Transcription

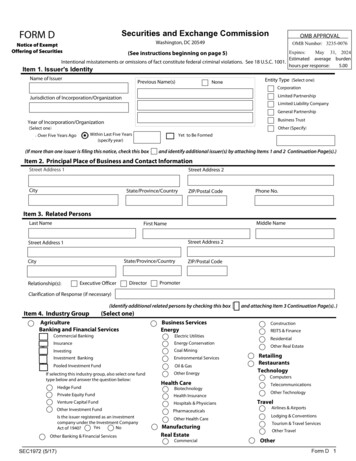

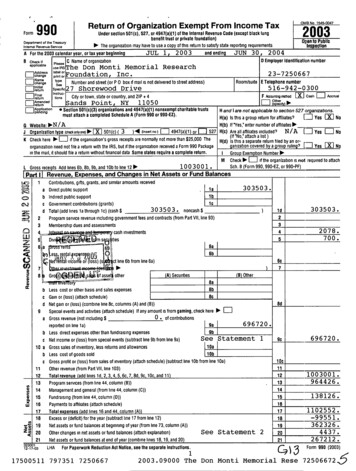

.,Form 990OMB No ,545-004Return of Organization Exempt From Income TaxUnder section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lungbenefit trust or private foundation)" The organization may have to use a copy of this return to satisfy state reporting requirementsDepartment or the TreasuryInternal Revenue ServiceA For the 2003 calendar year, or tax year beginningJUL12003and endingJUN30,B Check Ifappl cablePlease C Name of organizationuse IRSThe Don Monti Memorial ResearchAddress labelE:Ichangeprint o'rrFoundation, Inc .NametypeNumber and street (or P 0 box if mad is not delivered to street address)T hangeSeeInisPec1fic27 Shorewood DriveOretumInstrucCityFinalor town, state or country, and ZIP 4 c mcio sSandsPointNY11050 rAeumd 4947(a)(1)nonexempt charitable trusts0Section501(c)(3)organizationsand pendia must attach a completed Schedule A (Form 990 or 990-EZ) .2003upon 10 PU#Ei4g fipt 2004D Employer Identification number23-7250667Room/suite E Telephone number516-942-0 300F aaounbnomemod OX Cash 0 ti others ea 1H and I are not applicable to section 527 organizations.H(a) Is this a g rou p return for affiliates[ Yes D No"H(b) It 'Yes,' enter number ofaffiliatesG Website : " N/A) " (insert no) qgq7(a)(1) or 527 H(c) Are all affiliates includedN/A [ Yes D NoJ Organization type (check onlyone) " OX 501(c) ( 3(IT -NO,- attach a list )K Check here " if the organization's gross receipts are normally not more than 25,000 TheH(d) Is this a separate return filed by an oranization covered b a rou rulin g ? [ Yes D Noorganization need not file a return with the IRS, but if the organization received a Form 990 Packagem the mad, it should file a return without financial data Some states require a complete return .IGrou p Exem p tion NumberM Check " if the organization is not required to attach1003001 . ,Sch . 8 (Form 990, 990-EZ, or 990-PF)L Gross recei pts Add lines 6b, 8b, 9b, and 10b to line 12 .Revenue, Expenses, and Changes in Net Assets or Fund Balancespart 1Contributions, gifts, grants, and similar amounts receiveda Direct public supportb Indirect public supportc Government contributions (grants)303503 . noncash d Total (add lines iathrough lc)(cash 2Program service revenue including government fees and contracts (from Part VII, line3Membership dues and assessments4s earCash investments1 m(:1%pDews.t Burn s e sties 56 a e7R ayLe , al . x nsg a 0eth t 'I mco e or loss) (sct line 6b from line 6a)7 uaues"8Gro srftKsa 6s f asset other-303503 .1a1b1c)93)23456a6bA SecuritiesNN16171819ZQ 2021iZaoo 17500511Other changes m net assets or fund balances (attach explanation)Net assets or fund balances at end of year (combine lines 18, 19, and 20)For Paperwork Reduction Act Notice, see the separate Instructions .12003 .09000 The797351 72506677007B Other8a8b8cGross sales of inventory, less returns and allowances10aLess cost of goods sold10bGross profit or (loss) from sales of inventory (attach schedule) (subtract line 10b from line 10a)Other revenue (from Part VII, line 103)Total revenue add lines 1d 2 3 4 5 6c 7 8d 9c 10c and 11Program services (from line 44, column (B))Management and general (from line 44, column (C))Fundraising (from line 44, column (D))Payments to affiliates (attach schedule)Total exp enses add lines 16 and 44 column AExcess or (deficit) for the year (subtract line 17 from line 12)Net assets or fund balances at beginning of year (from line 73, column (A))20 78 .6c7b Less cost or other basis and sales expensesc Gain or (loss) (attach schedule)d Net gain or (loss) (combine line 8c, columns (A) and (B))9Special events and activities (attach schedule) If any amount is from gaming, check here 1111,- E::1a Gross revenue (not including 0 " of contributions696720 .reported on line 1a)9a9bb Less direct expenses other than fundraising expensesS22 Statement 1c Net income or (loss) from special events (subtract line 9b from line 9a)10 abc1112131415303503 .1d8d696720 .9c10c111213141003001 .964426 .13 812 6 .151617SetStatement2LHA18192021C DonMontiMemorial1102552 .-99551 .362326 .4437 .267212 .( ;(ReseForm 990 (2003)72506672,5

