Transcription

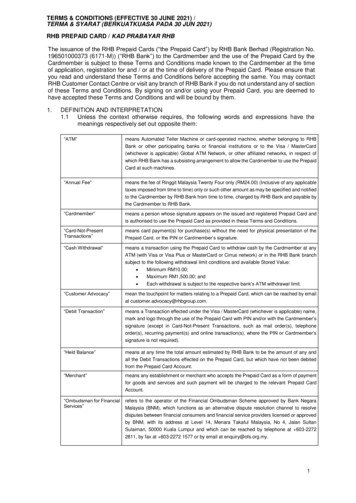

INSIGHT VISA PREPAID RELOADABLE CARDCARDHOLDER AGREEMENTList of all fees for Insight Visa Prepaid Reloadable CardIssued by Republic Bank of Chicago, Member FDIC, pursuant to a license from Visa U.S.A. Inc.ALL FEESAMOUNTDETAILSMonthly usageMonthly fee 9.95The Monthly Fee is 5.00 if you receive direct deposits every 35 days when you selectthe Monthly Plan. There is no Monthly Fee when you select the Pay-as-You-Go-Plan. 5.95Fee of up to 5.95 may apply when reloading your card at Retail Locations, Green Dot or Visa ReadyLink reload agents. This fee is charged by the reload agent and is subjectto change.Add moneyCash reloadMobile check load5%, 5.00minimumFee of up to 5% of the amount of a check loaded through third party applications mayapply, subject to a 5.00 minimum. Service is subject to third party terms and conditions.This fee is charged by a third party and is subject to change.Spend moneyThere is no Domestic non-PIN purchase fee if you select the Monthly Fee Plan.Per purchase without PIN 1.00Per purchase with PIN 2.00Bill paymentNoneBill payment stop payment 25.00Convenience check authorization 1.00Fee applies each time you contact us to authorize a convenience check.Convenience check order 5.00Convenience check stop payment 25.00Fee applies to each order of 12 blank convenience checks.Fee applies each time you request a stop payment on an authorized convenience check.Unauthorized convenience check 25.00Card to card transfer 1.00The Domestic PIN purchase fee is 1.00 if you select the Monthly Fee Plan.The Insight Bill Pay service is available when you log in to your account atwww.InsightVisa.com. There is no charge to complete a bill pay transaction.Fee applies when you ask us to stop payment of an Insight bill pay by check.Fee applies for each payment with a convenience check that has not been authorized.The fee may appear on the Card Account statement/transaction history as “conveniencecheck stop payment”.Fee applies to each transfer you originate from your Card Account to another InsightCard Account. You will not be charged a fee if you receive a card to card transfer to yourCard Account.Get cashCash withdrawal at participating retail locations 3.00ATM withdrawal 2.50Over the counter cash withdrawal3%, 5.00minimumFee of up to 3.00 may apply when unloading your card at participating Retail Locations.Locations may be found at www.InsightCards.com.This fee is charged by the Retail Location and is subject to change.This is our fee. You may also be charged a fee by the ATM operator, even if you donot complete a transaction.This is our fee. The fee assessed is the greater of 5.00 or 3% of the cash withdrawalamount made through participating banks. You may also be charged a fee by theparticipating bank.InformationFee applies each time you call the customer service line and select the option to speakwith a live agent. No fee for selecting the automated voice response option.Customer service inquiry 1.00ATM balance inquiry 1.00This is our fee. You may also be charged a fee by the ATM operator, even if you donot complete a transaction.3%, 1.00minimumThis is our fee. The fee assessed will be the greater of 1.00 or 3% of the internationalpurchase amount made with or without your PIN.Using your card outside the U.S.International per purchaseInternational ATM withdrawalInternational ATM balance inquiry3% ( 1.00minimum),plus 2.50 1.00This is our fee. The fee assessed will be the greater of 1.00 or 3% of the internationalATM withdrawal, plus 2.50 for each withdrawal. You may also be charged a fee by theATM operator, even if you do not complete a transaction.This is our fee. You may also be charged a fee by the ATM operator, even if you donot complete a transaction.

