Transcription

Capital One Escrow ExpressReference GuideSM

Table of ContentsOverview2Accessing Capital One Escrow ExpressAbout the Capital One Escrow Express MenuAbout the Master Account Summary245Creating a New Escrow Sub AccountSubmitting a W9 to the Bank611Viewing Escrow Sub Accounts for a Master AccountSelect Escrow AccountManage Account Option121215Making Changes to Escrow Sub AccountsEditing an Escrow Sub AccountClosing an Escrow Sub Account161618Managing TransactionsAllocating Funds to Escrow Sub AccountsTransferring (Disbursing) Funds to the Master AccountViewing/Deleting Pending Activity20202427Viewing/Printing Processing Alerts29Viewing/Printing/Downloading Transaction HistoryMaster Account Transaction HistoryEscrow Sub Account Transaction History303032Accessing StatementsMaster Account StatementsEscrow Sub Account Statements353537Viewing Activity Reports38Splitting Interest38Glossary of Terms39

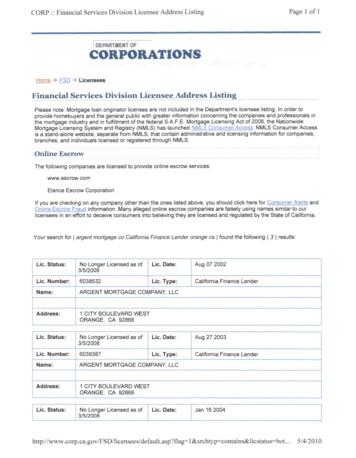

OverviewCapital One Escrow Express is a virtual sub-accounting system that lets you manage virtual Escrow SubAccounts securely and efficiently online. Once you enroll through Intellix,SM you will be able to create virtualEscrow Sub Accounts, manage transactions and access statements.Let’s get started Accessing Capital One Escrow Express1Within Intellix, from the Services menu, select Master Accounts List under Escrow Express.The Master Accounts List displays.Capital One Escrow ExpressAccessing Capital One Escrow Express 2

2Select the desired Master Account. The Master Account Summary screen displays:NOTE: A Timeout Warning pop-up will display in a separate window after 15 minutes of inactivity. If thiswarning displays, click Continue Session to extend the session. All information not submitted will be lostunless the session is extended.Capital One Escrow ExpressAccessing Capital One Escrow Express 3

ABOUT THE CAPITAL ONE ESCROW EXPRESS MENULocated at the top of every page, the menu provides links to all Capital One Escrow Express functions.Master AccountsView transactions and retrieve statements at the Master Account level.Escrow AccountsView transactions and retrieve statements at the Escrow Sub Account level. NOTE: Escrow Sub Accountsare referred to as Escrow Accounts in Capital One Escrow Express.TransactionsPerform allocations to Escrow Sub Accounts, perform transfers (disbursements) to and from Escrow SubAccounts, and view pending activity.Capital One Escrow ExpressAccessing Capital One Escrow Express 4

ABOUT THE MASTER ACCOUNT SUMMARYThe Master Account Summary includes information about your account, including the following: Master Account: Your Master Checking Account Number (also known as the DDA). Last Processing Date: The last day transactions were posted on Capital One Escrow Express. Current Date: Today’s date. Next Processing Date: If performing transactions outside of bank hours, the Next ProcessingDate will reflect weekends and Bank holidays. Processing Alerts: Items requiring your attention. Total Account Balance: Master Checking Account balance at the time the session was opened.For reconciling purposes, always use the Master Checking Account Statement. Current Master Balance: Amount that was not allocated as of the beginning of the day. Available Master Balance: Amount that is currently available for allocation. Number of Escrow Accounts: Number of Escrow Sub Accounts. Total Number of Open Escrow Accounts: Number of open Escrow Sub Accounts. Total Number of Closed Escrow Accounts: Number of closed Escrow Sub Accounts. Current Escrow Balance: Sum of funds in Escrow Sub Accounts as transactions are completedduring the day. Available Escrow Balance: Sum of funds already allocated to Escrow Sub Accounts as of thebeginning of the day.Below the Master Account Summary is the Information Messages section. Messages fromCapital One Bank including a note to review Processing Alerts, if necessary.Capital One Escrow ExpressAccessing Capital One Escrow Express 5

