Transcription

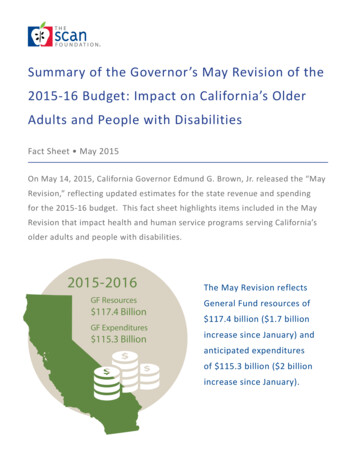

Summary of the Governor’s May Revision of the2015-16 Budget: Impact on California’s OlderAdults and People with DisabilitiesFact Sheet May 2015On May 14, 2015, California Governor Edmund G. Brown, Jr. released the “MayRevision,” reflecting updated estimates for the state revenue and spendingfor the 2015-16 budget. This fact sheet highlights items included in the MayRevision that impact health and human service programs serving California’solder adults and people with disabilities.2015-2016GF Resources 117.4 BillionGF Expenditures 115.3 BillionThe May Revision reflectsGeneral Fund resources of 117.4 billion ( 1.7 billionincrease since January) andanticipated expendituresof 115.3 billion ( 2 billionincrease since January).

Fact Sheet May 2015OverviewThe governor’s May Revision indicates that California’s fiscal outlook continues to improve, withGeneral Fund (GF) revenues reflecting a 6.7 billion increase (across budget years 2013-14 to2015-16) compared to the January Budget Proposal. The May Revision includes total reserves of 4.6 billion, with 1.1 billion in regular budget reserve and 3.5 billion in the Rainy Day Fund. Anadditional 633 million above the January proposed budget is included to repay budget debts,per the requirements of Proposition 2. The governor maintains that while the budget remainsbalanced with higher than anticipated revenues, there still is the possibility of deficits in futureyears based on infrastructure needs, unfunded liability for state employee retiree health benefitsand pensions, and other factors. As such, the governor’s May Revision proposes new funding tospecified priorities, including: Establishing the California Earned Income Tax Credit for low-income workers, impacting 2million individuals in families with less than 14,000/year annual income; Holding tuition flat at the state’s universities for California undergraduate students; and Providing health care and other safety net services to currently undocumented immigrantswith protected status under the President’s proposed executive actions.In total, the May Revision assumes resources of approximately 117 billion GF in 2015-16, andproposes 115 billion GF expenditures. This fact sheet addresses May Revision proposals impactingolder adults and people with disabilities. 1,2Financing Proposal: Managed Care Organization TaxBackground: The Managed Care Organization (MCO) tax, a revenue tax on Medi-Cal managed careplans authorized in Senate Bill 78 (2013), is a key financing resource for certain Medi-Cal long-termservices and supports (LTSS). Half of these total funds draw down federal matching funds andreimburse Medi-Cal managed care plans for the incurred taxes. The other half of the funds willoffset GF expenditures for Medi-Cal managed care rates.3 According to federal guidance, California’scurrent MCO tax is inconsistent with federal Medicaid regulations because the tax is only applied toMedi-Cal managed care plans verses all managed care plans. The current MCO tax will no longer beallowed after it expires on June 30, 2016.4www.TheSCANFoundation.org2

Fact Sheet May 2015January Budget Proposal: The January budget assumes an MCO tax contribution of 803 million in2014-15 and 1.1 billion in 2015-16. In January, Governor Brown announced that the state wouldreplace the current tax with a broad-based MCO tax in 2016 that complies with federal law. Thisnew tax would apply to all managed care plans regulated by Department of Managed Health Careand/or the Department of Health Care Services, and must raise the same amount of general fundsavings as the current tax.4May Revision: The MCO tax proposal remains as proposed in the January budget, while theAdministration continues to work with the managed care industry, legislature, and the federalgovernment on developing the new tax.Long-Term Services and SupportsCoordinated Care InitiativeBackground: The Coordinated Care Initiative (CCI) changed how medical care and LTSS are providedfor low-income older adults and people with disabilities. 5,6 The main components of the CCIinclude: 1) provisions of Cal MediConnect; 2) mandatory enrollment of dual eligible beneficiaries(individuals eligible for both Medicare and Medi-Cal, California’s Medicaid program) into Medi-Calmanaged care; and 3) integration of Medi-Cal-funded LTSS into managed care. 7 The CCI is slated forimplementation in seven counties (Los Angeles, Orange, Riverside, San Bernardino, San Diego, SanMateo, and Santa Clara). Operations began April 2014.4One component of the CCI is to transition the Multipurpose Senior Services Program (MSSP) froma federal waiver to a managed care benefit beginning January 1, 2015, or after 19 months of MSSPbeneficiary enrollment into managed care. The MSSP, a 1915(c) Medicaid waiver program, providescare management to frail older adults by connecting them with community-based services to helpthem remain in their homes.January Budget Proposal: The proposed budget assumed that the CCI would generate GF savings of 176.1 million in 2015-16, primarily attributed to funds generated through the MCO tax by the CCIplans. In his January budget proposal, the governor noted that implementation of Cal MediConnectas part of CCI has not aligned with the assumptions made when it was established in 2012, therebyimpacting the projected savings. Specifically, less-than-anticipated savings shared with the federalgovernment, enrollment delays, lower enrollment numbers, and higher than anticipated In-HomeSupportive Services (IHSS) costs have impacted the attributed savings. As such, the Januarywww.TheSCANFoundation.org3

