Transcription

Technology information leaflet ECA767Warm air heating equipmentA guide to equipment eligible forEnhanced Capital Allowances

ContentsIntroduction01Background01Setting the scene01Benefits of purchasing ETL-listed products01Warm air heating equipment eligibleunder the ECA scheme02Indirect-fired warm air heating02Direct-fired warm air heating03Calculating the payback of your investment04

Warm air heating equipmentIntroductionECAs are a straightforward way for a business to improveits cash flow through accelerated tax relief. The schemeencourages businesses to invest in energy saving plantor machinery specified in the ETL to help reduce carbonemissions, which contribute to climate change.The Energy Technology List (ETL) is a register of productsthat may be eligible for 100% tax relief under theEnhanced Capital Allowance (ECA) scheme for energysaving technologies1. The Carbon Trust manages the listand promotes the ECA scheme on behalf of government.01Did you know?ETL-listed indirect-fired warm air heating productscan use up to 9% less energy than non ETL-listedproducts based on the minimum efficiencyrequirement of EN 1020 (84%) compared to theETL criteria (91%).Benefits of purchasing ETL-listedproductsThis leaflet gives an overview of warm air heatingequipment specified on the ETL and aims to presenta sound business case for purchasing energy savingequipment from ETL manufacturers and suppliers.Warm air heating products listed in the ETL must meetminimum efficiency and/or functional criteria that arethen verified by independent test laboratories. Thismeans that they are generally more energy efficientthan products which are not on the list.BackgroundWhen replacing equipment, businesses are often temptedto opt for that with the lowest capital cost; however,such immediate cost savings can prove to be a falseeconomy. Considering the life cycle cost before investingin equipment can help reduce costs and improve cashflow in the longer term.The ETL comprises two lists: the Energy TechnologyCriteria List (ETCL) and the Energy Technology ProductList (ETPL). The ETCL defines the performance criteriathat equipment must meet to qualify for ECA schemesupport; the ETPL is a qualified list of products that havebeen assessed as being compliant with ETCL criteria.Setting the sceneWarm air heating can be divided into two maincategories: indirect-fired and direct-fired.Indirect-fired warm air heating has been used to provideheating in retail spaces and factory environments formany years. It can be an efficient heating solution aslong as attention is paid to minimising ventilation ratesand heat losses through the building fabric, effectivecontrols and, where appropriate, the addition of heatrecovery plant and destratification fans. Most stand-alonewarm air heating units recirculate air, but indirect heatingmodules are intended to be incorporated within airhandling units for heating fresh air.Direct-fired warm air heating provides both heating andventilation through the same unit. It is most often foundin factories that need continuously high ventilation ratesfor fume extraction.1The ECA scheme provides businesses with 100% firstyear tax relief on their qualifying capital expenditure.This means that businesses can write off the whole costof the equipment against taxable profits in the year ofpurchase. This can provide a cash flow boost and anincentive to invest in energy saving equipment whichnormally carries a price premium when compared toless efficient alternatives.Using this leaflet you can calculate the benefits ofinvesting in qualifying ETL energy saving equipmentover non qualifying equipment. The calculation includesthe benefits of accelerated tax relief, reduced runningcosts, increased efficiency, lower energy bills and reducedClimate Change Levy payments (if applicable), which inturn helps reduce payback periods.ImportantBusinesses purchasing equipment must checkthe ETPL at the time of purchase in order to verifythat the named product they intend to purchase isdesignated as energy saving equipment. Warm airheating equipment that meets the ETL eligibilitycriteria but is not listed on the Energy TechnologyProduct List (ETPL) at the time of purchase is noteligible for an ECA.Eligibility for ECAs is based on a number of factors. Visit www.eca.gov.uk/energy to find out more.

