Transcription

Cat Modeling & PricingSeminar on Reinsurance - PhiladelphiaJune 6, 2011

Antitrust Notice & Disclaimers The Casualty Actuarial Society is committed to adhering strictly to the letterand spirit of the antitrust laws. Seminars conducted under the auspices ofthe CAS are designed solely to provide a forum for the expression of variouspoints of view on topics described in the programs or agendas for suchmeetings. Under no circumstances shall CAS seminars be used as a means forcompeting companies or firms to reach any understanding – expressed orimplied – that restricts competition or in any way impairs the ability ofmembers to exercise independent business judgment regarding mattersaffecting competition. It is the responsibility of all seminar participants to be aware of antitrustregulations, to prevent any written or verbal discussions that appear to violatethese laws, and to adhere in every respect to the CAS antitrust compliancepolicy. All opinions are those of the speaker and not necessarily that of Swiss Re All examples are purely made up and don't represent real clients or Swiss RemethodsCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 2011

What is Catastrophe Modeling? Catastrophe modeling is the process of using computer-assistedcalculations to estimate losses that could be sustained by a portfolio ofproperties due to a catastrophic event such as a hurricane or earthquake. Modeled Nat Cat perils include– Hurricane (incl. storm surge)– Earthquake (incl. fire following and EQSL)– Tornado/Hail (including straight line winds)– Winterstorm– Flood– BrushfireCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 20113

Why Are Catastrophe Models Run? Management of Exposures– Control writings in regions– Scenario testing– Capital Costs– Probability of Ruin– Reinsurance Buying– Rating Agency Needs Ratemaking– Primary– ReinsuranceCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 20114

Choices of Models Main Vendors– RMS– AIR– EQE Broker Models Company Proprietary ModelsCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 20115

How Cat Models Work Exposures – Models start with the exposure distribution (geography,construction, occupancy, etc.). Hazard – Stochastic events are simulated against the exposures. Eachevent has an associated probability. Vulnerability – This is the amount of damage expected to result from anevent based on the exposure characteristics and event intensity. Financial Perspectives – Finally, varying perspectives of the loss aregenerated (application of primary insurance conditions and facultativeand treaty reinsurance).Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 20116

Terminology - Perils Storm Surge (SS) – Quickly rising ocean water levels associated withwindstorms that can cause widespread flooding. Measured as thedifference between the predicted astronomical tide and the actual heightof the tide when it arrives. Caused by the lower barometric pressureassociated with tropical or extra-tropical cyclones, and the action of thewind in piling up the surface of the water. The amount of surge dependson a storm's strength, the path it is following, and the contours of theocean and bay bottoms as well as the land that will be flooded. Tornado/Hail (TH) – Non hurricane wind eventsCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 20117

Terminology - Perils Earthquake Shake (EQ) – A sudden or abrupt movement along a fault orother pre-existing zone of weakness in response to accumulated stresses. Fire Following Earthquake (FFEQ ) – Hazard presented by fires whichcommonly occur following an earthquake, typically due to the rupture ofnatural gas lines or other structures carrying combustible materials. Earthquake Sprinkler Leakage (EQSL) – Direct damage to the building orcontents caused by the leakage or discharge of water or other substancesfrom an automatic sprinkler system due to earthquake or volcanic action.Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 20118

Terminology - Perils Demand surge/Loss amplification (DS) – Post event inflation.– Shortages of labor and materials cause prices to rise.– Supply/demand imbalances delay repairs resulting in structural deterioration.– Faced with the magnitude of the disaster and under pressure from politicians,insurers are encouraged to settle claims generously and to expand the terms ofcoverage beyond those strictly defined in contracts.Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 20119

Terminology - Financial PerspectivesGroundupGrosspolicy terms(Ded, SIR,limits, etc.)Layer Loss(Cat XL)inuringreinsurance(QS, SS, perrisk)Cat XSLayer 1Net PreCatCat XSLayer 2Note: Not allCat XS appliesafter inuringAfter allreinsuranceCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 2011Net Post Cat10Cat XSLayer 3

