Transcription

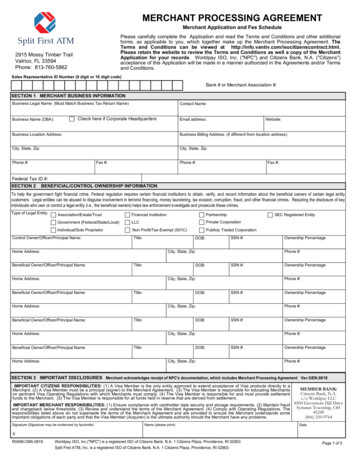

Empowering Global Citizensto CreateGlobal ChangeOur First Five Yearsof Social ImpactA Social Benefit Corporation11

TABLE OF CONTENTSA Message from Manu Smadja. 4A Message from Erika Norwood. 5Executive Summary. 6Our Mission. 8Our Social Impact Strategy and Objectives. 9Our Social Impact Philosophy and Approach. 10Our Unique Product is Credit-Building and Customer-Friendly. 11Our Data-Driven Credit Model is Based on Borrower’s Potential, Not Wealth. 12“Education is the most powerful weapon whichyou can use to change the world”- Nelson MandelaOur Customer Service Experience is Tailored to the Needs of International and DACA Students. 14We Bring the Service—and Compassion—to Servicing. 16Our Initiatives: How We’re Driving Progress Against Our Social Impact Objectives. 18Eliminating Financial Barriers Through Scholarships. 19Understanding and Eliminating Barriers for Women. 23Putting Our Borrowers on the Path to Success. 26Nurturing the Fintech and Social Enterprise Ecosystems and Shifting Lending Paradigms. 28Promoting Diversity, Equity, and Inclusion Internally. 31Our Results: How We Measure Up Against Our Social Impact Objectives. 34Progress Towards Objective #1: Removing Financial Barriers for Diverse, High-PotentialInternational and DACA Students. 35Progress Towards Objective #2: Building Borrower’s Credit and Enhancing FinancialInclusion and Financial Health. 36Progress Towards Objective #3: Enabling Tomorrow’s Scientists, Entrepreneurs, Innovators,and Leaders to Realize Their Full Potential. 38Progress Towards Objective #4: Helping Universities Meet Their Diversity Goals andStrengthen Their Bottom Line. 40Data Sources, Notes, and Methodology for Key Impact Metrics in This Report. 422

A MESSAGEfrom Manu Smadja, MPOWER CEODear shareholders, partners, clients, and friends of MPOWER,This report is a wonderful celebration of just how far we’ve come sinceMike Davis and I founded this company in 2014 — but also a reminderof how far there is yet to go.A Message from Erika NorwoodIn 2014, we were two former international students with an uglyPowerPoint deck and a dream: to help remove the financial obstaclesthat we had faced when accessing American higher education.Gray Matters Capital CEOWhen the Gray Matters Charitable Foundation (GMCF) awarded a Spark Program GrantIn our early years, we were so focused on building the business that wedidn’t always have time to measure our social impacts. We knew we werehaving them, since our core product— an education loan for internationaland DACA (Deferred Action for Childhood Arrivals) students in the U.S.and Canada that requires no co-signer, no collateral, and no U.S. orCanadian credit score—was designed with our mission in mind. We alsoknew anecdotally that we were having an impact on students, but we justdidn’t have data.Now, thanks in part to a generous grant from Gray Matters Capital, we’reable to quantify many of our impacts. As this report highlights, we serveone of the most socioeconomically and geographically diverse customerbases on the planet. Our borrowers are citizens of the world, and they arefounding companies, running for office, and making scientific discoveries.I hope you’ll enjoy reading about the impact we’re having on ourborrowers, their universities, and their communities. Most of all, I hopeyou’re inspired by our students’ stories—and that you’re inspired to joinus on this journey.to MPOWER Financing in April 2018, we hoped that it would catalyze the design andimplementation of a truly innovative social impact strategy. We have not been disappointed.The insights MPOWER has gathered from borrowers through surveys, case studies, videocontests, and focus groups have clearly advanced MPOWER’s data-driven decision-makingand understanding of the customer journey.I would like to particularly commend MPOWER for your work to illuminate the barriersfacing women in emerging markets. The data you have gathered is sobering. But asMPOWER would also like tothank its other investors:GMC persists in its mission to support an education leading to a more purposeful life for100 million women by 2036, we appreciate this clear-eyed assessment of the numerousobstacles facing women in the higher education pipeline.Given that MPOWER focuses on the tail end of this education pipeline, some of thesechallenges cannot be easily addressed by MPOWER. GMCF, however, intends to use theseinsights to inform its work with women and girls in India and around the globe, and I hopeother partners do as well.For the pool of women in emerging markets who do possess the academic and professionalqualifications to pursue higher ed in the U.S. or Canada, however, MPOWER is doing anextraordinary job of removing financial barriers for them.We are honored to have been partners in this journey.4I hope you’re inspired by our students’ stories—and that you’re inspired to join us on this journey.5

