Transcription

PROPERTY AND LIABILITYINSURANCE PRINCIPLESLuthardt . Wiening4th edition

Chapter TwoWho provides Insurance andHow is it regulated?

OBJECTIVES After studying this chapter, you should be able to know thefollowing:Describe the various types of private insurersthat provide property-casualty insurance. Explain how insurance rates are developed. Describe the objectives of rate regulation. Explain how insurance regulators monitorinsurers’ financial condition and protectconsumers. Explain how the excess and surplus linesmarket meets the needs of various classes ofbusiness that are often unable to findinsurance in the standard market.

WHO PROVIDES INSURANCE ANDHOW IS IT REGULATED? Insuranceis a risk management technique, atransfer system, a business and a contract, and itis provided by several types of insurers. Regulatorymechanisms are designed by thegovernment to maintain the integrity of insurers,govern rates and address the needs of thecustomers.

WHO PROVIDES INSURANCE ANDHOW IS IT REGULATED? Theinsurance industry is not well understood orheld in high regard by much of the purchasingpublic. The mechanism of insurance is relativelycomplex in comparison to purchases of othergoods and services. Besides, when some insurersfail to fulfill the promises made in their contracts ,this may heighten the public’s suspicionsregarding all insurers.

TYPES OF INSURANCE ORGANIZATIONSA)Private InsurersThey differ from one another in several ways, in terms of: The purpose for which they where formed. Their legal form of organization. Their ownership. Their method of operation.All insurers provide a means to indemnify insureds if acovered loss occurs, and to spread the cost of lossesamong insureds.All of them perform the basic functions, but the motivesof the parties forming different types of insurers are notthe same.

1- STOCK INSURERS“An insurer that is owned by its stockholdersand formed as a corporation for the purpose ofearning a profit for the stockholders.” Purposefor which formed: to earn a profit for itsstockholders. Legal form: corporation Ownership: stockholders Method of operation: the board of directors,elected by stockholders, appoints officers tomanage the company.

1- STOCK INSURERSIt creates the corporate goals andobjectives and appoints a (CEO) The stock form of ownership also providesfinancial flexibility for the insurer. The ability to raise additional funds byselling common stock is an importantaspect of the stock form of organization.

2- MUTUAL INSURERS“An insurer that is owned by its policyholdersand formed as a corporation for the purpose ofproviding insurance to them.” Purposefor which formed: to provide insurancefor its owners (policyholders). Legal form: corporation Ownership: policyholders Method of operation: the board of directors,elected by policyholders, appoints officers tomanage the company.

2- MUTUAL INSURERS Theypay dividends to policyholders as a returnof a portion of premiums paid. Some of them have the right to charge insuredsan assessment, or additional premium, after thepolicy has gone into effect. In recent years , some mutual companies havemade structural changes to be converted tostock companies through a process calleddemutualization.

3-RECIPROCAL INSURANCEEXCHANGE (INTER INSURANCE EXCHANGE)“An insurer that is owned by its policyholders,formed as an unincorporated association for thepurpose of providing insurance coverage to itsmembers (subscribers), and managed by anattorney-in-fact.” Purposefor which formed: to provide reciprocity forsubscribers (to cover each other’s losses) Legal form: unincorporated association Ownership: subscribers (members) Method of operation: subscribers choose an attorneyin-fact to operate the reciprocal

3-RECIPROCAL INSURANCEEXCHANGE(INTER INSURANCE EXCHANGE)Subscribers “ they are the policyholders of a reciprocalinsurance exchange who agree to insure each other”. Attorney-in-fact “is the contractually authorized managerof the reciprocal who administers its affairs and carries outits insurance transactions”. His existence distinguishes asa reciprocal from other types of insurers. A subscription agreement authorizes the attorney-in-fact toact on behalf of the subscribers to market and underwritethe insurance coverage, collect premiums, invest funds andhandle claims.

4- LLOYD’S Purposefor which formed: to earn a profit for itsindividual investors(“Names”) and its corporateinvestors. Legal form: unincorporated association Ownership: investors Method of operation: it is regulated by the U.K.Financial Services Authority (FSA), whichdelegates much authority to the Council of Lloyd’s

4- LLOYD’S Itis an association that provides the physical andprocedural facilities for its members to writeinsurance. Members of Lloyd’s are investors (companies andindividuals) that hope to earn profit from theinsurance operations that occur at Lloyd’s. Each investor called a “Name”, of Lloyd’s belongsto one or more groups called syndicates. Lloyd’s has earneda reputation for acceptingapplications for very unusual types of insurance.

