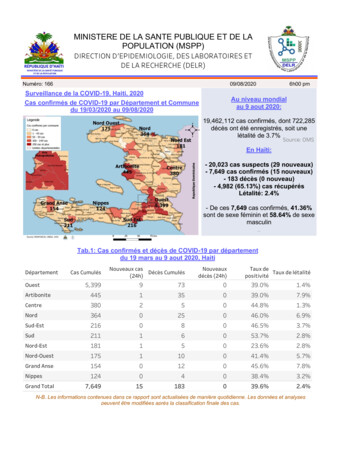

Transcription

2018 Annual Report

WHERE YOU CAN FIND MORE INFORMATIONAnnual -reportSustainability OKING STATEMENTSSome of the information we provide in this document is forward-looking and thereforecould change over time to reflect changes in the environment in which GE competes. Fordetails on the uncertainties that may cause our actual results to be materially differentthan those expressed in our forward-looking statements, see rward-looking-statement-information. We do notundertake to update our forward-looking statements.NON-GAAP FINANCIAL MEASURESWe sometimes use information derived from consolidated financial data but not presentedin our financial statements prepared in accordance with U.S. generally accepted accountingprinciples (GAAP). Certain of these data are considered “non-GAAP financial measures”under the U.S. Securities and Exchange Commission rules. These non-GAAP financialmeasures supplement our GAAP disclosures and should not be considered an alternativeto the GAAP measure. The reasons we use these non-GAAP financial measures and thereconciliations to their most directly comparable GAAP financial measures are included inthe CEO letter supplemental information package posted to the investor relations sectionof our website at www.ge.com.Cover: The GE9X engine hanging on a test stand at our Peebles Test Operation facility in Ohio. Herewe test how the engine’s high-pressure turbine nozzles and shrouds, composed of a new lightweightand ultra-strong material called ceramic matrix composites (CMCs), are resistant to the engine’swhite-hot air. Pictured left to right: Rachel Drake and Daniel Evans, GE Aviation

Dear fellow shareholder,This is my first letter as Chairman and CEO of our company.I want this to be a document you can use as a reference for howwe plan to run GE for the long term. As the saying goes, this is agame of inches every day, not feet or miles, and I want us all tokeep score together. My goals are aligned with yours.Like so many of you, I have been a lifelong student of GE. Myearliest mentors cut their teeth at this company, and muchof how I have operated and approached leadership andteamwork throughout my career is rooted in GE’s own storiedmanagement philosophy.Coming into GE with this foundation from the outside has itsadvantages. Someone with a fresh set of eyes can ask newquestions and look at challenges in a different way. We face anumber of hurdles, but the entire team at GE is focused on tacklingour issues head on and making progress across multiple metrics.In this letter, I’ll walk you through the actions we are taking toimprove our financial position and strengthen our businesses.It is clear we have work to do. In 2018, weak execution andmarkets in Power were partially offset by strength in Aviationand Healthcare. We took several charges related to Power andfinalized a 15 billion capital shortfall with our regulators relatedto our run-off insurance business. We made major changesto GE’s strategy, portfolio, leadership, and board—my ownappointment included.We are doing everything in our power to return GE to a position ofstrength, and we will need your support and patience to make surewe do so. I am confident that we can for three reasons: our team,our technology, and our global network.Our team at the Additive Customer Experience Center in Pennsylvania discusses the next stepin the additive manufacturing process of removing a build from an Electron Beam Melting(EBM) 3D-printer and moving it into a Powder Recovery System. This system salvages unusedmetal powder, reduces waste, and prevents cross-contamination. Pictured from left toright: Bryan Bossong, Jessica Gonzalez, and Ed (G) Rowley, GE Additive*1First and most importantly is our team. One of the first thingsI did as CEO was to begin to meet and talk with GE people. What Ifound were talented colleagues from all over the world with grit,resolve, and intelligence. They do not need any convincing thathow we operate must change. They are up for the fight and readyto win—because GE matters.We are doing everything in our powerto return GE to a position of strengthGE matters because our technology helps bring progress andpossibility to every corner of the planet—safely delivering peoplewhere they need to go; powering homes, schools, hospitals, andbusinesses; and offering more precise diagnostics and care whenpatients need it most. Our equipment and solutions are deployedin two-thirds of the world’s commercial aircraft departures,1 morethan 2,200 gigawatts of the world’s power generation capacity, andmore than 4 million healthcare installations. This vast and valuableinstalled base keeps us intimately involved with and often responsiblefor the daily operations of our customers around the world, constantlyhelping us to better understand and serve their needs.PERFORMANCE METRICSDollars in millions; except per-share amounts20182017YoYGAAPTotal RevenuesGE Cash from Operating Activities (CFOA)GE Industrial ProfitGE Industrial Profit MarginContinuing EPS (diluted)Net EPS (diluted) 121,615 2,258 (19,759)(17.4)% (2.43) (2.62) 118,243 11,033 1,4821.3% (0.99) (1.03)3%(80)%UUUUNon-GAAP*GE Industrial Segment Organic RevenuesAdjusted GE Industrial Free Cash Flows (FCF)Adjusted GE Industrial ProfitAdjusted GE Industrial Profit MarginAdjusted EPS (diluted) 109,340 4,515 10,2039.0% 0.65 109,220 5,562 11,25710.1% 1.00–(19)%(9)%(110) bps(35)%This purpose has driven more than 125 years of GE innovation, andit is as strong as at any time in our history. That’s what drives therenewal of our aircraft engine portfolio—from the T901 turboshaftfor the U.S. Army to the GE9X, the world’s largest jet engine. It iswhy Renewable Energy is building the Haliade-X, the world’s largestand most powerful wind turbine, which has blades longer than afootball field. It is why our engineers were the first to leverage newgas turbine technology, setting world records for combined-cycleNon-GAAP Financial Measures. Please see the Non-GAAP Financial Measures section on pages 70-77 of the Management's Discussion and Analysis within our Form 10-Kfor explanations of why we use these Non-GAAP measures and the reconciliation to the most comparable GAAP financial measures.Including CFM International, a 50-50 joint venture between Snecma (Safran) and GE.GE 2018 Annual Report3