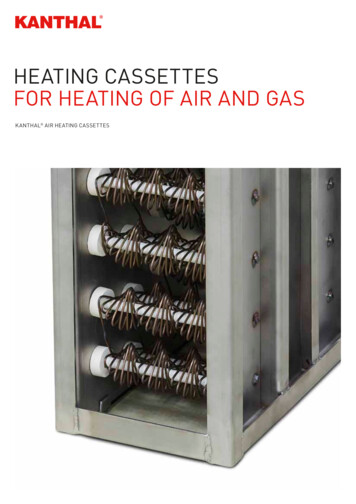

02The Carbon TrustWarm air heating equipment eligibleunder the ECA scheme2Suspended indirect-fired warm air heaterThere are two types of warm air heating equipmentspecified as energy saving under the ECA scheme: Indirect-fired warm air heaters– Indirect gas and oil-fired packaged warm air heaters– Indirect gas and oil-fired packaged air heatermodules for air handling units Direct gas-fired packaged warm air heaters.Source: ReznorNote: Hot water and portable warm air heatingappliances are not eligible under the ECA scheme.Using the baseline scenario below, the potentialfinancial ( ), energy (kWh) and carbon savings (tonnesCO2 ) have been calculated for comparison unlessotherwise indicated: The ETL-listed indirect-fired air heater product is 9%Floor standing indirect-fired cabinet warm air heatermore efficient than the standard product but 11% moreexpensive to purchase. The gas price is 3p/kWh with the Climate ChangeLevy (CCL) at 0.15p/kWh. Gas consumption is based on single shift working(10 hours per day during the heating season). Improved controllability of the ETL-listed direct-firedair heater relative to a basic product provides 10%fuel saving.Indirect-fired packaged warm air heaters consist of a gasor oil burner, heat exchanger and hot air fan. Air fromthe room is recirculated through the heat exchangerand back into the room at high velocity. The hot air maybe discharged directly from the unit or ducted into theroom. Flue gases are discharged to atmosphere outsidethe building. Both floor standing and suspended unitsare available.Indirect-fired packaged warm air heater modules usea similar set of burners and heat exchangers, but aredesigned to fit within air handling units to heat the freshair being introduced to the building. Only the module iseligible for an ECA and not the air handling unit in whichit is mounted, or the associated ductwork.2 Source: AmbiRadIndirect-fired warm air heatingThe descriptions of the warm air heating equipment given in this leaflet are examples only. The formal criteria and details governing the ECA schemecan be found at www.eca.gov.uk/energy.

Warm air heating equipment03In addition to low operating costs and reducedcarbon emissions, further advantages of indirectair heating include:In addition to low capital costs and reduced carbonemissions, further advantages of direct-fired warm airheating include: Low or high-level mounting possible Relatively inexpensive High thermal outputs available More efficient than using a boiler and convector Modulating burners and condensing heat exchangers Ventilation and heating in winter and ventilationare available.Installation or replacement of indirect-fired warm airheating should always be considered in conjunction withpossible building fabric improvements and minimisinguncontrolled air leakage. There may also be benefitsfrom the installation of ventilation heat recovery insome circumstances.in summer Low discharge temperature eliminates the riskof stratification Fast provision of heat from start up A single unit can serve a large area Low maintenance requirements.Direct-fired warm air heaterSource: AmbiRadInstalling an ETL-listed indirect warm air heatingsystem at a total cost of 13,920 rather than anon-specified product at a cost of 13,200, with arespective annual running cost of 13,163 and 11,978the potential annual savings are: 1,185 39,500kWh 7.5 tonnes CO2.Information for purchasersDirect-fired warm air heatingIn direct-fired warm air heaters, combustion occurs withinthe inlet ventilation air stream, resulting in a thermalefficiency of 100% (net calorific value). Direct-fired warmair heating discharges the products of combustion intothe surrounding space. It is therefore only possible insituations where there is good ventilation. For example,the classic application of direct-fired warm air heating isin factory buildings with high ventilation rates for fumecontrol. The technology is also commonly used as partof the heating system for warehouses, large retail shedsand sports arenas.ETL-listed direct-fired warm air heaters include variablespeed fans and high turndown ratio burners to providea flexible and efficient heating solution that can result insignificant fuel savings compared to a basic heater. Thevariable speed fans in direct-fired warm air heaters canalso provide efficient summer ventilation.For further information about the ECA scheme, theEnergy Technology List (ETL) and other TechnologyInformation Leaflets in the series please visitwww.carbontrust.co.uk/eca, contact the CarbonTrust on 0800 085 2005 or email customercentre@carbontrust.co.uk

