Transcription

ENROLLMENT GUIDEPERAPlus 401(k) PlanCreate your Plan for the future.

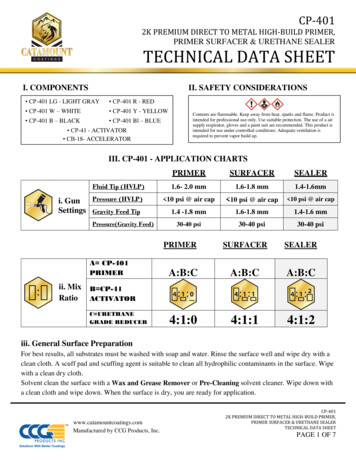

Today most financial experts agree that you will need approximately80 percent of your income to maintain your current way of life in retirement.And while your PERA defined benefit or DC Plan will contribute to thatamount, you may want additional savings.That’s where the PERAPlus 401(k) Plan comes into play. The PERAPlus 401(k) Plan,a voluntary retirement savings program offered through Colorado PERA, can helpyou create your plan for the future.Enroll Today! Go to www.copera.org, click on “401(k), 457, and DC Plan Information,” and select “Enroll in the401(k) Plan Online” to enroll Complete the 401(k) Contribution Authorization Form and return it to your employer’s payrolloffice to start contributing to the Plan. A copy of the form is also included in this Enrollment GuideYou’ll need to decide how to invest your contributions. Your elections must total 100 percent inwhole percentages or whole dollar increments. If you do not make an investment election, your firstcontribution will be invested in a Target Retirement Date Fund based on your date of birth and anexpected retirement at age 65. You can change your investment election(s) online by logging on to youraccount through www.copera.org or by calling 1-800-759-7372 and selecting the PERAPlus option.** You will need your PERA Personal Identification Number (PIN), which will be mailed to you by PERA afterreceipt of your first contribution. Your PERA PIN will allow you to access all of your PERA accounts. If youalready have a PERA PIN and have forgotten it, call PERA’s Customer Service Center to have it mailed toyou. You will use your PERA PIN to create a User ID and password.Who Can Enroll in the Plan? All employees working for a PERA-affiliated employer Retirees who have returned to work for PERA-affiliated employers Retirees and inactive members who would like to roll money into the Plan2Choose Your BeneficiaryPlan Web SiteWhen you enroll, be sure to choose a beneficiaryThe PERAPlus 401(k) Plan Web site is accessible throughof your PERAPlus 401(k) Plan—someone whowww.copera.org by clicking on the “401(k), 457, and DCwill receive your account in the event of yourPlan Information” link. Or, you can log in to your account ondeath. A 401(k) Beneficiary Designation Form iswww.copera.org with your PERA PIN/User ID and passwordincluded in this Enrollment Guide.and then select “PERAPlus 401(k) Account Access.”

Plan FeaturesPre-tax ContributionsYou may save 100 percent of your eligiblecompensation, subject to the annual IRS maximumcontribution limits. Contributions will be automaticallydeducted from your paycheck. If you need helpdetermining how much to save, you can usethe retirement planning calculators onlineat www.copera.org.Investment AdviceThrough the Plan, you can access investment adviceat no additional cost through ING’s Personal OnlineAdvisor, which offers a step-by-step action plan thatFor detailed informationabout the PERAPlus401(k) Plan, please reviewPERA’s 401(k) and DefinedContribution Plan and TrustDocument, available bycalling PERA.Catch-up Contributionsshows which investments to choose and how muchIf you are age 50 or older and contributing theto invest in each one. Or, for a fee (about 5.00 amaximum amount allowable to the Plan, you maymonth for every 10,000 in your account), you cancontribute an additional catch-up contribution,choose to have a Professional Account Managerup to the annual IRS limit.create and monitor a personalized plan for you. Formore information, call 1-800-759-7372 and select theMatching ContributionsYour employer may choose to match a percentage ofPERAPlus option or access the Plan Web site throughwww.copera.org and click the ”ING Advisor Service”link.the amount you contribute to the Plan (not to exceeda yearly IRS total contribution maximum). Contactyour employer to see if your employer providesmatching contributions.VestingYou’re always 100 percent vested in your entireaccount balance.Employer ContributionsYour employer may make discretionary contributionson your behalf. Contact your employer for moreinformation.Purchasing Service CreditYou may use your PERAPlus 401(k) contributions topurchase eligible service credit or purchase servicecredit based on a previously refunded account.For more information, review the Purchasing ServiceCredit booklet (available from PERA) or call1-800-759-7372 (do not select the PERAPlus option).This guide contains general information about the PERAPlus 401(k) Plan. Your rights, benefits, and obligations as a 401(k) Plan participant are governed byTitle 24, Article 51 of the Colorado Revised Statutes, the Rules of the Colorado Public Employees’ Retirement Association, and PERA’s 401(k) and DefinedContribution Plan and Trust Document, which take precedence over any interpretations in this guide.PERAPlus 401(k) Planwww.copera.org1-800-759-73723