5- AMERICAN LLOYD’SLloyd’s associations are much smallerthan Lloyd’s. Americanmembers are called “ underwriters” andhave limited liability [ limited to their investmentin the Lloyd’s association]. Their

6- CAPTIVE INSURERS“ An insurer formed as a subsidiary of its parentcompany, organization, or group, for the purpose ofproviding all or part of the insurance on the parentcompany or companies.” Threefactors have contributed to the growth ofcaptives in recent years:1) Low insurance cost2) Insurance availability3) Improved cash flow

7- REINSURANCE COMPANIESReinsurance “ is a contractual agreement thattransfers some or all of the potential costs of insuredloss exposures from policies written by one insurer toanother insurer.Primary insurer “is the insurer that transfers someor all of the potential costs its insured loss exposuresto another insurer in a reinsurance contractualagreement.Reinsurer “ is the insurer that assumes some or allof the potential costs of insured loss exposures of theprimary insurer in a reinsurance contractualagreement.”

B) GOVERNMENT INSURANCE PROGRAMS Someloss exposures do not possess thecharacteristicsthatmakethemcommercially insurable, but a significantneed for protection against costs oflosses still exists.

1- FEDERAL GOVERNMENT INSURANCE PROGRAMSOnly the government has the ability to tax in order toprovide the financial resources needed to insure some lossexposures and the power to make the system viable byrequiring mandatory participation. Mandatory participation in the social security program forthose eligible for coverage eliminates the need forindividual underwriting and helps to generate premiumrevenues to operate the system. Private insurersprovide similar benefits (retirementbenefits, life insurance, disability insurance, and healthinsurance) to some insureds, but they cannot approach thescope of the Social Security program.

1- FEDERALPROGRAMS operates the program and provides thefollowing benefits to the eligible citizens:1. Retirement benefits to elderly.2. Survivorship benefits for the dependents ofdeceased workers.3. Disability payments for disabled workers4. Medical benefits for the elderly.

2-STATEGOVERNMENTINSURANCEPROGRAM Amongthe most common types ofinsurance programs provided or operatedby state governments are as follows:1. Worker’s compensation insurance funds.2. Unemployment insurance programs.3. Automobile insurance programs.4. Fair access to Insurance Requirementsplans.5. Beachfront and windstorm pools.

INSURANCE REGULATION Thepossibility that an insurer might not be able topay legitimate claims to or for policyholders is theprimary concern of insurance regulators. Theywant to protect the public from irresponsible,unwise, or dishonest activities that could leaveconsumers with worthless insurance policies. The primary objectives of insurance regulation are asfollows:1. Rateregulation2. Solvency surveillance3. Consumer protection

1. RATE REGULATION“ the process insurers use tocalculate the rates that determine the premium tocharge for insurance coverage. An insurer must collect sufficient premiums topay for the insured losses that occur, to cover thecosts of operating the company, and to allow areasonable profit. Typically, the profit comes from the investmentof those premiums until losses are paid. Ratemaking

1. RATE REGULATION Rate “ the amount per exposure unit forinsurance coverage, used to arrive at a premiumwhen multiplied by the number of exposure units. Premium“ the price of the insurancecoverage provided for a specified period.Premium Rate Number of exposureunitsEx.: if an insurer charges a rate of 1.2 per 100 of coverage on jewelry, the premium for aring insured for 1000 would be 12.

OBJECTIVES OF RATE REGULATION1- To ensure that rates are adequate This means that the price charged for agiven type of insurance coverage shouldbe high enough to meet all anticipatedlosses and expenses associated with thatcoverage while generating a reasonableprofit for the insurer.

OBJECTIVES OF RATE REGULATION2- To ensure that rates are not excessive Determining whether rates are excessiveor inadequate are is difficult becauseinsurers must price insurance policieslong before the results of the pricingdecision are known.