International over the counter cash withdrawal3%, 5.00minimumThis is our fee. The fee assessed will be the greater of 5.00 or 3% of the cashwithdrawal made through participating banks. You may also be charged a fee by theparticipating bank.OtherDeclined card transaction 1.00Fee applies each time a purchase or ATM transaction is declined, for any reason –domestic or international.Returned ACH debit transaction 5.00Fee applies each time an ACH debit to your Card Account is returned by us due toinsufficient funds.Replacement, secondary, or custom design cardorder (standard delivery) 9.95Fee applies to each replacement, secondary or custom card requested and sentstandard delivery. Your card will typically arrive in 7-10 business days.Replacement, secondary, or customdesign card order (expedited delivery) 30.00Fee applies when you request expedited delivery and is in addition to the 9.95 per card fee. Your card will typically arrive in 3-5 business days.If you select the Pay-As-You-Go Plan, this fee will be applied after 90 days of nopurchases, cash withdrawals, loads, payments and declined transactions. There is noInactivity Fee when you select the Monthly Plan.Your funds are eligible for FDIC insurance and will be held at Republic Bank of Chicago, an FDIC insured institution. Once there, your funds are insuredup to 250,000 by the FDIC in the event Republic Bank of Chicago fails, if specific deposit insurance requirements are met and your card is registered.See fdic.gov/deposit/deposits/prepaid.html for details.Inactivity 3.95No overdraft/credit feature.Contact Insight Card Services, LLC by calling 1-888-572-8472, by mail at Insight Card Services, LLC, P.O. Box 5100 Pasadena, CA 91117, or visitwww.insightvisa.comFor general information about prepaid accounts, visit cfpb.gov/prepaid. If you have a complaint about a prepaid account, call the Consumer FinancialProtection Bureau at 1-855-411-2372 or visit cfpb.gov/complaint.CARDHOLDER AGREEMENTThis Cardholder Agreement (this “Agreement”) and the above “List of All Fees” constitute our disclosure to you and an agreementbetween you and us under which you establish one or more Visa Prepaid Reloadable cards (called a “Card”) at Republic Bank of Chicago pursuant to alicense from Visa U.S.A., Inc. Your Card may not be loaded until your identity has been confirmed as discussed below. Card includes any Secondary Cardissued pursuant to this Agreement.Please read this Agreement carefully and keep it for future reference. By applying for, maintaining, and using this Card Account, you representand warrant to us that: (i) you are citizen or permanent resident of the fifty (50) United States or the District of Columbia who can lawfully enter into andform contracts under applicable law in the state in which you reside; (ii) the personal information that you provide to us is true, correct and complete; and(iii) you have read this Agreement and agree to be bound by and comply with its terms.IMPORTANT NOTICES(1)THIS AGREEMENT CONTAINS AN ARBITRATION PROVISION REQUIRING ALL CLAIMS TO BE RESOLVED BY WAY OF BINDINGARBITRATION. THE TERMS OF THE ARBITRATION PROVISION ARE SET FORTH IN THE SECTION ENTITLED RESOLUTION OF DISPUTESBY BINDING ARBITRATION.(2)WE MAY CLOSE YOUR CARD ACCOUNT AT ANY TIME, WITH OR WITHOUT CAUSE AS DESCRIBED IN THE SECTION ENTITLEDAMENDMENT; CARD ACCOUNT CLOSURE AND TERMINATION.(3)PLEASE SIGN YOUR CARD IMMEDIATELY UPON RECEIPT. YOUR CARD IS NOT A CREDIT CARD AND IT IS NOT A GIFT CARD. THIS CARDIS NOT FOR RESALE AND IS NONTRANSFERABLE.(4)FOR ELECTRONIC DELIVERY YOU MUST CONSENT TO ELECTRONIC DELIVERY ON THE ONLINE BANKING WEBSITE OR MOBILE APP TOACCESS YOUR CARD ACCOUNT.(5)CARD SERVICES ARE NOT AVAILABLE AT REPUBLIC BANK OF CHICAGO RETAIL LOCATIONS.USA PATRIOT ACT NOTICEThe USA PATRIOT Act is a federal law that requires all financial institutions to obtain, verify, and record information that identifies each personwho opens an account. In order to open a Card Account, you will be asked to provide your name, a valid physical U.S. street address, a telephone number,a date of birth, and other information that identifies each person who opens a Card account. You may also be asked to provide other personal and financialinformation that will allow us to identify you, including a driver’s license or other identifying documents. If we are not able to verify your identity to oursatisfaction, we will not issue a Card or we may close the Card Account, if it was previously funded and return your funds, less any fees accrued up to thedate of closure, to you via ACH, EFT, or other method, at our sole discretion. We reserve the right to not open a Card Account for anyone or limit thenumber of Card Accounts that you have in our sole discretion. Your Card Account is subject to fraud prevention restrictions at any time, with or withoutnotice.CONSENT TO ELECTRONIC DELIVERYThe following notice contains important information that you are entitled to receive before you consent to transact business with us electronically. Byconsenting to electronic delivery, you agree that we may provide electronically all disclosures, notices, terms and conditions, other documents, includingperiodic statements, our responses to any claimed errors on the periodic statements, our privacy policy and all future changes to any of these materials(“Electronic Disclosures”). To transact business with us electronically, you must consent on the form provided online or through the Mobile App. Pleaseread the electronic notice carefully and print or download a copy for your files.Withdrawing Consent to Electronic Delivery. If you wish to withdraw your consent, you may do so by sending your request in writing to Attn:Customer Service, P.O. Box 5100 Pasadena, CA 91117 or by calling us at 1-888-572-8472. If you decide to withdraw your consent, the legaleffectiveness, validity and/or enforceability of prior consent to electronic delivery will not be affected. Any withdrawal of your consent to electronic deliverywill be effective only after we have a reasonable period of time to process your withdrawal.2

