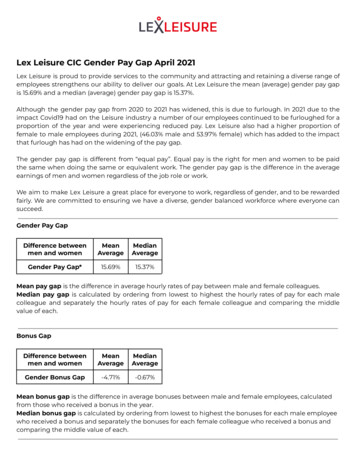

Transcription

Bonus GoldWITH LIFETIME INCOME BENEFIT RIDERTMFixed Index AnnuityAMERICAN EQUITYINVESTMENT LIFE INSURANCE COMPANY

Bonus GoldFixed Index AnnuityEvery retirement is different, each with its own inancial goals andunique needs. But, many of today’s retirement objectives are thesame — asset protection, growth opportunities and a reliableincome source.That is why many Americans are turning to ixed index annuities.These products have helped millions of people reach theirretirement goals with beneits like principal protection, tax-deferredgrowth and guaranteed income that cannot be outlived.

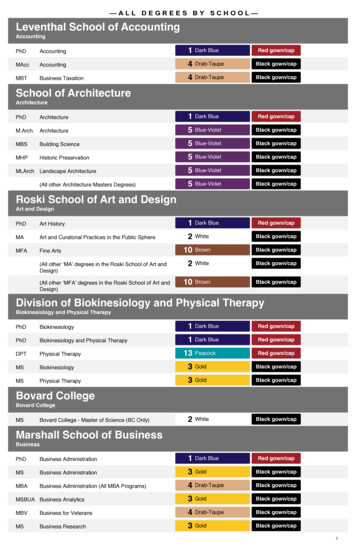

Understanding Fixed Index AnnuitiesWhat is a Fixed Index Annuity?How a Fixed Index Annuity WorksA ixed index annuity is a contract backed by theinancial strength and claims paying ability of theissuing company. This guarantees contract ownersa retirement vehicle designed to protect assets whileallowing for growth opportunities. It does thisthrough a combination of powerful beneits:The long-term retirement product is purchased withan insurance provider that, in turn, guaranteesprincipal protection, tax-deferred growth on assetsand a reliable income stream. Throughout thecourse of the contract, the ixed index annuity canearn additional interest credits based, in part, onequity index increases. Principal ProtectionGuaranteed IncomeTax-Deferred GrowthLiquidityMay Avoid ProbateAs an insurance product, the ixed index annuity isnot directly tied to any index. So, there are none ofthe exposure risks associated with direct stock orshare ownership. The annuity cannot lose money dueto index volatility and the interest credited will neverbe less than zero.Why American Equity?For over 20 years, American Equity has been committed to qualityannuity products backed by superior service. Today, as the numberthree all-time ixed index annuity provider1, we remain focusedon the business principles that have served our contract ownersfrom the beginning. Through our inancial strength and ongoingstability, we help fund more than half-a-million contract owners’retirements across the country. 53.71 Billion in Assets224,000 Active Agents500,000 Active Contract OwnersA- (Excellent) rating from A.M. Best3A- (Strong) rating from Standard & Poor’s4American-owned and operatedProtection. Income. Guaranteed. 3

Key TermsHere is a list of key terms and definitions that may be useful while learningabout this product.AnnuitizationConversion of the CashSurrender Value of the annuityinto regular guaranteedincome payments.AccumulationPeriodThe period of time duringwhich the Income AccountValue is credited the IncomeAccount Value he amount paid to the contractowner by American Equity whenthe contract is surrendered.The total of the values in theannuity contract.IAV RateThe interest rate used tocalculate the interest creditedto the Income Account Value.(Only applicable with LifetimeIncome Beneit Rider Options 1and 2.)InterestCreditingStrategiesContract owners choose fromseveral index or ixed valuecrediting strategies, eachoffering different opportunitiesfor growth.Joint LifePayoutA joint life payout is availableonly to legal spouses, asdeined under federal law.Both spouses must be at least50 years of age and paymentis based on the age of theyounger joint payee. Paymentsare made through the life of thelast surviving spouse, so long asspousal continuation is elected.MinimumGuaranteedSurrenderValue(MGSV)MGSV is calculated separatefrom your Contract Value. Itequals 80% of all irst-yearPremiums including the PremiumBonus, plus 87.5% of anypremiums paid after the irstyear, less any withdrawals,accumulated at the MinimumGuaranteed Interest Rate (MGIR).PartialWithdrawalAvailable at any time, forpartial distribution over thePenalty-Free Withdrawalamount. Surrender Chargesand minimum values will apply.The greater of the ContractValue or the MinimumGuaranteed Surrender Value.Available Death Beneitpayment options are listed inthe annuity contract.IncomeAccountValue(IAV)This value is used solely todetermine the amount of incometo be received under the LifetimeIncome Beneit Rider. It is not atraditionally accessible value.This serves as a measuring toolfor purposes of the rider only.IAVMultiplierA factor used to calculate theIAV credits, declared annually,and will not be less than aguaranteed minimum. (Onlyapplicable with Lifetime IncomeBeneit Rider Option 3.)Bonus Gold with Lifetime Income Beneit Rider

