Transcription

Fiscal Year2021-22DRAFTProposedBudgetMcIntosh Preserve ParkPlant City,Florida

OFFICE OF THE CITY MANAGERHonorable Mayor, City Commissioners, and Citizens:TSeptember 13, 2021AFThe Fiscal Year 2021-22 Budget is a balanced, responsible budget with a proactive spending plan that will benefitPlant City taxpayers for years to come. All funds are considered to be in a fiscally positive and prudent position.The General Fund Budget for Fiscal Year 2021-22 is 42,309,714, while the total budget (including Water/Sewer,Solid Waste, Stormwater, Streets, and several special revenue funds) is 91,243,207. The millage rate is set at5.7157 mills, which includes 1.0 mil dedicated solely to street resurfacing and related maintenance. With a netincrease of eight employees, the City’s total workforce will be 475 employees.This budget serves as a spending plan and investment in our community and our workforce. The CRA hasdedicated funds to Downtown and Midtown to encourage private sector development and businessimprovements to revitalize the area. The following core strategies are emphasized in this budget:Facilitate Economic DevelopmentFoster Community EngagementEmpower Outstanding Customer ServiceEngage in Effective Communication with Internal and External StakeholdersMaximize Organizational EffectivenessR ECONOMIC DEVELOPMENTDPlant City is the second largest city in Hillsborough County and is located along the I-4 corridor. The Cityprovides funding to the Plant City Economic Development Corporation for creating new jobs, investment of newcapital, and expansion of the local tax base in Plant City. Therefore, 150,000 is included in the Fiscal Year 202122 Budget for the Plant City Economic Development Corporation to market Plant City on a full-time basis, whichincludes a 10,000 annual investment fee to the Tampa Hillsborough Economic Development Corporation tofurnish leads and identify incentive programs for new business recruitment and existing business expansion.Financial aid is budgeted for the following organizations: Plant City Chamber of Commerce ( 65,000); Boys andGirls Club of Plant City ( 20,000); Railroad Museum Society ( 25,000); Economic Incentive QTI Program( 31,005); 1914 Building ( 40,000); Plant City Main Street ( 50,000); Arts Council of Plant City ( 6,000); and, 2,000 each to Black Heritage Celebration, Improvement League of Plant City, and the Christmas Parade.P.O. Box C, Plant City, FL 33564 813-659-4257 www.plantcitygov.com

INVESTING IN OUR WORKFORCEThe employees of the City of Plant City are our greatest asset, just like in the private sector. As such, the followinghave been included: T Non-step employees will receive a 2% cost-of-living adjustment on October 1st. In addition, employees will beeligible to earn up to 2% merit on anniversary date of hire or anniversary date of previous job change basedon performance. Employees at the top of their pay range will be eligible to earn up to 2% as a one-timeperformance bonus.Step employees will maintain the public safety step plans which provides for a step increase on theiranniversary date. Step employees that are at their maximum step will be eligible for a one-time bonusequivalent to 2% of their base pay.Increased the workforce to 475 by adding 11 new positions at a cost of 630,851, which includes nine GeneralFund employees and two Enterprise Fund employees. Three unoccupied Enterprise Fund positions were alsodeleted with a cost savings of 129,046. 20,000 to continue the tuition reimbursement program for employees seeking a degree.A cost increase of approximately 240,000 across all funds to cover the 4.4% health insurance premiumincrease.AF INVESTING IN CAPITAL OUTLAYThe City has some major Capital Improvement Projects on the horizon as an investment in our community tomaintain the utility system, improve travel on roads throughout the City, provide aesthetically pleasing park areas,and increase property values. R Invest 3.2 million to resurface arterial roads, neighborhood streets, and sidewalks: 2.9 million is generatedfrom the 1.0 mil property tax and 328,082 will be funded from a Community Development Block Grant.Several Parks and Recreation projects: create dog parks at Mike Sansone Park and Marie B. Ellis Park for 130,000; fund 100,000 towards the construction of a Spray Park; install Ornamental Cemetery Fencing for 125,000; provide 75,000 to design a larger cemetery operations maintenance building and a separatecustomer service building; rehabilitate the Recreation Division’s storage barn at the Otis M. Andrews SportComplex for 60,000; improve roadways in various cemeteries for 100,000; and other playgroundimprovements for 150,000.Water and sewer infrastructure improvements of 2,620,000 to repair lift stations, replace waterlines, gravitysewer lines, generators, pumps, water storage tanks, meters and force mains to improve water quality andprovide a more efficient system. Invest an additional 400,000 to construct Water Treatment Plant 5; providean additional 500,000 to the Reclaimed Water Recharge project; 100,000 toward the design of McIntoshIndirect Potable Reuse (IPR) project; and an additional 150,000 toward design and construction the McIntoshPark Wetland Expansion. Stormwater will also contribute 150,000 toward McIntosh Park Wetland Expansionproject.Appropriate 135,000 to upgrade the Traffic Signal Controllers and Cabinets.Invest 200,000 towards the rehabilitation and repair of stormwater drainage pipes and inlets.D

