Transcription

October to December 2008, Volume 4, Issue #4(This Newsletter is a quarterly publication containing topics of interest to the categories ofMSBs regulated by the Georgia Department of Banking and Finance. We hope that you willfind this publication to be informative and valuable for providing information about theissues affecting your industry. If there are any issues you would like for the Departmentto highlight or address in future editions, please e-mail your questions or suggestions todbfmort@dbf.state.ga.us.)In This Issue:REGULATORY MATTERSGeorgia Regulations & IssuesProposed DBFRegulations - Effective1Check CasherRenewals1Sellers of Checks &Money TransmitterRenewals2Proposed Rule Changes Become EffectiveChanges in the Regulations – Effective August 25, 2008The Department of Banking and Finance adopted Final Rules August 4, 2008.They were filed with the Secretary of State on August 4, 2008, and were effective20 days following, or August 25, 2008. These rules were proposed and distributedon June 30, 2008. We received one written comment letter in support of theproposed changes, therefore no changes to the Proposed Rules were made.To view or download the Final Rules on our website, go to and select theappropriate link for the Final Rules, OR you may access them directly l /vgn/images/portal/cit LATORY MATTERSBSA/FEDERAL NEWSMSB RegistrationUpdates-FinCENForms 107 & 109HB 4049-DepositAccount Reforms2Customer Service Star5Action on ApplicationsDuring the PreviousQuarter/ClosedLicensees5to833Of significant interest to Money Service Businesses in Georgia are the followingDepartment Contact9provisions:Information80‐3‐1‐.02 Check Cashers.A change has been added to require registrants to post their registration in publicview. Additionally, a form number change has been made.80‐3‐1‐.07 Administrative Fines and Penalties.A fine has been added for licensees and registrants that fail to post their licenseor registration as required. The fine is 500 for each instance of non‐compliance.80‐5‐1‐.02 License, Registration and Supervision Fees for Check Cashers andSellers, Money Transmitters, Representative Offices and Mortgage Lenders andBrokers; Due Dates.A non‐refundable application investigation fee has been included in the license fees for check sellers and moneytransmitters. This application fee is consistent with application investigation fees paid by all other licensees.Check Casher RenewalsLicensed and registered check cashers who hadnot completed their renewal by the midnightSeptember 30, 2008 deadline have had theirlicenses expire and will have to cease check cashingoperations. Failure to properly RENEW a licensewill require a REINSTATEMENT of the license in-1-order to conduct a check‐cashing business. Thoseaffected should please see the application on theinternet at:http://dbf.georgia.gov/msbforms.

Annual License Renewal ‐ Check Sellers andMoney TransmittersRenewals notices have been mailed to allcheck seller and money transmitter licensees.Renewals must be completed and submittedon or before November 1, 2008 in order to beconsidered filed on time and to avoid the latefee.This year the application for renewal is ON‐LINE only! Last year paper forms wereavailable, but this year you must complete therenewal on the internet.It is important, however, that licensees notethat as in the past, all explanations to thequestions that exceed the available on‐linespace, and any required supportingdocuments, MUST be attached to the renewalcover sheet and sent to the Department inorder to approve the license renewal. If youdid not receive a copy of the renewal notice,please contact Ms. Teresa Koeppel at 770/986‐1639 or via e‐mail at dbfcorp@dbf.state.ga.us.BSA/FEDERAL NEWSFINCEN ‐ MSB Registration ListThe MSB Registration List, which is updated andposted on a monthly basis, contains entities thathave registered as Money Services Businesses(MSBs) pursuant to the Financial CrimesEnforcement Network’s (FinCEN’s) Bank SecrecyAct regulations at 31 CFR 103.41. In accordancewith FinCEN Guidance (FIN‐2006‐G006) onRegistration and De‐Registration of Money ServicesBusinesses (February 3, 2006), FinCEN willperiodically omit from the List any persons whohave not renewed their registrations by theirrenewal deadlines.FinCEN’s Guidance of February 3, 2006 encouragedMSBs to confirm or renew their registrations.FinCEN is coordinating outreach activities with theIRS Stakeholder Liaison staff who will contact thoseMSBs that failed to renew their registrations todetermine if this was an inadvertent error orwhether the MSB no longer conducts services thatwould require the entity to register. This outreachto MSBs, which includes mailing of the followingletterhttp://www.msb.gov/pdf/2nd letter.pdf,will assist FinCEN in achieving its strategic goal ofeducating the MSB industry concerning BSAresponsibilities-2-This new August 2008 List, which is current as ofAugust 14, 2008, contains data on 37,149registered MSBs. This is an increase of 585 MSBregistrations from the July 17, 2008 total of 36,564.The List reflects information exactly as provided bythe filers and comprises Registrants’ names, “doingbusiness as” names, addresses, MSB servicesprovided, states in which the registrants offer MSBservices, numbers of branches, and dates ofauthorized signature. The List is arrangedalphabetically – first, by state, then, by each citywithin the state, and finally, by MSB Registrantname within each city. FinCEN has made eachState listing available in an Excel format that caneasily be downloaded so that queries can be runusing various other software applications. Datescontained in the posted MSB Registration List areformatted as mm/dd/yyyy in order to enablesorting of the List by authorization date.This posted List is intended only as generalreference for the public and should not be treatedas definitive or determinative of an entity’sregistration status. The only determinativeevidence of an entity’s registration status is theacknowledgement letter from the IRS‐DetroitComputing Center (DCC) received by an entity after

