Transcription

Paycheck Plus:A New Antipoverty Strategy for Single AdultsP O L I C YB R I E FBy Rachel Pardoe and Dan BloomM A Y2 0 1 4Over the past several decades,workers with college degreeshave seen their wages rise substantially, intandem with the nation’s economic growth.However, wages for less-skilled workers,specifically those without a college education,have followed a dramatically differentcourse. Many less-educated workers havefaced increasing hardship as their wagesstagnated over the past 30 years and some— particularly men — have seen theirearnings fall sharply. This decline in thepayoff to work has reduced employmentand contributed to persistently high povertyrates and growing economic inequality.The federal Earned Income Tax Credit (EITC)supplements the earnings of low-wageworkers and has become one of the nation’smost effective antipoverty programs. However,because most of its benefits go to low-incomeworkers with children, it only reaches aminority of low-wage workers.1 Although lowincome workers without dependent childrenare eligible for the EITC, benefits for this groupare nominal in comparison with those receivedby families with children.This brief describes Paycheck Plus, apathbreaking demonstration project testinga new EITC-like earnings supplement forlow-income single adults that aims toimprove their economic circumstanceswhile promoting employment. Theproject recently completed its firstmilestone, recruiting and enrolling over6,000 individuals, with half assignedat random to a program group eligiblefor the supplement and the other halfassigned to a control group not eligiblefor the supplement. MDRC will followboth the program and control groups forseveral years, to assess the supplement’seffects on economic well-being, work,and other outcomes. Funded by New YorkCity’s Center for Economic Opportunity(CEO) and the Robin Hood Foundationand managed by MDRC, the project is adirect response to the downward trend inemployment, wages, and earnings amongNew York’s and the nation’s least-skilledworkers. Paycheck Plus could serve as anational model and add to the currentbipartisan discussion about supportinglow-wage work, increasing the minimumwage, and expanding the EITC.THE POLICY CONTEXTEconomic growth used to be linked to wagegrowth in the United States, but over thepast few decades this relationship hasfundamentally broken down. Although theGross Domestic Product has more thandoubled since the 1970s, wages for lesseducated workers have stagnated; for maleworkers without college educations, wageshave fallen sharply (see Figure 1). In 1973, the

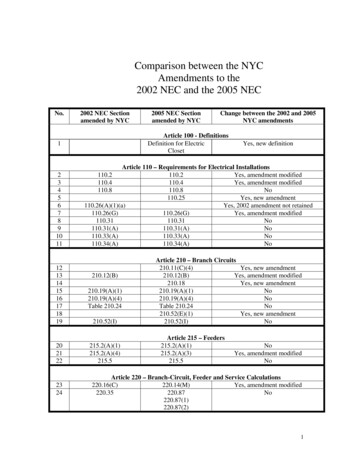

MDRC POLICY BRIEFFIGURE 1: REAL HOURLY WAGES, 1973–2012 (2012 DOLLARS) 40.00Advanced degreeCollege degree 30.00 20.00PROBLEM WORSE AMONG MENChange in wages, 1973 to 2012Less than high school-25% Men-3% WomenHigh school diplomaHigh school diploma-14% Men 7% Women 10.00Less than high school diploma 0.0019701980199020002010SOURCE: Mishel, Bivens, Gould, and Shierholz (2012).average male worker with only a high schooleducation could earn enough to support afamily just above the federal poverty line. In2012, that same worker earned 14 percent less.In comparison, wages for men with collegedegrees grew substantially (by 16 percent).2Research suggests that declining wagesare responsible, in part, for fallingworkers are employment rates. In addition, fallingwages at the lower end of the incomeeligible for distribution, in combination withthe EITC, the increasing wages at the upper end,have contributed to growing economicmaximum inequality. Even more concerning isamount they can the fact that the economic disparitiesand increased hardship confrontingreceive is 496. low-wage workers may be long-termproblems. The Bureau of LaborStatistics estimates that in 2020, five ofthe six occupations projected to have the mostjob growth will pay low wages.3While childless2What can be done to address the problem ofstagnant or declining real wages for less-skilledworkers? Policymakers and researchers oftenturn to federal income support as a possiblesolution. The EITC, first established in 1975,is a refundable federal income tax credit thatsupplements the earnings of low-incomeworkers. In 2012, the EITC lifted 6.6 millionpeople out of poverty while promoting workand reducing the need for public assistance.However, the current system was createdprimarily to support low-income workingfamilies with dependent children.Figure 2 provides a summary of the federalEITC by filing status and number ofchildren. 4 While single adults withoutdependent children (referred to henceforthas “childless workers”) are eligible for theEITC, the credit is capped at a maximumannual payment of 496 (compared withmore than 6,000 for families with three