FUND DISCUSSIONThe General Fund budget is projected to rise by 2.38 million over Fiscal Year 2020-21 mainly due to theadditional 1,646,168 in ad valorem tax revenue, 300,000 for ½ Cent Sales Tax, 191,540 in building permits andfees, 173,009 for cost allocation, and 71,870 for recreation fees. The 1.0 mil of the ad valorem millage rate willgenerate revenue of 2,861,105, which is dedicated solely for street resurfacing.TThe Water and Sewer Fund budget of 22.2 million will decrease by 1 million. The decrease is due to a reductionin the Capital Improvement Plan budget. The budget will use 1,467,217 of fund balance for current projects suchas Water Treatment Plant 5, Reclaimed Water Recharge, Utilities Maintenance/Solid Waste Facility, and LiftStation 2 Basin. Revenue projections include a rate increase of 4% based on the deflator index as specified in thecode. To cover cost of credit card processing fees, the base water rate will increase by 1 per month.The Solid Waste Fund budget of 9.99 million will increase by 354,149 related to investment of a new UtilitiesMaintenance/Solid Waste Facility and an increase in revenues. Residential customers will not see a rate increasein the coming year and the automation rates have already been set.AFThe Stormwater Fund will see an increase of 232,380 to a total budget of 3.5 million primarily due to the 3%rate increase per code to address drainage improvements.The Street Fund remained stable at 2.9 million. The increase in the capital outlay resulted in 435,000 beingtaken from fund balance. This fund will be monitored closely to seek additional revenue to maintain the system.RThe Community Redevelopment Agency assessed valuation increased by 12.6% to 265.1 million, with a taxincrement value of 196.2 million over the base value of 68.9 million. The Plant City millage rate remained at5.7157, which generated an additional 143,524 to be used in the district. Some main projects are parking lotimprovements ( 50,000), street resurfacing generated from the 1.0 mil ( 186,347), Evers Street improvements( 500,000), Collins Street complete street ( 100,000), Brick Restoration ( 100,000), dog park at Marie B. Ellis Park( 45,000), South Depot Parking Lot Boardwalk Patio ( 250,000) and Midtown utility improvements ( 200,000).ORGANIZATION-WIDE POSITIONSDThere was a net increase of eight positions added to the budget for Fiscal Year 2021-22; specifically, an increase ofnine positions to the General Fund, one to the Water/Sewer Fund and one to the Solid Waste Fund. Threepositions were deleted from the Solid Waste fund. A detail listing of the position changes can be seen below:General Fund A Legal Secretary was added to the Office of the City Attorney. An IT Technician II was added to Information Technology. One Environmental Lands Management Supervisor and two Park Rangers were added to the ParkMaintenance program. These positions are related to the opening of the McIntosh Preserve Park. A Fire Inspector was added to the Fire Department. A Digital Evidence Technician, Evidence Technician, and a Crime Intelligence Analyst were added to thePolice Department.Water/Sewer Fund A Meter Maintenance Specialist was added to Utilities Maintenance. This position will assist in thetransition to AMI meters.

