Transcription

BNY Mellon AggregateBond Index Fund of TheBank of New York MellonFinancial Statements and SchedulesSeptember 30, 2018

Report of Independent AuditorsTo the Trustee and BNY Mellon Commingled Funds Operating Committee ofBNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonWe have audited the accompanying financial statements of BNY Mellon Aggregate Bond Index Fund of The Bank of New YorkMellon (the “Fund”), which comprise the statement of assets and liabilities, including the schedule of investments, as ofSeptember 30, 2018, and the related statements of operations, of changes in net assets and the financial highlights for the yearthen ended. These financial statements and financial highlights are hereafter collectively referred to as "financial statements".Management's Responsibility for the Financial StatementsManagement is responsible for the preparation and fair presentation of the financial statements in accordance with accountingprinciples generally accepted in the United States of America; this includes the design, implementation, and maintenance ofinternal control relevant to the preparation and fair presentation of financial statements that are free from materialmisstatement, whether due to fraud or error.Auditors' ResponsibilityOur responsibility is to express an opinion on the financial statements based on our audit. We conducted our audit inaccordance with auditing standards generally accepted in the United States of America. Those standards require that we planand perform the audit to obtain reasonable assurance about whether the financial statements are free from materialmisstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financialstatements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatementof the financial statements, whether due to fraud or error. In making those risk assessments, we consider internal controlrelevant to the Fund's preparation and fair presentation of the financial statements in order to design audit procedures that areappropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internalcontrol. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policiesused and the reasonableness of significant accounting estimates made by management, as well as evaluating the overallpresentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate toprovide a basis for our audit opinion.OpinionIn our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of BNYMellon Aggregate Bond Index Fund of The Bank of New York Mellon as of September 30, 2018, and the results of itsoperations, changes in its net assets and the financial highlights for the year then ended, in accordance with accountingprinciples generally accepted in the United States of America.PricewaterhouseCoopers LLP, 600 Grant Street, Pittsburgh, PA 15219T: (412) 355 6000, F: (412) 355 8089, www.pwc.com/us

Other MatterOur audit was conducted for the purpose of forming an opinion on the financial statements taken as a whole. Thesupplementary schedules of investment transactions (in summary) are presented for purposes of additional analysis and arenot a required part of the financial statements. The information is the responsibility of management and was derived from andrelates directly to the underlying accounting and other records used to prepare the financial statements. The information hasbeen subjected to the auditing procedures applied in the audit of the financial statements and certain additional procedures,including comparing and reconciling such information directly to the underlying accounting and other records used to preparethe financial statements or to the financial statements themselves and other additional procedures, in accordance withauditing standards generally accepted in the United States of America. In our opinion, the information is fairly stated, in allmaterial respects, in relation to the financial statements taken as a whole.January 4, 2019

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonSchedule of InvestmentsSeptember 30, 2018% Ownership inUnderlying FundCollective Investment Funds - 99.06%EB DV Non-SL IntermediateGovt/Credit Bond Index Fund1EB DV Non-SL Long Term Credit BondIndex Fund1EB DV Non-SL Long TermGovernment Bond Index Fund1EB DV Securitized Index Fund1Total Collective Investment FundsU.S. Government AgencyObligation - 0.28%United States TreasuryNote/BondUnited States TreasuryNote/BondUnited States TreasuryNote/BondTotal U.S. Government ObligationCost Value urityPrincipalAmountCostValue%Date 6,054,0006,054,0006,038,9276,038,927Ginnie Mae - TBA23.50Total U.S. Government Agency ObligationU.S. Government Obligation urityPrincipalAmountCostValue%Date 004,506,77215,772,1504,508,12815,657,557The accompanying notes are an integral partof these financial statements.3

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonSchedule of InvestmentsSeptember 30, 2018UnitsTemporary Investment - 0.27%EB Temporary Investment Fund1Total Temporary Investment5,921,503Cost Value ,166,775,824Total Investments100.33%Other assets less liabilities(0.33)% (7,030,945)Net Assets100% 2,159,744,87912An affiliate of the Fund.TBA - To be announced.The accompanying notes are an integral partof these financial statements.4

