Transcription

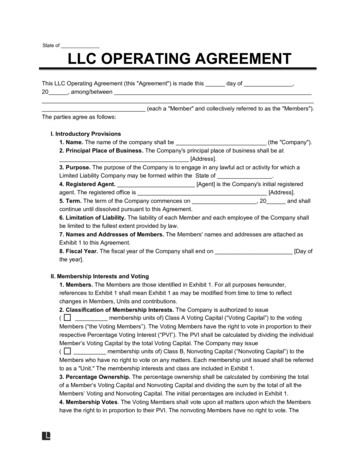

TYPE NAME OF LLCTYPE DATE LLC CREATEDTYPE NAME OF FOUNDING MEMBERTYPE PURPOSE OF LLCTYPE ADDRESS OF LLCTYPE NAME OF MANAGERTYPE NAME OF MEMBER #2TYPE ADDRESS OF MEMBER #2TYPE NAME OF MEMBER #3TYPE ADDRESS OF MEMBER #3TYPE NAME OF MEMBER #4TYPE ADDRESS OF MEMBER #4TYPE NAME OF MEMBER #5TYPE ADDRESS OF MEMBER #5

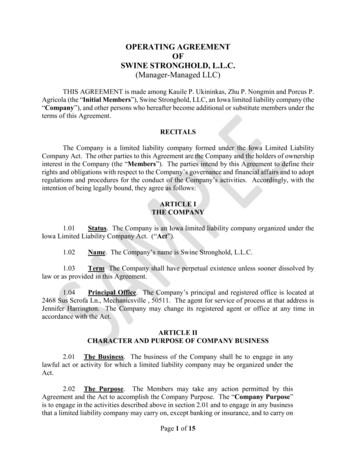

OPERATING AGREEMENTOF, L.L.C.

TABLE OF CONTENTSOPERATING AGREEMENTOF, L.L.C.Article I.1.11.21.31.41.51.61.7Article II.2.12.22.32.42.5Article III.3.13.23.33.4Article IV.4.1Article V.5.15.25.35.45.55.65.7THE COMPANYOrganizationCompany NamePurposePrincipal and Registered Place of Business;Registered AgentTermNo Payments of Individual ObligationsDefinitions1111111CAPITAL ACCOUNTS, MEMBERS, AND CAPITAL CONTRIBUTIONSCapital AccountsMembers and Initial CapitalAdditional CapitalValue of Capital Account, Death of a MemberOther Matters56666ALLOCATIONSProfitsLossesSpecial AllocationsOther Allocation thority of the ManagerRight to Rely on ManagerRestrictions on Authority of ManagerDuties and Obligations of ManagerResignation of ManagerRemoval of ManagerVacancies of Manager11121213131313

5.85.95.105.11Article VI.6.16.2Article VII.7.1Article VIII.8.18.28.38.48.5Article IX.9.19.29.39.49.59.69.79.8Article X.10.110.210.3Article XI.11.1Article XII.Limitation of LiabilityIndemnification of ManagersCompensation and LoansOperating Restrictions13131414ROLE OF MEMBERSRights or PowersVoting Rights1415MEETINGSMeetings of Members15FISCAL YEAR, BOOKS, AND RECORDSFiscal YearBooks and RecordsAnnual ReportsTax InformationTax Matters Partner1515161616TRANSFERS OF INTERESTSVesting of Company Percentage InterestsRestriction on TransfersTransfer to SubsidiarySale to Third-Party After Lapse of Option RightsProhibited TransfersRights of Unadmitted AssigneesRepresentationsDistributions and Allocations in Respect toTransferred n From or Concerning MembersConfidentiality of this Agreement; AnnouncementsRequired Disclosure202121RELATED PARTY TRANSACTIONS; OTHER ACTIVITIES; NON-COMPETERelated Party TransactionsTERMINATION, DISSOLUTION, AND WINDING UP21