Hardware and Software Requirements. You must have access to the following equipment and software to view and retain Electronic Disclosures: an Internet browser that supports 128-bit encryption, such as Internet Explorer version 8.0 or above, Firefox 4.0 and above, Safari 5.0 and aboveand Google Chrome; an email account and email reader software capable of handling HTML email; a personal computer or mobile phone, operating system and telecommunications connections to the Internet capable of supporting the foregoing; sufficient electronic storage capacity on your computer’s hard drive or other data storage unit; and a printer capable of printing both text screens and material directly from your browser and email software.Paper Copies of Disclosures. You may receive a paper copy of any Electronic Disclosures by sending a request to us at Attn: Customer Service,P.O. Box 5100 Pasadena, CA 91117 or by calling us at 1-888-572-8472.Your request should specify the document that you would like us to send andprovide your name, address and Card number.Procedures to Update Your Records. It is your responsibility to provide us with a true, accurate and complete email address, home address,telephone numbers, and other information related to the Card Account and to maintain and update promptly any changes in this information. You canupdate such information by sending a request to us at Attn: Customer Service, P.O. Box 5100 Pasadena, CA 91117 or by calling us at 1-888-572-8472.Insight Visa Prepaid Reloadable Card Announcement and Email List Opt-In Notice: By accepting this Agreement, you are opting in to ourAnnouncement & Notification email list. We do not sell this list nor misuse your permission allowing us to contact you. We respect your privacy, and youmay opt-out of email communication by clicking the link at the bottom of any email you receive. If you opt-out and wish to be added to our list at a latertime, please contact Insight Cards at support@InsightCards.com.SECTION I: CONTACT INFORMATIONWe encourage you to contact us if you have any comments or concerns about your Card. Please write to us at:Republic Bank of Chicago Insight Card Product Manager2221 Camden Ct.Oak Brook, IL 60523-9848Or, you may contact our Program Manager, Insight at:Insight Card Services, LLCCustomer Service P.O. Box 5100Pasadena, CA 91117SECTION II:DEFINITIONSIn this Agreement: “you” and “your” means the person who has received the Card Account and is authorized to use it as provided for in this Agreement,and “we”, “us” and “our” means Republic Bank of Chicago, and its successors and assigns. “Visa” means Visa U.S.A., Inc. and its successors and assigns.“Insight” refers to the product brand name under Green Dot Corp., the Program Manager for our prepaid debit card program under this Agreement and itssuccessors and assigns, employees, agents and service providers, all of whom, collectively, perform certain services related to your Card Account.In addition:“Access Device” means your Card, PIN, Login Credentials, mobile device, computer, and any other code or device made available to you to access yourCard Account, including through Online Banking and the Mobile App.“ACH” means the Automated Clearing House network, a funds transfer system governed by the rules of NACHA - the Electronic Payments Association,that provides funds transfer services to participating financial institutions.“Annual Percentage Yield” or “APY” is the total amount of interest paid on a Savings Account, based on the interest rate and the frequency of compoundingfor a 365-day period (366-day period in a leap year), and is expressed as a percentage.“ATM” means Automated Teller Machine.“Actual Balance” is the amount of money that is in your Card Account at any given time and reflects transactions that have posted to your Card Account.It does not include (i) the amount of pending transactions, such as POS transactions that have not yet settled; (ii) funds on hold in accordance with ourfunds availability policy; (iii) our receipt of notice that a transaction will be presented or returned; or (iv) our receipt of legal process relating to your CardAccount.“Available Balance” is the amount of prepaid funds available on your Card Account for withdrawal and authorizing transactions, which may be differentthan your actual balance. The Available Balance is used to determine whether to authorize, pay or return transactions. The Available Balance is reducedby: (i) the amount of pending transactions, such as a POS transaction; (ii) our receipt of notice that a transaction will be presented or returned; or (iii) ourreceipt of legal process relating to your Card Account. Available Balance of your Card Account does not include funds transferred to the Savings Account.