The Don Monti Memorial Research23-72506Ei7'"FoundationInc .Statement oAll organizations must complete column (A) Columns (B), (C), and (D) are required for section 501(c)(3)0Functional Expensesand (4) organizations and section 4947(a)(1) nonexempt charitable trusts but optional for othersDo not include amounts reported on linec, n o Ink ,. 1a s n., . i(B) Programcarweacgyp) Total22 Grants and allocations (attach schedule)cash a 950000 . noncsha950000 .123 Specific assistance to individuals (attach schedule)24 Benefits paid to or for members (attach schedule)25 Compensation of officers, directors, etc26 Other salaries and wages27 Pension plan contributions28 Other employee benefits29 Payroll taxes30 Professional fundraising fees(C) Managementand nanaralPage 2( D) Fundraising9950000 .IStatement 50.0.0 .14426 .964426 .10.138126 .138126 .31 Accounting fees32 Legal fees33 Supplies34 Telephone35 Postage and shipping36 Occupancy37 Equipment rental and maintenance38 Printing and publications39 Travel40414243abConferences, conventions, and meetingsInterestDepreciation, depletion, etc (attach schedule)Other expenses not covered above (itemize)cdase See Statement 3roughorpa tiorscowlb coiumiu(B (B) caZrrzyme setofirt . 1315144 1Joint Costs. Check " 0 if you are following SOP 98-21102552 .1Are any point costs from a combined educational campaign and fundraising solicitation reported in (B) Program services?, (II) the amount allocated to Program services If'Yes ; enter (i) the aggregate amount of these point costs , and (Iv) the amount allocated to Fundraising (11i) the amount allocated to Ma nagement and general 10- Yes EX-] NoI Part III Statement of Program Service AccomplishmentsWhat is the organization's primary exempt purposes " See Statement 4All organizations must describe their exempt purpose achievements in e clear and concise manner State the number of clients served, publications Issued, etc Discussachievements that era not measurable (Section 501(c)(3) and (4) organizations and 4947(aH1) nonexempt charitable trusts must also enter we amount of grants andallocations to others )a Provide funding for research treatmentpatient care relating to cancer .beducation andGrants and allocations Pro ram Service Zpe SBS(Required for 501(c)(3) end(q) orgs , and 4947(aK1)trusts, bu t optional (or others 950000 . )Grants and allocations CdGrants and allocations Grants and allocations (Grants and allocations e Other p rog ram services attach schedulef Total of Program Service Expenses (should equal line 44, column (B), Program services)0 17500511 797351 7250667"0 .Form 990 (2003)22003 .09000 The Don Monti Memorial Rese '72506672

Form sso(2oos)P 1VThe Don Monti MemorialFoundation, Inc .ResearchNdHPledges receivableLess allowance for doubtful accounts48a48b535455 aGrants receivableReceivables from officers, directors, trustees,and key employeesOther notes and loans receivableLess allowance for doubtful accountsInventories for sale or usePrepaid expenses and deferred chargesinvestments -securities Stmt 6Investments - land, buildings, andequipment basisLess accumulated deprecationInvestments - otherLand, buildings, and equipment basisb Less accumulated depreciationOther assets (describe t58b5657 aNdramm5051a51c5251b. 0 Costrz5359045 . . 54D FMV55b55c5657a57bSee Statement7Total liabilities add lines 60 throu gh 65Organizations that follow SFAS 117, check here " F7 and complete lines 67 through69 and lines 73 and 7467Unrestricted68Temporarily restrictedPermanently restricted69Organizations that do not follow SFAS 117, check here 1 D and complete lines70 through 74Capita stock, trust principal, or current funds63483 .55aTotal assets add lines 45 throw h 58 must equal line 74Accounts payable and accrued expensesGrants payableDeferred revenueLoans from officers, directors, trustees, and key employees64 a Tax-exempt bond liabilitiesb Mortgages and other notes payable65Other liabilities (describe 71727338644 .48c49 596061626370454647c66H(B)End of year138197 .47a47b51 ab52(A)Beginning of yearCash - non-interest-bearingSavings and temporary cash investments47 a Accounts receivableb Less allowance for doubtful accounts48 ab4950Page 3Balance SheetsNote : Where required, attached schedules and amounts within the descnphon columnshould be forend-of-yearamounts only.454623-7250667Paid-in or capital surplus, or land, building, and equipment fundRetained earnings, endowment, accumulated income, or other fundsTotal net assets or fund balances (add lines 67 through 69 or lines 70 through 72,column (A) must equal line 19, column (B) must equal line 21)Total liabilities and net assets / fund balances (add lines 66 and 73)165224 .57c58165225 .362466 .140 .596p267352 .140 .61626364a64b65)140 .66140 .676869362326 . 