Transcription

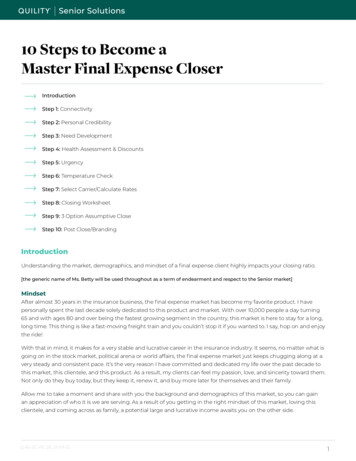

10 Steps to Become aMaster Final Expense CloserIntroductionStep 1: ConnectivityStep 2: Personal CredibilityStep 3: Need DevelopmentStep 4: Health Assessment & DiscountsStep 5: UrgencyStep 6: Temperature CheckStep 7: Select Carrier/Calculate RatesStep 8: Closing WorksheetStep 9: 3 Option Assumptive CloseStep 10: Post Close/BrandingIntroductionUnderstanding the market, demographics, and mindset of a final expense client highly impacts your closing ratio.[the generic name of Ms. Betty will be used throughout as a term of endearment and respect to the Senior market]MindsetAfter almost 30 years in the insurance business, the final expense market has become my favorite product. I havepersonally spent the last decade solely dedicated to this product and market. With over 10,000 people a day turning65 and with ages 80 and over being the fastest growing segment in the country, this market is here to stay for a long,long time. This thing is like a fast-moving freight train and you couldn’t stop it if you wanted to. I say, hop on and enjoythe ride!With that in mind, it makes for a very stable and lucrative career in the insurance industry. It seems, no matter what isgoing on in the stock market, political arena or world affairs, the final expense market just keeps chugging along at avery steady and consistent pace. It’s the very reason I have committed and dedicated my life over the past decade tothis market, this clientele, and this product. As a result, my clients can feel my passion, love, and sincerity toward them.Not only do they buy today, but they keep it, renew it, and buy more later for themselves and their family.Allow me to take a moment and share with you the background and demographics of this market, so you can gainan appreciation of who it is we are serving. As a result of you getting in the right mindset of this market, loving thisclientele, and coming across as family, a potential large and lucrative income awaits you on the other side.Q-AS-SC-FE 05 21-09-221

Final Expense Demographic:Age: 55-85Social Economic Status: Middle low to lower social economic classSES Characteristics: Retired Blue Collar School teachers Factory workers Dependent on pension May have not own a policy in the past Due to age and health maybe reluctant to apply due to possibility of denial[review, practice and demonstrate phone script] – Addendum 1[review, practice, and demonstrate door-knock script] – Addendum 2Step 1: ConnectivityMindsetThere’s an adage that states, “Many people communicate, but very few people connect.”In addition, it’s important to know that Communication is about what can I GET from you; Connection is aboutwhat I can DO for you!Along those lines, communication is about making statements; connection is about asking questions.2 Phrases for Connection: “I’ve never met anyone like you!” “A day is always better when you’re in it!”Live in such a way that if your presence doesn’t impact, then your absence won’t make a differenceKeep in mind the Final Expense sale is a very emotional and ‘touchy-feely” interaction. I am in no hurry to push orforce this part of the sale. I will take as much time as necessary for Ms. Betty to feel comfortable with me.Unlike many other types of sales, including other insurance products, this is not a transactional sale. I ammimicking my clients body language, tone, demeanor, and attitude. I am totally engaged in making anemotional connection.It’s much more and deeper than building rapport or doing what some call a “Warm up.” This is an eye to eye,heart to heart and soul to soul type of connection. I am there 100% for Ms. Betty. I want her to know and feel that.Ic. In other words, what are her “hot buttons” that will cause her to move forward, protect her family, and trust meas her insurance agent forever.I am not into the “Wham-bam thank you ma’am” kind of interaction or sales process. This section of the salemay take me 15 or more minutes to complete. Ms. Betty loves the attention and the interaction. I’m probably herentertainment for the week!Q-AS-SC-FE 05 21-09-222

