?If yes, appraiser must list items and dollar amountbeing paid; and Apply applicable guideline for maximum IPC FHA-Dollar amount of any down paymentndassistance (including 2 liens) must be notedin the sales contract provided to the appraiseras well as reflected on the appraisal report(not counted in max. IPC %)If transferred or acceptable converted appraisalnote on Form 54114 and the attempt made torequest correction from Appraiser.If yes, appraiser must: List sales concession items andprovide dollar amount/value; and Specifically address the effectexcessive concessions had on thesales price of the comparables as wellas the valuation of the subject; and Subtract dollar amount/value of salesconcessions from the sales price listedon the sales contract and recalculatethe LTV/CLTV based on the reducedsales price.Personal Property must be identified andexcluded from valuation.NEIGHBORHOOD1 Is the neighborhood under 25% Built-Up Yes No N/AIf yes, appraiser must satisfactorily comment. Yes No N/AIf yes, appraiser must address marketcharacteristics & issues; andIf yes Review/apply investor’s declining or softmarket requirements, if applicable. FHA- Follow requirements ofMortgagee letter 09-09 VA- Follow requirements of CircularLetter 26-07-04.If no or USDA, ensure comments foundthroughout report support this (i.e. no commentssuch as “oversupply of homes for sale”) Yes No N/AIf no, appraiser must comment; loan may not besaleable. Yes No N/AIf no, appraiser must comment. Yes No N/A Yes No N/AIf no, appraiser must comment.and is location “Urban” or “Suburban”?2 Is the subject property in a “declining,” “atrisk,” or “soft market”? Property Values Declining, or Demand/Supply Over Supply, or Marketing Time Over 6 Months, or Appraiser comments Property is in a“declining,” “at risk” or “soft” marketarea.3 Does the appraised value fall within theNeighborhood’s price range?4 Is the Present Land Use predominatelyresidential & similar to the subject’s use?56 Is the Present Land Use stable? Does the description of the NeighborhoodBoundaries match the location mapincluded with the report, and are all compslocated within these boundaries?7 Are there any negative comments in Yes No N/ANeighborhood Description or MarketConditions?If no, appraiser must satisfactorily comment, andAppraiser should provide at least 3 closedcomps located within the subject neighborhoodboundaries.Note: Map of the comparable sales should becarefully reviewed to ensure that it has not beenaltered to misrepresent the proximity of thecomps.If yes, appraiser must provide detailedexplanation.SITE1 Does the site contain excessive acreage Yes No N/Aor lot that is not typical for theneighborhood?Appraisal Review ChecklistPage 3If large acreage, Comparables provided mustsupport acreage. USDA- Excessive acreage beyondmodest not acceptable. VA- Must have history of being boughtand sold inclusive of excessive acreageFHA-If excess land exists, can be subdividedand capable of separate use ensure; No value is given; and Condition that excess land be excludedfrom mortgage security.Note: FHA-Site area must always be shown innumeric square feet or in number of acres(except when Condo)December 11, 2012

Appraisal Review ChecklistGovernment TransactionsAppraisal SectionAnswerAction RequiredSITE (continued)2 Is Zoning Classification residential but Yes No N/AZoning Compliance Legal NonConforming?3 Is Zoning Classification agricultural but Yes No N/AZoning Compliance allows for residentialuse with Zoning Compliance Legal NonConforming?4 Is Zoning Classification “Commercial” or Yes No N/AIf yes, appraiser to explain why property is LegalNon-Conforming, andConfirm that the dwelling can be rebuilt to itscurrent density if destroyed in part or in whole.If yes, confirm that the dwelling can be rebuilt toits current density if destroyed in part or in whole,property is not an income-producing farm, andtypical for the area; andShould have similar comparables.If AG exempt, follow state requirements.If yes, loan is not saleable.