“Bill Pay” means our service that permits you to pay bills though Insight’s Online Banking or the Mobile App.“Business Day” refers to Monday through Friday, except federal holidays, even if we are open. Non-Business Days are considered part of the followingBusiness Day.“Card Account” means the custodial sub-account we maintain on your behalf to track your balance on deposit with us and record transactions made usingyour Card or by other means authorized by this Agreement.“Direct Deposit” means an ACH credit intended for, or posted to, your Card Account.“EFT” means electronic funds transfer transactions.“FDIC” means the Federal Deposit Insurance Corporation.“Financial Service” means your Card or any financial product or service made available through Online Banking or the Mobile App or otherwise inconnection with your Card Account.“IRS” means the Internal Revenue Service.“Item” means service charges, electronic items or transactions, drafts, preauthorized payments, automatic transfers, telephone-initiated transfers, ACHtransactions, Online Banking transfers or Bill Pay instructions, adjustments, and any other instruments or instructions for the payment, transfer, orwithdrawal of funds.“List of All Fees” refers to the schedule that lists the fees and charges associated with the Card Account and its use.“Login Credentials” means the user name and password that you use to access Online Banking and/or the Mobile App.3

“Mobile App” means any application made available to you by the Bank or its Program Manager through which you may obtain information regarding, andotherwise manage, your Card Account through a mobile device or tablet. Message and data rates may apply.“Monthly Fee Plan” refers to the fee plan made available to you for 9.95 per month, or 5.00 per month when you receive regular direct deposits (at leastonce every 35 days) to your Card Account. The Monthly Fee Plan reduction for direct deposit takes affect the day following a direct deposit, with your nextMonthly Fee reflecting the reduced charge of 5.00. The Monthly Fee Plan avails you reduced domestic purchase transaction charges (None when youdo not use your PIN, and 1.00 when using your PIN to complete the purchase). All other fees are the same as Pay as You Go. There is no Inactivity Feewhen you choose the Monthly Fee Plan. If you select the Monthly Fee Plan, you will be charged the initial Monthly Fee when you open your Card Accountand each month thereafter on the same date of each month. Please refer to the List of all Fees for more details.“Online Banking” means the website made available to you by the Bank or its Program Manager at www.InsightVisa.com , through which you may obtaininformation regarding, and otherwise manage, your Card Account and pay bills.“Pay as You Go” refers to the fee plan made available to you with no monthly service charge, and standard domestic purchase transaction charges ( 1.00when you do not use your PIN, and 2.00 when using your PIN to complete the purchase). Please refer to the List of all Fees for more details on fees forthis Plan.“PIN” means a Personal Identification Number used in connection with your Card to conduct transactions.“POS” means your ability to make purchases with your Card at merchant locations or “points of sale.”“Retail Location” means locations of participating merchants where Cards can be acquired and where funds can be loaded to Cards, which are operatedand serviced independently of us.“Savings Account” means the optional savings account you may open at the Bank to earn interest on your deposited funds, funded through transfersinitiated by you from your Card Account.“Secondary Cardholder” refers to a person who has received a Card at your request and is authorized to use the Card as provided for in this Agreement.“System” means the electronic payment network operated by Visa, Mastercard or any other applicable card association.SECTION III: IMPORTANT INFORMATION ABOUT YOUR CARD ACCOUNT.Your Card Account is a general purpose reloadable prepaid debit card account that is held at Republic Bank of Chicago, an FDIC-insured financialinstitution. Your Card Account is non-interest bearing, and interest will not be paid on your balance. The Card Account is not a credit product. Your CardAccount is to be used only for personal, family, or household use and may not be designated for business use. We may close your Card Account if wedetermine that it is being used for business purposes. We may close your Card Account or refuse to process any transaction that we believe, in our solediscretion, may violate the terms of this Agreement or represents illegal or fraudulent activity.Opening Your Card Account. Your Card Account may be opened online or at a Retail Location. To open your Card Account, you must provideall of the personal information we require from you and pass the mandatory identification verification process described above. There is no minimumdeposit amount required to open a Card Account. When you open your Card Account, you will select either the Pay as You Go or