Executive SummaryAt MPOWER, we believe that now, more than ever, we need scientists, engineers, medical professionals, and businessand government leaders who are multilingual and cross-cultural; who bring a fresh perspective to a wide range ofglobal problems and who are equipped to solve them in a culturally appropriate way; and who are sensitive to theneeds of—or even themselves members of—often marginalized groups.This report highlights just how we’re trying to bring this about. It also highlights how diverse and bright our studentsare—and how their diversity, talent, and tenacity are already at work solving global problems ranging from poor waterquality in Pakistan to antibiotic-resistant infections in Africa.We’re Proud of the Recognitionand Awards We’ve ReceivedHighlighting This Impact:BEST FINTECHSTO WORK FOR2018 &2019SUMMARY OF RESULTS, BY OBJECTIVERemoving FinancialBarriers for Diverse, HighPotential Internationaland DACA Students85% couldn’t 2,000loans made120 76% ofcountriesborrowers53%ofcitizenshiphave familyincomes 15,00045%femalefromemergingmarkets75% of MPOWERborrowers who hadno FICO score at the4%DACAhave financeda degreewithoutMPOWEREnabling Tomorrow’s Scientists, Entrepreneurs,Innovators, and Leaders to Realize Their Full PotentialBuilding Borrower’s Credit and EnhancingFinancial Inclusion and Financial Healthtime of loan attained a primecredit score after making 12consecutive on-time payments6BestLender forInternationalStudents50%of borrowers wereapproved for acredit card45%ofgraduateswork in STEM3companyaPLATINUMOur impact work supports the followingU.N. Social and Development Goalshave foundedHelping Universities Meet Their Diversity Goalsand Strengthen Their Bottom LineSince our inception,our students havepaid over 100million in tuitionand fees to 148universities.While over half ofinternational students in theU.S. in 2018 were from Indiaor China (IIE Open DoorsReport), less than a quarterof MPOWER’s borrowers were fromthese two countries.7

Our MissionEnable high-promise global citizens tofurther their academic and financialaspirations and make socioeconomicmobility borderless.Our Social Impact Strategyand ObjectivesWe support our borrowers at every stage intheir customer journey, with the ultimate goal ofmaking socioeconomic mobility borderless.At each critical juncture in our borrowers’ journey,we’ve identified social impact objectives to keepus focused and accountable. We then developedmetrics to track our progress towards achievingthese objectives.Read on to find out how wellwe’ve done to date!MPOWER removes financialbarriers for diverse, high-potentialinternational and DACA studentsthrough no-cosigner loans andscholarshipsMPOWER assists U.S. andCanadian universities in meetingdiversity goals while keepingtheir underlying financialpositions strongOUR VALUESBoldnessCompassionExcellenceInclusionMPOWER buildsborrowers’ credit andputs borrowers on a pathto financial inclusion andfinancial healthData-driven Decision-MakingUnwavering IntegrityMPOWER enables tomorrow’sscientists, entrepreneurs,innovators, and leaders torealize their full potential andchange the world89