“Industrial?”56 Is Zoning Compliance “Illegal”? Is the Highest & Best use of the subject Yes No N/A Yes No N/AIf yes, loan is not saleable.If no, loan is not saleable.property as improved the present use?7 Are Electricity and Gas service public? Yes No N/A8 Are Water and Sewer service public? Yes No N/A9 Is the street public? Yes No N/AIf no, appraiser must explain; andA permanent recorded easement allowingingress/egress must be obtained or provideevidence road owned and maintained by HOA.FHA/VA- Any existing road agreementmaintenance fee must be added into the DTIcalculation.VA- Evidence of continued maintenance of theroad must be provided.USDA- Must have access to paved or allweather surface street, road or driveway.10 Is the property in a Special Flood Hazard Yes No N/AIf yes, confirm with Flood Certificate and requireflood insurance.FHA new construction property ineligible unlesslowest floor above base flood elevation.USDA- All property ineligible unless lowest floorabove base flood elevation.If no to “a”, have Appraiser provide Flood Map.If no to “b”, reconcile the applicable document.If no, appraiser must explain; loan may not besaleable.Area?a) Did the Appraiser provide a FloodMap?b) Does the Flood Map/Zone match theflood certificate?11 Are the utility and off-site improvements Yes No N/A Yes No N/Atypical for the market area?Appraisal Review ChecklistPage 4If no, Appraiser must provide type of service andevaluate accordingly.If no, appraiser must provide type of service; andFHA-Require applicable water/septic inspectionswhen: Deficiencies noted by appraiser Evident property has been vacant for anextended period of time. Requirement of the sales contractEnsure min. distance well/septic requirementmet in all cases. Follow Mtg. Letter 2002-25.Apply guidance in FHA Valuation Protocol FAQVA/USDA- Always require water quality test; andSeptic inspection when: Deficiencies noted by appraiser Requirement of the sales contract Required by VA Regional or RD RegionalLoan CenterComply with additional requirements whenproperty is serviced by a shared well orcommunity water.When hook-up to public services availabledetermine feasibility.December 11, 2012

Appraisal Review ChecklistGovernment TransactionsAppraisal SectionAnswerAction RequiredSITE (continued)12 Are there any adverse site conditions or Yes No N/AIf yes, appraiser must explain; andDetermine whether the site condition and/orexternal factor could be acceptable to theapplicable insuring agency; andEnsure the applicable requirements of theinsuring agency to meet eligibility are met. Yes No N/AIf no, appraiser must explain discrepancies; andProvide a revised appraisal report. Yes No N/AIf yes, appraiser must provide acceptablereasons for difference Yes No N/AIf no, loan is not saleable.external factors? Soil contamination Underground or Stationary storagetanks Oil or Gas Wells Heavy Traffic Slush Pits Airport noise and Hazards Overhead High-Voltage TransmissionLines Smoke, fumes, offensive noises &odors. Improvements located within utility/gaspipeline easementsIMPROVEMENTS1 Does the General Description, DesignAmenities, Car storage, etc. match thephotos of the subject property?2 Is there a difference between Year Builtand Effective Age? Are both Exterior and Interior materials in34 average condition? Is there evidence of Foundation Yes No N/Asettlement, dampness, or infestation?5 Do the following items match the Yes No N/Ainformation included in the ComparableSales Approach section? Design/Style Condition Amenities Finished Area Above Grade roomcount and GLA Additional features (energy efficientitems, etc.) Actual Age Heating/Cooling Car Storage6 Are any functional utility issues noted? Yes No N/A(i.e. have to go through one bedroom toget to another bedroom, or only bathroomis on a different floor than the bedrooms)7 Are there any Physical Deficiencies (e.g., Yes No N/Aroof leaks, water seepage, etc.), orAdverse Conditions (e.g., environmentalissues, etc.) affecting livability, soundness,or structural integrity of the property?8 Does the property conform to the Does the construction stage agree with Pg2 reconciliation?10 If property 1 yr. olda) Is month and year built provided?b) Are applicable new constructiondocuments provided?c) Were competing builder and resalecomparables provided?11 Does the square footage of the subjectproperty agree with figure reported in gridon page 2?Appraisal Review ChecklistIf yes, appraiser must explain; andComps in the Sales Comparison Approach mustbe adjusted accordingly.Note: Any modifications must be legal and not inviolation of local code and/or deed restrictions.If yes, appraiser must explain; andAll repairs that affect livability, soundness orstructural integrity must be completed prior toclosing unless an allowable repair escrow isestablished. Yes No N/AIf no, appraiser must explain; loan probably notsaleable. Yes No N/AIf no, appraiser must reconcile & provide acorrected Appraisal report.neighborhood?9If yes, obtain applicable professionalinspections.If VA, always require clear termite inspection ifrequired by VA Regional Center.Note: Minor settlement that is noted as typical forthe area by the Appraiser may be acceptable.If no, appraiser must explain discrepancies; andA revised appraisal report must be provided. Yes No N/A Yes No N/A Yes No N/A Yes No N/APage 5FHA-If no to answer “a”, contact appraiser tocorrect appraisal providing this information.FHA/VA/USDA-If no to “b”, obtain requireddocuments.