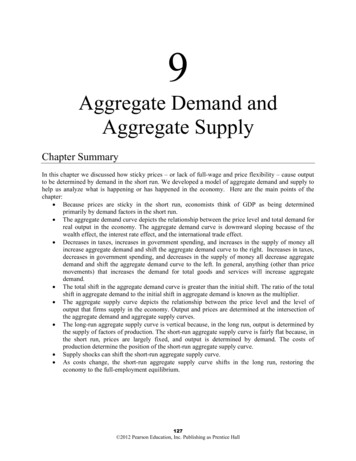

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonNotes to Schedule of InvestmentsSeptember 30, 2018(a)Fair Value MeasurementsThe following is a summary of the inputs used to value the Fund’s investments as of September 30, 2018:Quoted Prices(Level 1)Other SignificantObservable Inputs(Level 2)SignificantUnobservable Inputs(Level 3)Portfolio Holdings*U.S. Government Agency ObligationsU.S. Government Obligations - 6,038,92715,657,557 - 6,038,92715,657,557Subtotal - 21,696,484 - 21,696,484TotalNAV as a Practical Expedient**Affiliated Collective Investment FundsAffiliated Temporary Investment Funds 2,139,157,8375,921,503Total 2,166,775,824* Portfolio holdings designated above are disclosed individually in the Schedule of Investments. Refer to theSchedule of Investments for industry specifics of the portfolio holdings.** In accordance with ASC 820-10, certain investments that are measured at fair value using the net assetvalue per share (or its equivalent) practical expedient have not been classified in the fair value hierarchy. Thefair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to theamounts presented in the Schedule of Investments.Changes in valuation techniques may result in transfers into or out of an investment's assigned level within thehierarchy. Transfers between fair value hierarchy levels are recognized at the end of the year. There wereno transfers into or out of Level 3 during the year ended September 30, 2018 and there were no securitiesclassified as Level 3 at the beginning of the year.The accompanying notes are an integral partof these financial statements.5

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonStatement of Assets and LiabilitiesSeptember 30, 2018AssetsInvestments, at value (cost 2,167,606,007)Receivable for Fund units issuedReceivable for investments soldInterest income receivable 9Total AssetsLiabilitiesPayable for Fund units redeemedPayable for investments purchasedCustody fees payableFund accounting fees payableAsset based fee payableAudit fee payableOperational vendor fees 14,717,330Total LiabilitiesNet Assets 2,159,744,879 137.44Net Assets Value per UnitClass I (Net Assets of 1,863,712,856, Units Outstanding of 13,560,011) 135.87Class IV (Net Assets of 2,471,122, Units Outstanding of 18,512) 133.49Class Instl (Net Assets of 293,240,716, Units Outstanding of 2,134,621) 137.37Class II (Net Assets of 320,185, Units Outstanding of12,357)1Net Assets Value per Unit for Class II may not recalculate due to rounding of net assets and/or units outstandingThe accompanying notes are an integral partof these financial statements.6

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonStatement of OperationsYear Ended September 30, 2018Investment IncomeInterest income 400,782400,782Total investment incomeExpensesAsset based fees - Class II1Asset based fees - Class IV1Asset based fees - Class Instl13,3867,06957,234Administrative ExpensesRelated PartyCustody feesFund accounting fees27178,088Third PartyAudit feesOperational vendor feesFacilitation fees18,287514116Total Administrative Expenses97,276Total expenses164,965Net investment income (loss)235,817Net realized and unrealized gain (loss)Net realized gain (loss) on:Investments in Collective Investment FundsInvestments320,964,433(856,436)320,107,997Net realized gain (loss)Net change in unrealized appreciation/depreciation of:Investments in Collective Investment et change in unrealized appreciation/depreciation(24,282,052)Net realized and unrealized gain (loss)Net increase (decrease) in net assets resulting from operations1 (24,046,235)The asset based fees are comprised of investment management fees and plan service provider fees (if applicable).The accompanying notes are an integral partof these financial statements.7

