Transcription

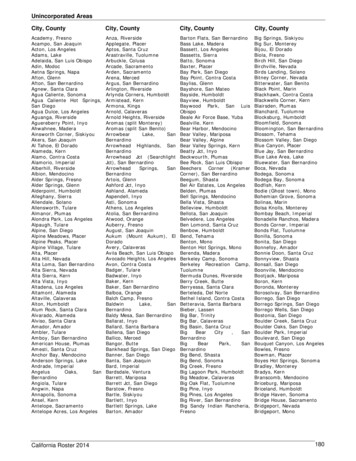

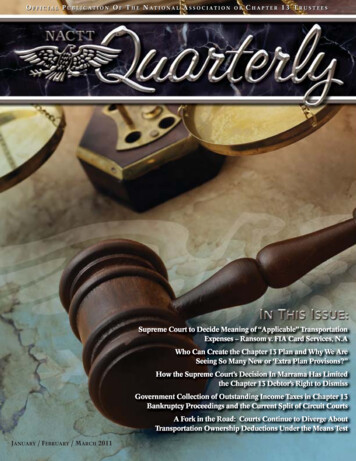

NACTT 57th AnnualSeminarSan Francisco, CAEducational Materials7KXUVGD\ -XO\ Enforcement of Court Orders and Rules: Does Contempt Power Exist in theBankruptcy Court?Moderator: Martha G. Bronitsky, Chapter 13 Standing Trustee for the Northern District of California(Haywood)Honorable Craig A. Gargotta, Chief United States Bankruptcy Judge, Western District of Texas (SanAntonio)Honorable William Lafferty, United States Bankruptcy Judge, Northern District of California (SanFrancisco)MATERIALS INDEX1. Speaking Outline2. In re Blanco3. In re Gravel4. Newrez LLC v. Beckhart5. Taggart v. Lorenzen6. Speaker Biographies

Outline1.Can Judges hold parties in contempt and issue sanctions? How Judges have determined they have thispower.a. Section 105b. Inherent power of any Judicial Officer2.Why is this such a hard concept? Overview of a small number of cases that get it right or do they?3. What do Judge’s worry about before issuing orders?a. Definitive Ordersb. Clear requirementsc. Clear consequences4. What attorneys should be thinking about – laying the case for or against contempt and sanctions.a. Trial concernsb. Appeal concerns5. Questions

In re Blanco, 633 B.R. 714 (2021)2021 WL 4190170633 B.R. 714United States Bankruptcy Court,S.D. Texas, Brownsville Division.IN RE: Ramon BLANCO andMaria P Blanco, Debtors.Ramon Blanco and Maria P Blanco, Plaintiffs,v.Bayview Loan Servicing LLC, Defendant.CASE NO: 20-10078 ADVERSARY NO. 20-1005 Signed September 14, 2021SynopsisBackground: Chapter 13 debtor-mortgagors broughtadversary proceeding against assignee of deed of trustencumbering real property and corresponding note, objectingto assignee's proof of claim, seeking avoidance of loan andlien, and asserting claims for, inter alia, willful violation of theautomatic stay, violation of discharge injunction, contempt,and breach of contract. Assignee asserted counterclaims forbreach of contract and declaratory judgment. Assignee movedto dismiss for failure to state a claim. Debtors filed competingmotion to dismiss with respect to assignee's counterclaims,and sought entry of judgment on the pleadings.[5] judicial estoppel did not apply to bar debtors' adversarycomplaint even though debtors' position was contrary to theirposition in prior bankruptcy case in which they treated lienas valid;[6] res judicata applied to bar debtors from challengingvalidity of assignment of deed of trust and note and seekingavoidance of the loan and lien; and[7] as matter of apparent first impression, rule requiringcreditor secured by principal residence to file detailed noticesetting forth all postpetition fees, expenses, and chargespermitted award of sanctions and punitive damages, ifmerited.Ordered accordingly.Procedural Posture(s): Motion to Dismiss for Failure toState a Claim; Motion for Judgment on the Pleadings.West Headnotes (70)[1]Holdings: The Bankruptcy Court, Eduardo V. Rodriguez, J.,held that:[4] failure to record assignment of deed of trust and note asrequired by Texas statute did not render assignment void;BankruptcyPleading; dismissalBankruptcy court reviews motions to dismiss forfailure to state a claim by accepting all wellpleaded facts as true and viewing those facts inthe light most favorable to the plaintiffs. Fed. R.Civ. P. 12(b)(6); Fed. R. Bankr. P. 7012.[1] purported assignment of deed of trust and note was merelyan incomplete document and thus, not void or voidable underTexas law;[3] alleged errors in notarization of assignment of deed of trustand note did not affect assignee's rights or render assignmentvoid under Texas law;Pleading; dismissalMotions to dismiss for failure to state a claim aredisfavored and therefore, rarely granted. Fed. R.Civ. P. 12(b)(6); Fed. R. Bankr. P. 7012.[2][2] alleged manipulation of previously incomplete andunrecorded assignment of deed of trust and note did not makesecond alleged assignment void under Texas law;Bankruptcy[3]BankruptcyPleading; dismissalAlthough the bankruptcy court will not strain tofind inferences favorable to the plaintiff whendeciding a motion to dismiss for failure to statea claim, the facts need only be sufficient for aninference to be drawn that the elements of theclaim exist. Fed. R. Civ. P. 12(b)(6); Fed. R.Bankr. P. 7012. 2022 Thomson Reuters. No claim to original U.S. Government Works.1

