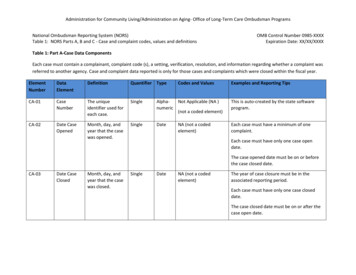

Transcription

Case StudyEcobank connects34 African countrieswith a unified cashmanagement system

“About EcobankThanks to Fusion CashManagement we have been ableto grow our cash management andpayments business by 100 percentover a four-year period.”Isaac KamutaLargest banking platformin AfricaOver 10 millioncustomers1,265 branchesLocated in36 countriesGroup Head: Cash Management & ClientAccess, Corporate and Investment Bank,ecobank.comEcobankAbout Fusion Cash ManagementFusion Cash Management addresses the growing ubiquity offaster, modern payments with integrated liquidity managementtools and working capital-focused capabilities. The solutionenables a bank’s customers to automate payables and receivables,gain real-time cash position visibility, and leverage automateddelivery tools for balance and information reporting.Find out more2 FINASTRAEcobank connects 34 African countries with a unified cash management systemCase Study

The ChallengeEmbracing changeEcobank empowers international business development in Africa with aconsolidated payments system powered by Fusion Cash Managementfrom Finastra.In recent decades, the combined forces ofglobalization and demographic change havegiven rise to a host of exciting opportunitiesfor economic development and businessgrowth in Africa.As the largest pan-African bank, Ecobankis on a mission to drive the economicdevelopment and the financial integrationof businesses and individuals acrossAfrica. To achieve this, it looked to createa unified payments and cash managementplatform that would enable it to meetincreasing customer demand for even moresophisticated banking services acrossthe continent.3 FINASTRAOluwole Akinroye, Group Product Head,Payments at Ecobank, says: “We set outto make banking more convenient for ourcorporate clients by enabling them to seeall their accounts in a single dashboard,and perform all their financial transactionselectronically. We knew that by establishinga single platform for payments, we couldsignificantly improve our ability to competewith international banks and pave the wayfor the development of innovative digitalbanking solutions.”A centralized cash management platformwould also help Ecobank automate manualtransactions through new electronicchannels; this would, in turn, greatlyimprove processing efficiency and reduceoperational costs.Ecobank connects 34 African countries with a unified cash management systemThe challengeThe solutionEcobank knew that any solutions it usedto build the common payments platformwould need to be sufficiently flexible toaccommodate all the varying local businesspractices applied in the different countries inwhich the bank operates, yet also powerfulenough to support a high volume oftransactions across the bank’s network.Case StudyDelivery journeyThe result

The SolutionOvercoming complexityEcobank creates an innovative cross-border payment and cashmanagement system with Fusion Cash Management—fuelinginternational expansion.Ecobank realized that building a cashmanagement system that could meet itsunique requirements from scratch wouldbe incredibly time- and resource-intensive,and require the bank to commit to long-termIT expenditure, while also greatly increasingits risk exposure.Instead, Ecobank selected Fusion CashManagement from Finastra as a platformto build Ecobank Omni: its own integrated,real-time cross-border payment and cashmanagement system.“Our digital strategy, stipulateddigitalizing ourselves, ourcustomers and our stakeholders.Fusion Cash Management was thecatalyst that enabled this for ourcorporate customers.”Tomisin Fashina PhDGroup CIO/MD, eProcess International SAEcobankIsaac Kamuta, Group Head: CashManagement & Client Access, Corporateand Investment Bank at Ecobank, says:“Fusion Cash Management stood apartfrom other solutions because it was flexibleenough to support our unique needs,and provided the best strategic fit forour business.”4 FINASTRAEcobank connects 34 African countries with a unified cash management systemThe challengeThe solutionCase StudyDelivery journeyThe result

“Finastra’s commitment toDelivery Journeyour vision of developinga pan-African cashmanagement solutionconvinced us that theFinastra team could supporta complex, aggressivemulti-country rollout.”With support from Finastra, Ecobank rolled out Fusion Cash Managementacross multiple countries quickly and effectively.Attracting new customersEcobank was impressed with Finastra’sstrong track record of successfullydelivering solutions for some of the world’sbiggest banks—a critical considerationgiven the scale of Ecobank’scorporate-wide initiative.Starting with a single-country pilotimplementation in June 2011, the bankeventually embarked on a swift andfocused implementation of Fusion CashManagement across its branch network.Isaac Kamuta explains: “With the support ofFinastra, we were able to bring 34 countrieson-stream in just three years, with minimaldisruption to business.”Oluwole AkinroyeGroup Product Head PaymentsEcobank5 FINASTRAEcobank connects 34 African countries with a unified cash management systemThe challengeThe solutionCase StudyDelivery journeyThe resultOluwole Akinroye adds: “We set out todevelop a cash management system thatwas flexible enough to accommodatevarying local business practices,yet powerful enough to support a highvolume of transactions across our entirenetwork. We are confident that we havebeen able to implement a robust solutionthat will facilitate cross-border and multicurrency business for our customers—removing many of the traditionalbottlenecks in the cash managementprocess and powering economicdevelopment in Africa.”