Fact Sheet May 2015budget projected that the CCI could result in net costs to the state without solutions to improveparticipation, address the MCO tax, and lower state costs. The January budget noted that the CCIwould stop operating in January 2017 if the program does not generate sufficient savings. 4May Revision: Core elements of the CCI remain the sameas indicated in the January budget proposal. However,the May Revision proposal would extend the MSSPtransition deadline to December 31, 2017, and allowearlier transition in a county/region when MSSP sitesand managed care plans mutually agree on the earlytransition. In addition, both the MSSP sites and managedcare plans would be required to meet readiness criteria tobe developed by the Department of Health Care Services(DHCS), California Department of Aging (CDA), MSSPproviders, managed care plans, and stakeholders. 8DHCS proposes to extendthe transition date for MSSPto become to a managedcare benefit in CCI countiesno later than December 31,2017.In-Home Supportive Services (IHSS)Background: The IHSS program provides in-home personal care assistance to low-income adultswho are over 65 years of age, blind, or disabled, and to children who are blind or disabled.Services include assistance with bathing, feeding, dressing, and/or domestic services such asshopping, cooking, and housework so that individuals can remain safely in their own homes.County social workers assess individuals using a standardized assessment to determine needand then authorize service hours per month based on functional need. IHSS is expected to serve463,000 recipients per month on average in 2015-16.4January Budget Proposal: The proposed budget included 8.2 billion ( 2.5 billion GF) for the IHSSprogram in 2015‑16, a 14.4 percent increase over the revised 2014‑15 level. Restoration of Seven Percent Across-the-Board Reduction: The budget proposed to restorethe current seven percent across‑the‑board reduction in service hours with proceeds fromthe revised MCO tax, effective July 1, 2015. The cost to restore the seven percent reductionwere estimated to be 483.1 million in 2015‑16.4 Federal Overtime Regulations: A federal district court ruled that a portion of the U.S.Department of Labor Fair Labor Standards Act (FLSA) rule requiring overtime pay fordomestic workers exceeded the Department of Labor’s authority and thus haltedimplementation of the regulations. Therefore, the state halted implementation of overtimewww.TheSCANFoundation.org4

Fact Sheet May 2015and related requirements, including compensation for providers traveling between multipleIHSS recipients, wait time associated with accompanying recipients to medical appointments,and time spent in mandatory provider training.4,9May Revision: Restoration of Seven Percent Across-the-Board Reduction: The proposal to restore the 7%across-the-board reduction in IHSS service hours beginning July 1, 2015 remains as indicatedin the January Budget proposal.2 IHSS Caseload: The May Revision reflects an increase of 147.6 million GF in 2014-15 and 179.1 million GF in 2015-16, which is primarily associated with increases in the number ofpeople enrolled, hours authorized, and wage increases. FLSA Rule: The January budget proposal included 184 million GF to the California Departmentof Social Services (CDSS) for implementation of the overtime rule in 2014-15 and 316 millionin 2015-16. To date, none of the 2014-15 funds have been spent for this purpose. SenateBill 855 included a provision requiring that any unspent FLSA-related funding in the currentyear resulting from delayed federal implementation of the rule shall be used for otherpurposes within the IHSS program. The May Revision uses these one-time unspent funds topartially offset the 326.7 million in increased IHSS costs related to caseload, hours per case,and costs per hour. The May Revision continues to assume full-year funding in 2015-16 forimplementation of the federal rule, pending further legal developments. 1Health HomesBackground: Assembly Bill 361 (2013), permits DHCS to develop a health homes program thatwould enhance care management and coordination for beneficiaries with complex needs. Uponimplementation, the program seeks to provide comprehensive care management, care coordination,health promotion, comprehensive transitional care, individual and family support, and referralto community and social support services. The program will be funded primarily through federalfunds, with non‑federal funding coming from non‑state sources.*In 2013, the United States Department of Labor announced new regulations that require overtime pay for domesticworkers, compensation for providers who travel between multiple recipients, for wait time associated with medicalaccompaniment, and for time spent in mandatory provider training.www.TheSCANFoundation.org5