Creating a New Escrow Sub Account1 Click the Create New Account option from the menu. The New Escrow Account screen displays.2Select the Product from the drop down.NOTE: The Opened Date defaults to today’s date. This date can be backdated or future dated by up to 30 days,but cannot be prior to the Master Account’s open date. The Opened Date can be changed for newaccounts only. If this date must be changed, the account can be closed and a new account opened. Additional fields may display depending on the Product selected.Capital One Escrow ExpressCreating a New Escrow Sub Account 6

3Enter information in the appropriate fields; guidelines as follows:ReferenceContents of this field will be put into the memo line of any official checks that are issued by thebank. This field has an alpha/numeric character limit of 15.Short NameInput a name that may serve as an alternate way to identify the Escrow Sub Account. This field hasan alpha/numeric character limit of 15.Item IDThe apartment number, client number, case number or some other unique account identifier. Thisis another way you can associate an Escrow Sub Account to a customer for tracking purposes.Tax StatusSelect the Tax Status, choices are as follows: W8 – COMPLETE W8 – INCOMPLETE (Federal Backup Withholding at 28%) W9 – COMPLETE W9 – EXEMPT W9 – INCOMPLETE (Federal Backup Withholding at 28%)Capital One Escrow ExpressCreating a New Escrow Sub Account 7

4Complete the Primary Name and Address section using the following guidance:Name and Address FieldsFour names can be associated with the Escrow Sub Account. Tax ID/SSN can also be entered for the firstthree names entered. For multiple names, the 1099 Tax ID selection field can be used to select whichname will receive the 1099.CountrySelect UNITED STATES OF AMERICA.Address TypeIf address is located in the US, select A UNITED STATES ADDRESS. If the address is located outside theUS, select appropriate web format option.Comments/Email/Fax fieldsThese are optional.W-8 Expiration DateFor display only.Capital One Escrow ExpressCreating a New Escrow Sub Account 8

5 Expand and complete the 1099 Name, Address section only if the 1099 needs to be sent to an address other than the Primary Name and Address. NOTE: Leave these fields blank or select the Same as Primary Address checkbox to send the 1099 to thePrimary Address.6 Expand and complete the Statement Name and Address section only if statements need to be sent to an address other than the Primary Name and Address. NOTE: Leave these fields blank or select the Same as Primary Address checkbox to send statements to thePrimary Address.7Once all fields are completed, click the Submit button.Capital One Escrow ExpressCreating a New Escrow Sub Account 9

The Escrow Account Details screen displays.Capital One Escrow ExpressCreating a New Escrow Sub Account 10

NOTE: The assigned Escrow Sub Account Number displays in the Account Number field at the top. The account Status field displays as Active. If an Escrow Sub Account is opened in error and no allocations or transfers have been entered, theEscrow Sub Account may be deleted the same day by clicking the Delete button.Submitting a W9 to the BankA W9 is required for every interest bearing Escrow Sub Account in order to prevent automatic federalbackup withholding. For convenience, Capital One Escrow Express can produce a W9 form. Click the W9 button to produce a W9 form withprepopulated information from the Escrow SubAccount. Click the Fax button to produce a fax cover form. The fax cover will include the Escrow Sub AccountNumber and Tax ID fields pre-filled.You can email, mail, or fax the forms to the Bank.Email: tenantsecurity@capitalone.comFax: 1-855-898-0619Mailing Address: Capital One Bank Deposit Escrow ServicesP.O. Box 3100Hicksville, NY 11802-3100Capital One Escrow ExpressCreating a New Escrow Sub Account/Submitting a W9 to the Bank 11

