Transcription

GhanaCorporatization of Distribution ConcessionsThrough CapitalizationReport 272/03December

GHANA:CORPORATIZATION OF DISTRIBUTIONCONCESSIONSTHROUGH CAPITALIZATIONDecember 2003Joint UNDP/World Bank Energy Sector Management Assistance Programme(ESMAP)

Copyright 2003The International Bank for Reconstructionand Development/THE WORLD BANK1818 H Street, N.W.Washington, D.C. 20433, U.S.A.All rights reservedManufactured in the United States of AmericaFirst printing December 2003ESMAP Reports are published to communicate the results of ESMAP’s work to the developmentcommunity with the least possible delay. The typescript of the paper therefore has not been prepared inaccordance with the procedures appropriate to formal documents. Some sources cited in this paper may beinformal documents that are not readily available.The findings, interpretations, and conclusions expressed in this paper are entirely those of theauthor(s) and should not be attributed in any manner to the World Bank, or its affiliated organizations, or tomembers of its Board of Executive Directors or the countries they represent. The World Bank does notguarantee the accuracy of the data included in this publication and accepts no responsibility whatsoever forany consequence of their use. The Boundaries, colors, denominations, other information shown on anymap in this volume do not imply on the part of the World Bank Group any judgement on the legal status ofany territory or the endorsement or acceptance of such boundaries.The material in this publication is copyrighted. Requests for permission to reproduce portions ofit should be sent to the ESMAP Manager at the address shown in the copyright notice above. ESMAPencourages dissemination of its work and will normally give permission promptly and, when thereproduction is for noncommercial purposes, without asking a fee.

ContentsContents . iiiAbbreviations and Acronyms.vAcknowledgments . viiExecutive Summary. ixElectricity Sector in Ghana: Status of Reforms and Evolving Market Structure.1Emergency Power Purchases .4The Reasons for Privatization in Ghana.7The Government Portfolio.7How Privatization Has Been Implemented .8The Privatization Program .8Management of the Program .8The Delay in Giving the Divestiture Implementation Committee itsMandate .9The Divestiture Implementation Committee Not Authorized to ApproveDeals .9Ghana’s Privatization Program Not Centralized.9The Divestiture Implementation Committee Pressured to IntroduceUniform Divestiture Procedures.10Insufficient Resources for Divestiture.10External Support .10Enterprise Preparation .11Major Constraints to Privatization .12A Lack of Commitment and Consensus .12Employee End-of-Service Benefits .13Land Title.14Enterprise Valuations .14Selection of Divestiture Methods .15Competitive Bidding to Acquire Shares and Assets.16iii

Deal Approval.17Deferred Payment.17Completed Transactions through 1997 .18The Rationale for Employee Stock Ownership Plans in Privatization .21Broadening Share Ownership and Creating an Ownership Culture .24Accelerating Privatization .25Alleviating Labor Concerns and Overcoming Opposition from OrganizedLabor .25Building Support for Market Reforms and Privatization .26Privatization and ESOP Financing .26Improving Enterprise Performance.26Attracting Foreign Investors.27Integrating ESOPs into Overall Privatization Strategies .27Conclusion: Employee Ownership Requires Policy Support .30A Legal Framework for ESOPs in Ghana.33Review of Legal Regime: Company Code, Trust Act.34An Appropriate Range of ESOP Tax Reliefs.34The U.K. Model of ESOP Tax Incentives .35Financial Prefeasibility Analysis of ESOPs in Distribution Concession Capitalization39Financing ESOPs: Issues and Options .39Feasibility of Employees as a Financing Source for the ESOP.40The Strategic Investor as an ESOP Financing Source.40The Ghanaian Government as a Source of ESOP Financing .41The Proposed Analysis Model .41Balance Sheet.42Transaction Structure.42Tax Implications .43Shares Held by the Government .43Dilution .43Share Allocation and Governance.44iv