In re Blanco, 633 B.R. 714 (2021)2021 WL 4190170[4]BankruptcyPleading; dismissalTo defeat a motion to dismiss for failure to statea claim, plaintiff must satisfy requirement thatpleading contain a short and plain statement ofthe claim showing that the pleader is entitled torelief. Fed. R. Civ. P. 8(a)(2), 12(b)(6); Fed. R.Bankr. P. 7008, 7012.[5]BankruptcyPleading; dismissalClaim has facial plausibility, as required towithstand motion to dismiss for failure to state aclaim, when the plaintiff pleads factual contentthat allows the court to draw the reasonableinference that the defendant is liable for themisconduct alleged. Fed. R. Civ. P. 12(b)(6); Fed.R. Bankr. P. 7012.[6]Bankruptcy[10]Action[11]Under Texas law, standing focuses on whetherparty has sufficient relationship with lawsuit soas to have justiciable interest in its outcome.[8]Action[12]BankruptcyValidityIn general; standingMortgages and Deeds of Trustand enforceabilityValidityAlleged manipulation of previously incompleteand unrecorded assignment of deed of trustencumbering real property and correspondingnote did not make second alleged assignmentvoid under Texas law, thereby foreclosingChapter 13 debtor-mortgagors' standing tochallenge validity of purported assignment ofdeed of trust and note in adversary proceedingobjecting to assignee's proof of claim andseeking avoidance of loan and lien.Persons entitled to sueMortgages and Deeds of Trustentitled to sue; standing; partiesIn general; standingPurported assignment of deed of trustencumbering real property and correspondingnote to assignee was merely an incompletedocument, and thus not void or voidableunder Texas law, thereby foreclosing Chapter13 debtor-mortgagors' standing to challengevalidity of purported assignment of deed of trustand note in adversary proceeding objecting toassignee's proof of claim and seeking avoidanceof loan and lien; document at issue referredto the property and debtors by name, but didnot designate an assignee and did not contain arecording stamp. Tex. Prop. Code Ann. § 13.001.Under Texas law, if party was personallyaggrieved by alleged wrong, then it has standingto sue; conversely, if party does not have legalright belonging to it, then it does not havestanding to sue.[9]BankruptcyMortgages and Deeds of Trustand enforceabilityPleading; dismissalPersons entitled to suePersonsUnder Texas law, a mortgagor has standing tochallenge a deed of trust assignee's efforts toenforce the obligation on a ground that wouldrender the assignment void rather than voidable.Plausibility standard on motion to dismiss forfailure to state a claim is not akin to a probabilityrequirement, but it asks for more than a sheerpossibility that a defendant has acted unlawfully.Fed. R. Civ. P. 12(b)(6); Fed. R. Bankr. P. 7012.[7]Mortgages and Deeds of Trustentitled to sue; standing; partiesPersonsMortgagor's standing to challenge assignmentsof a deed of trust lien that secures a debt to whichthe mortgagor was not a party is limited.[13]Mortgages and Deeds of Trustand enforceabilityValidityMortgages and Deeds of Trustentitled to sue; standing; partiesPersons 2022 Thomson Reuters. No claim to original U.S. Government Works.2