04The Carbon TrustWarehouse application The unit price (kWh) of the fuel your businessconsumes. Estimated fuel usage (kWh) for the ETL proposedequipment solution(s), which the manufacturer orsupplier should be able to help you with. Estimated fuel usage (kWh) for the non-ETL proposedequipment solution(s), which the manufacturer orsupplier should be able to help you with. Estimated annual maintenance costs incurred byyour business for the ETL-listed equipment (yourmanufacturer or supplier should be able to help youwith estimates).Source: Nordair Niche Estimated annual maintenance costs incurred byyour business for the non-ETL-listed equipment (yourmanufacturer or supplier should be able to help youwith estimates). The value of the proposed capital expenditure. Your business’s corporation tax rate.In addition, the following information is also required: A copy of the Carbon Trust fact sheet Energy andInstalling a specified energy saving ETL direct-firedair heating at a cost of 14,000 rather than a nonspecified product with a cost of 13,100, with arespective annual running cost of 9,256 and 10,284the potential annual savings are: 1,028 34,280kWh 6.5 tonnes CO2.Calculating the payback ofyour investmentBased on the operating conditions above, indicativesavings can be calculated for replacing your existingequipment with either ETL-listed equipment or non-ETLlisted equipment.The accelerated tax relief and cash flow benefit providedby the ECA, together with the life cycle cost savings fromETL-listed equipment, aid in bridging the price premiumand shortening the investment payback period3.To calculate the payback period for ETL-listed equipmentand non-ETL-listed equipment for comparison youwill need:3carbon conversion (CTL004). I ncorporation of the fact that capital allowance (CA)tax relief for non ETL equipment is 20% (10% ifallocated to the ‘special rate’ pool) and that enhancedcapital allowance (ECA) tax relief for ECA equipmentis 100%.Step 1: To prepare your business case for investmentyou first need to estimate annual energy consumption ofthe ETL-listed equipment and non-ETL-listed equipment.Annual energyconsumption(kWh/y) Equipmentconsumption (kW)xNumber ofoperatinghours/yearAdditionally, you can calculate the carbon emissionsassociated with the energy consumption usingeither the Carbon Trust fact sheet Energy andcarbon conversion (CTL004) or by using the tool atwww.carbontrust.co.uk/conversionfactors by simplymultiplying the energy consumption by the carbonemission factor for that fuel type.Carbonemissions Annual energyconsumption (kW)xEmission factor(kg CO2 /kWh) he values used in the examples given are for illustrative purposes only and do not reflect specific case studies. Anyone considering purchasing thisTtype of equipment would be advised to also analyse the benefits that would be available based on their own circumstances. It should also be notedthat the use of formally trained warm air heating equipment technicians can provide significant energy saving benefits.

Warm air heating equipment Enhanced capital allowance (ECA) tax relief forStep 2: Calculate the annual running cost (ARC) ofETL-listed equipment and non-ETL-listed equipment.ARC Annual energyconsumption (kW)xPence/kWhECA equipment is 100%Annualmaintenancecost Step 1 and 2 can also be done for your existingequipment to calculate an ARC, in order to allowcomparisons of the annual saving (step 3) between theexisting equipment, the ETL-listed equipment, and thenon-ETL-listed equipment.Step 3: Calculate the annual saving between theETL-listed annual running costs and non-ETL-listedannual running costs.Annualsaving ARC of ETL listedequipmentARC of ETL non-listedequipment-05 The rate of corporation or income tax foryour business.CA taxallowance Capitalexpenditurex20%*xRate ofcorporation taxECA taxallowance Capitalexpenditurex100%xRate ofcorporation taxTo calculate the available CA tax allowance on capitalexpenditure beyond Year 1 you need to decrease thecapital expenditure by 20% per year (10%if allocated tothe special rate pool) on a reducing balance basis. Overthe nine years the available CA tax allowance are shownin the table below.Step 5: Calculate the pay back for ETL-listed equipmentand non-ETL-listed equipment.Step 4: Calculate the tax allowance for ETL-listedequipment and non-ETL-listed equipment which willbe business-specific based on the following:Paybackperiod The value of your capital expenditure. Capital allowance (CA) tax relief for non-ETLTaxallowance Annualsaving Capital expenditureequipment is 20%. If allocated to the special rate poolit is reduced to 10%.Table 1 The cash flow boost to your business of an ECA over a CA for a capital investment of 10,000Year123456789Capital Expenditure ( ital Allowance (CA)@ 20% ( 91841471179410,000000000002,80000000000CA Tax AllowanceEnhanced CapitalAllowance @100% ( )ECA Tax AllowanceCalculations are based on 28% corporation tax/income tax and a capital allowance rate of 20%.*Replace with 10% if allocated to the special rate pool.

