Transcription

This Review provides an analysis of the activities of all pension funds for the accumulation of a portion of the state socialinsurance contribution, supplementary voluntary accumulation of pensions, and collective investment undertakings operating in Lithuania over 2014; all data presented in the tables and charts below is the data as of 31 December 2014, unlessotherwise specified.In the preparation of this Review, the data of the Bank of Lithuania, pension accumulation companies, management companies, distributors and other, published by 31 December 2014, was used.The coordinator of this publication is Audrius Šilgalis, senior specialist of the Financial Services and Markets AnalysisDivision, tel. ( 370 5) 268 0524, e-mail: asilgalis@lb.ltContentsI. GENERAL 2II. 2NDIII. 2NDPILLAR PF MARKET DATA .4PILLAR PF INVESTING PERFORMANCE .5NDPILLAR PF INVESTMENT PORTFOLIO COMPOSITION .6IV. PARTICIPANTS IN 2V. GENERAL 3VI. 3RDRDNDPILLAR PFS .7PENSION PILLAR MARKET DATA .8PILLAR PF INVESTING PERFORMANCE .8VII. PF INVESTMENT PORTFOLIO COMPOSITION .9VIII. GENERAL CIU MARKET DATA .10IX. CIU PARTICIPANTS .11X. CIU ASSETS .12XI. CIU INVESTING PERFORMANCE .13XII. CIU INVESTMENT PORTFOLIO COMPOSITION .14XIII. UNITS OF FOREIGN CIUS DISTRIBUTED IN LITHUANIA .15

List of tables2Table 1. PF participants and managed assets by investment strategy .4Table 2. Changes in PF unit values and benchmark indices .5rdTable 3. 3 pillar PF market data .8Table 4. Changes in PF unit values and benchmark indices .8Table 5. CIU market data .10Table 6. Weighted changes in CIU unit values .13Table 7. Changes in CIU unit values .13List of chartsChart 1. Dynamics of the number and assets of 2Chart 2. Distribution of assets managed by 2ndndpillar PF participants.4pillar PFs by PAC .4Chart 3. Changes in the indices reflecting world market changes .5Chart 4. Distribution of 2ndpillar PF market investment by asset class .6Chart 5. CIU distribution by type.6Chart 6. General distribution of 2ndpillar PF investment.6Chart 7. Distribution of 2ndpillar PF investment by currency .6Chart 8. Distribution of 2ndpillar PF total investment by country .6Chart 9. Distribution of new participants by PAC in 2014 .7Chart 10. Participants who changed their PAC in 2014.7rdChart 11. Dynamics of the number and assets of 3 pillar PF participants .8Chart 12. Distribution of3rdpillar PF market investment by asset class .9Chart 13. CIU distribution by type.9Review of Lithuania's 2nd and 3rd Pillar Pension Funds and of the Markets of Collective Investment Undertakings /2014rdChart 14. General distribution of 3 pillar PF investment .9rdChart 15. Distribution of 3 pillar PF investment by currency .9rdChart 16. Distribution of 3 pillar PF investment by country .9Chart 17. Dynamics of the number and assets of CIU participants .10Chart 18. Distribution of CIU assets by type of CIU.10Chart 19. Distribution of CIU participants by type of CIU.10Chart 20. Distribution of CIU participants by type of MC .11Chart 21. CIUs with most of participants .11Chart 22. Distribution of CIU assets by MC .12Chart 23. CIUs with most of assets .12Chart 24. Distribution of investment of the entire CIU market by asset classChart 25. Distribution of investment in CIU by type .14Chart 26. General distribution of CIU investment .14Chart 27. Distribution of CIU investment by currency .14Chart 28. Distribution of CIU total investment by country .14Chart 29. Dynamics of the number and assets of foreign CIU participants . 15Chart 30. Distribution and redemption by CIUs registered in Lithuania and by foreign CIUs .15Chart 31. Distribution of foreign CIU assets by distributor .15Chart 32. Distribution of foreign CIU participants by distributor .15

Abbreviationsnd3pillarCIUaccumulation of a portion of the state social insurance contribution in pension funds managed bypension accumulation companiessupplementary voluntary pension accumulation in pension funds managed by pension accumulationcompaniesCollective investment undertakingECBGSIFMCPACPFUABUAGDPBthe European Central BankGovernment securitiesInvestment fundManagement companyPension accumulation companyPension fundsPrivate limited liability company (PLLC)Private limited liability life assurance and pension companyrd3 pillarReview of Lithuania's 2nd and 3rd Pillar Pension Funds and of the Markets of Collective Investment Undertakings /20142

