Transcription

DRIVING WITHFEWER EMISSIONS:how can carmakers meet the 2021targets for CO2 emissions?

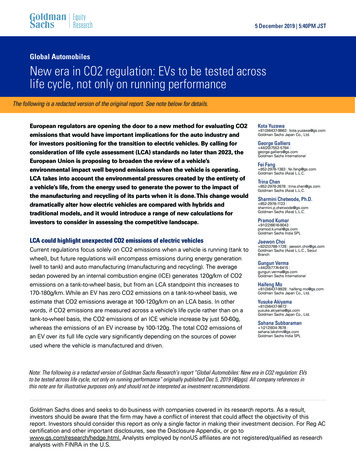

DRIVING CHANGE: HOW CAN CARMAKERS MEET THE 2021 TARGETS FOR CO 2 EMISSIONS?Our new forecast shows many carmakers are struggling to hit theEuropean Union’s CO2 emission targets for 2021.How can they make the performance changes required in time to avoid costly penalties?The European automobile industry invests 32 billion into R&Dannually1, a large percentage of which goes towards fuel-efficiencytechnologies. Much of this spend is driven by the EU’s mandatoryemission reduction targets for new cars — the cornerstone of itsstrategy to improve the fuel economy of cars sold to Europeanmarkets. While our research reveals many carmakers are ontrack to meet the target of a fleet average of 130 grams of CO2per kilometre (g/km) by 2015, our latest forecast, as shown inFigure 1, indicates four of the major carmakers — Volkswagen,BMW, Daimler and Jaguar Land Rover — are unlikely to meet the2021 targets.Ranking per average CO2 (g/km) emission 2021:Figure 1: How carmakersrank against theircompetitors for CO2emissions. Forecast byPA Consulting Groupis based on pre-2014figures from Transport& Environment, ICCT,JLR SustainabilityReport, ACEA and PwCAutofactsOur way of benchmarking, which is unavailable anywhere else inthe market, includes the overall EU target of 95g CO2/km as well asthe specific targets set for each carmakers’ business. This is basedon their fleet portfolio (with super credits received for their share ofe-vehicles below 50g CO2/km) and their average vehicle weight.On targetClose to targetOff target1.European Automobile Manufacturers Association, Research and innovation,17 September 2013RankOEM2021 Prediction2021 095.07Ford95.594.08General 1BMW104.9100.012Daimler106.2101.013Jaguar Land Rover135.8132.02

DRIVING CHANGE: HOW CAN CARMAKERS MEET THE 2021 TARGETS FOR CO 2 EMISSIONS?Analysis of the resultsAs Figure 1 shows, individual CO2 targetsare achievable for a few carmakers suchas Renault, Peugeot-Citroen, Fiat, Toyotaand Volvo. Renault, for example, will be3g CO2/km ahead of target, whilePeugeot-Citroen will achieve 89g CO2/km —4g CO2/km ahead of target in 2021.Some overseas carmakers are close to theirspecific targets with their European fleets,such as Hyundai, Nissan, Ford and GM, butthey may struggle to hit their targets by 2021.Carmakers face an ambitious target of 95gCO2/km across all new cars sold — a 40%reduction compared to the 2007 fleet averageof 158.7g CO2/km. In fuel consumption, the2015 target is equivalent to 5.6 litres per100km (l/100km) of petrol or 4.9 l/100kmof diesel, while the 2021 target equates to4.1 l/100km of petrol or 3.6 l/100km ofdiesel — an imposing challenge.An interesting factor to consider, with thepotential to negatively affect CO2 emissions,is falling gas prices — impacting currentcustomer behaviour. Buying preferences haveshifted to bigger and heavier vehicles withmore powerful engines, rather than hybridor electric vehicles, making the targets evenmore challenging for carmakers to meet.Carmakers that miss their 2021 targets riskpenalties of 95 from the first gram of CO2above the limit, multiplied by the numberof cars they sell in 2020. For the threeGerman carmakers, this ranges from around 100 million for BMW and Daimler, up to 1 billion for Volkswagen. As a premiumcarmaker, Jaguar Land Rover is slightlydifferent because of its low sales volume. Itcurrently has 60,000 registered vehicles peryear in its European fleet, which will not growto above 300,000 by 2020 – leaving it lessaffected by the EU legislation. However, interms of achieving their individual CO2 targetin 2021, they may still face some difficulties.3

