Transcription

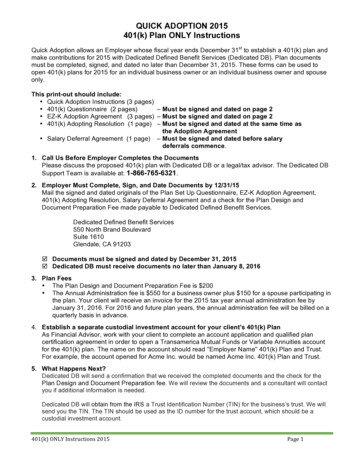

QUICK ADOPTION 2015401(k) Plan ONLY InstructionsQuick Adoption allows an Employer whose fiscal year ends December 31st to establish a 401(k) plan andmake contributions for 2015 with Dedicated Defined Benefit Services (Dedicated DB). Plan documentsmust be completed, signed, and dated no later than December 31, 2015. These forms can be used toopen 401(k) plans for 2015 for an individual business owner or an individual business owner and spouseonly.This print-out should include: Quick Adoption Instructions (3 pages) 401(k) Questionnaire (2 pages)– Must be signed and dated on page 2 EZ-K Adoption Agreement (3 pages) – Must be signed and dated on page 2 401(k) Adopting Resolution (1 page) – Must be signed and dated at the same time asthe Adoption Agreement Salary Deferral Agreement (1 page) – Must be signed and dated before salarydeferrals commence.1. Call Us Before Employer Completes the DocumentsPlease discuss the proposed 401(k) plan with Dedicated DB or a legal/tax advisor. The Dedicated DBSupport Team is available at: 1-866-765-6321.2. Employer Must Complete, Sign, and Date Documents by 12/31/15Mail the signed and dated originals of the Plan Set Up Questionnaire, EZ-K Adoption Agreement,401(k) Adopting Resolution, Salary Deferral Agreement and a check for the Plan Design andDocument Preparation Fee made payable to Dedicated Defined Benefit Services.Dedicated Defined Benefit Services550 North Brand BoulevardSuite 1610Glendale, CA 91203! Documents must be signed and dated by December 31, 2015! Dedicated DB must receive documents no later than January 8, 20163. Plan Fees The Plan Design and Document Preparation Fee is 200 The Annual Administration fee is 550 for a business owner plus 150 for a spouse participating inthe plan. Your client will receive an invoice for the 2015 tax year annual administration fee byJanuary 31, 2016. For 2016 and future plan years, the annual administration fee will be billed on aquarterly basis in advance.4. Establish a separate custodial investment account for your client's 401(k) PlanAs Financial Advisor, work with your client to complete an account application and qualified plancertification agreement in order to open a Transamerica Mutual Funds or Variable Annuities accountfor the 401(k) plan. The name on the account should read "Employer Name" 401(k) Plan and Trust.For example, the account opened for Acme Inc. would be named Acme Inc. 401(k) Plan and Trust.5. What Happens Next?Dedicated DB will send a confirmation that we received the completed documents and the check for thePlan Design and Document Preparation fee. We will review the documents and a consultant will contactyou if additional information is needed.Dedicated DB will obtain from the IRS a Trust Identification Number (TIN) for the business’s trust. We willsend you the TIN. The TIN should be used as the ID number for the trust account, which should be acustodial investment account.401(k) ONLY Instructions 2015Page 1