Benefits of Saving With the PERAPlus ProgramGet an Immediate Tax AdvantageWhen you invest in the PERAPlus 401(k) Plan,your contributions are deducted fromKeep More ofWhat You EarnSavingWith aTaxableAccountfor federal income taxes is lower.Annual salary 25,000 25,000The example (at right) shows that if anPre-tax savings (6%) 0- 1,500individual earning 25,000 annually investsSalary less pre-tax savings 25,000 23,500 1,500 in a tax-deferred savings accountPersonal exemption- 3,900- 3,900Standard deduction- 6,100- 6,100pay compared to what he or she would haveAdjusted gross salary 15,000 13,500received if the same 1,500 were investedFederal income tax (15%) 2,250 2,025Net take-home pay 22,750 21,475Regular savings- 1,500 0Annual net take-home pay 21,250 21,475your paycheck before income taxes are takenout. This means your taxable income is lower,so the amount deducted from your paychecklike the PERAPlus 401(k) Plan, he or she willbenefit from a 225 increase in take-homein a taxable savings account.This illustration is hypothetical and for demonstrationpurposes only. Assumes an annual salary of 25,000 and anincome tax rate of 15 percent. It is not indicative ofany investment. The examples above do not constitutespecific tax or investment advice.Tax-deferred makes the difference.SavingWith aTax-DeferredAccount 225Tax-Deferred Compounding Helps You Save Even MorePERAPlus 401(k) Plan earnings grow tax-deferred and compound over time until you receive the money from thePlan. This means that your account balance grows much faster because all of your earnings are reinvested withoutbeing reduced by current income taxes.The chart below offers a hypothetical example of how tax-deferred compounding can make your savings grow faster.Assumptions: 200 monthlyinvestment in a taxable versustax-deferred account earning a6 percent return and an incometax rate of 25 percent. This is anexample and is not intended toguarantee an actual rate of return.Actual returns may be more or less,depending on your investments.45 years10 years15 years20 years25 years30 yearsTaxable account value 13,429 30,240 51,283 77,625 110,600 151,877Tax-deferred account value 13,954 32,776 58,164 92,408 138,599 200,903 525 2,536 6,881 14,783 27,999 49,026Difference