the Monthly Fee Plan.You may change your fee plan through Online Banking or by calling us at 1-888-572-8472.Warning regarding unverified prepaid card accounts. It is important to register your Card Account as soon as possible. Until you registeryour Card Account and we verify your identity, we are not required to research or resolve any error regarding your Card Account. To register your CardAccount, go to www.insightVIsa.com or call us at 1-888-572-8472. We will ask you for identifying information about yourself (including your full name,address, date of birth, and government issued identification number).Payment of Fees. You agree to pay the fees shown on the above List of All Fees. Except for third party fees paid directly to the thirdparty, as these fees are incurred, we will deduct them directly from your Card Account. We will not be liable for dishonor of any Item resulting from ourdeduction of any charges as authorized by this Agreement. NOTE: Fees assessed to your Card Account balance may bring your balance negative.Any time your balance is less than the fee amount being assessed to your Card Account or your Card Account balance is already negative, theassessment of the fee will result in a negative balance on your Card Account, increase the negative balance,, or will pend for payment, asapplicable. If that occurs, any subsequent deposits to your Card Account will first be applied to the negative balance or pending fees. Becauseof this, up to three monthly fees may be collected in a single month, if due upon a subsequent deposit to your Card Account.Customer Service Live Agent Assistance. Each time you speak with a live customer service agent your Card Account is subject to a fee asdisclosed in the List of All Fees. This fee can be avoided by using the automated customer service option when calling 1-888-572-8472 or by accessingyour Card Account through Online Banking or the Mobile App.Accessing Funds and Limitations. You are responsible for all obligations arising out of the ownership and maintenance of your Card Account,including the amount of any deposits to the Card Account and for which the Card Account was credited, any negative balances on your Card Account, anyservice charges to the Card Account, or losses arising from the breach of any representation or warranty you make to us in this Agreement or underapplicable law, and the costs we incur to enforce our rights under this Agreement or to collect any sum you owe us under this Agreement, including, to theextent permitted by law, our reasonable attorneys’ fees or other costs as permitted under applicable law. You may not use your Card Account for illegaltransactions, and you may not resell your Card. Internet Gambling Transactions Are Prohibited: You may not use your Card Account to initiate anytype of electronic gambling transaction through the Internet. For security reasons, there may be additional limits on the amount, number and type oftransactions you can make using your Card Account, and we may restrict access to your Card Account if we notice suspicious or illegal activity. If accessis denied, you should contact us by calling 1-888-572-8472 so that we may discuss and rectify any problems.Card Account Balance and Statements. You may obtain information about the amount of money you have remaining in your Card Account by calling1-888-572-8472. This information, along with a 12-month history of account transactions, is also available online at www.insightvisa.com. If your CardAccount is registered with us, you also have the right to obtain at least 24 months of written history of account transactions by calling 1-888-572-8472, orby writing us at Attn: Customer Service, P.O. Box 5100 Pasadena, CA 91117. You are responsible for keeping track of the transactions on your CardAccount to ensure that you do not exceed your Available Balance. Merchants will not be able to determine your Available Balance. You will be able toreview Card Account transactions and obtain your Available Balance through Online Banking or the Mobile App, enrolling in Insight Alerts, or by calling 1888-572-8472. This information is available to you 24 hours a day, 7 days a week. Statements in electronic format will be made available at no charge atwww.InsightVisa.com each month in which a transaction occurs. If you have agreed to conduct business with us electronically, we will send you an emailthat your Card Account statement is available in Online Banking. Periodic statements will be available for each monthly cycle in which an EFT has occurred.If no transfer has occurred, a periodic statement will be available at least quarterly, and all EFT transactions since the date of your last statement will bereported on your statement. If your Card Account is dormant, we may stop sending you Card Account statement emails or posting statements to OnlineBanking or both.4