Post-Transaction Valuation of the Concession .44Rate of Return.44ESOP Participation .44Scenario Analysis with Larger ESOP Stake.45Repurchase Obligation .45Conclusions.46ESOPs in the Privatization of Ghana’s Electricity Distribution: Steps and ConceptualFramework.47Steps for Implementing ESOPs in the Electricity Distribution Concessions .49A Strategy to Promote ESOPs .50Annex 1 .53International Best Practice with Employee Ownership .53The United Kingdom .53Profit-sharing schemes .54Save-as-You-Earn (SAYE) Schemes.54Company Share Option Schemes.54Statutory ESOPs.54The United States .55Bolivia .56The Capitalization Act.57Option Contract.58Registration of Shares on the Stock Exchange.58The Offer to Labor and the Results .58Promotion.60Profits 61Egypt .62Results .63Jamaica.64Employee Ownership Incentives in Other Countries .66Annex 2 .71v

The Role of Labor Unions in Employee Ownership .71Annex 3 .73Ghana’s National Savings and Investment, With Special Reference to the Financingof ESOPs in Privatized Successor Businesses of the Electricity Corporationof Ghana.73Long-Term Trends .73The Investment Growth Trend Continues, 1990–96 .74Annex 4 .77Discounted Cash Flow Analysis .77Valuation .77Cash Flow Projections .77Investment Horizon .78Terminal Value .78Discount Rate.78Debt.78Equity .79Risk Free Rate .79Equity Risk Premium.79Size Premium .79Company- or Project-Specific Premium .79Adjusted Cost of Equity .80Weighted Average Cost of Capital .80Discounted Cash Flow.80Implied Equity Value .80TablesTable 5.1. The Effects of Increased ESOP Participation Levels .45Table A1.1. Employee Participation in Capitalized Companies.57Table A1.2. Market Value of Companies.61vi

Table A1.3. ESOP Return on Investment.62Table A3.1. Gross Domestic Savings and Gross Investment as a Percentage ofGDP, Annual Averages .73Table A3.2. Gross Domestic Investment as a Percentage of GDP, 1991–96.74Table A3.3. Private Investment as a Percentage of GDP, 1991–96 .74Table A3.4. National Savings as a Percentage of GDP, 1991–96 .74Table A3.5. National Savings as Recorded by Ghana Statistical Service (percent).75Table A3.6. Gross Investment as Recorded by Ghana Statistical Service (percent).75Table A3.7. Ghana Statistical Service Estimates of Foreign Savings (percent) .75FiguresFigure 1.1. Proposed Structure of Electricity Market, Electricity Commission Act 541of 1997 for Ghana .3Figure 1.2. Emergency IPPs: Project Structure .5Figure 3.1. A Standard Leveraged ESOP .23Figure 3.2. Leveraged Worker Buy-Out from Outside Seller .23BoxesBox A3.1. Forms of ESOPs .22Box A1.1. The First ESOP.55Box A1.2. United Airlines ESOP Buy-Out .56Box A1.3. The Alexandria Tire Company of Egypt .64Box A1.4. The Privatization of the National Commercial Bank of Jamaica.65Box A2.1. Employee Ownership and the United Steelworkers of America.72vii

Abbreviations and CSAYESECSOETICTUCUSAIDVRAWSUAssocia tion of Ghanaian IndustriesAlexandria Tire CompanyBuy-One-Get-One-FreeA government planning agencyDistribution Added ValueDivestiture Implementation CommitteeEarnings before interest, taxes, depreciation and amortizationEnergy CommissionElectricity Corporation of GhanaEmployee shareholders associationEnd-of-service benefitsEmployee stock ownership planFinancial Structural Adjustment ProgramGross domestic productInternational Monetary FundInitial public offerIndependent power producerInternal rate of returnLondon interbank offered rateMinistry of Mines and EnergyNational Commercial Bank of JamaicaNational Transmission UtilityProvisional National Defense CouncilPower Purchase AgreementsPublic Utilities Regulatory CommissionSave-as-you-earnState Enterprises CommissionState-owned enterpriseTotal investment incomeTrade Union CongressU.S. Agency for International DevelopmentVolta River AuthorityWorker-shareholders’ union