The ResultExponential GrowthFusion Cash Management enables Ecobank to broaden its customer base,helping it to onboard an average of 4,000 new customers each year.With Fusion Cash Management poweringits core payment and transaction services,Ecobank has consistently grown itscustomer base by more than 25 percentyear-on-year.Since launching Ecobank Omni, the bankhas significantly increased transactionvolumes, while also streamlining itsmission-critical cash managementprocesses.“By developing a versatile cashmanagement system, we can participate inmore requests for proposal from potentialclients,” comments Isaac Kamuta. “As aresult, we are much better placed to buildstrong relationships with new customers,including large multinational companies.”Isaac Kamuta comments: “Thanks toFusion Cash Management we have beenable to grow our cash management andpayments business by 100 percent over afour-year period. This growth correspondswith a boost in transaction volumes. Forinstance, from 2017 to 2018, we recordedan 86 percent increase in transactionvolumes with a collective total value ofUSD 21 billion.”Oluwole Akinroye comments: “Thanks toour cash management platform, we haveenhanced cross-selling opportunities for ourproducts and services, which has helpedus to increase our share of wallet for bothprospective and existing customers. Wehave also enhanced our brand visibility andwon a larger ‘share of mind’ among ourcustomers through our integrated ‘one bank,one platform’ solution across the region.”6 FINASTRATomisin Fashina says: “Fusion CashManagement fitted perfectly into our digitalbanking strategy, and enabled us to provideseamless digital experience to our growingcustomer base as they fulfilled theirtransactional needs.”Ecobank connects 34 African countries with a unified cash management systemThe challengeThe solutionUsing the straight-through processingfeatures of the Finastra solution, Ecobankhas been able to automate over 20 percentof manual funds transfers—making it easyfor customers to make rapid, reliable andsecure transfers and freeing up employeesto focus on revenue-generating tasks.Olufemi Sojirin, CIO Commercial,Corporate and Investment Banking atEcobank reflects: “With Fusion CashManagement we have been able to furtherdrive our unique value proposition across34 countries, by providing a consolidatedservice for payments, collections, liquiditymanagement, supply chain finance andtrade to our customers.”With Ecobank Omni, Ecobank can offercomprehensive online banking functionalityto its corporate and high-value domesticbanking customers—including featurerich liquidity and enterprise transactionmanagement capabilities.Case StudyDelivery journeyThe resultOluwole Akinroye concludes: “The Finastrasolution has helped us to establish aconsistent, standardized interface acrossall of our operations, a feat that no otherfinancial institution has been able to achievein Africa. What’s more, we have been ableto take this standardized approach whilestill customizing our platform to supportthe different languages, currencies andregulatory requirements of the communitieswe serve.”100%growth in cashmanagement andpayments business infour years 21 billionincrease in transactionvolumes from 2017to 201820%of manual fundstransfers automated

Contact usAbout FinastraFinastra is building an open platform that accelerates collaboration and innovation in financial services, creating betterexperiences for people, businesses and communities. Supported by the broadest and deepest portfolio of financial servicessoftware, Finastra delivers this vitally important technology to financial institutions of all sizes across the globe, including90 of the world’s top100 banks. Our open architecture approach brings together a number of partners and innovators.Together we are leading the way in which applications are written, deployed and consumed in financial services to evolvewith the changing needs of customers. Learn more at finastra.comFinastra and the Finastra ‘ribbon’ mark are trademarks of the Finastra group companies. 2020 Finastra. All rights reserved.GL 3051 / 0620Corporate Headquarters4 Kingdom StreetPaddingtonLondon W2 6BDUnited KingdomT: 44 20 3320 5000

With Ecobank Omni, Ecobank can offer comprehensive online banking functionality to its corporate and high-value domestic banking customers—including feature-rich liquidity and enterprise transaction management capabilities. Oluwole Akinroye concludes: "The Finastra solution has helped us to establish a consistent, standardized interface across