700 .0 .7172267212 .0 .0 .362326 . 73267212 .362466267352 .174 1Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particular organization How the publicperceives an organization in such cases may be determined by the information presented on its return Therefore, please make sure the return is complete and accurateand fully describes, m Part III, the organization's programs and accomplishments .7432302112-17-0317500511 797351 725066732003 .09000 The Don Monti Memorial Rese 72506672

The Don Monti Memorial ResearchFoundationInc .23-72506 67Page aForm 990 ZoosPast IV-8 Reconciliation of Expenses per AuditedPart 1V-A Reconciliation of Revenue per AuditedFinancial Statements with Revenue perFinancial Statements with Expenses perReturnReturna Total revenue, gains, and other supporta Total expenses and losses per" a1007438 ." a1102552 .per audited financial statementsaudited financial statementsb Amounts included on line a but not onb Amounts included on line a but not online 17, Form 990.line 12, form 990(1) Donated services(1) Net unrealized gamsand use of facilitieson investments4437.(2)Prior year adjustments (2) Donated servicesreported on line 20,Form 990and use of facilities (3) Recoveries of prior(3) Losses reported onyear grantsline 20, Form 990 (4) Other (specify)(4) Other (specify)ES4437 .Add amounts on lines (1) through (4)" bAdd amounts on lines (1) through (4)" b1102552 .c line a minus line b" c1003001 . c Mme a minus line b" cd Amounts included on line 12, Formd Amounts included on line 17, Form990 but not on line a:990 but not on line a(1) Investment expenses(1) Investment expensesnot included onnot included onfine 6b, Form 990line 6b, Form 990 (2) Other (specify)(2) Other (specify)ss" d0.Add amounts on lines (1) and (2)Add amounts on lines (1) and (2)" d0.e Total revenue per line 12, Form 990e Total expenses per line 17, Form 990(line c plus line d1003001 . ,line c plus line Il l1102552 ." e11111. ePan ifList of Officers, Directors, Trustees, and Key Employees (List each one even it not compensated .)(B) Title and average hours (C) Compensation (D Conmbutions c (E) Expenseper week devoted to(It not p pi , enter plans &a ;, account and(A) Name and address-a .other allowancespositioncoin nsatlonSee attached listing of directors---------------------------------s --------------------------75Did any officer, director, trustee, or key employee receive aggregate compensation of more than 100,000 from your organization and all relatedorganizations, of which more than 10,000 was provided by the related organizations? If 'Yes,' attach schedule . 100. Yes [X] No323031 12-17-0.317500511 797351 7250667Form 990 (2003)42003 .09000 The Don Monti Memorial Rese 72506672

1.1The Don Monti Memorial ResearchInc .Form 990 (2003)FoundationP1!1 Other Information23-7250667Did the organization engage in any activity not previously reported to the IRS If *Yes .' attach a detailed description of each activityWere any changes made in the organizing or governing documents but not reported to the IRSIf 'Yes,* attach a conformed copy of the changes78 a Did the organization have unrelated business gross income of 1,000 or more during the year covered by this returnsN/Ab It "Yes,' has it filed a tax return on Form 990-T for this n,termination,orsubstantialcontraction79If 'Yes,' attach a statement80 a Is the organization related (other than by association with a statewide or nationwide organization) through common membership,.governing bodies, trustees, officers, etc , to any other exempt or nonexempt organization'?01b If 'Yes' enter the name of