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonStatement of Changes in Net AssetsYear Ended September 30, 2018Increase/Decrease in Net AssetsFrom operationsNet investment income (loss)Net realized gain (loss)Net change in unrealized appreciation/depreciation 235,817320,107,997(344,390,049)(24,046,235)Net increase (decrease) in net assets resulting from operationsFrom participant transactionsProceeds from issuance of units (3,897,760 units)Cost of units redeemed (10,397,629 units)538,378,347(1,446,650,017)Net increase (decrease) in net assets resulting from participanttransactions (net 6,499,869 units redeemed)(908,271,670)(932,317,905)Net increase (decrease) in net assetsNet Assets3,092,062,784Beginning of year End of yearThe accompanying notes are an integral partof these financial statements.82,159,744,879

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonStatement of Changes in Net Assets (continued)Year Ended September 30, 2018Year EndedSeptember 30, 2018UnitsAmountUnits of ParticipationParticipant transactions for the Fund were as follows:Class IUnits purchasedUnits redeemedNet decrease from unit transactions3,343,399(9,940,227)(6,596,828)Class IIUnits purchasedUnits redeemedNet decrease from unit transactionsClass IVUnits purchasedUnits redeemedNet increase from unit transactionsClass InstlUnits purchasedUnits redeemedThe accompanying notes are an integral partof these financial statements.9 5,198(60,389)(55,191) 9,504(7,215)2,289 539,659(389,798)149,861Net increase from unit transactions 538(53,683,385)20,765,153

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonFinancial Highlights - Class IYear Ended September 30, 2018For a Unit outstanding throughout the year:Per Unit operating performanceNet asset value per unit, beginning of the year 139.20Income from investment operationsNet investment income (loss)1Net realized (and unrealized) gain/loss0.02(1.78)Total from investment operations(1.76) Net asset value per unit, end of the yearTotal return2137.44(1.26)%Ratios/supplemental data:Net assets, end of the year (000's)Ratio of total expenses to average net assets2, 3Ratio of net investment income (loss) to average net assets21231,863,7130.00%0.01%Net investment income (loss) per unit is calculated using average units outstanding during the year.Total return and the ratios of total expenses and of net investment income (loss) to average net assets do not reflect feescharged directly to the Fund's participants. The ratio of total expenses to average net assets does not include expenses of theaffiliated collective investment funds in which the Fund invests. The calculation includes only those expenses charged directlyor allocated to the class. The Fund's past performance is not necessarily indicative of how it will perform in the future.The calculated ratio is less than 0.01%.The accompanying notes are an integral partof these financial statements.10

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonFinancial Highlights - Class IIYear Ended September 30, 2018For a Unit outstanding throughout the year:Per Unit operating performanceNet asset value per unit, beginning of the year 137.88Income from investment operationsNet investment income (loss)1Net realized (and unrealized) gain/loss(0.19)(1.82)Total from investment operations(2.01) Net asset value per unit, end of the yearTotal return2135.87(1.46)%Ratios/supplemental data:Net assets, end of the year (000's)Ratio of total expenses to average net assets2Ratio of net investment income (loss) to average net assets2123200.15%(0.14)%Net investment income (loss) per unit is calculated using average units outstanding during the year.Total return and the ratios of total expenses and of net investment income (loss) to average net assets do not reflect feescharged directly to the Fund's participants. The ratio of total expenses to average net assets does not include expenses of theaffiliated collective investment funds in which the Fund invests. The calculation includes only those expenses charged directlyor allocated to the class. The Fund's past performance is not necessarily indicative of how it will perform in the future.The accompanying notes are an integral partof these financial statements.11