* FHA- Valuation protocol-FAQ VA- Handbook Chapter 10 & 14 USDA- AN 5443 Doc. Matrix- Pg 28FHA/VA/USDA- If no to “c”, appraiser mustprovide competing builder & resale comparables.Note: FHA/VA-Use New construction Cheat Sheetto complete Conditional Commitment and/orNotice of Value (VA -Circular 26-06-01)If no, contact Appraiser to correct the appraisal;&Make applicable adjustments.December 11, 2012

Appraisal Review ChecklistGovernment TransactionsAppraisal SectionAnswerAction RequiredSALES COMPARISON APPROACH1 Do the first two lines (re: # of avail. comps Yes No N/AIf no, appraiser must explain discrepancies; andA revised appraisal report must be provided. Yes No N/AIf no, appraiser must satisfactorily comment;may need additional comp(s). Yes No N/AIf yes, appraiser to comment; may needadditional comp(s).and sales prices) confirm the informationincluded in the Neighborhood section?2 Are comps within close proximity ofsubject based on neighborhoodcharacteristics (e.g., Urban 1 mile,Suburban 1-3 miles, or Rural over 3miles?)3 Do the comps located farther away fromthe subject have higher sales prices thanthe closer comps?4 Does the sales price of the closed sale Yes No N/Acomps provided bracket the appraisedvalue?5 Are Data Source(s) and Verification Yes No N/ASource(s) used acceptable?6 Is Sale or Financing Concessions listed for Yes No N/Aany of the comps?7 Are comps dated within 6 months of the Yes No N/Adate of the appraisal?8 Did the appraiser give negative time Yes No N/Aadjustments?9 Do comps that sold longer ago have a Yes No N/Ahigher sales price than more recentcomps?10 Does the reported days-on-the market of Yes No N/Athe comparables indicate a marketing timeover six months?11 Is the Days-on-the-Market of the Yes No N/Acomparables consistent with theappraiser’s range of marketing timeincluded in the Neighborhood section?12 Do the comps and the subject have similar Yes No N/Acharacteristics, such as: Location View Actual Age Quality of Construction Above Grade Room Count Above Grade GLA Basement – Rooms & GLA Functional Utility Heating/Cooling Energy Efficient Items Garage/Carport Porch/Patio/Deck Site Design Condition13 Do any of comps bracket the subject’s: Yes No N/A Site Size Actual Age Gross Living Area14 Does the subject property have a unique Yes No N/Adesign; (e.g., log home, earth/berm home,geodesic dome, etc)?15 Is the Condition of the subject property Yes No N/AIf no, appraiser to comment; may need additionalcomp(s).Note: FHA- Preference is bracketing beaccomplished with Comp. 1-3 when more than 3comparables provided.If no, appraiser must comment; andA revised appraisal report must be provided.Note: MLS by itself is not considered averification source. Data and verification cannotbe the same source.If yes, appraiser must comment; andProvide dollar amount of concession; andProvide adjustment, if applicable.If no, appraiser must comment; may needadditional comparables.Note: Comps 1-3 must have sold 12 monthsprior to the appraisal date.If declining market, follow requirements of:FHA- Mortgagee Letter 2009-09VA- Circular Letter 26-07-04If declining market, follow requirements of :FHA- Mortgagee Letter 2009-09VA- Circular Letter 26-07-04If declining market, follow requirements of :FHA- Mortgagee Letter 2009-09VA- Circular Letter 26-07-04If no, appraiser must explain discrepancies; andA revised appraisal report must be provided.If no, appraiser must comment; probably needadditional comp(s) that contain similarcharacteristic(s).If no, appraiser must comment; may needadditional comp(s) that bracket the subject’s sitesize, age, and/or GLA.Note: FHA-Preference bracketing beaccomplished with Comp. 1-3 when more than 3comparablesIf yes, appraiser to comment; may need additionalcomps (s) with similar design; andReview/apply investor overlay on unique property.If no, loan is not saleable. C4?Appraisal Review ChecklistPage 6December 11, 2012