Units of MeasurekWh Kilowatt-hourMW MegawattCurrency EquivalentsUS 1.00 2,427 Ghanaian cedis as of April 19, 1999vi

AcknowledgmentsThis report was prepared by a team that comprised Mangesh Hoskote (Task TeamLeader), Robert Oakshott, Angela Atherton, Oliver Campbell-White, and OlivierFremond. Significant contributions were made by Gerard Byam, Joel Maweni, DavidBinns, and David Ellerman. David Binns also assisted with formatting and editing thefinal report.The preparation of the report would not have been possible without the dedicationof the officials in the government of Ghana, private financial sector officials, andmembers of the Ghana Trade Union Congress. The ESMAP team was assisted by thefollowing counterparts from the Ministry of Mines and Energy: Amarquaye Armar,Advisor; Michael Opam, Acting Director of Energy Affairs; and Juliet Pumpini,Regulatory Specialist.The ESMAP team gratefully acknowledges the management support andguidance received from Peter Harrold, Country Director; Karl Jechoutek,Advisor/Knowledge Manager; Mark Tomlinson, Sector Manager, Africa Region; andDenis Clarke, Sector Manager, Energy Unit. This study was made possible by thefinancial support of the government of Sweden. This report was edited by theGrammarians Inc., and desktop published by Sumit Kayastha from ESMAP. Production,printing, distribution and dissemination was supervised by Marjorie K. Araya fromESMAP.

Executive Summary1.The government of Ghana has initiated fundamental reforms to improvethe performance of the electricity supply industry. The objective of the reforms is aboveall to allow the government to focus on its roles as policymaker and regulator for thesector and permit transfer of responsibility for operations and investment to the privatesector.2.Such reforms are expected to take place in the context of the government’spublic enterprise reform program, which was first formulated in 1985. Since thebeginning of the privatization program, more than 200 transactions have been reported.3.This study looks at the potential for using employee stock ownership plans(ESOPs) as a means of allowing employees of state-owned enterprises to obtain anownership stake in the privatization of electricity distribution concessions. Privatizationprograms worldwide are increasingly including a focus on incorporating an element ofemployee ownership in order to ensure that ownership of the privatized enterprises willbe shared broadly by its workers, not just wealthy investors. This study looks at therelevant international experience and offers guidelines for introducing appropriate legalreforms that could facilitate the implementation of employee ownership as a key elementof the government’s privatization strategy.4.Dozens of countries have utilized employee ownership as a technique ofprivatization and scores more are actively considering such a strategy. This reportaddresses the rationale for incorporating the use of ESOPs in privatization transactions,analyzes the Ghanaian legal framework in the context of potential ESOP reforms, andincludes a prefeasibility analysis for implementing an ESOP for electricity distributionconcessions. It also includes recommendations for implementing reforms conducive tothe introduction of ESOP strategies in Ghana generally.5.The report also includes detailed discussions of the use of employee stockownership strategies in Bolivia, Egypt, El Salvador, Jamaica, the United Kingdom, andthe United States and the role of unions in employee ownership.