filing its registration. A copy of the DCCacknowledgment letter, along with a facsimile ofthe registration form, should be maintained as apart of an MSB’s records for five years.2732. For inquiries regarding MSB registrationacknowledgement letters, call the IRS‐DCC Hotlineat 800‐800‐2877. MSB Registration List – August2008FinCEN continues to work with DCC on data qualityissues with regard to the List. For more informationon MSB registration, visit www.msb.gov. Forinquiries regarding the MSB registration list, callthe FinCEN MSB Regulatory Helpline at 1‐800‐949‐THE INCLUSION OF A BUSINESS ON THIS LIST ISNOT A RECOMMENDATION OR ENDORSEMENT OFTHE BUSINESS BY ANY GOVERNMENT AGENCY.FINCEN – Forms UpdatesForm 107 – Registration of MoneyService Business (RMSB)Important Notice: Revised RMSB Form 107 forMoney Services Business Registration isEffective September 1, 2008.Effective September 1, 2008, a Money ServicesBusiness is required to use the revised FinCENForm 107, Registration of Money Services Business(RMSB) to register its business. FinCEN announcedin April 2008 that it was revising the RMSB Form107.This change is required to incorporate the five (5)critical fields that are now mandatory for aregistration to be accepted (Legal name, Address,City, State, and EIN (entity) or SSN/ITIN(individual)). All previous versions of Form 107will not be accepted after December 31, 2008.Please note the “will not be accepted after” dateson the revised RMSB Form 107 are different on theWebCBRS facsimile of the form (2/29/09) and onthe form posted on the FinCEN website (12/31/08).The date of December 31, 2008 was chosen for“after which previous editions will not beaccepted” because it coincides with the December31st deadline for registration. Questions regardingthe revised RMSB Form 107 may be directed to theFinCEN Regulatory Helpline at 1‐800‐949‐2732.Form 109 – SAR MSBThis update is to the forms instructions. Nochanges have been made to the data elements(fields) in the form, but the changes in instructionsmay affect the form’s completion. The date on theform remains 03/07; the instructions are dated10/08.FYI - House Bill 4049 - Pending7/22/2008—(Washington) House Bill 4049, the purpose of which is to amend section 5318 of Title 31, UnitedStates Code by eliminating regulatory burdens imposed on insured depository institutions and money servicesbusinesses and enhance the availability of transaction accounts at depository institutions for such business, hasbeen passed in the House. The bill now goes on to be voted on in the Senate. Keep in mind that debate maybe taking place on a companion bill in the Senate, rather than on this particular bill.Known as the Money Service Business Act of 2008, this bill amends federal law governing anti-moneylaundering programs to provide that an insured depository institution has no obligation to review thecompliance with federal anti-money laundering requirements of a money transmitting business for whom itmaintains an account if such institution has on file specified mandatory self-certifications submitted by themoney transmitting business.-3-

