Transcription

95%85%* of attendees surveyed saidthe event met or exceededtheir learning objectives* of attendees surveyed said theyeither strengthened existing businessrelationships or generated new business* Survey results from the 2015 Novogradac Tax Credit Housing Finance Conference

Thank You to Our Co-Host and SponsorsCO-HOSTSSPONSORSALDENCAPITALPARTNERS

LIHTC 101: The BasicsWEDNESDAY, NOV. 30, 9 A.M.–4 P.M. (SEPARATE REGISTRATION REQUIRED)8–9 A.M.Registration and Breakfast9–9:50 A.M.Intro and Housekeeping, Affordable Housing Overview9:50–10 A.M.BreakTenants, owners, investors, government, tax creditsHow Tax Credits Are Calculated10–10:50 A.M.10:50–11 A.M.Total development costs, eligible basis, 30% basis boost, applicable fraction,qualified basis, tax credit percentages, 9% credit pool, annual credits,total creditsBreakTypical Ownership Structure and Project Timeline11 A.M.–NOONNOON–1 P.M.Developer, syndicator, investor(s), upper-tier fund, lower-tier operatingpartnership, asset management, developer fees, credit pricing, equity, formingthe partnership, lining up service providers, preparing forecast, applying forcredits, state qualified allocation plans (QAPs), 10 percent test (9% deals)LuncheonProject Timeline (continued)1–1:50 P.M.1:50–2 P.M.Tax-exempt private activity bonds, typical bond transaction structure, 50 percenttest (bond deals), finish construction, final cost certification, placed-in-servicepackage, regulator agreement, Forms 8609, yearly audits and tax returnsBreakAcq/Rehab Deals, Program Rules and Avoiding Recapture2–3 P.M.3–4 P.M.Construction method, financing method, tax credit percentages quirk, 30%basis boost quirk, minimum set-asides (20-at-50 and 40-at-60), multi-buildingelection, income limits, rent limitsProgram Rules and Avoiding Recapture (continued),Conclusion/Wrap-UpTax credit period vs. compliance period vs. extended-use period, stateinspections, Form 8823, earned vs. accelerated credits

LIHTC 202: Year 15 OverviewWEDNESDAY, NOV. 30, 9 A.M.–3 P.M. (SEPARATE REGISTRATION REQUIRED)9–10 A.M.Special Rules for Nonprofit Right of First RefusalDiscuss right of first refusal under IRC 42(i)(7)Understanding the Economics of the Limited Partner Exit10–10:50 A.M.10:50–11 A.M.11 A.M.–NOONNOON–1 P.M.1–1:30 P.M.1:30–1:50 P.M.1:50–2 P.M.2–2:30 P.M.2:30–3 P.M.Discuss key information needed to calculate gain/loss on exit, cash flow split andexit taxes. Review how capital accounts affect cash waterfall. Case study will beprovided, but please bring your own documents.BreakBuying Property vs. Buying LP Partnership InterestDiscuss the economics under various scenarios and how it can affect re–syndication.LunchEarly Exit by Limited PartnerDiscuss pros and cons of early exits and reasons why both parties may or maynot want an early exit.ResyndicationDiscuss 10–year hold rule, tack back rule, grandfathering tenants and resettingrent & income limits in acq/rehab developments.BreakQualified ContractsBrief 30,000-foot view of qualified contracts; and pros and cons of exercisingqualified contract.Planning for Year 15 in Year 1Discuss how to plan for a successful Year 15 transaction early to avoid issues.

LIHTC 301: Advanced LIHTC FinancingWEDNESDAY, NOV. 30, 9 A.M.–3 P.M. (SEPARATE REGISTRATION REQUIRED)8–9 A.M.Registration and BreakfastSources and Uses, Eligible Basis Issues, and Taxable Income9–10:30 A.M.Offsite improvements, land vs. land improvements, bond issuance costs,construction/perm loan fees, taxable income10:30–10:45 A.M.Break10:45 A.M.–NOONNOON–1 P.M.1–1:50 P.M.1:50–2 P.M.2–3 P.M.First-Year Credit Calculation, Internal Rate of Return and704(b) IssuesFirst-year credit calculation, maximizing first-year credits, lease up for acq/rehabdeals and basis cushionLuncheonRevenue and Expenses, Equity MarketEquity market, 9% floorBreakYear 15 Options, Historic Boardwalk Hall CaseEarly exit, Year 15 exit, qualified contract, resyndication