efficiency with our HA turbines in both 2016 and 2018.2 And it iswhy Healthcare helps doctors develop more precise diagnostics andtreatment that can give hope to patients whose diagnoses werepreviously considered hopeless.Many companies have strong talent and technology. But few alsooperate with the depth and strength of GE’s global network.We’ve built a local presence, a strong brand, and deep customerrelationships in more than 180 countries, and we have investedin emerging markets in Africa and Asia for more than 100 years.We are proud to serve as true partners in their growth anddevelopment—offering resources and experience, investingin local talent and supply chains, and bringing other partnersalong with us. These networks will continue to be our uniquecompetitive advantage as we pursue profitable, cash-generatinggrowth for years to come.With these strengths as our foundation, we have a straightforwardplan to address our issues and define GE’s path forward, focusedon two priorities.1Improve our financial positionFirst, we are putting GE on firmer financial footing. Simply put, wehave too much debt and we need to reduce it thoughtfully andsoon. Once we put our balance sheet in a healthier place, we’ll bein a better position to play offense across all our businesses.We intend to maintain a disciplined financial policy, targetinga sustainable credit rating in the single-A range, GE industrialleverage of less than 2.5x net debt*-to-EBITDA, a GE Capitaldebt-to-equity ratio of less than 4-to-1, and ultimately a dividendlevel in line with our peers.This starts with reducing leverage at both our industrialbusinesses and GE Capital, and we have taken important stepsto get there. We completed substantially all of our 20 billionindustrial asset sale plan, and we also announced the sale ofour BioPharma business to Danaher Corporation for more than 21 billion. We have more options available to us down the lineto generate cash to help bring down our leverage, including ourremaining interests in Baker Hughes, a GE company (BHGE)2018: Investing forthe Future*24and Wabtec Corporation and continued flexibility for ourgo-forward Healthcare business. We also took the painful butnecessary action of reducing GE’s dividend, allowing GE to retainapproximately 4 billion of cash per year compared to the priorpayout level.Our strategy at GE Capital continues to center on de-riskingthe balance sheet and reducing our assets to become a smaller,more focused business. We made strides in 2018, executing on 15 billion of our 25 billion asset reduction plan, paying downdebt by 21 billion, and enabling 10 billion of orders for ourindustrial businesses. We also recently assessed the reserves wehold for our run-off insurance business. We recorded an additionalreserve of 65 million, after tax, and consistent with what we laidout last January, we plan to contribute approximately 14.5 billionof capital over seven years. We contributed 3.5 billion of this in2018 and 1.9 billion in 2019.Over time, the biggest lever we have to improve our financialposition is to prioritize cash generation in each of our businesses.To that end, we are improving how we operationally manage cashevery day, in every business, and are using lean managementpractices to improve working capital levels. For example, ourAviation team used lean and digital tools to improve average cycletime for the LEAP-1B, reducing the average engine assembly timeby 10 days, or 36 percent. This led to lower inventory levels, moreefficient throughput, and ultimately more available cash.We are also removing waste and increasing speed across oursupply chains—from our suppliers through our factories and fieldservice force and into our customers’ workflows. That helps ourpartners, and it helps us.2Strengthen our businesses,starting with PowerOur goal is to run more empowered, accountable businesses thatare in the best possible position to create value for their customersand improve top-line and bottom-line performance.Launched the LOGIQ E10, a next-generation radiologyultrasound system integrating artificial intelligence, cloudconnectivity, and advanced algorithms to acquire andreconstruct data faster than ever before—which helpsclinicians make a real difference in patient care.Announced Reservoir battery energy storageplatform that delivers 5 percent higherefficiency and reduced installation timeand costs.Non-GAAP Financial Measure. Please see the Non-GAAP Financial Measures section on pages 70-77 of the Management's Discussion and Analysis within our Form 10-Kfor explanations of why we use these Non-GAAP measures and the reconciliation to the most comparable GAAP financial measures.62.22 percent combined-cycle net efficiency (at EDF Bouchain in 2016 with a 9HA.01) and 63.08 percent combined-cycle gross efficiency (at Chubu’s Nishi Nagoya in2018 with three 7HA.01 turbines).GE 2018 Annual Report