Terminology – Model Results Exceedance Probability (EP) - Also known as "exceeding probability" or"EP", it is the probability of exceeding specified loss thresholds. EP curve defines the probability of various levels of potential loss for adefined structure or portfolio of assets at risk of loss from natural hazards. By combining probabilities of occurrence with the loss levels of allpotential events, the probability of exceeding certain loss levels in a givenyear (return period loss) can be calculated.Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201111

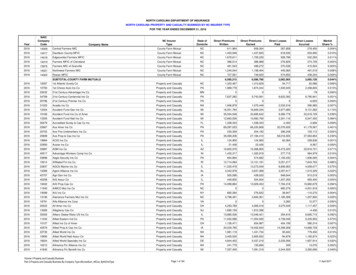

Terminology - Model 0.01%0.01%0.01% 119,579114,923110,707106,891103,167100,001 052Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 2011Exceedance ProbabilityEqiv 5543,12312

Terminology - Model Results Expected Annual Loss (Average Annual Loss or Pure Premium) – Sum ofall modeled event losses divided by the number of years modeled. This isthe annual premium required to cover the loss exposure over time. The expected annual loss cost rate load is a good index of relative riskbetween programs and accounts. Loss cost rate loads can be developedby dividing the expected annual loss by the sums insured per hundred.Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201113

Terminology - RMS Secondary Uncertainty - While primary uncertainty measures uncertaintyin the likelihood that a particular event occurs, secondary uncertaintyincorporates the distribution of potential loss amounts for the event. Inother words, it recognizes that when an event occurs, there is a range ofpossible loss values. The inclusion of secondary uncertainty producessmoother EP curves with longer tails; a longer tail on the curve indicates apositive probability that losses exceed a maximum event.Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201114

Terminology - RMS Risk Management Solutions (RMS) – Founded at Stanford University in1988, this company developed RiskLink. RiskLink (RL) – RMS catastrophe modeling tool with models for Hurricane,EQ, FFEQ, EQSL, TH, Brushfire, Winterstorm, and Terrorism. Aggregate Loss Module (ALM) – Version of RiskLink that works withaggregate input data, and is designed to support treaty reinsuranceunderwriting and other applications when detailed exposure data is notavailable.Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201115

Terminology - RMS Detailed Loss Module (DLM) - Version of RiskLink that works with detailedinput data, and is designed to support underwriting situations whendetailed exposure data is available. Exposure Data Model (EDM) – The RMS database structure for capturinginformation about property exposures such as location, values, andinsurance terms, for use in risk modeling. Results Data Model (RDM) – The RMS database structure for capturingloss estimates and other output data generated by RMS catastrophemodeling products. Includes by event losses for all financial perspectivesand perils analyzed.Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201116

Agenda Cat Terminology & Model Basics Cat Exposure Data Model Differences & Selection Model Adjustments Experience Rating SummaryCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201117

Common Data Formats EDM – detailed data in RiskLink format UNICEDE file – aggregated data in AIR format UNICEDE/2 file – aggregated data in AIR format UNICEDE/px (UPX)– detailed data in AIR format Raw detailed data– Format into model(s) you want to use– Format differs by client– Other formats start as raw dataCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201118

What is in an EDM? Exposure data contained in multiple files in EDM– Primary location details - address, construction, occupancy, year built, numberof stories, values by coverage– Secondary characteristics - Characteristics of a structure (other than theprimary details) that can be specified to differentiate vulnerability, such as yearof upgrade, soft story, setbacks and overhangs, torsion, and cladding.– Geocoding information - Latitude/Longitude, may be entered or generated byRiskLink based on address information.– Primary policy conditions (deductibles, limits )– Portfolios - A grouping of policies for purposes of risk analysis and riskmanagement. User can create portfolios based on policy information such asline of business or geographic region.– Reinsurance - facultative, per risk, quota share, surplus share, and cat.Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201119

