Transcription

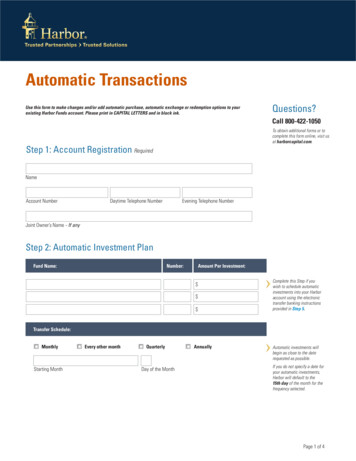

Automatic TransactionsResetUse this form to make changes and/or add automatic purchase, automatic exchange or redemption options to yourexisting Harbor Funds account. Please print in CAPITAL LETTERS and in black ink.Questions?Call 800-422-1050To obtain additional forms or tocomplete this form online, visit usat harborcapital.com.Step 1: Account Registration RequiredNameAccount NumberDaytime Telephone NumberEvening Telephone NumberJoint Owner’s Name - If anyStep 2: Automatic Investment PlanFund Name:Number:Amount Per Investment: Complete this Step if youwish to schedule automaticinvestments into your Harboraccount using the electronictransfer banking instructionsprovided in Step 5.Transfer Schedule:MonthlyStarting MonthEvery other monthQuarterlyDay of the MonthAnnuallyAutomatic investments willbegin as close to the daterequested as possible.If you do not specify a date foryour automatic investments,Harbor will default to the15th day of the month for thefrequency selected.Page 1 of 4

Step 3: Automatic Exchange PlanAdd new instructionsReplace instructions already on filePlease make the following Automatic Exchange:Exchange Amount:Frequency:Monthly On theday of the month beginningDate (mm/yyyy)Every other monthAmountQuarterlyAnnuallyAutomatic exchanges willbegin as close to the daterequested as possible. If dateis not specified, the exchangewill be made on the 5th day ofthe month, or the first businessday thereafter.From:Account NumberFund NameNumberAccount NumberFund NameNumberTo:Step 4: Automatic Withdrawal PlanAdd new instructionsReplace instructions already on fileFund Name:Number:Amount Per Withdrawal:Complete this Step if youwish to schedule automaticwithdrawals out of your Harboraccount using the electronictransfer banking instructionsprovided in Step 5. Transfer Schedule:MonthlyEvery other monthStarting MonthQuarterlyAutomatic withdrawals willbegin as close to the daterequested as possible.AnnuallyIf you do not specify a date foryour automatic withdrawals,Harbor will default to the15th day of the month for thefrequency selected.Day of the MonthPayable to:Shareholder and send to address of recordShareholder via Electronic Transfer instructionsShareholder via Wire instructionsDeposit into my Harbor Funds non-retirement account:Account NumberCompletion of the Wire/Electronic Transfer section ofStep 5 is required.Fund NameNumberMedallion SignatureGuarantee in Step 6 isrequired.Designated Payee:First NameM.I. Last NameStreet AddressCityStateZip CodePage 2 of 4

Step 5: Banking InformationThere will be a 10 business day hold on on the use of this information for redemptions once it has been added or replaced, unlessaccompanied by a Medallion Signature Guarantee in Step 6.Wire (for redemptions only):Add new instructionsComplete this Step if youwish to add wire instructionson your account.Replace instructions already on fileABA Routing Number (9 digits)Bank Account NumberBank NameName(s) on Bank AccountFor further credit to (if applicable):Bank Account NumberName(s) on Bank AccountPlease note: Your bank must be a member of the Federal Reserve System and may have very specific wire instructions. Confirm withyour bank before completing this application.Electronic Transfer (for purchases, redemptions, distributions and Automatic Investment Plans):Add new instructionsABA Routing Number (9 digits)Complete this Step if youwish to add electronictransfer instructions to youraccount.Replace instructions already on fileBank Account NumberBank NameAccount Type (Check one):CheckingName(s) on Bank AccountSavingsPlease note: Your banking institution must be a member of the Automated Clearing House (ACH) network and may have very specificinstructions. Confirm with your banking institution before completing this form.John ShareholderMary Shareholder123 Main St.Anywhere, USA 123458506VOIDPay to the order of DOLLARSIf you selected account typeChecking for electronictransfer,a voided checkmust be taped to the spaceprovided. Otherwise, therecould be a delay in setting upthese instructions.MEMO SIGNEDc123456789ca1234567898735264351a8506ABA Routing NumberYour Bank Account NumberCheck NumberPage 3 of 4