12.112.212.312.412.512.612.712.8Article 113.1213.1313.1413.1513.1613.17Terminating EventsWinding UpElection to Continue OperationEffect in Case of One MemberElection to Continue Operation in the Eventof the Death of a MemberCompliance With Timing Requirements ofRegulations; Deficit Capital Account BalanceDeemed Distribution and RecontributionRights of the mentWaiverRemediesBinding ation by ReferenceFurther ActionVariation of PronounsGoverning Law [Disputes]No Partnership Intended for Non-Tax PurposesCounterpartsEntire AgreementSchedules and ExhibitsSchedule IExhibit A21222223-Members and Initial CapitalArticles of Organization2425252525252626262626262626262627

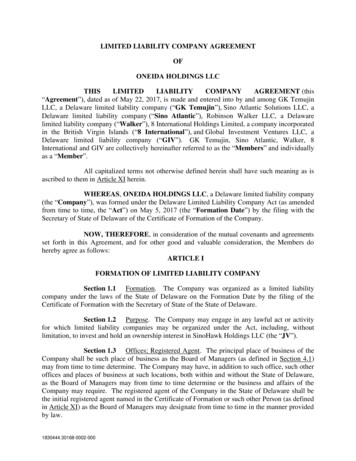

OPERATING AGREEMENTOF, L.L.C.This OPERATING AGREEMENT of , L.L.C.(“Company”) is entered into and shall be effective as of the , by andbetween (“Founding Member”) and any and allMembers of the Company whose names are set forth on Schedule I, attached hereto, who havebecome Members pursuant to the terms of this Agreement (“Members”).Article ITHE COMPANY1.1Organization. The Founding Member has (a) filed Articles of Organization, attachedas Exhibit “A” hereto, and (b) has taken or caused the Company to take such other actions as maybe necessary in connection with the organization of the Company consistent with the terms of thisAgreement, including obtaining all necessary authorizations and licenses and qualifying theCompany to do business in the State of Florida.1.2CompanyName.ThenameoftheCompanyshallbe, L.L.C., and all business of the Company shall beconducted in such name. The Company shall hold all of its property in the name of the Companyand not in the name of any Member.1.3Purpose.ThepurposeoftheCompanyshallbe:. The Manager will periodically review additionalbusiness opportunities for the Company and may expand the business of the Company as it deemsappropriate.1.4Principal and Registered Place of Business; Registered Agent. The principal andregisteredplaceofbusinessoftheCompanyshallbe:. The Managermay change the principal and registered place of business of the Company to any other place withinthe State of Florida upon ten (10) days’ notice to the Members. The Company’s registered agentshall be the Person designated by the Manager from time to time to act in that capacity.1.5Term. The term of the Company shall commence onand shall continue until the winding up and liquidation of the Company and its business iscompleted following a Terminating Event, as provided in Article XIII hereof.1.6No Payments of Individual Obligations. The Members shall use the Company’s creditPage 1 of 34

and assets solely for the benefit of the Company. No asset of the Company shall be transferred orencumbered for or used in payment of any individual obligation of a Member.1.7Definitions. Capitalized words and phrases used in this Agreement and not otherwisedefined herein have the following meanings:“Act” means the Florida Limited Liability Company Act, as amended from time totime (or any corresponding succeeding law).“Adjusted Capital Account Deficit” means the deficit balance, if any, in a Member’sCapital Account as of the end of the relevant fiscal year, after giving effect to the followingadjustments:(i)Credit to such Capital Account any amounts which such Member isobligated to restore pursuant to any provision of this Agreement or pursuant to Regulation Section1.704-1(b)(2)(ii)(c) or is deemed to be obligated to restore pursuant to the penultimate sentencesof Regulations Sections 1.704-2(g)(1) and 1.704-2(i)(5); and(ii)Debit to such Capital Account the items described in Sections 1.7041(b)(2)(ii)(d)(4), 1.704-1(b)(2)(ii)(d)(5), and 1.704-1(b)(2)(ii)(d)(6) of the Regulations.The foregoing definition of Adjusted Capital Account Deficit is intended to comply with theprovisions of Section 1.704-1(b)(2)(ii)(d) of the Regulations and shall be interpreted consistentlytherewith.“Affiliate” means, with respect to any Person, (i) any Person directly or indirectlyowning, owned by, or under common ownership with such Person, (ii) any Person owning any ofthe outstanding voting interests of such Person, (iii) any officer, director, or general partner of suchPerson, or (iv) any Person who is an officer, director, general partner, member, trustee, or holderof any of the voting or equity interests of any Person described in clauses (i) through (iii) of thissentence.“Agreement” or “ Operating Agreement” means this Operating Agreement, asamended from time to time. Words such as “herein,” “hereinafter,” “hereof,” and “hereunder”refer to this Agreement as a whole, unless the context otherwise requires.“Book-Tax Disparity” means with respect to any Company property as of the date ofdetermination, the difference between the Book Value of such property and the adjusted basis ofsuch property for Federal income tax purposes.“Book-Value” means with respect to any property reflected in the Capital Accounts ofthe Members, the fair market value of such property as agreed to by the contributing Member andthe Manager at the time such property was contributed to the Company or otherwise revalued asprovided in Section 2.1 hereof, reduced (but not below zero) by all depletion, depreciation, orPage 2 of 34