In re Blanco, 633 B.R. 714 (2021)2021 WL 4190170Under Texas law, homeowner does not havestanding to challenge assignment of deed oftrust based on fraud because any claim of fraudbelongs to grantor of assignment, rather than tothird-party homeowner; conversely, homeownerhas standing to challenge assignment based onforgery because forged instrument is void.[14]Bankruptcyand seeking avoidance of loan and lien. Tex. Loc.Gov't Code Ann. § 192.007(a).[17]Mortgages and Deeds ofTrustAcknowledgmentValidityAlleged errors in notarization of assignment ofdeed of trust encumbering real property andcorresponding note did not affect assignee'srights against Chapter 13 debtor-mortgagors'or render assignment void under Texaslaw, thereby foreclosing Chapter 13 debtormortgagors' standing to challenge validity ofpurported assignment of deed of trust and notein adversary proceeding objecting to assignee'sproof of claim and seeking avoidance of loanand lien. Tex. Prop. Code Ann. §§ 12.001(b),13.001(a).[15]BankruptcyIn general; standingMortgages and Deeds of TrustNecessityFailure to record assignment of deed of trustencumbering real property and correspondingnote as required by Texas statute did notrender assignment void under Texas law, therebyforeclosing Chapter 13 debtor-mortgagors'standing to challenge validity of purportedassignment of deed of trust and note in adversaryproceeding objecting to assignee's proof of claimEstoppelClaim inconsistent with previousclaim or position in generalDoctrine of judicial estoppel is intended toprevent internal inconsistency, preclude litigantsfrom playing fast and loose with courts, andprohibit parties from deliberately changingpositions based upon exigencies of moment.[19]EstoppelClaim inconsistent with previousclaim or position in generalIn evaluating whether judicial estoppel shouldapply, bankruptcy courts consider whether: (1)position of party to be estopped is clearlyinconsistent with its previous one; (2) partyto be estopped convinced court to accept thatprevious position; (3) party to be estoppedacted inadvertently; and (4) whether party to beestopped would derive an unfair advantage orimpose an unfair detriment if not estopped.RecordingUnder Texas law, mortgage assignment must benotarized for recording. Tex. Prop. Code Ann. §§12.001(b), 13.001(a).[16][18]Mortgages and Deeds ofTrustAcknowledgmentMortgages and Deeds of Trustand RegistrationWaiver andJudicial estoppel may be properly raised inmotion to dismiss for failure to state claim whereits application is warranted on face of pleadingsand in judicially noticed facts. Fed. R. Civ. P.12(b)(6); Fed. R. Bankr. P. 7012.In general; standingMortgages and Deeds of Trustand enforceabilityFederal Civil Procedureestoppel[20]BankruptcyIn general; standingEstoppelClaim inconsistent with previousclaim or position in generalJudicial estoppel did not apply to barChapter 13 debtor-mortgagors from bringingadversary proceeding challenging assignmentof deed of trust encumbering real propertyand corresponding note, even though debtors'position was contrary to their position in priorbankruptcy case in which they treated the lien asvalid and continued to make payments thereon;debtors had acted inadvertently because they 2022 Thomson Reuters. No claim to original U.S. Government Works.3

