Transcription

ANNUAL STATEMENTOF THELIBERTY MUTUAL INSURANCE COMPANYAND ITS AFFILIATED PROPERTY AND CASUALTY INSURERSofin the state ofBOSTONMASSACHUSETTSTO THEInsurance DepartmentOF THESTATE OFFOR THE YEAR ENDEDDecember 31, 2006PROPERTY AND CASUALTY COMBINED2006

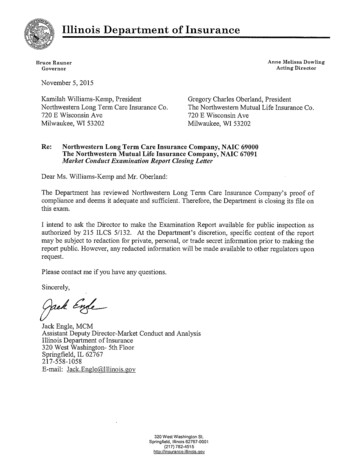

COMBINED PROPERTY AND CASUALTY COMPANIES - ASSOCIATION 200620100100COMBINED ANNUAL STATEMENTFor the Year Ended December 31, 2006OF THE CONDITION AND AFFAIRS OF THELiberty Mutual Insurance Company and its Affiliated Property and Casualty InsurersNAIC Group CodeNAIC Company Code0111Mail Address175 BERKELEY STREETBOSTON, MA 02117Annual Statement ContactDOUGLAS LINK617-357-9500Name of Companies:0111245668NAIC Company Code: State of Domicile:LIBERTY MUTUAL INSURANCE COMPANYLIBERTY MUTUAL FIRE INSURANCE COMPANYLIBERTY INSURANCE CORPORATIONLM INSURANCE CORPORATIONTHE FIRST LIBERTY INSURANCE CORPORATIONLIBERTY NORTHWEST INSURANCE CORPORATIONNORTH PACIFIC INSURANCE COMPANYOREGON AUTOMOBILE INSURANCE COMPANYLIBERTY INSURANCE COMPANY OF AMERICALIBERTY MUTUAL PERSONAL INSURANCE COMPANYLIBERTY SURPLUS INSURANCE CORPORATIONLIBERTY LLOYDS OF TEXAS INSURANCE COMPANYLIBERTY COUNTY MUTUAL INSURANCE COMPANYGOLDEN EAGLE INSURANCE CORPORATIONSAN DIEGO INSURANCE COMPANYMONTGOMERY MUTUAL INSURANCE COMPANYLIBERTY MUTUAL MID-ATLANTIC INSURANCE COMPANYLIBERTY PERSONAL INSURANCE COMPANYCOLORADO CASUALTY INSURANCE COMPANYBRIDGEFIELD CASUALTY INSURANCE COMPANYBRIDGEFIELD EMPLOYERS INSURANCE COMPANYWAUSAU BUSINESS INSURANCE COMPANYWAUSAU GENERAL INSURANCE COMPANYWAUSAU UNDERWRITERS INSURANCE COMPANYEMPLOYERS INSURANCE COMPANY OF WAUSAUPEERLESS INSURANCE COMPANYPEERLESS INDEMNITY INSURANCE COMPANYINDIANA INSURANCE COMPANYTHE NETHERLANDS INSURANCE COMPANYEXCELSIOR INSURANCE COMPANYCONSOLIDATED INSURANCE COMPANYAMERICA FIRST INSURANCE COMPANYAMERICA FIRST LLOYDS INSURANCE COMPANYLIBERTY INSURANCE UNDERWRITERS, INC.THE MIDWESTERN INDEMNITY COMPANYGLOBE AMERICAN CASUALTY COMPANYAMERICAN AMBASSADOR CASUALTY COMPANYHAWKEYE-SECURITY INSURANCE COMPANYNATIONAL INSURANCE ASSOCIATIONMID-AMERICAN FIRE AND CASUALTY COMPANYLM PROPERTY AND CASUALTY INSURANCE COMPANYLM PERSONAL INSURANCE COMPANYLM GENERAL INSURANCE OHINDEDEThis annual statement contains combined data for the Property/Casualty insurance companies listed above,compiled in accordance with the NAIC instuctions for the completion of annual statements.a. Is this an original filing?b. If no:YES [ X ] NO [1. State the amendment number2. Date filed 3. Number of pages attached1 ]