MAY 2014FIGURE 2: EITC BY NUMBER OF CHILDREN AND FILING STATUS, 2014 7,000Credit amount 6,000Single, 3 children 5,000Single, 2 children 4,000 3,000 2,000Single, 1 child 1,0000Single, no children0 10,000 20,000 30,000 40,000 50,000EarningsSOURCE: Urban Institute and Brookings Institution Tax Policy Center (2014).NOTE: Those with “married, filing jointly” status can still claim, but the schedule is not discussed in this brief and thereforeis not shown here.children). It is consequently less effective thanit might be at reducing poverty and increasingemployment among childless workers.The EITC for families with children has beenexpanded considerably since the early1990s and has been found to have positiveeffects on single parents’ employment ratesand incomes and on their children’s wellbeing.5 Similar results were found in MDRC’sMake Work Pay experiments, which testedwhether offering earnings supplementswould increase employment and income, raisechildren’s school performance, and improvefamily well-being among welfare recipients.6Analyses by the Center on Budget and PolicyPriorities suggest that in 2012 the most recentexpansions of the EITC (through the 2009American Recovery and Reinvestment Act)lifted an estimated 600,000 people out ofpoverty and reduced the severity ofpoverty for approximately 10 millionWill the7people. Expansion of the EITCsupplementfor childless workers has recentlyreceived bipartisan support; forreduce povertyexample, Glenn Hubbard, chairmanand materialof the Council of Economic Advisorsunder President George W. Bush,hardship? Willnoted recently that increasing theit increase workcredit for childless workers would“augment the direct work incentiveand boostand help counter poverty among theearnings?working poor.”8 President Obamaalso proposed an expanded EITC forsingles in his 2014 State of the UnionAddress.93

