Transcription

HEC ParisMaster II Grande Ecole - FinanceEvaluation of a start-up through the signaling theory:Tesla case studyProfessor: Patrick LeglandStudent: Alessandro Frau S39624May 20151

Table of contentsAbstract .6Theory .71.Useful signals .7A. Leland and Pyle theory on informational asymmetries, financial structure and financialintermediation (1977) .8B.Signalling through inter-organizational relationships (Reuer, Tong and Wu, 2012) . 10C.Headcount growth as a signal for changes in valuation (Davila, Foster and Gupta, 2002) . 12D. Deducting information from insiders’ trades (Jeng, Metrick, and Zeckhause, 2003; Nejat Seyhun,2000; Nejat Seyhun, 1986; Finnerty 1976; Lin and Howe 1990; Zaman 1988) . 132.Fundamental analysis . 14A.DCF. 15B.Multiples approach. 203.Venture capitalist (VC) method . 224.Real option valuation. 24Case study: Tesla . 271.Adding to Damodaran fundamental analysis . 27A.DCF valuation. 29B.Impact of new information. 30C.Impact of noise trading. 322.Financial analysis . 333.Financings . 37A.Theoretical review of a Warrant ratchet . 37B.Tesla Equity Series A, B, C, D, E, F . 39C.Bridge convertible notes (converted in Series E) . 40D.Tesla’s IPO in 2010 . 40E.Convertible bonds . 414.Analyzing signals in the Tesla case . 42A.Founder investment . 43B.Capital increase subscriptions by existing shareholders . 44C.Signals from partnering with IB; VC; Alliances . 46D.Number of employees . 48E.Investments by insiders . 492

F.5.Convertible bond analysis . 52Analysis of beta before and after the third follow-on. 54Conclusion . 56References . 583

Graphs:Graph 1: key aspects for an investment decision 7Graph 2: investment decision process 7Graph 3: lognormal distribution 26Graph 4: Tesla and S&P500 share price evolution . 28Graph 5: impact of new information on Tesla share price .31Graph 6: Mr Musk incremental borrowings (in red) by time period 44Graph 7: regression line between number of employees and Tesla’s stock price 49Graph 8: Tesla stock price vs number of shares owned by insiders .50Graph 9: Tesla stock price vs number of shares owned by Tesla management .50Graph 10: Tesla stock price vs number of shares owned by institutional investors that have a seat on the board 51Graph 11: Tesla stock price vs stock price expected by convertible bond analysis 534

Tables:Table 1: key issues in multiples approach.21Table 2: VC method.22Table 3: start-up target returns .23Table 4: actual return by segment of companies .23Table 5: Damodaran’s results .30Table 6: profit and loss statement .33Table 7: economic balance sheet .34Table 8: days of working capital .35Table 9: cash flow statement .36Table 10: theoretical impact of warrant ratchets on shareholding structure.38Table 11: Tesla equity financing rounds pre-IPO .39Table 12: subscription of convertible notes by major shareholders .40Table 13: IPO proceeds .41Table 14: convertible bonds features .42Table 15: Mr Musk investment in Tesla .43Table 16: Tesla’s investors prior IPO .47Table 17: Tesla alliances .48Table 18: expected stock price by the market from convertible bonds .53Table 19: Tesla analysis of unlevered beta and cost of equity .54Table20: Tesla frequency of returns over S&P500 returns from IPO to third follow-on .55Table21: Tesla frequency of returns over S&P500 returns from third follow-on.555

AbstractFundamental analysis does not explain all of the value of start-ups or young companies. This analysisproposes to utilize selected signals to have a more accurate and complete view of the value of startups and young companies. Tesla is used as an example of this.The research is divided in two parts: (i) a review of the literature body and key methods concerningcompany valuations, both fundamental and signal-based, and (ii) a case study to apply the signalstheory to Tesla.In the first part, a review of the signals theory is complemented by an analysis of the valuationtechniques used to value a company.In the second part, a fundamental valuation of Tesla done by Damodaran is used as a starting point todemonstrate that some signals were to be taken into account to fully understand Tesla’s stock pricesince fundamental analysis alone justified only a portion of the company’s value.6

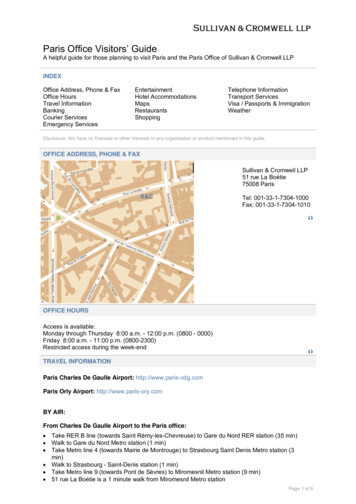

Theory1. Useful signalsIn evaluating a start-up company standard valuation techniques only explain part of the company’svalue. For this reason, I find it appropriate to add a new perspective to the valuation analysis: thesignals a company and its stakeholders give to the market may be a good leading indicator of futurecompany performance and, hence, stock prices.Interpreting the signals and account for them in a valuation model appears a difficult exercise andprobably not so “scientific” compared to a DCF, a trade multiple analysis or a transaction multipleanalysis. Nevertheless, some signals like the equity investment of an entrepreneur, the number ofemployees or the investment in the company by officers are strong indicators and ought to be takeninto account to have a full view of a company’s valuation.For this thesis I interviewed Mr Boris Golden of Partech Ventures, a venture capitalist fund (‘VC’), andfound his point of view about seed investments and financing extremely interesting. When Partechinvests in early-stage companies a significant part of the due diligence is based on signals given by theentrepreneurs rather than on results which are not yet achieved. The investment decision process isbased on both rational elements, a sort of check list for some specific requirements, and subjectiveassessments or intuitions based on signals and market knowledge. In particular, Graph 1 shows threeimportant aspects which are taken into account in Partech’s investment decision: people, disruptiveapproach (product, business model) and market. Graph 2 shows a simplification of the investmentdecision process.Graph 2: key aspects for an investment decisionGraph 1: investment decision process7

Both graphs are a rationalization of a much more complex process. However, they help understand atwhat level the signals are identified (Graph 1) and when they are used ( Graph 2). Signals can then bedivided in soft signals, more linked to intuition and experience, and factual signals, more linked to theinterpretation of facts. Many soft signals are linked to the management team: credibility, reputation,critic management (open vs defensive), investment in the project (time, money.). On the other side,factual signals are likely to be found in the product and the market: maturity of the idea related to themarket, readiness of the market to accept it, market insights on the product quality, other VCswillingness to invest. Both soft and factual signals are then processed in a rational way to express thereasons that bring to the willingness to invest, or not, in a project.In general, signals can be a strong tool to evaluate or give an insight on the future valuation of a startup or a company with a short track record. In fact, if the definition of a start-up is that of a companywith negative results, negative cash flows and a binary business that either works or fails, using classicvaluation techniques such as multiples and DCF is most of times impossible because:-There are no positive results to compare with the industry-Risk and the cost of capital are difficult to estimate-Growth is hard to measure in the long term-The probability of success of the business is unclear at this early sta

HEC Paris Master II Grande Ecole - Finance Evaluation of a start-up through the signaling theory: Tesla case study Professor: Patrick Legland Student: Alessandro Frau S39624 May 2015