We have strong fundamentals in many places from which to build.Aviation had an outstanding 2018, expanding segment profitby 20 percent. The team shipped over 1,100 CFM InternationalLEAP engines—a remarkable achievement in just the third yearof production—and ended 2018 with more than 11,000 units inbacklog. 2018 also marked entry into service for our Passportengine and the first flight of the GE9X.Revenue in Healthcare grew by 5 percent organically*, drivenby growing demand in developed and emerging markets forHealthcare Systems and continued growth in both biologics andcontrast agents in Life Sciences. Segment margins increased by100 basis points on an organic basis* due to the team’s strongproductivity and execution.Renewable Energy revenue grew by 4 percent in 2018, andour onshore team was recognized as the No. 1 wind turbinemanufacturer in the United States in 2018 based on new installs.3However, profitability fell, and we are focused on improvingmargins by driving better productivity and reducing cost.2019 will be a year of change for Power in particular. Power’schallenges in 2018 were rooted in a combination of secular andcyclical market pressures, ongoing profit and cash pressures fromlegacy contracts, and some issues of our own doing. Going forward,we will continue aligning our cost structure with this new marketreality, and we’ve eliminated some headquarter layers to improveaccountability and cost structures in underlying businesses.We also need to run Power better, improving how we manageour inventory and material management, product developmentand delivery, and billings and collections. For example, by movingresponsibility for collections closer to the customer relationshipmanagers, Power was able to improve its visibility to cashand collect it earlier in the quarter. Where we used to get just35 percent of our cash in the first two months of the quarter, inthe fourth quarter, Power increased this to 50 percent. This kind ofoperational improvement takes hard work, and it is a multi-yearjourney, but I’m encouraged by the Power team’s dedicationand progress.Introduced the Haliade-X 12 MW, the mostpowerful offshore wind turbine in the world.*3At Merkur Offshore Wind Farm, 66 Haliade 150-6 MW wind turbines will power ahalf million German homes.For changes like these to truly take root, our businesses needto have more control over their decisions and rely less on thecorporate office. Broadly speaking, if we want to run moreempowered and accountable businesses, we need to radicallychange how we operate across GE.Part of this involves sharpening our focus. We are investing inhigh-tech industries where we have large, mission-critical installedbases with high potential for aftermarket services and parts, andwhere our engineering, manufacturing, and service scale providecompetitive advantages.This kind of work takes time. But it’s workwe can no doubt doWe announced plans to exit BHGE and Transportation to givethem greater control over their strategic direction and capitalallocation. The recently announced sale of our BioPharma businessgets us closer to a place where we aren’t spending so much of ouragenda tending to the balance sheet, putting us on better footingto consider the right options for Healthcare over time.Launched onshore wind turbine platformCypress, which features a jointed, customizableblade that is easier to transport and tailoraccording to each customer’s needs.Achieved first flight of the GE9X, the world’s largestjet engine. Slated for certification this year, the GE9Xpowers Boeing’s new 777X, and is designed to deliver10 percent improvement in fuel efficiency comparedto the GE90-115B-powered Boeing 777-300ER.Non-GAAP Financial Measure. Please see the CEO letter supplemental information package posted to the investor relations section of our website at www.ge.comfor explanations of why we use these Non-GAAP measures and the reconciliation to the most comparable GAAP financial measures.American Wind Energy Association (2019, January 19). “U.S. Wind Industry Fourth Quarter 2018 Market Report.” Retrieved from -reports.GE 2018 Annual Report5