OBJECTIVES OF RATE REGULATION3- To ensure that rates are not unfairlydiscriminatory Because insurance is a system of sharingthe costs of losses, each insured shouldpay a fair share of all policyholder’s losses. Thereare two concepts under which a fairshare could be determined:

OBJECTIVES OF RATE REGULATIONOne concept involves “Actuarial equity”It is a ratemaking concept through which actuariesbase rates on calculated loss experience to placeinsureds with similar characteristics in the samerating class. On the other hand “Social equity”It is a rating concept that holds that rate structuresdiscriminate unfairly if they impose a higher rate onan insured for factors beyond the insured’s control,such as age or gender.Rate regulation attempts to balance both concepts.

2- SOLVENCY SURVEILLANCE: “is the ability of an insurer tomeet its financial obligations as theybecome due, even those resulting frominsured losses that may be claimed severalyears in the future.” Solvency Surveillance:“is the process,conducted by state insurance regulator, ofverifying the solvency of insurers anddetermining whether their financial conditionenables them to meet their financialobligations and to remain in business.” Solvency

2- SOLVENCY SURVEILLANCE Thereare two major aspects:a) Insurer Examinations: Regulatory authorityperiodically examine insurers.An examinationconsists of a thorough analysis of an insurer’soperations and financial condition. In addition, theinsurer’s financial records are carefully analyzed toensure that the company is meeting all statefinancial reporting requirements and to determinewhether the insurer has the ability to meet itsobligations. If the examination uncovers problems,the insurance department usually has broad powersto take control of the situation to correct whateverproblems are identified.

2- SOLVENCY (IRIS):An information and early-warning systemestablished and operated by National Associationof Insurance Commissioners (NAIC) to monitor thefinancial soundness of insurers.

3- CONSUMER PROTECTIONIn addition to rate regulation and solvencysurveillance, the activities that regulators undertaketo protect insurance consumers include:a) Licensing insurers.b) Licensing insurer representatives.c) Approving policy forms.d) Examining market conduct.e) Investigating consumer complaints.

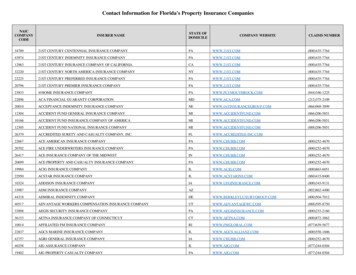

A)LICENSING INSURERS Licensedinsurer or admitted insurer: “an insurerauthorized by the state insurance department to sellinsurance within that state.” Domesticinsurer: “an insurer incorporated in thesame state in which it is writing insurance.” Foreigninsurer: “an insurer licensed to operate in astate but incorporated in another state.” Alieninsurer: “an insurer licensed in a U.S. state butincorporated in another country.”

B)LICENSING INSURER REPRESENTATIVES Alicense is usually granted only after theapplicant passes an examination on insurancelaws and practices. In most states, the agent, broker, or claimrepresentative must complete a prescribedamount of continuing education during aspecified period before renewing a license.

C)APPROVING POLICY FORMS Manystates require insurers to file their policyforms with the state insurance department . Whenever an insurer wants to change thelanguage of a particular policy, it must submit thenew form for approval. Regulatory approval of policy forms reduces thepossibility of misleading wording. Having clearand readable, fair and reasonable provisions ininsurance policies is a goal of most regulators.

D)EXAMINING MARKET CONDUCT Marketconduct regulation:“Regulation of the practices of insurers in regard tofour areas of operation: sales practices,underwriting practices, claim practices and bad –faith actions.”

E) INVESTIGATING CONSUMER COMPLAINTS Everystate insurance department has aconsumer complaints division to investigateconsumer complaints help insureds dealwith problems they have encountered withinsurers and their representatives.

EXCESS AND SURPLUS LINES INSURANCE Standardmarket: “ Collectively, insures whovoluntarily offer insurance coverages at ratesdesigned for customers with average or better thanaverage loss exposures.” Changes in business practices or technology mightcreate new loss exposures not contemplated intraditional insurance policies. These exposuresrequire a creative, nontraditional insurance market. Insurance coverages unavailable in the

primary concern of insurance regulators. They want to protect the public from irresponsible, unwise, or dishonest activities that could leave consumers with worthless insurance policies. The primary objectives of insurance regulation are as follows: 1. Rate regulation 2. Solvency surveillance 3. Consumer protection