The bill provides that money services businesses (MSBs) may self-certify their compliance with anti-money andcounter-terrorism regulations when establishing accounts with federally insured depository institutions. MSBsmust certify that they are in compliance with federal banking law and registered as such. Additionally, the MSBmust certify that it maintains an anti-money laundering program as required by federal law, be licensed orregistered as an MSB by each State in which it operates, and meet such other regulations as the TreasurySecretary formulates to assure strong anti-crime regimes. The bill prescribes requirements for self-certification bya money transmitting businessThe MSB certification requirements under this bill also extend to agents of money transmitting businesses. Inaddition to the certification requirements for MSBs, agents of MSBs must provide that they are contract boundagents of an MSB, will comply with all applicable laws, and will notify any federally insured depository institutionof any material changes to their relationship with the MSB to which they are a contracted agent.The Bill also sets forth civil and criminal penalties for violations of this Act without regard to whether suchviolations were willful and shields such institution from liability for the non-compliance of a money transmittingbusiness and its agents with federal anti-money laundering requirements. The Bill directs the Secretary of theTreasury to prescribe implementing regulations.Where does it stand? As noted, it has passed in the House. The bill now goes on to be voted on in the Senate.Keep in mind that debate may be taking place on a companion bill in the Senate, rather than on this particularbill.E‐MAIL UPDATES!!! https://bkgfin.dbf.state.ga.us/MSBUpdate.htmlA reminder –make certain we have the correct e‐mail address for your license or registration so that you will receive allnotices and correspondence!Upcoming Speaking EngagementsThere are no upcoming speakingengagements for the 4th quarter, 2008.-4-REMAINING 2008 STATE HOLIDAYS – the offices of theDepartment of Banking & Finance will be closed as noted below.HolidayDate or Observed DateColumbus DayOctober 13th - MondayVeterans’ DayNovember 11th - TuesdayThanksgiving DayNovember 27th - ThursdayLee’s Birthday will be observed on Friday,November 28ththChristmas DayDecember 25th - ThursdayWashington’s Birthday will be observed onFriday, Dec. 26th