We reorganized our Global Growth Organization and GlobalOperations to serve local market and GE business needs moreefficiently. Going forward, our center will be smaller and primarilyfocused on strategy, capital allocation, research, talent, andgovernance. In 2018, we reduced headquarters spend by over 400 million, and we’re de-layering at both Corporate andour businesses to improve accountability and visibility acrossour teams.Finally, we’re reinventing how we work. GE has a long legacy ofoperating rigor, leadership development, and innovation, but ourrecent performance has exposed some gaps. We are getting “backto basics” by focusing on three main things: Put our customer at the center. As I’ve spent time withcustomers in China, the Middle East, Europe, and the UnitedStates, it’s become clear to me that what they value isnot always aligned with GE’s own metrics for success. Forexample, when I ask about quality internally, I often hearabout our cost of quality, which measures our issues ratherthan how the customer experiences us. We need to shift ourlens back to the customer and work backward to improvewhat matters to them. If we can do this successfully, our owngrowth and performance will follow. We can’t win unless ourcustomers win. Manage for operational performance first. This meansnot just setting ambitious targets, but also making sure wehave clear, achievable paths to get there. I’ve been spendinglots of time in my reviews with the business leaders lookingat detailed operational metrics and processes so that we canunderstand not just the “how much” of what we choose to do,but the “how.” Set fewer, more impactful priorities. GE has ambition likeno other company I’ve seen. That’s mostly a good thing, butwe need to focus our attention on the things that matter mostso we can move them the furthest. At the company level, wehave committed to the two priorities I just outlined: Improveour financial position and strengthen our businesses, startingwith Power. We’ll operate in a similar fashion in each ofour businesses.and support continued operation of mature-fleet aircraft, whileglobal defense spending is rising at its fastest rate in a decade.5GE has provided groundbreaking propulsion technology for100 years—since a Packard-Lepere biplane equipped with a GEturbosupercharger climbed to nearly 30,000 feet over McCookField in Dayton, Ohio, in 1919. Today, GE Aviation’s enginescontain highly advanced technology including carbon compositefan blades, heat-resistant ceramic matrix composite (CMC)components, and 3D-printed metal parts designed to deliverindustry-leading performance, reliability, and durability.GE’s BusinessesHigh-tech focused companyPowerEquipping 90 percent of transmission utilities worldwide7,000 gas turbines and nearly 6,000 coal andnuclear steam turbinesRenewable EnergyInstalled 400 GW capacity globally40,000 onshore wind turbinesAviationPowering two-thirds of commercial aircraft departures6 70,000 aircraft enginesHealthcareProviding 16,000 scans every minute4 million healthcare installationsDigital Capital Research Global Growth AdditivePositioned for upside in extended industriesThis kind of work takes time. But it’s work we can no doubt do.Path to growthI am excited by the growth opportunities I see across GE’s markets.In aviation markets, demand for air travel continues to grow, withmore than 4.5 billion passenger departures projected in 2019.4Relatively low fuel prices enhance commercial airline profitability4566Baker Hughes,a GE CompanyWabtecPursuing an orderly separationfrom BHGE, the world’s firstand only fullstream oil & gascompany, to maximize valuefor both companiesCombined GE Transportationwith Wabtec, creating a globalleader for rail equipment,services, and softwareInternational Air Transport Association (2018, December 12). “Economic Performance of the Airline Industry.” Retrieved from nce-of-the-Industry-end-year-2018-report.pdf.IHS Markit (2018, December 18). “Jane’s Annual Defence Budget Report .” Retrieved from ts.html.Including CFM International, a 50-50 joint venture between Snecma (Safran) and GE.GE 2018 Annual Report