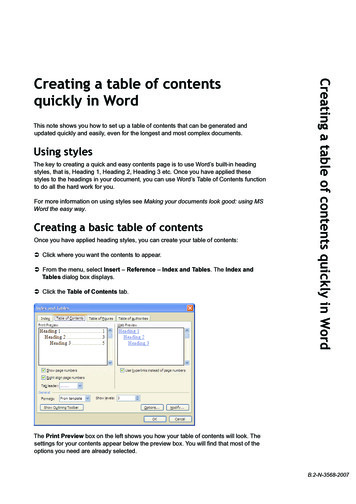

I. GENERAL 2ND PILLAR PF MARKET DATAndAt the end of 2014, 26 2 pillar PFs operated in Lithuania (see Table 1).They were managed by seven PACs: six MCs and one life assurancendundertaking. MCs managed twenty three 2 pillar PFs the asset value ofwhich as of 31 December 2014 amounted to EUR 1,589.8 million (LTL5,489.1 million); 955.0 thousand participants accumulated their pension inndthem. Life assurance undertaking managed three 2 pillar PFs the assetvalue of which as of 31 December 2014 amounted to EUR 277.9 million(LTL 959.6 million); 201.6 thousand participants accumulated theirpension in them. As of 2014, the pension contribution amount consists ofa 2 per cent contribution by Sodra, an additional 1 per cent contributionfrom a participant’s income and a 1 per cent pension contribution from thestate budget (the amount of which is equal to the average monthly bruttoearnings of workers of the domestic economy for the four quarters of theyear before last published by Statistics Lithuania).Number ofparticipantsValue of managedassets, EUR (LTL)millionsConservativeinvestment8108,605704.28 (203.97)Small equity share4286,7221,696.55 (491.35)Medium equityshare19609,0123,356.60 (972.14)Equity5152,284691.34 (200.23)Total261,156,6231,867.69(6,448.77)* By investment strategy, funds are divided into four risk groups:conservative investment; small equity share (investing up to 30%of funds in equity); medium equity share (30–70%), and equity(70–100%).High concentration in the market1 600957.3 997.51 4001,035.7 1,054.41,117.0 1,156.61 2001,069.31 000880.91 200780.41 0008001,868557.5800 44.6600945400200489371191,117 1,1821,3921,577400652200Turtas (skalė 010-12-312009-12-310Dalyviai (skalė dešinėje)Chart 2. Distribution of assets managed by 2nd pillar PFsby PACAviva Lietuva14.88%Danske CIV3.26%DNB IV11.76%SEB IV26.79%Swedbank IVAt the end of 2014 about 77 per cent of assets were concentrated in theMP PF Baltic35.00%5.01%Finasta AMfunds managed by three PACs (see Chart 2): almost 62 per cent of PF3.31%assets were managed by two management companies (UAB Swedbankinvesticijų valdymas — 35.00% and UAB SEB investicijų valdymas — 26.79%) and 14.88 per cent — by UAGDPB AvivaLietuva. It is the third largest in terms of the size of assets managed by PFs.The distribution of participants by PAC was very close to that by assets — about 78 per cent of participants accumulatedtheir pension in a fund managed by one of the three PACs. Most of participants chose the funds managed by UABSwedbank investicijų valdymas (38.59%) and UAB SEB investicijų valdymas (21.91%); then followed UAGDPB AvivaLietuva (17.43%).ndThese three MCs have been dominating the 2 pillar PF market since the very beginning of the functioning of the pensionaccumulation system. Because of a large network of customer service units and active selling strategy these companies inalready the first years of the functioning of the pension accumulation system managed to attract most of participants and1assets. As of 31 December 2014, compared to the end of 2013, the Herfindahl-Hirschman index increased by 25.75points and was 2,323.3 points. ( ) , where:The Herfindahl-Hirschman index is one of the most frequently applied concentration indicators. This index is calculated as follows:— i is thePAC market share by assets, n — the number of PACs. The values of the Herfindahl-Hirschman index vary within the interval of 10 000/n HHI 10 000. This value of thisindex would be the lowest if all structural components were equal, i. e. every PAC held an equal market share. The value of the index would the highest if one structural16002622008-12-31ndIn the second half of 2014 the assets managed by 2 pillar PFs grew byEUR 147.09 million (LTL 507.89 million) — 8.55 per cent and stood atEUR 1,867.69 million (LTL 6,448.77 million) at the end of December.Over the recent year, the assets expanded by even 18.45 per cent orEUR 290.87 million (LTL 1,004.30 million). The number of participantsndaccumulating their pension in 2 pillar PFs increased by 1.97 per cent(22,313 participants) over a half-year and 3.55 per cent (39,614 participants) over the last twelve months. Over 2014, Sodra transferred to PFsEUR 131.82 million (LTL 455.16 million), the participants who chose topay additionally — EUR 22.74 million (LTL 78.53 million), while the statetransferred to them additionally EUR 27.39 million (LTL 94.58 million).1 4001 8002007-12-31pillar PFs grew by 18.45 per cent over the year.ThousandsEUR millions2 00020

As of 2014, the pension contribution amount consists of a 2 per cent contribution 1,867.69 by Sodra, an additional 1 per cent contribution from a participant’s income and a 1 per cent pension contribution from the state budget (the amount of which is equal to the average monthly brutto earnings of workers of the domestic economy for the four quarters of the year before last published by .