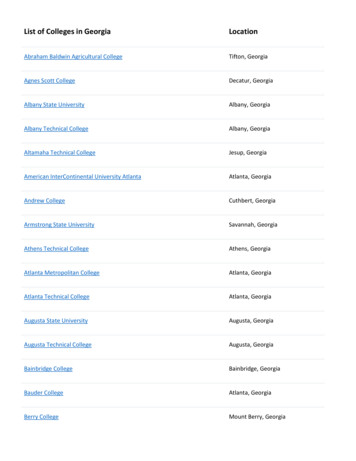

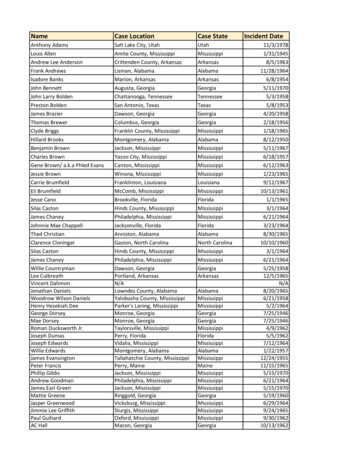

CUSTOMER SERVICE GEORGIAGovernor Sonny Perdue’s campaign is to put new emphasis on customer service, emphasizing easier access to governmentservices, faster processes so customers can get business done quickly, and friendlier service in a customer-focused, goaloriented culture. It is the Department’s goal to provide excellent customer service, meeting and exceeding theexpectations of our customers. Along those lines, we would like to recognize the following individual for going above andbeyond in serving our customers.Teresa Koeppel, Administrative Examiner, MSB Staff: The Department received comments from acustomer stating: "Of all the regulators we have dealt with, holding almost 50 state licenses throughoutthe country, my basis for writing you is that I found you to be the most professional, responsive and organizedregulator I dealt with."CONGRATULATIONS AND GREAT JOB!!The Department is the state agency that regulates and examines banks, credit unions, and trust companies chartered by the State.The Department also has regulatory and/or licensing authority over mortgage brokers, lenders, and processors, money servicebusinesses, international banking organizations, and bank holding companies conducting business in Georgia.Our MISSIONis to promote safe, sound, competitive financial services in Georgiathrough innovative, responsive regulation and supervision.Z Z ZOur VISIONis to be the best financial services industry regulator in the countryProgressive. Proactive. Service-Oriented.ACTION ON APPLICATIONS DURING THE PREVIOUS QUARTERAPPROVED CHECK CASHERS (License/Registration) – Third Quarter 5102351423518-5-Company NameSol & Kay, Inc.Swamy USA Inc.Advanced Title Pawn, LLCH & S Business Inc.Regina M. BoneWest Georgia Check Cashing, Inc.KK Business Inc.Bhawani Krupa, Inc.Tabo's Retail, Inc.West Park Enterprises, Inc.Asha Pura, LLCDBA NameC&D Package StoreShell Food MartCagney's Party ShopWest GA Check CashingShop RiteTabo's Food MartChevron Food MartYogi's Liquor MartCityStone tonKennesawAmericusJeffersonStone 87/18/08

36142361523623236242362523626Company NameU. B. Identity Solutions, Inc.Akshat Wine and Spirits, Inc.Star Package Shop, LLCJavier GranadosDhrup CorporationJZS, Inc.Alwani Group of Companies, Inc.Bellavista II, LLCShree Shiv, Inc.C & H Liquor Store, Inc.Lucero GroceryAtlanta Drinks, LLCAfshan Enterprises, Inc.AAS Investment Inc.Jaineta R. AminAryan Food Corporation of Jesup, Inc.Ayesha Enterprises, LLCVraj Investment, Inc.Food Basket, Inc.M K Investment Firm, LLCOne Stop Money Center, Inc.Mukesh KalaSong's Easy Shop, Inc.MARKSND Investments, Inc.Aquil Investment, Inc.SOWEGA Financial Services, LLCJ. C. Enterprises & Co., LLCSWL CorporationBlackshear Investment Group, Inc.Jae James LeeShivam Corporation of GAA and D Foods, Inc.Local Check Cashing, Inc.Shree Laxmi Investments, Inc.H&S Mart, Inc.R Registrant L Full Service-6-DBA NameCash It USARooster's PackageJack's Package ShopJavier's Check CasherNorth Ridge Stop N ShopWashington Food MartShell Food MartTaqueria Y Carniceria Bellavista #2Lakeland Quick StopSkyland PackageA Shell Convenience CenterExxon Food MartSunny SwiftyCountry CornerRibitz Bait & TackleLatimer Minit MartFood BasketAlpharetta Street Bottle StoreTwin Lakes Beverage HausEasy ShopPharr Food and GasQuick Pick Food MartRaceway 868Family SupermarketWhistle Stop Package StoreWalton Food Mart341 Quick StopQuick StopLocal Check CashingTexaco Food MartH&S MartCityUnion CityColumbusSavannahGainesvilleRomeEast PointForest 9/089/29/089/29/0846