UNICEDE File Includes state, county, and total values by line of business forhomeowners, mobile homes, commercial and auto.Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201120

UNICEDE/2 File Includes peril, line of business, coverages, average deductible, risk count,value and premiumUNICEDE/px Primary Data Exchange Format used by primary insurers to transferdetailed exposure formatted for use in AIR’s detailed model (CLASIC/2). Format used for all types of property insurance including commercial,residential, single-location, multi-location and excess insurance.Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201121

Raw Data – Basic Data Address – state, county, city, zip code, and street address Occupancy Construction Values by coverage - building, contents, time element Limits Deductibles Peril specific deductibles and/or sub-limits Year built Number of stories Not required, but good to have - secondary characteristicsCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201122

Raw Data – Data Prep Format– One row of data per risk if reported by coverage– Is it consistent with per risk definition of risk? Data complete?– Missing lines of business?– Missing states?– Missing perils?Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201123

Raw Data – Address Formatting - state, county, city, zip code, street address– Minimum of two address fields required– Reasonable (state codes vs. name/wrong column)– Check for billing vs. location address information Why important?– As in real estate – location, location, location– Street level most important for earthquake and hurricane storm surge Assumptions– Generally cannot make assumptionsCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201124

Raw Data – Occupancy Formatting– Map client codes/description– Default unknown or not reported Why important?– Single most important risk characteristic for damage calculation Assumptions– Personal lines easily defaulted to either single or multiple family– Commercial damageability differs greatly by occupancy– May overstate or understate damageCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201125

Raw Data – Construction Formatting– Map client codes/description– Default unknown or not reported Why important?– Important characteristic for damage calculation– Very important for mobile homes Assumptions– If all or many risks reported as unknown, underwriting judgment used toassume most likely assumption– May overstate or understate damageCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201126

Raw Data – Values Formatting– Many clients report limits by coverage not values– BOP risks generally reported without time element Why important?– Starting point for damage calculation Assumptions– Damage will be understated if limits are run as values and ITV is less than100%– Use ITV by line of business to convert limits to values if only limits are reported– Often default time element value for BOP as % of building and/or contentsvaluesCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201127

Raw Data – Limits Formatting– Correctly apply at coverage, site, or policy level as applicable Why important?– Used to calculate insured loss from damage Assumptions– Improperly applied limits can result in understated or overstated insured lossCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201128

Raw Data – Deductibles Formatting– Correctly apply at coverage, site, or policy level as applicable– May be dollar amounts or percentages Why important?– Used to calculate insured loss from damage Assumptions– Improperly applied deductibles will result in understated or overstated insuredlossCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201129

Raw Data – Peril Specific Conditions Formatting– CA mini policy structure– Confirm whether or not wind deductibles and limits apply to tornado/hail aswell as hurricane Why important?– Used to calculate insured loss from damage Assumptions– Missing or improperly applied limits/deductibles will result in understated oroverstated insured lossCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201130

Raw Data – Year Built Formatting– Reported for all risks?– Format reported year built to “01/01/YYYY”– If unknown, appears as 12/31/9999 Why important?– Important characteristic for damage calculation– Vulnerability curves reflect building codes in force when built Assumptions– Generally difficult to make assumptions if data is not providedCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201131

Raw Data – Number of Stories Formatting– Reported for all risks?– Reasonable against construction? Why important?– Affects damage calculation Assumptions– Generally difficult to make assumptionsCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201132

Raw Data – Secondary Characteristics Formatting– Reported for all risks?– Reported only for better than average? Why important?– Affects damage calculation Assumptions– Generally difficult to make assumptions– Use with cautionCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201133

Agenda Cat Terminology & Model Basics Cat Exposure Data Model Differences & Selection Model Adjustments Experience Rating SummaryCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201134

Model Differences Models differ because of the different methodologies utilized as well asdifferent views on perils and vulnerability. Source of differences– Geocoding– Hazard– Vulnerability– Application of insuranceCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201135