Viewing Escrow Sub Accounts for a Master AccountSELECT ESCROW ACCOUNTSelect Escrow Account provides a list of Escrow Sub Accounts attached to the Master. This option displaysbalances, pending allocations, pending transfers and a function to view closed Escrow Sub Accounts.1Click Select Escrow Accounts under Escrow Accounts on the menu.All Escrow Sub Accounts for this Master Account display.Capital One Escrow ExpressViewing Escrow Sub Accounts for a Master Account 12

2 To view closed Escrow Sub Accounts, select the No option for Hide Closed Escrow Accounts question. Accounts that are closed display with a line drawn through the account.Capital One Escrow ExpressViewing Escrow Sub Accounts for a Master Account 13

3Click an Escrow Sub Account to see detailed information. The Escrow Account Details screen displays.When viewing the Escrow Sub Account, balance information displays at the bottom half of theEscrow Account Details screen. These details are defined below. Balance: Current balance Interest Accrued: Pending interest not yet posted – Federal Withholding: Interest withheld Net Closing Available: Balance interest accrued Federal Withholding YTD: Interest withheld year-to-date Interest Posted YTD: Interest posted to principal year-to-date Interest Rate: Annual percentage rateCapital One Escrow ExpressViewing Escrow Sub Accounts for a Master Account 14

MANAGE ACCOUNT OPTIONIf you have navigated to another Escrow Express function, the Manage Account option allows you to returnto the Escrow Sub Account details.1 ClickManage Account under Escrow Accounts on the menu.The Escrow Account details screen displays. If you have not previously accessed an Escrow Sub Account,then this menu option will not be available. Go to Select EscrowAccount option from the Escrow Accounts menu.Capital One Escrow ExpressViewing Escrow Sub Accounts for a Master Account 15

Making Changes to Escrow Sub AccountsEDITING AN ESCROW SUB ACCOUNT1 Locate and select the Escrow Sub Account using the Select Escrow Account option from the menu. The Escrow Account details screen displays:2Click the Edit button.Capital One Escrow ExpressMaking Changes to Escrow Sub Accounts 16

The Escrow Sub Account fields become editable:3Make necessary edits.4Click the Submit button at the top of the screen to update the record.ORTo exit without saving changes, click the Cancel button.NOTE: If you select another link from the menu or time out of the application before changes aresubmitted, all edits will be lost.Capital One Escrow ExpressMaking Changes to Escrow Sub Accounts 17

CLOSING AN ESCROW SUB ACCOUNTWhen an Escrow Sub Account is closed, Escrow Sub Account Principal and any Interest Due is automaticallyposted to the Unallocated Balance of the Escrow Master Account. There is no need to transfer funds to theEscrow Master Account prior to closing the Escrow Sub Account.1 Locate and select the Escrow Sub Account using the Manage Account option from the menu. The Escrow Account Details screen displays:2Click the Close button.3A closing account description promptly displays. Optional description can be entered. Click OK.Capital One Escrow ExpressMaking Changes to Escrow Sub Accounts 18

The Escrow Sub Account will be closed and any funds will be disbursed automatically to the Master Account.The Status field on the Escrow Account Details screen updates to reflect the account is closed and theclosed date.Capital One Escrow ExpressMaking Changes to Escrow Sub Accounts 19

Managing TransactionsTransaction functions include allocating funds between the Escrow Master Account and Escrow SubAccounts, transferring (disbursing) funds from the Escrow Sub Accounts to the Master Account, viewingpending transactions and deleting pending transactions.ALLOCATING FUNDS TO ESCROW SUB ACCOUNTSAllocate Funds option is the method for funding Escrow Sub Accounts from Master Account transactions.Funds not allocated within three days will trigger a processing alert.Funds can be moved in a single allocation to an Escrow Sub Account or as multiple allocations acrossmultiple Escrow Sub Accounts. Allocated funds cannot exceed the total amount of the transaction.FOR EXAMPLE:If two checks in the amount of 100 and 200 each are deposited in the Master Account at thesame time, the 300 deposit displays as a single transaction when selecting the Allocate Fundsoption to distribute the exact amounts to the appropriate Escrow Sub Accounts. In addition, the 300 deposit will be reflected in the Current Escrow Balance and Available Escrow Balance fieldson the Master Account Summary screen.1Capital One Escrow ExpressClick Allocate Funds under Transactions menu.Managing Transactions 20