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonFinancial Highlights - Class IVYear Ended September 30, 2018For a Unit outstanding throughout the year:Per Unit operating performanceNet asset value per unit, beginning of the year 135.67Income from investment operationsNet investment income (loss)1Net realized (and unrealized) gain/loss(0.45)(1.73)Total from investment operations(2.18) Net asset value per unit, end of the yearTotal return2133.49(1.61)%Ratios/supplemental data:Net assets, end of the year (000's)Ratio of total expenses to average net assets2Ratio of net investment income (loss) to average net assets2122,4710.36%(0.34)%Net investment income (loss) per unit is calculated using average units outstanding during the year.Total return and the ratios of total expenses and of net investment income (loss) to average net assets do not reflect feescharged directly to the Fund's participants. The ratio of total expenses to average net assets does not include expenses of theaffiliated collective investment funds in which the Fund invests. The calculation includes only those expenses charged directlyor allocated to the class. The Fund's past performance is not necessarily indicative of how it will perform in the future.The accompanying notes are an integral partof these financial statements.12

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonFinancial Highlights - Class InstlYear Ended September 30, 2018For a Unit outstanding throughout the year:Per Unit operating performanceNet asset value per unit, beginning of the year 139.15Income from investment operationsNet investment income (loss)1Net realized (and unrealized) gain/loss(0.01)(1.77)Total from investment operations(1.78) Net asset value per unit, end of the yearTotal return2137.37(1.28)%Ratios/supplemental data:Net assets, end of the year (000's)Ratio of total expenses to average net assets2Ratio of net investment income (loss) to average net assets212293,2410.02%(0.01)%Net investment income (loss) per unit is calculated using average units outstanding during the year.Total return and the ratios of total expenses and of net investment income (loss) to average net assets do not reflect feescharged directly to the Fund's participants. The ratio of total expenses to average net assets does not include expenses of theaffiliated collective investment funds in which the Fund invests. The calculation includes only those expenses charged directlyor allocated to the class. The Fund's past performance is not necessarily indicative of how it will perform in the future.The accompanying notes are an integral partof these financial statements.13