the organizationand check whether it is 0 exempt or 0 nonexempt .01 81a81a Enter direct or indirect political expenditures . See line 81 instructions7677b Did the organization file Form 1120-POL for this years82 a Did the organization receive donated services or the use of materials, equipment, or facilities at no charge or at substantially less thanfair rental valueb If 'Yes," you may indicate the value of these items here Do not include this amount as revenue in Part I or as anN/A82bexpense m Part II (See instructions m Part III )83 a Did the organization comply with the public inspection requirements for returns and exemption applications?N/Ab Did the organization comply with the disclosure requirements relating to quid pro quo contnbutions984 a Did the organization solicit any contributions or gifts that were not tax deductiblesb If *Yes,' did the organization include with every solicitation an express statement that such contributions or gifts were notN/Atax deductible9N/A85501(c)(4), (5), or (6) organizations . a Were substantially all dues nondeductible by membersNBAb Did the organization make only in-house lobbying expenditures of 2,000 or lessIf'Yes' was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a waives for proxy taxowed for the prior yearN/A85cc Dues, assessments, and similar amounts from membersN/A85dd Section 162(e) lobbying and political expendituresN/A85ee Aggregate nondeductible amount of section 6033(e)(1)(A) dues noticesN/A85ff Taxable amount of lobbying and political expenditures (line 85d less 85e)N/Asection6033(e)taxontheamountonline85f?9 Does the organization elect to pay toitsreasonableestimateof duesh If section 6033(e)(1)(A) dues notices were sent,N/Aforthefollowingtaxyearsallocable to nondeductible lobbying and political expendituresN/A86a86501(c)(7) organizations. Enter a Initiation fees and capital contributions included on line 12N/A86bb Gross receipts, included on line 12, for public use of club facilitiesN/A87a87501(c)(12) organizations . Enter a Gross income from members or shareholdersb Gross income from other sources (Do not net amounts due or paid to other sources87bagainst amounts due or received from them )88At any time during the year, did the organization own a 50% or greater interest in a taxable corporation or partnership,or an entity disregarded as separate from the organization under Regulations sections 3017701-2 and 3017701-37It "Yes,' complete Part IX89 a 501(c)(3) organizations. Enter Amount of tax imposed on the organization during the year under0 . ; section 4955 .section 4911 .0 " , section 4912 .b 501(c)(3) and 501(c)(4) organizations. Did the organization engage m any section 4958 excess benefittransaction during the year or did it become aware of an excess benefit transaction from a prior year92323041and enter the amount of tax-exempt interest received or accrued during the tax year12-17-0317500511 797351725066780aX81bK82aXKXFl4b05a05ba585h88X89bK0 "090b7etephone no. " 516-942-0300Sands Point, New YorkSection 49470(1) nonexempt charitable trusts filing Form 990 in lieu of Form 1041- Check hereX0 .If 'Yes,' attach a statement explaining each transactionLocated at " 27 Shorewood Drive,X78a78b79N/Ac Enter. Amount of tax imposed on the organization managers or disqualified persons during the year undersections 4912, 4955, and 4958d Enter Amount of tax on line 89c, above, reimbursed by the organizationNew York90 a List the states with which a copy of this return is filed IiipayperiodthatincludesMarch 12, 2003b Number of employees employed m the"TitaMonti91The books are in care of767783aH3b84a.age 5NoXXziP a " 11050" 1 92I.1NIAForm 990 (2003)52003 .09000 The Don Monti Memorial Rese '12506672