QUICK ADOPTION 2015401(k) Plan ONLY Instructions (Continued)The following instructions should help you to properly complete the documents. Please call DedicatedDefined Benefit Services if you have questions: 1-866-765-63211. 401(k) Questionnaire – Please complete each item of the Questionnaire, then sign and date at thebottom. Most items are self-explanatory; however, please pay particular attention to the following items:Item 2 – Sole Proprietorships must have an Employer Identification Number (EIN) for plan reportingpurposes; you cannot use your social security number. You can obtain an EIN online at www.irs.gov orrefer to your CPA.Item 3 – If your business entity type is an LLC, please indicate how the LLC is taxed: as a soleproprietorship, partnership, C-corporation or S-corporation.Item 12 – If you currently maintain a SEP, SIMPLE, 401(k) or other defined contribution plan, anycontributions already deposited for 2015 may limit or prohibit plan contributions.Item 14 – If your business is a member of a controlled group or affiliated service group, employees of anygroup must be covered under the plan. This can occur if you (or family members) have ownership in otherbusinesses. Please refer to your legal/tax advisor to determine if a controlled group or affiliated servicegroup exists.2. EZ-K Adoption Agreement (3 pages)Complete Items 1 through 7 (6 is already pre-filled), then sign and date the middle of page 2 as boththe Employer and the Trustee. You do not need to complete page 3.Most items are self-explanatory; however, please pay particular attention to the following items:Item 2 – Enter the Plan Name. The plan name is the employer’s name plus 401(k) Plan. For example, ifthe employer’s name is Acme, Inc., then you would enter “Acme, Inc. 401(k) Plan”.Item 4 – The trustee is generally the business owner.Item 7 – Enter the employer identification number (EIN), not your Social Security number (see Set UpQuestionnaire above, Item 2).Signatures – The employer and trustee must sign and date the middle of page 2.3. 401(k) Adopting Resolution (1 page)Enter the employer’s name at the top, then sign and date the bottom of the page.4. Salary Deferral Agreement (1 page):Enter the employer’s name and participant’s name at the top.401(k) ONLY Instructions 2015Page 2

QUICK ADOPTION 2015401(k) Plan ONLY Instructions (Continued)Select one of the three salary deferral options: (i) maximum amount; (ii) a dollar amount less than themaximum; or (iii) a percentage of W-2 income per payroll period.The participant and the employer must sign and date at the bottom. Note: If your spouse is coveredunder the plan, make a copy of this form -- he or she must also complete a salary deferral agreement.Timing of salary deferral contributions:If you are an owner of an unincorporated business (e.g., sole proprietorship), you must complete a salarydeferral agreement by December 31st specifying the amount you intend to defer. The deferral should bedeposited by the due date of the business tax return (generally April 15th of the following year).If you receive W-2 income, you must complete a salary deferral agreement specifying the amount youintend to defer, before the compensation is paid to you. (NOTE: You can only make salary deferrals onfuture income that has not been paid at the time you complete the salary deferral election form). Thedeferral should be deposited as soon as administratively possible and no later than the 15th day of themonth following the month in which deferrals are withheld.Please retain copies of these documents for your file.Mail the completed and signed originals of the four documents (401(k) Questionnaire, EZ-KAdoption Agreement, 401(k) Adopting Resolution and Salary Deferral Agreement) and a check for thePlan Design and Document Preparation Fee to Dedicated Defined Benefit Services.Dedicated Defined Benefit Services550 North Brand Boulevard Suite 1610Glendale, CA 91203401(k) ONLY Instructions 2015Page 3

OnePerson401(k) QuestionnaireTMThe following information is required to complete the set-up of your One Person 401(k) plan. This 401(k) is only available to cover either (i) an owner only or (ii) family members who are owners. This plan is not appropriate if you have employees. The IRS allows each participant to make elective salary deferrals equal to the lesser of 18,000 (plus 6,000 catch-upif age 50 ) or 100% of compensation and a 25% profit sharing contribution to the 401(k) plan The maximum total contribution for each participant for 2015 is 53,000 plus 6,000 catch-up if age 50 Administration of your plan is provided by Dedicated Defined Benefit Services LLC, a leading provider of administrative services forbusinesses with 1-10 retirement plan participants. All answers are confidential. The questionnaire must be completed and signed bythe employer. Please call Dedicated DB with any questions at 1-866-765-6321.Employer Information1. Legal Name of Employer:DBA Name (if applicable):2. Employer ID# (EIN, not Social Security#)3. Entity Type:C-corpIf an LLC, how is it taxed?S-corpPartnershipSole ProprietorSole ProprietorPartnershipC-CorpLLCOtherS-corp4. Employer’s Fiscal Year End: Date of Incorporation or Date Business Began: If business entity type has changed, please explain under Notes (Item 21).5. Principal Business Activity: Six Digit Business Code:6. Mailing Address of Employer:City:State:Zip:7. Owner Information:Owner Name: Date of Birth: Date of Hire: Ownership: %Owner(s)’ Email Address:Phone:Fax:2nd Owner Name: Date of Birth: Date of Hire: Ownership: %8. Financial Representative:Name: Email:Company:Mailing Address:Phone: Fax:9. Accountant:Name: Email:Company:Mailing Address:Phone: Fax:—1—TSA