amortization with respect to such property charged to the Members’ Capital Accounts.“Capital Account” means the capital account established and maintained for eachMember in accordance with the provisions of Section 2.1 hereof.“Capital Contributions” means, with respect to any Member, the amount of cashcontributed, and the fair market value of property contributed (as agreed to by the contributingMember and the Manager at the time of contribution), to the Company with respect to the Interestheld by such Member.“Code” means the Internal Revenue Code of 1986, as amended from time to time (orany corresponding succeeding law).“Company” means , L.L.C., a FloridaLimited Liability Company.“Company Minimum Gain” means the gain (regardless of character) which would beby the Company if the Company property subject to a nonrecourse debt (other than a “partnernonrecourse debt” as such term is defined in Regulation Section 1.704-2(b)(4)) were disposed ofin full satisfaction of such debt on the relevant date. Such amount shall be computed separatelyfor each nonrecourse liability of the Company. For this purpose the adjusted basis of propertysubject to two or more liabilities of equal priority shall be allocated among such liabilities inproportion to the outstanding balances of such liabilities and the adjusted basis of property subjectto two or more liabilities of unequal priority shall be allocated to the liability of inferior priorityonly to the extent of the excess, if any, of the adjusted basis of such property over the aggregateoutstanding balance of the liabilities of superior priority. If property of the Company is reflectedin the Capital Accounts of the Company at other than its basis, Company Minimum Gain shall bedetermined by using the amount recorded for such property in determining Capital Accountsinstead of the basis of such property.“Consent of the Members” means and requires the unanimous consent of all Members.“Interest” means a Member’s ownership interest in the Company, including any andall benefits to which the holder of such an Interest may be entitled as provided in this Agreement,together with all obligations of such Member to comply with the terms and provisions of thisAgreement.“Majority in Interest of the Members” means the Member or Members whose(combined) Percentage Interests represent more than eighty-five percent (85%) of the Interests ofall Members.“Manager” means the Person referred to as such in Section 5. 1 (a) of this Agreementor who becomes the Manager pursuant to the terms of this Agreement.Page 3 of 34