The Don Monti Memorial ResearchFoundationInc .23-72506 67Form 990(2003)pak VilAnalysis of Income-Producing Activities (see page 33 of the instructions)Unrelated business incomeExcluded b section sit, sia, orsiaNote : Enter gross amounts unless otherwiseindicated.(A)codeS93 Program service revenue .a(B)Amountbcde1 Medicare/Medicaid paymentsg Fees and contracts from government agencies94 Membership dues and assessments95 Interest on savings and temporary cash investments96 Dividends and interest from securities97 Net rental income or (loss) from real estate se1414(0)AmountPagesRelated or exemptfunct ion income2078 .700 .a debt-financed propertyb not debt-financed property98 Net rental income or (loss) from personal property99 Other investment income100 Gam or (loss) from sales of assetsother than inventory101 Net income or (loss) from special events102 Gross profit or (loss) from sales of inventory103 Other revenue696720 .a6cde0.2778 .696720 .104 Subtotal (add columns (B), (D), and (E))"699498 .(8),(D),and(E))105 Total (add line 104, columnsNote : Line 105 plus line 1d, Part 1, should equal the amount on line 12, Part l.pprt VEll Relationship of Activities to the Accomplishment of Exempt Purposes (see page 34 of the instruction s)Explain how each activity for which income is reported in column (E) of Part VII contributed importantly to the accomplishment of the organization'sLine No .exempt purposes (other than by providing funds for such purposes)and raised bthe or g anization are donated entirel y to North Shoretreatmen t andU niversit y Hos p ital, utilized in cancer p atient carecostsareunderwrittenbthe fou ndationsesearch . All administrativeoundersMr . and Mrs . Jose p h Monti .p I)(Information Regarding Taxable Subsidiaries and Disregarded Entities (See page 34 of the instruction s)CEA)0)0)Perce( tge ofTota( inomeEnd-o p-yearName, address, andEIN of corporation,Nature of actiwtiesownershi interestassetsartnershi ordisre g arded entiN/A%IIInformation Regarding Transfers AssociatedPort X(a) Did the organization, during the year, receive any funds, directly or indirectly,(b) Did the organization, during the year, pay premiums, directly or indirectly, onNote : If "Yes" to (b), file Form 8870 and Form 4720 see instructions).PleaseSignHerePaidUnder penalh of penury, Icorrect, and mplete D I' ature o officelace hat I have examined this retain, Including accoiorepa y r (other than office's Is based on all infos- f aka. o, T(5 , DatePreparer'ssignature P41jf .-)0j VPreparer's Fi ,;Sname (orMichael GerardUse Only32316112 .117 .111yours If/self-employed),address, end71P 4C.Norman,JerichoTpkSuite'410Jeric h 17500511 797351 7250667New York117 2003 .0900

SCHEDULE A(Form 990 or 990-EZ)Department of tie TreasuryInternal Revenue ServiceName of the organizationOrganization Exempt Under Section 501(c)(3)OMB No 15450047(Except Private Foundation) and Section 501(e), 501(i), 501(k),501(n), or Section 4947(a)(1) Nonexempt Charitable TrustSupplementary Information-(See separate instructions .)1 MUST 6e completed by the above organizations and attached to their Form 990 or 990-EZEmployer Identification numberThe Don MOIItl MemOrResearch200323 7250667Foundation, Inc .Directors,and TrusteesCompensation of the Five Highest Paid Employees Other Than earenone,enter'None(See(b) Title and average hoursper week devoted tooosdion(a) Name and address of each employee paidmore than 50,000(c) Compensation(d)ncdnucio s co(e) Expensepa sCo ad account and ---------------------------------------------Total number of other employees paidover 50,0001P n11 Compensation of the Five Highest Paid Independent Contractors for Professional Services(See page 2 of the instructions List each one (whether individuals or firms) If there are none, enter'None')(a) Name and address of each independent contractor paid more than 50,000(b) Type of service(c) al number of others receiving over 50,000 for professional services323101/12-OS-03LHA" I0For Paperwork Reduction Act Notice, see the Instructions for Form 990 and Form 990-EZ .17500511 797351 72506677Schedule A (Form 990 or 990-EZ) 20032003 .09000 The Don Monti Memorial Rese 72506672