5The following chart highlights the differences among the three types of tax-deferred plans that may be availableto you. Annual rates of return, administrative and investment expenses, and surrender fees also are importantvariables that you should compare.Remember that it is often difficultto discern what fees are being chargedin different plans. Very often, it’s not an“apples–to–apples” comparison. You needto determine what management fee eachfund is charging (usually representedas basis points, or as a percentage of thetotal amount of money you have inthat fund), in addition to the monthlyadministrative fees charged by thePlan. These fees are assessed monthly,so you’ll have to review the bottom lineto determine your total cost.COMPAREPERAPlus 401(k)MaximumContributionLesser of the annual IRS limit or 100% of gross salary, minus PERA contributionsLoan ProvisionsYes, up to two at any timeYes, up to two at any timeMay be possible; checkwith 403(b) administratorActive ServiceWithdrawalFinancial hardshipor after age 59½Unforeseeable emergencyor after age 70½Financial hardshipor after age 59½RolloverProvisionsTo 401(a) plans, other 401(k) plans, 403(b) plans, 457 plans, and to IRAsPERAPlus 457403(b)Tax on Distributions As ordinary incomePenalty on EarlyWithdrawalsYes, unless rolled over orretiring at age 55 or olderNoYes, unless rolled over orretiring at age 55 or olderCommission,Load, Surrender,or Payout FeesNoneNoneMay be possible; checkwith 403(b) administratorCatch-UpYesPurchaseService CreditYesYesMay be possible, askabout surrender feesBenefit From Investing RegularlySaving Early Pays OffMaking regular contributions to the PERAPlus 401(k)Saving with the PERAPlus 401(k) Plan is onePlan allows you to take advantage of a strategy calledof the best ways to take advantage of both pre-taxdollar-cost averaging. You buy shares of a fund bycontributions and tax-deferred growth. The longerinvesting the same amount of money on a regularyou have to save, the more time your money willschedule, regardless of the market price of thehave to grow. Saving early lets you take advantageinvestment. Dollar-cost averaging allows you toof compounding, as illustrated in the chart below.buy more shares when the price is lowerand fewer shares when the price is 93,316higher. The result is a potentially loweraverage cost per share compared to a 67,629lump-sum investment. 30,000 12,000Assumptions: Each individual makes a 100 monthly contribution earning 6 percentannually compounded return. This is an example and is not intended to guarantee an actualrate of return. Actual returns may be more or less, depending on your investments.Julie starts saving at age25 and stops saving at 35.She contributes for 10 years.Total ContributionsPERAPlus 401(k) PlanMichael starts saving at age40 and stops saving at 65.He contributes for 25 years.Approximate Value at Age 65www.copera.org1-800-759-73725

PERAdvantage Investment OptionsThrough the PERAPlus 401(k)Pick a PathPlan, you have access to thePERAdvantage investment options allow you to select your investments by choosingfollowing PERAdvantageinvestment options.Primary investment options PERAdvantage Target Retirement Date Funds:PERAdvantage Income, 2015, 2020, 2025,2030, 2035, 2040, 2045, 2050, 2055 PERAdvantage Capital Preservation Fundone of the two paths below that best describe your level of investment knowledge.I am not sure how to invest.If you feel like you don’t have the time or knowledge to make investment decisions,consider this option.Choose a Target Retirement Date Fund. You can make one investment decisionby choosing one fund, based on your expected retirement date and date of birth(see chart below). Target Retirement Date funds are designed to automaticallygrow more conservative as you reach your retirement date.FundDate of Birth RangePERAdvantage Income FundDecember 31, 1947 or earlierPERAdvantage 2015 FundJanuary 1, 1948 – December 31, 1952PERAdvantage 2020 FundJanuary 1, 1953 – December 31, 1957PERAdvantage 2025 FundJanuary 1, 1958 – December 31, 1962PERAdvantage 2030 FundJanuary 1, 1963 – December 31, 1967PERAdvantage 2035 FundJanuary 1, 1968 – December 31, 1972PERAdvantage 2040 FundJanuary 1, 1973 – December 31, 1977PERAdvantage 2045 FundJanuary 1, 1978 – December 31, 1982PERAdvantage 2050 FundJanuary 1, 1983 – December 31, 1987Additional investment optionsPERAdvantage 2055 FundJanuary 1, 1988 or later PERAdvantage SRI FundFor an additional fee, ING’s Professional Account Management program can providea personalized savings and investment plan, implement your plan, monitor yourplan, and make ongoing changes to keep you on track. For more information, call1-800-759-7372, select the PERAPlus option, and ask to speak with an ING Advisor. PERAdvantage Fixed Income Fund PERAdvantage Real Return Fund PERAdvantage U.S. Large Cap Stock Fund PERAdvantage International Stock Fund PERAdvantage U.S. Small andMid Cap Stock Fund Self-Directed Brokerage AccountIf you do not choose how you wantyour contributions to be invested,your money will be placed in thePERAdvantage Target RetirementDate Fund based on your date of birthand expected retirement at age 65 asdescribed in the table to the right.I am comfortable making my own investment decisions.If you have the time and knowledge to learn about your investment options and wantto be responsible for making investment changes, consider these options.Choose a Mix of Primary Investments with Available Advice. You choose whichPERAdvantage investment options you’d like to invest in and what percentageof your contributions to invest in each. If you need help deciding what assetallocation is right for you, online investment advice through Personal Online Advisoris available at no additional cost.See Investment FundDetails on pages 11–13.Choose Additional Investment Options. You may also invest in an SRI fund thatscreens for various social causes. A Self-Directed Brokerage Account is available foran additional fee.6