“Member” means any Person whose name is set forth on Schedule I attached heretoor who has become a Member pursuant to the terms of this Agreement. “Members” means allsuch Persons.“Member Minimum Gain” means the gain (regardless of character) which would beby the Company if property subject to a “partner nonrecourse debt” (as such term is defined inRegulation Section 1.704-2(b)(4)) were disposed of in full satisfaction of such debt on the relevantdate. The adjusted basis of property subject to more than one partner nonrecourse debt shall beallocated in a manner consistent with the allocation of basis for purposes of determining CompanyMinimum Gain hereunder.“Net Cash” means the gross cash proceeds from Company operations and the cashproceeds from all sales and other dispositions and all refinancing of property, less the portionthereof used to pay or establish reserves for all Company expenses, debt payments, capitalimprovements, replacements, and contingencies, all as determined by the Manager. “Net Cash”shall not be reduced by depreciation, amortization, cost recovery deductions, or similarallowances, but shall be increased by any reductions of reserves previously established.“Percentage Interest” means, with respect to each Member, the Percentage Interest setforth opposite such Member’s name on Schedule “I”.“Person” means any individual, partnership, limited liability company, corporation,trust, or other entity.“Profits” and “Losses” means, for each fiscal year or other period, an amount equal tothe Company’s taxable income or loss for such year or period, determined in accordance with CodeSection 703(a) (for this purpose, all items of income, gain, loss, or deduction required to be statedseparately pursuant to Code Section 703(a)(1) shall be included in taxable income or loss), withthe following adjustments:(i)Any income of the Company that is exempt from Federalincome tax and not otherwise taken into account in computing Profits or Losses pursuant to thisdefinition shall be added to such taxable income or loss;(ii)Any expenditures of the Company described in Code Section705(a)(2)(B) or treated as Code Section 705(a)(2)(B) expenditures pursuant to Regulations Section1.704-1(b)(2)(iv)(i), and not otherwise taken into account in computing Profits or Losses pursuantto this definition, shall be subtracted from such taxable income or loss; and(iii)Gain or loss resulting from any disposition of property withrespect to which gain or loss is recognized for Federal income tax purposes shall be computed byreference to the Book Value of the property disposed of, notwithstanding that the adjusted tax basisof such property differs from such Book Value.Page 4 of 34

“Regulations” means the Income Tax Regulations, including Temporary Regulations,promulgated under the Code, as such Regulations may be amended from time to time (includingcorresponding provisions of succeeding Regulations).“Substituted Member” means a transferee of a Member’s Interest who is approved tobecome a Member by a Majority in Interest of the Members. A Substituted Member shall have allof the rights and obligations of a Member.“Transfer” means, as a noun, any voluntary or involuntary transfer, sale, pledge,hypothecation, grant of a security interest, or other disposition, and, as a verb, voluntarily orinvoluntarily to transfer, sell, pledge, hypothecate, grant a security interest, or otherwise disposeof.Article IICAPITAL ACCOUNTS, MEMBERS, AND CAPITAL CONTRIBUTIONS2.1Capital Accounts. Capital Accounts shall be maintained for each Member inaccordance with the following provisions:(a)To each Member’s Capital Account there shall be credited such Member’sCapital Contributions, such Member’s distributive share of Profits, and the amount of anyCompany liabilities assumed by such Member or which are secured by any property distributed tosuch Member.(b)To each Member’s Capital Account there shall be debited the amount ofcash and the fair market value of any property distributed to such Member pursuant to anyprovision of this Agreement, such Member’s distributive share of Losses, and the amount of anyliabilities of such Member assumed by the Company or which are secured by any propertycontributed by such Member to the Company.(c)In the event all or a portion of an Interest is Transferred in accordance withthe terms of this Agreement, the transferee shall succeed to the Capital Account of the transferorto the extent it relates to the transferred interest.(d)In determining the amount of any liability for purposes of the foregoingsubparagraphs (a) and (b) of this definition of “Capital Account,” there shall be taken into accountCode Section 752(c) and any other applicable provisions of the Code and Regulations.(e)If, after the initial capital is contributed, money or property, in other thana de minimis amount, is contributed to the Company in exchange for an interest in the Company,or money or property is distributed to a Member in exchange for an interest in the Company butthe Company is not liquidated, the Capital Accounts of the Members shall be adjusted based onthe fair market value of Company property at the time of such contribution or distribution, and theunrealized Profits or Losses inherent in the Company property which has not previously beenPage 5 of 34