Appraisal Review ChecklistGovernment TransactionsAppraisal SectionSALES COMPARISON APPROACH (continued)16 Does the subject have any auxiliary features (e.g., garage apt., guest house, etc)?a)b)17Is marketability demonstrated viaacceptable comps?Should the property be considered a2-4 family property? Are there any “additional” adjustments (i.e.Answer Yes No N/A Yes No N/A Yes No N/A Yes No N/Apool, outbuildings, etc.)?Action RequiredIf answer to “a” is no, appraiser to provideadditional comps(s) with auxiliary features.If answer to “b” is yes, ensure correct appraisalreport form 1025 is used; andFHA- Apply guidance in Valuation Protocol FAQUSDA-If answer to “b” is yes- property isineligible.If yes, appraiser to comment, and may needadditional comps with similar “additional” features.USDA- 18 Is the subject property description Yes No N/Aconsistent with the General Description inthe Improvements section?19 Are there any “across the board” line Yes No N/Aadjustments?20 Are there line item adjustments given on Yes No N/Amore than one of the following? Design(Style) Quality of Construction Actual Age Condition21 Are any line adjustments greater thanIf yes, appraiser to comment; may need additionalcomp(s).If yes, appraiser to comment; may need additionalcomp(s).If no, appraiser must provide transfer date (month& year on FHA) and sales price/dollar value for allsale/transfers.Note: Land sales should not be included in saleshistory.If yes, an additional level of review/justification isrequired.If yes-FHA: If 90 days or less since last transferensure requirements of Temporary FlippingWaiver are met; ando Execute FHA 90 day FlippingExemption UW Certification. 90 but 180 days since last transferndo 2 appraisal required when100% increase in sales pricefrom prior acquisition salesprice.Check investor overlays for additional restrictionIf yes, appraiser must comment; andAppraiser to address declining market concerns. Are net adjustments greater than 15%? Yes No N/A23 Are gross adjustments greater than 25%? Yes No N/A24 Did appraiser provide the sale/transfer Yes No N/Ahistory of subject for the last 3 years andlast year for the comparables? Yes No N/Apast 12 months, has a “flip” occurred?26 If the subject property was sold within the Yes No N/Apast three years, is the current appraisedvalue less than the prior sale?27 If one or more of the comparable Yes No N/AIf yes, appraiser must comment; andAppraiser to address declining market concerns. Yes No N/AIf no, appraiser must comment; andAn additional level of review/justification isrequired.Note: If appreciation is due to upgrading, theimprovements must be more than maintenancerelated and/or cosmetic.If no, appraiser to comment; andAn additional level of review/justification isrequired.properties has a prior sale within the past12 months, did the most recent sales pricedecreased from the prior sales price?28 If subject was purchased in the past fewyears, is the rate of appreciation since thepurchase reasonable?29 Are subject and comps void of foreclosure Yes No N/Aor non-arm’s length transactions?30 If the subject property was an REO or is in Yes No N/AIf yes, appraiser must acknowledge and comment.Note: Neighborhoods with a high inventory ofREOs competing with the subject propertycould impact the value. Yes No N/AIf no, appraiser to provide additional comp(s).Note: FHA-Preference bracketing accomplishedw/ Comp. 1-3 when 3 comparables provided.an area where there is significant REOactivity, is the appraised value impacted?31 Is the Market Value bracketed by AdjustedSales Price of Comparables?Appraisal Review ChecklistIf yes, appraiser to comment; probably needadditional comp(s) that don’t require theadjustment.If yes, ensure that the appraiser has thoroughlyexplained and supported these adjustments andthat no “padding” has occurred.If yes, appraiser to comment; may need additionalcomp(s).22 If the subject property was sold within the Excessive outbuildings not acceptable.If no, appraiser must explain discrepancies; andA revised appraisal report must be provided. Yes No N/A10%?25Contributory value of pool cannot beincluded in new loan amount.Page 7December 11, 2012