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonNotes to Financial Statements1.Description of the FundBNY Mellon Aggregate Bond Index Fund of The Bank of New York Mellon (the "Fund") is authorized by The Bank of New YorkMellon Employee Benefit Collective Investment Fund Plan (the "Plan"). The Bank of New York Mellon (the "Trustee") servesas the Trustee, Investment Manager, Custodian, and Transfer Agent of the Fund. As Trustee of the Fund, The Bank of NewYork Mellon is a fiduciary with regard to the Fund. The Fund is operated in accordance with Section 9.18 of Regulation 9issued by the Office of the Comptroller of the Currency and by other applicable laws and regulations as defined by the Plan.The objective of the Fund is to track the performance of the Bloomberg Barclays U.S. Aggregate Index. In meeting thisobjective, the Fund may invest in securities (including those issued through private placements), exchange-traded/mutualfunds, and a combination of other collective funds (each an affiliate of the Fund and collectively referred herein as the"Collective Investment Funds") that together are designed to track the performance of the Bloomberg Barclays U.S. AggregateIndex. If exchange-traded/mutual funds are purchased or sold, there will be additional expenses embedded within those fundsand imposed on the Fund which may negatively impact the Fund’s performance and those exchange-traded funds/mutualfunds may participate in securities lending programs. The Fund may also invest in the EB Temporary Investment Fund, anaffiliate of the Fund. Financial futures may be used to provide liquidity for cash flows, to obtain exposure, to hedge or for otherpurposes that facilitate meeting the Fund’s objective. Cash investments or assets used as collateral underlying the derivativespositions may be comprised of other collective funds and short to medium-term debt of investment grade that may include,without limitation, Treasury bills and notes, corporate obligations, commercial paper (including paper issued or resold underSection 3(a)(3), Section 4(2) and Rule 144A of the Securities Act of 1933), repurchase agreements, and obligations ofgovernment sponsored enterprises. The Fund may utilize short settling.The Fund will not participate in The Bank of New York Mellon's securities lending program.During the year ended September 30, 2018, the Fund did not engage in futures activity.The Trustee has authorized five classes of units (Class I, II, IV, Instl, R5). Income, expenses (other than asset based fees),distributions and realized and unrealized gains or losses on investments are allocated to each class based on unitsoutstanding of each class. Each class of units of the Fund will be charged such fees and expenses as are permitted by theDeclaration of Trust. The Trustee receives investment management fees from Class I participants directly, and therefore theFund makes no payment and incurs no expense for these services. Asset based fees for Class II will be charged at 0.15% perannum of the average daily net assets of Class II. Asset based fees for Class IV will be charged at 0.35% per annum of theaverage daily net assets of Class IV. Asset based fees for Class Instl will be charged at 0.02% per annum of the average dailynet assets of Class Instl. Asset based fees for Class R5 will be charged at 0.12% per annum of the average daily net assets ofClass R5. The asset based fees are comprised of investment management fees and plan service provider fees (if applicable).The Trustee may in its discretion and with prior notice to the sponsors of affected plans from time to time, add, delete, amendor otherwise modify a class of units of the Fund.As of September 30, 2018, there were no Class R5 units issued.2.Summary of Significant Accounting PoliciesThe following significant accounting policies are in conformity with Generally Accepted Accounting Principles in the UnitedStates ("U.S. GAAP"). Such policies are consistently followed by the Fund in preparation of its financial statements. TheTrustee has determined that the Fund is an investment company in accordance with Financial Accounting Standards Board(FASB) Accounting Standards Codification Topic 946 for the purpose of accounting and financial reporting. The preparation offinancial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect thereported amounts and disclosures in the financial statements, including the estimated fair value of investments. Actual resultscould differ from those estimates.The following is a summary of significant accounting policies followed by the Trustee in preparing the financial statements ofthe Fund.Fair Value MeasurementsThe Fund’s financial instruments are reported at fair value, which U.S. GAAP defines as the price that would be received tosell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Inaccordance with the authoritative guidance on fair value measurements and disclosures under U.S. GAAP, the Fund disclosesthe fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure fair value.The inputs are summarized in the three broad levels listed below: Level 1 - Quoted prices (unadjusted) in active markets that are accessible at the measurement date for identicalsecurities;14