Choice of Models Models differ because of the different methodologies utilized as well asdifferent views on perils and vulnerability. Options can include– Use one model exclusively– Use one model by “territory”– Use multiple models for each accountCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201136

Choice of Models – Option # 1Use One Model Exclusively Benefits–––––Simplify process for each dealConsistency of ratingLower cost of licenseAccumulation easierRunning one model for each deal involves less time Drawbacks– Can’t see differences by deal and in general– Conversion of data to your model formatCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201137

Choice of Models – Option # 2Use One Model by "Territory" Detailed review of each Model By “Territory”Territory examples (EU wind, CA EQ, FL wind)Select adjustment factors for the chosen modelBenefits––––Simplify process for each dealConsistency of ratingAccumulation easierRunning one model involves less time Drawbacks– Can’t see differences by deal– Conversion of data to your model formatCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201138

Choice of Models – Option #2Use One Model By “Territory” – a fictitious exampleWeightsZoneCA EQJapan EQFL WSThis reinsurer Euro Windhappened tolike the RMSFactorsshape for FLWS, butwanted anZone20%CA EQadjustment to Japan EQFL WSfrequencyEuro 80%90%150%RMS150%120%120%80%EQE130%125%50%110%Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 2011averagerelativity todesiredblend39

Choice of Models – Option #3Use Multiple Models Benefits– Can see differences by deal and in general Drawbacks––––––Consistency of rating?Conversion of data to each model formatSimplify process for each dealHigh cost of licensesAccumulation difficultRunning one model for each deal is time consumingCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201140

Agenda Cat Terminology & Model Basics Cat Exposure Data Model Differences & Selection Model Adjustments Experience Rating SummaryCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201141

Model Adjustment – Climate PredictionDespite impressive science, the individual season predictions, the lastseveral years was off the mark.Named StormsHurricanesMajor 20101584However, actual and forecast are both above average in total relative to longterm averages, but consistent with the last 16 yearsCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201142

Nat Cat Costing – Adjustments Growth– exposures are typically "yesterday's" exposures– need to adjust to prospective treaty period– occasionally need to adjust for less "organic" changes ALAE – reflective of cat specific ALAE missing from model Pools and Fair Plans – reflect treaty wording Historical miss – compare actual hurricane losses to modeled returnperiod losses or modeled footprint Data Quality – blanket load for non-corrected elementsCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201143

Nat Cat Costing – Adjustments If not included in Model results– Storm Surge– Post event demand surge – cost of labor and materials rises after major event– Pre event demand surge – prior event in general area already lead to increasesin costs– EQ Fire Following– EQ Sprinkler Leakage "Unmodeled" ExposuresCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201144

Nat Cat Costing – "Unmodeled" Perils Tornado/Hail Winter Storm Wildfire Flood Terrorism Fire Following OtherCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201145

Nat Cat Costing – Tornado/HailTornado Hail National writers may not to include all TH exposuresModels are improving, but not quite there yetSignificant exposure– Frequency: TX– Severity: 5 of top 20 US all time (untrended) Methodology– Experience and exposure rate– Compare to peer companies with more data– Determine use of longer term or shorter term averages– Weight methods– Percentile Matching with modelCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201146

Nat Cat Costing – "Unmodeled" PerilsWinter storm Not insignificant peril in some areas, esp. low layers– Several 1B industry events or cluster of events in last 20 years– separating occurrences in a cluster?– Possible Understatement of PCS data Methodology–––––Degree considered in modelsEvaluate past event return period(s)Adjust loss for today’s exposureFit curve to eventsAggregate Cover?Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201147

Nat Cat Costing – "Unmodeled" PerilsWildfireNot just CAOakland Fires: 1.7B untrendedAustin "It Could Happen Tomorrow"2003, 2007 Fires: multiple occurrences?Development of land should increasefreq/severity Two main loss drivers– Brush clearance – mandated by code– Roof type (wood shake vs. tiled) Methodology– Degree considered in models– Evaluate past event return period(s), if possible– Incorporate Risk management, esp. changes– No loss history - not necessarily no exposure Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201148