If I ask questions, sit back, and listen carefully, Ms. Betty will sell herself in this connectivity stage. I’m going tocome across humble, unassuming, and relaxed. There is nothing formal taking place here. I’ll probably be sittingin her living room. If the place is messy, unclean, or out of order, I pay no attention to that. My job and goal are toprotect Ms. Betty and her family.Even though I am a detective, I am not an interrogator. I practice good bedside manners – even as a doctor wouldtoward a patient. I am gathering facts, problems, and challenges to build my case as to why Ms. Betty needs meand my product.Therefore, I use the “FORM Method” to keep me on track and help me build my case and discover her hot buttons: F – family O – occupation R – recreation M – moneyFamilyI spend as much time as possible talking about Ms. Betty’s family. Who doesn’t like to talk about their mostfavorite topic – kids and grandkids!This information is so important in building your case and helping Ms. Betty recognize why she sent the card inand who it is she is trying to protect. Remember, all of this is done conversationally, with genuine interest and lovefor her and her family.I want to know about Ms. Betty’s parents, brothers, and sisters. Where was she born and raised? How long did herparents live and if they are still alive today? How about grandparents, uncles, and aunts? This will tell me if shehas longevity in her family. Perhaps, she has a policy in place and feels it’s enough. But, if she is only 60 years oldand a lot of her family lived into their 80’s and 90’s, her policy may be outdated, and she may be underinsured. I’mlooking for cracks in the coverage and opportunities to enhance what she has.I want to know how many kids she has – boys and or girls. Who lives close by? Who is she close too? Who livesfar away? What do they do for a living? How many grandkids? Who is the “apple in her eye?” Who does she bragabout and dote over?I have made hundreds of sales to Ms. Betty by making a connection with her family needs, desires and loves.Remember, Ms. Betty loves her family and wants to protect them from having to go around and do the “BBSProgram” (beg, borrow and steal). It really bothers her with the thought of her kids and grandkids having to dothat when she passes away. Sometimes, when she doesn’t feel she needs anymore insurance, I’m still able to sellpolicies based on gifting and leaving a legacy for the grandkids. It’s enormously powerful when you find herhot button!Now would be a great time to make your first connection with Ms. Betty. You can show her pictures of yourspouse, kids, grandkids, and pets. This brings out the human side of you and allows her to take a sneak peek intoyour personal life. In addition, showing her a copy of your insurance and driver’s licenses will help bring down thewalls of skepticism and establish some credibility.[picture of my spouse and kids] – Addendum 3[picture of my grandkids] – Addendum 4[picture of insurance and driver’s licenses] – Addendum 5Q-AS-SC-FE 05 21-09-223

OccupationSince I am trying to make a connection, I am looking for things in common. Personally, I have a farming andblue-collar background. I’m going to try and connect with Ms. Betty on that level if she has a similar background.I’m going to talk with her about chickens, cows, pigs, tobacco fields, huge gardens, canning, freezing food, etc. Ifwe can’t connect on that level, then I will find something else to connect our background together. Rememberconnectivity is the key!In addition, I want to find out what kind of work and jobs Ms. Betty has done through the years. Somewhere,along the lines, I am going to find a connection with myself or someone in my family that has a similarexperience. I want to be on her level in life. I don’t and will not come across as if I am better or in any way,shape, form, or fashion that my life or job is superior to hers. She is family as far as I am concerned! And I treather as such.Along those lines, as a detective, I am listening and searching for what type of pension her job may haveprovided. Or is she just living on social security income. This area begins to open the door for income qualificationand what she may be able to afford.RecreationThis area tells me several things about Ms. Betty. It will tell me how active she is. It will tell me a great deal abouther health. Also, it will tell me about discretionary income.I want to know if Ms. Betty is getting out and about travelling, going places with her kids and grandkids orfriends, or is she pretty much a “couch potato” and sits home and watches TV for the most part.This kind of detective work opens the door wide open to give me insight about her health, monies, and lifestyle.Typically, when Seniors are active, their health is better, and they have extra income to spend and enjoy.On the other hand, if she tells me, she can’t afford to go anywhere or do anything extra but pay bills, then I knowI have to be careful on what I recommend and present to Ms. Betty. Unfortunately, it’s also an indication, she maysit around a lot, have a poor diet, watch a lot of TV and is not very mobile. That type of lifestyle will indicate whatshe may or may not be able to qualify health wise. Remember, you are a detective, building a case, and gettingyour thoughts in order before you make a recommendation.MoneyThis is the one area I want to carefully pay close attention to. I’m listening for monies, or the lack thereof, in eacharea of FORM. Each area is a reflection on monies and disposable income.If Ms. Betty has lots of disposable income, already has a good size policy, then I will find other cracks in herprotection and suggest insurance to fill those areas. I will put on the hat and take on the demeanor of a differentkind of protective agent: Got plenty of life insurance – I am a burial guy Got plenty of burial insurance – I am a life insurance guy to replace income Got plenty of life insurance that will cover burial too – I am a legacy protection guy – leave monies to kids/grandkids – income tax free from life insurance instead of in a savings account where it will be taxed Got plenty of regular life insurance for all those things – I am a property protection guy to leave money behindfor family to pay property taxes Got plenty of life insurance for all those things – I am a mortgage protection guy to keep the house fromgoing into foreclosureQ-AS-SC-FE 05 21-09-224