uthorizationFormFormCOLORADOCOLORADOPERA 72www.copera.orgwww.copera.orgDO NOTDOSENDSENDTHISTHISFORMTO INGTOTOINGORINGPERAOR ORPERADO lloffice;makecopiesanyotheremployerswillbe deducting401(k)contributions.DeliverDeliverthis thisformformto piescopiesfor anyfor lbe ributions.PARTICIPANTINFORMATIONPA y AddressHomeHomeAddressAddressCityCity umberNumber( () ))E-mailAddressE-mailE-mailAddressAddressStateZIP Code ZIP CodeStateStateZIP CodeI requestI requesta PERAPlusaa tioncontributionof eitherof ofeither%%or or (whole(wholepercentagespercentagesor wholeor ither%or uctedbeonly)deductedmy mypay.pay.or wholedollarstofrombefromdeductedfrom my 0percenttestcompensationor mustmustnot notexceedthe thelesserof 100ofof100percentpercentof IRSof oftestIRSIRStestcompensationcompensationor theor theannualannualIRSlimitIRS limit(seelimit(seethe thePlanWebWebsite),site),plusplusany .site),pluscatch-upanyallowedcatch-up ONSignaturSignature of eParticipantofSignatureof ParticipantParticipantDateDateDate

COLORADO PERA401(k) Plan Beneficiary Designation Form401(k)PlanINGAttn: Colorado PERA 401(k) PlanPO Box 23219Jacksonville, FL 32241-3219Fax: cipant NameLastFirstDate of BirthM.I.Mailing AddressStreet, Route, or Box NumberCityStateZIP Code)Home Telephone Number (E-mail AddressEmployer NameEmployer Mailing AddressStreet, Route, or Box NumberCityStateZIP Code()Work Telephone NumberBeneficiaryInformationYour designation can only be changed by you. Your divorce, annulment or any dissolution or declaration of invalidity of yourmarriage SHALL NOT revoke the beneficiary named below as your designated beneficiary unless you revoke the designation bysubmitting a new form. Colorado Revised Statute § 15-11-804 does not act to revoke a spouse’s designation as a beneficiary.To change your existing beneficiary information, please fill in the name and relationship of the individuals you would like todesignate as your future beneficiaries. A primary beneficiary is the person who is your first choice to receive your 401(k) Planbenefits if you should die. A contingent beneficiary is the person who would receive your 401(k) Plan benefits if your primarybeneficiary should die prior to your death. You may name one or more primary and contingent beneficiaries. Your contingentbeneficiaries will not receive benefits unless all of your primary beneficiaries predecease you.Name of Primary BeneficiaryRelationshipSocial Security NumberDate of Birth% PayableRelationshipSocial Security NumberDate of Birth% Payable(Total 100%)Name of Contingent Beneficiary(Total 100%)AuthorizationThe execution of this form and delivery thereof to ING for the Colorado PERA 401(k) Plan revokes all prior designations thatI have made.Signature of Participant14-2 (REV 4-13)04/09/2013DatePlease return your completed form to: INGAttn: Colorado PERA 401(k) PlanPO Box 23219Jacksonville, FL 32241-3219CO650301BENEMAN

For current information on thesefunds, including the objective,investment strategy, quarterlyreturns, risks, and underlyinginvestment managers, accessInvestment Fund Detailsthe Plan Web site throughwww.copera.org.PERAdvantage Target Retirement Date Funds: PERAdvantage Income,2015, 2020, 2025, 2030, 2035, 2040, 2045, 2050, and 2055 fundsPassive100%Each fund is 100 percent comprised of the corresponding BlackRock LifePath Index TargetRetirement Date Fund. These funds grow more conservative as they reach their target retirementdate. The funds provide a diverse mix of quality index-based commingled trust funds assembled toprovide exposure to U.S. large cap equities; U.S. small and mid cap equities; international equities;global real estate; commodities; U.S. inflation-linked bonds; U.S. bonds; and money market.Benchmarks: Custom blends for each fund weighted in proportion to the fund mix. The followingindices may be included: Russell 1000 Index, Russell 2000 Index, MSCI ACWI es-U.S. IMI Index,Barclays Capital U.S. Aggregate Bond Index, Barclays Capital U.S. TIPS Index, FTSE ESPRA/NAREITDeveloped Index, Citigroup 3 Month T-Bill Index, and Dow Jones-UBS Commodity IndexPERAdvantage Capital Preservation FundStable Value100%Assets in this fund are 100 percent invested in a Great-West Stable Value Fund.Benchmark: Hueler Stable Value IndexPERAdvantage Fixed Income FundAssets in this fund are automatically invested in two different categories: passive and core plus.PassiveCore PlusBlackRock U.S. Debt Index FundPIMCO Total Return FundPassive25%Core Plus75%TIPS30%RealReturn70%Benchmark: Barclays Capital Aggregate Bond IndexPERAdvantage Real Return FundAssets in this fund are automatically invested in two different categories:TIPS (Treasury Inflation-Protected Securities) and real return.TIPSReal ReturnSSgA U.S. Inflation Protected Bond Index FundSSgA Real Assets FundBenchmark: 30 percent Barclays Capital U.S. TIPS Index and 70 percent composite of the followingindices: DJ-UBS Roll Select Commodity Index, Barclays Capital U.S. TIPS Index, Dow Jones U.S.Select REIT Index, S&P Global LargeMidCap Commodity and Resource IndexPERAPlus 401(k) Planwww.copera.org1-800-759-737211

Investment Fund Details (continued)PERAdvantage U.S. Large Cap Stock FundAssets in this fund are automatically invested in four different categories: passive, value, core, and growth.PassivePERA Russell1000 IndexPortfolioValueLSV Asset ManagementU.S. Large Cap ValueEquity PortfolioCorePERA Growth &Income PortfolioGrowthWinslow CapitalManagement Large CapGrowth PortfolioPassive50%Core20%Growth15%Benchmark: Russell 1000 IndexPERAdvantage International Stock FundAssets in this fund are automatically invested in three different categories: passive, value, and growth.PassiveBlackRock MSCI ACWIex-U.S. IMI Index FundValueDodge & Cox InternationalStock FundBenchmark: MSCI ACWI ex-U.S. Index12GrowthHarding LoevnerInternational EquityStrategy PortfolioValue15%Passive30%Value35%Growth35%

PERAdvantage U.S. Small and Mid Cap Stock FundAssets in this fund are automatically invested in three different categories: passive, value, and growth.PassiveBlackRock Russell 2500 Index FundValueDimensional Fund AdvisorsU.S. Targeted Value FundPassive30%GrowthTimesSquare Small/MidCap Growth PortfolioGrowth35%Benchmark: Russell 2500 IndexPERAdvantage SRI FundGovernment/Agency Bonds40%Assets in this fund are automatically invested in two different categories: Government/agency bonds andpassive stocks.Passive StocksNorthern Funds GlobalSustainability Index FundValue35%Passive Stocks60%Government/Agency BondsJPMorgan GovernmentBond FundBenchmark: 60 percent MSCI World ESG Index, 40 percent Barclays Capital Government IndexSelf-Directed Brokerage AccountYou can choose investments beyond the primary funds using a Self-Directed Brokerage Account with TD Ameritrade. You must transfer 1,000or more to open a Self-Directed Brokerage Account and must keep at least 500 invested in the primary PERAdvantage funds. Money in theprimary funds will be used to pay the annual 50 Self-Directed Brokerage fee and the 0.06 percent annual Plan administration asset-based feeon the balance in your brokerage account. You will also be subject to additional transaction and management fees for your activities andinvestments in the brokerage account. For more information or to open an account, call 1-800-759-7372 and select the PERAPlus option.PERAPlus 401(k) Planwww.copera.org1-800-759-737213

Managing Your AccountTransactions and InformationMost transactions and information requests can be made by loggingon to your account at www.copera.org and selecting “401(k)Account Access” or by calling 1-800-759-7372 and selecting thePERAPlus option.To access your account information or make transactions, youwill need your PERA PIN/User ID and password. You will receive yourPERA PIN from PERA after your first contribution is received. You willuse your PERA PIN to create a User ID and password.If you prefer to speak with a Participant Service Representative,call 1-800-759-7372 and select the PERAPlus option weekdaysfrom 6:00 a.m. to 6:00 p.m. (Mountain time), excluding New YorkStock Exchange holidays. You must have your PERA PIN to accessaccount information from a Participant Service Representative.Changing Your Contribution AmountTo change your contribution amount, contact your employer.Changes are usually effective for the following payroll period.Transferring Money AmongInvestment Options Move money between investment options or across all investmentoptions (reallocate your balances) online or over the phone Transfers may be made in 1 dollar or 1 percent increments You cannot transfer money from one investment option to anotherand back to the original option in the same day14Rolling Over Money From a FormerEmployer’s Retirement PlanYou can transfer, or roll over, money from a former employer’sretirement plan to your PERAPlus 401(k) Plan. You can also rollmoney from an Individual Retirement Account (IRA) to your Planaccount, provided that the entire balance in the IRA is attributableto pre-tax contributions and earnings.Retirees and Inactive MembersRetirees and inactive members who were not previously enrolled inthe PERAPlus 401(k) Plan are allowed to roll money from anotherqualified plan into the PERAPlus 401(k) Plan.To Roll Over Money: Contact your previous employer to request a direct rollover; therollover check must be made out to: PERAPlus 401(k) Plan, for thebenefit of (your name) Complete a 401(k) Plan Rollover Form available on the Plan Web siteor by calling 1-800-759-7372 (select the PERAPlus option) and send itwith your rollover check to the address indicated on the formQuarterly Account StatementsEach quarter you will receive a statement that summarizes youraccount status, including total account balance, investmentselections, and the current value of each investment. Statementsare also available online.

FeesLoansThe PERAPlus 401(k)/457 and PERA DC Plans charge an administrativeIf you take a loan from your PERAPlus 401(k) Plan account, you will payflat fee of 1.00 per month to all participants. If you participate ina 75 non-refundable loan application fee for each loan. The interestmultiple plans, you will pay 1.00 per month for each plan.rate for loans is the prime rate as quoted in The Wall Street Journal inTo ensure that administrative costs are equitable among all Planeffect at the time you apply for the loan, plus 1 percent.participants, participants will also pay a Plan administration assetbased fee of 0.14 percent on each PERAdvantage fund. That fee isautomatically built into the total asset-based fee you see in the chartbelow. Fees are deducted from the investment option’s rate of return.There are no other shareholder-type fees that apply.Professional Account ManagerIf you enroll in ING’s Professional Account Manager program, you willpay a fee of approximately 5 per month for every 10,000 in youraccount. Fees are proportionately lower for accounts with balancesover 50,000.Revenue SharingThe PERAdvantage International Stock Fund and PERAdvantageFunds from revenue sharing, Plan administrationSRI Fund utilize revenue sharing. This is used to reduce the Planasset-based fees, and Plan administration flat feesadministration asset-based fee by the amount of suchare used by PERA for Plan expenses including Planrevenue sharing.recordkeeping, custodial services, consulting, andinternal PERA administrative expenses.Self-Directed Brokerage AccountIf you have a Self-Directed Brokerage Account, you will pay an annualA complete fee schedule is available on the Plan 50 Self-Directed Brokerage fee and a 0.06 percent annual PlanWeb site accessible through www.copera.org. Feesadministration asset-based fee on the balance in your brokerageand expenses are only one of several factors thataccount. Additional trading fees charged by TD Ameritrade may apply.participants should consider when making investmentdecisions. The cumulative effect of fees and expensescan substantially reduce the growth of a participant’saccount. Fees are subject to change at any time.Total Asset-Based FeeFundPercentagePer 1,000PERAdvantage Capital Preservation Fund0.35% 3.50PERAdvantage Fixed Income Fund0.50% 5.00PERAdvantage Real Return Fund0.32% 3.20PERAdvantage U.S. Large Cap Stock Fund0.36% 3.60PERAdvantage International Stock Fund0.61% 6.10PERAdvantage U.S. Small and Mid Cap Stock Fund0.56% 5.60PERAdvantage SRI Fund0.38% 3.80PERAdvantage Target Retirement Date Funds0.26% 2.60For current information on the investment fees, access the Plan Web site through www.copera.org. Fees are subject to change at any time.PERAPlus 401(k) Planwww.copera.org1-800-759-737215