Our Social Impact Philosophy and ApproachSOCIAL IMPACT ISN’T JUST A PILLAR OF MPOWER FINANCING’S BUSINESS—IT’S THE CORE OF OUR BUSINESS.When designing our business model andoperations, we took a social impact lensto each step in the process Customer-Friendly,Credit-Building ProductCredit Model Based onPotential, Not WealthCustomer Service Tailoredto Needs of InternationalStudentsCompassionate Servicing and then layered on special initiativesto further remove financial barriers andsupport borrowers ScholarshipsOutreach to WomenOur Unique Product is Credit-Buildingand Customer-Friendly to drive continuous improvement inour social impact objectives Consumer-Friendly Features of our Core ProductRemoving Financial Barriersfor Diverse, High-PotentialInternational and DACA Students Can be used at any one of our 350 partner schoolsBuilding Borrower’s Creditand Enhancing FinancialInclusion and FinancialHealth Funds are disbursed directly to school Can be used to fund graduate school or junior or senior yearof undergraduate studies to achieveour ultimate goal No collateral required No credit score required Fixed interest ratesEnabling Tomorrow’sScientists, Entrepreneurs,Innovators, and Leaders toRealize Their Full PotentialHelping Universities MeetTheir Diversity Goals andStrengthen Their BottomLine No co-signer required Flexible loan amounts from 2,001 to 50,000 Interest-only payments in school and six months after graduation Assists in building borrower credit No pre-payment penaltiesIncrease the number and diversityof high-potential global citizenswho can benefit from—and enrich—North America’s top educationalinstitutions, and support themduring and after their degree sothey can realize their full potential. Generous forbearance policyPath2Success1011

Our Borrowers Have a Wealthof Potential Sumei X., MPOWER BorrowerFrom Au Pair to Software EngineerOriginally from Jiangsu, China, Sumei came to Shanghai to attend college. She studiedcomputer science and worked diligently to improve her English, but says she was“extremely shy” and lacked confidence.61%of our MBA studentsscored in the top10th percentile on the GraduateManagement Admission Test(GMAT)Our Data-Driven Credit Modelis Based on Borrowers’POTENTIAL, Not Wealth.The idea behind MPOWER is simple yet audacious: credit decisionsfor international and DACA students should be forward-looking andbased on the student’s extraordinary potential.How do we put this into practice?Rather than looking at family income or assets, our proprietaryalgorithm uses each student’s test scores, the caliber of theiruniversity, their degree program, and a myriad of other factors toestimate the student’s future earnings—and their ability to servicedebt.As a result, we’re proud to serve the planet’s highest-potentialindividuals, regardless of income, family background, or gender.12After college, she took a job as a technical support specialist for Citibank, but she foundherself restless for an opportunity to “see the world.” When she learned about the au pairprogram, she jumped at the opportunity, believing it would help her improve her English,learn about American culture, and gain self-confidence. but not necessarily monetary wealthSumei was surprised by some of the challenges she encountered as an au pair. “I thoughtmy English was pretty good,” she said, “and it was—by Chinese standards. But while Icould read and write it fairly well, speaking was a real challenge. Beyond the languageitself, there’s also a big difference in communication styles. Chinese people tend to bemore indirect, while Americans are more straightforward. It took me a while to adjust.”17%of our borrowersare from familieswith annualincomes 2,50085%53%of our borrowersare from familieswith annualincomes 15,000of our borrowers say theycouldn’t have financedtheir degree withoutMPOWER“Unlike in China,[the American kids’]schooling focused oncritical thinking, notrote memorization.”STUDENT SPOTLIGHTWorking as an au pair also gave her a taste of the American educational system. “I was soimpressed by the projects that the children I worked with did at school. Unlike in China,their schooling focused on critical thinking, not rote memorization.”That experience inspired Sumei to continue her education in the U.S. When she receivedthe news that she had been accepted to the Master of Computer Science program atBoston University, Sumei was elated. However, she soon realized her savings werewoefully inadequate. She considered applying for a loan from a Chinese bank, but therewere no Chinese banks willing to lend without a mortgage on her parents’ house. She wasalso reluctant to ask her parents for help.Fortunately, her online research quickly led her to MPOWER and, as a result, she was ableto cover her funding shortfall. Sumei doesn’t know just what the future will bring, butit’s already looking bright. She has a great software engineering internship lined up thissummer, and she’s hopeful this will turn into a full-time job offer.13