Solid Waste Fund A Code Enforcement Inspector was added to Code Enforcement (General Fund) but will be funded fromthe Solid Waste Fund. This position will provide code enforcement duties related to solid wasteviolations. Three Refuse Collector positions were deleted. These positions were unoccupied.SPECIAL RECOGNITIONThe City received several awards throughout various departments. Below are a few of these special recognitions:The Finance Department received the Distinguished Budget Presentation Award from the Government FinancialOfficers Association (GFOA) for the fifth consecutive year. The award is the highest form of recognition ingovernmental budgeting and represents a significant achievement for the City and its budget. We believe thecurrent budget will meet the guidelines of the Program’s requirements to receive the award.The GFOA awarded the City the Certificate of Achievement for Excellence in Financial Reporting for itsComprehensive Annual Financial Report for the fourth consecutive year. This prestigious award meets theprogram requirements and satisfies generally accepted accounting principles and applicable legal requirements.The Police department had an individual, Captain Alfred Van Duyne III, complete the Florida Department of LawEnforcement’s Florida Leadership Academy, Class 48.The Fire department had an individual award presented to Justin Stokes as the 2020 Firefighter of the Year.Stokes is one of the department’s Field Training Officers that helps guide new paramedic trainees. He alwaysdemonstrates the importance of having a positive attitude and encourages others.The Water/Sewer department received the 2021 Earle B. Phelps Honorable Mention Award from the FloridaWater Environment Association. Individual awards include the 2020 David B. Lee Award (Wastewater) received byDavid Stevens, 2020 Florida Select Society of Sanitary Sludge Shovelers Award received by Mike Darrow, 2020WEF William Hatfield Award received by Patrick Murphy, 2021 Advocacy Achievement Award and the 2020Presidents Award for Water Reuse both received by Lynn Spivey.CONCLUSIONThe Fiscal Year 2021-22 Budget is balanced with collective efforts from departments in order to provide asustainable spending plan. I want to thank CFO Diane Reichard, Budget Manager Lauren Shatto, as well as, alldepartment directors for their outstanding efforts in preparing a responsible budget for Fiscal Year 2021-22.We sincerely appreciate the leadership and support from the City Commission in planning and guiding thefinancial affairs of the City in a progressive manner.Respectively submittedBill McDanielCity Manager

City of Plant CityDebt SummaryDebt Overview:The Financial Policy of the City of Plant City limits general obligation bonds to no greater thantwo and a half percent (2.5%) of the non-exempt assessed valuation of the City. The taxablevalue at September 30, 2021 is 2,674,204,538. Under this policy, the maximum in bondsissued would be 66,855,113. At 4.0% interest for 20 years, the bonds would require an annualdebt service payment of 4,861,548. The millage levy required to support debt service on thesebonds would be 1.8179 mills. The City takes a planned and methodical approach to debt. Alldebt obligations serve a valuable physical purpose for the citizens of Plant City and the overallcommunity. All long term debt obligations are thoroughly analyzed and reviewed by the CityCommission prior to approval. There is no external debt planned for the next five years.Each note is managed within a debt service account and payments are paid out of theirrespective funds.The constitution of the State of Florida, Florida Statute 200.181 and the City of Plant City,Florida, set no legal debt limit.Overall Principal and Interest Payments:The annual debt service requirements to maturity for the debt outstanding as of September 30,2021, are as follows:Fiscal Year202220232024202520262027-2028Governmental 5,00025,583 2,420,491 150,218Enterprise 76,248,00080,608 21,318,000 832,425Government vs. Enterprise Debt PrincipalPayments 20222023Governmental Funds2024Enterprise Funds2025

City of Plant CityDebt SummaryGovernmental Debt Service:There are two Governmental Revenue notes that are recorded in the Debt Service Funds.CIT revenues are used to pay the debt service for the 2010 Series and 2012 Series Non-AdValorem Refunding Revenue Notes.Governmental Debt ServiceSpecial RevenuesTBelow you will find the summary of the Revenue Notes:2010 SeriesNon-Ad ValoremRefunding Revenue NoteJune 3, 2010September 1, 2024 4,610,000 1,200,0003.660%City Hall and InfrastructureImprovements to StreetsAFIssuedFinal MaturityOriginal DebtOutstanding PrincipalInterest RateMain Use2012 SeriesNon-Ad ValoremRefunding Revenue NoteNovember 1, 2012September 1, 2024 3,290,000 1,030,0002.035%Police Station, General ServicesBuilding, and Fleet Maintenance FacilityEnterprise Debt Service:ROn November 25, 2020, three Enterprise Revenue notes were refinanced into one note at alower interest rate. The savings from this refinance will be used toward the utilities portion ofconstruction of a new Utilities Maintenance/Solid Waste facility. This note is located within theWater/Sewer Fund. Below you will find a summary of the Revenue Note:The Water/Sewer revenues are used to pay the debt service for the Water/Sewer - EnterpriseFund Debt listed below:Enterprise Funds Debt ServiceWater SewerD2020 SeriesUtility Refunding Revenue NoteNovember 25, 2020July 1, 2028 24,139,000 21,318,0001.030%Expand and Upgrade WaterTreatment PlantIssuedFinal MaturityOriginal DebtOutstanding PrincipalInterest RateMain Use