Go online to get moreThe Carbon Trust provides a range of tools, services and information to help you implementenergy and carbon saving measures, no matter what your level of experience. Carbon Footprint Calculator – Our online calculator will help you calculate yourorganisation’s carbon terest Free Loans – Energy Efficiency Loans from the Carbon Trust are a costeffective way to replace or upgrade your existing equipment with a more energy efficientversion. See if you qualify.www.carbontrust.co.uk/loans arbon Surveys – We provide surveys to organisations with annual energy bills ofCmore than 50,000*. Our carbon experts will visit your premises to identify energy savingopportunities and offer practical advice on how to achieve them.www.carbontrust.co.uk/surveys ActionPlans – Create action plans to implement carbon and energy saving measures.www.carbontrust.co.uk/apt Case Studies – Our case studies show that it’s often easier and less expensive than youmight think to bring about real change.www.carbontrust.co.uk/casestudies vents and Workshops – The Carbon Trust offers a variety of events and workshopsEranging from introductions to our services, to technical energy efficiency training, mostof which are free.www.carbontrust.co.uk/events Publications – We have a library of free publications detailing energy saving techniquesfor a range of sectors and d further help?Call our Customer Centre on 0800 085 2005 Our Customer Centre provides free advice on what your organisation can do to saveenergy and save money. Our team handles questions ranging from straightforwardrequests for information, to in-depth technical queries about particular technologies.* Subject to terms and conditions.

The Carbon Trust was set up by Government in 2001 as anindependent company.Our mission is to accelerate the move to a low carbon economyby working with organisations to reduce carbon emissions anddevelop commercial low carbon technologies.We do this through five complementary business areas:Insights – explains the opportunities surrounding climate changeSolutions – delivers carbon reduction solutionsInnovations – develops low carbon technologiesEnterprises – creates low carbon businessesInvestments – finances clean energy businesses.www.carbontrust.co.uk0800 085 2005The Carbon Trust is funded by the Department for Environment, Food and Rural Affairs (Defra),the Department for Business, Enterprise and Regulatory Reform, the Scottish Government, the WelshAssembly Government and Invest Northern Ireland.Whilst reasonable steps have been taken to ensure that the information contained within this publicationis correct, the authors, the Carbon Trust, its agents, contractors and sub-contractors give no warrantyand make no representation as to its accuracy and accept no liability for any errors or omissions.Any trademarks, service marks or logos used in this publication, and copyright in it, are the propertyof the Carbon Trust. Nothing in this publication shall be construed as granting any licence or right to useor reproduce any of the trademarks, service marks, logos, copyright or any proprietary information inany way without the Carbon Trust’s prior written permission. The Carbon Trust enforces infringementsof its intellectual property rights to the full extent permitted by law.The Carbon Trust is a company limited by guarantee and registered in England and Wales underCompany number 4190230 with its Registered Office at: 8th Floor, 3 Clement’s Inn, London WC2A 2AZ.Printed on paper containing a minimum of 75% recycled, de-inked post-consumer waste.Published in the UK: August 2008. The Carbon Trust 2008. All rights reserved.ECA767

Improved controllability of the ETL-listed direct-fired air heater relative to a basic product provides 10% fuel saving. Indirect-fired warm air heating Indirect-fired packaged warm air heaters consist of a gas or oil burner, heat exchanger and hot air fan. Air from the room is recirculated through the heat exchanger and back into the room .