Schedule A (Form 990 orThe Don Monti Memorial ResearchZoos Foundation . Inc .23-72506677 Statements About Activities (See page 2 of the instructions )YesDuring the year, has the organization attempted to influence national, state, or local legislation, including any attempt to influencepublic opinion on a legislative matter or referendum? If 'Yes," enter the total expenses paid or incurred m connection with the(Must equal amounts on line 38, Part VI-A,lobbying activities 1 or line i of Part VI-8 )Organizations that made an election under section 501(h) by filing Form 5768 must complete Part VI-A Other organizations checking'Yes ; must complete Part VI-8 AND attach a statement giving a detailed description of the lobbying activitiesDuring the year, has the organization, either directly or indirectly, engaged m any of the following acts with any substantial contributors,trustees, directors, officers, creators, key employees, or members of their families, or with any taxable organization with which any such12person is affiliated as an officer, director, trustee, majority owner, or principal beneficiary? (if the answer to any question is "Yes,"attach a detailed statement explaining the transactions)a Sale, exchange, or leasing of propertyb Lending of money or other extension of creditsc Furnishing of goods, services, or facilities. .2aX 2bX 2cXd Payment of compensation (or payment or reimbursement of expenses if more than 1,000)2de Transfer of any part of its income or assets2eX3aX3 a Do you make grants for scholarships, fellowships, student loans, etc ? (If'Yes; attach an explanation of howyou determine that recipients quality to receive payments )b Do you have a section 403(b) annuity plan for your employees4No3bDid you maintain any separate account for participating donors where donors have the right to provide adviceon the use or distribution of fundsPart .iv., Reason for Non-Private Foundation Status (See pages 3 through 6 of the instructions)4LXThe organization is not a private foundation because it is (Please check only ONE applicable box .)5D A church, convention of churches, or association of churches Section 170(b)(1)(A)(i)6D A school section 170(b)(1)(A)(u) (Also complete Part V )7 A hospital or a cooperative hospital service organization Section 170(b)(1)(A)(ui)80 A Federal, state, or local government or governmental unit Section 170(b)(1)(A)(v)9 A medical research organization operated in conjunction with a hospital Section 170(b)(1)(A)(iii) Enter the hospital's name, city,10011a011b12 FX113E:1and stateAn organization operated for the benefit of a college or university owned or operated by a governmental unit . Section 170(b)(1)(A)(iv)(Also complete the Support Schedule m Part IV-A )An organization that normally receives a substantial part of its support from a governmental unit or from the general publicSection 170(b)(1)(A)(vi) (Also complete the Support Schedule m Part IV-A )A community trust . Section 170(b)(1)(A)(w) (Also complete the Support Schedule m Part IV-AAn organization that normally receives . (1) more than 331/3 /a of its support from contributions, membership fees, and grossreceipts from activities related to its charitable, etc , functions - subject to certain exceptions, and (2) no more than 331% ofits support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquiredby the organization after June 30, 1975 See section 509(a)(2) (Also complete the Support Schedule in Part IV-A )An organization that is not controlled by any disqualified persons (other than foundation managers) and supports organizations described in(1) lines 5 through 12 above ; or (2) section 501(c)(4), (5), or (6), if they meet the test of section 509(a)(2) (See section 509(a)(3) )Provide the following information about the supported organizations. (See page 5 of the instructions )(a) Name(s) of supported organization(s)140An organization organized and operated to test for public safety Section 509(a)(4) (See page 6 of the instructions(b) Line numberfrom aboveSchedule A (Form 990 or 990-EZ) 200332311112-05-0317500511 797351 725066782003 .09000 The Don Monti Memorial Rese 72506672