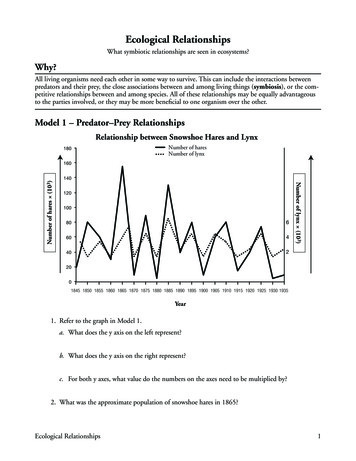

Conference AgendaTHURSDAY, DEC. 1, 201610:30–10:45 A.M.Break10:45 A.M.–12 P.M.8–9 A.M.Equity Marketplace Trendsto Watch for in 2017Registration andContinental BreakfastInvestors and syndicators provide perspectiveon what's driving the high equity prices andwhether they’re sustainable. Preview the yearahead with our experts and take away tips onways to raise equity in this hot market.9–9:15 A.M.Welcome Address9:15–10:30 A.M.The Washington ReportWith the general election in the rear-viewmirror and a new-look Senate and Houseof Representatives preparing to take office,what does tax reform look like for the 115thCongress? Does the Affordable Housing TaxCredit Act of 2016 stand an improved chanceof passing? How will Senate and House leaderswork with the new president? Mike Novogradacshares the latest information from the capital.MICHAELNOVOGRADACNovogradac &Company LLPDAVID GASSONBoston CapitalRICK GOLDSTEINNixon PeabodyLLPJEFF WEISSAlden CapitalPartners LLCTONY ALFIERIRBC CapitalMarketsRAOUL MOOREEnterpriseCommunityInvestment Inc.TERRY GENTRYRichman Group12–1:15 P.M.LuncheonDARRICK METZWNC & AssociatesInc.

Conference AgendaTHURSDAY, DEC. 1, 2016CONCURRENT SESSION 11:30–2:30 P.M.Affordable Housing Debt SolutionsWhat's Old is New AgainReview interest rate and yield curve and hearhow to maximize taxable and tax-exemptinterest-rate relationships, yield curve andmore for debt refinancing with case studies tohelp understand the role of variable rate debt.PAUL CHARRONNovogradac &Company LLPMATT ZARLENGO HELEN FEINBERGThe Community RBC CapitalDevelopmentMarketsTrustTAMMY OFEKCapM FundingMATHEWROB HOSKINSWAMBUAThe NuRockRichmac Funding Companies2:45–3:45 P.M.KENJI TAMAOKIPrudentialSUSAN WILSONNovogradac &Company LLPIRENA EDWARDS JOHN ROBERTSKeyBankBellwetherEnterprise RealEstate Capital LLCPAUL WEISSMANHunt MortgageGroup4–5 P.M.Pairing the LIHTC with HTC, NMTCAffordable housing developers can tap intoadditional sources of financing by combiningthe LIHTC with historic tax credit (HTC)equity or new markets tax credit (NMTC)equity–often pairing state programs with thefederal programs. Examine the challenges andopportunities in expanding affordable housing’sconnection with historic preservation andcommunity development to help understandwhether you may benefit from broadening yourtax credit base.ROY CHOUNovogradac &Company LLPLIHTC MFH Lending Trends for 2017Learn about hits and misses in 2016 and how toapply them to 2017. Hear about such things aswho is lending, where they are lending, new andold lending programs, interest rate predictions,industry factors that may affect lendingand underwriting and how equity plays intolending programs. Also examine 2017 goalsand outlooks for Fannie, Freddie and HUD, andcompare them 2016 statistics.THOMASVANDIVERDentonsJANICE HETLANDLathrop & GageLLPWARREN SEBRANovogradac &Company LLPGLENN GRAFFApplegate &Thorne-Thomsen

Conference Agenda2:45–3:45 P.M.THURSDAY, DEC. 1, 2016At Year 15, LIHTC property owners facesignificant decisions, including whetherto retain the property or exit ownership.This session prepares you for Year 15 byconsidering issues involving the partnershipbetween the owner and investor, exitstrategies, when and how to reposition yourproperty, potential tax consequences, Year 15compliance issues and more.CONCURRENT SESSION 21:30–2:30 P.M.Nonprofit/HousingAuthority Hot TopicsPanelists discuss the most important issuesfacing both nonprofit organizations and publichousing authorities when it comes to affordablehousing financing, including best practices forclosing RAD transactions, potential changesconcerning the use of PHA reserves, andeffects of the Housing Opportunity throughModernization Act of 2016.Year 15 IssuesDIRK WALLACENovogradac &Company LLPRICH LARSENNovogradac &Company LLPCATALINA VIELMANational EquityFundHILARY LOPEZMARKPraxis Consulting SHELBURNEGroup LLCNovogradac &Company LLPTHOMASMORTONPillsbury WinthropShaw Pittman LLPTIM FLINTCBRE AffordableHousingCLIFF MCDANIELARA, A NewmarkCompany