The Master Account Transaction Allocation screen displays. If an Escrow Sub Account is in session, it willdisplay at the top of the screen.2 To allocate funds to a particular Escrow Sub Account not already in session, locate and select the Escrow Sub Account by clicking the link.3 At the bottom of the screen, select the Master Account Transaction from which you would like to allocate funds. The allocation can be a portion of the transaction amount or the entire amount.Capital One Escrow ExpressManaging Transactions 21

In the Allocation area, the Effective Date defaults to the date of the Master Account transaction posting.This date should be changed to a date equal to or later than the opened date of the selected EscrowSub Account.4Enter an optional, custom Description to be applied in addition to the default bank description.5Select which Escrow bucket to apply the funds, by default the first bucket is selected.6 EnterCredit Amount equal to the portion of the transaction to be allocated to single Escrow Sub Account(full or partial amount of the transaction depending on how deposit was processed).7 Clickthe Submit button to process the allocation.Capital One Escrow ExpressManaging Transactions 22

An Allocation Complete message displays and the Available Balances are updated. The updated Unallocatedand Escrow Account amounts display for the Master and Escrow Sub Accounts.8 Repeat these steps to make additional allocations for this Escrow Sub Account or select a different Escrow Sub Account to make allocations to another Escrow Sub Account9Capital One Escrow ExpressTo view the Escrow Sub Account after the allocations arecomplete, from the menu, select Manage Account underEscrow Accounts. The Escrow Accounts Detail screendisplays including the balance information.Managing Transactions 23

TRANSFERRING (DISBURSING) FUNDS TO THE MASTER ACCOUNTThe Transfer Funds option should be used when you need to move funds from or to Escrow Sub Accountsand back and forth between the Escrow Master Account Balance. When closing an Escrow Sub Account,funds do not need to be transferred first; the close function will automatically post Escrow Sub AccountPrincipal and any Interest Due to the Unallocated Balance of the Escrow Master Account.1Click Transfer Funds under Transactions on the menu.The Transfer Funds screen displays. Available Balance is shown for the Master Account and Escrow SubAccount.Capital One Escrow ExpressManaging Transactions 24

2 If you need to change the Escrow Sub Account, click the Select Escrow Account link. 3Select the Type of transfer – From Escrow to Master Account or From Master Account to Escrow.4 Enter an optional custom Description to be applied in addition to the default bank description. 5 EnterAmount of Escrow Sub Account to be transferred (full or partial amount depending on purpose). REMINDER: If attempting to close an account, please use the Escrow Sub Account Close function on theEscrow Account Details screen. If the full Escrow Balance amount is transferred using the Transfer Fundsoption, any interest due will not be posted and the Escrow Sub Account will not be closed. Interest willpost to principal on a regular cycle and account will stay open until actively closed.6Click the Submit button.Capital One Escrow ExpressManaging Transactions 25

In the Available Balance box, balances are updated and a Transfer Complete message displays.Capital One Escrow ExpressManaging Transactions 26

VIEWING/DELETING PENDING ACTIVITYPending Activity includes allocations and transfers entered during the current day. When viewing PendingActivity, allocations or transfers can be deleted.1Click View Pending Activity under Transactions menu.The Pending Account Activity screen displays and includes processing dates and balance information inaddition to the pending allocations and transfers. If an allocation or transfer has not been processed, it can be deleted nce allocations or transfers have been processed by the Escrow system they no longer display on theOPending Account Activity screen.Capital One Escrow ExpressManaging Transactions 27