Key TermsAmerican Equity is dedicated to simple product designs and easy-to-understandcrediting strategies.Penalty-FreeWithdrawalPremiumBonusRider FeeThis is a once a yearopportunity (after the irstcontract year) to take a PenaltyFree Withdrawal of up to 10%of the Contract Value.Guaranteed 10% PremiumBonus on all premiums receivedin the irst contract year.The fee charged for the LifetimeIncome Beneit Rider is deductedfrom the Contract Value each yearas long as the rider is attachedto the contract.Single LifePayoutFor the owner and soleannuitant, payouts are basedon sex and age at election.SurrenderTermination of the contractin exchange for CashSurrender Value.SurrenderChargeFee charged, when applicable,for full or partial distribution overthe Free Withdrawal ses the amount ofincome payments by anenhanced income factor, for upto ive years. (Only applicablewith Lifetime Income BeneitRider Option 2.)Protection. Income. Guaranteed. 5

The Power of a Fixed Index AnnuityA fixed index annuity offers a powerful combination of benefits that help protectagainst many of today’s common retirement concerns.Common Retirement ConcernsFixed Index posureAccessto FundsTaking Careof LovedOnesPrincipal ProtectionGuaranteed IncomeTax-Deferred GrowthLiquidityMay Avoid ProbatePrincipal Protection: Premium payments are secure,and each year any interest credited to the contract islocked in and cannot be lost due to index volatility.Guaranteed Income: Flexible payout optionsavailable, including lifelong paychecks.Tax-Deferred Growth: Earn interest on moneywithout paying taxes on it until any distributionoccurs. This enables faster growth by allowingcredited interest to compound over time.**Assumes contract is individually owned.6Bonus Gold with Lifetime Income Beneit RiderLiquidity: Each contract deines variousopportunities to withdraw funds, such as PenaltyFree Withdrawals, Partial Withdrawals and lifetimeincome options. (Subject to applicableSurrender Charges.)May Avoid Probate: If applicable, beneiciariesreceive any remaining value in the contract whileavoiding the expense and time spent in probate.

Bonus GoldBonus Gold is a fixed index annuity designed to help protect hard-earned dollarsfrom index fluctuations while offering interest growth opportunities based onincreases in an index.Premium BonusThe initial premium payment can be allocated, inany combination, to either the ixed interest or anyof the index strategies. Payments received after theinitial premium automatically go into the ixed intereststrategy. On each contract anniversary, there is anopportunity to transfer between the different strategies.The Bonus Gold includes a Premium Bonus, whichis applied to the Contract Value immediately.This provides a jump start for the Contract Value,because the premiums paid during the irst yearreceive a bonus and can help increase interestgrowth from the start.Surrender Values and ChargesPremium Bonus AllocationsThe annuity’s Surrender Value will never be lessthan 80% of all irst-year premiums including thePremium Bonus, plus 87.5% of any premiums paidafter the irst year, less any withdrawals, accumulatedat the Minimum Guaranteed Interest Rate (MGIR),compounded annually. If a Partial Withdrawal orSurrender is taken during the Surrender Chargeperiod, a deduction will be taken out according to theSurrender Charge schedule.The Bonus Gold offers a 10% Premium Bonus on allpremium received in the irst contract year. This isadded to the Contract Value on the date received,and allocated to the same values as the premiums.In the event of death, the beneficiary receives the entireContract Value including the Premium Bonus.Surrender Charge Schedule (Age 18-80)Contract Year1234567891011121314151617 Surrender Charge on. Income. Guaranteed. 7