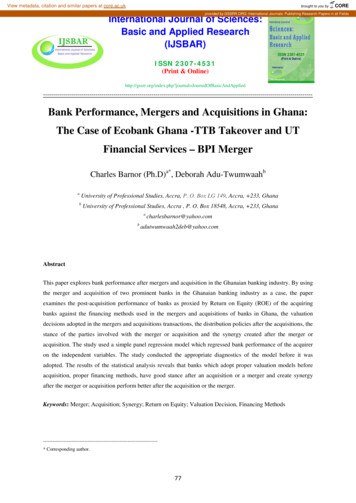

1Electricity Sector in Ghana: Status of Reformsand Evolving Market Structure1.1The government of Ghana has initiated fundamental reforms to improvethe performance of the electricity supply industry. The objective of the reforms is aboveall to allow the government to focus on its roles as policymaker and regulator for thesector and permit transfer of responsibility for operations and investment to the privatesector. In a process coordinated through the Ministry of Mines and Energy (MOME), therelevant stakeholders participated in a Power Sector Reform Committee. Thestakeholders also participated in various task forces under this committee to addressrestructuring options, tariff regime at commercial interfaces, and legal and regulatoryrequirements to address market structures.1.2Based on recommendations of the Power Sector Reform Committee TaskForces and the Energy Policy Advisor to the Minister of Mines and Energy, thegovernment of Ghana enacted two legislative instruments: the Public Utilities RegulatoryCommission Act 538 of 1997 and the Energy Commission Act 541 of 1997. These twolegislative instruments have virtually created a whole new landscape in the electricitysupply industry of Ghana. The Public Utilities Regulatory Commission (PURC) Act hasled to the formation of the PURC, an independent multisectoral regulatory agencyresponsible for regulating tariffs of network industries, such as electricity,telecommunications, and water. In the electricity subsector, the PURC regulates thetariffs of the transmission utility and the distribution utility companies.1.3The Energy Commission (EC) Act requires vertical and horizontalunbundling of the Volta River Authority (VRA) and the Electricity Company of Ghana,respectively, and creates a National Electricity Market in Ghana. The National ElectricityMarket will establish a single wholesale market for electricity and an open access regimefor the transmission and distribution networks. The key features of the proposed newmarket arrangements for the purchase and sale of energy are summarized below.?Licensing: Wholesale suppliers of electricity deemed to be “publicutilities,” transmission service providers, and distribution companies willbe licensed under the EC Act. An independent power producer (IPP)selling directly to a “bulk customer” is not deemed to be a public utility1

2 Ghana: Corporatization of Distribution Concessions through Capitalization?and therefore may not require a license. A “public utility” is an entity thathas a public service obligation to sell electricity to retail service providers.Open access: A new entity, the National Transmission Utility (NTU), willbe responsible for operational planning, scheduling, and dispatch. To carryout these functions it will receive data on water inflows, reservoir levels,plant availability, and fuel costs. Using this information, it will plansystem operations on successively shorter periods, ensuring hydrothermaloptimization through use of merit-order dispatch procedures. The tradingarrangements would be based on a tight, centralized approach to systemoptimization in which generators and distribution companies would submittechnical data to the NTU. There would be no price bidding. The NTUwould be responsible for operational planning, scheduling, and dispatchaccording to a set of explicit, agreed procedures. New software has beendeveloped by MOME consultants. As part of the final stage of operationalplanning, it is envisaged that the NTU will calculate a price that representsthe system marginal cost or the spot price at which supply and demand arein balance.Energy trading rules: All energy flows will be considered in thedetermination of the optimum schedule, in the treatment of losses, and forother relevant purposes. Energy accounting in the pool market willtherefore deal with metering data for all energy. Bulk supply tariffs andnodal transmission loss factors will be used to adjust generation anddemand to a single point for use in settlement.Bilateral contracts: Generators and the public service distributioncompanies will trade most of their energy under bilateral contracts, whichwill specify contract prices and fixed volumes for their entire duration.Initially there will be a set of bilateral contracts between suppliers anddistributors, suppliers, and the transmission service provider to initiate theelectricity market in an orderly fashion. The term, price, and volumeprofile of these initial contracts will be developed by MOME consultantsonce the EC is in place, which is expected to be sometime in September1999.System planning and new investment: Recognizing the shift to amarket-oriented system, in which there is no longer any deterministiccentral planning and in which purchasers and large customers haveresponsibility for acquiring energy at the lowest possible cost, the EC Actrequires the preparation of indicative plans for the power sector by a jointtechnical committee.Indicative long-term expansion planning: These indicative plans wouldidentify least-cost system investment programs, including the specifichydro and thermal projects required, under a range of assumptions andscenarios. These plans would be for orientation only, and there would beno obligation on any party to undertake the investments. Informationrequired for short-term transmission planning (that is, up to five years