Appraisal Review ChecklistGovernment TransactionsAppraisal SectionAnswerAction RequiredRECONCILIATION1 Is the appraisal made “as is”? Yes No N/AIf yes, ensure there are no contradictorystatements elsewhere in the report that mayindicate repairs/inspections may be needed.If no, page 2 must reflect one of the following: 90% complete “Subject tocompletion”;or 90% complete “Subject to repairs”; or“Subject to inspections”List all required repairs (per appraiser and/orinspections) on the conditional commitment/NOVFHA- “Appraisal Update and/or CompletionReport” cannot serve as final inspection on newconstruction.Reminder: HUD REO- Please review appraisaladdendum for any required repairs as theappraisal will always reflect “as is”.2 Is the Appraisal more than 120 days old? Yes No N/A3 Is the Market Value supported by the Yes No N/AIf yes, and FHA-Appraisal is expired. ReviewPermissible FHA Validity Period Matrix posted tointranet for guidance.USDA/VA- Appraisal valid for 180 days (bothexisting and New Construction)If no, loan is not saleable. Yes No N/AIf no, appraiser must provide comments. Yes No N/AIf yes, appraiser must comment; andAdd’l level of review/justification may be required. Yes No N/AIf yes, appraiser to provide additional detail asneeded; andAn additional level of review/justification isrequired; loan may not be saleable. Yes No N/AIf yes, appraiser to provide additional detail asneeded to reconcile all contradictory comments. Yes No N/AIf no, Follow AN4543 Documentation Matrix – seepage 27.Sales Comparison Approach, CostApproach (if developed) and IncomeApproach (if developed)?4 Does the market value support the salesprice on a purchase transaction?5 Is there a significant difference betweenmarket value and sales price?ADDITIONAL COMMENTS1 Are there any comments that identify asituation that negatively impacts safety,habitability or marketability of theproperty?2 Do any comments contradict otherinformation in the appraisal/inspectionreport?3 USDA-Is the appraiser on the FHA roster& certified that requirements of HUD4150.2 & 4905.1 have been met?COST APPROACHMust be completed in the following instances:FHA/USDA- New construction, unique or specialized improvement property. (Site value must still be provided on existing construction)VA- New construction 1 yr old. or when determined relevant by the Appraiser.1 If the site value exceeds 30%, did the Yes No N/Aappraiser provide an acceptableexplanation?2 Is there above average physical, Yes No N/Afunctional and/or external depreciation?3 Is Remaining Economic Life listed & is the Yes No N/Aremaining life the term of the loan?If no, appraiser must comment.USDA- If yes, Must be typical for area and unableto be subdivided.If yes, appraiser must comment; andAn additional level of review/justification may berequired.If no, loan is not saleable.Reminder: Remaining Economic Life is requiredon Condo properties.INCOME APPROACH1 If Small Residential Income Appraisal(Form 1025)a) Does the report contain thesupporting comparable rental andsales data, and the calculations usedto determine the gross rentmultiplier?b) Does the income approach supportthe market value? Yes No N/A Yes No N/AIf no to “a”, Appraiser must provide amendedreport with missing information/ documentation.If no to “b”, Appraiser must comment andreconcile. Yes No N/APUD INFORMATION1 Did the appraiser complete this section if Yes No N/Athe developer/builder is in control of theHOA, AND the PUD consists of attachedunits?Appraisal Review ChecklistPage 8If no, the appraiser must complete the PUDInformation section.December 11, 2012

Appraisal Review ChecklistGovernment TransactionsAppraisal SectionAnswerAction RequiredAPPRAISAL ADDENDA / OTHER1 Are all pages and exhibits of appraisal Yes No N/AIf no, appraiser must provide a revised appraisalreport containing all required exhibits. Yes No N/AIf no, appraiser must provide a revised appraisalreport containing his/her signature, date and anymissing information.If yes, must be an acceptable conversion of aconventional, USDA or HUD REO appraisal.report included? (see Exhibit section onnext page) Form 1004 & 1073 – 11 pages at min. Form 1025 – 14 pages at minimum2 Is the appraisal signed, dated and allap

Use Condo Quick Underwriting Checklist to ensure all loan level certifications are met. Execute Lender Condo certification Attachment C. Ensure all data reflected on the FHA project maintenance screen matches appraisal and HOA Condo questionnaire (i.e. # of units) USDA- Project must be FHA or VA approved.