Review of Card Account Statement. You agree to promptly and carefully review your Card Account statement and any accompanying items uponreceipt. You must report an unauthorized transaction or fraud within a reasonable time (within 60 days) after we sent or posted your statement to OnlineBanking, by calling our Customer Service at 1-888-572-8472. Additionally, if you fail to report an unauthorized transaction on your Card Account statementwithin the time frame specified, we are not responsible for subsequent unauthorized transactions on your Card Account by the same person. There arespecial rules for statement review applicable to electronic funds transfers. Please refer to the section below entitled YOUR LIABILITY FORUNAUTHORIZED USE.Death or Adjudication of Incompetency. We may freeze, refuse, or reverse deposits and transactions and/or return governmental benefit paymentsmade to the Card Account if you die or are adjudicated incompetent. If you give us instructions regarding your Card Account which are to be effective at afuture date, and you die or are adjudicated incompetent prior to the date you specified, then the instructions shall be effective, unless we receive writtennotice of death or incompetency prior to honoring such instructions.Dormancy. Your Card Account is dormant if your Card Account has not had any customer-initiated activity (that is, if you have not logged in to OnlineBanking or the Mobile App, and have made no purchases, no cash withdrawals, no cash deposits, or no balance inquiry fees have been assessed) for 365consecutive days. For security reasons, we may refuse a withdrawal or transfer from a Card Account we internally classify as dormant if we cannot reachyou in a timely fashion to confirm the transaction’s authorization. A Card Account that has become dormant and that has no funds will be closed. AnInactivity Fee as described in the List of All Fees may be assessed against remaining funds, if permitted by applicable state law.Card Accounts Presumed to Be Abandoned. In accordance with applicable state law, funds in dormant, inactive and/or abandoned Card Accountswill be remitted to the custody of the applicable state agency at the time required by state law, and we will have no further liability to you for such funds.We may, at our option, attempt to contact you prior to remittance of funds to the applicable state and will attempt to do so if required by applicable law. Wemay assess a fee for sending you notice and publishing your name in a newspaper of your state, unless prohibited by law. Once remitted, you must applyto the appropriate state agency to reclaim your funds. After the funds on deposit have been remitted to the state, the Card Account is closed and theinterest does not continue to accrue on any interest-bearing account. The fact that you have an active Card Account with us does not keep your other CardAccounts active.Legal Process. We may accept and comply with any writ of attachment, execution, garnishment, tax withhold order or other levy, subpoena, warrant,injunction, restraining order, government agency request for information or other legal process relating to your Card Account which we believe (correctlyor incorrectly) to be valid and binding regardless of the location of the Bank or method of service on the Bank even if the law requires personal service atthe branch of record or other specified location for your Card Account or where the records are stored (but we reserve the right to require service at suchlocation as may be required by law). We may, but are not required to, give you notice of any such legal process except as required by law and will not doso if prohibited by law. In responding to a search warrant or other legal process from a city, county, state or federal law enforcement or other agency, wemay produce documents, including from facilities owned and operated by third parties maintaining such records on our behalf, even if such facility is notdesignated as the place to be searched in the search warrant or legal process. If we are required to pay any attachment, garnishment, writ, levy or otherlegal process related to your Card Account, then we may debit your Card Account even if such debit creates a negative balance. If we incur any expenses,including without limitation research, photocopy, handling and administrative costs and reasonable attorneys’ fees, in responding to an attachment,garnishment, writ, levy or other legal process that is not otherwise reimbursed, then we may charge, in addition to other amounts set forth herein, suchexpenses to your Card Account without prior notice to you.Our Right of Setoff. If you ever owe the Bank money as a borrower, guarantor, or otherwise, and it becomes due, we have the right under the lawto use the money from your Card Account to pay the debt. We may (without prior notice and when permitted by law) setoff the funds on the Card Accountagainst any such due and payable debt you owe us now or in the future. Our right of setoff does not apply to your Card Account, if prohibited by law. Youagree to hold us harmless from any claim arising as a result of our exercise of our right of setoff.Our Notices to You. We will endeavor to inform you of changes to your rights and obligations by providing a notice to you. In some cases, we maypost a notice of a change on our website, www.InsightVisa.com. Othe

INSIGHT VISA PREPAID RELOADABLE CARD CARDHOLDER AGREEMENT List of all fees for Insight Visa Prepaid Reloadable Card Issued by Republic Bank of Chicago, Member FDIC, pursuant to a license from Visa U.S.A. Inc. . If you have a complaint about a prepaid account, call the Consumer Financial Protection Bureau at 1-855-411-2372 or visit cfpb .