Plan Information10. What is the first plan year of administration that Dedicated DB is responsible for?20152016Other11. Trustee(s) (usually the owner):12. Other Plans:Does the employer sponsor any other plans?Yes; DescriptionIf Yes, amount already contributed for 2015 to other plan: No13. Employees:YesNoDoes the employer have any rank and file W-2 employees?Does the employer have any leased employees?14. Related Employers:If your business is part of a controlled group or affiliated service group, employees of any group must be covered by thisplan. Please review the items below and check any that apply to you.YesNoDo any owners (or spouses) own interests in other businesses?Is the employer part of a controlled group of businesses?Is the employer part of an affiliated service group?15. Notes/Other Information:Client Authorization to ProceedBy signing this form, you are acknowledging as the sponsoring Employer that there is a one-time Plan Design andDocument Preparation fee and annual administration fees beginning in the year that you establish the plan. These feesare tax deductible. With that understanding, you are authorizing the establishment of the plan based on the informationprovided in this questionnaire. Please retain a copy of this questionnaire for your files.Signature:Date:Please make your check for the Plan Design and Document Preparation fee payable toDedicated Defined Benefit Services.Mail this signed form with your check to:Dedicated Defined Benefit Services, LLC550 North Brand Boulevard, Suite 1610Glendale, CA 91203—2—TSA

“The EZ-K” IT’S FAST! IT’S EASY!”The Owner Only 401(k) Profit-Sharing PlanADOPTION AGREEMENT #02007PROTOTYPE EXPANDED PROFIT-SHARINGPLAN AND TRUSTGENERAL INFORMATIONThe undersigned Employer hereby adopts the Sponsor's Prototype EZ-K Profit-Sharing Plan in the form of a standardized Plan, as set out in thisAdoption Agreement and the Prototype Defined Contribution Plan and Trust Document #02 and all completed Addendums, and agrees that the followingdefinitions, elections and terms shall be part of such Plan.1. (a)Name & Street Address of Plan Sponsor/Employer:(1) Yes(2) N/AThe Employer named above is part of a Controlled Group or Affiliated Service Group:If “yes”, complete Controlled Group Addendum.401(k) Plan and Trust2. Name of Plan:3. Phone:4. Trustee/Custodian:(a) C Corporation, Date of incorporation:5. Type of Business Entity:(b) S Corporation, Date of incorporation:(c) Partnership(d) Sole Proprietor(e) Other (must be a legal entity recognized under federal income tax laws):6. Employer's Taxable Year: 12/317. Employer Identification Number (EIN)::8. 3-Digit Plan Number (see Form 5500 Instructions)9. Business Code (see Form 5500 Instructions):10. Plan Administrator:(a) Employer(b) Other (specify name, address and phone):11. Sponsor of the Prototype (specify name, address and phone): Dedicated Defined Benefit Services, LLC550 N. Brand Blvd., Suite 1610, Glendale, CA 91203 (800)982-696112. Effective Dates:This is a:Initial Effective DateAmendment/Restatement Effective Datest01/01/2015(a)New Plan (not earlier than the 1 day of current plan year)N/A(b)Restatement of a Plan previously adopted by the Employer(for PPA restatement, restatement date cannot be earlierthan 1-01-2007)(c)Amendment of a Plan (List amendment(s) made:)(d)Merger, amendment and restatement of thePlan(surviving(merger)Plan into thePlanand thePlan)(e)Restatement of thePlan, AND a restatement of thePlan, AND a merger of thePlan into thePlan(f)Amendment of a Plan to a wasting Trust(b)13. This Plan shall be governed by the laws of the state or commonwealth where the Employer’s (or in the case of a corporate Trustee, such Trustee’s)principal place of business is located unless another state or commonwealth is specified:(a) are(b) are not available. Default – (b)14. Loans to Participants(1) shall(2) shall not be permitted. Default – (2)15. (a) Roth Elective Deferrals(1) shall(2) shall not be permitted. Default – (2)(b) In-Plan Roth RolloversOVERRIDING LANGUAGE FOR MULTIPLE PLANS16. (a) If the Employer maintains or ever maintained another qualified plan in which any Participant in this Plan is (or was) a Participant or couldbecome a Participant, the Employer must complete this section. If the Participant is covered under another qualified defined contribution planmaintained by the Employer, other than a master or prototype plan:(1) The provisions of Section 6.02 of Article VI will apply as if the other plan were a master or prototype plan.(2) Provide the method under which the plans will limit total annual additions to the maximum permissible amount, and will properly reduceany excess amounts, in a manner that precludes employer discretion:(b) The Employer wishes to add overriding language to satisfy section 416 in the case of required aggregation under multiple plans:(1) No(2) Yes (Employer must attach overriding language, if elected):(c) If 16(b)(2) is elected, complete the following:(1) Interest Rate:; Mortality Table:; or(2) The interest rate and mortality table specified to determine “present value” for top-heavypurposes in the defined benefit plan.RELIANCE ON OPINION LETTER17. The adopting Employer may rely on an opinion letter issued by the Internal Revenue Service as evidence that the Plan is qualified under § 401 of theInternal Revenue Code except to the extent provided in Rev. Proc. 2011-49.Copyright 2008-2013, PenServ Plan Services, Inc.Control EZK 02007 PPA.doc (03/12)(11/13)Page 1 of 3