reflected in the Capital Accounts shall be allocated among the Members as if there had been ataxable disposition of the Company property at its fair market value on such date. The fair marketvalue of contributed, distributed, or revalued property shall be agreed to among the participatingMember(s) and the Manager or, if there is no such agreement, shall be determined by appraisal. Ifproperty of the Company has a fair market value different than its tax basis to the Company at thetime of contribution, distribution, or revaluation so that the fair market value rather than tax basisof such property is used to determine the Capital Accounts of the Company, Profits and Losseswith respect to such property shall be computed on the basis of its fair market value using the samemethod and period as used for tax purposes and the Capital Accounts of the Members shall beadjusted for their respective shares of such Profits and Losses on the basis of fair market valuerather than tax basis.The foregoing provisions and the other provisions of this Agreement relating to themaintenance of Capital Accounts are intended to comply with Regulations Section 1.704-1(b) andshall be interpreted and applied in a manner consistent with such Regulations.2.2Members and Initial Capital. The names, addresses, the initial Capital Contributions,and Percentage Interests of the Members are set forth on Schedule I attached hereto.2.3Additional Capital. If the Manager determines that each Member should contributeadditional capital to the Company, then each Member shall contribute additional capital inproportion to its Percentage Interest within thirty (30) days from receipt of notice from theManager of the total and respective amounts to be contributed; provided, however, that theaggregate amount of additional capital to be contributed by all Members as a group shall not exceed 10,000.00 in any fiscal year without the Consent of the Members. The additional capital shall becontributed in the form of cash. The Company shall not issue any Interest to any third partywithout the Consent of the Members.2.4Value of Capital Account, Death of a Member. The value of a Member’s CapitalAccount, in the event that the Members elect to continuing to operate the business of the Companypursuant to paragraph 12.3, below, shall be an amount equal to the Company’s most recent twelve(12) months total gross revenue multiplied by the Members Percentage Interest in the Company.2.5Other Matters.(a)Except as otherwise provided in this Agreement, no Member shall demandor receive a return of its Capital Contributions or withdraw from the Company without the Consentof the Members. If a Member withdraws in violation of this Section 2.4(a), its Interest shall notbe liquidated and it shall forfeit all rights as a Member except the rights to allocations anddistributions as provided in Articles Ill and IV as if it were still a Member. Further, suchwithdrawal shall be considered a breach of this Agreement, including for purposes of Sections12.1(h)(iii) and 12.3 hereof. Under circumstances requiring a return of any Capital Contributions,no Member shall have the right to receive property other than cash except as may be specificallyprovided herein.Page 6 of 34

(b)No Member shall receive any interest, salary, or drawing with respect toits Capital Contributions or its Capital Account or for services rendered on behalf of the Companyor otherwise in its capacity as a Member, except as provided in this Agreement.(c)Except as otherwise provided in this Agreement, no Member shall beliable for the debts, liabilities, contracts, or any other obligations of the Company. Except asotherwise provided in this Agreement, any other agreements among the Members, or applicablestate law, a Member shall be liable only to make its Capital Contributions and shall not be requiredto lend any funds to the Company or, after its Capital Contributions have been paid, to make anyadditional contributions to the Company. Without limiting the generality of the foregoing, exceptas otherwise agreed or provided by law, no Member or Manager shall have personal liability forthe repayment of any Capital Contributions to any Member.Article IIIALLOCATIONS3.1Profits.Profits for any fiscal year shall be allocated to the Members as follows:(a)First, Profits shall be allocated to any Member in the amount of any Lossespreviously allocated to such Member pursuant to Section 3.2(b) to the extent not previouslyallocated pursuant to this Section 3.1(a); and(b)Second, any remaining Profits for such fiscal year shall be allocated to theMembers in accordance with their Percentage Interests.3.2Losses.Losses for any fiscal year shall be allocated as set forth in Section 3.2(a)below, subject to the limitation in Section 3.2(b) below.(a)Losses for any fiscal year shall be allocated to the Members in accordancewith their Percentage Interests.(b)The Losses allocated pursuant to Section 3.2(a) hereof shall not exceedthe maximum amount of Losses that can be so allocated without causing any Member to have anAdjusted Capital Account Deficit at the end of any fiscal year. All Losses in excess of thelimitations set forth in this Section 3.2(b) shall be allocated to those Members for whom suchallocations would not create or increase the amount of an Adjusted Capital Account Deficit, withany excess carried forward to the subsequent fiscal year.3.3Special Allocations. Notwithstanding anything to the contrary in Sections 3.1 and 3.2above, the special allocations described in Section 3.3(a) through Section 3.3(f) shall be made inthe order listed:(a)Qualified Income Offset. Notwithstanding any other provision of thisPage 7 of 34

