Transcription

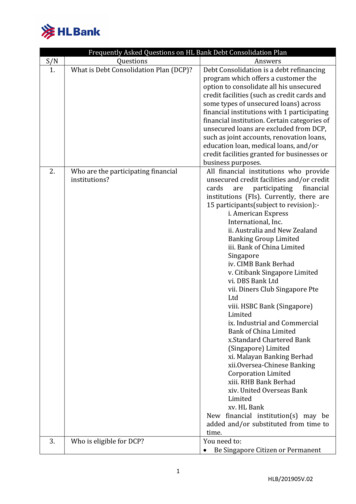

S/N1.2.3.Frequently Asked Questions on HL Bank Debt Consolidation PlanQuestionsAnswersWhat is Debt Consolidation Plan (DCP)?Debt Consolidation is a debt refinancingprogram which offers a customer theoption to consolidate all his unsecuredcredit facilities (such as credit cards andsome types of unsecured loans) acrossfinancial institutions with 1 participatingfinancial institution. Certain categories ofunsecured loans are excluded from DCP,such as joint accounts, renovation loans,education loan, medical loans, and/orcredit facilities granted for businesses orbusiness purposes.Who are the participating financialAll financial institutions who provideinstitutions?unsecured credit facilities and/or creditcards are participating financialinstitutions (FIs). Currently, there are15 participants(subject to revision):i. American ExpressInternational, Inc.ii. Australia and New ZealandBanking Group Limitediii. Bank of China LimitedSingaporeiv. CIMB Bank Berhadv. Citibank Singapore Limitedvi. DBS Bank Ltdvii. Diners Club Singapore PteLtdviii. HSBC Bank (Singapore)Limitedix. Industrial and CommercialBank of China Limitedx.Standard Chartered Bank(Singapore) Limitedxi. Malayan Banking Berhadxii.Oversea-Chinese BankingCorporation Limitedxiii. RHB Bank Berhadxiv. United Overseas BankLimitedxv. HL BankNew financial institution(s) may beadded and/or substituted from time totime.Who is eligible for DCP?You need to: Be Singapore Citizen or Permanent1HLB/201905V.02

4.How can I apply for DCP?5.I am currently under the RAS scheme.Am I eligible for DCP?6.Do I need to apply to all Participating FIs?7.Can I apply for a DCP with a ParticipatingFI that I am not a customer with?8.What documents are required forapplication?Resident;earn between S 30,000 and belowS 120,000 per annum with NetPersonal Assets of less than 2million**; andhave total interest-bearing unsecureddebt on all credit cards and unsecuredcredit facilities with financialinstitutions in Singapore that exceeds12 times of your monthly income** The term "Net Personal Assets" refersto the total value of the individual's assetsless his liabilities. Assets should besubstantiated by documents provided bythe applicant.You may approach any of the 15Participating FIs above which offerDCPs to apply for a DCP. An applicantshould only apply once with oneParticipating FI in Singapore, as anapplicant can only have one DCP.Yes, RAS outstanding amounts will betransferred to DCP upon approval andshall abide by DCP Terms and Conditionsat new DCP interest rates.No, you only need to apply to 1Participating FI to avail yourself of theDCP. You are encouraged to compare theterms and conditions from differentParticipating FIs before putting throughan application with the Participating FI ofyour choice.Yes, this is no different from applying fora new unsecured credit facility or creditcard today.The following documents need to besubmitted at the point of application:1. Copy of NRIC (front and back); and2. Copy of valid Passport (ForPermanent Residents); and3. Latest Credit Bureau Report; and4. Income Documents; and(a) Latestcomputerized / electronic payslip andLatest Income Tax Notice of AssessmentOR (b) Latest 6 month’s CPF contributionhistory statement (for monthly income2HLB/201905V.02