MDRC POLICY BRIEF4As part of other efforts to make work payfor low-wage workers, a number of stateshave moved to increase their minimumwages. In New York, for example, theminimum wage will increase from 8.00in 2014 to 8.75 in 2015 and then to 9.00in 2016. President Obama, New York CityMayor Bill de Blasio, and others haveproposed additional increases. Even with ahigher minimum wage, the added boost ofa more generous EITC for childless workerswould further help to make work payadequately.10 For example, at 9 per hour,a person who works full time for the entireyear will earn 18,000. Paycheck Plus wouldadd an additional 2,000 in income, in effectturning a 9-per-hour job into a 10-perhour job. In addition, as national policy amore generous EITC for childless workerswould be indexed to inflation and would bewell targeted to workers from low-incomefamilies.reflects the diversity of the low-wage workerswho would be affected by federal policychanges.PAYCHECK PLUS: APOTENTIAL SOLUTIONAs shown in Figure 3, the Paycheck Plussupplement mimics the federal EITC in thatit has “phase-in” and “phase-out” ratescomparable to the EITC for workers withchildren. Importantly, it offers a significantlymore generous maximum benefit than thecurrent EITC for childless workers ( 2,000rather than 496) and extends eligibility toindividuals making up to 29,863 (comparedwith only 14,590 for the current EITC forchildless workers). As with the federal EITC,all earnings will count when determiningindividuals’ Paycheck Plus supplements,including income from self-employmentand normal wages. Also following themodel of the federal EITC, supplementswill be calculated using the previous taxyear’s earnings: supplements will beissued in 2015, 2016, and 2017 based onWith funding from CEO and the RobinHood Foundation, MDRC is developingrigorous evidence on the potential effectsof an enhanced EITC for single adults. ThePaycheck Plus pilot project is evaluating anEITC-like earnings supplement for lowincome workers without dependent childrenthat aims to improve their economic wellbeing while promoting employment. Theproject is also a timely addition to thenational discussion on low-wage work andthe minimum wage, given the increases inthe minimum wage that began this year.New York City is not only an ideal site toinvestigate the value of an enhanced EITCon top of an increased minimum wage, itspopulation — and thus the study’s sample —The project recruited just over 6,000individuals, half of whom were randomlyselected to be eligible for the supplement:up to 2,000 a year for three years, withthe maximum payments targeted to thoseearning between 6,667 and 18,000.The other 3,000 study participants forma control group that is not eligible for thenew supplement. MDRC will track bothgroups for several years to answer severalkey questions: Will the supplement reducepoverty and material hardship? Will itincrease work rates and boost earnings?Will it increase child-support paymentsamong noncustodial parents? Will it havean effect on criminal activity? Will it affectother outcomes such as public assistancereceipt, marriage, or overall well-being?

MAY 2014FIGURE 3: HOW PAYCHECK PLUS WORKSPaycheck PlusCurrent EITCMaximum benefit of 2,000 6,667 18,000 2,000 1,500Benefit30%phase-inrate17%phase-outrate 1,000 500 0 14,590 29,900Annual earningsSOURCES: Urban Institute and Brookings Institution Tax Policy Center (2014), Paycheck Plus design documents.FIGURE 4: EFFECT OF EITC ON SINGLE ADULTS IN 2014PRETAX EARNINGS 11,650CURRENT FEDERAL EITC 226 1,774EARNINGS EITC SUPPLEMENTPAYCHECK PLUS SUPPLEMENT 13,650SOURCES: Urban Institute and Brookings Institution Tax Policy Center (2014), Paycheck Plus design documents.5

MDRC POLICY BRIEFAbout 70percent of studyparticipantsworked in theyear before theyenrolled in thestudy, althoughnearly halfof those whoearnings from 2014, 2015, and 2016respectively.11Because participants receivemore generous Paycheck Plussupplements the more theyearn, up to 6,667 (the incomesassociated with those most likelyto be marginally attached to theworkforce), the demonstration isexpected to provide incentives foremployment for both unemployedand underemployed participants.worked earnedThe Paycheck Plus supplement isless than 7,000 designed to “top up” any credit anindividual might receive from theduring the year. existing childless worker EITC. Anexample of this can be seen in Figure4. A single adult with no dependentchildren earning 11,650 before taxes wouldreceive 226 from the federal EITC for childlessworkers. By participating in Paycheck Plus, hewould receive an additional 1,774 for a totalof 13,650, 15 percent more than under thecurrent EITC.RECRUITINGPARTICIPANTS ANDO P E R AT I N G T H EPROGRAM6MDRC partnered with Food Bank for New YorkCity (FBNYC) to implement Paycheck Plus.FBNYC was chosen for its firsthand experiencewith the federal EITC program as well as itshistory serving low-income New Yorkers.The organization coordinates an extensivenetwork of community-based organizationsand operates one of the city’s largest networksof Volunteer Income Tax Assistance (VITA)programs.12 FBNYC was asked to directoutreach to potential participants, identifyand partner with organizations that couldserve as recruitment sources, recruit andenroll individuals into the program, andcoordinate the tax-preparation effort.Individuals were eligible for Paycheck Plus ifthey met the following criteria at the timeof enrollment: 1) resided in New York City, 2)planned to file their taxes as single, with nodependent children, 3) did not work or earnedless than 30,000 in the previous 12 months,3) were between the ages of 21 and 64, 4) hada Social Security number, and 5) did not receiveor plan to apply for Supplemental SecurityIncome or Social Security Disability Insurance.13FBNYC directed its outreach effort atorganizations in its network and throughoutthe city that served populations eligible forPaycheck Plus. These included FBNYC’sformer VITA clients, food pantries andsoup kitchens, programs that serveformerly incarcerated people, workforceand job-training organizations, one-stopcareer centers, community colleges,fatherhood programs, and social serviceagencies. With support from New YorkCity’s Human Resources Administration,letters explaining the study were sentto Supplemental Nutrition AssistanceProgram recipients and noncustodial parents.In addition, the study was advertised usingvarious media outlets including local radiostations, city government websites (suchas NYC 311), and Twitter, and through acommunity flyering campaign.FBNYC began to recruit study participants atthe end of September 2013, and reached theenrollment goal in just five months.