We are among the first to industrialize 3D-printing, also knownas additive manufacturing, which expands design capability,improves performance, and simplifies manufacturing. We’veproduced more than 30,000 additive fuel nozzle tips for the CFMLEAP engine, and we’re expanding the use of additive on newengines such as the GE9X, Catalyst turboprop, and T901. Whilestill an emerging technology, additive manufacturing continues togrow, and it’s helping us make better products for our customersat a scale few others have achieved.intelligence, machine learning, and robotics to material science,electric power, and bioelectric medicine. And our Digital team,newly reorganized to operate more like a startup, is focused ondeveloping software for the Industrial Internet of Things. Theirbreakthroughs will help enable growth across our industrialportfolio for decades to come.In energy markets, governments and utilities all over the worldface the challenge of bringing affordable, reliable, and sustainableelectricity to ever more people, all while reducing emissions andmanaging different fuel sources.I’d like to extend my heartfelt appreciation to GE’s employees,customers, alumni, and Board for their commitment and passionto advance this company forward. I’ve found inspiration in theirexpressions of support (“we’re rooting for you!”) and offers to help(“what can I do?”). We have work to do, but we’ve identified clearopportunities for improvement and are addressing them withfocus and energy.Now it’s more about what we do thanwhat we sayThe energy mix continues to shift dramatically, with roughlytwo-thirds of global capacity additions through 2040 projected tobe in renewables. Meanwhile, demand for natural gas is still on therise, due in part to ample availability at low cost in markets likethe United States and increasing coal-to-gas switching, especiallyin emerging economies in Asia.7GE is determined to lead this transition. We’re making bold bets inclean energy while our turbines and technology allow customers toquickly dispatch more reliable, affordable fuels such as natural gaswhen they are needed. Across our product portfolio, we are using acombination of hardware and software to grow our service offeringsand help utilities maintain and extend the life of their equipment.Final thoughtsErnst Kraaij, a GE Power leader, wrote to me recently saying thathe felt GE’s attitude right now is reflected in the famous proverb,“the beginning of wisdom is to call things by their proper name.”I think that Ernst is right. At times, doing so can be painful, but weare embracing our reality and executing the plan we’ve laid out tocreate value for our people, for our customers, and for you. Now it’smore about what we do than what we say.Thank you for the opportunity to earn your confidence and trust.Finally, healthcare markets need increased capacity, improvedproductivity, and better patient outcomes across the world. Agingpopulations, increasing chronic and lifestyle-related disease,accelerating demand for healthcare in emerging markets, andthe increasing use of diagnostics and monitoring in patient carecontinue to fuel demand for GE’s offerings. And our imaging agentsalso help researchers improve clinical trials for new therapies byhelping identify the patients most likely to respond to innovativenew medicines.It’s this kind of invention that is at GE’s heart and soul—in thewords of our founder Thomas Edison, finding out what the worldneeds and proceeding to invent it. And our Research, Digital, andAdditive teams reach across all GE’s industries to further boostthis capability. More than 1,000 scientists at GE Research arecontinuing to invent the future in these markets, from artificial7H. Lawrence Culp, Jr.Chairman of the Board andChief Executive OfficerFebruary 26, 2019International Energy Agency (2018, November 13). “World Energy Outlook 2018.” Retrieved from https://www.iea.org/weo2018/.GE 2018 Annual Report7