Gizem GirgimOur Customer Service Experienceis Tailored to the Needs ofInternational and DACA StudentsMPOWER’s Customer Success Team serves as the customer’s guide and partnerthroughout the application process. MPOWER representatives are available toanswer questions on a wide range of topics, from applying for our scholarships, torequesting a visa support letter from MPOWER, to uploading the right supportingdocuments for a loan application. Our representatives also keep customersupdated on the status of their applications and collect real-time customerfeedback.We use this customer feedback to continuously improve our processesand loan platform. Just a few examples from the past year include: Improving self-service options for uploading therequired supporting documentation;MPOWER Senior Customer Success AnalystFrom Struggling International Student toCustomer Service GuruWhat Our Borrowers Have to SayAbout Our Customer Service“[I had a] very good experience. I have got hope out of myhopeless situation of being withdrawn from the Master’sdegree in Global Health Policy and Management. So, Icommend MPOWER Financing for the good work.” Launching a Frequently Asked Questionsfeature; Creating a customer welcome video andfinancial literacy quiz to ensure borrowersfully understand the terms of their MPOWERloan; and Creating a Customer Welcome Team to proactivelyreach out to customers who fail to progress fromone stage of the loan approval process to the next in areasonable amount of time. We have found that this isoften due to issues related to identifying and uploadingthe correct documentation, so rather than wait for acustomer to reach out to us, we call them!“[I] really appreciate your great heart to humanity by liftingthe burden of education funding [and] enhancing educationprivileges to the less privileged. Your prompt response tomails is second to none.”“Ms. Thomas was absolutely amazing! She helped mefrom day one all the way. She talked me through all thechallenges and made what was a very stressful processmuch more bearable and doable. I am eternally grateful forher stellar service. She really was amazing!”“Wow! Gizem is [a] very professional, quick responderand knowledgeable staff [member]. She is [an] excellentproblem-solver. She responds to customers’ concerns andis able to resolve them to make customers satisfied.”14Growing up in Izmir, Turkey, Gizem acquired the nickname “American girl” because shespoke English better than all of her classmates—better, even, than her English teacher.But she still found she faced a language barrier when she came to U.S. in 2010 to pursue aMaster of Finance at Florida International University. “There are a lot of words and phrasesused daily in the U.S. that come from social media, movies, songs, and the culture itself,and I just wasn’t familiar with those,” she recalls. “So I made friends with people who wereraised in the U.S. and asked them to explain these phrases to me.”“I love helpinginternational studentslike myself achieve theireducation goals everysingle day.”Gizem’s English quickly improved, she received excellent grades, and she was even askedto serve as a teaching assistant. But even so, she found that it was difficult to secure afinance job post-graduation without permanent residency, so she ended up in retail—but then found she loved the sales side of it. Eventually, she landed a job as a financialadvisor for Edward Jones. She enjoyed that role, but still jumped at the chance to work forMPOWER—and help international students work through some of the same challengesshe had faced.“I love helping international students like myself achieve their education goals every singleday,” she says.That passion shines through in Gizem’s work—and in the results. In recognition of herexcellence in customer service, MPOWER’s CEO asked her to stand up the CustomerWelcome Team.STAFF SPOTLIGHT“Gizem is motivated by seeing others succeed,” says her manager, Kristin, “and this isapparent in the way she interacts with students. She checks in on applicants to see howtheir visa interviews or school exams went. She shares her experiences as an internationalstudent in hopes it that it will make someone else’s journey easier. She thrives on therelationships she builds with each student. We’re extremely lucky to have her as part ofthe MPOWER family.”15