MAY 2014WHO IS IN THE STUDY?The study sought to recruit a sample thatreflects the diversity of low-wage workers,specifically targeting groups that face themost challenges, including noncustodialparents, formerly incarcerated people, andindividuals with little or no earnings. Bytargeting recruitment this way, the study cangenerate results and lessons applicable to thebroader population but also to the groupswho may need the most support.Table 1 shows selected characteristics of thestudy participants at the time of enrollment.14The majority of study participants are male(59 percent), most are black (58 percent),and their average age is 37 years old. Themajority of the sample had earned at least ahigh school diploma or a General EducationalDevelopment (GED) credential (78 percent).15To help illuminate the effects of thesupplement on recidivism (the rateat which formerly incarcerated peopleare arrested or returned to prison) andchild-support payments, the study usedrecruitment methods designed to ensureadequate numbers of noncustodial parentsand the formerly incarcerated. Both groupsare known to be particularly difficult torecruit into community-based programs.16About 12 percent of study participants reportbeing noncustodial parents and 18 percentreport having ever been incarcerated.The study also aimed to recruit thosemarginally attached to the workforce —individuals who earned no income or verylittle income in the prior year (defined as upto 18,000) — as a means of analyzing thesupplement’s ability to increase employment.This group may include individuals whohave not worked in many years, as well asthose who have only recently experiencedunemployment due to the “Great Recession”and the slow economic recovery that hasfollowed. While over 97 percent of theparticipants had been employed at sometime in the past, only about 71 percent hadheld employment in the year before theyenrolled in the study, and nearly half ofthose who did work earned less than 7,000during the year. About 45 percent wereworking at the time of enrollment, but only24 percent were working full time, and theaverage weekly earnings were only 292.Although the Paycheck Plus sample is similarto the national population of low-incomeadults without dependent children insome ways, it is less educated and raciallydissimilar. In 2012, for example, nationallythe majority of low-income singles withoutdependent children were white and overage 35 — while the Paycheck Plus sampleis predominantly black. Nonetheless, thediversity of the Paycheck Plus sample willallow the results to inform a national policy.NEXT STEPS FORPAYCHECK PLUSFollow-up data will be collected and analyzedstarting in early 2014. Administrative recordsdata will be used to assess effects on earnings,employment, and child-support payments. Theevaluation will also include a 32-month followup survey to measure outcomes that are notcaptured in records data — for example, jobcharacteristics, material hardship, involvementin the criminal justice system, marriage, andfamily formation.All participants are encouraged to file theirtaxes for free at one of FBNYC’s VITA centers.7