Fact Sheet May 2015May Revision: A new proposal in the MayRevision includes budget and spending authorityfor 61.6 million in non-state funds for additionalpayments to health plans that participate in theHealth Homes Program beginning January 2016.1The May Revision includes newbudget and spending authorityfor health plans participatingin the Health Homes Programstarting January 2016.Other Medi-Cal ProposalsAnnual Open Enrollment for Specified Medi-Cal Managed Care EnrolleesBackground: Currently, people enrolled in Medi-Cal are able to switch health plans each month.January Budget Proposal: The governor’s budget proposed an annual open enrollment periodfor certain Medi-Cal beneficiaries who are required to enroll in a Medi-Cal managed care plan.However, older adults, people with disabilities, people fully eligible for both Medi-Cal andMedicare, people in counties with only one Medi-Cal health plan, and adults newly eligiblethrough the Affordable Care Act expansion are excluded, and not impacted by the more restrictedenrollment opportunities of this proposal. Individuals can still apply for and be newly enrolled inMedi-Cal at any time during the year.10May Revision: The annual open enrollment proposal remains as indicated in the January budgetproposal.Skilled Nursing Facility Quality Assurance FeeBackground: Current law authorizes a quality assurance fee on skilled nursing facilities thatleverages additional federal funding to offset GF expenditures in these facilities. Authority for thecurrent quality assurance fee lasts through July 31, 2015, and includes a three percent increase inreimbursement rates in 2013-14 and 2014-15.January Proposed Budget: The governor’s budget proposed continuation of the quality assurancefee for an additional five years, including annual rate increases of 3.62 percent beginning in August2015.4May Revision: The Skilled Nursing Quality Assurance Fee remains as indicated in the Januarybudget proposal.www.TheSCANFoundation.org6

Fact Sheet May 2015Other Program ChangesSupplemental Security Income/State Supplementary Payment (SSI/SSP)Background: The federal SSI program provides a monthly cash benefit to eligible aged, blind, anddisabled persons who meet the program’s income and resource requirements. The federal SocialSecurity Administration (SSA) administers the SSI/SSP program, making eligibility determinations,grant computations, and issuing combined monthly checks to recipients. In California, the SSIpayment is augmented with an SSP grant. The SSA applies an annual cost‑of‑living adjustment tothe SSI portion of the grant equivalent to the year-over-year increase in the Consumer Price Index.Effective January 2015, maximum SSI/ SSP grant levels are 881 per month for an individual and 1,483 per month for couples. The average monthly caseload in this program is estimated to be 1.3million people in 2015‑16, a slight increase over the 2014‑15 projected level.January Budget Proposal: The proposed budget included 2.8 billion GF for the SSI/SSP program,including the federal cost-of-living adjustment for SSI/SSP recipients (1.7 percent for 2015 and aprojected 1.5 percent for 2016). These changes keep the SSI/SSP grant levels at their minimumas allowed under federal law for both couples and individuals in order to maintain eligibility forMedicaid funding.4,11May Revision: Based on an adjustment of the federal Consumer Price Index, the SSA eliminatedthe 2016 COLA of 1.5 percent to individuals and couples. The May Revision reflects this federalchange.12Community Care LicensingBackground: The CDSS Community Care Licensing (CCL) Division oversees the certification ofapproximately 66,000 licensed community care facilities, including residential care facilities forthe elderly, adult residential facilities, child care centers, family child care homes, as well as fosterfamily and group homes. Prior to 2002-03, most facilities licensed by CCL were required to bevisited annually. Budget related legislation enacted in 2003 lengthened the intervals between visitsfor most facilities from one year to five years.13The enacted 2014-15 budget included funding for quality enhancement and programimprovements, as well as a 10 percent increase for licensing fees in order to improve the structureof the CCL program.www.TheSCANFoundation.org7

Fact Sheet May 2015January Budget Proposal: The proposed 2015-16 budget included 3 million GF and 28.5 statepositions to address a backlog of facility complaint cases and expand training and technicalassistance to implement quality enhancement and program improvements. Under this proposal,beginning in January 2017, DSS would begin increasing inspection frequency to every three years forall facilities, every two years by 2018 for all facility types except child care, and annually by 2019 foradult day care and residential care facilities for the elderly, with ongoing GF expenditures totaling 14 million.4May Revision: The CCL proposal remains as indicated in the January budget proposal.Developmental Center ClosuresBackground: In January 2014, The Plan for The Future of Developmental Centers in California,recommended that the state should plan to close the remaining developmental centers and operatea limited number of safety-net crisis and residential centers.May Revision: The governor proposes that the state initiate planning for closure of the remainingdevelopmental centers – Sonoma Developmental Center by 2018, and Fairview and PortervilleDevelopmental Centers by 2021. The May Revision includes 49.3 million ( 46.9 million GF) todevelop community resources to help Sonoma residents transition into the community. 1What’s Next in the Budget ProcessThe governor’s proposed 2015-16 budget, including the May Revision, requires approval by theSenate and the Assembly. The Legislature continues to deliberate the 2015-16 proposed budgetthrough a series of budget subcommittee hearings in each house, extending through the end ofMay. Each subcommittee votes on its respective issue area(s) in the budget and submits a reportto the full budget committee for a vote. Next, the budget bill will be sent to the full membershipof the Senate and Assembly for a vote. From the floor, each house’s budget bill is referred to ajoint budget conference committee where differences between the houses can be resolved. Theconference committee votes on the proposed version, which, if passed, is sent to the floor of eachhouse simultaneously. By law, the Legislature must approve the budget by June 15 in time for thegovernor to sign it by July 1. Finally, the governor has the authority to “blue pencil” (reduce oreliminate) any appropriation contained in the budget. 14www.TheSCANFoundation.org8

Fact Sheet May 2015Key Budget Dates June 15, 2015 – Deadline for Legislature to Approve Final Budget July 1, 2015 – Governor Must Sign the BudgetReferences1.California Department of Finance. 2015-16 May Revision.2015; http://dof.ca.gov/documents/2015-16 May Revision.pdf. Accessed May 14, 2015.2.Assembly Budget Committee. Highlights of Governor’sProposed 2015-16 May Revision. 2015; inal%29.pdf. Accessed May 14,2015.3.9.California Department of Social Services. State HaltsImplementation of Overtime for In-Home SupportiveServices. 2014; ease/Judges Ruling Vacates.pdf. AccessedMay 14, 2015.10. California Department of Health Care Services. 2015-2016Governor’s Budget Highlights. 2015; ighlights.pdf.Accessed May 14, 2015.The SCAN Foundation. Summary of the Enacted 2013-2014Budget: Implications for Older Adults and People withDisabilities. 2013; on.org/files/tsf-fact-sheet-ca budgetfinal-2013-2014 1.pdf. Accessed May 14, 2015.11. Assembly Budget Committee. Highlights of Governor’sProposed 2015-2016 Budget. 2015; s.pdf. Accessed May 14, 2015.4.State of California DoF. 2015-16 Governor’s BudgetSummary. 2015; y/FullBudgetSummary.pdf. Accessed May 14,2015.12. California Department of Social Services. Local AssistanceEstimates for the 2015-16 Governor’s Budget. 2015; http://www.cdss.ca.gov/cdssweb/PG3682.htm. Accessed June 30,2015.5.Senate Bill 1008 (Chapter 33, Statutes of 2012).6.Senate Bill 1036 (Chapter 45, Statutes of 2012).7.The SCAN Foundation. California’s Coordinated CareInitiative: Background and Overview. 2012; view. Accessed May 14,2015.13. Assembly Budget Subcommittee No. 1 on Health andHuman Services. Agenda: Assembly Budget SubcommitteeNo. 1 on Health and Human Services. 2014; CS.pdf.Accessed May 14, 2015.8.California Department of Health Care Services. Departmentof Health Care Services Proposed Trailer Bill Legislation;650 - Multipurpose Senior Services Program TransitionTimeline. 2015; http://www.dof.ca.gov/budgeting/trailer bill language/health and human services/documents/650MSSPTransitionTimeline.pdf. Accessed May15, 2015.14. California State Senate. How the Budget ProcessWorks (Taken from “The Budget Process”, prepared by theSenate Rules Committee). /files/BWORKINGS.PDF. Accessed May14, 2015.For more information, contact Megan Burkeat orgLike us on FacebookFollow us on Twitter9

2015-2016 Fact Sheet May 2015. Fact Sheet May 2015 . Supportive Services (IHSS) costs have impacted the attributed savings. As such, the January . . of Social Services (CDSS) for implementation of the overtime rule in 2014-15 and 316 million in 2015-16. To date, none of the 2014-15 funds have been spent for this purpose. .