Annual Statement for the year 2006 of the Liberty Mutual Insurance Company and its Affiliated Property and Casualty Insurers ASSETS1.2.Bonds (Schedule D)Stocks (Schedule D):2.1 Preferred stocks2.2 Common stocksMortgage loans on real estate (Schedule B):3.1 First liens3.2 Other than first liensReal estate (Schedule A):4.1 Properties occupied by the company (less 0 encumbrances)4.2 Properties held for the production of income (less 0 encumbrances)4.3 Properties held for sale (less 0 encumbrances)Cash ( 628,590,368 , Schedule E-Part 1), cash equivalents ( 490,976,767Schedule E-Part 2) and short-term investments ( 1,304,067,572 , Schedule DA)Contract loans (including 0 premium notes)Other invested assets (Schedule BA)Receivables for securitiesAggregate write-ins for invested assetsSubtotals, cash and invested assets (Lines 1 to 9)Title plants less 0 charged off (for Title insurers only)Investment income due and accruedPremiums and considerations:13.1 Uncollected premiums and agents' balances in the course of collection13.2 Deferred premiums, agents' balances and installments booked but deferred andnot yet due (including 45,170,256 earned but unbilled premiums)13.3 Accrued retrospective premiumsReinsurance:14.1 Amounts recoverable from reinsurers14.2 Funds held by or deposited with reinsured companies14.3 Other amounts receivable under reinsurance contractsAmounts receivable relating to uninsured plansCurrent federal and foreign income tax recoverable and interest thereonNet deferred tax assetGuaranty funds receivable or on depositElectronic data processing equipment and softwareFurniture and equipment, including health care delivery assets ( 0 )Net adjustment in assets and liabilities due to foreign exchange ratesReceivables from parent, subsidiaries and affiliatesHealth care ( 0 ) and other amounts receivableAggregate write-ins for other than invested assetsTotal assets excluding Separate Accounts, Segregated Accounts and Protected CellAccounts (Lines 10 to 23)From Separate Accounts, Segregated Accounts and Protected Cell AccountsTotal (Lines 24 and 25) 3. 4. 28,498,846,673 438,033,5212,667,919,33328,498,846,673 438,033,5212,667,919,33326,659,338,981 87,373,4232,272,086,716 366,799,1431,111,445 366,799,1431,111,445 25.26. 3,970,74841,021,898 1,897,049,829 2,423,634,707355,450,0191,199,491 2,423,634,70739,500,000 932,334316,337,015 1,272,525,027 42,878,472 2,913,916,565739,172,10638,601,932,334316,337,015 1,229,646,555 33,776,991,105302,205,768 1,085,201,811 2,905,576,307704,100,692 58832,535,958 295,511,696 295,511,696 Net AdmittedAssets 15.16.116.217.18.19.20.21.22.23.24. Net AdmittedAssets(Cols. 1 - 2) 14. AssetsNonadmittedAssets Prior Year4 3 6.7.8.9.10.11.12.13. Current Year2 5. 1 1,366,821,62154,777,900295,470,55526,417,430 3,217,96254,113,788 252,650,80926,417,430 993,101,83754,777,90042,819,746 136,305,543918,905,435 37,280,3051,037,149,66661,970,62044,392,678 47,385,579,543 373,719,784 47,385,579,543 868,062,424 3,217,962 54,113,788 731,756,881 918,905,43546,466,674,108 122,589,565 715,511,861 46,466,674,10841,400,141,924 41,400,141,924DETAILS OF WRITE-INS0901.0902.0903.0998. Summary of remaining write-ins for Line 09 from overflow page0999. Totals (Lines 0901 through 0903 plus 0998) (Line 09 above) 122,927,09113,378,4522301. Other assets2302. Amounts billed and receivable under high deductible policies2303. Cash surrender value life insurance2398. Summary of remaining write-ins for Line 23 from overflow page2399. Totals (Lines 2301 through 2303 plus 2398) (Line 23 above) 363,360,364261,034,456243,667,604 868,062,4242 136,305,543240,433,273247,656,004243,667,604 731,756,881250,223,405250,203,929215,084,527 715,511,861