MDRC POLICY BRIEFTABLE 1: BASELINE CHARACTERISTICSCHARACTERISTICTOTALGENDER (%)MALEAVERAGE AGE (YEARS)59.137RACE/ETHNICITY ANIC57.8OTHER5.9EARNED AT LEAST A HIGH SCHOOL DIPLOMA OR GED CERTIFICATE (%)78.3HAS ANY CHILDREN UNDER AGE 19 NOT LIVING AT HOME (%)11.9EVER CONVICTED OF A FELONY (%)16.7EVER INCARCERATED IN JAIL OR PRISION (%)18.1EVER EMPLOYED (%)97.4EMPLOYED IN THE PAST YEAR (%)70.5EARNINGS IN THE PAST YEAR (%) 029.5 1– 6,66628.1 6,667– 11,99916.3 12,000– 17,99913.2 18,000 or higher12.9CURRENTLY WORKING (%)45.2WORKING FULL TIMEa (%)23.8AVERAGE WEEKLY EARNINGS, AMONG THOSE CURRENTLY WORKING ( )292SAMPLE SIZE5,937SOURCE: MDRC calculations using Paycheck Plus Baseline Information Form data.8NOTES: Includes sample members randomly assigned between September 27, 2013 and February 18, 2014.Percentages for some categories may not add up due to rounding or missing values.Among the full sample, 39 individuals (0.66 percent) are missing the Baseline Information Form. The sample forthis table is less than 6,000 because some individuals withdrew from the study after enrolling and others failed toprovide signed informed-consent forms.aThe measure refers to working 30 hours or more per week.

MAY 2014Over the course of the implementationperiod (through 2017), FBNYC will sendregular reminders to the Paycheck Plus groupabout the program, specifically noting thatparticipants can only claim the supplementif they work and file taxes. In addition, in aneffort to assess the most effective meansof increasing study participants’ knowledgeand engagement, the study will evaluatevarious messaging and design approachesfor these reminders. This substudy will takeplace through the Behavioral Interventionsto Advance Self Sufficiency Project (BIAS),run by MDRC for the U.S. Department ofHealth and Human Services and designedto explore how tools from behavioral sciencecan be used to improve the well-being oflow-income children, adults, and families.17Separately, as an embedded test, a randomlyselected subset of individuals eligible forthe Paycheck Plus supplement will also begiven referrals to employment services.This second embedded study will assesswhether the supplement combined withmodest employment assistance has largereffects on income and employment than thesupplement by itself.Additional policy briefs about thedemonstration will be published in early2015 and early 2016, followed by an interimimpact report in 2017 and a final impactreport in 2018. MDRC is also consideringan expansion of the study to a second city.Testing the supplement’s effects in a settingthat is demographically, economically, andgeographically distinct from New York Citywill strengthen the evidence and make thefindings more broadly applicable.The Paycheck Plus project will provideimportant lessons on policies designedto assist low-wage workers — an oftenoverlooked group. Unlike other economicgroups, who have felt the benefits of thenation’s growing economy, many low-wageworkers have seen their wages stagnate oreven fall. While the minimum wage and otherpolicy proposals geared to low-wage workingadults are currently on the national agenda,there is little real evidence about whatworks or about how to target programs.The Paycheck Plus project will providegroundbreaking data to inform policy andhelp millions of working Americans.NOTES1Cooper (2013).2Mishel, Bivens, Gould, and Shierholz (2012).3Lockard and Wolf (2012).Individuals filing as “married, filing jointly” canalso claim the credit. Benefits for married couplesare not shown in Figure 2.4Berlin (2007); Edelman, Holzner, and Offner(2006); Scholz (2007); Eissa and Hoynes (2006);Holt (2006); Dahl and Lochner (2012).5Michalopoulos (2005); Miller et al. (2008).6The American Recovery and Reinvestment Acttemporarily increased benefits for families withthree or more children, and allowed marriedcouples to continue receiving benefits at somewhathigher income levels. The latter expansion wasdesigned to reduce the loss in benefits, or penalty,some couples face when they marry. Center onBudget and Policy Priorities (2014).78Hubbard (2014).9Obama (2014).10Bernstein and Parrott (2014).If an individual has child-support debt, thePaycheck Plus supplement will be intercepted tohelp pay off this debt.11The VITA program, a national initiativesponsored by the Internal Revenue Service,employs volunteers to provide free income-taxpreparation to people who make 52,000 or less.FBNYC’s VITA program completes approximately35,000 tax returns every year for low- tomoderate-income New Yorkers.129