9.What if I have other transactions notreflected in my statement?10.Can I consolidate the outstanding underan existing renovation loan, educationloan and joint account under DCP?11.What will be the total DCP amount?12.What is the purpose of the additional 5% over and above the total DCPamount?13.Can I choose not to have this 5%allowance? S 6,000)5. Proof of Balances(a) Statements evidencing billed balances;(b) Online statements evidencing unbilledbalances;(c) Confirmation letter evidencing newbalance transfers / loans; and/or(d) Any other relevant documentsevidencing account information orbalances.You are advised to presentdocumentation of these othertransactions for the DCP application.No, the DCP excludes any renovation loan,education loan, medical loan, creditfacility granted for businesses or businesspurposes and/or outstanding debts underjoint accounts.In recognition of the purposeful or needsbased nature of such loans, MAS hasexempted them from the industry-wideand per-FI borrowing limits.The DCP amount is equivalent to the totalprincipal outstanding including interestand any other fees and/or chargesaccruing on your statemented accountsplus an additional 5% allowance overand above the total DCP amount, for thefirst DCP.If the approved DCP Amount isinsufficient to repay your outstandingunder any existing unsecured creditfacilities in full, you will remainresponsible for paying off the balance ofthese amounts directly to your existingFIs.It is to cater for any incidental charges(e.g. interest and fees payable) incurredfrom the time the DCP is approved till thetime the disbursed DCP amount isreceived by the financial institutions.The 5% allowance is mandatory for thefirst approved DCP Loan. It is intended asa buffer against any incidental chargesthat may be incurred from the time thatthe DCP loan is approved to when the DCPamount is disbursed to your financialinstitutions. Any portion of the allowance3HLB/201905V.02

will be credited or refunded to you byyour DCP financial institution.The allowance will not be applicable forsubsequent refinanced DCP loans.14.Can I do a partial consolidation of mybalances?15.Can I request for the DCP amount to bedeposited into my designated savings orcurrent account?16.Why am I given the 1x Revolving Creditfacility?17.Is it compulsory to have a RevolvingCredit facility?18.Are there fees attached to RevolvingCredit facility?Do I need to pay any service fee or annualfee?19.Can I request for lower limit on theRevolving Credit facility?20.In case of exigencies, can I request fortemporary line increase on my RevolvingCredit facility?Can I apply for a permanent credit limitincrease on the Revolving Credit facilitybundled with the DCP if my incomeincreases?Can I cancel my Revolving Credit facility?21.22.23.Can I continue to use my existing creditfacilities after I apply for DCP but beforeit’s being approved?No, DCP must be done in full with oneParticipating FI so that you may pay downyour total outstanding amounts with asingle FI.No, the DCP amount will be disburseddirectly to the respective financialinstitutions with whom you haveoutstanding unsecured credit facilities.You will be automatically given aRevolving Credit Facility to provide youwith a convenient mode of payment formanaging your daily essentials.The Revolving Credit facility and the DCPare bundled together as a single product.However, you can choose not to use theRevolving Credit Facility should you nothave any need for it.If you use the Revolving Credit Facility,you will have to pay fees and charges onthe Revolving Credit facility in accordancewith the HL Bank Standard Terms andConditions Governing Revolving CreditFacility (Line of Credit). Annual fee applyfor your Revolving Credit Facility but firstyear annual fee waived.No, it will be fixed at 1x your monthlyincome. However, you are not obliged toutilise the full limit.No, it will be fixed at 1x your monthlyincomeYes, with submission of fresh incomedocuments.No, it is bundled with the DebtConsolidation Loan Account.No. Further usage of existing unsecuredcredit facilities will not be allowed once aborrower decides to take up the DCP.If the approved DCP Amount isinsufficient to repay your outstanding4HLB/201905V.02