Electricity Sector in Ghana: Status of Reforms and Evolving Market Structure3ahead) would be identified by the NTU in the light of generation projectsin progress and applications for new connections.1.4An overview of the new evolving structure is shown in figure 1.1. Thisshows the bilateral contractual arrangements between the retail businesses of thedistribution companies, such as the Electricity Corporation of Ghana (ECG) (and otherpotential retailers), and generators, such as VRA Generation and IPPs.Figure 1.1. Proposed Structure of Electricity Market, Electricity Commission Act541 of 1997 for GhanaTakoradi PowerTAPCOHydroPowerThermal PowerTDPSVolta River AuthorityCross Border TradeCEB, CIE, SONABELFree Zone Customerse.g., VALCOWesternPowerTraditional IPPsLong-term contractsKMR PowerEmergencyIPPsNational Transmission UtilityOpen Access and Independent System OperatorDistribution Licenseese.g., Electricity Company of GhanaBulk Supply Customerse.g., AGC, Ghacem1.5It should be recognized, however, that these arrangements must alsocomply with (1) competition policy regarding the right of third parties to gain access tothe services of a facility that is uneconomic to duplicate and is nationally significant (forexample, electricity transmission networks), (2) nondiscriminatory access charges, and(3) obligations to provide ancillary services to assure the system integrity of thetransmission network. Therefore, the EC, through its Technical Committee, will developa transmission grid code that will set out the operational rules for the national electricitymarket. The national transmission grid code should address two distinct but interrelatedelements: first, the wholesale electricity market rules including cross-border trading

4 Ghana: Corporatization of Distribution Concessions through Capitalizationarrangements, and second, the access arrangements to the transmission and distributionsystems.1.6In contrast to the arrangements governing electricity generation and itswholesale and retail sale, the access arrangements are the rules governing connection toand use of the physical wires infrastructure for the transport of electricity. Therefore, thegrid code will be characterized by a flexible set of arrangements covering diverse mattersrelating to electricity connection and pricing while being broad enough to encompass allof a network’s customers (for example, generators, users, and retailers). This flexibility isnecessary because, to a greater or lesser extent, every connection to an electricity networkwill affect the performance of that network and therefore other connected customers.1.7The grid code will also describe arrangements through which generatorswill physically deliver electricity into the market and will allow customers, such as bulkcustomers, to avoid retailers by separately purchasing wholesale electricity and itstransport on transmission and distribution networks.1.8International “best practices” in grid code development show the need forflexibility, and therefore provide in some detail the following:?A framework for achieving and maintaining a secure power system.A framework for generators and users to connect to an electricitytransmission or distribution network, including a requirement to negotiateand sign a detailed connection agreement.An agreement on connection equipment design and technical standards.Inspection, testing, and commissioning requirements for connectedequipment, and disconnection procedures.Administrative planning processes, in the case of a general increase indemand within the network.Regulatory pricing arrangements to be followed by the regulatory agency.Dispute resolution and enforcement mechanisms.Transitional arrangements for each of the stakeholder companies.1.9The consultants to the MOME have drafted a grid code that will beprovided to both the ECG and VRA for their review and comments.Emergency Power Purchases1.10The low water level in the Volta Lake has led to a nearly 50 percentreduction in energy generation at Akosombo. Power outages and rolling brownouts are adaily phenomenon. To redress this power shortage situation, the Ministry of Mines andEnergy has entered into two power purchase agreements (PPAs) with two IPPs: one is a30 MW diesel engine (AGGRECO) and the other a 70 MW gas turbine (FAROE) to beoperated on diesel fuel, both to be located adjacent to the existing nonperforming dieselgenerating station at Tema. Both PPAs are for a term of two years, and the ECG will bethe “purchasing” agent to facilitate and settle the energy transaction.

Electricity Sector in Ghana: Status of Reforms and Evolving Market Structure51

analyzes the Ghanaian legal framework in the context of potential ESOP reforms, and includes a prefeasibility analysis for implementing an ESOP for electricity distribution concessions. It also includes recommendations for implementing reforms conducive to the introduction of ESOP strategies in Ghana generally. 5.