MDRC POLICY BRIEFIf an individual marries during the studybut does not claim dependent children, he orshe will still be eligible for the Paycheck Plussupplement based on his or her earnings. Therationale for this rule is so that the program doesnot create disincentives to marry. If someonegains dependent children over the course of thestudy, Paycheck Plus will continue to “top up”any federal EITC for which he or she is eligible.However, given that the federal EITC for familieswith children is much more generous thanPaycheck Plus, most of these individuals willprobably receive no supplement from PaycheckPlus.13There are no systematic differences betweenresearch groups, as one would expect in arandom assignment study.14In 2014, New York discontinued its use of theGED in favor of the Test Assessing SecondaryCompletion.15MDRC’s Parents Fair Share Evaluation alsofaced significant challenges in recruitingnoncustodial parents for a community-basedprogram, and found that success was contingenton the involvement of child-support agencies. SeeMiller and Knox (2001).16For more information about the BehavioralIntervention to Advance Self Sufficiency Project,visit www.mdrc.org.17REFERENCESBerlin, Gordon. 2007. “Rewarding the Workof Individuals: A Counterintuitive Approach toReducing Poverty and Strengthening Families.”The Future of Children 17, 2: 17-42.Bernstein, Jared, and Sharon Parrott. 2014.Proposal to Strengthen Minimum Wage WouldHelp Low-Wage Workers, With Little Impact onEmployment. Washington, DC: Center on Budgetand Policy Priorities.Center on Budget and Policy Priorities. 2014.“Policy Basics: The Earned Income Tax Credit.”Website: www.cbpp.org.10Cooper, David. 2013. “Raising the FederalMinimum Wage to 10.10 Would Lift Wagesfor Millions and Provide a Modest EconomicBoost.” EPI Briefing Paper #371. Washington, DC:Economic Policy Institute.Dahl, Gordon B., and Lance Lochner. 2012. “TheImpact of Family Income on Child Achievement:Evidence from Changes in the Earned Income TaxCredit.” American Economic Review 102, 5: 1927-1956.Edelman, Peter, Harry J. Holzer, and Paul Offner.2006. Reconnecting Disadvantaged Young Men.Washington, DC: Urban Institute.Eissa, Nada, and Hilary W. Hoynes. 2006.“Behavioral Responses to Taxes: The EarnedIncome Tax Credit and Labor Supply.” Pages 73110 in James M. Poterba (ed.), Tax Policy and theEconomy, Volume 20. Cambridge, MA: NationalBureau of Economic Research.Holt, Steve. 2006. The Earned Income Tax Creditat Age 30: What We Know. Washington, DC: TheBrookings Institution.Hubbard, Glenn. 2014. “Tax Reform is the BestWay to Tackle Income Inequality.” WashingtonPost (January 10).Lockard, C. Brett, and Michael Wolf. 2012.“Occupational Employment Projections to2020.” Monthly Labor Review January 2012:84-108.Michalopoulos, Charles. 2005. Does MakingWork Pay Still Pay? An Update on the Effectsof Four Earnings Supplement Programs onEmployment, Earnings, and Income. New York:MDRC.Miller, Cynthia, Aletha Huston, Greg Duncan,Vonnie McLoyed, and Thomas S. Weisner.2008. New Hope for the Working Poor: EffectsAfter Eight Years for Families and Children. NewYork: MDRC.Miller, Cynthia and Virginia Knox. 2001. TheChallenge of Helping Low-Income Fathers SupportTheir Children: Final Lessons from Parents’ FairShare. New York: MDRC.Mishel, Lawrence, Josh Bivens, Elise Gould,and Heidi Shierholz. 2012. The State of WorkingAmerica, 12th Edition. Ithaca, NY: CornellUniversity Press.Obama, Barack. 2014. “State of the UnionAddress.” Website: www.whitehouse.gov.Scholz, John Karl. 2007. “Employment-BasedTax Credits for Low-Skilled Workers.” HamiltonProject Discussion Paper 2007-14. WashingtonDC: The Brookings Institution.Urban Institute and Brookings Institution TaxPolicy Center. 2014. “Historical EITC Parameters.”Website: www.taxpolicycenter.org.