2 If an allocation or transfer should not be processed, select the Delete checkbox for the allocation. Multiple transactions can be selected for deletion.3 Clickthe Delete button. Allocation or transfers are deleted and the Available Master Balance and AvailableEscrow Balance update.Capital One Escrow ExpressManaging Transactions 28

Viewing/Printing Processing AlertsProcessing Alerts advise of unallocated transactions aging beyond three days, W-9s that need to besubmitted to the Bank and open Escrow Sub Accounts that have a zero balance.1 ClickReports under the Master Accounts menu and select Alert Reportsfrom the reports list. The Master Account Processing Alerts screen displayswith alerts for the current day.2Click the Processing Date drop-down to select a different date’s alerts.3Click the Print button to print the current list of alerts.Capital One Escrow ExpressViewing/Printing Processing Alerts 29

Viewing/Printing/Downloading Transaction HistoryTransaction history includes allocations and transfers that have been processed. Transactions can beviewed for the Master Account or for a specific Escrow Sub Account. The transaction history can be printedor downloaded if desired.MASTER ACCOUNT TRANSACTION HISTORY1 ClickTransaction History under the Master Accounts menu.The Master Account Transaction History screen displays.Capital One Escrow ExpressViewing/Printing/Downloading Transaction History 30

2Click the Print button to view transactions in a separate window and print.ORClick the Download button to save information as a .csv fileThe selection feature provides the ability to filter transactions that you would want to print or export.Capital One Escrow ExpressViewing/Printing/Downloading Transaction History 31

ESCROW SUB ACCOUNT TRANSACTION HISTORYUp to 18 months of history can be viewed for each Escrow Sub Account.1Capital One Escrow ExpressClick Transaction History under Escrow Accounts menu.The Escrow Account Transaction History screen displays.Viewing/Printing/Downloading Transaction History 32

2 UseSelect Escrow Account under the Escrow Accounts menu to select a different Escrow Sub Account.A list of Escrow Sub Accounts displays.3 Select the desired account, then select Transaction History from the Escrow Accounts menu. Transaction history information displays.Capital One Escrow ExpressViewing/Printing/Downloading Transaction History 33

4 To select multiple transactions, use the Data Selection feature to filter the transaction list. Below are the various fields that can be used to select transactions.5After applying the selection filter, click the Print button to print the transactions.ORClick the Export button to save the information as a .csv file.Capital One Escrow ExpressViewing/Printing/Downloading Transaction History 34

Accessing StatementsStatements are generated monthly. Master Account Summary and Detail statements are available onCapital One Escrow Express by default. However, Escrow Sub Account Detail statements are only availableon Capital One Escrow Express.The statements are available on the system for 18 months. If a statement is needed for a different daterange, it can be requested and presented the next business day.MASTER ACCOUNT STATEMENTSStatements under Master Accounts on the menu.The Master Account Statements screen displays.1 Click2 ClickSummary to open the Summary Statement in a new window. The Summary Statement providesa high level view of the Escrow Master Account and starting and ending monthly balances of eachEscrow Sub Account.Capital One Escrow ExpressAccessing Statements 35

3 Clickon Detail to open the Detailed Statement in a new window. The Detailed Statement provides acombined view of the transactions passing through the Escrow Master Account and transactions ineach of the Escrow Sub Accounts.4To request a statement for a custom date range, click the Statement Request tab.5 Enterthe From and To dates and click Create Request. The statement will be accessible from this screenthe next day. If a custom statement request has been made in error, it can be removed the same day byclicking the red X next to the date range.Capital One Escrow ExpressAccessing Statements 36

ESCROW SUB ACCOUNT STATEMENTS1 ClickStatements under the Escrow Accounts menu. The Escrow Account Statements screen displays.2Click the Open Statement link to view a statement in PDF format. The Escrow Sub Account Client Information will display first followed by Information for theMaster Account. The Escrow Sub Account Summary Information is next and then the Detail Information.3 To request a statement for a custom date range, enter the From and To dates and click Request. The request will display on this screen the next day. NOTE: A customized statement request can be canceledif the statement has not been generated by clicking thered X next to the dates requested.Capital One Escrow ExpressAccessing Statements 37