An Employer who has ever maintained or who later adopts any plan (including a welfare benefit fund, as defined in § 419(e) of the Code, whichprovides post-retirement medical benefits allocated to separate accounts for key employees, as defined in § 419A(d) (3) of the Code, or anindividual medical account, as defined in § 415(l) (2) of the Code) in addition to this Plan may not rely on the opinion letter issued by the InternalRevenue Service with respect to the requirements of § 415 and 416.If the Employer who adopts or maintains multiple plans wishes to obtain reliance with respect to the requirements of § 415 and 416, applicationfor a determination letter must be made to Employee Plans Determinations of the Internal Revenue Service.The Employer may not rely on the opinion letter in certain other circumstances, which are specified in the opinion letter issued with respect to thePlan or in Rev. Proc. 2011-49.This Adoption Agreement may be used only in conjunction with basic Plan Document #02.The Sponsor will inform the adopting Employer of any amendments it makes to the Plan or of its discontinuance or abandonment of the Plan.NOTICE: Failure to properly complete this Adoption Agreement may result in disqualification of the Plan. The Employer's tax advisor should reviewthe Plan and Trust and this Adoption Agreement prior to the Employer adopting such Plan.The undersigned Employer acknowledges receipt of a copy of the Plan, the Trust Agreement, and this Adoption Agreement and related Addendums andadopts such Plan on the date indicated below.Name of Employer:Authorized Signature: X Date:Print Name/Title of Signer:Name of Trustee:Authorized Signature: X Date:Print Name/Title of Signer:PLAN DEFAULTS FOR EZ-K 401(k) PROFIT-SHARING PLAN 14)(15)(16)(17)(18)(19)(20)The Plan Year shall be the calendar year.The Limitation Year shall be the calendar year.The Valuation Date shall be the last day of the Plan Year and such other dates as may be directed by the Plan Administrator determined on anondiscriminatory basis.Employees who have attained the age of 21 and have completed 1 Year of Service are eligible to participate in the Plan. However, these eligibilityrequirements shall be waived for employees employed on the effective date of the Plan.All Employees shall be eligible except the following: All Employees included in a unit of Employees covered by a collective bargaining agreementas described in Section 14.08 of the Plan; Employees who are nonresident aliens as described in Section 14.25 of the Plan; and Employees whobecome Employees as the result of a “§410(b)(6)(C) transaction”, as described in section 14.01 of the Plan.Service under the Plan shall be computed on the basis of actual hours for which an Employee is paid or entitled to payment. A Year of Serviceshall mean a 12-consecutive month period during which an Employee completes at least 1000 Hours of Service. A Break in Service shall mean a12 -consecutive month period during which an Employee does not complete more than 500 Hours of Service. Once eligible, contributions will beallocated to the account of each Participant regardless of the number of hours of service completed in a Plan Year. The contribution is notdependent on the Participant being employed on the last day of the Plan Year.thEntry Date for an eligible Employee who has completed the eligibility requirements will be the 1st day of the first month or the first day of the 7month of the Plan Year after the Employee satisfies the eligibility requirements.Employer Nonelective and Matching Contributions shall be made at the discretion of the Employer on a nondiscriminatory basis. .Rollover (excluding After-Tax Employee Contributions) and Transfer Contributions are permitted pursuant to Article IV of the Plan.Employee Nondeductible and Mandatory Contributions are not permitted.Elective Deferrals are permitted up to the maximum permitted under section 402(g) of the Code. Each Participant shall have an effectiveopportunity to make or change and election to make Elective Deferrals (including Designated Roth Contributions) at least once each Plan Year.Catch-up Contributions are permitted.Safe Harbor 401(k) provisions do not apply.Vesting for all contributions under the Plan shall be full and immediate.Compensation for any Participant shall be the 415 safe harbor definition as described in Section 14.39 of the Plan. Such Compensation includes suchamounts that are actually paid to the Participant during the Plan Year and includes employer contributions made pursuant to a salary reductionagreement which are not includible in the gross income of the Employee under sections 125, 132(f)(4), 402(e)(3), 401(k), governmental 457(b), or402(h)(1)(B) of the Code. Amounts received by an Employee pursuant to a nonqualified unfunded deferred compensation plan shall be consideredCompensation in the year the amounts are actually received. Such amounts may be considered Compensation only to the extent includible in grossincome.In-service distributions are available. Once an Employee has participated in the plan for 60 months, all employer contributions are available forwithdrawal. Prior to the 60-month period, Employees may withdraw all employer contributions, which have been in the Plan for a period of 24months or apply for a hardship distribution. In-Service distributions from all employer contributions are available upon the Participant’s attainmentof age 55. Elective Deferrals are available for distribution upon attainment of age 59 1/2 or due to financial hardship. Rollover account is availableat any time. If In-Plan Roth Rollovers are permitted, all in-service distribution provision shall apply.A Participant may not elect benefits in the form of a life annuity. All other forms of benefit payments are available. Benefits are available to theParticipant on such Participant's termination of employment or upon Disability.The Plan is designed to operate as if it were Top-Heavy at all times.The Normal Retirement Age under the Plan shall be age 55.The Required Beginning Date of a Participant with respect to a Plan is the April 1 of the calendar year following the calendar year in which theParticipant attains age 70 , except that benefit distributions to a Participant (other than a 5-percent owner) with respect to benefits accrued afterthe later of the adoption or effective date of the amendment to the Plan must commence by the later of the April 1 of the calendar year followingthe calendar year in which the Participant attains age 70 or retires. The waiver for 2009 Required Minimum Distributions was subject toparticipant choice. If no election was made, the default was to discontinue the 2009 Required Minimum Distribution.Copyright 2008-2013, PenServ Plan Services, Inc.Control EZK 02007 PPA.doc (03/12)(11/13)Page 2 of 3