Article III, in the event any Member unexpectedly receives any adjustments, allocations, ordistributions described in Section 1.704-1(b)(2)(ii)(d)(4), 1.704-1(b)(2)(ii)(d)(5), or 1.7041(b)(2)(ii)(d)(6) of the Regulations, items of Company income and gain shall be specially allocatedto each such Member in an amount and manner sufficient to eliminate, to the extent required bythe Regulations, the Adjusted Capital Account Deficit of such Member as quickly as possible,provided that an allocation pursuant to this Section 3.3(a) shall be made only if and to the extentthat such Member would have an Adjusted Capital Account Deficit after all other allocationsprovided for in this Article III have been tentatively made as if this Section 3.3(a) were not in theAgreement.(b)Company Minimum Gain Chargeback. Notwithstanding any otherprovision of this Article III, in the event there is a net decrease in the Company Minimum Gainduring any taxable year, each Member shall be specially allocated Profits for such year (and, ifnecessary, subsequent years) in an amount equal to such Member’s share of the net decrease inCompany Minimum Gain, determined in accordance with Regulations Section 1.704-2(g)(2).Allocations pursuant to the previous sentence shall be made in proportion to the respectiveamounts required to be allocated to each Member pursuant thereto. The Profits to be so allocatedshall be determined in accordance with Regulations Sections 1.704-2(f)(6) and 1.704-2(j)(2)(i).This Section 3.3(b) is intended to comply with the minimum gain chargeback requirement inRegulations Section 1.704-2(f) and shall be interpreted consistently therewith, including theexceptions to the minimum gain chargeback requirement set forth in Regulations Sections 1.7042(f)(2) and (3). If the Manager concludes, after consultation with tax advisor(s), that the Companymeets the requirements for a waiver of the minimum gain chargeback requirement set forth inRegulations Section 1.704-2(f)(4), the Manager shall take all steps reasonably necessary orappropriate in order to obtain such waiver.(c)Member Minimum Gain Chargeback. Notwithstanding any otherprovision of this Article III except Section 3.3(b) (which shall be applied first), in the event thereis a net decrease in Member Minimum Gain, determined in accordance with Regulations Section1.704-2(i)(5), each Member shall be specially allocated Profits for such year (and, if necessary,subsequent year) in an amount equal to such Member’s share of the net decrease in MemberMinimum Gain. Allocations pursuant to the previous sentence shall be made in proportion to therespective amounts required to be allocated to each Member pursuant thereto. The Profits to beso allocated shall be determined in accordance with Regulations Sections 1.704-2(i)(4) and 1.7042(j)(2)(ii). This Section 3.3(c) is intended to comply with the minimum gain chargebackrequirement in Regulations Section 1.704-2(i)(4) and shall be interpreted consistently therewith,including the exceptions set forth in Regulations Sections 1.704-2(f)(2) and (3) to the extent thatsuch exceptions apply to Regulations Section 1.704-2(i)(4). If the Manager concludes, afterconsultation with tax counsel, that the Company meets the requirements for a waiver of theMember Minimum Gain chargeback requirement set forth in Regulations Section 1.704-2(f)(4),but only to the extent that such exceptions apply to Regulations Section 1.704-2(i)(4), the Managershall take all steps necessary or appropriate in order to obtain such waiver.(d)Member Nonrecourse Deductions. Notwithstanding any other provisionPage 8 of 34