Step 6: Signature & CertificationBy signing this form, I understand that:I must already have a minimum initial investment in the Fund(s) into which I will be making automatic investments/exchanges.The automatic transaction will begin as close to the date requested as possible. Scheduled transactions that fall ona weekend or holiday will be executed on the next business day.For IRAs (if applicable) all investments will be current year contributions.Any changes to the bank/wire information must be made in writing.Harbor Funds will not be responsible for any bank rejection due to invalid electronic transfer information.I have received, read and agree to the terms of the current prospectus for each Fund in which I am investing/exchanging.Owner(s)/Authorized Person(s) Sign Below: Signature of OwnerDate (mm/dd/yyyy)Signature of Joint Owner - If anyDate (mm/dd/yyyy)Medallion Signature Guarantee Stamp - If applicableMail completed form to:Standard MailOvernight DeliveryHarbor FundsHarbor FundsP.O. Box 804660111 South Wacker Drive, 34th FloorChicago, IL 60680-4108Chicago, IL 60606-4302Distributed by Harbor Funds Distributors, Inc.F.AO Revised 02/01/2022

Funds ListDomestic EquityRETIREMENT CLASSINSTITUTIONAL CLASSADMINISTRATIVE CLASSFund NumberTickerFund NumberTickerFund NumberTickerINVESTOR CLASSFund NumberTickerCapital Appreciation Fund2512HNACX2012HACAX2212HRCAX2412HCAIXDisruptive Innovation Fund2519HNMGX2019HAMGX2219HRMGX2419HIMGXLarge Cap Value Fund2513HNLVX2013HAVLX2213HRLVX2413HILVXMid Cap Fund2546HMCRX2046HMCLX2246HMCDX2446HMCNXMid Cap Value Fund2523HNMVX2023HAMVX2223HRMVX2423HIMVXSmall Cap Growth Fund2510HNSGX2010HASGX2210HRSGX2410HISGXSmall Cap Value onal & GlobalRETIREMENT CLASSINSTITUTIONAL CLASSADMINISTRATIVE CLASSINVESTOR CLASSFund NumberTickerFund NumberTickerFund NumberTickerFund NumberTickerDiversified International All Cap Fund2538HNIDX2038HAIDX2238HRIDX2438HIIDXEmerging Markets Equity Fund2536HNEMX2036HAEMX2236HREMX2436HIEEXGlobal Leaders nal nal Growth nal Small Cap Fund2539HNISX2039HAISX2239HRISX2439HIISXOverseas Fund2544HAORX2044HAOSX2244HAOAX2444HAONXFixed IncomeConvertible Securities FundRETIREMENT CLASSINSTITUTIONAL CLASSADMINISTRATIVE CLASSINVESTOR CLASSFund NumberTickerFund NumberTickerFund NumberTickerFund re Bond Fund2543HCBRX2043HACBXN/AN/AN/AN/ACore Plus Fund2514HBFRX2014HABDX2214HRBDXN/AN/AHigh-Yield Bond Fund2524HNHYX2024HYFAX2224HYFRX2424HYFIXMoney Market Fund**CLOSED TO NEW INVESTORSN/AN/A2015HARXX2215HRMXXN/AN/A*Effective at 4:00 p.m. Eastern Time on Tuesday, June 1, 2021, Harbor Small Cap Value Fund will be closed to new investors subject to limited exceptions. Please seethe additional information in the Prospectus regarding the closing parameters for the Fund in “How to Purchase Shares.”**Limited existing investors are permitted to continue investing in the Harbor Money Market Fund. You could lose money by investing in the Harbor Money MarketFund. Although the Fund seeks to preserve the value of your investment at 1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insuredor guaranteed by the FDIC or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund and you should notexpect the sponsor to provide financial support to the Fund at any time.Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. A summary prospectus or prospectusfor this and other information is available at harborcapital.com or by calling 800-422-1050. Read it carefully before investing.HARBOR FUNDS and the Lighthouse Design are Reg. U.S. Pat. & Tm. Off.D.FD.NAA Effective 07/22/2022