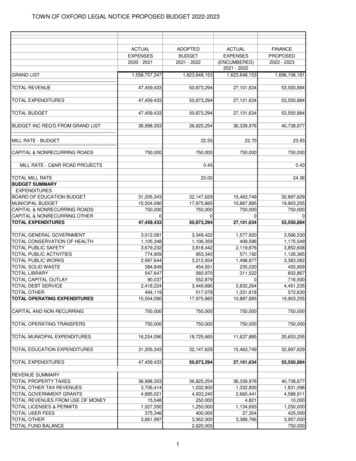

Fund:All FundsDepartment:All DepartmentsOrg Code:001-510*REVENUE DETAILS2019-20ACTUAL2020-21ADOPTEDBUDGET36,960,888 39,926,2252020-212020-21REVISED PROJECTEDBUDGETACTUAL2021-22PROPOSEDBUDGETREVENUES Law Enforcement Trust680Federal Equitable3,693Ticket Surcharge8,966Community Investment Tax127,151Library Donations1,509533,439Transportation Surtax FundDebt Service FundCapital Projects 0003,000,000804,007803,237803,237--Wastewater Development772,276Impact Fees-Parks/Recr-50,000211,309Impact Fees - Police-30,000224,019Impact Fees - Fire37,500 42,309,71450,000Water Development FundImpact Fees-Library 39,708,848AFCommunity Development Block GrantStreet Fund-2,453,709Cemetery Escrow 39,998,228TGeneral 342,306,877Water/Sewer ,442Solid Waste tormwater leet 25,70487,124,391 91,649,648 93,821,341 84,283,205 91,243,207 RTransportation impact/Mobility FeesCommunity Redevelopment AgencyDTOTAL REVENUES --950,000DEDUCT INTERFUND TRANSFERSGeneral Fund 8,53029,18829,18829,18831,464Street Fund254,161657,328657,328657,328341,919Debt Service804,007803,237803,237803,237799,841Capital Projects Fund211,309Water/Sewer Fund-1,313,380Stormwater Fund293,359386,898Fleet Replacement Fund 7,795,392NET TOTAL REVENUES 79,328,9997,185,813 84,463,8357,500,813 86,320,528311,081-1,339,418 -293,359-1,124,418 -293,359-961,100TOTAL INTERFUND TRANSFERS100,000-1,339,418 7,400,813 76,882,392232,447 6,210,473 85,032,734

Fund:All FundsDepartment:All DepartmentsOrg Code:001-510*APPROPRIATIONS DETAIL2019-20ACTUAL2020-21ADOPTEDBUDGET 35,250,608 39,926,2252020-212020-21REVISED Law Enforcement Trust4,649Federal Equitable56,820Ticket Surcharge16,126Community Investment Tax1,944,007Cemetery Escrow-Community Development Block GrantStreet FundTransportation Surtax FundDebt Service FundCapital Projects 150,000---617,181----545,685----3,295---RPark - Impact Fees30,0005,00019,120Fire - Impact Fees-444,981Water Development FundPolice - Impact Fees 42,309,714-623,454Wastewater DevelopmentLibrary - Impact Fees 37,526,81437,500AFLibrary Donations 40,197,607-TGeneral Fund201,6658,818Community Redevelopment 7Water/Sewer ,442Solid Waste tormwater leet 25,704 86,286,580 91,649,648 97,812,628 87,306,028 91,243,207 DTransportation Impact/Mobility FeesTOTAL EXPENSES-40,646-950,000DEDUCT INTERFUND TRANSFERSGeneral FundCommunity Investment TaxStreet 9226,370Water and Sewer olid Waste tormwater Fund311,541341,249556,249556,249410,315 6,472,932 10,350,525 7,400,813 7,398,116 6,210,473 79,813,648 81,299,123 90,411,815 79,907,912 85,032,734TOTAL INTERFUND TRANSFERSNET TOTAL EXPENDITURES

CITY OF PLANT CITYFIVE-YEAR CAPITAL IMPROVEMENT PROGRAMFY 2021-22 THROUGH FY 2025-26Cost ofFive-YearProgram 17,618,753 1,260,00023,903,2865,093,286SOLID WASTE FUND1,736,7141,736,714STORMWATER FUND2,150,000350,00055,646,835CIT FUNDCDBG FUNDSTREET FUND FY23-243,990,323 425,000FY24-253,166,202 425,000-TOTAL CITY FUNDS CRATOTAL ALL FUNDS 00-4,490,000-700,000700,000 14,123,284 12,780,323 ,944 15,554,631 14,044,465 12,073,181-200,000RAFWATER/SEWER FUNDFY22-23TGENERAL FUNDFY21-22 8,372,536200,000 269,859 8,642,3958,639,490247,782 8,887,272Fiscal Year 2021-22General Fund: 4,005,20226%DWater/Sewer Fund: 5,093,28633%CDBG Fund: 328,0822%Solid Waste: 1,736,71411%Steet Fund: 1,260,0008%Stormwater Fund: 350,0002%CRA: 1,431,3479%CIT Fund: 1,350,0009%