(21) Investments shall be determined pursuant to the Trust Agreement. The Trustee may develop any investment policy necessary.PENSION PROTECTION ACT (PPA) RESTATEMENT EFFECTIVE DATES ADDENDUMNote: If this plan is not a restatement of any existing Plan, this item does not apply.General Restatement Effective Dates (If applicable enter the Item ive DateNot applicable. This is not an amendment and restatement.The eligibility requirements under Plan DefaultsThe Employer Profit Sharing contribution provisions under Plan DefaultsThe Vesting Formula under Plan DefaultsIn-Service Distributions under Plan DefaultsDefinition of Required Beginning Date under Plan DefaultsEnter Provision and Item Number, if applicableEnter Provision and Item Number, if applicableEnter Provision and Item Number, if applicableNote: The effective date(s) above may not be earlier than January 1, 2007 and not later than the last day of the Plan Year in which the AdoptionAgreement is signed.If this box is checked, the following protected benefits from another plan must be incorporated into the provisions of this Plan:CONTROLLED GROUP ADDENDUMSchedule of Affiliated Service Group Companies and Commonly Controlled EmployersThe Employer that adopts this Plan includes all members of a controlled group of corporations (as defined in section 414(b) of the Code as modified bysection 415(h)), all commonly controlled trades or businesses (as defined in section 414(c) as modified by section 415(h)) or affiliated service groups (asdefined in section 414(m)) of which the adopting employer is a part, and any other entity required to be aggregated with the Employer pursuant toregulations under section 414(o) of the Code.Failure to include in this Adoption Agreement all Employers under common control may violate the provisions of Internal Revenue Code section 410 andother sections of the IRC with respect to plan qualification.Name of Adopting Employer:Address of Adopting Employer:The above-named Adopting Employer, together with the below-listed entities, is defined as a:Controlled Group; orAffiliated Service GroupList all “affiliated” employers with the above listed Employer.Name1.2.3.4.5.6.7.8.9.10.11.12.Copyright 2008-2013, PenServ Plan Services, Inc.Control EZK 02007 PPA.doc (03/12)(11/13)AddressEINPage 3 of 3