Hopefully, you get the point! I will become a “chameleon” depending on where Ms. Betty is not fully coveredand protected.On the other hand, if Ms. Betty is basically broke and living day to day and can barely make ends meet, then I want toknow that up front. There are still ways I can help her. I just need to know her situation. “To see how I can help you andfind out which program is best for you, I need to ask you a question, Ms. Betty. So, what does your social security look likeeach month?” Most of the time she will tell me. If she has no coverage and limited income, I might go down the road of acremation policy – something small – something affordable.Along those lines, let’s not be too hasty and “Throw the baby out with the bath water.” I will ask Ms. Betty about hercurrent coverages and if she has a policy in place, I will ask her for how long. She could have an old Whole Life policy inplace for 10-20 years. She may have a ton of cash value sitting in it doing nothing. If her health is still great, perhaps I canhelp her get some monies out, and get a new policy.I must be careful here and so should you. We don’t want to encourage her to get rid of something that is not in her bestinterest. We ALWAYS must do what is best for the client. Yet, if her needs are great, living hand to mouth, can’t afford toget her home or car repaired, and she is sitting there on several thousand dollars of cash, then helping her retrieve thatmay be an option.One of the services I do for Ms. Betty is call the insurance company for her and get all the details and find out all theoptions for her. Sometimes, we can help her get a “paid up” policy on her current plan, save her some money and get heran additional plan. Your upline manager can help you with this if you are new.In closing, the Connectivity Step is very vital in setting the proper stage for an effective and rewarding outcome, for youand your prospect. I suggest you do not take a shortcut in this step of the presentation. Take your time. A bird in hand isworth more than two in the bush, as the old saying goes. As you do this step correctly, you are now in a very trustworthyposition to take the next step very confidently. You are armed with information as a detective to solve this case.Congratulations on passing your first step in becoming a master final expense closer![transition statement]“Ms. Betty, I could talk about your family and life all day long, but I know you have places to go, people to see and things todo!” (smile)Step 2: CredibilityMindsetEstablishing personality credibility upfront on any sales presentation is crucial in setting the right stage for a positiveoutcome. In my humble opinion, this is where the sale is made. A trigger goes off in the mind of the client that says, Iwant to do business with this person. This is where you separate yourself from the competition.Unfortunately, what I have found in almost three decades of selling insurance, is many agents are just peddling product.It seems very few have the best interest of the client at hand. It’s as if every Tom, Dick, and Harry are just slinging productand throwing around rates. I do my best to separate myself from that mentality and those actions.In addition, if an agent is getting the old “I want to think about it” at the end of most presentations, typically it is a trustissue. This leads back to them not establishing enough credibility in the beginning. I am a firm believer in what hashelped me become a top closer in the industry is having and sharing a strong and impactful credibility statement.Q-AS-SC-FE 05 21-09-225