nPlayground ImprovementsPlanteen Recreation Center RemodelRehab Recreation OMA Storage Barn 75,00075,000 150,000250,00060,000460,000 ParksBike/Nature Trail - Sansone ParkPark ImprovementsEllis-Methvin Park Pedestrian BridgeRowena Mays Park Bridge/Dort Street CourtsSpray ParkOrnamental Cemetery FencingDog Park at Mike Sansone ParkDog Park at Marie B. Ellis ParkCourier Field FencingCemetery Roadway ImprovementsCemetery Operations BuildingsCemetery Property General ServicesCity Buildings Air ConditioningRoof Upgrade/MaintenanceCity Hall Exterior Brick & Window Maintenance TrafficAdvanced Traffic Management System (ATMS)Fiber Optic Cable UpgradeTraffic Signal Controller UpgradeTraffic Signal Cabinet Upgrade StreetPublic Parking Lot PavingSidewalk ReplacementBridge Repair, Replacement & UpgradeCollins Street Complete Street ImprovementsStreet Resurfacing from Additional MilPedestrian Handrail & Safety GuardrailBrick Road ,00035,000100,00075,000100,0001,517,500Project Project NameWater Resource ManagementWR001 Backflow Prevention Assembly & Large UM020UM021UM027UM033TotalUtilities MaintenanceMeter Replacement/Repair ProgramWater Distribution System Asset ManagementMinor Water Main ExtensionsMinor Sewer Main ExtensionsCollection System Asset ManagementWRF Asset ManagementWTP Asset ManagementLift Station Generator and Pump ReplacementLift Station Maintenance and RehabilitationBuilding Rehabilitation/ReplacementMidtown Utility SystemsLift Station 2 Basin 100,000185,000 4,436,105Funding 100,000100,000 ,000165,0002,300,000200,000500,0005,145,000 AFRC008NEWNEWTotalPolicePCPD Outdoor Firearms Range/Training FacilityRNEWTotalFundingTProject Project lities OperationsWater System Storage Tank Rehab ProgramWater System ImprovementsWater Treatment Plant Upgrade ProgramWastewater/Reclaimed Water Tank RehabReclaimed Water RechargeMcIntosh Park Wetland ExpansionMcIntosh Park Indirect Potable Reuse (IPR)Water Capacity ImprovementsStormwaterSW014 Stormwater Drainage Pipe ty ServicesForest Park/Madison Park NeighborhoodsCommunity Redevelopment AgencyPublic Parking Lot PavingEvers Street ImprovementsSouth Depot Parking Lot Boardwalk PatioTotal Budget of 15,554,631 0,0001,825,000 200,000200,000 328,082328,082 50,000610,000250,000910,000

BUDGET SUMMARYCITY OF PLANT CITYFISCAL YEAR 2021/2022THE PROPOSED OPERATING BUDGET EXPENDITURESOF THE CITY OF PLANT CITY ARE 1.6% MORE THANLAST YEAR'S TOTAL OPERATING EXPENDITURESGENERALFUNDMillage Rate 1,0005.715716,368,2186,736,260Permits & Fees5,175,360Intergovernmental Revenue5,614,871Charges For Services1,936,720Fines and 7,4296,927,119-4,493,721373,383Fund Balances/Reserves/Net Assets1,628,5641,601,071TOTAL REVENUES, TRANSFERSAND BALANCES42,309,7148,901,573Transfers InREXPENDITURES:General 53,125,70491,243,207--20,704,56840,000--Physical 3,901,042Economic 32,5751,110,000DDebt ServicesTOTAL EXPENDITURESTransfers OutTOTAL APPROPRIATEDEXPENDITURES TRANSFERS,RESERVES & 08-35,348,684166,000--2,335,400-9,020,636Public SafetyTOTAL ALLFUNDS-40,000TOTAL SOURCESINTERNALSERVICEFUND-126,000Miscellaneous RevenuesENTERPRISEFUNDSAFOther Taxes-DEBTSERVICEFUNDTESTIMATED REVENUES:Taxes:Ad Valorem 1,243,207THE TENTATIVE, ADOPTED, AND/OR FINAL BUDGETS ARE ON FILE IN THE OFFICE ABOVE REFERENCED TAXING AUTHORITY AS A PUBLICRECORD.396

Plant City is the second largest city in Hillsborough County and is located along the I-4 corridor. The City provides funding to the Plant City Economic Development Corporation for creating new jobs, investment of new capital, and expansion of the local tax base in Plant City. Therefore, 150,000 is included in the Fiscal Year 2021-