200190DRIVING CHANGE: HOW CAN CARMAKERS MEET THE 2021 TARGETS FOR CO 2 EMISSIONS?4180170Figure 2: VW, BMW, Daimler and Jaguar Land Rover are struggling to achieve the 2021 CO2 emission target,160all others will get closeto the target150140CO2 g/km2301301.52202.0220KEY:210FORCASTEDEMISSIONS 2010210200FORECASTEDEMISSIONS 2015200190FORECASTEDEMISSIONS 2021190180 1.52021 targetHigh1702015 10FORCASTEDEMISSIONS 2010100FORECASTEDEMISSIONS 20159080FORECASTEDEMISSIONS 20211.0Low1.25Average fleet weights in tonnes1.5High2021 target2015 target

DRIVING CHANGE: HOW CAN CARMAKERS MEET THE 2021 TARGETS FOR CO 2 EMISSIONS?5The challenge of testcycles regulationAnother complication to carmakers hittingEU targets is the harmonisation of test cycleswhich the EU intends to use to measurefuel consumption and CO2 emissions.Information regarding cars’ CO2 emissionsis currently derived from a test cycle knownas the New European Driving Cycle (NEDC)— a standardised procedure designed tocompare different vehicles under similarconditions. However, it is performed inlaboratory conditions, so critics state itdoes not represent a realistic picture ofdriver behaviour, fuel consumption andCO2 emissions.The Worldwide Harmonised Light VehiclesTest Procedure (WLTP) test cycle, on the otherhand, is designed to represent a more accuraterepresentation of real-world driving – higherspeed limit (130km/h), harder accelerationand longer test duration. There is currentlydiscussion of it being implemented in 2017across all regions, adding further pressure tocarmakers in Europe – increasing CO2 emissionsfrom current circumstances by 15% to 25%(depending on carmaker’s fleet portfolio).If this new regulation on test cycles takeseffect in 2017 every carmaker will strugglewith CO2 targets for 2021. This is becausethey are facing a mere one digit percentpositive gap against their specific targets.As cars and engines are already developedfor market launches until 2020, this wouldrequire further effort from carmakers todevelop a new generation of engines at anadditional cost of up to 300 per engine unit.We therefore suggest the EU implements theWLTP test cycle on a global scale post-2021— after the next generation of engines havebeen developed and CO2 targets would havebeen reviewed.

DRIVING CHANGE: HOW CAN CARMAKERS MEET THE 2021 TARGETS FOR CO 2 EMISSIONS?To meet European carbon emissions reduction targets for 2021 and reduce the risk of incurring penalties,carmakers must take action on three fronts – investing more than 1,200 per vehicle unit.1. Optimise engine performance to achievegreen compliance2. Cut vehicle weight to meet carbon emissionsreduction targets3. Reshape the vehicle portfolio to ensureenvironmental complianceImproving the components that generate powerand deliver it to the road surface (the ‘drive train’)lowers fuel consumption and therefore helpscarmakers make progress on carbon emissionsreduction targets. For example, for a VolkswagenGolf or similar, improvements to the drive trainhave the potential to reduce carbon emissions byup to 60%.Cars have been becoming heavier for decades.Higher safety standards require rigid car bodies,and features such as air conditioning, powersteering and in-car entertainment also add weight.But for every 100kg a vehicle’s weight is reduced,fuel consumption falls by 0.25l/km, delivering areduction in carbon emissions of approximately6-7g CO2/km.Additional measures manufacturers can take toreduce fuel consumption include incorporating amechanism to automatically disengage the enginewhen the car is stationary in traffic and usingsuper- or turbo-charged engines to reduce thecylinder capacity required. Innovative technologiesthat are still evolving, from cylinder deactivationto electro-mechanical valve control, could alsoimprove performance, reduce emissions andsupport environmental compliance.Carmakers must use innovative materials such ashigh-alloy steel, aluminium and carbon fibre in thebody shell, chassis and drive train, and in engines,seats and axles to reduce vehicle weight, cutfuel consumption and achieve carbon emissionsreduction targets.Carmakers can further reduce average carbonemissions from the fleet by reshaping their vehicleportfolios to include a higher proportion of smallercars and engines, downsizing eight cylinders tosix cylinders for instance, or six to four or three.Extending the use of alternative drive trains(hybrid or electric vehicles) in their portfolios willhelp meet European carbon emissions reductiontargets (although the overall carbon balance sheetfor electric vehicles remains dependent on thepower mix used to charge them).We have worked with a number of manufacturersto help prepare their fleets to meet Europeancarbon emissions reduction targets. Our work forMagna Steyr, for instance, to refine the lithiumion batteries supplied to fleets of commercialvehicles led to reduced carbon emissions and lowerbattery costs. Meanwhile, our work with a premiumcarmaker has reduced the weight of its future smallvehicles by more than 5%.6