In re Blanco, 633 B.R. 714 (2021)2021 WL 4190170had no motive to conceal claim that lien wasinvalid, rather, when frustrated by assignee'salleged practices post-discharge, debtors stoppedmaking payments on the debt and asserted thelien was invalid.[21]Claim inconsistent with previousEstoppelclaim or position in general[25]Entry of an agreed order that accepts a party'sprior position generally satisfies the judicialacceptance factor for judicial estoppel.[26]EstoppelClaim inconsistent with previousclaim or position in generalEstoppelClaim inconsistent with previousclaim or position in general[27]In general; standingTo lack knowledge of an undisclosed claim,for purposes of determining whether debtor'sfailure to satisfy its statutory disclosure dutyis “inadvertent” in context of judicial estoppel,debtor must have been unaware of the factsgiving rise to its claim during the pendency of itscase.[28]BankruptcyIn general; standingEstoppelClaim inconsistent with previousclaim or position in generalCourts consider whether debtor had any motiveto conceal claim for purposes of determiningwhether debtor's failure to satisfy its statutorydisclosure duty is “inadvertent” in context ofjudicial estoppel; motivation in this contextis self-evident because of potential financialbenefit resulting from the nondisclosure.Claim inconsistent with previousEstoppelclaim or position in generalParty seeking judicial estoppel mustaffirmatively show, by competent evidence orinescapable inference, that prior court adopted orrelied upon previous inconsistent assertion.BankruptcyEstoppelClaim inconsistent with previousclaim or position in generalCourts exercise great caution in applying judicialestoppel because the doctrine precludes acontradictory position without examining thetruth of either statement.[24]In general; standingIn bankruptcy, debtor's failure to satisfy itsstatutory disclosure duty is “inadvertent” forpurposes of judicial estoppel only when, ingeneral, debtor either lacks knowledge ofundisclosed claims or has no motive for theirconcealment.Judicial acceptance of prior inconsistentposition, in context of judicial estoppel, doesnot mean that the party to be estopped wassuccessful on the merits; rather, it merely meansthat the party made the argument with the explicitintent to induce the court's reliance, and thecourt accepted or relied on the party's position inmaking a determination.[23]BankruptcyEstoppelClaim inconsistent with previousclaim or position in generalReferred to as the “prior success” or “judicialacceptance” factor, judicial estoppel factorthat considers whether party to be estoppedconvinced court to accept its prior inconsistentposition seeks to minimize the danger of a partycontradicting a court's determination based onthe party's prior position and, thus, mitigate thecorresponding threat to judicial integrity.[22]EstoppelClaim inconsistent with previousclaim or position in general[29]BankruptcyIn general; standingEstoppelClaim inconsistent with previousclaim or position in general 2022 Thomson Reuters. No claim to original U.S. Government Works.4

In re Blanco, 633 B.R. 714 (2021)2021 WL 4190170Pertinent inquiry in determining whether debtorshad motive to conceal claim, when determiningif debtors' failure to satisfy statutory disclosureduty is “inadvertent” in context of judicialestoppel, is whether debtors would reap awindfall if they are able to recover on theundisclosed claim without having disclosed it totheir creditors.[30]BankruptcyIn general; standingEstoppelClaim inconsistent with previousclaim or position in generalDebtor's motive to conceal is presumed asa matter of law for purposes of determiningwhether debtor's failure to satisfy its statutorydisclosure duty is “inadvertent” in context ofjudicial estoppel; because of the structure of thebankruptcy process, a debtor that fails to disclosea claim during the bankruptcy, but later pursuesit after discharge or confirmation, always has thepotential to gain a windfall.[31]BankruptcyPreclusive effect of a judgment is defined byclaim preclusion and issue preclusion, which arecollectively referred to as res judicata.[34][35]Claim inconsistent with previousEstoppelclaim or position in generalApplication of judicial estoppel is notappropriate where a party acted inadvertentlyeither because it lacked knowledge of theundisclosed claim or had no motive forconcealment.[33]Res JudicataRes JudicataRes JudicataRes JudicataDoctrine of res judicata bars litigation of claimpreviously litigated or one that could or shouldhave been raised in prior suit if: (1) the parties areidentical in both actions; (2) a court of competentjurisdiction rendered the prior judgment; (3)there was a final adjudication on the merits; and(4) both cases involve the same cause of action.[36]Res JudicataexceptionMotion, demurrer, orGenerally, res judicata should not be raised inmotion to dismiss for failure to state a claim andis reserved for summary judgment or trial. Fed.R. Civ. P. 12(b)(6); Fed. R. Bankr. P. 7012.EstoppelClaim inconsistent with previousclaim or position in general[32]BankruptcyRes judicata applies with equal force in thecontext of bankruptcy proceedings.In general; standingDebtors’ motivation after prior bankruptcy casewas closed or discharged is irrelevant whendetermining whether debtors' failure to satisfystatutory disclosure duty was “inadvertent”for purposes of judicial estoppel in later-filedbankruptcy case; their motivation at the time ofthe non-disclosure is all the court in later-filedcase can consider.Res Judicata[37]Res JudicataexceptionMotion, demurrer, orRes judicata is appropriate on motion to dismissfor failure to state a claim if it appears on the faceof the complaint and any judicially noticed facts.Fed. R. Civ. P. 12(b)(6); Fed. R. Bankr. P. 7012.[38]Res JudicataBankruptcyRes judicata applied to bar Chapter 13 debtormortgagors from bringing adversary proceedingagainst assignee of deed of trust encumberingreal property and corresponding note challengingvalidity of assignment under Texas law andseeking avoidance of the loan and lien, based onagreed order entered in debtors' prior bankruptcycase granting assignee's motion to lift theautomatic stay; prior bankruptcy case and theinstant case were based on the same nucleus of 2022 Thomson Reuters. No claim to original U.S. Government Works.5

