Transcription

CEO & Board PracticePrivate Equity Practice2021Private Equity–BackedChief Executive OfficerCompensation Survey

Document title2

Heidrick & StrugglesContentsIntroduction4Methodology4Who are the CEOs?573

2021 Private Equity–Backed Chief Executive Officer Compensation SurveyIntroductionWelcome to our 2021 Private Equity–Backed Chief Executive Officer Compensation Survey, whichgathered data on these leaders’ compensation in countries around the world. Together with oursurveys of private equity investment and operating professionals and PE-backed chief financialofficers, these reports help to create a comprehensive picture of the compensation that keyexecutives are currently receiving in PE firms and portfolio companies.For this report, Heidrick & Struggles compiled compensation data from 879 CEOs around the worldin a survey fielded in March and April of 2021. Because there were relatively small numbers ofrespondents in countries other than the United States, this public report only includes full data onthe 654 CEOs in the United States.We hope you enjoy reading the report and we welcome suggestions, so please feel free to contactus questions and comments.With warmest regards,Todd MontiManaging PartnerPrivate Equity PracticeJeffrey SandersCo-Managing PartnerCEO & Board Practicetmonti@heidrick.comjsanders@heidrick.comOn confidentialityThe private equity–backed chief executive officer compensation survey, 2021, has been conductedon an anonymous basis, and all data is reported in aggregate.AcknowledgmentsThe authors wish to thank Mohd Arsalan and Daria Sklyarova for their contributions to this report.4MethodologyIn an online survey, we asked participantsto provide their base compensation for2021, as well as the value of cash bonusesand equity they received in 2020. CEOs alsoprovided information on their companies,the PE firms backing them, and their ownrace and gender. All data collected is selfreported and has been aggregated.All compensation figures in tables andcharts are reported in USD thousands.

Heidrick & StrugglesWho are the CEOs?The CEOs who responded to the survey mostoften had less than 10 years of experience inthe CEO role and in the private equity industry.Overall respondent demographicsCEO experience (years, %)Less than 105401910–121015–2020–25Less than 10196113–15915–20820–254More than 251Prefer not toanswerAnd, as is typical across PE, the vastmajority of CEOs were male and white.It is important to note, however, that PE firmsof all sizes are making increasing efforts toincrease both gender and racial or ethnicdiversity in their own ranks and at theirGender (%)Male58010–12913–15More than 25Experience at PE-backed companies (years, %)0.2portfolio companies. Indeed, we see increasingcompetition, and often higher offers, for diverseinvestment professionals at these firms andsenior executives at the companies they back.On the portfolio company side, more and morefemale leaders, in particular, are thriving.1Race and ethnicity (%)FemalePrefer not to answer586White/CaucasianNon-binary3 0.193Asian/AsianAmerican5Prefer not to answer5Hispanic/Latinx2Arab/Arab American/Middle Eastern1Black/AfricanAmerican1Other1Mixed0.5Native American/Alaska Native0.21 For more on the perspectives of three female CEOs at PE-backed companies, see Stephen Schwanhausser and Amanda Worthington,“Insights from women CEOs at PE-backed companies,” Heidrick & Struggles, on heidrick.com.5

2021 Private Equity–Backed Chief Executive Officer Compensation SurveyIn terms of their backers, a strong majorityof firms had direct investors. And theircompanies ranged across industries and sizes.Company backgroundFinancial investors (%)Revenue (%)Direct investmentprivate equity group88Direct lenders15Other (please specify)3Pre-revenue24 0– 50m914 51m– 100m 101m– 250m22 251m– 500m17 501m– 1bn11 1bn– 3bn7 3bn– 5bn1More than 5bn1Don’t know/prefernot to answer1Industry (%)1818171678762Industrial6ConsumerTechnology ortelecomsHealthcare orlife cationOther

Heidrick & StrugglesUS CEO compensationtotal cash compensation all rise as revenuedoes, with total median cash compensationcoming in at 1,639,000 at companies withrevenue above 1 billion. By industry, CEOsat financial services firms are paid the most: 1,013,000 in median total cash compensation.The median base compensation among USCEOs surveyed for this report was 476,000in 2021, and the median cash bonus receivedin 2020 was 294,000, for a total median cashcompensation of 800,000. (Eleven percentof CEOs said they received no cash bonusin 2020.) By company size, base, bonus, andMedian base and bonus (USD, thousands)Median baseMedian bonusMedian total cash compensationBy industry800720By revenue7998001013800775800706548By 6426ConsumerEnergy626173526476289476476476476Less than10 years10 yearsor more426FinancialservicesHealthcare orlife sciencesIndustrialTechnologyor telecoms376376Other 100mor less 101m– 500m 501m– 1bnMore than 1bn7