DRIVING CHANGE: HOW CAN CARMAKERS MEET THE 2021 TARGETS FOR CO 2 EMISSIONS?Our methodology for ranking carmakers’ CO2 emissionsThe following assumptions were made to forecast original equipment manufacturers’ (OEM)specific CO2 targets and emissions:Manufacturer specific CO2 targets depend on the average fleet weight of each OEM. The averagefleet weight is forecasted according to a PA assessment on present and previous weight trends,as well as on the capability of OEMs to reduce weight in the future. The expected potential ofeach OEM to enlarge their product portfolio with smaller and lighter cars is also important here.We expect fleet weight reductions between 0.2% and 1% per year, and, on average, there will bea weight reduction of around 10kg per car per year.OEM specific CO2 emissions describe a weighted fleet average for each OEM, taking into accountsuper credits for low emission vehicles (less than 50g CO2/km). Therefore, assumptions for eachOEM were made regarding the development of the CO2 emissions of different powertrain types,such as internal combustion machines, hybrid, plug-in hybrid, electro and others, eg naturalgas. Our assessment expects CO2 emission reductions per OEM a year at between 0.8% and2.6%, depending on former reductions and OEM specific capability for reductions.The respective number of registrations of each powertrain type is forecasted on a basisof extrapolation and PA market insights on future focal points of OEMs – ie PA expects anaverage market share of 5% for electric vehicles in 2021.7

To find out how our experts can help you meet European carbonemissions reduction targets, please contact us now.Tel: 49 69 71 70 22 93Email: /CO2rankingCorporate headquarters123 Buckingham Palace RoadLondon SW1W 9SRUnited Kingdom 44 20 7730 9000DeutschlandEschersheimer Landstraße 22360320 Frankfurt am Main 49 69 71 70 20Maximilianstraße 1380539 MünchenTel: 49 89 203006 440paconsulting.comWe are an employee-owned firm of over 2,500 people,operating globally from offices across North America,Europe, the Nordics, the Gulf and Asia Pacific.This document has been prepared by PA.The contents of this document do notconstitute any form of commitment orrecommendation on the part of PA andspeak as at the date of their preparation.We are experts in energy, financial services, life sciencesand healthcare, manufacturing, government and publicservices, defence and security, telecommunications,transport and logistics.02067-5Our deep industry knowledge together with skills inmanagement consulting, technology and innovationallows us to challenge conventional thinking and deliverexceptional results with lasting impact. PA Knowledge Limited 2015.All rights reserved.No part of this documentation maybe reproduced, stored in a retrievalsystem, or transmitted in any form orby any means, electronic, mechanical,photocopying or otherwise without thewritten permission of PA Consulting Group.

9 Volkswagen 98.5 94.0 10 Volvo 99.3 100.0 11 BMW 104.9 100.0 12 Daimler 106.2 101.0 13 Jaguar Land Rover 135.8 132.0 Figure 1: How carmakers rank against their competitors for CO 2 emissions. Forecast by PA Consulting Group is based on pre-2014 figures from Transport & Environment, ICCT, JLR Sustainability Report, ACEA and PwC Autofacts 1.