How Our Segments Performed in 2018(Dollars in millions)Renewable EnergyPowerMission: Powering lives and making electricitymore affordable, reliable, accessible,and sustainableUnits: Gas Power Systems, Steam PowerSystems, Power Services, Grid Solutions,Power Conversion, Automation & Controls,GE Hitachi NuclearEmployees: 59,700Revenues:Profit/(Loss):Profit/(Loss) margin:Orders:Backlog:2018YoY 27,300 (808)(3.0)% 27,460 91,876(22)%U(860) bps(23)%(6)%2018YoY 9,533 2873.0% 10,894 17,2694%(51)%(330) bps5%16%Revenues:Profit/(Loss):Profit/(Loss) margin:Orders:Backlog:2018YoY 30,566 6,46621.2% 35,517 223,52713%20%130 bps22%12%TransportationMission: Making precision health a reality—delivering outcomes by digitally connectingprecision diagnostics, therapeutics,and monitoringUnits: Healthcare Systems, Life SciencesEmployees: 53,800YoY2018Mission: Being a global technology leaderand supplier to the railroad, mining, marine,stationary power, and drilling industriesUnits: Locomotives, Services, DigitalSolutions, Mining, Marine, Stationary & DrillingEmployees: 9,4002018YoYRevenues:Profit/(Loss): 19,784 4% 3,698 6%Revenues:Profit/(Loss): 3,898 633(1)%(1)%4.6%(30) bps 23,895 39% 21,492 (2)%Profit/(Loss) margin:Orders:Backlog:18.7%40 bps 20,897 2% 17,409 (4)%Profit/(Loss) margin:Orders:Backlog:16.2% 5,684 18,925(10) bps17%5%Lighting82018 22,859 33% 1,045 25%YoYCapitalMission: Helping businesses, cities andhomes become more energy efficient andproductive with LED and solar technologies,networked sensors and software, andconnected lighting solutionsUnits: GE Lighting, CurrentEmployees: 3,000Revenues:Profit/(Loss):Profit/(Loss) t/(Loss) margin:Orders:Backlog:AviationMission: Providing our aviation customerswith the most technologically advanced andproductive engines, systems, and services fortheir successUnits: Commercial Engines, CommercialServices, Military, Systems, AdditiveEmployees: 48,000HealthcareOil & GasMission: Providing leading physical and digitaltechnology solutions to enhance customerproductivity across the oil & gas value chainUnits: Oilfield Services, Oilfield Equipment,Turbomachinery & Process Solutions,Digital SolutionsEmployees: 65,800Revenues:Adjusted Profit/(Loss)*:Adjusted Profit/(Loss)margin*:Orders:Backlog:Mission: Making renewable power sourcesaffordable, accessible, and reliable for thebenefit of people everywhereUnits: Onshore Wind, Offshore Wind, Hydro,LM Wind PowerEmployees: 22,9002018YoY 1,723 704.1% 966 217(11)%F270 bps(16)%(10)%GE 2018 Annual ReportMission: Designing and delivering innovativefinancial solutions for customers and theGE industrial businesses in markets aroundthe worldUnits: GE Capital Aviation Services (GECAS),Energy Financial Services (EFS), IndustrialFinance (IF), InsuranceEmployees: 2,3002018YoYCapital continuingoperations: (489)93%Discontinuedoperations:GE Capital Earnings: (1,670) U (2,159) 70%*Non-GAAP Financial Measure. Please see theNon-GAAP Financial Measures section onpages 70-77 of the Management 's Discussionand Analysis within our Form 10-K forexplanations of why we use these non-GAAPmeasures and the reconciliation to the mostcomparable GAAP financial measures.UUnfavorableFFavorable

United States Securities and Exchange CommissionWASHINGTON, D.C. 20549FORM 10-K(Mark One)Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934For the fiscal year ended December 31, 2018orTransition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934For the transition period from toCommission file number 001-00035General Electric Company(Exact name of registrant as specified in charter)New York14-0689340(State or other jurisdiction of incorporation or organization)(I.R.S. Employer Identification No.)41 Farnsworth Street, Boston, MA02210(617) 443-3000(Address of principal executive offices)(Zip Code)(Telephone No.)Securities Registered Pursuant to Section 12(b) of the Act:Title of each className of each exchange on which registeredCommon stock, par value 0.06 per shareNew York Stock ExchangeSecurities Registered Pursuant to Section 12(g) of the Act:(Title of class)Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YesNoIndicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YesNoIndicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filingrequirements for the past 90 days. YesNoIndicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 ofRegulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YesNoIndicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to thebest of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment tothis Form 10 K.Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or anemerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" inRule 12b-2 of the Exchange Act. (Check one):Large accelerated filerAccelerated filerNon-accelerated filerSmaller reporting companyEmerging growth companyIf an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any newor revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.Indicate by chec

4 GE 2018 Annual Report * Non-GAAP Financial Measure. Please see the Non-GAAP Financial Measures section on pages 70-77 of the Management s Discussion and Analysis within our Form 10-K for explanations of why we use these Non-GAAP measures and the reconciliation to the most comparable GAAP financial measures. '