401(k) ADOPTING RESOLUTIONThe undersigned Principal or Officer of(the Employer) hereby certifies that the following resolutions are adopted by the Employer as of the datehereof.RESOLVED, that the form of the 401(k) Plan and Trust presented to this meeting, is hereby approved andadopted and that the duly authorized agents of the Employer are hereby authorized and directed to executeand deliver to the Trustee of the Plan one or more counterparts of the Plan.RESOLVED, that for purposes of the limitations on contributions and benefits under the Plan, prescribedby Section 415 of the Internal Revenue Code, the "limitation year" shall be the 12-consecutive monthperiod ending on the last day of the Plan Year.RESOLVED, that not later than the due date (including extensions) of the Employer's federal income taxreturn for each of it's fiscal years hereafter, the Employer shall contribute to the Plan for each such fiscalyear such amount as determined by the Employer, and that a duly authorized agent of the Employer isauthorized and directed to pay such contribution to the Trustee of the Plan and to designate to the Trusteethe year for which such contribution is made.RESOLVED, that the duly authorized agents of the Employer shall act as soon as possible to notify theemployees of the Employer of the adoption of the 401(k) Plan and Trust.The undersigned further certifies that attached hereto is a true copy of the 401(k) Plan and Trust asapproved and adopted in the foregoing resolutions.SignatureDate

SALARY DEFERRAL AGREEMENT401(k) Plan(Employer Name)Participant Name:In accordance with the Plan, I enter into this Salary Deferral Agreement ("Agreement").As a participant in the 401(k) Plan, I understand the Plan permits me to defer a portion of my compensation. Theamount that I elect to defer will be withheld from my compensation and paid by the Employer into the Plan on mybehalf.This salary deferral agreement remains in effect until I revoke or modify it. Modifications to the Agreement arepermitted prior to any pay period. I am also permitted to revoke my Agreement at any time during the Plan Year.The Plan permits me to defer my compensation up to the maximum amount allowed by law. The Plan alsopermits me to make "catch-up" contributions if I am age 50 or older; these are additional amounts that I may deferonce the maximum elective deferral limit is reached.I hereby elect to defer my compensation by (select one):!The maximum amount allowed by law (For 2015: 18,000 deferral PLUS 6,000 catch-up if age 50).! (enter a dollar amount less than the maximum).!% of W-2 income per payroll period.This election authorizes the Employer to withhold this amount from my compensation, and shall remain in effectuntil I revoke or modify this election.Participant SignatureDateEmployer SignatureDate20152016Maximum ElectiveDeferral 18,000 18,000Maximum Catch-upContribution 6,000 6,000You must be age 50 or older by year’s end to be eligible for catch-up contributions.

The plan name is the employer's name plus 401(k) Plan. For example, if the employer's name is Acme, Inc., then you would enter "Acme, Inc. 401(k) Plan". Item 4 - The trustee is generally the business owner. Item 7 - Enter the employer identification number (EIN), not your Social Security number (see Set Up Questionnaire above, Item 2).