of this Article III, Losses in an amount up to the amount of Member nonrecourse deductions(treating “Member nonrecourse deductions” as “partner nonrecourse deductions” as that term isdefined in Regulation Section 1.704-2(i)(2)) shall be allocated to those Members who bear theeconomic risk of loss for the liability to which such deductions are attributable within the meaningof Regulation Section 1.704-2(i).(e)Book-Tax Disparity and Code Section 704(c) Allocations. In general,Profits and Losses shall be allocated for Federal income tax purposes in the same manner as Profitsand Losses are allocated for book purposes under this Article Ill.Nevertheless and notwithstanding anything to the contrary in this Article III, in an attempt toeliminate any Book-Tax Disparity with respect to a property contributed to the capital of theCompany (“Contributed Property”) and property of the Company revalued for book purposes asprovided in Section 2.1(v), Profits and Losses with respect to each such property shall be allocatedfor Federal income tax purposes among the Members as follows:(i)In the case of any Contributed Property with a Book-TaxDisparity, any item of depreciation, amortization, or other cost recovery allowance attributable tosuch property shall be allocated as follows: (A) first, to those Members (the “Non-ContributingMembers”) other than the Member who contributed such property to the Company (the“Contributing Member”) in an amount up to the book allocation of such items made to the NonContributing Members pursuant to Sections 3.1 and 3.2 hereof, pro rata in proportion to therespective amount of book items so allocated to the Non-Contributing Members pursuant toSections 3.1 and 3.2 hereof; and (B) any remaining depreciation, amortization, or other costrecovery allowance to the Contributing Member. In no event shall the total depreciation,amortization, or other cost recovery allowance allocated hereunder exceed the amount of theCompany’s depreciation, amortization, or other cost recovery allowance with respect to suchproperty.(ii)In the event the Company sells or otherwise disposes of aContributed Property with a Book-Tax Disparity, any Profits or Losses recognized by theCompany in connection with such sale or other disposition shall be allocated among the Membersas follows: (A) first, any Profits or Losses shall be allocated to the Contributing Member to theextent required to eliminate any Book-Tax Disparity with respect to such property; and (B) anyremaining Profits or Losses shall be allocated among the Members in the same manner that thecorrelative items of book Profits or Losses are allocated among the Members pursuant to Sections3.1 and 3.2 hereof.(iii)In the event the Book Value of a Company asset (including aContributed Property) is adjusted pursuant to Section 2.1(v) hereof, and such asset has not beendeemed distributed by, and recontributed to the Company pursuant to Code Section 708subsequent thereto, all Profits and Losses in respect of such property shall be allocated for Federalincome tax purposes among the Members in the same manner as provided in Section 3.3(e)(i)hereof to take into account any variation between the fair market value of the property, asPage 9 of 34

determined under Section 2.1(v) as of the date of such adjustment, and the Book Value of suchproperty immediately prior to such adjustment.(iv)The Members hereby intend that the allocation of tax itemspursuant to this Section 3.3(e) comply with the requirements of Code Section 704(c) and theRegulations promulgated thereunder. To the extent that Regulations promulgated pursuant toCode Section 704(c) permit the Company to elect alternative methods to eliminate the Book-TaxDisparity with respect to a Contributed Property, the Manager shall have the authority to elect themethod to be used by the Company.(v)The allocation of Profits and Losses pursuant to this Section3.3(e) are solely for Federal, state, and local income tax purposes, and the Capital Accountbalances of the Members shall be adjusted solely for allocations of “book” items in respect ofCompany property pursuant to Article III hereof.(f)Curative Allocations. It is the intent of the Members that each Members’tax allocations of Profits and Losses shall be determined and allocated in accordance with thisArticle III to the fullest extent permitted by Section 704(b) of the Code and the Regulations. Iflegal counsel to the Company determines that the allocation required under this Article III is notin compliance with Section 704(b) of the Code and the Regulations, the Manager is authorized anddirected to make an allocation that complies with Section 704(b) of the Code and the Regulations;provided, however, that such curative allocation under this Section 3.3(f) is the minimummodification necessary to assure that each Member’s distributive share of Profits and Losses isdetermined and allocated in accordance with this Article III to the fullest extent permitted bySection 704(b) of the Code and the Regulations.3.4Other Allocation Rules.(a)For purposes of determining the Profits, L

"Agreement" or " Operating Agreement" means this Operating Agreement, as amended from time to time. Words such as "herein," "hereinafter," "hereof," and "hereunder" refer to this Agreement as a whole, unless the context otherwise requires.