In re Blanco, 633 B.R. 714 (2021)2021 WL 4190170operative facts, as assignee's proofs of claim inboth cases were based on the same mortgage loanand those proofs of claim and the amounts owedwere central in both cases, assignee's motionto lift stay in prior case placed validity of liensquarely at issue, and debtors could and shouldhave challenged the lien's validity then, as theassignment was public record at the time of priorbankruptcy case and could have been discovered.recover, instead of reopening prior bankruptcycase. Fed. R. Bankr. P. 3002.1.[43]Rule requiring creditor secured by principalresidence to file detailed notice setting forth allpostpetition fees, expenses, and charges that itseeks to recover permits the award of sanctionsand punitive damages if merited as “otherappropriate relief.” Fed. R. Bankr. P. 3002.1(i)(2).11 U.S.C.A. § 362.[39]Res JudicatatransactionAct, occurrence, orIn assessing the fourth element of res judicata,namely, the same cause of action in both cases,court employs transactional test, which askswhether the prior case and the current case arebased on the same nucleus of operative facts.[40]Res Judicatain General1 Cases that cite this headnote[44]Claims or Causes of ActionBankruptcyLiens and encumbrances;secured creditorsDebtors may seek to impose sanctions inadversary proceeding for alleged violations ofrule requiring creditor secured by principalresidence to file detailed notice setting forth allpostpetition fees, expenses, and charges that itseeks to recover. Fed. R. Bankr. P. 3002.1.[42][45]Liens and encumbrances;Bankruptcysecured creditorsDebtors have no duty to allege harm as a resultof violations of rule requiring creditor secured byprincipal residence to file detailed notice settingforth all postpetition fees, expenses, and chargesthat it seeks to recover. Fed. R. Bankr. P. 3002.1.BankruptcyLiens and encumbrances;secured creditorsChapter 13 debtor could seek to impose sanctionsin subsequent bankruptcy case for allegedviolations in prior bankruptcy case of rulerequiring creditor secured by principal residenceto file detailed notice setting forth all postpetitionfees, expenses, and charges that it seeks toBankruptcyLiens and encumbrances;secured creditorsDismissal of Chapter 13 debtors' claim thatassignee of deed of trust encumbering realproperty and corresponding note violated rulerequiring creditor secured by principal residenceto file detailed notice setting forth all postpetitionfees, expenses, and charges that it seeks torecover was not warranted based on assignee'sargument that elimination of a lien or ofany contractual obligations would not be anappropriate remedy, since debtors did not askthe court to “eliminate” assignee's lien orany contractual obligations, but rather sought“appropriate relief” without specifying what thatrelief might be. Fed. R. Bankr. P. 3002.1.In assessing the fourth element of res judicata,namely, the same cause of action in both cases,courts must question whether the facts are relatedin time, space, origin, or motivation.[41]BankruptcyLiens and encumbrances;secured creditors[46]StatutesMandatory or directory statutesFor purposes of statutory construction, use of“may” indicates that a court has discretion. 2022 Thomson Reuters. No claim to original U.S. Government Works.6

In re Blanco, 633 B.R. 714 (2021)2021 WL 4190170[47]willful violation of automatic stay.U.S.C.A. § 362; Fed. R. Bankr. P. 3002.1.Liens and encumbrances;Bankruptcysecured creditorsDecision to impose sanctions for violationsof rule requiring creditor secured by principalresidence to file detailed notice setting forth allpostpetition fees, expenses, and charges restssolely with the court, after notice and hearing.Fed. R. Bankr. P. 3002.1.[48][51]BankruptcyConclusiveness; res judicata;collateral estoppelof discharge injunction.11 U.S.C.A. §§ 105, 1327.[52]Chapter 13 debtors' allegations that creditor, interalia, failed to apply payments to their mortgageloan account in the correct amounts and/orapplied payments to improper and undisclosedfees and expenses, in contravention of confirmedplan in their prior bankruptcy case, weresufficient to support claims for violations ofBankruptcyStayPendent or ancillaryBankruptcyDischarge as injunctiondischarge provision.11 U.S.C.A. §§ 105,524.11BankruptcyViolation of discharge orderChapter 13 debtors' allegations that creditor, interalia, failed to properly apply mortgage paymentsin accordance with provisions of confirmed planin their prior bankruptcy case, in violation ofBankruptcy Court's previous orders, supportedEnforcement of Injunction orBankruptcyLiens and encumbrances;secured creditorsChapter 13 debtors' allegations that creditor,inter alia, misapplied their mortgage paymentspursuant to confirmed plan in their priorbankruptcy case, filed proof of claim thatincluded prepetition escrow shortage andsubsequently collected monthly mortgagepayments including the same amounts, andchanged monthly mortgage payment amountswithout filing a respective notice of paymentchange were sufficient to support claim forBankruptcyjurisdictionBecause the bankruptcy court has the power toenforce its own orders, debtors are permittedto sue for violations of the court's orders and[53][50]11 U.S.C.A. §§ 105,524.BankruptcyConclusiveness; res judicata;collateral estoppelthe plan and order confirming the plan.U.S.C.A. §§ 105, 1327.Lien enforcementChapter 13 debtors' allegations that creditor, interalia, failed to properly apply mortgage paymentsin accordance with provisions of confirmedplan in their prior bankruptcy case and creditordiverted such payments to amounts not actuallyowed under bankruptcy law, and that debtorsincurred damages, including attorneys’ fees andout-of-pocket expenses and ultimately forcingdebtors to file the instant bankruptcy case,were sufficient to support claim for violationConfirmed plan constitutes a new arrangementbetween the debtor and creditors, and a claimmay arise for violation of the confirmed plan.[49]Bankruptcy11claim seeking to find creditor in contempt.U.S.C.A. § 105.[54]BankruptcyCodeCarrying out provisions ofBankruptcyContempt11Bankruptcy courts have both inherent contemptauthority and equitable authority under statuteauthorizing the court to issue any order necessary 2022 Thomson Reuters. No claim to original U.S. Government Works.7

In re Blanco, 633 B.R. 714 (2021)2021 WL 4190170or appropriate to carry out the provisions of title11.[55]11 U.S.C.A. § charge of contract by breachContractsGrounds of actionUnder Texas law, elements of breach of contractclaim contain no materiality requirement, rather,questions of materiality arise when a party claimsto be excused from performing under a contractbecause of the other party's prior material breach.[58]ContractsProceedingsDebtors andCreditor could not seek declaratory judgmentin adversary proceeding for right to seeknonjudicial foreclosure, which was not expresslyallowed under the Bankruptcy Code, rather,creditor was required to plead that relief from theautomatic stay was warranted by filing motionfor relief from stay in the main bankruptcy case.11 U.S.C.A. § 362; Fed. R. Bankr. P. 4001.[60]BankruptcyPleading; dismissalAlthough procedural rules contain liberalamendment rules, the party requestingamendment must at least set forth withparticularity the grounds for the amendment andthe relief sought. Fed. R. Civ. P. 7(b), 15(a); Fed.R. Bankr. P. 7007, 7015.Grounds of actionUnder Texas law, elements of a breach ofcontract claim are: (1) the existence of avalid contract; (2) performance or tenderedperformance by the plaintiff; (3) breach of thecontract by the defendant; and (4) damagessustained by the plaintiff because of the breach.BankruptcyDeclaratory JudgmentcreditorsNature and form; adversaryCreditor's breach of contract counterclaim wasprocedurally proper as part of its answer toadversary complaint filed by Chapter 13 debtormortgagors objecting to proof of claim, seekingavoidance of loan and lien, and asserting claimsfor, inter alia, willful violation of the automaticstay, violation of discharge injunction, contempt,and breach of contract. Fed. R. Bankr. P. 3007(b),7001, 7013.[56][59][61]BankruptcyPleading; dismissalBare request to amend a pleading in anopposition to a motion to dismiss, without anyindication of the particular grounds on whichthe amendment is sought, does not constitute amotion to amend. Fed. R. Civ. P. 7(b), 15(a); Fed.R. Bankr. P. 7007, 7015.[62]BankruptcyProceedingsCreditor's request to amend its answer andcounterclaim in adversary proceeding seekingrelief from automatic stay would be denied,since creditor's request contained no groundsfor permitting amendment and no proposedamendment, and any amendment to creditor'sanswer would not survive a motion to dismiss,as a request for relief from stay must be filed inAllegation of damageCreditor's allegations that it suffered actualdamages because of Chapter 13 debtors' failureto make timely mortgage payments in breachof contract, and because of debtors' failure tomaintain insurance and maintain the propertyin a good and safe condition of repair, andthat debtors accrued 33,607.60 in arrearages,plausibly alleged actual damages supportingcreditor's breach of contract claim under Texaslaw.the main bankruptcy case. 11 U.S.C.A. § 362;Fed. R. Civ. P. 7(b), 15(a); Fed. R. Bankr. P. 4001,7007, 7015.[63]BankruptcyPleading; dismissal 2022 Thomson Reuters. No claim to original U.S. Government Works.8