Money Access Options and FeaturesWith the Bonus Gold there is always access to money in the annuity.American Equity provides withdrawal flexibility and a variety of liquidity options.Penalty-Free WithdrawalsThis is a once a year opportunity (after the irstcontract year) to take a Penalty-Free Withdrawal ofup to 10% of the Contract Value.Waiver of Surrender Charge RidersNursing Care RiderIncluded automatically for owners under age 75at issue. After the irst contract year, a one-timewithdrawal of up to 100% of the contract valueis allowed if the owner is conined to a qualiiednursing care facility for a minimum of 90 days.Coninement must begin after the contract issue dateand written proof is required from both the qualiiednursing care facility and recommending physician.Any payment made under this rider will not besubject to withdrawal charges, surrender charges,or MVAs.8Bonus Gold with Lifetime Income Beneit RiderTerminal Illness RiderIncluded automatically for owners under age 75at issue. After the irst contract year, a one-timewithdrawal of up to 100% of the contract value isallowed if the owner is diagnosed with a terminalillness. Diagnosis must occur after the contractissue date and written proof with supportingdocumentation is required from a qualiied physician.Any payment made under this rider will not besubject to withdrawal charges, surrender charges,or MVAs.Death BenefitDeath Beneit proceeds are paid to the namedbeneiciary(ies) with no Surrender Charges.Generally paid in a lump-sum, other incomeoptions are also available.

Bonus Gold with Lifetime Income Benefit RiderThe fixed index annuity and income rider work together to provide a lifetime of benefits.What is the optional Lifetime Income Benefit Rider (LIBR)?Available for issue ages 50 , the LIBR helps secure a lifelong income source. The amount of income to bereceived is measured by the Income Account Value (IAV). The IAV is credited over time and grows until theearlier of income payments beginning or the end of the Accumulation Period. A Rider Fee is deducted from theContract Value each year the rider is attached to the contract. Income payments may begin any time after theirst contract anniversary and are available without a Surrender Charge or having to Annuitize the contract.Lifetime Income Benefit Rider OptionsThe optional LIBR has options to help individuals reach their income goals and meet their lifestyle needs.Option 1: LIBRThis option has a set Initial IAV Rate, declared at issue andguaranteed for 10 years. After that guarantee period, therate credited for the remainder of the 20 year accumulationperiod will not change and will never be less than a statedminimum. The IAV is calculated on a compoundinginterest basis.Option 2: LIBR with Wellbeing BenefitIn addition to the beneits of Option 1, the Wellbeing Beneitoption is designed to help address the inancial burdenrelated to signiicant health issues. Plus, the WellbeingBeneit Enhanced Income Payment increases the amount ofincome by an income payment factor, for up to ive years,should the contract owner or their spouse become unableto perform multiple activities of daily living outlined in thecontract. This option is not coninement driven, so it isavailable to those receiving home care. There is a two yearwaiting period before the Wellbeing Beneit can be activated.Option 1Initial IAV Rate: 6.00%Initial IAV Period: 10 yearsAccumulation Period: 20 yearsRider Fee: 0.90%Option 2Initial IAV Rate: 6.00%Initial IAV Period: 10 yearsAccumulation Period: 20 yearsRider Fee: 1.00%Option 3Initial Multiplier:400% guaranteed for irst yearRider Fee: 0.90%Option 3: LIBR with Indexing IncomeWith this option, the IAV is calculated based on the rate ofreturn on the contract from the previous anniversary. TheContract Value rate of return is then multiplied by the IAVMultiplier to determine the percentage of IAV credit for theyear. Every anniversary, the IAV credit is applied to the IAV.If there are no interest credits for the year, the IAV will notincrease. The IAV is calculated using compounding interest.Protection. Income. Guaranteed. 9

Predictable Lifetime IncomeGuaranteed income payments based on easy-to-understand payout factors.Payout 4%3.78%3.82%3.87%3.91%3.96%3.99%4.03%4.06%The annual income payment equals the IAV on the day the income payments begin, multiplied by thebeneit payout percentage applicable to the contract owner’s sex and age (if joint payout is elected,whoever is youngest) at the time of election.If, on the day before income payments are to begin, the Contract Value is greater than the IAV,American Equity will increase the IAV to equal the Contract Value.10 Bonus Gold with Lifetime Income Beneit Rider