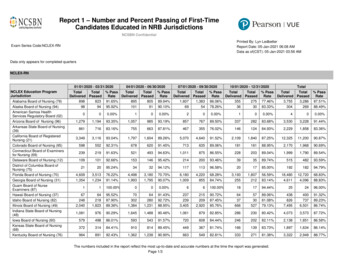

2021 Private Equity–Backed Chief Executive Officer Compensation SurveyForty-one percent of US CEOs reported thatthey received no equity in 2020. Among thosewho did, the median value was 876,000.Median base, bonus, and equityMedian base(USD, thousands)Median bonus (%)(Note: 11% reportedno cash bonus in 2020)Median bonus(USD, thousands)Median total cashcompensation(USD, thousands)(For respondents reportingbase and bonus)Median equity(USD, thousands)(Note: 41% reportedno equity in 488001,1322768761,600Business services(n sumer(n Energy(n Financial services(n 0Healthcare/life sciences(n Industrial(n nology/telecoms(n Other(n 61)326376576366288992885184307061,0823768012,000 100m or less(n 269)32637647626466899173289430548767225476976 101m– 500m(n 266)4264766264668882383745946948941,1764769762,000 501m– 1bn(n 00More than 1bn(n 004,000Less than 10 years(n 10 or more years(n Overall (n 654 for basecash compensation)By industryBy revenueBy experience8

Heidrick & StrugglesAbout the authorsTodd Montiis the global managing partner of Heidrick &Struggles’ Private Equity Practice; he is basedin the New York office.Jeffrey Sandersis a vice chairman in the Stamford, New York,and San Francisco offices and co-managingpartner of the CEO & Board Practice.tmonti@heidrick.comjsanders@heidrick.com9

CEO & BoardPracticeHeidrick & Struggles’ CEO & Board Practice has beenbuilt on our ability to execute top-level assignmentsand counsel CEOs and board members on thecomplex issues directly affecting their businesses.We pride ourselves on being our clients’ most trusted advisorand offer an integrated suite of services to help manage thesechallenges and their leadership assets. This ranges from theacquisition of talent through executive search to providingcounsel in areas that include succession planning, executiveand board assessment, and board effectiveness reviews.Our CEO & Board Practice leverages our most accomplishedsearch and leadership consulting professionals globally whounderstand the ever-transforming nature of leadership. Thisexpertise, combined with in-depth industry, sector, andregional knowledge; differentiated research capabilities;and intellectual capital, enables us to provide sound globalcoverage for our clients.Leaders of Heidrick & Struggles’CEO & Board PracticeGlobalBonnie GwinNew Yorkbgwin@heidrick.comPrivate EquityPracticeJeffrey SandersNew Yorkjsanders@heidrick.comHeidrick & Struggles’ global Private Equity Practice combines a deepunderstanding of private equity markets with world-class expertiseacross all major industries and functions to provide a broad range ofvalue-adding services.With more than 80 consultants in 50 offices around the world, our expertiseshadows the private equity life cycle from pre-deal due-diligence support topre- and post-acquisition executive search, leadership assessment, proactiveintroductions, and the construction of advisory boards for both private equityfirms and their portfolio companies.Leaders of Heidrick & Struggles’ Private Equity PracticeGlobalAmericasEurope and AfricaTodd MontiNew Yorktmonti@heidrick.comDaniel EdwardsWashington, DCdedwards@heidrick.comMuriel MoreauParismmoreau@heidrick.comJonathan GoldsteinNew Yorkjgoldstein@heidrick.comWill MoynahanLondonwmoynahan@heidrick.comSteven GreenbergTokyosgreenberg@heidrick.comTom ThackerayLondontthackeray@heidrick.comCopyright 2021 Heidrick & Struggles International, Inc.All rights reserved. Reproduction without permission isprohibited. Trademarks and logos are copyrights of theirrespective owners.

2021 Private Equity-Backed Chief Executive Officer Compensation Survey 6 Direct investment private equity group Direct lenders Other (please specify) Pre-revenue 0- 50m 51m- 100m 101m- 250m 251m- 500m 501m- 1bn 1bn- 3bn 3bn- 5bn More than 5bn Don't know/prefer not to answer Industrial Consumer Technology or telecoms .