EXPIRED/CLOSED CHECK CASHERS (License/Registration)Lic 23145-7-CompanyThe Check Mart, Inc.Secondi, Inc.Howard H. RaineyOk Sun KimYoo Ja KimCedar Heights CorporationJ & Kay, Inc.Prince Andrew, Inc.Chul Ho YunHDC Group, Inc.Chang K. Enterprises, Inc.Woong Ok JunChesterfield Finance of Georgia, Inc.ZMA Enterprise, Inc.Duluth Package Store IncorporatedHye Son ThurstonClark‐Dodge Enterprises, Inc.Jae‐Wang ChoiKB Investments, Inc.Geeta B. PatelAMB‐JAL‐SAR, Inc.Tayco, Inc.Jay Gopal, Inc.ARB Check CashersAnshoya Food Market of Jesup, Inc.ANB Enterprises, Inc.E&J Liquors, Inc.Jack's Package Shop, Inc.Emil Kaneti, Inc.Akshat Beverage, Inc.Jong U. KimP&E Title Pawn & Check Cashing, Inc.Jagi, Inc.Shanker IncGuatam DesaiFS Super Market, Inc.Ramniklal Retail, LLCRiley Food Mart, Inc.Cash All Time, Inc.A&A Business, Inc.Dhruti, Inc.DBA NameThe Check Mart, Inc.U.S. Check Cashing Services of GA (USCCS)C. J.'s ExchangePark Pointe Community GroceryWalton Food SupermarketWestern Way Station #1Shell Gas StationUnited Check CashingC & H Liquor StoreJ & J Eagles Package StoreBottle HouseSeven to Seven NewsstandChesterfield FinanceAmoco Food MartDuluth Package StoreEasy ShopLighthouse LiquorsE‐Z Check CashSt. Marlowe Convenience StoreYogi's Liquor MartQwik Stop #11Whistle Stop Package StoreBrookwood Stop & ShopPharr Food MartCountry CornerCommunity GroceryE&J Liquor StoreJack's Package ShopMr. Check CashingRooster's PackageEZ Check CashingMr. MoneyCordele Food MartPanola PackageDJ PetroFive Star Super MarketSunoco Food MartCitgo Food MartCash All TimeQuick PickGorin's Homemade 28/087/17/089/17/087/1/089/18/088/6/08

Lic #2316523424CompanyEscamilla, Inc.Arafat AfanehDBA NameJJ's Liquor StoreBill Payment 5/087/29/0843APPROVED/EXPIRED CHECK SELLERS/ MONEY TRANSMITTERSLic #Company NameApproved Money Transmitters23217Banrural CorporationDBA NameCityApproved8/05/2008Closed Money Transmitters21348PreCash, Inc.2291322685CambioReal IncorporatedJay International, D NAME CHANGE: CHECK SELLERS/ MONEY TRANSMITTERSLic #Company NameApproved Money TransmittersNONEDBA NameCityApprovedTotalCheck Casher Upgrades/Downgrades in Third QuarterDowngraded from Full License to Registration –23 Total for 2008 - 26Upgraded from Registration to Full License – 24 Total for 2008 - 33-8-ST0

Department Contact InformationNAMEE-MAIL ADDRESSPHONE#Melinda Kinard, Director of Money Service Businesses andMortgage Licensingmkinard@dbf.state.ga.us770-986-1649Joel Byers, Supervisory Manager - Money Service eter Lisowski, Financial Examinerlisowski@dbf.state.ga.us770-986-1315Teresa Koeppel, Administrative Examinertkoeppel@dbf.state.ga.us770-986-1639Susan Nelson, Applications Analystnelson@dbf.state.ga.us770-986-1652Mailing Address: Department of Banking and Finance2990 Brandywine Road, Suite 200Atlanta, GA 30341-5565Website: http://dbf.georgia.govPhone & Fax Numbers: Phone:(770) 986-1633 orToll Free: (888) 986-1633Fax: (770) 986-1655 or (770) 986-1029E-MAILING THE DEPARTMENTThe Department would like to encourage you to correspond with us using e-mail. Providing written details inthe e-mail regarding any questions or concerns you may have allows the Department to forward the requestto the appropriate person who handles that area, and if sufficient details are included in the request, thatperson can then more efficiently provide you an answer.The main Division e-mail address isdbfmort@dbf.state.ga.usIn the event you still need additional information or you do not receive a timely response to your e-mail,please contact us by phone.NOTE: This publication is delivered to interested parties via e-mail and is alsoavailable from the Department’s website at: http:// dbf.georgia.gov underNews/Press Releases. If you would like to be added to our distribution list,please send an e-mail to dbfcorp@dbf.state.ga.us and indicate your name, thecompany you are with, license or registration # (if applicable), and phonenumber. Also, please indicate which publication(s) you would like to receive.See the list under PUBLICATIONS on our home page.-9-

on MSB registration, visit www.msb.gov. For inquiries regarding the MSB registration list, call the FinCEN MSB Regulatory Helpline at 1‐800‐949‐ 2732. For inquiries regarding MSB registration acknowledgement letters, call the IRS‐DCC Hotline at 800‐800‐2877. MSB Registration List - August 2008