The Don Monti Memorial ResearchPage 3Schedule A (Form 990 or 990-EZ) 2003 Foundation , Inc .23-7250 667methodofaccounting.Support Schedule (Complete only if you checked a box on line 10, 11, or 12 .) Use cashNote : You ma use the worksheet in the instructions for converting from the accrual to the cash method of accountin .Calendar year (orfiscal year(d) 1999(e) Total(a) 2002(b) 2001(c) 2000be g in nin in"15 Gifts, grants, and contributionsunusualreceived eoo nao28cludeunusual497026 .348072 .1787651 .558653 .383900 .Membershi p fees received1617Gross receipts from admissions,merchandise sold or servicesperformed, orfurnishmg offacilities m any activity that isrelated to the organization'schantable,etc,purpose18Gross income from interest,dividends, amounts received frompayments on securities loans (section 512(a)(5)), rents, royalties, andunrelated business taxable income(less section 511 taxes) frombusinesses acquired by theorganization after June 30,1975Net income from unrelated businessactivities not included in line 18Tax revenues levied for theorganization's benefit and eitherpaid to it or expended on its behalf19Zp21The value of services or facilitiesfurnished to the organization by agovernmental unit without chargeDo not include the value of servicesor facilities generally furnished tothe public without chargeOther income Attach a schedule .Do not include gain or (loss) fromsale of capital assetsTotal oflines 15through 22ZZ23242526Line 23minus line l7Enter 1% ofline 230 .374401 .484792 .478090 .1337283 .5034 .11161 .32440 .27598 .76233 .563687 .563687 .5637 .769462 .395061 .1014258 .529466 .3201167 .1863884 .7695 .10143 .853760 .375670 .8538 .Organizations described on lines 10 or 11 : a Enter 2% of amount in column (e), line 24b Prepare a list for your records to show the name of and amount contributed by each person (other than a governmentalunit or publicly supported organization) whose total gifts for 1999 through 2002 exceeded the amount shown in line 26aDo not file this list wish your return . Enter the total of all these excess amountsc Total support for section 509(a)(1) test Enter line 24, column (e)19d Add Amounts from column (e) for lines1826b22111110- 26aN/A1 26bN/AN/A1 26c1 26d1 26e1110-, 26fN/AN/Ae Public support (line 26c minus line 26d total)N/Ai -Public support percentage (line 26e (numerator) divided by line 26c (denominator))27Organizations described on line 12 : a For amounts included m lines 15, 16, and 17 that were received from a 'disqualified person ; prepare a list for yourrecords to show the name of, and total amounts received m each yearfrom, each disqualified person' Do not file this list with your return . Enterthe sum ofbcdefgsuch amounts for each year80500 . (2000)30500 . (1sss)3051780500 . (200 )(2002)For any amount included in line 17 that was received from each person (other than disqualified persons'), prepare a list for your records to show the name of,and amount received for each year, that was more than the larger of (1) the amount on line 25 for the year or (2) 5,000 (Include m the list organizationsdescribed in lines 5 through 11, as well as individuals ) Do not file this list with your return . After computing the difference between the amount received andthe larger amount described m (1) or (2), enter the sum of these differences (the excess amounts) for each year.75000 . (2000)145800 . (1sss)241350219944 . (2001)(2002)1787651 .16Add Amounts from column (e) for lines151337283 .31249341720210- 27c682094 .904111Add pine 27a total222017 .and pine 27b total" 27d222082327cminus27dtotal)1027ePublic support (linetotalline3201167 .127fTotal support for section 509(a)(2) test Enter amount on line 23, column (e).1 2769 .3754 %Public support percentage (line 27e (numerator) divided by line 27f (denominator))2 . 3814%10- 27hh Investment income p ercenta g e line 18 column e numerator divided b line 27f denominator28 Unusual Grants : For an organization described in line 10, 11, or 12 that received any unusual grants during 1999 through 2002, prepare a list for y our recordsto show, for each year, the name of the contributor, the date and amount of the grant, and a brief description of the nature of the grant Do not file this list withyour return . Do not include these grants in line 15NoneSchedu le A (Form 990 or 99G-E7) 2003323121 12-05

The Don Monti Memorial Research ' " Foundation Inc. - 23-72506Ei7 Statement o All organizations must complete column (A) Columns (B), (C), and (D) are required for section 501(c)(3) Page 2 0 Functional Expenses and (4) organizations and section 4947(a)(1) nonexempt charitable trusts but optional for others Do not include amounts reported on .