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonNotes to Financial Statements Level 2 - Quoted prices for identical financial instruments in markets that are not considered to be active or financialinstruments for which all significant inputs are observable, either directly or indirectly (including quoted prices forsimilar investments, interest rates, prepayment speeds, credit risk, etc.);Level 3 - Significant unobservable inputs based on the best information available in the circumstances, to the extentobservable inputs are not available, which may include assumptions made by the Trustee or persons acting at theirdirection that are used in determining the fair market value of investments.In May 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update 2015-07 –Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or its Equivalent) (“ASU 2015-07”),as an amendment to Accounting Standards Codification 820, Fair Value Measurement ("ASC 820-10"). The amendments inASU 2015-07 remove the requirement to categorize within the fair value hierarchy, as described above, all investments forwhich fair value is measured using the net asset value as a practical expedient and correspondingly have not been classifiedin the fair value hierarchy.The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing inthose securities. In accordance with the requirements of U.S. GAAP, a fair value hierarchy and Level 3 reconciliation, asapplicable, have been included in the Notes to Schedule of Investments for the Fund.Valuation of InvestmentsInvestments are generally valued on the basis of market valuations obtained from recognized automated pricing services (the"Service") or counterparties, subject to review and approval by the Trustee. Such valuations are generally determined asfollows: Fixed income securities are valued on the basis of valuations provided by the Service which determines valuations usingmethods based upon market transactions for comparable securities and various relationships between securities whichare generally recognized by institutional traders. These valuations are based on methods which include the considerationof: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers;and general market conditions. If market quotations are not readily available for valuations, assets may be valued by amethod the Trustee of the Fund has determined accurately reflects fair value. These types of investments are generallycategorized within Level 2 of the fair value hierarchy. Investments in units of the EB Temporary Investment Fund are generally valued at the amortized cost net asset value of 1.00, unless the Trustee determines that a significant difference exists between amortized cost and the market value. Inaccordance with ASC 820-10, investments that are measured at fair value using the net asset value per share (or itsequivalent) have not been classified in the fair value hierarchy. Investments in the units of Collective Investment Funds are generally valued at the net asset value as reported by therespective fund at each valuation date (transactional net asset value), unless the Trustee determines that a significantdifference exists between the transactional net asset value and the market value. In accordance with ASC 820-10,investments that are measured at fair value using the net asset value per share (or its equivalent) have not been classifiedin the fair value hierarchy.For the Fund's investment in affiliated collective investment funds valued on the basis of net asset value, the investmentstrategy of each underlying fund, other than investments in temporary investment funds, matches the investment strategy ofthe Fund. Investments in units of the Collective Investment Funds may be redeemed on a daily basis. Investments in units ofthe EB Temporary Investment Fund may be redeemed on a daily basis. The financial statements of the Fund should be read inconjunction with the affiliated collective investment funds' financial statements and plan documents, which are available fromthe Trustee on request and which provide information about the investment strategy, accounting policies, investment holdingsand redemption terms of the affiliated collective investment funds.Investment Transactions and Investment IncomeInvestment transactions are accounted for on a trade date basis. Gains and losses on the sale of investments are determinedusing the average cost method. Interest income on securities is recorded net of applicable withholding taxes on an accrualbasis. Interest income, if any, on foreign currency balances is recorded when the Fund is first notified of the amount creditedby the depository bank. Interest income includes accretion of discounts and amortization of premiums, if any. Undistributed netinvestment income, accumulated net realized gains (losses) and net unrealized appreciation/depreciation of CollectiveInvestment Funds are reflected as unrealized gains and losses. Income earned from investments in units of the EB TemporaryInvestment Fund, if any, is recorded as interest income. Realized and unrealized gains and losses and net investment income(loss) before class specific expenses are allocated to each class of units on each valuation based upon the relative unitsoutstanding of each class of units.15

BNY Mellon Aggregate Bond Index Fund of The Bank of New York MellonNotes to Financial StatementsParticipants' Unit TransactionsParticipants may purchase or redeem units in their relative class for cash or securities (in-kind transactions at the solediscretion of the Trustee) based on the class unit value determined as of the valuation date. Class unit value is determinedeach business day of the year. All participants have a proportionate undivided interest in their relative class' net assets.DistributionsThe Fund’s policy is to not make any distributions to its participants.TaxesThe Fund qualifies for tax exemption under Internal Revenue Service Revenue Ruling 81-100. Accordingly, no provision forfederal income tax has been included in the accompanying financial statements. Participants of the Fund are limited topension, profit-sharing, stock bonus and other accounts: (i) that meet the requirements of Section 401 (a), including thosedescribed in Section 401(a)(24) and inclusive of Section 414(d), of the Internal Revenue Code of 1954, as amended, orcorresponding provisions of subsequent income tax laws of the United States ("Code"), and are exempt from federal incometax, (ii) that are eligible government deferred compensation plans within the meaning of Section 457(b) of the Code and areexempt from federal income tax pursuant to Section 457(g) of the Code, (iii) that are church plans (as defined by Section414(e) of the Code) that are either a retirement income account within the meaning of Section 403(b)(9) of the Code or achurch plan organization defined in Section 414(e)(3)(A) of the Code, together with other assets permitted to be commingledfor investment purposes with the assets of such retirement income account or church plan organization without adverselyaffecting the tax status of such retirement income account or church plan organization, (iv) that constitute

BNY Mellon Aggregate Bond Index Fund of The Bank of New York Mellon Schedule of Investments September 30, 2018 The accompanying notes are an integral part of these financial statements. 4 Units Cost Value Temporary Investment - 0.27% EB Temporary Investment Fund1 5,921,503 5,921,503 5,921,503