Nat Cat Costing – "Unmodeled" PerilsFlood Less frequent Development of land should increase frequency Methodology– Degree considered in models– Evaluate past event return period(s),if possible– No loss history – not necessarily no exposureTerrorism Modeled by vendor model? Scope? Adjustments needed– Take-up rate – current/future– Post TRIA extension issues– Other – depends on dataCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201149

Nat Cat Costing – "Unmodeled" PerilsOther Perils Expected the unexpectedExamples: Blackout caused unexpected lossesMethodology– Blanket load– Exclusions, Named Perils in contract– Develop default loads/methodology for an complete list of perilsCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201150

Agenda Cat Terminology & Model Basics Cat Exposure Data Model Differences & Selection Model Adjustments Experience Rating SummaryCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201151

Experience Rating Overview Similar to normal experience rating from earlier sessions today Main Difference – Need to adjust for volume (150 houses will give 50%more loss than 100 houses) May need to adjust for geographical, policies changes, etc. (winddeductible) Adjustments in examples herein assume organic growth of the samegeneral exposures (overly simplistic for many carriers) Important for low layer catastrophe layers, aggregate XS and pro rataCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201152

Experience Rating ExampleExperience Approach #1Excess Cat Load Analysis - longer 03,9504,2304,4104,8505,000Trended &Dev rage (90-10)Industry 40 yr Avg XS WindIndustry 21 yr Avg XS WindLong term/Short TermSelected adjustmentSelected Experience LoadVol AdjLoss2,5003,12515,000 jected2,13780,000100,00080%90% (partially wighting in old years)1710 1,158*90%Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 2011Trended exposure EarnedHouse Years, Onlevel EP,Onlevel TIV,Analyst chose to rely 50/50on 21 years andextrapolated 40 yearexperience53

Experience Rating ExampleExperience Approach #2Excess Cat Load Analysis - Shorter 03,9504,2304,4104,8505,000Trended &Dev Loss5001,0006,0003,0002,0003,5005,0003,0002,500Vol 577Average (90-10)Weighted Avg2,1372,483Selected Experience 0%100%100%100%100%ProjectedCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 2011Analyst chose to rely moreheavily on recentexperience due to changesat company and/or weatherpatterns54

Experience Rating ExampleExperience Approach #3Excess Cat Load Analysis - 10 03,9504,2304,4104,8505,000Trended &Dev Loss5001,0006,0003,0002,0003,5005,0003,0002,500Vol 577Average (90-10)Weighted Avg2,1372,426Selected Experience %100%ProjectedCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 2011Analyst chose to rely on 10year experience as olderyears less reliable due tolack of faith in adjustments,changes in company,weather.55

Experience Rating FittingExperience Approach AlternativePercentile 002,5003,2003,8004,8006,2007,5009,00013,000Cat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 2011Used a vendor modelsshape of curve asreasonable, but usedexperience as basis foradjustmentFirst, fit curve to experiencehe trusted then adjustedvendor model56

Agenda Cat Terminology & Model Basics Cat Exposure Data Model Differences & Selection Model Adjustments Experience Rating SummaryCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201157

Summary Data – Garbage in, garbage out Data – understand assumptions used in populating Models – understand limitations and biases Experience Rating – a powerful tool Actuaries can provide valuable insight and judgment Expect the "unexpected" Use Judgment – Don't be a fool to the toolCat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201158

Wrap UpQ&ACat Modeling & Pricing Sean Devlin CAS Seminar on Reinsurance June 6, 201159

Catastrophe modeling is the process of using computer-assisted calculations to estimate losses that could be sustained by a portfolio of properties due to a catastrophic event such as a hurricane or earthquake. Modeled Nat Cat perils include - Hurricane (incl. storm surge) - Earthquake (incl. fire following and EQSL)