Annual Statement for the year 2006 of the Liberty Mutual Insurance Company and its Affiliated Property and Casualty Insurers Losses (Part 2A, Line 34, Column 8)Reinsurance payable on paid losses and loss adjustment expenses (Schedule F, Part 1, Column 6)Loss adjustment expenses (Part 2A, Line 34, Column 9)Commissions payable, contingent commissions and other similar chargesOther expenses (excluding taxes, licenses and fees)Taxes, licenses and fees (excluding federal and foreign income taxes)Current federal and foreign income taxes (including 0 on realized capital gains (losses))Net deferred tax liabilityBorrowed money 961,000 and interest thereon 345,151Unearned premiums (Part 1A, Line 37, Column 5) (after deducting unearned premiums for ceded reinsurance of 1,000,795,141 and including warranty reserves of 0 )Advance premiumDividends declared and unpaid:11.1 Stockholders11.2 PolicyholdersCeded reinsurance premiums payable (net of ceding commissions)Funds held by company under reinsurance treaties (Schedule F, Part 3, Column 19)Amounts withheld or retained by company for account of othersRemittances and items not allocatedProvision for reinsurance (Schedule F, Part 7)Net adjustments in assets and liabilities due to foreign exchange ratesDrafts outstandingPayable to parent, subsidiaries and affiliatesPayable for securitiesLiability for amounts held under uninsured plansCapital notes 0 and interest thereon 0Aggregate write-ins for liabilitiesTotal liabilities excluding protected cell liabilities (Lines 1 through 23)Protected cell liabilitiesTotal liabilities (Lines 24 and 25)Aggregate write-ins for special surplus fundsCommon capital stockPreferred capital stockAggregate write-ins for other than special surplus fundsSurplus notesGross paid in and contributed surplusUnassigned funds (surplus)Less treasury stock, at cost:34.10 shares common (value included in Line 28 0 )34.20 shares preferred (value included in Line 29 0 )Surplus as regards policyholders (Lines 27 to 33, less 34) (Page 4, Line 39)TOTALS (Page 2, Line 26, Col. 3) .29.30.31.32.33.34.35.36. 10.11. 2Prior 25,725 1,306,151 102,773,665 6,264,845,62845,266,654 5,702,782,13960,027,465 7,497,723669,415,9801,943,829,551682,415,832 163,016,283 494,042,969 4,647,529732,737,9122,283,925,620608,776,621 2,500,0001,013,209,4313,666,760,1056,203,269,568 147,227,370 560,618,933 34,335,482,1681,219,752,83625,700,000 (172,246,798)34,335,482,168 186,202,986 510,299,270 1Current YearLIABILITIES, SURPLUS AND OTHER FUNDS1.2.3.4.5.6.7.17.28.9. ,64625,000,000 924DETAILS OF WRITE-INS2301.2302.2303.2398.2399.Other liabilitiesRetroactive reinsurance reserve - cededAmounts held under uninsured plansSummary of remaining write-ins for Line 23 from overflow pageTotals (Lines 2301 through 2303 plus 2398) (Line 23 ,662397,893,616(720,565,999) 2701. Special surplus from retroactive reinsurance2702.2703.2798. Summary of remaining write-ins for Line 27 from overflow page2799. Totals (Lines 2701 through 2703 plus 2798) (Line 27 above) 3001. Guaranty funds3002.3003.3098. Summary of remaining write-ins for Line 30 from overflow page3099. Totals (Lines 3001 through 3003 plus 3098) (Line 30 above)1,219,752,8361,174,770,646 1,219,752,8362,500,0001,174,770,6462,500,000 2,500,00032,500,000