In re Blanco, 633 B.R. 714 (2021)2021 WL 4190170Court may deny leave to amend a pleading whereamendment would be futile. Fed. R. Civ. P. 15(a);Fed. R. Bankr. P. g; dismissalClaims will not be dismissed on motion forjudgment on the pleadings unless nonmovantwould not be entitled to relief under any set offacts or any possible theory that it could proveconsistent with its allegations. Fed. R. Civ. P.12(c); Fed. R. Bankr. P. 7012.[67][69]Mortgages and Deeds of Trusttransfers in generalRights and Liabilities on BreachContractsRights and Liabilities on BreachUnder Texas law, when one party breachescontract, other party is entitled to terminatecontract and sue for breach, but party who electsto treat contract as continuing deprives himself ofany excuse for ceasing performance on his ownpart.Pleading; dismissalIn determining whether motion for judgment onthe pleadings should be granted, court must viewall well-pleaded facts as true and in the lightmost favorable to nonmovant, and conclusoryallegations will not be accepted. Fed. R. Civ. P.12(c); Fed. R. Bankr. P. 7012.ContractsGenerally, party in breach of contract cannotmaintain suit for breach against anothercontracting party.Pleading; dismissalA motion for judgment on the pleadings isdesigned to dispose of cases where the materialfacts are not in dispute and a judgment onthe merits can be rendered by looking to thesubstance of the pleadings and any judiciallynoticed facts. Fed. R. Civ. P. 12(c); Fed. R. Bankr.P. 7012.[65][68][70]Mortgages and Deeds of TrustParticularcases, contexts, and questions in generalAllegations by assignee of deed of trustencumbering real property and correspondingnote that Chapter 13 debtor-mortgagors did notvoluntarily stop making payments until yearsafter assignee allegedly breached the note anddeed of trust by misapplying payments plausiblyalleged that debtors deprived themselves ofany excuse for ceasing to make payments bycontinuing to perform under note and deed oftrust, supporting assignee's breach of contractclaim under Texas law. Fed. R. Civ. P. 12(c); Fed.R. Bankr. P. 7012.ParticularModification agreement between Chapter 13debtor-mortgagor and assignee of deed of trustencumbering real property and correspondingnote that was attached to debtor's adversarycomplaint seeking avoidance of loan and liensufficiently indicated that assignee was theholder of the note and deed of trust; agreementindicated that assignee was the holder or theservicing agent of the holder of the note executedby debtor, and stated that the note evidenceda loan along with a deed of trust or mortgagesecuring said note.Attorneys and Law Firms*722 Karen L. Kellett, Kellett & Bartholow PLLC, Dallas,TX, Abelardo Limon, Jr., Limon Law Office PC, Brownsville,TX, for Plaintiffs.Andrew Paul Barber, Daniel Francis Patton, Michael W.Twomey, Scott Patton PC, Michael L. Weems, HughesWatters Askanase, Houston, TX, for Defendant.MEMORANDUM OPINION 2022 Thomson Reuters. No claim to original U.S. Government Works.9

In re Blanco, 633 B.R. 714 (2021)2021 WL 4190170Eduardo Rodriguez, United States Bankruptcy Judge**1 Plaintiffs Ramon and Maria P. Blanco filed anadversary proceeding, incorporating their previously filedcla

Moderator: Martha G. Bronitsky, Chapter 13 Standing Trustee for the Northern District of California (Haywood) Honorable Craig A. Gargotta, Chief United States Bankruptcy Judge, Western District of Texas (San Antonio) Honorable William Lafferty, United States Bankruptcy Judge, Northern District of California (San Francisco) MATERIALS INDEX