Choosing a Share ClassEach of the Harbor funds have multiple classes of shares, with each class representing an interest in the same portfolio of investments. However, theFunds’ separate share classes have different expenses and, as a result, their investment performances will differ. When choosing a share class, youshould consider the factors below:RETIREMENT CLASSRetirement Class shares are available to individual and institutional investors.No 12b-1 fee and no intermediary fee of any kind paid by any FundTransfer agent fee of up to 0.02% of average daily net assets 1,000,000 minimum investment in each FundThe Harbor Target Retirement Funds are not eligible to invest in the Retirement Class.INSTITUTIONAL CLASSInstitutional Class shares are available to individual and institutional investors.No 12b-1 feeTransfer agent fee of up to 0.10% of average daily net assets 50,000 minimum investment in each FundADMINISTRATIVE CLASSAdministrative Class shares are available only to employer-sponsored retirement or benefit plans and othernon-retirement accounts maintained by financial intermediaries. Employer-sponsored retirement and benefitplans include: (i) plans established under Internal Revenue Code Sections 401(a), 403(b) or 457, (ii) profit-sharingplans, cash balance plans and money purchase pension plans, (iii) non-qualified deferred compensation plans,and (iv) retiree health benefit plans. Administrative Class shares are not available through personal plans, such asindividual retirement accounts (IRAs), SEP IRAs, Simple IRAs or individual 403(b) plans, unless investing throughan account maintained by a financial intermediary.12b-1 fee of up to 0.25% of average daily net assetsTransfer agent fee of up to 0.10% of average daily net assets 50,000 minimum investment in each Fund for accounts maintained by financial intermediariesNo minimum investment for employer-sponsored retirement or benefit plansINVESTOR CLASSInvestor Class shares are available to individual and institutional investors.12b-1 fee of up to 0.25% of average daily net assetsTransfer agent fee of up to 0.21% of average daily net assets 2,500 minimum investment in each Fund for regular accounts 1,000 minimum investment in each Fund for IRA and UTMA/UGMA accountsMeeting the minimum investment for a share class means you have purchased and maintained shares with a value at the time of purchase that is at leastequal to that minimum investment amount. Redemptions out of your account can cause your account to fail to meet the minimum investment amountrequirement. Changes in the market value of your account alone will not cause your account to either meet the minimum investment amount or fall belowthe minimum investment amount.DISTRIBUTION AND SERVICE (12b-1) FEESHarbor Funds has adopted a distribution plan for each Fund’s Administrative and Investor Classes of shares in accordance with Rule 12b-1 under theInvestment Company Act of 1940. Under each plan, the Funds pay distribution and service fees to Harbor Funds Distributors, Inc. (the “Distributor”)for the sale, distribution and servicing of the Administrative and Investor Class shares. All or a substantial portion of these fees are paid to financialintermediaries, such as broker-dealers, banks and trust companies, which maintain accounts in Harbor Funds for their customers. Because the Fundspay these fees out of the Administrative and Investor Class assets on an ongoing basis, over time these fees will increase the cost of your investment inAdministrative and Investor Class shares and may cost you more than paying other types of sales charges.TRANSFER AGENT FEESThe Funds pay Harbor Services Group, Inc. (“Shareholder Services”) transfer agent fees (specified above) on a per-class basis for its services as shareholderservicing agent for each Fund. For each class except for the Retirement Class of shares, Shareholder Services uses a portion of these fees to pay unaffiliatedfinancial intermediaries for providing certain recordkeeping, subaccounting and/or similar services to shareholders who hold their shares through accountsthat are maintained by the financial intermediaries. These fees may consist of per fund or per sub-account charges that are assessed on a periodic basis (i.e.,quarterly) and/or an asset based fee that is determined based upon the value of the assets maintained by the financial intermediary.

Step 2: Automatic Investment Plan. Name. Joint Owner's Name - If any. Automatic Transactions. Use this form to make changes and/or add automatic purchase, automatic exchange or redemption options to your . existing Harbor Funds account. Please print in CAPITAL LETTERS and in black ink. Questions? Call 800-422-1050. To obtain additional forms .