Annual Statement for the year 2006 of the Liberty Mutual Insurance Company and its Affiliated Property and Casualty Insurers STATEMENT OF INCOME 1 2Current YearPrior YearUNDERWRITING INCOME1. Premiums earned (Part 1, Line 34, Column 4)DEDUCTIONS2. Losses incurred (Part 2, Line 34, Column 7)3. Loss expenses incurred (Part 3, Line 25, Column 1)4. Other underwriting expenses incurred (Part 3, Line 25, Column 2)5. Aggregate write-ins for underwriting deductions6.Total underwriting deductions (Lines 2 through 5)7. Net income of protected cells8. Net underwriting gain (loss) (Line 1 minus Line 6 plus Line 7) 14,798,631,626 8,808,867,2862,147,740,6314,193,478,504 13,652,912,028 8,322,967,5152,376,130,9523,715,986,991 15,150,086,421(351,454,795) 14,415,085,458(762,173,430) INVESTMENT INCOME9. Net investment income earned (Exhibit of Net Investment Income, Line 17)10. Net realized capital gains (losses) less capital gains tax of 57,097,715 (Exhibit of Capital Gains (Losses))11. Net investment gain (loss) (Lines 9 10) 273,728,4721,891,771,447OTHER INCOME12. Net gain (loss) from agents' or premium balances charged off(amount recovered 2,368,593 amount charged off 23,378,950 )13. Finance and service charges not included in premiums14. Aggregate write-ins for miscellaneous income15.Total other income (Lines 12 through 14)16. Net income before dividends to policyholders, after capital gains taxand before all other federal and foreign income taxes (Lines 8 11 15)17. Dividends to policyholders18. Net income, after dividends to policyholders, after capital gains taxand before all other federal and foreign income taxes (Line 16 minus Line 17)19. Federal and foreign income taxes incurred20. Net income (Line 18 minus Line 19) (to Line 22) ,695,258)72,247,251(145,780,694)(112,228,701) 1,392,561,42860,715,562 1,017,369,31646,803,383 1,331,845,866464,902,820866,943,046 970,565,93350,238,128920,327,805 CAPITAL AND SURPLUS ACCOUNT21.22.23.24.25.26.27.28.29.30.31.32.Surplus as regards policyholders, December 31 prior year (Page 4, Line 39, Column 2)Net income (from Line 20)Net transfers (to) from Protected Cell accountsChange in net unrealized capital gains or (losses) less capital gains tax of 98,574,408Change in net unrealized foreign exchange capital gain (loss)Change in net deferred income taxChange in nonadmitted assets (Exhibit of Nonadmitted Assets, Line 26, Col. 3)Change in provision for reinsurance (Page 3, Line 16, Column 2 minus Column 1)Change in surplus notesSurplus (contributed to) withdrawn from protected cellsCumulative effect of changes in accounting principlesCapital changes:32.1 Paid in32.2 Transferred from surplus (Stock Dividend)32.3 Transferred to surplusSurplus adjustments:33.1 Paid in33.2 Transferred to capital (Stock Dividend)33.3 Transferred from capitalNet remittances from or (to) Home OfficeDividends to stockholdersChange in treasury stock (Page 3, Lines 34.1 and 34.2, Column 2 minus Column 1)Aggregate write-ins for gains and losses in surplusChange in surplus as regards policyholders for the year (Lines 22 through 37)Surplus as regards policyholders, December 31 current year (Line 21 plus Line 38) (Page 3, Line 35) 9,869,045,943866,943,046 700,000156,763,001 4,914,806)135,529 099222,976 8,739,369,790920,327,805 34.35.36.37.38.39. 33. 881,963,148585,724,963 0,851,000)18,565,9541,129,676,1539,869,

Liberty Mutual Insurance Company and its Affiliated Property and Casualty Insurers NAIC Group Code 0111 NAIC Company Code 01112 Mail Address 175 BERKELEY STREET BOSTON, MA 02117 Annual Statement Contact DOUGLAS LINK 617-357-9500 45668 Name of Companies: NAIC Company Code: State of Domicile: