Transcription

FORTUNE 500 CFO INDEXJanuary 2017

Fortune 500 CFO IndexGoals & Methodology The Spencer Stuart Fortune 500 CFO Index is an analysis of the CFOs atFortune 500 companies for the 11 year period from 2006-2016. The goal ofthis analysis is to answer the question, “What is the profile of the F500CFO?” The data for each year represents a snapshot of executives sittingin the CFO seat as of 12/31 of their respective year.Industry Acronyms CG&S – Consumer Goods & Services ENER – Energy FS – Financial Services IND – Industrial LS – Life Sciences TMT – Technology, Media, & Telecommunications2

Fortune 500 CFO IndexTurnover Annual CFO turnover averages approximately 14%Route Up The most prevalent primary route up is accounting and controls anddivisional finance 25% had prior public company CFO experience 61% were internally placed 14% come from different industriesDemographics 61 (12.5%) are women and 31 (6.4%) are people of color 47% have MBAs and 36% have CPA Although 28% sit on boards, only 9% are for Fortune 500 companies3

Turnover & Tenure4

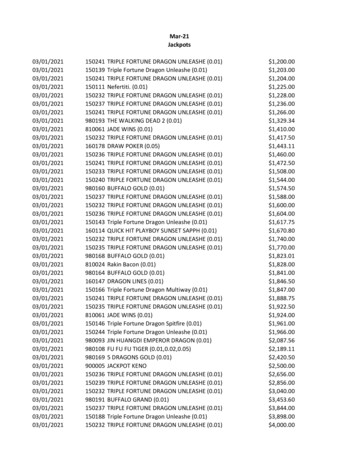

TurnoverFortune 500 CFO Turnover 2006-2016Cases of Turnover, % of F50092, 18%95, 19%88, 18%72, 14%71, 14%63, 13%61, 12%53395761, xternal473026254338313070, 14%59, 12%504373, 15%201225201320142320152016Total5

TurnoverTurnover by 73706

TurnoverFortune 500 CFO 0Jan-Jun49405060Jul-Dec7

TurnoverCFO Origin 2006-2016 Over theeleven yearperiod, therewere 805 CFOtransitions.39% ExternalPlacements61% InternalPlacements8

TurnoverInternal by S20092010ENER2011FSIND20122013LS201420152016TMT9

Tenure75.865.35.3200620075.1520082009Tenure 1201210

Tenure2016 Average Tenure 1 year70, 14%2-5years242, 50%6-10years108, 22%11 years67, 14%0%10%20%30%40%50%60%11

Route Up12

Route UpRoute 07DIV FINANCE20082009FP&A2010GM2011INV BANKING20122013OTHER2014PUB ACCTING2015TREASURY2016Other includes IR, audit, law, consultingRoute up determined by longest time spent in functional role13

Route UpInternal Placements40%30%20%10%0%ACCT/CNTRL CORP DEVDIV FINANCE FP&A20062007200820092010GM2011INV BANKING OTHER PUB ACCTINGTREASURY20122013201420152016External Placements40%30%20%10%0%ACCT/CNTRL CORP DEVDIV FINANCE FP&A20062007200820092010GM2011INV BANKING OTHER PUB ACCTINGTREASURY20122013201420152016Other includes IR, audit, law, consultingRoute up determined by longest time spent in functional role14

Route UpIndustry 0%10%18%21%201611%16%13%13%17%18%15

Former CFO Experience16

Former CFO Experience2016 Type of CFO ExperiencePrivate6%Public25%No prior CFOexperience69%17

Former CFO ExperienceFormer 1618

Former CFO ExperienceFormer CFO Experience by S20132014TMT2015201619

Former CFO Experience2016 External Placements Former CFO ExperiencePrivate9%Public65%None26%20

Prior Position21

Prior Position2016 Prior PositionTreasury12%Pub Accting1%Other6%Acct/Control20%Inv Banking2%GM13%CFO18%FP&A1%Div Finance22%Corp Dev5%Other includes IR, audit, law, consulting22

Prior PositionPrior Postion 2006 - 201630%25%20%15%10%5%0%ACCT/CONTROL2006CFO2007CORP DEV DIV FINANCE20082009FP&A20102011GM2012INV BANKING OTHER20132014PUB ACCTING TREASURY20152016Other includes IR, audit, law, consulting23

Prior Position2016 External Placements Prior PositionCorp Dev3%Div Finance14%FP&A1%GM12%CFO56%Inv Banking4%Other4%Pub AcctingTreasury 2%Acct/Cntrl 2%2%Other includes IR, audit, law, consulting24

Prior PositionExternal Placements Prior ORP DEVDIV FINANCE FP&A2008200920102011GM INV BANKING OTHER PUB ACCTINGTREASURY20122013201420152016Other includes IR, audit, law, consulting25

Demographics26

Gender DiversityFemale CFOs in the 320142015201627

Gender DiversityFemale CFOs by 008FS20092010IND20112012LS20132014TMT2015201628

Ethnic DiversityDiverse Execs in the Fortune 5201629

Ethnic DiversityDiverse CFOs by S20092010IND20112012LS20132014TMT2015201630

EducationCFO Education60%Top five most attended MBAschoolsUniversity of Chicago – 3150%Harvard – 16Kellogg - 1540%Wharton – 13Columbia – 1130%20%10%0%2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016MBACPA31

Fortune 500 CFOs inthe Boardroom32

Fortune 500 CFOs in the BoardroomF500 CFOs on Corporate Boards35%30%25%20%15%10%5%0%AllClass 5%201628%13%33

Fortune 500 CFOs in the BoardroomF500 CFOs on Corporate : This data includes CFOs sitting on their own company board.34

Fortune 500 CFOs in the BoardroomF500 CFOs on Corporate BoardsF500 CFOs on F500 boards28%(136 CFOs)91%(443 CFOs)72%(351 CFOs)Sits on corporate board9%(44 CFOs)No boardsSits on a F500 boardNo F500 boardsF500 CFOs on Outside F500 Boards7%(33 CFOs)93%(454 CFOs)*Some CFOs sit on their owncorporate board and externalcorporate board(s)Sits as an Independent Director on a F500 boardDoes not sit on an outside F500 board35

Appendix36

Fortune 500 Company Breakdown by 3%7014%6814%TTL49749749749849649549649749649749737

Fortune 500 companies for the 11 year period from 2006-2016. The goal of this analysis is to answer the question, "What is the profile of the F500 CFO?" The data for each year represents a snapshot of executives sitting in the CFO seat as of 12/31 of their respective year. Industry Acronyms CG&S -Consumer Goods & Services ENER -Energy FS -Financial Services IND -Industrial .