Viewing Activity ReportsActivity Reports provide the activity performed in Capital One Escrow Express. The Time and User ID areincluded.1 ClickReports under the Master Accounts menu. Select Activity Reports from the list of reports.2 ClickOpen Report next to the date to view the report. The report opens in a separate window.Print or save the report if desired.Splitting InterestInterest can be split between multiple parties within the same Escrow Sub Account or between theMaster Account and the Escrow Sub Account. Please contact Treasury Management Client Solutionsat 1-866-632-8888 or TMHelp@capitalone.com for more informationCapital One Escrow ExpressViewing Activity Reports/Splitting Interest 38

Glossary of TermsEscrow Account: Escrow Sub Accounts are referred to as Escrow Accounts in Capital One Escrow Express.The Master Account Summary details: Account Number: Checking Account Number (also known as the “Master Account or DDA”). Last Processing Date: The last day transactions were posted on Capital One Escrow Express. Current Date: Today’s date. Next Processing Date: If performing transactions outside of bank hours, the Next Processing Date willreflect weekends and Bank holidays. Processing Alerts: Items requiring your attention. Pending Allocations: Number of allocations pending. Pending Transfers: Number of transfers pending. Current DDA Balance: Master Checking Account balance at the time the session was opened. Forreconciling purposes, always use the Master Checking Account Statement. Start-of-day Unallocated Balance: Amount that was not allocated as of the beginning of the day. Current Unallocated Balance: Amount that is currently available for allocation. Number of Escrow Accounts: Number of Escrow Sub Accounts. Start-of-day Escrow Balance: Sum of funds already allocated to Escrow Sub Accounts as of thebeginning of the day. Current Escrow Balance: Sum of funds in Escrow Sub Accounts as transactions are completed duringthe day.The Escrow Account Summary details: Opened Date: The date that the Escrow Sub Account was opened. Reference: Contents of this field will be put into the memo line of any official checks that are issuedby the bank. Short Name: Used as an alternate way to identify the Escrow Sub Account. Item ID: The apartment number, client number, case number, or some other unique account identifier.This is another way to associate an Escrow Sub Account to a customer for tracking purposes. Tax ID: The Employer Identification Number or Social Security Number. Tax Status: Tax Status, which can be one of the following: W8 – COMPLETE W8 – INCOMPLETE (Federal Backup Withholding at 28%) W9 – COMPLETE W9 – EXEMPT W9 – INCOMPLETE (Federal Backup Withholding at 28%) Comments: A field for additional comments.Capital One Escrow ExpressGlossary of Terms 39

Balance Information tab: Balance – current balance Interest Accrued – pending interest not yet posted – Federal Withholding – interest withheld Net Closing Available – balance interest accrued Federal Withholding YTD – interest withheld year-to-date Interest Posted YTD – interest posted to principal year-to-date Interest Rate – annual percentage rate Name/Address/Statement tab: W-8 Expiration Date– For display only Send to Master – 1099– When this checkbox is selected, the original 1099 will be sent to the Master Account addressinstead of the Escrow Sub Account address. Create Escrow Sub Account Statement – Web– When this checkbox is selected, the Escrow Sub Account statement will be available onCapital One Escrow Express. 1099 Name, Address tab: This tab should only be completed if the original 1099 needs to be sentto an address other than the one on the Name, Address, Statement tab or the Master Account(by way of checkbox).Capital One Escrow ExpressGlossary of Terms 40

9.12.17

Complete the Primary Name and Address section using the following guidance: Name and Address Fields ax ID/SSN can also be entered for the first ax ID selection field can be used to select which name will receive the 1099. Country Select TES OF AMERICA. ype If address is located in the US, select TES ADDRESS. If the address is located outside the