This is where I walk a mile in my client’s shoes. This is where we will make that emotional connection. This is where Ms.Betty will see me differently than anyone else that has ever been in her home and presented a product. When donecorrectly, with passion and sincerity, while being very genuine, the defense mechanisms will come down and Ms. Betty’strust radar will go up.During the connectivity step, my body language was laid back, relaxed and low key. Now, for the credibility step, I will situp straight, look Ms. Betty in the eyes, and command a presence. I want Ms. Betty to take advice from me and see me asshe would her doctor, attorney, banker, and any other professional’s she trusts with important decisions in her life.It’s up to me to create that professional atmosphere. I don’t have a plaque on the wall as does the doctor when she goesin to see him/her, that establishes instant credibility. I create that plaque through visuals, mental pictures, tones, bodylanguage, demeanor, and attitudes.Now, I will demonstrate my personal credibility statement. Notice, in my words, I will tell an emotional story, yet I will bevery assumptive. I will assume she is going to buy my product from the start. This is enormously powerful when lookingsomeone straight in the eyes. Do not be fidgety, shuffling papers, or flicking your pen. Be firm. Be strong. And control yournervous energy.Script“Ms. Betty, let me begin by saying, I’m licensed by the State and these programs I’m about to share are approved by theState. I have dedicated (impact word) my life to helping you get things in place (assumptive) before it’s too late”(urgency).“I have committed (impact word) my life over the past 30 years (if you’re new, you don’t have to give a time frame) inhelping folks like you (assumptive) take that burden off your children (making it personal) before the Good Man abovecalls you home” (urgency – recognizing many are a God-fearing people).“I hope you live to be a hundred (many will say, “I claim that”– you’re also painting the picture of living a long life andneeding more insurance). But, unfortunately, we don’t know what tomorrow brings (urgency). We never know when ournumber will be called, do we?” (rhetorical – establishing the need to get it done now).“Do you know the best part of my job Ms. Betty? (rhetorical) The best part of my job is when your son or daughter (usetheir names here if you can – makes it more personal and powerful) will call me down the road (mentally they picturethis happening) and say, we need to use this policy (I’m already assuming she’s buying). Now, don’t get me wrong Ms.Betty. I’m not glad they have to use this policy. I’m glad you loved them so much and had something in place for them”(assumptive – painting a picture down the road).“Do you know the worst part of my job, Ms. Betty? (rhetorical) The worst part of my job is when I see your children (usenames if possible) on the streets having to go around and doing the BBS program – beg, borrowing and stealing – tocollect enough money to put you away properly. You wouldn’t want that to happen, would you?” (shaking your head, no)“With that in mind, Ms. Betty, let me explain to you why I’m in this business and do what I do for a living.”[tell a personal impactful story]“I grew up on a farm in SC. We lived off the land. We raised everything. Do you remember those days, Ms. Betty? Great! Didyou or your family ever do any farm work growing up? You did? Then you know what I mean.My dad told us kids, you don’t work, you don’t eat! And he meant it! Remember those days? Yep, for sure! Those were thegood ole days!Q-AS-SC-FE 05 21-09-226

On the farm, when someone passed away with no insurance, the folks around the area would do a fish fry, a bakesale or garage sale to collect money for them. Remember that? Today, people do these “Go Fund Me” accounts onFacebook. Ever seen that? Yeah, that’s embarrassing and humiliating. (nodding your head)Well, Ms. Betty, what got me doing this business is when I was ten years old, my father had an accident on the farm. Ittook his life. He was only 49. He had no life insurance. He meant to get around to it, but never did. I mean who expectsto die at the age of 49? (rhetorical) He left my mom raising a bunch of kids and she really struggled. He didn’t mean todo that to her. He just wasn’t prepared. I’m not angry about it. It just happened.After I got grown, I told my mom I was going to go do this kind of work for a living. She thought I meant farming(laugh). I said “No mam, I’m going to educate the public about getting their insurance stuff in order before it’s too late”.She was sad I was leaving but wished me well.You see, Ms. Betty, this is no longer a job for me. This is a mission (impact word) and a crusade (impact word) for me. I’vededicated (impact word) my life to helping folks like you get things in place so your children won’t have to do that “BBS program.”Also, Ms. Betty, I want you to know, I’m independent, like a broker, licensed through the State. I represent manycompany’s so I can find the best deal for you. I don’t work for any particular insurance company. I work for you.In addition, Ms. Betty, you never have to send one of these cards back in the mail again (hold up card she sent in) or callanother TV commercial about life insurance again. I’m your insurance man now and forever (assumptive). I’ll save youa lot of headache, heartache, and time. I live locally here and have been for 37 years. I’ll be here for you when the needarrives today or years down the road. When it comes claim time, I’ll be here for your sons and daughters to help themfill out the claim form, submit the death certificate and console them in time of grief. (assumptive – painting a grimfuture filled with hope).In other words, allow me to roll up my sleeves, go to work for you and find you something that will take care of your kidsdown the road and bring you peace of mind now. Fair enough?”When delivered with conviction and passion, while being genuine and sincere, you will feel and see Ms. Betty’s bodylanguage, demeanor and attitude change and defenses drop. You have created a ton of emotion, built an enormousamount of trust, and separated yourself from all other agents in the field. I can promise you, no one else establishes thistype of personal credibility.You are now very credible in Ms. Betty’s eyes. Your trust gauge is off the charts. You are now in position to move forwardin a very positive way.Congratulations on passing your 2nd step in becoming a master final expense closer![Transition Statement]“Now, let me help you with what you’re entitled to and qualify for.”Step 3: NeedMindsetThis area of the presentation is where the mindset of the doctor/patient relationship really comes into play. It’s thedoctors’ job to find out where the pain points are before he/she can make a recommendation. If he/she cannot find aproblem, then he/she cannot recommend a solution.Q-AS-SC-FE 05 21-09-227