We Bring the Service—and Compassion—to ServicingA SERVICINGSUCCESS STORY!CHALLENGE:Employment BarriersMPOWER aims to treat every customer likea VIP at every stage in the process, includingservicing. We know that our borrowers faceunique challenges, so we’ve designed acompassionate, borrower-driven servicingprocess to assist in overcoming thesechallenges.CHALLENGE:International Transfer FeesSome of our borrowers return to theirhome countries after graduation, whichmeans they no longer have access to U.S.dollar-denominated accounts—and facebank fees of up to 13 percent to transfermoney internationally.OUR SOLUTIONWe partner with Flywire, a secureglobal payment platform that allowsstudents to seamlessly pay MPOWERfrom over 200 countries andterritories. Our borrowers can makea payment in their local currency ata very competitive exchange rate, bymobile phone, without any hidden fees.Some of our borrowers run intoshort-term financial difficulties, oftenas a result of circumstances thatdisproportionately affect internationaland DACA students, such as workauthorization issues.CHALLENGE:Lack of Familiarity withU.S. Banking PracticesOUR SOLUTIONWe tailor our assistance to eachborrower’s unique circumstances: For borrowers still in school, weoffer a special credit buildingpayment option that temporarilyreduces a borrower’s monthlypayment to 25. MPOWER reportsthe loan as “paid current” to thecredit bureaus. This option allowsthe borrower to continue buildinga good U.S. credit history while inschool, without the pressure ofsupporting larger loan payments. For borrowers facing difficulties inobtaining a job or internship, weprovide referrals to MPOWER’s suiteof free Path2Success services.(See page 26 for details.)Some of our borrowers are unfamiliarwith common practices in the U.S. bankingsystem, such as automatic payments, andare reluctant to use these options.OUR SOLUTIONWe proactively reach out to borrowers toeducate them about the importance of makingon-time payments, as well as options to makethis as easy as possible. As an incentive, weoffer interest-rate discounts of 0.5 percentagepoints for each of the following: Signing up for automatic payments; Making 6 consecutive, on-time autodebit payments; Graduating and obtaining full-timeemployment.Citizen of the World and MPOWERCustomer Success AnalystWith the financial assistance providedby MPOWER, Mirjeta* was able tocomplete her Master of InternationalBusiness at Tufts University. But shestruggled to find employment aftergraduation because she didn’t knowhow to represent herself in her résuméand in interviews. Her loan becameseverely delinquent and she stoppedcommunicating with MPOWER.As the loan approached default,MPOWER’s Servicing Team wasfinally able to get in touch. Using theforbearance option, the team wasable to not only bring her past duepayments back up to date and stopthe loan from defaulting, but also put acouple of her upcoming payments onhold as well to give her some breathingroom. While her loan was paused withforbearance, Servicing connected herwith our Path2Success team, whichrevamped her résumé, tapped intotheir networks to get Mirjeta interviewsat three top consulting firms, andimproved her interview skills throughmock interviews.As a result of MPOWER’s assistance—plus Mirjeta’s own stellar credentials—she obtained a consulting positionand is now back on track with herpayments!*Name has been changed to protect borrower’s privacy16Tania SalazarTania’s manager, Kortney, describes her as “totally dedicatedto doing whatever she can to help the borrower, throughoutthe life of the loan. Whether it’s onboarding a new borrower orbrainstorming options to bring a delinquent account current, shetakes the time that is needed with every borrower to ensure all oftheir worries are eased.”“I am passionate abouthelping borrowersfind the best solutionfor them.”STAFF SPOTLIGHTWhen counseling students, Tania draws on her experience asa former financial advisor for Merrill Lynch. She often reviewsborrowers’ personal finances and suggests budget-stretchingtips and tricks. She also works to address the root cause oftheir financial difficulties, working in tandem with MPOWER’sPath2Success team to address immigration and employmentissues.Part of what makes Tania so passionate about assisting borrowersis her own experience as a former international student—anda true global citizen. Born in Brazil to Colombian parents, Taniaspent her formative years in Brazil, the U.S., and Quebec, Canada,becoming fluent in English, Spanish, Portuguese, and French.She completed her undergraduate studies at Temple Universityand the Sorbonne, and then received her MBA from McKenzieUniversity in Sao Paulo, Brazil, before working as a strategist forstart-ups in Brazil.“I am passionate about helping borrowers find the best solutionfor them,” Tania says, “and I enjoy educating them about theimportance of personal financial responsibility in credit building. Ilove it when I’m on a call with a borrower and the lightbulb finallygoes off. Then I can tell the borrower really understands theirloan payment schedule, how any pre-payments or late paymentswill affect the total amount they pay—and how this loan, and thecredit it builds, will affect their long-term financial goals.”17