MAY 2014ACKNOWLEDGMENTSFunding for the project is provided byNew York City’s Center for EconomicOpportunity (CEO) and the Robin HoodFoundation. Additional funding for thisbrief is also provided by the Laura and JohnArnold Foundation. The project wouldnot have been possible without the workand dedication of several individuals andorganizations, including Linda Gibbs,former New York City deputy mayor forHealth and Human Services; Kristin Morse,former Executive Director of CEO; andseveral staff members at New York City’sHuman Resources Administration. GermanTejeda and Arlene Sabdull at Food Bank forNew York City were instrumental in gettingthe program up and running. The authorsthank Gordon Berlin, Cynthia Miller, CarolineSchultz, Gilda Azurdia, John Hutchins, andJames Riccio from MDRC and Carson Hicksand Jean-Marie Callan from CEO for theirhelpful comments on the brief, and JoshuaMalbin for editing.Dissemination of MDRC publications issupported by the following funders thathelp finance MDRC’s public policy outreachand expanding efforts to communicate theresults and implications of our work topolicymakers, practitioners, and others:The Annie E. Casey Foundation, The Harryand Jeanette Weinberg Foundation, Inc.,The Kresge Foundation, Laura and JohnArnold Foundation, Sandler Foundation, andThe Starr Foundation.In addition, earnings from the MDRCEndowment help sustain ourdissemination efforts. Contributors tothe MDRC Endowment include AlcoaFoundation, The Ambrose MonellFoundation, Anheuser-Busch Foundation,Bristol-Myers Squibb Foundation, CharlesStewart Mott Foundation, Ford Foundation,The George Gund Foundation, The GrableFoundation, The Lizabeth and FrankNewman Charitable Foundation, The NewYork Times Company Foundation, JanNicholson, Paul H. O’Neill CharitableFoundation, John S. Reed, SandlerFoundation, and The Stupski Family Fund,as well as other individual contributors.The findings and conclusions in this reportdo not necessarily represent the officialpositions or policies of the funders.For information about MDRC and copiesof our publications, see our website:www.mdrc.org.Copyright 2014 by MDRC .All rights reserved.11

NONPROFITORGANIZATION16 East 34th StreetNew York, NY 10016-4326US POSTAGEPAIDABR20602CHANGE SERVICE REQUESTEDPaycheck Plus:A New Antipoverty Strategy for Single AdultsBy Rachel Pardoe and Dan BloomWages for less-skilled workers, specifically those without a college education, have stagnatedover the past 30 years. Some — particularly men — have seen their earnings fall sharply.This decline in the payoff to work has reduced employment and contributed to persistently high povertyrates and growing economic inequality. The federal Earned Income Tax Credit (EITC) supplements theearnings of low-wage workers and has become one of the nation’s most effective antipoverty programs.However, most of its benefits go to low-income workers with children. This brief describes Paycheck Plus,a pathbreaking demonstration project testing a new EITC-like earnings supplement for low-income singleadults that aims to improve their economic circumstances while promoting employment. The projectrecently completed its first milestone, recruiting and enrolling over 6,000 individuals.

year will earn 18,000. Paycheck Plus would add an additional 2,000 in income, in effect turning a 9-per-hour job into a 10-per-hour job. In addition, as national policy a more generous EITC for childless workers would be indexed to inflation and would be well targeted to workers from low-income families. PAYCHECK PLUS: A POTENTIAL SOLUTION