24.Will I be able to continue using myunsecured credit facilities once my DCPapplication is approved?25.Do I need to continue to repay theoutstanding balances on my unsecuredcredit facilities with my existing financialinstitutions after I have submitted by DCPapplication but before it is approved?26.Do I need to stop my recurring /giroarrangement on the Designated accounts?27.If DCP amount is insufficient to repay myexisting credit facilities, what willhappen?28.What will happen to me if I am under DCPbut fail to pay my excess/shortfall on myexisting credit facilities?under any existing unsecured creditfacilities in full, you shall remain fullyresponsible for the payment of any extracosts / expenses / shortfall incurred inaccordance with the terms and conditionsgoverning such DCP. Your obligationsunder such unsecured credit facilitiesshall remain unchanged and continue.No, all your unsecured credit facilities willbe closed or suspended once your DCPapplication is approved. However, you arestill able to use the 1x Revolving Creditfacility.Yes, you shall continue to be liable foryour existing unsecured credit facilitieswith your respective financial institutionsand will be bound by the terms andconditions governing such facilities,before your DCP application is approved.Once your DCP has been approved, youneed to repay your monthly DCPrepayment amount to the DCP FI. In theevent that the 5% DC allowance isinsufficient to cover all your outstandingdebts, you will also be responsible forrepaying the excess outstanding amountsowing to the respective financialinstitutions directly with your financialinstitutions.Yes, once the DCP has been approved, youshall be fully responsible for terminatingany existing recurring/GIROarrangements you may have on yourexisting unsecured credit facilities. Youwill also need to make alternativepayment arrangements with yourrespective billing organisations.You will be responsible for repaying anyoutstanding amounts you owe to anyfinancial institution in excess of theapproved DCP amount. Your obligationsunder such unsecured credit facilitiesshall remain unchanged and continue.If a DCP borrower defaults on the existingcredit facilities, the relevant financialinstitution shall follow their regularcollection/remedial process.5HLB/201905V.02

29.Do I need to inform the FIs to close myaccounts?30.When can I start applying for newfacilities?31.Can I settle the DCP balance anytimewhen I have available funds?32.Can I refinance my DCP loan with anotherParticipating FI?33.How will my Credit Bureau records beimpacted if I take up DCP?34.How long will the DCP account stay in myCredit Bureau report?No. Upon DCP loan approval, theParticipating FI with whom you havetaken up the DCP will proceed to paydown your outstanding amounts withexisting financial institutions and will alsonotify your existing financial institutionsof account suspension.You can start applying for new unsecuredcredit facilities: with another financial institution(non-DCP financial institution)once your overall BTI reduces toor below 8 times your monthlyincome; or with the DCP financial institutiononce your overall BTI reduces tobelow 4 times your monthlyincomeNote: BTI Aggregate interest-bearingunsecured outstanding balance tomonthly incomeYes. However please note that you mayneed to pay a prepayment fee at suchrate(s) as financial institutions may fromtime to time prescribe. Please check withyour DCP financial institution on thespecific repayment fee amount, if any.Yes, but you may only do so at least 3months after the approval of your latestDCP and subject to any penalty feeimposed by the original DCP financialinstitution for early termination.Your Credit Bureau record will beupdated with the “Debt Consolidation”product code as the DCP is viewed to be aunsecured credit product.Note: To ensure that all your otheraccounts are not reflected as being pastdue, you are encouraged to continueservicing at least the monthly minimumpayment amounts until the DCP isapproved, and make sure thatoutstanding amounts (if any) in excess ofthe DCP amount are settled.Credit information will stay on yourCredit Bureau report for 3 years after DCPclosure, as is the practice for other6HLB/201905V.02

35.What is a DC Registry?36.How long will it take to process myapplication?37.My DC application has been approved,when will my respective bank beinformed and the amount beingdisbursed?Can I refinance my DCP loan with anotherparticipating bank?38.products.This is a centralized registry that helpsFIs ensure that customers only have oneactive DC account at any point in time.The registry helps to prevent a situationwhere a borrower is on multiple DCPswith multiple FIs.When we receive the completedapplication form with all requireddocumentations, it will takeapproximately 7-14 working days for usto process.When it is approved, please allow 5 - 7working days for us to let other financialinstitutions know and to disburse theamount.Yes, but you may only do so only after 3months from the approval of your latestDCP and subject to any penalty or transferfee imposed by the original DCP financialinstitution for early termination.7HLB/201905V.02

1. What is Debt Consolidation Plan (DCP)? program which offers a customer the Debt Consolidation is a debt refinancing option to consolidate all his unsecured credit facilities (such as credit cards and some types of unsecured loans) across financial institutions with 1 participating financial institution. Certain categories of