Our Initiatives: How We’re Driving ProgressAgainst Our Social Impact ObjectivesJanuary 2019Launch offirst MPOWERscholarshipprogram, the GlobalCitizen ScholarshipProgramLaunch of two newjoint scholarshipprograms withLa Unidad LatinaFoundationAugust 2018March 2019Launch ofWomen in STEMScholarshipProgramFebruary 2019April 2019MPOWER’s firstwebinar forborrowers withan immigrationattorneyLaunch of NursingScholarshipProgramMPOWER’s firstsocial impactcase competitionLaunch of webinarseries for MPOWERborrowers withprofessionalcareer coachMarch 2019MPOWER’s firstfocus groups inNigeria tounderstand accessbarriers, particularlyfor womenLoans are just one way that MPOWER achieves our mission ofensuring socioeconomic mobility is borderless. Scholarships arean increasingly important part of the way we achieve this missionand remove financial barriers for international and DACA students.In 2018, MPOWER awarded 20,000 in scholarships to internationaland DACA students. In 2019, MPOWER will increase this to over 65,000.MPOWER Global CitizenScholarship ProgramOur signature scholarship program awards scholarships tointernational students at schools we support. We’ve intentionallydesigned this scholarship program to be as broad as possible tomatch the broad, diverse experiences of international and DACAstudents.May 2019MPOWER’s firststakeholderinterviews tounderstand accessbarriers for IndianwomenEliminatingFinancialBarriers ThroughScholarshipsLaunch of groupcareer coachingpilot for highest-riskborrowersOTHER WINNERS:Vaqar Syed, Pakistan,University of California, Los AngelesZainab Ilumoka, Nigeria,Northeastern University Law SchoolApril 201918May 2019May 2019FEATURED WINNERCHIDOZIE D. OJOBOR, NIGERIANANTIBIOTIC RESISTANCE RESEARCHERAT THE UNIVERSITY OF TORONTOLike so many of our winners, Ojobor’spersonal experiences provided theinspiration for his career choice.“One of the greatest breakthroughsof medicine was the discovery ofantibiotics,” he wrote in his essay.“However, over the years, there hasbeen an uprising of antibiotic-resistant bacteria which have posed agreat threat to human existence. Antibiotic-resistant bacteria, if leftunchecked, would cause 10 million deaths yearly by 2050 worldwide,according to a CDC report. Coming from Nigeria, I have firsthandexperience with persons infected with bacteria which are unresponsiveto drugs.”Now a Ph.D. student in Molecular Genetics at the University of Toronto,Ojobor’s contributions to the field greatly impressed our judges. “In thelast three years of my Ph.D. in Canada,” he wrote in his essay, “I haveidentified novel bacteria-killing entities, called tailocins, which I havesuccessfully used to kill antibiotic-resistant bacteria in the laboratory.Interestingly, in any case that the bacteria then develop resistance, I cangenetically engineer the tailocins to overpower the resistant superbugs.My work has the potential to help the world in overcoming diseasescaused by antibiotic-resistant bacteria.”“’I feel immensely honored to be a winner of the prestigious MPOWERGlobal Citizenship Scholarship,” Ojobor said. “For me, this recognitionrevitalizes my drive toward my education, and because this scholarshipis monetarily applied to funding my schooling, it is truly freeing and‘empowering.’”Tabitha Wacuka Kiiru, Kenya,Iowa State University19

MPOWER Women in STEMScholarship ProgramOn February 11th, the United Nation’s International Day of Womenand Girls in Science, MPOWER launched its Women in STEMScholarship Program. This scholarship program focuses on womenwho will use their Science, Technology, Engineering, or Math (STEM)degree to benefit society and the planet and who have the potentialto serve as role models and advocates for women in STEM.FEATURED WINNERARUNIMA SEN, NYU ENGINEERINGSTUDENT AND RECIPIENT OF INDIA’STOP CIVILIAN HONOR FOR CHILDRENAt just 17, Sen is the youngest recipientever of an MPOWER scholarship—but that’s not the only distinction thisyoung woman holds. She is also oneof just six individuals—and the only female—to receive the PradhanMantri Rashtriya Bal Puraskar (National Child Award for ExceptionalAchievement), the highest civilian honor for Indians under the age of 18.Sen was also selected to participate in the prestigious New York Academyof Sciences’ Junior Academy, a selective online research program for highschool students interested in STEM. Within the program, she developedan energy-efficient solar hybrid bus and a smart green building withzero- carbon footprint. She presented these projects for two consecutiveyears in New York and Florida to global leaders in STEM, including NobelLaureates and CEOs of Fortune 500 companies.Sen will use her scholarship to pursue an undergraduate degree inElectric and Computer Engineering at New York University (NYU).“I feel extremely honored to havebeen chosen for this award,”OTHER WINNER:Sen says.Iris Braunstein, Canada,Harvard Medical School20MPOWER SCHOLARSHIP PROGRAMS IN PARTNERSHIP WITHLA UNIDAD LATINA FOUNDATIONMPOWER Nursing Scholarship ProgramIn March, MPOWER celebrated our expansion to support 25 ofthe top nursing schools in the U.S.—and its continued support for188 North American univers

PLATINUM SUMMARY OF RESULTS, BY OBJECTIVE Since our inception, our students have paid over 100 million in tuitionno FICO and fees to 148 universities. While over half of international students in the U.S. in 2018 were from India or China (IIE Open Doors Report), less than a quarter of MPOWER's borrowers were from these two countries.