If you as the sales agent cannot find a problem, concern, or a need (a pain point) then it’s very unlikely your solutions withresonate with your prospect. You will just be wasting time and barking up the wrong tree.There are two axioms I like to use here. One is called, “Peeling the Onion.” The other is called, “Putting a Burr underthe Saddle.” The prospect must come to feel a little uncomfortable in their current situation. The thought of having noinsurance and their family having to go around and doing the BBS (beg, borrow and steal) program should really botherthem and make them feel uncomfortable. It’s akin to peeling an onion and getting to the core. The more you peel, themore you cry and get uncomfortable. The same is true when there is a burr under the saddle. The horse gets erratic andbecomes extremely uncomfortable as the burr is pressing against his/her skin.In addition, it’s important that we don’t put words in Ms. Betty’s mind or mouth. We need to ask the tough questions (justas the doctor would) and allow her to speak and tell us her pain points. We want her to own this and allow herself to hearthose words coming out of her mouth. In other words, we want to help her uncover her “Why” by asking questions. We sitback and listen, just as a doctor would their patient.We call this the Socratic Method of Selling. This is in essence asking questions, listening for the answers, thus stimulatingcritical thinking, and drawing out Ms. Betty’s ideas, needs and desires. My job is to keep the “Ball up in the air” (byquestioning), dig deeply (peel the onion), build my case (doctor or detective mindset), allow Ms. Betty to sell herself (yougain more by asking than you do by telling), before I provide any types of solutions.Remember, if I cannot help Ms. Betty uncover a need, that she personally verbalizes, then any solutions I offer will morethan likely fall on deaf ears. At this point, sometimes we as salespeople, start forcing our personal beliefs, needs anddesires on others. We set ourselves up for failure. We would be better served by politely excusing ourselves and go serveour next prospect.Script(while holding up the card Ms. Betty mailed in)“Ms. Betty, thanks for taking the time to mail this card back into us. I receive dozens of these every week from folks like youwho are interested in these programs”. (let’s her feel like she is not the only one requesting this information. People like tobe a part of a crowd and not be a Lone Ranger)Typically, when people mail these cards in, they do it for one of three reasons: First reason is they don’t have any coverage (insurance) and they realize they need to put something in place. They hadsomething on their job but when they retired, they lost it. Second reason is they have a little bit of coverage (insurance) in place, but they realize it’s not enough. The cost offunerals, burials and cremations have gone up and they need to add a little more. Third reason is they have a good amount already in place, but they would love to leave something behind for their kidsor grandkids. Something like a little legacy or gift for the family.Of those three categories, which one best describes you you don’t have any, you have a little bit, or you want to leavesomething behind for your family?(at this point, just sit tight, close your mouth, and listen to Ms. Betty tell you her initial pain points)(after she is done, now is the time to “Peel the onion”, go deeper than the surface answer)Q-AS-SC-FE 05 21-09-228