Income and WithdrawalsThe Lifetime Income Benefit Rider offers guaranteed income through a securerevenue source.Income Payment ElectionDeath of OwnerIncome payments can begin any time after the irstcontract anniversary. At the time of election, contractowners select either Single Life or Joint Life Payouts.Once income payments begin these choices arelocked in and may not be changed.American Equity’s annuities have a Death Beneitthat allows the beneiciaries immediate access tocontract value at the time of death. This can helpavoid a costly prolonged probate process. Single Life – payout factors are determinedby the owner’s sex and their age at the timeof payout election. Joint Life – payout is based on the youngestage of the contract owner or spouse, whois at least age 50, and income paymentsare guaranteed until the death of thesurviving spouse subject to the spousalcontinuation provision.Excess WithdrawalsAny Partial Withdrawals taken from theContract Value after income payments have startedare considered excess withdrawals and will reducefuture income payment amounts and your IAVon a pro-rata basis. For example, an additionalwithdrawal of 5% of your Contract Value reducesyour future income payments by 5%. If an excesswithdrawal plus income payment exceeds thePenalty-Free Withdrawal amount allowed in anycontract year, Surrender Charges will be appliedto any amount in excess of the Penalty-FreeWithdrawal amount.Should excess withdrawals reduce the ContractValue to zero, the IAV will also be reduced tozero, and the contract as well as the rider will beconsidered surrendered. Any remaining incomepayments would also terminate.If the owner’s spouse is sole primary beneiciaryof the contract, elects spousal continuation, andis at least age 50, then income beneits maycontinue. Details and available options are inthe contract.The LIBR terminates and income payments stopupon the earliest of either the owner’s written request,the date the contract terminates, the date the contractis Annuitized or the date the owner of the contractchanges. Once the LIBR terminates, it may notbe reinstated.Tax TreatmentAll income payments are considered a withdrawalfrom the Contract Value, and any part of thewithdrawal that is deferred interest is taxable asincome. If the contract is in a qualiied plan theentire amount of the withdrawal may be taxable. Thetaxation of income payments is calculated as outlinedin the Internal Revenue Code.In addition, the taxable portion of any withdrawaltaken before age 59½ may be subject to anadditional penalty of 10% by the InternalRevenue Service.Please contact a qualiied tax professional foradditional information.Protection. Income. Guaranteed. 11

American EquityCommitment to ValuesServiceOur contract owners are why we are here, and we do our best toprovide service, second to none, every day.IntegrityOur values of honesty, fairness and truthfulness have been central toour past success and will continue to be for generations to come.ExcellenceOur dedication to going above and beyond in every facet of our businesshas established us as a top-tier ixed index annuity provider.SafetyOur products provide Sleep Insurance for contract owners that cantrust their principal is protected and their income is guaranteed for life.For additional resources and blogs, visitwww.american-equity.comTMAmerican Equity Investment Life Insurance Company 6000 Westown Pkwy, West Des Moines, IA 50266www.american-equity.com Call us at 888-221-1234Annuity Contract and Rider issued under form series INDEX-1-07, ICC17 R-LIBR-FCP, ICC17 R-LIBR-W-FCP, ICC16 R-LIBR-IDX, ICC19 R-TIR, ICC19 R-NCR and state variations thereof.Availability may vary by state.1Source: https://www.looktowink.com/2019/05/overall indexedannuitysales2018/. If you cannot access this article online, you may call 888-647-1371 to request a copy.2As of 12/31/18 - Assets 53.71 billion, Liabilities 50.45 billion.3A.M. Best has assigned American Equity an “A-” (Excellent) rating, reflecting their current opinion of American Equity’s financial strength and its ability to meet its ongoingcontractual obligations relative to the norms of the life/health insurance industry. A.M. Best utilizes 15 rating categories ranging from A to F. An “A-” rating from A.M. Best is itsfourth highest rating. For the latest rating, access www.ambest.com. Rating effective 8/2/2006, affirmed 6/20/2019.4Standard & Poor’s rating service has recognized American Equity Investment Life Insurance Company with an “A-” rating. An insurer rated “A” has strong financial securitycharacteristics, but is somewhat more likely to be affected by adverse effects of changing circumstances or economic conditions than are insurers with higher ratings. Ratings from ‘AA’to ‘CCC’ may be modified by the addition of a plus ( ) or minus (-) sign to show relative standing within the major rating categories. Rating effective 8/5/15, affirmed 9/28/2018.The “S&P 500 ” is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by American Equity Investment Life Insurance Company (“AEL”). Standard & Poor’s and S&P are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”).These trademarks have been licensed to SPDJI and sublicensed for certain purposes by AEL. AEL’s products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, ortheir respective affiliates, and such parties make no representations regarding the advisability of investing in such product(s) and have no liability for any errors, omissions, or interruptionsof the S&P. American Equity Investment Life Insurance Company does not offer legal, investment, or tax advice. Please consult a qualified professional.Guarantees are based on the financial strength and claims paying ability of American Equity and are not guaranteed by any bank or insured by the FDIC.01SB1107 10.16.19 2019 American Equity. All Rights Reserved.

With the Bonus Gold there is always access to money in the annuity. American Equity provides withdrawal flexibility and a variety of liquidity options. 8 Bonus Gold with Lifetime Income Beneit Rider Penalty-Free Withdrawals This is a once a year opportunity (after the irst contract year) to take a Penalty-Free Withdrawal of