Accessing Money From Your AccountAlthough the primary function of your PERAPlus 401(k) Plan is saving foryour retirement, we understand there are times you may need access toyour money.Distribution Options for Active EmployeesAge 59½ Withdrawals*Financial Hardship Withdrawals** If you are age 59½ or older, you may beginYou may be able to withdraw money from yourtaking withdrawals from your account Withdrawals are not subject to the 10 percentfederal early withdrawal penalty tax; however,withdrawals may be subject to 20 percent federaltax withholding unless the funds are rolled over toanother qualified plan or IRAPartial withdrawals canbe taken by participantswho are retired ordisabled, or who haveterminated PERA-coveredemployment. There isno minimum withdrawalamount. You must first withdraw after-tax and rolloveraccount balancesAfter-Tax Withdrawals* Taken from your after-tax money Call 1-800-759-7372 and select the PERAPlusoption to request this type of paymentPERAPlus 401(k) Plan for the following circumstances: To purchase your primary residence To prevent eviction from or foreclosure onyour primary residence For tuition expenses For non-reimbursed medical expenses For funeral expenses For expenses for repair of damage to your principalresidence that would qualify as deductiblecasualty expensesDocumentation of financial hardship must beprovided. The amount withdrawn cannot exceed theRollover Withdrawals*amount needed to satisfy the emergency plus any Taken from your rollover accountfederal and state income taxes and penalties. You You must first withdraw after-tax accountbalancesmust exhaust all your loan options before applyingfor a hardship withdrawal. Contributions to the Planmust be suspended for six months after processingyour request.* Withdrawals from the Plan may be subject to 20 percent federal tax withholding. Ordinary income taxes may apply and, if you are younger than age 59½, a10 percent early withdrawal penalty may also apply.** Hardship withdrawals are subject to voluntary tax withholding on the distribution. However, ordinary income tax will apply. State and local taxes may alsoapply. For the specific tax consequences of your withdrawal, please consult your tax adviser.16

You can elect to have your lump-sum distributionrolled over to a qualified plan, 403(b) plan,457 plan, or IRA (if the plan accepts rollovermoney from other plans). If you elect a directrollover, you will not owe federal income taxeson your distribution in the year it is paid.Distribution Options for Terminated EmployeesWhen you leave PERA-covered employment, youhave the following choices regarding the money inyour Plan account: Leave the money in the Plan (you must startdistributions once you reach age 70½) Request installment payments Roll over the balance to another qualified plan,403(b), governmental 457 plan, or IRA Take the money in cash, called a lump-sumdistributionTax ConsiderationsAny money withdrawn from your PERAPlus 401(k)Plan account is subject to ordinary federal and stateincome tax and is subject to a federal 10 percentearly withdrawal tax penalty if you withdraw itbefore age 59½. The tax penalty may not apply ifyou separate from PERA-covered employment (youend emp

PERA's 401(k) and Defined Contribution Plan and Trust Document, available by calling PERA. Plan Features PERAPlus 401(k) Plan www.copera.org 1-800-759-7372. 4 Get an Immediate Tax Advantage When you invest in the PERAPlus 401(k) Plan, your contributions are deducted from