Conference AgendaTHURSDAY, DEC. 1, 20164–5 P.M.Considering Resyndication–Acq/Rehab IssuesResyndication is an attractive option for manygeneral partners. General partners interestedin pursuing this strategy will learn aboutsuch things as the 10-year hold rule, eligiblebasis issues, lease-up, multiple regulatoryagreements, qualifying existing tenants, rehabtiming, timing of ownership issues and more.9:30–10:20 A.M.HUD IssuesHUD retains a crucial position in the affordablehousing world and this session provides alook at how HUD is adjusting as the RentalAssistance Demonstration (RAD) programnears its fifth year since passage, as well ashow HUD’s proposed energy benchmarkingaffects LIHTC properties, the impact of HUD’srules on fair housing and more.MOLLY O'DELLNovogradac &Company LLPBRENT PARKERNovogradac &Company LLPHOLLY HEERBarnes &Thornburg LLPRICHARD SHEACREA LLCBILL TRUAXInflectionDevelopment LLC5–6:30 P.M.MONICASUSSMANNixon PeabodyLLPJEFF WEISSAlden CapitalPartners LLCERIC NOVAKPraxis ConsultingGroup LLC10:20–10:30 A.M.BreakTax Credit HousingFinance Reception10:30–11:30 A.M.FRIDAY, DEC. 2, 2016Experts discuss hot-button issues in valuation,including the impact of real estate taxes,market trends and eligible basis. Also learnabout valuation of partnership interests.8–9 A.M.Registration and BreakfastValuation Issues9–9:30 A.M.Keynote AddressLINDSEY SUTTON BRAD WEINBERGNovogradac &Novogradac &Company LLPCompany LLPSEN. DEANHELLERSenator (R-Nev.)11:30 A.M.Conference Concludes

Registration InformationCONFERENCE RATESCorporateNonprofitEarly BirdAfterEarly BirdOn-Site 675 775 800 575 675 700Online RegistrationREGISTER NOWWORKSHOP RATESLIHTC 101LIHTC 202LIHTC 301With Conf. Reg.Workshop OnlyOnline Registration 325 325 325 425 425 425REGISTER NOWREGISTER NOWREGISTER NOWRegister at novoco.com/vegaslihtc2016Early Bird rate ends Nov. 1Questions? Contact the Events Desk:415.356.7970events@novoco.comRegistration Cancellation PolicyAll cancellations must be made in writing and must be received no later than ten (10) days beforean event. A 100 administrative fee will be deducted from all refunds. We regret that we cannotrefund cancellations made within 10 days of the conference or to registrants who do not attendthe conference. Confirmed registrants who fail to attend and do not cancel will be chargedthe entire registration fee.AccreditationNovogradac & Company LLP is registered with the National Association of State Boards ofAccountancy (NASBA) as a sponsor of continuing professional educationon the National Registry of CPE Sponsors. State boards of accountancyhave final authority on the acceptance of individual courses for CPEcredit. Complaints regarding registered sponsors may be addressed to theNational Registry of CPE Sponsors, 150 Fourth Avenue North, Nashville,TN 37219-2417. Website: www.nasba.org.

Hotel InformationTo make a reservation please call 702.698.7000 and identify yourself as an attendee of theNovogradac Tax Credit Housing Finance Conference to secure the discounted rate. A limited blockof rooms will be held until November 1, 2016. Reservations made after November 1, 2016 will beaccepted on a space-available basis only and cannot be guaranteed at the discount rate.The Cosmopolitan3708 S Las Vegas Blvd.Las Vegas, NV 89109Telephone: 702.698.7000Cutoff Date: November 1, 2016Hotel Rate: 209/night, plus taxSPECIAL ASSISTANCEHOTEL REGISTRATIONOur conference facilities are in compliance with the Americans with Disabilities Act (ADA). Pleasecontact Alex Bernard at 415.356.7627 or alex.bernard@novoco.com if you require assistance.

Sponsorship InformationIncrease the visibility of your companyJOIN THE PREMIERE EXHIBITION SPACE FOR LIHTC SERVICES AND PRODUCTSSPONSORSHIP LEVELSSponsoring a Novogradac conference is acost-effective and targeted method to reachthe LIHTC community. Our sponsorshipsoffer a prime opportunity to establish yourcompany as a leader in the industry, whilecreating pre- and post-event exposure.Sponsorships may include free ordiscounted registrations. 10,000Conference Co-Host 5,500- 9,000SponsorSelect Sponsor 5,500Supporting Sponsor 3,500Exhibitor Space 2,500MADE-TO-ORDER (M-T-O) PROMOTIONAL PRODUCTSPromote your brand among conference attendees with M-T-O products. Visit oursponsorship page for complete details. *Sponsorship subject to availabilityReception: 9,000Hotel Keycard: 6,500Receive prominent recognition onsignage and place your logo oncocktail napkins and/or coasters.Display your company logoon hotel keycards distributedto attendees.Wi-Fi: 8,500Breakfast: 6,000Help attendees connectby providing Wi-Fi accessand printing.Start attendees off on aproductive note with your logoon paper cups, cup sleevesor napkins.Luncheon: 7,000Highlight your company at thenetworking luncheon with yourlogo on the tabletop tent card.Conference Manual: 6,000Place your logo on the front coverof our conference manual.Conference Notepad: 5,500Put your logo on the conferencenotepad received by all attendees.Charging Station: 5,500Energize our attendees bysponsoring the charging station.Contact Carol Hough atcarol.hough@novoco.comor 415.356.8040

The NuRock Companies 2:45-3:45 P.M. LIHTC MFH Lending Trends for 2017 Learn about hits and misses in 2016 and how to apply them to 2017. Hear about such things as who is lending, where they are lending, new and old lending programs, interest rate predictions, industry factors that may affect lending and underwriting and how equity plays into