“That makes sense Ms. Betty you don’t want to be a burden on your children. Why is that so important to you”? (now weare going a layer deeper. This is where Ms. Betty starts to sell herself. We don’t want to put words in her mouth. This is thebeginning of the real pain points.)“I see Ms. Betty; this is so important to you because you love them so much and you don’t them having to go aroundasking people for money to put you away properly. I can see why you sent this card in. Makes sense now.”(Being devil’s advocate, going a little deeper now having her go to the real core uncovering all the pain points)“But, Ms. Betty, being devil’s advocate, you have done so much for your kids in your lifetime, why can’t they take care ofyou at this time of need?”(at this point, many times Ms. Betty will get very passionate and emphatic this is where it gets good because she is notonly convincing herself but she is preparing herself in case one of her kids come by and tries to talk her out of buying apolicy she is now armed with the answer.)(Ms. Betty will say something like, “I don’t want my kids having to worry about the financial responsibilities of my funeralwhen I die. They have enough on their plate taking care of their own kids. They can barely pay their own bills. I wantthem to enjoy and celebrate at my memorial service, not worry about how they are going to pay for the funeral. Oh, no,no, I am not having any of that!!!Plus, when my brother died, I had to go around and ask people for money and it was not only humiliating, butfrustrating. I couldn’t collect enough to bury him, so I had to end up having him cremated. That was against his wishes. Istill feel sad about that.”)(when done right, this type of communication from Ms. Betty will go on and on. She has now convinced herself sheneeds to buy more insurance. If you did the credibility statement correctly, she will buy it from YOU! Most importantly,she will keep it for many years and refer all her family and friends to you.)“Well, Ms. Betty, I can definitely see why I’m here and why you sent this card in. If I understand you correctly, youdon’t want to be a burden on your kids, you don’t want them going around asking people for money, you don’t wantthem having to make the tough decision between burial and cremation because of lack of funds and you want themcelebrating your life at your funeral rather than worrying about the financial responsibility. Is that what you’re telling me?Is there any other reason you’re taking care of this now?” (assumptive)(the last paragraph is called, doing a summation of all the pain points, nailing it down, checking to see if you missedanything, while being very assumptive. You have uncovered the need and got Ms. Betty to agree with her own words.Armed with that by your side, you have positioned yourself to continue forward)(Current Coverage) – (Before we jump out of this section and onto the next, it’s important to mention you may encountera situation where Ms. Betty already has coverage in place. Maybe she will say, she already has plenty of insurance. On theother hand, she may just want to add some more coverage on to what she has. Either way, encourage Ms. Betty to go gether policy so you can do a review for her. You may find she has a term policy and she thought she had whole life. You mayfind she has a universal life policy that is about ready to balloon (go up in price) or expire.[If necessary, show Term, Whole Life, UL graph to explain how each policy works – Addendum 6][If prospect feels like they already have enough coverage in place, show them the chart from the US Government Social SecurityAdministration. This shows what the projected cost of a funeral will be in the future based on their age today – Addendum 7]Q-AS-SC-FE 05 21-09-229

Many times, Ms. Betty thinks she has one thing but come to find out she actually has something else. Sometimes, shewill not be able to find her policy. Ask her to grab her bank statement, as it will list the name of the insurance companyand the premium she pays. From there you can google the name of the company, get the phone number, and call thecompany with Ms. Betty to find out all the details about the policy. This is one of the ways you provide a true serviceto your clients and your community making sure they have the right policy, with the right coverage, paying the mostcompetitive rate. Look over the policy in detail. Make sure the previous agent did not “clean sheet” the application. Thatmeans answering all questions “No” when it is clear some questions should have been answered “Yes.” The tobaccoquestion is a very common area where this happens. Look at her face amount, premium, cash value, paid-up insurance,riders, etc. Call your upline manager for help in guiding you through this process to make sure Ms. Betty has the bestcoverage and premium she can qualify for. She will thank you a hundred times over).Congratulations on passing your 3rd step in becoming a master final expense closer![transition statement]“Now, my job is to help you find the best company, best product with the best rates.”Step 4: Health Assessment & DiscountsMindsetThe goal here is to place Ms. Betty with the right carrier, right product with the best premium. Gathering all the pertinenthealth information is vital to meeting that g

Understanding the market, demographics, and mindset of a final expense client highly impacts your closing ratio. [the generic name of Ms. Betty will be used throughout as a term of endearment and respect to the Senior market] Mindset After almost 30 years in the insurance business, the final expense market has become my favorite product. I have